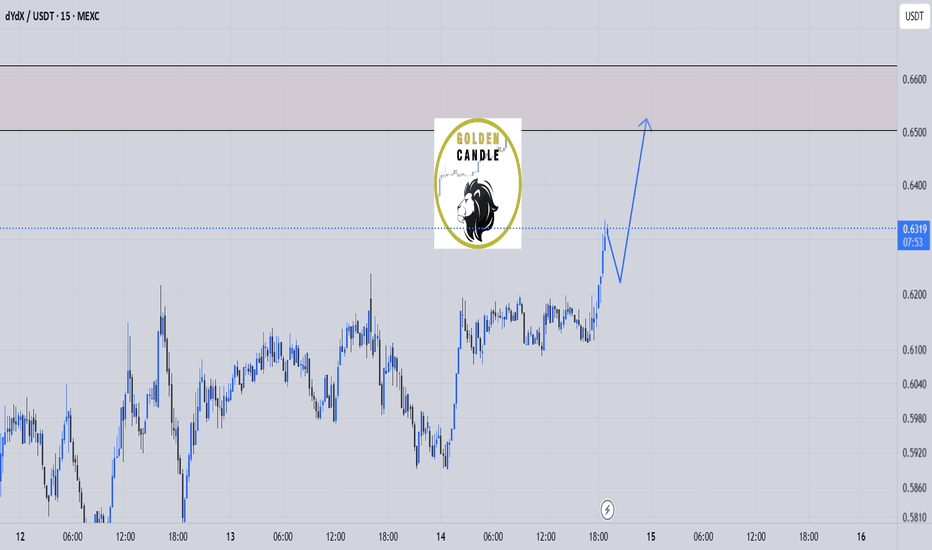

dydx buy midterm "🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

Bullish Patterns

XRP Approaches Critical Support at $2.00Key Technical Level:

XRP is testing the strong $2.00 support level, which has consistently acted as a key price floor since December.

Descending Triangle Formation:

The price action is forming a descending triangle, where decreasing volatility suggests an imminent breakout. This pattern emerges as XRP approaches the intersection of descending resistance and horizontal support.

Bullish or Bearish?

A confirmed breakout above resistance could trigger a strong rally.

A sustained drop below $2.00 would invalidate the bullish outlook, potentially leading to a retracement toward $1.60-$1.80.

Market Perspective:

XRP’s rally from $0.60 to over $3.40 since November suggests that the current correction is likely a phase of profit-taking rather than a full trend reversal. However, traders should remain cautious and watch for confirmation of direction.

Stay alert—XRP is at a decisive moment! 🚀📉

#XRP #Crypto #MarketAnalysis #Trading #TechnicalAnalysis #Cryptocurrency #Bullish #SupportLevel

Rocket Companies (RKT) – Fintech-Driven Mortgage GrowthCompany Overview:

Rocket Companies NYSE:RKT is a fintech leader in mortgage and real estate solutions, leveraging AI-driven efficiency to enhance profitability and market share.

Key Catalysts:

Surging Profitability & Efficiency 💰

Adjusted EBITDA margin rose to 18% in Q4 2024, up from 2% a year prior, reflecting strong financial performance.

Rocket Mortgage Growth 📊

Net rate lock volume surged 47% YoY to $23.6 billion, far outpacing industry trends.

Expanding Servicing Portfolio 📈

The $593 billion servicing portfolio (+17%) provides stable revenue and cross-selling opportunities, acting as a hedge against rate volatility.

Resilient Market Share Expansion 🏆

Despite industry headwinds, Rocket continues to grow market share, proving its competitive edge in mortgage lending.

Investment Outlook:

Bullish Case: We are bullish on RKT above $11.80-$12.00, driven by profitability gains, market expansion, and portfolio strength.

Upside Potential: Our price target is $20.00-$21.00, reflecting sustained growth and operational efficiency.

