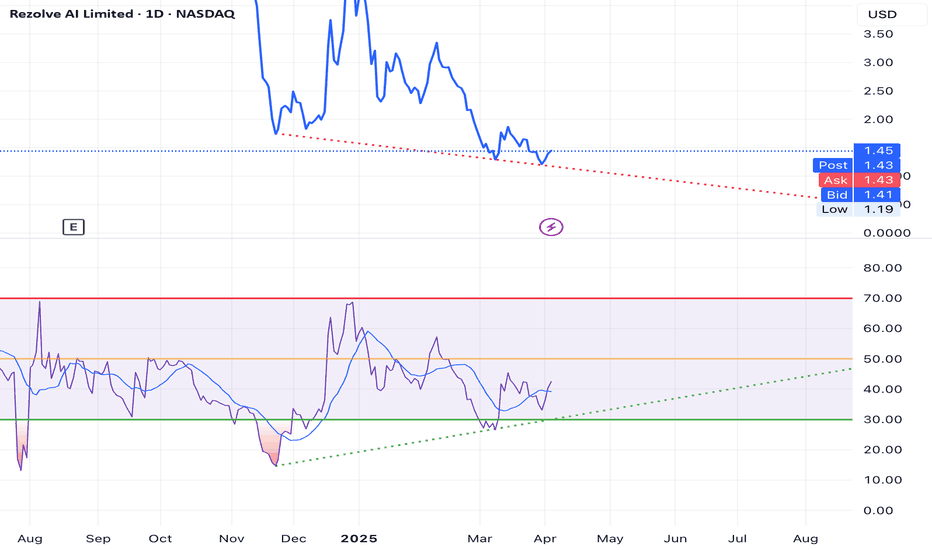

BULLISH RSI DIVERGENCE ON REZOLVE AI (RZLV) 1D CHARTA bullish RSI divergence appeared to gather more strength on the 1 hour chart today. This could possibly signal a bullish up trend. The London based company provides AI solutions for commerce. Rezolve recently closed an acquisition of GroupBy, an ECommerce company, and has recently been featured favorably in articles by Nasdaq and others.

Bullish Patterns

Cable Is Trading Impulsively HigherCable is making a very nice and strong extension higher on the 4-hour time frame, so it appears to be impulsive. We should be aware of further upside, especially as the market has broken out of a base channel, which typically happens within wave three of three.

In fact price is now even higher after a triangle in wave four so wave 5 of red (3) is in progress as expected, but it can target 1.32, so be aware of a new red higher degree wave (4) correction before the bullish trend for wave (5) resumes. Ideal support is at 1.29 – 1.28 area.

Expand Energy (EXE) – Fueling Growth in the LNG BoomCompany Overview:

Expand Energy NASDAQ:EXE is strategically positioned near the Gulf Coast, enabling it to capitalize on rising global LNG demand with a disciplined growth strategy.

Key Catalysts:

$2.7 Billion Capital Plan (2025) 💰

$500M for debt reduction & share buybacks, improving financial flexibility.

Balances growth investments with shareholder returns.

Production Expansion 📈

2024: 6.41 Bcfe/d

2025: 7.1 Bcfe/d 🚀

2026: 7.5 Bcfe/d 🌍

Scalable drilling & infrastructure investments enhance efficiency.

Strategic LNG Market Positioning ⚡

Located near key export hubs, maximizing access to high-demand markets.

Flexible capacity investments ensure adaptability to pricing trends.

Investment Outlook:

✅ Bullish Above: $95.00-$96.00

🚀 Upside Target: $140.00-$145.00

📈 Growth Drivers: LNG market demand, financial discipline, and production scalability.

🔥 Expand Energy – Driving the Next Wave of LNG Growth. #EXE #Energy #LNG

Nano Nuclear Energy – Pioneering Next-Gen Small Modular ReactorsCompany Overview:

Nano Nuclear Energy NASDAQ:NNE is revolutionizing clean, compact nuclear power with small modular reactors (SMRs), addressing data centers, remote sites, and disaster relief energy needs.

Key Catalysts:

ZEUS Microreactor Development 🚀

Successfully assembled first hardware, marking a key milestone toward commercialization & revenue generation.

