Bullishpattern

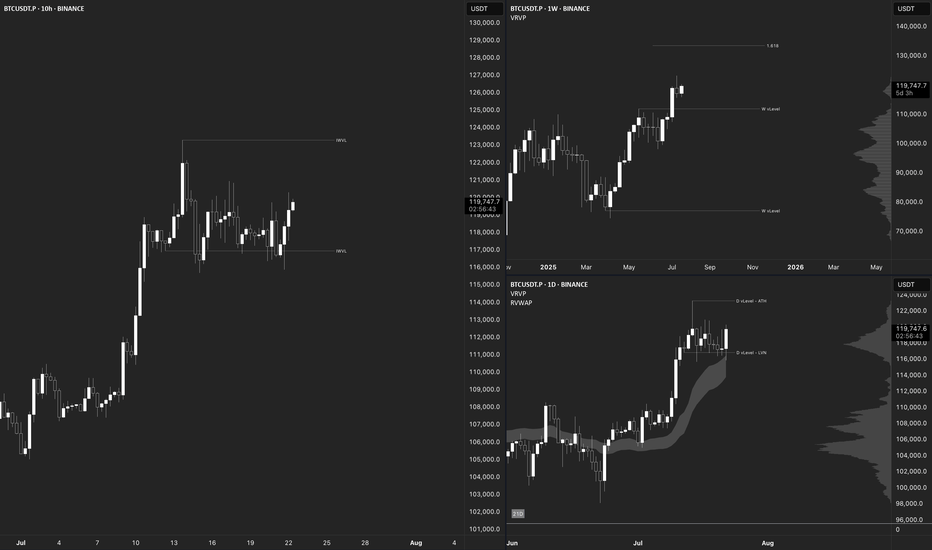

$BTC Macro UpdateBitcoin Macro Outlook BINANCE:BTCUSDT.P

Weekly

Bias & momentum remain bullish. Price is pressing toward new ATHs despite last week’s pullback.

Next macro target: ~$133,550 (extension of the current DeCode V-Range: 111,959.5 – 77,111.0).

A weekly close back inside that range (<111,968.0) = Failed Auction → serious red flag for reversal.

Daily

Clean rejection off the 21-Day Rolling VWAP + bounce at the structural HL V-Level (116,862.4).

A strong bullish engulfing today would set the tone for follow-through this week.

10-Hour

Structure is still bullish. Multiple Failed Auctions from ~116,960.0 are driving price toward the ATH.

Intraday

Choppy and hugging range lows → harder read. That behavior near balance edges triggers AMT Rule #5: “If time/volume builds at the edge of balance, price is likely to push through.”

Auction Market Theory – Quick Reminders

Price : advertises opportunity

Time : regulates opportunity

Volume : tells you if the auction is succeeding or failing

Rule #5 (above) is in play right now. Stay patient, wait for confirmation, and don’t FOMO.

IOTA / USDT looking good to buy at the price of $0.2100IOTA/USDT faced rejection from local horizontal resistance and is now heading for a retest of the lower support zone. If market conditions remain stable, the $0.2100 area looks like a solid buy zone. The structure suggests a healthy pullback before a potential strong bounce.