🔥 Rocket Companies – Powering the Future of Mortgage & Fintech. #RKT #MortgageTech #FintechGrowth

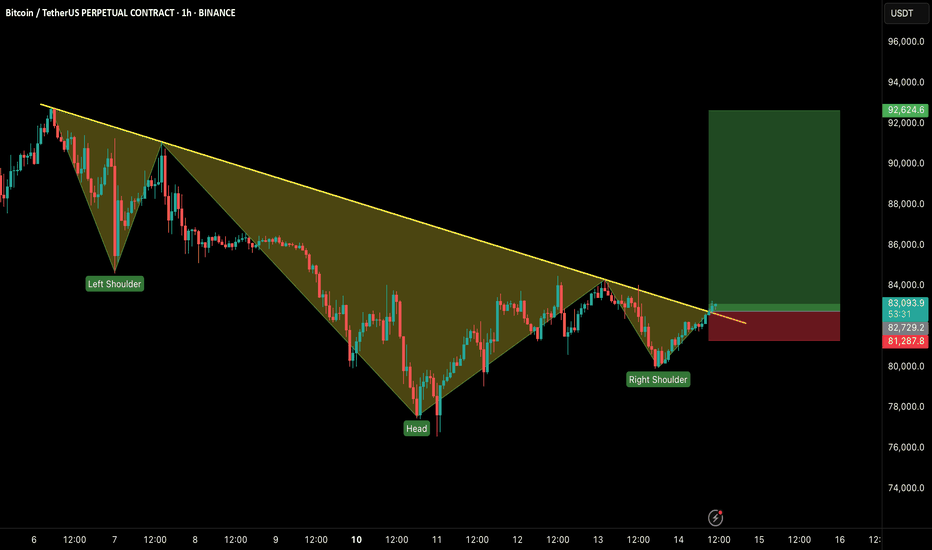

#BTCUSDT: BULLISH BREAKOUT IN LTF!!🚀 Hey Traders!

If you're finding value in this analysis, smash that 👍 and hit Follow for high-accuracy trade setups that actually deliver! 💹🔥

BTC is breaking out from an inverse head & shoulders pattern on the 1H timeframe, signaling strength! 📈 If it holds above the neckline, we could see a strong rally toward $90K– GETTEX:92K in the coming days! 🚀

🔹 Key Levels to Watch:

✅ Target: $90K– GETTEX:92K

❌ Invalidation: Close below $81,200

Momentum is building—can bulls take control? Let us know in the comment section.

Silver Is Eyeing 34-35 Area; Intraday Elliott Wave AnalysisSilver made a three-wave abc correction in wave 4 which can now extend the rally for wave 5 within a new five-wave bullish cycle towards 34-35 area. After recent five-wave impulse into wave "i", followed by an abc corrective setback in wave "ii", it formed a nice intraday bullish setup. Seems like it's now ready for a bullish resumption within wave "iii", so more upside is expected, especially if breaks above trendline and 32.66 level, just watch out on short-term pullbacks.

$SOL Dumps 60% - Is it Over !?CRYPTOCAP:SOL DUMPED OVER 60% ‼️

That’s after a 3,500% pump

from the bear market low in ’22.

Is it over!?

TL;DR - NO.

This is common after such an insane pump.

SOL Dec ’20 - May ’21

5,700% pump

71% correction

then another 1,290% pump

Let’s look at previous cycles with $ETH.

Dec ’16 - June ’17

6,380% pump

67% correction

then another 916% pump

Dec ’18 (bear market low) - May ’21

4,860% pump

62% correction

then another 185% pump

So you see my fine feathered friends,

there’s nothing new here.

Targets still remain $700-850 🤠

The Next Leg nas100To me this is very bullish (break and retest on lower time frames and even the 6month chart is showing a retest to the last candle close) Im looking for a 50 percent push back up on the bearish candle on the 6month chart and if we continue i will continue to hold and close partials

Tencent Music (TME) – Streaming Growth & Fan Engagement Company Overview:

Tencent Music Entertainment NYSE:TME is a leading digital music streaming platform with a 35.7% stock return over the past year, signaling strong market confidence.

Key Catalysts:

Q4 2024 Earnings on March 18 📊

Analysts anticipate positive results, which could boost investor sentiment.

Bubble Service Expansion on QQ Music 🚀

The new partnership with SM Entertainment’s Dear U enhances artist-fan engagement, increasing user retention and monetization.

Diverse Platform Ecosystem 🎧

Platforms like QQ Music, Kugou, Kuwo, and WeSing provide stable revenue while reducing reliance on any single platform.

Strategic Entertainment Partnerships 🤝

Collaborations with major entertainment entities expand TME’s content library and user engagement, solidifying its industry position.

Investment Outlook:

Bullish Case: We remain bullish on TME above $11.00-$12.00, driven by user growth, service expansion, and industry alliances.

Upside Potential: Our price target is $19.00-$20.00, backed by earnings growth, new services, and a strong content strategy.