Patent-Backed Innovation 🏆

Filed four new patents in February 2025 for its Annular Linear Induction Pump (ALIP).

Strengthens NNE’s edge in molten-salt & liquid-metal reactor technology.

Surging Global Electricity Demand ⚡

Aligns with the growing need for cost-effective, sustainable energy solutions.

Ideal for off-grid, military, and high-demand industrial applications.

Investment Outlook:

✅ Bullish Above: $21.50-$22.00

🚀 Upside Target: $44.00-$47.00

📈 Growth Drivers: Breakthrough SMR tech, patent leadership, and clean energy demand.

🔥 Nano Nuclear – Powering the Future, One Microreactor at a Time. #NNE #NuclearEnergy #CleanTech

atom buy midterm"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

GBPAUD - One More Leg!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈GBPAUD has been overall bullish trading within the rising channel marked in blue.

Moreover, it is retesting a strong structure.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of structure and lower blue trendline acting as a non-horizontal support.

📚 As per my trading style:

As #GBPAUD approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USOIL BULLS ARE STRONG HERE|LONG

USOIL SIGNAL

Trade Direction: long

Entry Level: 69.37

Target Level: 70.64

Stop Loss: 68.53

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 2h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

AUD/JPY BULLS WILL DOMINATE THE MARKET|LONG

Hello, Friends!

AUD/JPY pair is trading in a local downtrend which we know by looking at the previous 1W candle which is red. On the 8H timeframe the pair is going down too. The pair is oversold because the price is close to the lower band of the BB indicator. So we are looking to buy the pair with the lower BB line acting as support. The next target is 93.929 area.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBP/AUD BEST PLACE TO BUY FROM|LONG

Hello, Friends!

It makes sense for us to go long on GBP/AUD right now from the support line below with the target of 2.061 because of the confluence of the two strong factors which are the general uptrend on the previous 1W candle and the oversold situation on the lower TF determined by it’s proximity to the lower BB band.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBP/NZD BULLISH BIAS RIGHT NOW| LONG

Hello, Friends!

GBP/NZD is making a bearish pullback on the 1H TF and is nearing the support line below while we are generally bullish biased on the pair due to our previous 1W candle analysis, thus making a trend-following long a good option for us with the target being the 2.264 level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

BUY GBPUSDLadies and Gents, in todays session we are monitoring GBPUSD for potential upwards move. BULLS INCOMING. Our target is 1.2923 and stops are below 1.2852 and targets above 1.31207. This set up is on higher time frame meaning it might take few days to play out make sure to look for confluence on lower time frames and use proper risk management.

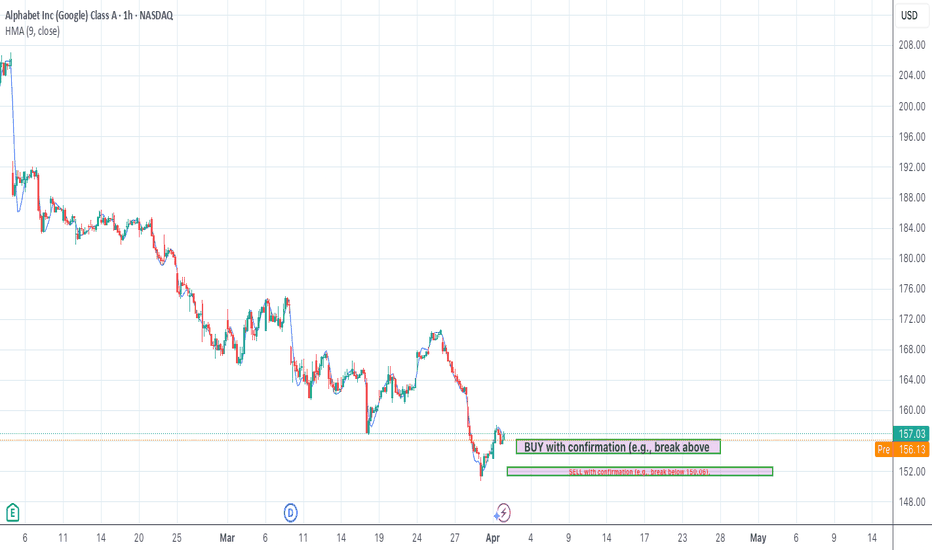

The analysis focuses on the short-term to medium-term timeframe.The analysis focuses on the short-term to medium-term timeframe.

