🔥 Bitcoin Bull-Flag: High Risk-Reward EntryBTC has reversed yet again from the 44k area and is currently in a short-term downtrend. In case this downtrend will continue for the next few days, I want to be prepared.

I'm eyeballing an entry from the bottom support of the bull-flag pattern. High probability that this area will cause some kind of reversal.

With a stop below the most recent swing low and a target at 48k, we can construct a very decent trade with a R/R of 7,64. A more risk-averse trader can take profits around the top resistance of the flag-pattern.

Bullish Flag

🚧EGLDUSDT will Go Up Again🚧 Road Map(DAILY)🗺️!!!

➡️EGLD has done a Impressive Movement recently but the odds of another bullish Movement is Pretty high because the pattern which EGLD is in, Is a Bullish Flag Pattern! Since The break out has not happened, there is no confirmation of a Bullish Movement But If It happens, we Can Expect a Bullish Movement as much as the Measured Price movement (flag pole) to happen!

🤑 Stay Awesome my friends.

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Thank you and for more ideas ❤️like❤️ and 🌟follow🌟!

🔥 Bitcoin Bull-Flag Break Out: Bulls Keep Winning!Over the course of the last week I've made multiple analyses where I discussed the bull-flag pattern that BTC was trading in, and my expected move towards 48k.

www.tradingview.com

After a retest of the top resistance of the triangle, the bullish trend continueed. In m view, it's a matter of time before BTC will make a new yearly high. With a little more than a week to go, 48k is still in the cards for this year.

The period between Christmas and New Year is historically a bullish one, so I think we can expect some fireworks. Even if we don't reach 48k this year, I still think it's going to be reached soon.

Like mentioned before, 48k is going to be a highly contested area. We're either going to sharply reverse from there and see a bearish period, or we will pierce the resistance and move to >50k.

GBPCADGBPCAD is in strong bullish trend.

As the market is consistently printing new HHs and HLs.

currently the market is retracing a bit after last HH, which is also the healthy retracement and local support as well. if the market successfully sustain this bullish confluence the next leg high could go for new HH

What you guys think of this idea ?

Speculative 3moth chart channel/bullflag on bitcoin So I basically took a trendline on the 3 month chart and connected the 2 bottom wicks on the most prominent red candles for the bottom trendline of the channel…I then cloned that specific trendline and placed the left side of it on the highest green candle wick for a top trendline to the potential channel low and behold our current 3 month candle is very very close to retesting that top trendline of the channel. SHould it retest this exact line and find it as resistance it greatly increases that this speculative channel is aa valid one in which case we can then take a measured move and determine were we then to later break up out of the channel…the target of the channel alone, were it to break up from the arbitrary spot I placed the dotted purple line on is around 80k-82k. We’re it to be more of a bullflag than just a channel then we can see a measured move of a bull flag breakout with the dotted green line that would then take is just above 100k. For now, I wont be confidant that this is a valid channel until I see precise resistance right on the top trendline either on this current 3 month candle or the next one, however I do get the feeling we will see something of the sort the way rice is acting when this close to it. We shall soon see. There are also people claiming because of the law of diminishing returns that there’s a chance the top of the upcoming bull market may not crack 100k, so keeping that in mind, if this channel does become valid, once we would hit the full target of the channel breakout, I would probably start taking a very close look at the pi cycle top indicator just in case the diminish returns theorists out there have a point, however with the wave of institutional level adoption poised for this next bull market I think probability still currently favors a bull market top above 100k this upcoming run. Still wise to seriously consider both sides to be ready for either outcome though. I just wanted to post this 3 month speculative pattern on here for now so I can continue to easily watch it the next few 3 month chart candles. *not financial advice*

Look At That Textbook Bull Pennant On The Bitcoin Daily ChartWould you just look at that beautiful, textbook bull pennant on the Bitcoin daily chart! You can't get much more textbook than that. What I am thinking based on this chart is that Bitcoin will make at least one more big rally this week up to that big supply zone between $47K-49K.

How this move happens has yet to be seen. We know that none of us have a crystal ball as much as we may think we do, and we need to take the data one candle at a time, but this is looking pretty bullish to me for the week.

Now, I fully expect Bitcoin to have a pretty major correction once we get to that supply zone. That bearish order block was formed at a pretty strong level so I fully expect for people to take profits in this area and looking for Bitcoin to make a correction, or at least some good consolidation so that we have a chance to repack our bags for the next moon shot.

We are still a few months off from the mining rewards being cut in half and anticipation is building. The ETF talk has got the markets all stirred up, so I am just taking it one day at a time.

Be safe out there in the crazy crypto markets! Nothing is set in stone and this is only my somewhat educated guess on what I see happening this week!

Trade Logically!

🔥 ADA Aggressive Bull-Flag SignalThis signal is based on the idea that ADA is currently trading inside a bullish flag pattern, consolidating before the next break out.

We're going to assume that the lows of the flag are already in and that the break out will occur shortly, hence the aggressive nature of the trade.

Stop below the recent low, target at 0.6$. A more patient trader might want to wait for the break out to be confirmed, which will result in a lower risk-reward.

🚧BITCOIN will Go Up Again🚧 Road Map(1-H)🗺️!!!As you can see, the price has reacted well to patterns in the past. If we are optimistic or realistic now, the price can grow well after breaking this pattern.

🤑Stay awesome my friends.

