CAD/CHF BULLS ARE GAINING STRENGTH|LONG

CAD/CHF SIGNAL

Trade Direction: long

Entry Level: 0.586

Target Level: 0.607

Stop Loss: 0.572

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Bullish Patterns

TC/GOLD: Could 1 BTC Reach 6,000 oz of Gold by 2027 ($19.2M US)The chart tracks Bitcoin (BTC) priced in ounces of gold (oz) on a logarithmic scale, revealing its historical growth and a speculative projection. As of April 2025, 1 BTC equals approximately 25 oz of gold, which translates to $80,000 per BTC at an implied gold price of $3,200/oz (derived from the projection).

The chart forecasts a dramatic rise to 6,000 oz of gold by 2027, a 240x increase from the current level. At $3,200/oz for gold, this would value 1 BTC at $19.2M, resulting in a market cap of $378 trillion (19.7M BTC in circulation). Historically, Bitcoin has shown exponential growth, with significant spikes during bull cycles (e.g., 2017-2018 and 2024-2025, as circled). Factors like Bitcoin’s capped supply, post-2024 halving scarcity, and potential for increased adoption as "digital gold" could support such a run.

What are your thoughts? Could Bitcoin achieve this monumental target, or is the projection too optimistic? Let’s discuss!

TL;DR: BTC/GOLD ratio is set to ****ing pump! From 25 oz now to 6,000 oz by 2027—1 BTC could hit $19.2M. Buckle up for a wild ride!

The Yield Curve is NOT InvertedLately I've been seeing a lot of people incorrectly state that the Yield Curve is currently inverted.

IT IS NOT.

Easily measurable 10Y - 2Y.

Google the definition if you need to.

I laid out the impact of the yield curve inverting against the S&P 500.

In most cases, you can see SP:SPX sells off slightly after inverting.

The higher the spread, the healthier the market is.

You want funds buying longer dated securities for market stability and confidence.

JUP Long Spot Trade Setup – Oversold and Approaching Key SupportJUP is showing strong signs of oversold conditions and is now approaching a major support zone ($0.22 – $0.30). This area offers a favorable risk-to-reward opportunity for a bounce if buyers step in.

📌 Trade Setup:

Entry Zone: $0.22 – $0.30

Take Profit Targets:

🥇 $0.4050

🥈 $0.4467

Stop Loss: Just below $0.20

SUI Long Spot Trade Setup – Oversold Bounce PotentialSUI has dropped into a key support zone ($1.60 – $1.96) after an extended selloff. The price is showing oversold conditions, making this a potentially high-reward setup if a bounce confirms from this zone.

📌 Trade Setup:

Entry Zone: $1.60 – $1.96

Take Profit Targets:

🥇 $2.50 – $2.90

🥈 $3.25 – $3.60

Stop Loss: Just below $1.50

RSR/USDT: FALLING WEDGE BREAKOUT! 100%+ PROFIT POTENTIAL!!🚀 Hey Traders! RSR Breakout Alert – 100%+ Rally Incoming? 👀🔥

If you’re hyped for big moves and real alpha, smash that 👍 and hit Follow for high-accuracy trade setups that actually deliver! 💹🚀

RSR has just broken out of a falling wedge structure on the daily timeframe—a powerful bullish pattern. The chart’s signaling a potential 100–150% upside move if momentum picks up from here. 📈

📍 Entry Zone: CMP – Add more on dips down to $0.0066

🎯 Target: 100%–150% upside

🛑 Stop-Loss: $0.0054

📊 Trade Plan:

✅ Buy from current levels

✅ Add on dips near breakout support

✅ Ride the breakout wave with tight risk control!

💬 What’s Your Take?

Are you riding this RSR breakout or waiting on confirmation? Drop your thoughts and targets in the comments—let’s ride this wave together! 💰🔥

$BTC Not Out Of The Weeds Yet - Must Break $84kIf CRYPTOCAP:BTC can break back above ~$84k then we could continue to follow my OG setup (yellow) and rip,

but since PA dumped slightly below the 50WMA it technically invalidated my inverse h & s idea.

A rejection of $84k would dump us back to ~$78k to form the right shoulder (red) and complete the setup.

nonetheless, i believe we've seen the bottom 👋

HAPPENING NOW?! HERTZ CUP AND HANDLE BREAKOUT 1D CHART?HERTZ (HTZ) Price rose significantly to $4.26 on the 1 Day chart. Is this a sign of an impending bullish breakout? My personal target opinion for bullish movement is $5.50. Will this be a major bullish turning point for Hertz? Or will it be a easy grab for traders running short positions?

BTC UPDATE: Flash Crash? Or Bullish Retest?🚀 Hey Traders! 👋

If you’re enjoying this analysis, smash that 👍 and hit Follow for high-accuracy trade setups that actually deliver! 💹🔥

📉 BTC just dropped nearly $10K in a single day, sliding from $84K to $74K amidst growing tariff tensions and broader market turmoil.

But here’s the bullish twist—this dump might just be a healthy retest.