Tug-of-War Between Bulls and Bears: At the current price of 157.04, the market is in a tug-of-war between buyers (bulls) and sellers (bears).

Bulls are defending key support levels near 152.48 (Fibonacci 100% retracement of Wave C) and 154.34 (Expanded Flat target). A hold above these levels could signal a potential reversal.

Bears are attacking resistance levels at 160.31 (Fibonacci 100% projection of Wave C) and 162.82 (Expanded Flat target). A break below 152.48 could accelerate downward momentum.

Recent Price History: The market has been in a downtrend recently, with the price dropping from 191.18 (July 10, 2024) to 157.04. Key Fibonacci levels (e.g., 161.8% retracement at 159.84) and Elliott Wave patterns (e.g., Diagonal Ending Downward Candidate) have guided this decline. Momentum indicators (e.g., RSI at 47.51) suggest the downtrend may be losing steam, but the MACD histogram turning positive hints at a potential short-term bounce.

Current Sentiment (Technical & News):

Technical Indicators: Mixed signals. RSI (47.51) is neutral, while MACD shows a bullish crossover (histogram turning positive). The price is below key moving averages (e.g., 200-day SMA at 167.35), indicating a bearish bias.

News Sentiment: Mixed to slightly negative. Ad revenue pressures and regulatory risks weigh on sentiment, but long-term growth catalysts (AI, cloud) provide optimism. Analysts maintain a "Buy" rating despite near-term challenges.

Synthesis: The technical picture aligns with the news—short-term bearishness (price below MAs, ad revenue concerns) but potential for a reversal if support holds (undervaluation, bullish MACD).

Key Levels & Momentum:

The price is currently below the 50-day SMA (161.89) and 200-day SMA (167.35), signaling bearish dominance.

Momentum is fading (RSI neutral, Stochastic not oversold), but the MACD histogram suggests a possible short-term bounce.

2. Elliott Wave Analysis (Contextualized to Current Price)

Relevant Elliott Wave Patterns:

Diagonal Ending Downward Candidate (Valid): Suggests the downtrend may be nearing completion, with Wave 5 potentially ending near 152.48-154.34 (Fibonacci 100% projection).

Expanded Flat Upward Candidate (Potentially Valid): If the price holds above 152.48, this pattern could signal a corrective rally toward 162.82.

Wave Count vs. Indicators/Sentiment:

The Diagonal Ending pattern contradicts the bearish news sentiment but aligns with oversold technicals (RSI, MACD). This divergence suggests a potential reversal if support holds.

The Expanded Flat pattern would confirm a bullish reversal if the price breaks above 160.31.

Near-Term Projections:

Downside: A break below 152.48 could extend losses to 148.36 (161.8% Fibonacci projection).

Upside: A hold above 152.48 and break above 160.31 could target 162.82 (Expanded Flat target) and 167.35 (200-day SMA).

3. Strategy Derivation (Realistic, Actionable NOW, News Considered)

Primary Strategy: WAIT (due to conflicting signals).

Why Wait? The technical setup is mixed (bullish MACD vs. bearish MAs), and news sentiment is neutral-to-negative. The upcoming Q1 earnings could add volatility.

If Price Holds Support (152.48-154.34):

BUY with confirmation (e.g., break above 160.31).

Entry Zone: 154.34-156.13 (Fibonacci 78.6% retracement).

Stop-Loss: 151.44 (below recent low).

Take Profit: TP1 at 160.31 (Fibonacci 100%), TP2 at 162.82 (Expanded Flat target).

Risk/Reward: ~1:2 for TP1.

If Price Breaks Below Support (152.48):

SELL with confirmation (e.g., break below 150.06).

Entry Zone: 152.48-151.44.

Stop-Loss: 154.34 (above support).

Take Profit: TP1 at 148.36 (161.8% Fibonacci), TP2 at 145.90 (Wave 5 projection).

News Context Check:

Earnings uncertainty and ad revenue pressures favor caution. Reduce position size if trading.

4. Trade Setup (Actionable, Realistic, News Aware)

Direction: WAIT (watch key levels).