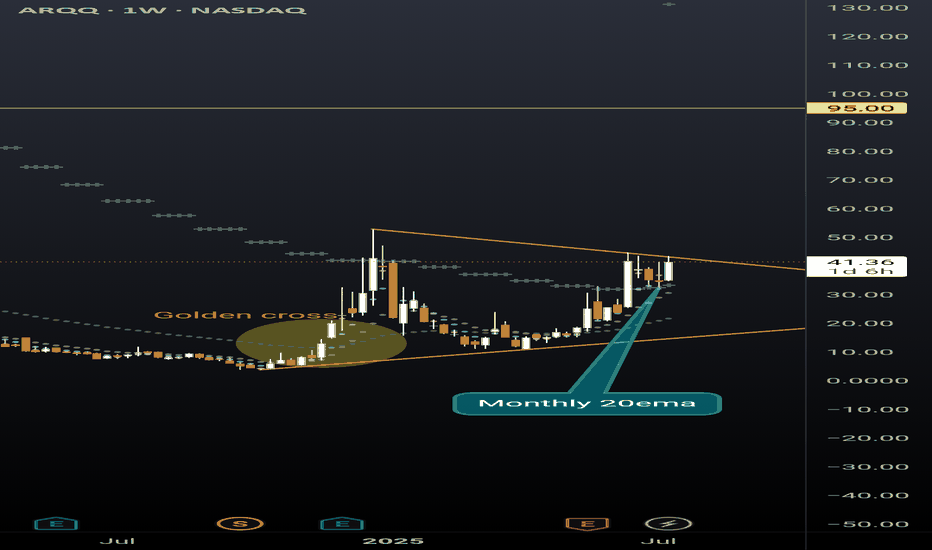

ARQQ weekly pennantBeautiful weekly pennant on ARQQ weekly timeframe. This chart is coiling nicely for a continuation. Still early in the process of reaching breakout but given the recent momentum in this sector a premature break to the upside can happen at any moment.

The ticker is currently sitting above the monthly 20ema (overlayed on this weekly chart), and just had a strong bounce off the daily 20ema (overlayed on this weekly chart). Golden cross is also highlighted that occurred in December 2024 with the daily 50ema retracing back to the daily 200ema and then continuing the uptrend earlier this spring.

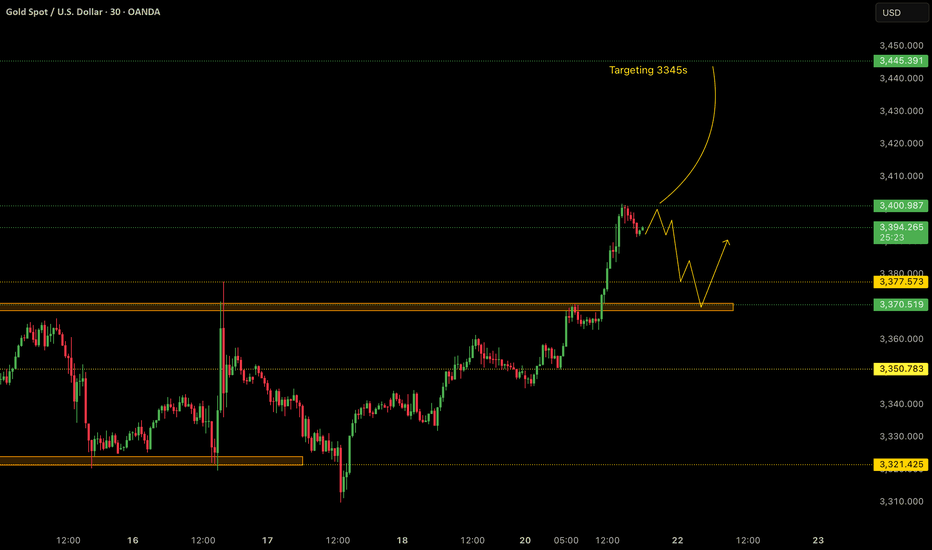

NordKern - XAUUSD InsightNordKern | Simplified Insight OANDA:XAUUSD possible scenarios

Gold saw some upside today, primarily driven by softer TVC:DXY and trade deadlines ahead. To be specific:

1. Softer U.S. Dollar (DXY)

The U.S. Dollar Index fell ~0.1–0.2% today, making gold more attractive for international buyers

Kitco confirms the decline in USDX, paired with weaker Treasury yields, is fueling bullion demand.

2. Cautious Market Ahead of Trade Deadlines

Markets are bracing for the August 1 U.S. tariff deadline, especially involving the EU. Investors are positioning defensively, increasing safe-haven interest in gold.

