S Trade Setup - Waiting for Retrace to SupportS has had a strong rally over the last two weeks and is now at resistance. We’re waiting for a retrace to the next support level before entering a long spot trade.

🛠 Trade Details:

Entry: Around $0.55

Take Profit Targets:

$0.62 (First Target)

$0.74 - $0.80 (Mid Target)

$0.91 - $0.98 (Extended Target)

Stop Loss: Just below $0.48

We'll be watching for confirmation of support before executing the trade! 📈🔥

Bullish Patterns

AVAX Trade Setup - Waiting for Retrace to SupportAVAX has had a strong run over the last two weeks. Now, we're waiting for a retrace to key support before entering a long spot trade.

🛠 Trade Details:

Entry: Around $20.00

Take Profit Targets:

$23.50 (First Target)

$31.00 (Extended Target)

Stop Loss: Just below $18.00

Watching for buying pressure at the support level before confirming the move! 📈🔥

GOLD - Eyeing Two Levels!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 XAUUSD remains overall bullish in both the short and medium term, trading within the rising channels marked in orange and green.

🔍 Here are two key levels I'm watching for potential trend-following long setups:

1️⃣$3,000 – A psychological round number that aligns with the lower orange trendline.

2️⃣$2,950 – A support level that intersects with the lower blue trendline.

Let’s see if the bulls hold the line! 🐂✨

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

ZEC/USDT: Breakout in Play – 100%+ Upside Move Incoming?🚀 Hey Traders! ZCASH Breakout Alert – 100%+ Move Loading? 👀🔥

If you’re pumped for this setup, smash that 👍 and hit Follow for premium trade ideas that actually deliver! 💹🔥

🔥 ZEC/USDT – Massive Breakout in Play! 🚀

ZEC is breaking out from a symmetrical triangle on the 6H timeframe and has successfully retested it, confirming the breakout. 💥

With this solid retest, ZEC looks poised for a 100%+ upside move.

Long some here with low leverage and add more on dips to ride the wave higher. 🚀

💰 Trade Setup:

📍 Entry: CMP and add more up to $35

🎯 Targets: $41 / $52 / $63 / $72 📈

🛑 Stop-Loss: $32.80

⚡ Leverage: Use low lev (Max 5x)

🔎 Strategy:

✅ Enter with low leverage now

✅ Add more on dips and ride the breakout momentum 🚀

💬 What’s Your Take?

Are you bullish on ZEC’s breakout potential? Share your targets, analysis, and predictions in the comments! Let’s crush it and secure those gains together! 💰🔥🚀

UNI Trade Setup - Strength After Liquidity SweepUNI has swept underside liquidity and is now holding strong. If price consolidates above $7, we’ll be looking for local lows to form, setting up a medium-term move higher as broader markets push into resistance.

🛠 Trade Details:

Entry: Around $7 zone

Take Profit Targets:

$10.50 – $11.00 (First Target)

$14.50 – $15.00 (Extended Target)

Stop Loss: Daily close below $5.5

Waiting for market confirmation before positioning for the next leg up! 📈🚀

LINK Trade Setup - Higher Low ConfirmationLINK is showing early signs of reversal from a key higher timeframe support zone. We anticipate a short-term dip into the buy zone before shifting into an expansion phase.

🛠 Trade Details:

Entry: $13 – $14 (Buy Zone)

Take Profit Targets:

$17.00 - $17.70 (Initial Resistance)

$21.70 - $22.40 (Breakout Target)

Stop Loss: Daily close below $12

Looking for higher low confirmation before the move up. 📈🚀

S/USDT: FALLING WEDGE BREAKOUT!! 🚀 Hey Traders! SONIC Breakout Alert – ATH Incoming? 👀🔥

If you’re excited for this setup, smash that 👍 and hit Follow for premium trade ideas that actually deliver! 💹🔥

🔥 SONIC/USDT – Breakout & Retest in Play! 🚀

SONIC is breaking out of a falling wedge on the 4H timeframe and is currently retesting the breakout level. With momentum building, we’re expecting a move toward ATH soon.

💰 Trade Setup:

📍 Entry: CMP, add more up to $0.50

🎯 Targets: $0.56 / $0.62 / $0.69 / $0.78 / $0.85 / $0.96

🛑 Stop-Loss: $0.46

⚡ Leverage: Low (Max 5x)

🔎 Strategy:

Enter with low leverage now

Add more on dips and ride the wave higher

💬 What’s Your Take?

Are you bullish on SONIC’s breakout? Share your analysis, predictions, and strategies in the comments! Let’s lock in those gains and ride this pump together! 💰🚀🔥

USDJPY BUY📊 EUR/JPY - Order Block & Break of Structure (BOS) Strategy 📊

Tracking EUR/JPY on the 15-minute timeframe, we see a potential bullish setup based on order blocks (OBs) and smart money concepts (SMC). However, confirmation via Break of Structure (BOS) on lower timeframes will be key before entering a trade.

Key Zones:

Bullish Order Block (Demand Zone): 161.000 - 160.700

Expecting price to drop into this area, where institutions previously showed strong buying pressure.

Looking for BOS on lower timeframes (M5/M1) to confirm bullish intent before entering a buy position.

Bearish Order Block (Supply Zone): 163.500 - 163.700

A strong resistance level where price previously sold off.

If price reaches this area, we could see a reaction or potential reversal.

Trade Plan:

📉 Wait for price to enter the demand zone (161.000 - 160.700).

🔎 Look for a Break of Structure (BOS) on lower timeframes (M5/M1) to confirm bullish reversal.