Key Levels to Watch:

Upside: 160.31 (breakout confirmation).

Downside: 152.48 (breakdown confirmation).

News Reminder: Be mindful of Q1 earnings and ad revenue trends.

5. Summary Section

✅ Investor / Long-Term Holder Summary:

Key Support: 152.48 (accumulation zone if held).

Long-Term Outlook: Undervalued (DCF: $260 vs. $157). Focus on AI/cloud growth.

Action: Wait for pullback to 152.48 or break above 167.35 (200-day SMA).

NZDUSD - Like a Bow and Arrow!!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈NZDUSD has been overall bullish trading within the rising wedge pattern marked in blue.

Today, NZDUSD is retesting the lower bound of the wedge.

Moreover, it is approaching a strong structure marked in green.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of structure and lower blue trendline acting as a non-horizontal support.

📚 As per my trading style:

As #NZDUSD approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

JPMorgan at a Crossroads Bullish Surge or Bearish Retreat ? Hello, fellow traders!

Today, I’m diving into a detailed technical analysis of JPMorgan Chase & Co. (JPM) on the 2-hour chart, as shown in the screenshot. My goal is to break down the key elements of this chart in a professional yet accessible way, so whether you’re a seasoned trader or just starting out, you can follow along and understand the potential opportunities and risks in this setup. Let’s get started!

Price Action Overview

At the time of this analysis, JPM is trading at 243.62, down -1.64 (-0.67%) on the 2-hour timeframe. The chart spans from late March to early May, giving us a good look at the recent price behavior. The price has been in a strong uptrend, as evidenced by the higher highs and higher lows, but we’re now seeing signs of a potential pullback or consolidation.

The chart shows a breakout above a key resistance zone around the 234.50 level (highlighted in red on the Volume Profile), followed by a retest of this level as support. This is a classic bullish pattern: a breakout, a retest, and then a continuation higher. However, the recent price action suggests some hesitation, with a small bearish candle forming at the current price of 243.62. Let’s dig deeper into the tools and indicators to understand what’s happening.

Volume Profile Analysis

The Volume Profile on the right side of the chart is a powerful tool for identifying key price levels where significant trading activity has occurred. Here’s what it’s telling us:

Value Area High (VAH): 266.25

Point of Control (POC): 243.01

Value Area Low (VAL): 236.57

Profile Low: 224.25

The Point of Control (POC) at 243.01 is the price level with the highest traded volume in this range, acting as a magnet for price. Since the current price (243.62) is just above the POC, this level is likely providing some support. However, the fact that we’re so close to the POC suggests that the market is at a decision point—either we’ll see a bounce from this high-volume node, or a break below could lead to a deeper pullback toward the Value Area Low (VAL) at 236.57.

The Total Volume in VP Range is 62.798M shares, with an Average Volume per Bar of 174.44K. This indicates decent liquidity, but the Volume MA (21) at 165.709K is slightly below the average, suggesting that the recent price action hasn’t been accompanied by a significant spike in volume. This could mean that the current move lacks strong conviction, and we might see a consolidation phase before the next big move.

Trendlines and Key Levels

I’ve drawn two trendlines on the chart to highlight the structure of the price action:

Ascending Triangle Pattern: The chart shows an ascending triangle formation, with a flat resistance line around the 234.50 level (which was later broken) and an upward-sloping support trendline connecting the higher lows. Ascending triangles are typically bullish patterns, and the breakout above 234.50 confirmed this bias. After the breakout, the price retested the 234.50 level as support and continued higher, reaching a high of around 248.02.

Current Support Trendline: The upward-sloping trendline (drawn in white) is still intact, with the most recent low around 241.50 finding support on this line. This trendline is critical—if the price breaks below it, we could see a deeper correction toward the VAL at 236.57 or even the 234.50 support zone.

Key Price Levels to Watch

Based on the Volume Profile and price action, here are the key levels I’m watching:

Immediate Support: 243.01 (POC) and 241.50 (recent low on the trendline). A break below 241.50 could signal a short-term bearish move.

Next Support: 236.57 (VAL) and 234.50 (previous resistance turned support).

