Bullflags

Is Tinley trading in a Bullish Flag?Possibly a descending triangle as well, but with the Long Beach facility license imminent I'm strongly leaning towards a bullish outcome.

The RSI looks like it recently made a Triple Bottom.

Only time will tell.

Next BULL FLAG! EthereumHey there,

Please support this idea with your likes and follow me!

Next bull flag on Ethereum coming up. Looking for a break on BTC and on ETH.

ETH might break out sooner than Bitcoin will, so keep an eye out for that.

Most likely a major move coming up soon.

I think bullish breakout is currently more likeley.

Cheers,

Konrad

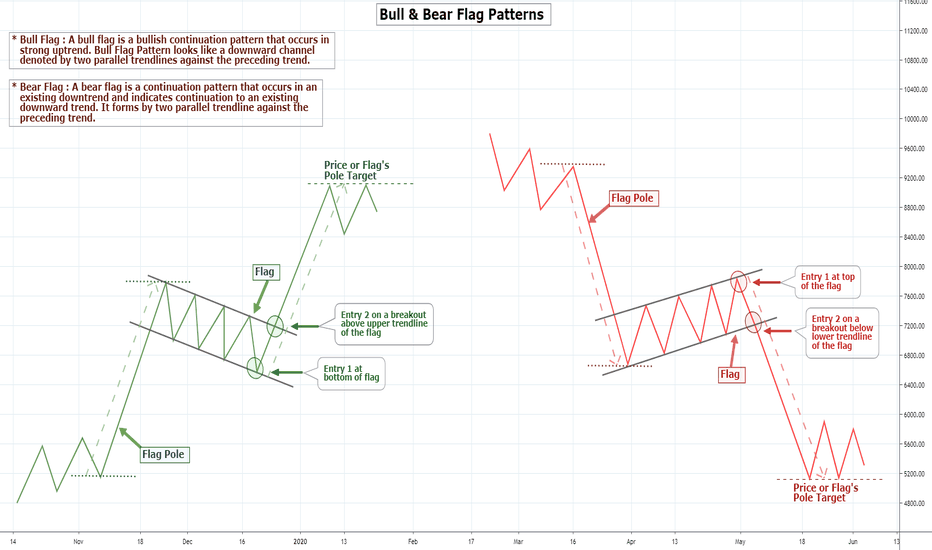

How to Trade Bull & Bear Flag Pattern | Flag Pattern Tutorial !Bull & Bear Flag chart patterns Tutorial!

Bull Flag : A bull flag forms in bullish trending market, After a strong bullish movement when this pattern forms it signals the market is likely to move more higher. Bull flag pattern much similarly looks like a horizontal parallel channel or downward parallel channel along with a strong bullish vertical rally; when we draw the pattern it looks like flag on a pole, that's why they are called bull flags.

How to identify and Trade Bull Flags : - It is easy to identify a bull flag you just need to look for a Bullish Vertical Rally or Trend which is Pole of the Flag then identify the consolidation which will look like either horizontal channel or downward channel which will be the Flag. After identifying the pattern you can enter at the bottom of the flag or you can enter when price breaks the upper trendline of the flag which is more safe.

The breakout may also be a fakeout that's why we will take help of Volume and RSI Indicator to confirm the breakout. As shown on the below example you can see when price breaked the uppper trend of the flag the Trend drawn on the RSI was also broke and the Volume was high.

()

( *Key things to know : If the retracement measured from the vertical rally or Flag Pole retrace more than 50% the pattern becomes weak and it may not be a Flag Pattern but sometimes it stays valid if it breakouts above the uppertrend of the flag.)

Bear Flag : Bear Flag is just the opposite of the Bull Flag Pattern. A bear Flag forms in bearish trending market. Bear Flag pattern signals the market is likely to drop more lower. You need to identify Bear Flag in bearish trend when the price of a financial asset drops then if the price forms a horizontal channel or upward channel which will look like a inverted flag whose flag pole will be upside and the flag will be downside.

Stay Tuned; 👍

Like this tutorial & share your comment below and also

check other tutorials with example linked below;

Thank You-

Bull Flag or Descending Triangle. What Does The Death Cross Tell You?

The death cross occurs when a short-term moving average (typically 50-day SMA ) crosses over a major long-term moving average (typically 200-day SMA ) to the downside and is interpreted by analysts and traders as signaling a definitive bear turn in a market.

The opposite of the death cross occurs with the appearance of the golden cross, when the short-term moving average of a stock or index moves above the long-term moving average. Many investors view this pattern as a bullish indicator. The golden cross pattern typically shows up after a prolonged downtrend has run out of momentum. As is true with the death cross, investors should confirm the trend reversal after several days or weeks of price movement in the new direction. Much of the process of investing by following patterns is self-fulfilling behavior, as trading volumes increase with the attention of more investors who are driven in part by an increase in financial news stories abut a particular stock or the movement of an index.

Limitations Of Using The Death Cross

All indicators are “lagging,” and no indicator can truly predict the future. Once & while a death cross can produce a false signal, and a trader placing a short at that time would be in some near-term trouble. Despite its apparent predictive power in forecasting prior large bear markets, death crosses also do regularly produce false signals. Therefore, a death cross should always be confirmed with other signals and indicators before putting on a trade.

Possibly Bull Flag or Descending Triangle as well, outlined in dark Green.

Is Bitcoin trading in a descending triangle?Bitcoin appears to have a hard time breaking above the downward slonping resistance, which is forming a descending triangle or bullish flag.

The RSI is at a level where we've seen rejection multiple times in the past, and there may be a H&S pattern shaping in addition to the descending triangle.

Triple Bottom & Inverse Head & Shoulders. Has Aleafia stuck in a bottom recently, it appears as though on the RSI there is a staircase creation of higher lows & higher highs, and now a Inverse Head & Shoulders is forming & may break-out bullishly to the upside in the near term.

It also seems like a bull flag is breaking out to the upside right now.

Gold - Bullish Setup (Inverse Head & Shoulders & Bull Flag)Folks,

It looks like there's a really nice bullish setup forming in gold right now with an inverse head & shoulders pattern along with a bull flag. Given the bullish sentiment around gold now along with all the stimulus recently rolled out globally...it's hard not to throw all the chips in on this one.

Look for an entry ~1,610-1,615 range with a tight stop loss around 1,600 for those more risk adverse or around 1,550 if there's a bit more tolerance for risk. Initial target is the recent high and neckline of the head & shoulders patter at 1,700-1,705.

An alternative and more conservative entry would be a break of the downward sloping trend line of the bull flag.

This is all adding up to a nice play if it doesn't break down.

Cheers!

Days Off

#Bitcoin to attack 7000$ again #Bitcoin is going to attack 7000$ again.

Right now we are facing horizontal resistance, but if #BTC can push trough it another leg up will follow.

Last time we went above 7000$ it was only for a brief moment a the end of an explosive leg up. Now the more has more depth to it, even though he volume is rapidly falling. Buyers not convinced, yet.

Once the stock market opens we will be having more clarity. As of now still moderately bullish on #BTC.