Heightened trade tensions and uncertainty including possible Trump-Xi talks boost demand for safe assets.

3. Falling Treasury Yields & Fed Policy Expectations

The U.S. 10‑year Treasury yield has slipped (~4.37%), reducing gold’s opportunity cost and supporting its attractiveness.

Market pricing shows increasing odds of a Fed rate cut at next week’s FOMC meeting, something analysts like Christopher Waller suggested.

4. Geopolitical & Trade Risk Premiums

Escalating trade risk (tariffs looming) and geopolitical uncertainty are prompting safe-haven inflows into gold.

India’s MCX mirror those sentiments: gold rose ~0.5% on local contracts amid global trade nerviness.

To sum it up:

Gold is rallying today primarily because of the softer dollar, lower yields, and elevated trade risks ahead of the August 1 tariff deadline all of which reinforce its safe-haven allure.

Trade Setup - Shorts; if we retest 3370s

- We would primarily look to enter into lower risk buys on gold at more preferable levels such as 3370. After breaking to the upside from the consolidation area, a pullback and a retest to that area would not be out of the ordinary.

Trade Setup - Buys; if we break above 3400

- In case of the dollar remaining soft, we can expect gold to continue its upside rally without any major pullbacks. In this case, we would be looking for the breaks of 3400 and continue to hold until around 3345s.

Key Notes:

- Softer Dollar

- Possible retest of 3370s

- Watch for potential breaks of 3400

This remains a tactically driven setup. Manage risk appropriately and stay alert for any renewed political developments.

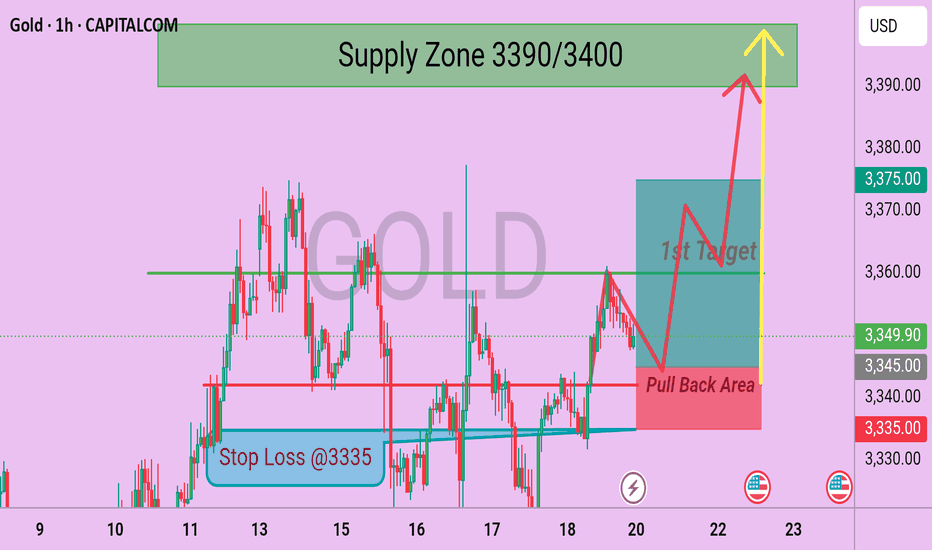

GOLD (XAU/USD) 1H Analysis – Bullish Setup in PlayGold is currently trading around the 3349.90 level after breaking out of a key consolidation range. Price action has shown bullish momentum supported by a breakout above a short-term descending trendline, suggesting potential continuation toward higher levels.

🔍 Key Technical Outlook:

Pullback Area (3345–3335): This zone has been identified as a potential retest area. Price may revisit this zone before continuing its upward trajectory. A clean bounce from here would confirm bullish control.

Stop Loss: Positioned below recent structural lows at 3335, giving room for the pullback while protecting against trend invalidation.

First Target Zone: The next major resistance and potential reaction level sits around 3360–3375, where profit-taking may occur. This aligns with historical resistance.

