Bullish Patterns

eth buy midterm "🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

BTC - One More Leg...Hello TradingView Family / Fellow Traders!

This is Richard, also known as theSignalyst.

📉 BTC has been overall bearish , trading within the falling channel marked in red.

But the big question is — where could the potential bottom be?

👉 I’m watching the $70,000 zone!

Here’s why:

The $70,000 area is a key confluence zone — it aligns with the lower red trendline, horizontal support, a psychological round number, and a potential demand zone.

📚 According to my trading style:

As #BTC approaches the blue circle zone, I’ll be looking for bullish reversal setups — such as a double bottom pattern, trendline break, and more.

📚 Reminder:

Always stick to your trading plan — entry, risk management, and trade management are key.

Good luck, and happy trading!

All Strategies Are Good, If Managed Properly!

~Rich

SILVER SENDS CLEAR BULLISH SIGNALS|LONG

SILVER SIGNAL

Trade Direction: long

Entry Level: 3,050.2

Target Level: 3,274.5

Stop Loss: 2,899.9

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 8h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

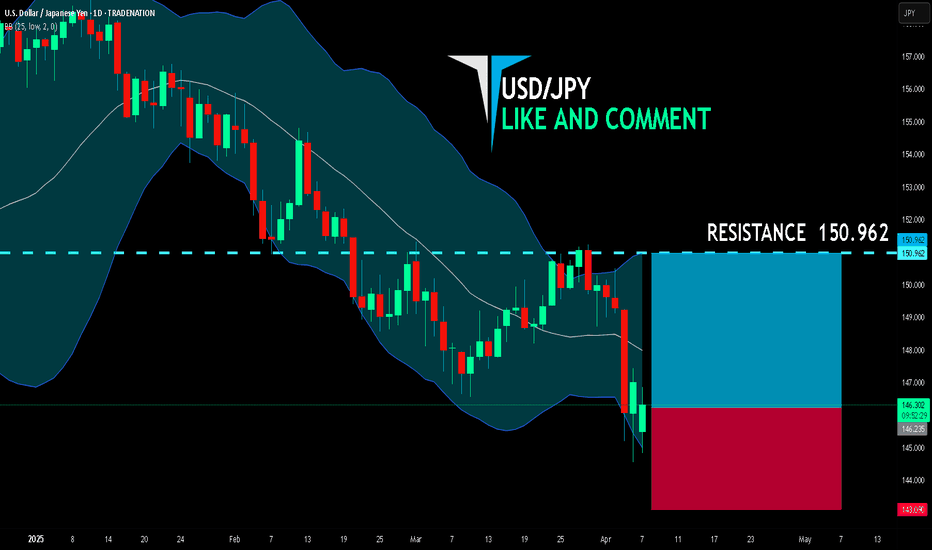

USD/JPY BULLS ARE GAINING STRENGTH|LONG

USD/JPY SIGNAL

Trade Direction: long

Entry Level: 146.235

Target Level: 150.962

Stop Loss: 143.090

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

NZD/USD BULLISH BIAS RIGHT NOW| LONG

Hello, Friends!

We are going long on the NZD/USD with the target of 0.568 level, because the pair is oversold and will soon hit the support line below. We deduced the oversold condition from the price being near to the lower BB band. However, we should use low risk here because the 1W TF is red and gives us a counter-signal.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

I'm Bullish, but... NEAR / USDTHello again my brothers and sisters,

3 Drive Structure, do I need to say anything else?

I mean, look at this symmetrical triangle, when this blows, in the past, did it only touch base twice? I dont think so, 3 drive structure is needed for this and then we can be extremely bullish!

I'll be loading my boat down there.

If this helped you out, let me know!

Trade thirsty!

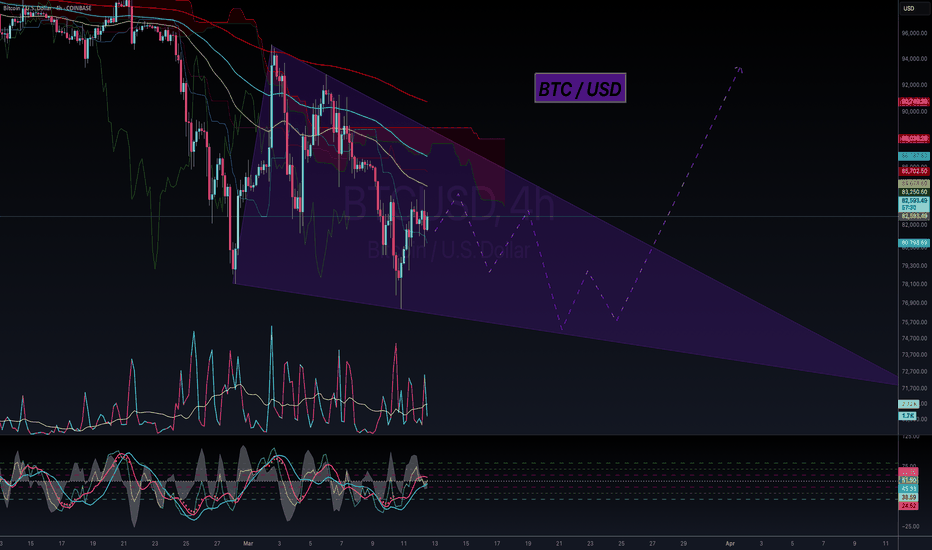

I'm Bullish, but... BTC / USDHello my friends,

At a minimum we're looking at 30 days inside this wedge before breaking out and testing the $96k range once again. Trust me, Bitcoin must form a bullish structure before doing anything interesting.