✅ Enter a long position upon confirmation.

🎯 Targeting the supply zone at 163.500 - 163.700.

⚠️ Stop-loss below 160.700 to manage risk.

S - Roadmap to $1S has been overall bullish trading within the rising channel marked in blue.

Currently, S is retesting the upper boundary of the channel and a key structure at $0.63.

For the bulls to stay in control and aim for the $1 round number, a break above $0.63 is needed.

In the meantime, if S retests the lower boundary of the blue channel and the $0.50 round number, we will be looking for trend-following long opportunities.

IP/USDT: BREAKOUT ALERT!!🚀 Hey Traders! IP Breakout Alert – 80% Move on the Horizon? 👀🔥

If you’re pumped for this setup, smash that 👍 and hit Follow for premium trade ideas that actually deliver! 💹🔥

🔥 IP/USDT – Massive Breakout in Play! 🚀

IP is breaking out from a triangle on the 4H timeframe and looks primed for a 70-80% upside move. This setup has huge potential, making it a must-watch trade. 💥

💰 Trade Setup:

📍 Entry: $6.10 – $6.35

🎯 Targets: $6.96 / $7.84 / $8.92 / $11.2 📈

🛑 Stop-Loss: $5.78

⚡ Leverage: Use low lev (Max 5x)

🔎 Strategy:

✅ Enter with low leverage now

✅ Add more on dips and ride the breakout momentum 🚀

💬 What’s Your Take?

Are you bullish on IP’s breakout potential? Share your targets, analysis, and predictions in the comments! Let’s crush it and lock in those gains! 💰🔥🚀

avax buy limit midterm "🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

BEAM Trade Setup - Gaming Sector StrengthWith the gaming sector holding strong, BEAM is showing signs of momentum after forming a higher low, signaling a possible upward move.

🛠 Trade Details:

Entry: Around $0.0075 (Support Level)

Take Profit Targets:

$0.0083 (Initial Resistance Zone)

$0.0098 (Breakout Zone)

$0.011 (Major Resistance Target)

Stop Loss: $0.0067

Looking for bullish confirmation before entry. 🎮🚀

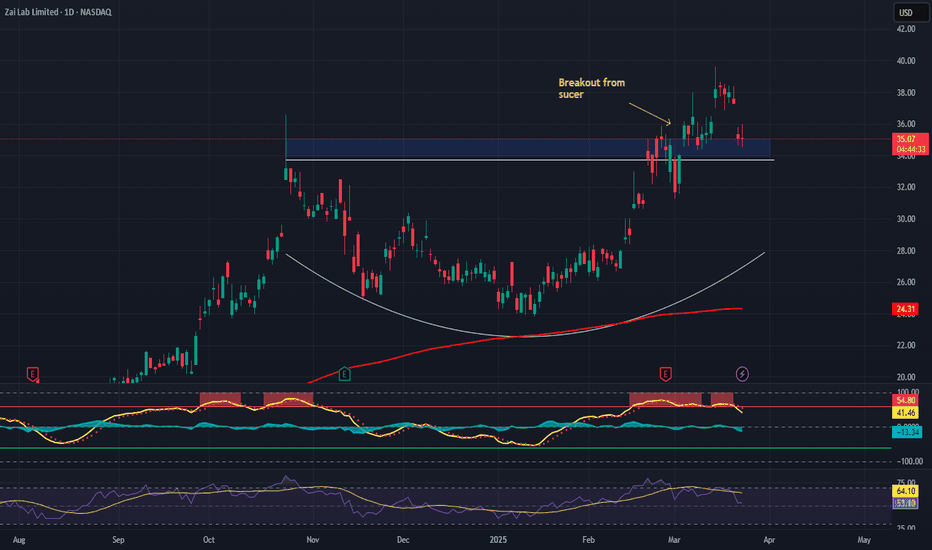

Zai Lab (ZLAB) – Biotech Growth & Profitability PathCompany Overview:

Zai Lab NASDAQ:ZLAB , a leading Chinese biotech firm, is on track for non-GAAP profitability by Q4 2025, driven by strong revenue growth & cost management.

Key Catalysts:

Financial Discipline & Expansion 💰

Operating losses fell 45% in Q4 2024, highlighting cost efficiency while scaling operations.

Analysts project $2 billion in annual revenue by 2028, reinforcing long-term value creation.

Blockbuster Drug Pipeline 💊

VYVGART generated $93.6M in its first full launch year, demonstrating strong adoption.

KarXT & bemarituzumab are key upcoming growth drivers, expanding ZLAB’s market footprint.

Investment Outlook:

Bullish Case: We are bullish on ZLAB above $34.00-$35.00, supported by financial execution & product expansion.

Upside Potential: Our price target is $54.00-$55.00, driven by strong product adoption & long-term growth trajectory.

🔥 Zai Lab – Unlocking the Future of Biotech Innovation. #ZLAB #Biotech #GrowthStocks

GBPUSD - Chasing the Bulls!!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈GBPUSD has been overall bullish trading within the rising channel marked in red.

Moreover, the blue zone is a major daily support.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of daily support zone and lower red trendline acting as a non-horizontal support.

📚 As per my trading style:

As #GBPUSD approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

QTUM is almost ready...NASDAQ:QTUM -@qtum

Qtum is a smart contract platform forked from Bitcoin Core and Ethereum.🔐

#QTUM rejected the $2 support level and round number.

For the bulls to take control in the medium term, a break above the inverse head and shoulders neckline marked in orange at $2.47 is needed.🚀