BTC recently broke out of a strong inverse head & shoulders pattern, and what we’re seeing now looks like a classic neckline retest.

📌 Key Support: $72K

As long as BTC holds above this level, there’s no reason to panic. Once the dust settles from this bloody Monday, momentum could shift back to the upside.

🟢 This could be a golden accumulation zone—low risk, high potential reward.

❌ Invalidation Level: Weekly close below $72K

💬 What’s Your Take?

Will BTC bounce from this level, or is there more downside ahead? Drop your analysis and predictions below—let’s navigate this together and secure those gains! 💰🔥🚀

Monster Beverage Corp (MNST) – Energizing Global GrowthCompany Snapshot:

Monster NASDAQ:MNST continues to dominate the $60B+ global energy drink market, expanding across 159 countries with a diverse portfolio and strong executive leadership.

Key Catalysts:

Global Market Expansion 🌐

Strategic brands like Predator and Fury targeting emerging markets

New geographies = incremental revenue & brand exposure

Category Leadership & Diversification 🥤

Strong lineup: Monster Energy®, Reign®, Bang®, Java Monster®, NOS®

Broad consumer appeal → fuels market share gains in both premium & value tiers

Industry Tailwinds 📊

Energy drink market projected to grow at 7.6% CAGR (2025–2029)

Monster well-positioned with affordable, recognizable, and global brands

Leadership & ESG Strength 💼💚

Longtime Co-CEOs Rodney Sacks & Hilton Schlosberg driving global strategy

Involvement in charitable events reinforces brand goodwill and consumer trust

Investment Outlook:

✅ Bullish Above: $50.00–$51.00

🚀 Upside Target: $75.00–$76.00

📈 Growth Drivers: Emerging market expansion, brand strength, leadership, and rising category demand

⚡️ Monster – Powering growth from the shelf to the streets. #MNST #EnergyDrinks #GlobalLeader

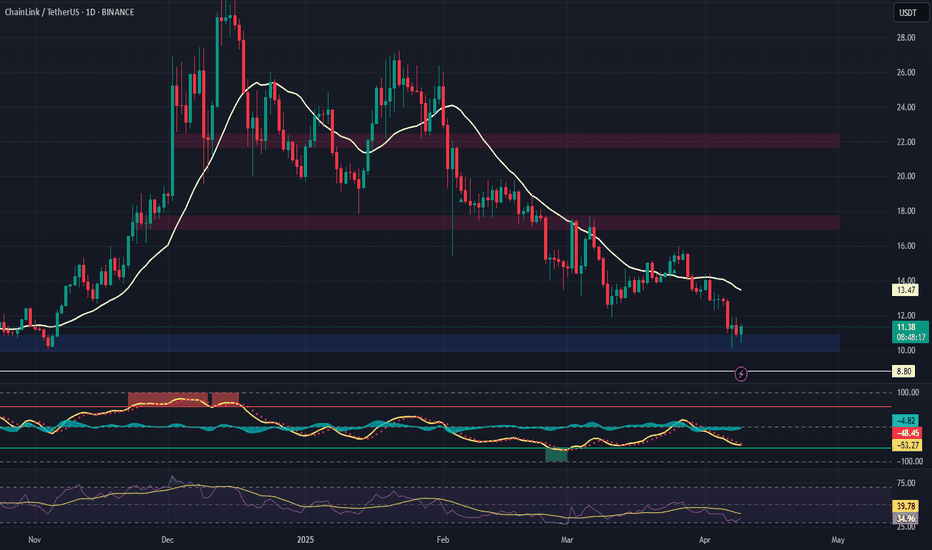

LINK Long Spot Trade Setup – Major Support TestLINK has retraced sharply and is now sitting at a critical support zone ($10.00–$11.00), historically a strong base for reversals. This offers a solid risk/reward opportunity for a potential bounce and test of upper resistance zones.

📌 Trade Setup:

Entry Zone: $10.00 – $11.00

Take Profit Targets:

🥇 $17.00 – $17.70

🥈 $21.70 – $22.40

Stop Loss: Around $8.80

USOIL SENDS CLEAR BULLISH SIGNALS|LONG

USOIL SIGNAL

Trade Direction: long

Entry Level: 57.67

Target Level: 66.44

Stop Loss: 51.82

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 12h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EUR/CHF BULLISH BIAS RIGHT NOW| LONG

Hello, Friends!

Previous week’s red candle means that for us the EUR/CHF pair is in the downtrend. And the current movement leg was also down but the support line will be hit soon and lower BB band proximity will signal an oversold condition so we will go for a counter-trend long trade with the target being at 0.943.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

USDJPY Analysis: Reversal Estimations Based on Trading MathDear Trader,

Please find attached my analysis of $Subject, which uses mathematical calculations to identify potential reversal times and price levels. The analysis details projected south and north price targets (horizontal lines on the chart), along with estimated time frames for possible reversals (vertical lines on the chart, accurate to within +/- 1-2 candles). Please note that all times indicated on the chart, including the vertical lines representing potential reversal times, are based on the UTC+4 time zone.