🔥 Tencent Music – The Future of Digital Streaming & Fan Engagement. #TME #MusicTech #StreamingStocks

BITCOIN - WHERE ARE WE? When zooming out and looking at the Bitcoin chart, despite how crazy the market has been in recent weeks it comes down to a simple market structure with three separate clearly definable ranges:

RED RANGE (Accumulation) - From FEB '24 until the US election BTC chopped in primarily the top half of a range with five separate midpoint retests with progressively shallower rallies that eventually broke out with a catalyst from the political world.

BLUE RANGE (Expansion) - After a 10 month accumulation range the next phase in the bull cycle was expansion, a rally above ATH and into price discovery. An extremely thin inefficiency rally.

Now price currently is at the midpoint of this range and despite the geo-political waterfall of bad news BTC has held up better than I had expected given that usually a rally that goes straight up has no support levels on the way back down. The chart does suggest a retest at $73,700 at some point before deciding which direction to go in after that.

GREEN ZONE (Distribution) - For the last 3 months Bitcoins price has been extremely volatile, bouncing between $91-108K, the range containing price perfectly with weekly retests of the range bottom and a swing fail of the range high. That SFP set off the beginning of BTCs sell-off eventually breaking through the bottom and back into the blue range.

With Bitcoin at the midpoint of the middle range it's a perfect time to have a data release in CPI, A volatile news event that can be a catalyst for a larger market move and with Tradfi selling off, this CPI is the most important of the Trump administrations term so far:

CPI DAY

PREVIOUS: 3.0%

FORECAST: 2.9%

ACTUAL: ??

Bullish - sub 2.8% print. At least the market sell-off is having a positive effect on inflation and isn't painful for no reason. BTC reclaims blue midpoint with a view to retest blue high.

Bearish - 2.9% or higher. Market sell-off hasn't has an immediate effect on inflation so the sell-off is bad in all aspects, except for the Trump admin moving closer to their wish of a weaker dollar and lower interest rates. FWB:73K blue range bottom retest on the cards.

USOIL BEST PLACE TO BUY FROM|LONG

USOIL SIGNAL

Trade Direction: long

Entry Level: 66.90

Target Level: 73.40

Stop Loss: 62.52

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Bitcoin CME Gap at $77,930 Filled! Now, can $BTC push to $150K?Bitcoin CME Gap at $77,930 Filled! Now, can CRYPTOCAP:BTC push to $150K? 🚀

🔹 Support Level: $75,000 – If it holds, #BTC may target $100K+

🔻 If support breaks, my spot bids: $72K | $69K | $66K (Already filled at $77K ✅)

This drop was a liquidity flush to shake out high leverage traders. Stay prepared!

📢 Where’s your next buy order? Share below! 👇

#Bitcoin

doge longterm buy spot"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

TIA Trade Setup: Potential Double Bottom FormationWith seller exhaustion possibly setting in, TIA is shaping up for a double bottom formation. If price deviates from launch levels and confirms a market structure shift, we could see a strong upside move.

🛠 Trade Details:

Entry: Around $4.00

Take Profit Targets:

$5.50 (First TP - Key Resistance Zone)

$7.10 (Second TP - Breakout Level)

$9.00 (Third TP - Full Expansion Target)

Stop Loss: Below $3.00

Keeping an eye on volume confirmation and resistance reclaim before full conviction. 🚀

Hindalco-Bullish Swing- Very good signs of bullish momentum!

Buy above 644.05

Risk reward- 01:01

Target & Stoploss- 4.3%

1.Inside bar breakout found with bullish engulfing after forming 3 green soldiers- Good signs of momentum

2.Price has formed double bottom and hammer before reversal

3.Rejection from 0.318 Fibonacci level

4.Resistance turned to support after breakout with retesting

5.Reacted at support from RSI level

6.Very good fair value gap covered and rejected from FVG

7. 21 EMA cross over for reversal confirmation

8. Previous green candles strength are very good

Jindal Steel- Time to move?!

Buy Above 895.3

Risk: Reward- 01:01

Target and stop Loss: 4%

1.Parallel downward channel Resistance breakout and retest

2.Good green bars formation

3.Double bottom( W Pattern) and resistance in RSI

4. 21 EMA Support taken

5.Bullish fair value gap rejection

6. Bounced from Resistance turned to support zone

Hedera Goes From April Highs, To ATH, To Elliot Wave Theory? Lets break down what COINBASE:HBARUSD may be setting up for a long-term scenario!

We saw a impressive Bullish Rally from beginning of November 2024 that facilitated a Breakout of the April 2024 High @ .1842 to then create its All Time High @ .4010.