Final Target: If momentum sustains above 3375, the broader bullish move could extend toward the 3400 psychological level.

🧭 Bias:

Bullish, as long as the price holds above the pullback zone and does not close below the 3335 level on the 1H timeframe.

⚠️ Risk Note: Always wait for confirmation on lower timeframes or candlestick validation before entering trades. Maintain proper risk management.

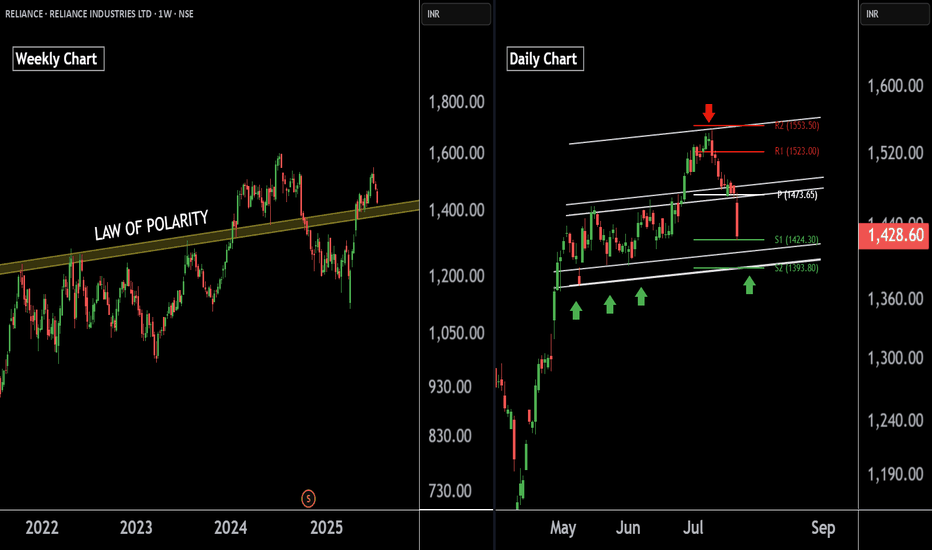

Reliance Industries — Preparing for the Next Bullish Leg !!There are two charts of Reliance Industries — one on the weekly timeframe and the other on the daily timeframe.

On the weekly timeframe:

Reliance industries is trading near (LOP), with a key support zone in the range of 1385–1400.

On the daily timeframe:

Reliance industries is moving in well defined parallel channel with support zone near at 1400-1410.the stock is also taking support at pivot levels S1 and S2, positioned between 1393 and 1422 levels.

If this level is sustain then we may see higher prices in Reliance industries.

Thank You !!