To increase the probability of these analyses, I recommend monitoring the 5-minute and 15-minute charts for the following key reversal candlestick patterns:

Doji’s

Double Bottom/Top

Engulfing Bullish /Bearish

Hanging Man

Hammer/Inverted Hammer

Morning Star

Shooting Star

Triple Top/Bottom

For those interested in further developing their trading skills based on these types of analyses, consider exploring the mentoring program offered by Shunya Trade.

I welcome your feedback on this analysis, as it will inform and enhance my future work.

Regards,

Shunya Trade

Price levels

Price DH Price DL

144.52194 144.63007

144.48096 144.67107

144.38595 144.76618

144.19602 144.95648

144.00622 145.14691

143.81654 145.33746

143.62698 145.52814

143.43756 145.71894

143.24825 145.90987

143.05907 146.10093

142.30361 146.86639

141.55015 147.63385

140.79868 148.40332

140.04922 149.17478

139.30176 149.94824

138.55630 150.72370

137.81283 151.50117

137.07137 152.28063

⚠️ Disclaimer: This post is educational content and does not constitute investment advice, financial advice, or trading recommendations. The views expressed here are based on technical analysis and are shared solely for informational purposes. The stock market is subject to risks, including capital loss, and readers should exercise due diligence before investing. We do not take responsibility for decisions made based on this content. Consult a certified financial advisor for personalized guidance.

Bond Futures Back At SupportTrade is fairly simple here. Go long treasuries and if it breaks down cut.

- A bounce and push back up could be another ugly catalyst for the US stock market.

- A breakdown however would push yields up (and economic growth forecasts) which would be quite bullish for stocks especially down at these levels

ONDO Long Spot Trade Setup – Bullish Divergence PotentialONDO is showing relative strength amid the broader altcoin pullback, holding key levels and now pulling into the $0.50 support zone. This area lines up for a possible RSI bullish divergence, which could spark the next leg up.

📌 Trade Setup:

Entry Zone: ~$0.50

Take Profit Targets:

🥇 $0.85

🥈 $1.13

🥉 $1.34

Stop Loss: Daily close below $0.42

LTO - Shift in Momentun in Action!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📚 LTO is a perfect practical example of a momentum shift in action.

It’s clear that the bears are losing steam — the impulse moves marked in red are becoming flatter and smaller, forming a wedge pattern.

Moreover, LTO just tapped into a key weekly support zone near the $0.03 round number, making it a prime area to look for potential long setups.📈

🚀For the bulls to confirm this momentum shift in their favor and aim for the $0.05 round number as the first target 🎯, a break above the last major high marked in green at $0.0345 is essential ✅.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Ripple May Face Another Rally This YearRipple with ticker XRPUSD hit all-time highs for the final blue wave V as expected, so we should be aware of limited upside this year. However, despite recent slowdown, which we see it as an ABC correction within red subwave (IV), there can still be room for another rally this year, at least up to 4-5 area to complete final subwave (V) of V of an impulse on a daily chart.

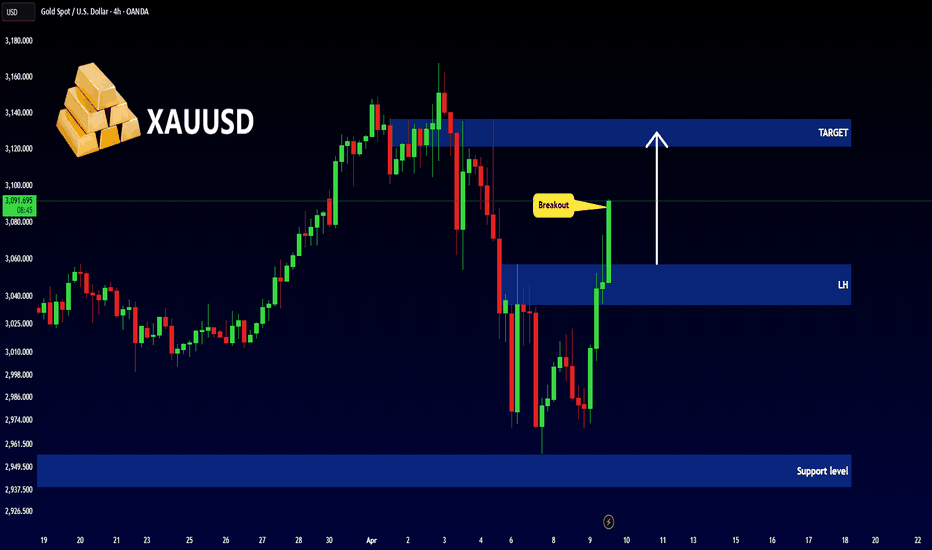

GOLD BEST PLACE TO BUY FROM|LONG

GOLD SIGNAL

Trade Direction: long

Entry Level: 3,008.04

Target Level: 3,136.65

Stop Loss: 2,921.80

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 12h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