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⤵️⤵️⤵️⤵️⤵️⤵️⤵️⤵️⤵️⤵️⤵️⤵️⤵️⤵️⤵️⤵️⤵️⤵️⤵️⤵️⤵️⤵️⤵️

🔥 Bitcoin Bull-Flag: Road To 48,000$After a massive pump towards 44k, BTC has been consolidating for a couple of days now. My expectation is that this period of consolidation is only temporary and that we will break out in the near future, confirming the bull-flag pattern on the chart.

Patient traders will wait for the price to break through the top resistance of the pattern, potentially even for the retest of said resistance.

My target for 2023 has been 48k for a while now, so I'm aiming for a move towards that area, plus minus a percent or two.

Patience is key!

coins for pump listso here we will write the list of the coins and check time by time whats going on to them

SIDUS - is the next coin to be list for now , already had more than 300%

bought on 0.020500 and had chance for 0.0009 as well but fool to miss the entry point

as far as now made 1500+ Tether on 500 and from partial profit also added to another coin.

🔥 XRP: The Biggest Bull-Flag In Crypto Will Break Out SoonXRP has been trading inside a consolidating pattern since the massive pump at the height of the 2017-2018 bull-market.

During this time, the price has made higher-lows and lower-highs, forming a triangle pattern, which I classify as a bull-flag since it has been formed directly after the 7,000x in 2017.

This huge pattern will explode at some point in 2024, with the most likely move being a bullish one with the halving in mind.

My target for the break out is placed at 25$. It might be too high, but ADA also made a top 6x higher than the previous one last cycle, so why not? With a relatively tight stop and a far target we're able to create a signal with a risk-reward of almost 80, a potential game changer for anyone's portfolio.

TQQQ - Leveraged QQQ rising after reversal LONGOn the highly reliable weekly chart, price was under the Ichimoku cloud since April 2022

putting in a couple of bear flags on the way down while first getting support two standard

deviations below the mean anchored VWAP and then one standard deviation showing

increasing strength finally crossing above the mean VWAP in May then with a retest and bounce

in late October while forming a bull flag. The breakout in the past month suggests another

leg up is underway with a potential of the same magnitude as the flagpole in the current

pattern. If accurate this could lead to a price of $68 by next July or 70% higher than

the present over 7 months. I will take a trade of 10 call options with a strike of $ 65.00 for

a July expiration. Each time the stock price rises by $5.00 I will close one of the options

yielding a tiered liquidation along the way to collect profit.

🔥 Ethereum PERFECT Bull-Flag Break OutIn my most recent ETH analysis I wrote that ETH was likely forming a bull-flag pattern and was going to break out in the near future.

And here we are. A break out, followed by a retest of the top resistance, which is exactly what bulls want to see.

Our entry has been hit and stop moved just below the retested resistance. This constructs a very decent trade with a risk-reward well over 12.

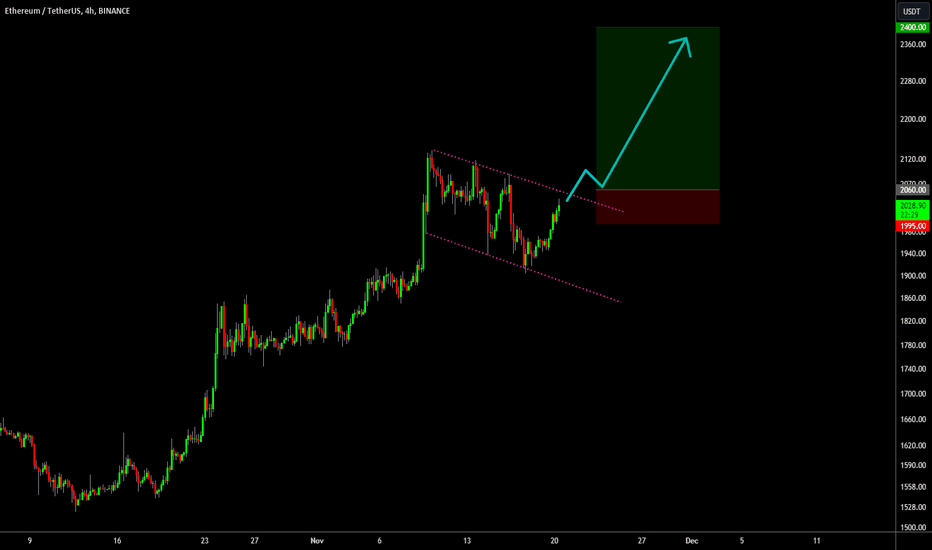

🔥 Ethereum Bull-Flag: Patience For Break OutETH has been consolidating for nearly 10 days now, after a huge move from the 1500's to 2100$.

With the market rallying over the last couple of days, I see a decent probability for ETH to break out of this bull-flag and continue the rise up. Bull-flags are bullish continuation patterns, to bullish price action is the most likely result from this pattern.

Target at 2400$ for the coming weeks.

🔥 Bitcoin Breaking Out! $40,000 Here We Come 🚀Bitcoin is currently in the process of breaking out of a bullish flag pattern that has been in the works ever since we hit 35k last week.

If we can get a 4H candle close above 35,250 I'm considering it a successful break out, with a likely continuation of the bull trend.

40k is my target for now, as per my initial bullish break out analysis several days ago.

Keep in mind that we have a FED meeting tonight. The market expects the rates to remain the same, so unless the FED will surprise the market it should be business as usual?

Nevertheless, things are looking better for the bulls!