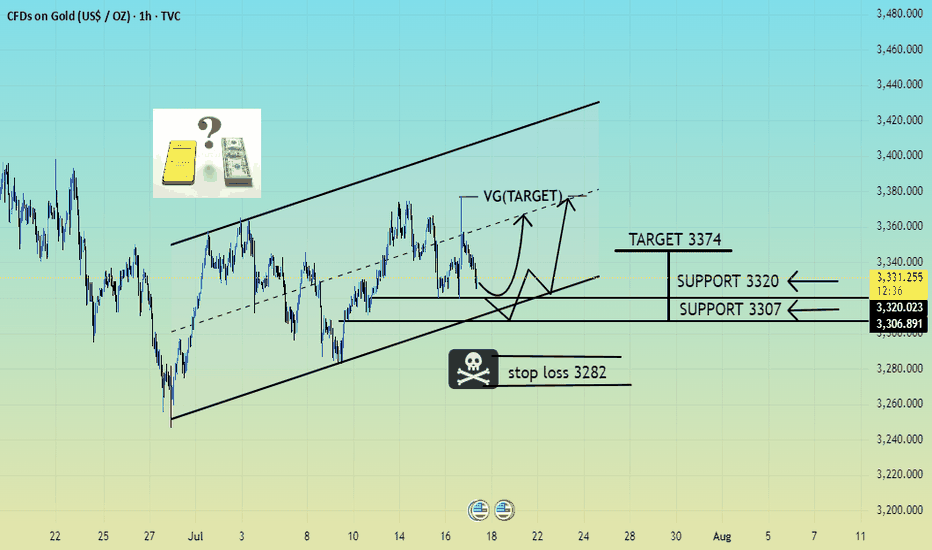

XAUUSD SELL OR TRAP (READ CAPTION)Hi trader's. what do you think about gold

current price: 3331

gold is working in bullish Parrallal channel under gold retest is down side 3320 and 3307 this is support market respect this zone and reject support and and h1 candle close in bullish so possible gold pump upside

support zone: 3320:3307

resistance zone :3345

supply 3374

please like comment and follow thank you

AUD/NZD – Falling Wedge Breakout with Bullish DivergenceAUD/NZD is currently forming a falling wedge pattern on the 1-hour timeframe, a structure typically associated with bullish reversals. Notably, bullish divergence on the RSI is developing while price continues to print lower lows, RSI is making higher lows, indicating weakening selling momentum.

Trade Setup:

Buy Stop Entry: 1.09309 (above recent Lower High — confirmation of breakout)

Stop Loss: 1.09094 (recent Lower Low )

Take Profit 1 : 1.09520

Take Profit 2 : 1.09740 (full pattern projection target)