Resistance: 248.02 (recent high). A break above this level could target the Value Area High at 266.25, though that’s a longer-term target.

Deeper Support: If the price breaks below 234.50, the next significant level is 224.25 (Profile Low), which would indicate a major trend reversal.

Market Context and Timeframe

The chart covers 360 bars of data, starting from late March. This gives us a good sample size to analyze the trend. The 2-hour timeframe is ideal for swing traders or those looking to capture moves over a few days to a week. The broader trend remains bullish, but the recent price action suggests we might be entering a consolidation or pullback phase before the next leg higher.

Trading Strategy and Scenarios

Based on this analysis, here are the potential scenarios and how I’d approach trading JPM:

Bullish Scenario: If the price holds above the POC at 243.01 and the trendline support at 241.50, I’d look for a bounce toward the recent high of 248.02. A break above 248.02 could signal a continuation toward 266.25 (VAH). Entry could be on a strong bullish candle closing above 243.62, with a stop-loss below 241.50 to manage risk.

Bearish Scenario: If the price breaks below 241.50 and the POC at 243.01, I’d expect a pullback toward the VAL at 236.57 or the 234.50 support zone. A short position could be considered on a confirmed break below 241.50, with a stop-loss above 243.62 and a target at 236.57.

Consolidation Scenario: Given the lack of strong volume and the proximity to the POC, we might see the price consolidate between 241.50 and 248.02 for a while. In this case, I’d wait for a breakout or breakdown with strong volume to confirm the next move.

Risk Management

As always, risk management is key. The 2-hour timeframe can be volatile, so I recommend using a risk-reward ratio of at least 1:2. For example, if you’re going long at 243.62 with a stop-loss at 241.50 (a risk of 2.12 points), your target should be at least 248.02 (a reward of 4.40 points), giving you a 1:2 risk-reward ratio. Adjust your position size to risk no more than 1-2% of your account on this trade.

Final Thoughts

JPMorgan Chase & Co. (JPM) is showing a strong bullish trend on the 2-hour chart, with a confirmed breakout above the 234.50 resistance and a retest of this level as support. However, the recent price action near the POC at 243.01 and the lack of strong volume suggest that we might see a pullback or consolidation before the next move higher. The key levels to watch are 241.50 (trendline support), 243.01 (POC), and 248.02 (recent high).

For now, I’m leaning slightly bullish as long as the price holds above 241.50, but I’ll be ready to adjust my bias if we see a break below this level. Stay disciplined, manage your risk, and let the market show its hand before taking a position.

What are your thoughts on this setup? Let me know in the comments below, and happy trading!

This analysis is for educational purposes only and not financial advice. Always do your own research before making any trading decisions.

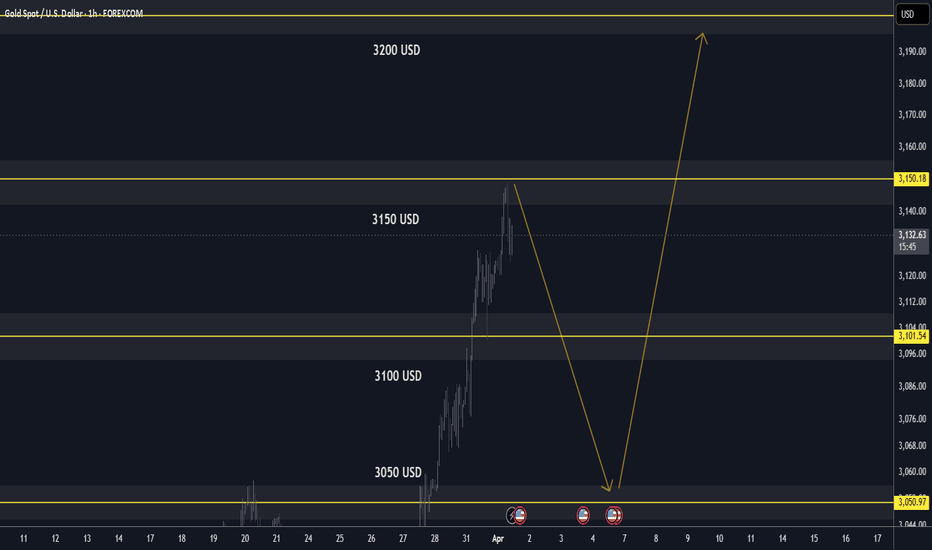

GOLD Market Update: Pullback in Progress BUY DIPS TP 3200 USD🏆 Gold Market Update (April 1st, 2025)