With this Price Action going from a Significant Low to create a new Higher High, we can apply the Elliot Wave Theory which is first supported by seeing some sort of Fibonacci Retracement from the Low to New High and we see that February of 2025 delivered a Fibonacci Retracement to the Golden Ratio Zone twice to now be showing support from Bulls pushing price higher!

Technically, with Wave 1 having been corrected successfully by Wave 2, both being completed, we now can expect price to give us another extension starting Wave 3, giving us a Break of the ATH created by Wave 1, to then confirm our directional bias and validate the Elliot Wave Theory.

Based on the Fibonacci Extension, we can project a potential "Roadmap" price may follow while outlining the rest of the Impulse and Corrective Waves where we see Price ultimately ending Wave 5 at the Potential Range Target of ( .7571 - .89441 )

Rules:

- The 2nd Wave cannot retrace the 1st Wave more than 100%

- The 3rd Wave can never be the shortest of the Impulse Waves ( 1,3,5 )

- The 4th Wave cannot retrace the 3rd Wave more than 100%

USD/CHF BULLISH BIAS RIGHT NOW| LONG

Hello, Friends!

We are going long on the USD/CHF with the target of 0.895 level, because the pair is oversold and will soon hit the support line below. We deduced the oversold condition from the price being near to the lower BB band. However, we should use low risk here because the 1W TF is red and gives us a counter-signal.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

SUI’s Wild Ride – Finding the Next Long Trade SetupSUI had an incredible 2024, skyrocketing +1060% in just 154 days. The price peaked at the psychological $5 mark, where multiple rejections signaled a momentum shift. By the end of January 2025, the trend turned bearish, leading to a sharp correction.

Trend Shift & Momentum Analysis

I've been working on a new trend identifier indicator that helps spot trends, allowing traders to identify swing trade opportunities and manage their positions effectively. This indicator clearly highlighted the momentum shift, confirming the bearish turn and the sharp price drop that followed.

Key Support Zones & Confluences

Now that the bearish trend is in play, the focus is on identifying a solid long opportunity:

Point of Control (POC) from Previous Trading Range (~$2) – A major psychological level that many traders are watching

Trend-Based Fibonacci Extension (1:1) at $2.0373 – Adding confluence to this critical support area

Fib Speed Fan (0.75 Level) – Aligns with the $2 region, reinforcing support

Anchored VWAP (~$1.885) – From the 2023 lows, acting as an additional support zone

What’s Next for SUI?

The market is in search of a strong support level where bulls can regain control. Let’s see if we find support at the $3 mark. The $2 zone stands out as a prime area for a potential long entry, given the multiple technical confluences. If price reaches this level, we’ll be watching closely for confirmation of a bullish reversal.

Final Thoughts

SUI has had an extraordinary run, but corrections are natural in strong trends. The key now is to see where price stabilises and if the bulls can make a strong comeback. Time will tell how this plays out, but for now, $2 is a level to keep an eye on for a potential long setup.

BTW: I've just launched a FREE TradingView indicator – Multi Timeframe 8x MA Support & Resistance Zones. It helps visualise key support and resistance levels across different timeframes. Check it out and let me know your thoughts!

$BTC: Key Levels to Watch in the MarketKey Levels to Watch in the Market

📉 Bybit hack aftermath:

Destroyed market sentiment

Shook institutional confidence

Killed the national reserve idea (US states considering Bitcoin reserves have now canceled their votes)

🚀 The last push to $99K was all Michael Saylor, spending SEED_TVCODER77_ETHBTCDATA:2B alone.

Is he insane? Buying at the top of the market?

Painful Consolidation Ahead?

We’re sitting at $91K—a crucial support. If Bitcoin fails to hold this level, expect a freefall to $85K, then possibly $81K (major support zones).

From there, Bitcoin can either:

✅ Bounce into a relief rally

❌ Break down into a full bear market if it falls below Support 3

Tough Times for Crypto

Meme coin frenzy scared off retail investors after massive losses.

Presidents rugging people doesn’t help trust in the industry.

Trump’s tariff policies could push inflation up, forcing the FED to hike interest rates.

Any Good News? Nope.

📉 SPX500 is also dropping.

🔍 TruthLabs warns that if a bear market starts, most exchanges and DeFi protocols won’t survive —they aren’t backed 1:1. This could trigger the worst bear market ever.

(See their warning here: x.com)

Final Thoughts

⚠️ Watch $91K—if it breaks, exit the market and wait. No need to get rekt in this toxic environment.

And pray that Tether has enough liquidity to handle the mass exodus. Put your funds on Binance or another reputable exchange.

🔍 DYOR