It could wick to FWB:73K but I'm thinking the heavy orders around $75k might hold and we range instead of dumping more.

Keep an eye on this wedge.

Trade thirsty, my friends!

DOT - Strong bounce from the ultimate low ?Bounced each time for consequent gains around 3.75, so I expect the same now

placed a SL a bit wide, a good fuel could be the 2.0 update of Polkadot but didn hear any news about it to be honest

In the other hand, lower would means I'll quit this asset for a mid/long term hehe,

Cheers

$BTC Inverse Head and Shoulders Finally FormedAnd just like that, the Death Cross has formed the right shoulder for the Inverse H & S idea I formed on March 14th

We may sit a bit more downside to retest the 50WMA at $76k for confirmation

If we get a V-shaped recovery tomorrow, this very well could be the bottom for CRYPTOCAP:BTC

USOIL BEST PLACE TO BUY FROM|LONG

USOIL SIGNAL

Trade Direction: long

Entry Level: 62.31

Target Level: 71.18

Stop Loss: 56.40

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBP/USD BULLS ARE STRONG HERE|LONG

Hello, Friends!

We are now examining the GBP/USD pair and we can see that the pair is going down locally while also being in a downtrend on the 1W TF. But there is also a powerful signal from the BB lower band being nearby indicating that the pair is oversold so we can go long from the support line below and a target at 1.302 level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EUR/USD BULLS WILL DOMINATE THE MARKET|LONG

Hello, Friends!

The BB lower band is nearby so EUR-USD is in the oversold territory. Thus, despite the downtrend on the 1W timeframe I think that we will see a bullish reaction from the support line below and a move up towards the target at around 1.110.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

CAD/CHF SENDS CLEAR BULLISH SIGNALS|LONG

Hello, Friends!

Previous week’s red candle means that for us the CAD/CHF pair is in the downtrend. And the current movement leg was also down but the support line will be hit soon and lower BB band proximity will signal an oversold condition so we will go for a counter-trend long trade with the target being at 0.613.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

ADA Spot Trade Setup – Support Level OpportunityCardano (ADA) is currently sitting at a key support zone, presenting a solid risk-to-reward long opportunity if bulls can hold the level.

🛠 Trade Plan:

Entry: $0.63 – $0.70

Take Profit Targets:

$0.78 – $0.84 (First Target)

$0.96 – $1.02 (Extended Target)

Stop Loss: Just below $0.58

Nintendo Co., Ltd. (NTDOY) – Powering Up for the Next Level Company Snapshot:

Nintendo OTC:NTDOY continues to dominate global entertainment with iconic franchises, cross-platform expansion, and the highly anticipated Switch 2 in 2025.

Key Catalysts:

Switch 2 Launch in 2025 🚀

150M+ Switch units sold → massive installed base

Backward compatibility + hardware upgrades could drive a super-cycle in hardware/software sales.

Franchise Diversification 💡

Digital Pokémon card game gaining momentum → strong in-app revenue potential

The Super Mario Bros. Movie surpassed SEED_TVCODER77_ETHBTCDATA:1B + in global box office 🍿

Expanding theme park partnerships (Universal Studios) enhance recurring brand engagement

Multi-Channel Monetization 📱🎢

Transitioning beyond consoles: movies, mobile, merchandise, and theme parks

Reinforces IP value and opens new revenue verticals

Investment Outlook:

✅ Bullish Above: $15.50–$16.00

🚀 Upside Target: $27.00–$28.00

📈 Growth Drivers: Switch 2 super-cycle, diversified IP monetization, and brand strength

🍄 Nintendo – Not just gaming, but a global entertainment powerhouse. #NTDOY #Switch2 #Nintendo

LTC - Bulls Getting Ready!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 Long-term, LTC has been overall bullish, trading within the rising channel marked in red.

📍 As it retests the lower bound of the channel — perfectly intersecting with the blue support—I will be looking for medium-term longs.

🚀 For the bulls to take over long-term and initiate the next bullish phase, a breakout above the last major high marked in orange at $97 is needed.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

AUD/CAD BUYERS WILL DOMINATE THE MARKET|LONG

AUD/CAD SIGNAL

Trade Direction: long

Entry Level: 0.880

Target Level: 0.889

Stop Loss: 0.874

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