📊 Technical Outlook Update

▪️Bullish OUTLOOK

▪️Broke out and set new ATH

▪️Strong UPTREND: Sequence of Higher Lows

▪️Recommend to BUY DIPS at $3,050 USD

▪️Price Target BULLS: $3,150 USD - $3,200 USD

📈 Market Performance & Price Action

🚀 Gold Hits All-Time High: Surpassed $3,100 per ounce

📊 Driven by: Geopolitical tensions and economic uncertainty

🏦 Federal Reserve Impact

🛑 Fed Keeps Interest Rates Steady: Maintained at 4.25%–4.50%

🔮 Signals: 2 rate cuts likely in 2025 due to slowing growth

📉 Lower rate outlook supports bullish gold sentiment

💹 Gold Investment Trends

📈 Gold ETFs Outperform Physical Gold

GDX (Gold Miners ETF): ↑ 32%

GLD (SPDR Gold Shares): ↑ 15.5%

📊 Investors leaning toward mining stocks & ETF exposure for higher returns

theta buy midterm "🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

HelenP. I Gold is still rising and can reach 3115 pointsHi folks today I'm prepared for you Gold analytics. Some time ago, the price tested Support 2 at the 2985 level, which coincided with the support zone between 2985 and 2976 points. This area provided strong support, resulting in a bullish reaction that pushed Gold significantly higher. After bouncing from this key support zone, the price began a steady upward movement, eventually breaking above Support 1 at the 3055 level. This breakout was an important signal, as buyers continued to dominate, driving Gold further up. Following this breakout, the price continued its bullish momentum, clearly holding above the trend line, which has repeatedly acted as reliable support during this rise. Recently, Gold reached the support zone at 3055-3065 points again, retested it, and confirmed the strength of the buyers with a quick upward reaction. Currently, the price is trading comfortably above this support zone and remains firmly bullish in structure. Given the recent bullish impulse, the successful retest of the support zone, and the continuing hold above the trend line, I expect the price to move upward toward my current goal at 3115 points. If you like my analytics you may support me with your like/comment ❤️

ZEC ANALYSIS📊 #ZEC Analysis

✅There is a formation of Falling Wedge Pattern on daily chart with a good breakout and currently retesting the major resistance zone🧐

Pattern signals potential bullish movement incoming after a breakout of major resistance zone

👀Current Price: $37.80

🚀 Target Price: $50.00

⚡️What to do ?

👀Keep an eye on #ZEC price action and volume. We can trade according to the chart and make some profits⚡️⚡️

#ZEC #Cryptocurrency #TechnicalAnalysis #DYOR

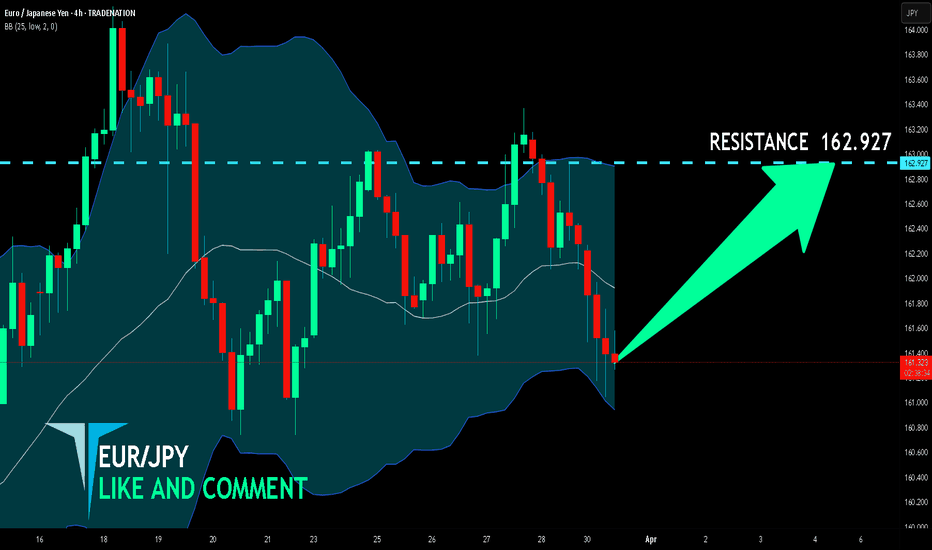

EUR/JPY BEST PLACE TO BUY FROM|LONG

Hello, Friends!

We are targeting the 162.927 level area with our long trade on EUR/JPY which is based on the fact that the pair is oversold on the BB band scale and is also approaching a support line below thus going us a good entry option.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

US100 BULLS ARE STRONG HERE|LONG

US100 SIGNAL

Trade Direction: long

Entry Level: 19,170.0

Target Level: 20,308.4

Stop Loss: 18,413.4

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 9h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

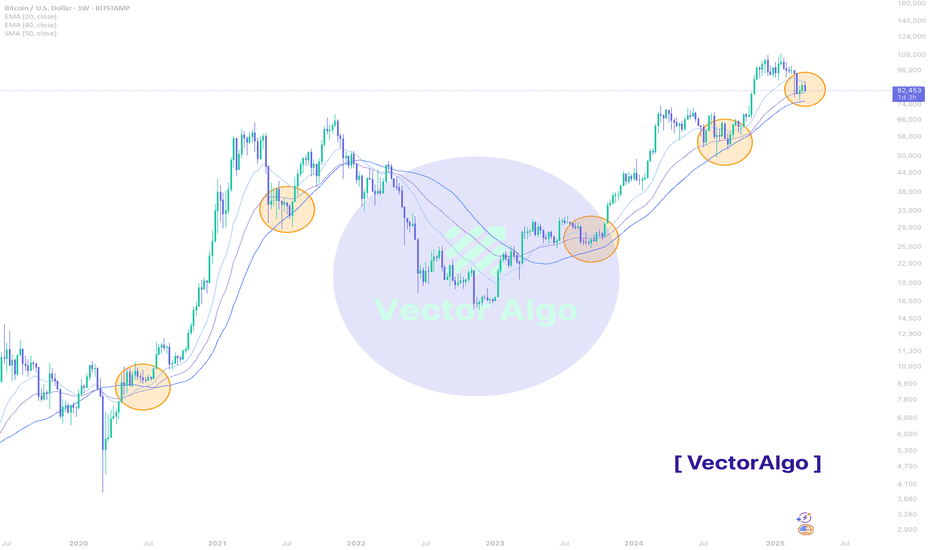

Bitcoin - EMA Support Holding Strong!#BTC/USD #Analysis

Description

---------------------------------------------------------------

BTC/USD – Weekly Chart Analysis

📉 Current Price: $82,239 (-4.47%)

📈 Key Moving Averages:

🔹 EMA 20: 88,143

🔹 EMA 40: 81,116

🔹 SMA 50: 76,230

EMA Support Holds Strong – The chart highlights multiple historical instances where BTC found support at the 20-40 EMA zone (orange circles). This pattern has played out consistently in past market cycles.

- Bullish Trend Continuation – Each time BTC has tested this EMA region on a pullback, it has led to strong recoveries and further bullish momentum.

- Current Market Structure – BTC is once again testing this key EMA support zone. A bounce from here could signal a continuation of the uptrend.

- Historical Patterns Repeat – The blue shaded region and Vector Algo's AI-optimized signals indicate that similar setups have resulted in upward moves.

✅ Bullish Scenario: If BTC holds above the EMA 40 ($81,000) and forms bullish confirmation candles, we could see a move toward previous highs ($96,000) and possibly $100,000+.

❌ Bearish Scenario: A breakdown below $81,000 could lead to further downside towards the 50 SMA ($76,000) and lower demand zones.

Bitcoin remains in a strong uptrend, and the current EMA support test is crucial for trend continuation. Keeping an eye on price action around this zone is key for potential long opportunities!

---------------------------------------------------------------

Enhance, Trade, Grow

---------------------------------------------------------------

Feel free to share your thoughts and insights. Don't forget to like and follow us for more trading ideas and discussions.

Best Regards,

VectorAlgo