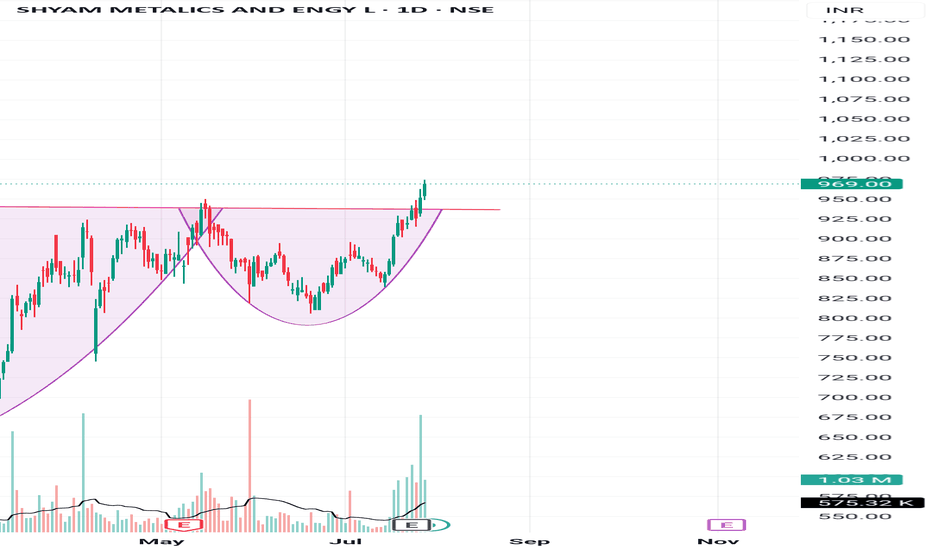

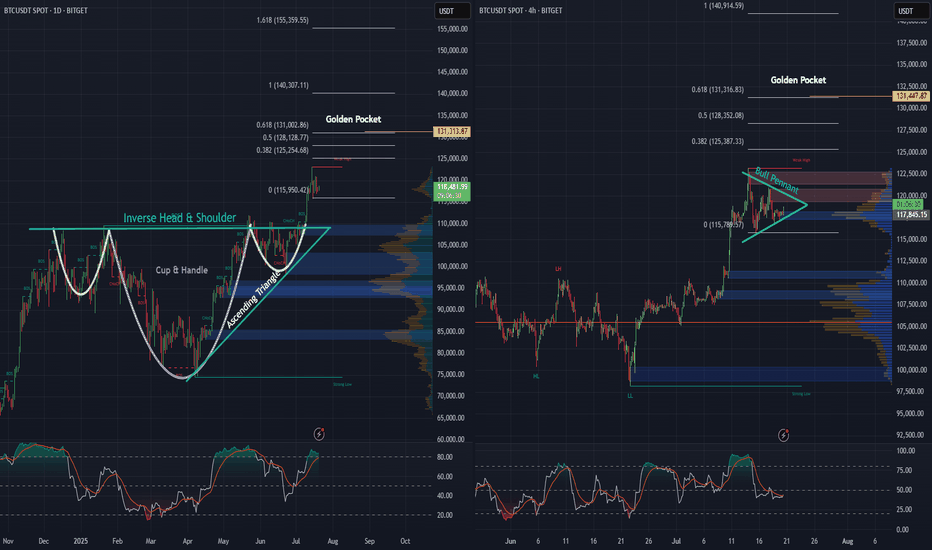

BTC daily, and 4 hr. Bullish Patterns Stack Up!Looking at the Daily and 4-hour charts for BTC, we can see multiple bullish formations unfolding.

An inverse head and shoulders - daily

A cup and handle - daily

An ascending triangle - daily

Price action looks strong, as we’ve begun the breakout from the neckline on the inverse H&S, as well as the cup and handle and ascending triangle simultaneously, and momentum is building fast.

Also, on the 4-hour chart, there’s a pretty substantial bull pennant taking shape. A breakout here could be the next leg up, and the push needed to keep momentum alive.

Zooming out, when we apply the trend-based Fibonacci extension, it reveals a $131,000 golden pocket, on both the the daily as well as the 4 hr. And that could be a major upside target if these bullish structures hold.

Stay tuned to see if BTC continues its move and sets a new all-time high.

Golden Cross on GME WeeklyGME Chart Breakdown, Déjà Vu or Destiny? Something big just lit up the weekly chart, the 50 MA has pierced through the 200 MA, forming that golden cross traders dream about. On the weekly timeframe. Not a drill.

Now, let’s rewind. The last time this pattern appeared? January 2021. The infamous squeeze. Back then, GME didn’t just nudge upward, it catapulted nearly 4000%, going from a $3 floor to $120 in a blink.

Fast forward to today, new golden cross, new setup, and a $23 floor. If history rhymes even remotely, we’re staring down a hypothetical $1000 per share move. Yes, one thousand.

Is lightning about to strike twice? Stay tuned to find out!

Is it finally time for a rally?Looking at NVIDIA (NVDA) on the weekly chart over the past two years, a significant gap up becomes apparent around April, which persisted for much of the year. Considering the recent news and the stock's pullbacks lately, this may be the moment for NVDA to resume its upward grind. The coming weeks will reveal its direction.

Additionally, it's worth noting the formation of a massive bull pennant on the weekly chart. If history repeats itself and this pattern holds, the next 2 to 6 weeks could prove to be a thrilling period for NVDA.

Bitcoin: Promising Patterns and Potential BreakoutBitcoin's recent price action has been nothing short of captivating for traders and analysts alike. On the daily chart, we've observed the formation of an Inverse Head & Shoulders and a Cup & Handle pattern, both of which have now transitioned into a Bull Flag. These bullish signals suggest a strong potential for upward movement.

Zooming into the 4-hour and 1-hour charts, we can see prominent Ascending Triangles taking shape. These patterns are often harbingers of significant breakouts, and it appears that Bitcoin is winding up for a substantial move.

Moreover, when utilizing a Trend-based Fibonacci Extension on the daily timeframe, the golden pocket points to a target of $126k, with the next pocket at $185k. This aligns with historical data and technical indicators, suggesting that Bitcoin might be poised to rewrite history once again.

Stay tuned as we monitor these developments and anticipate what could be a historic breakout for Bitcoin!

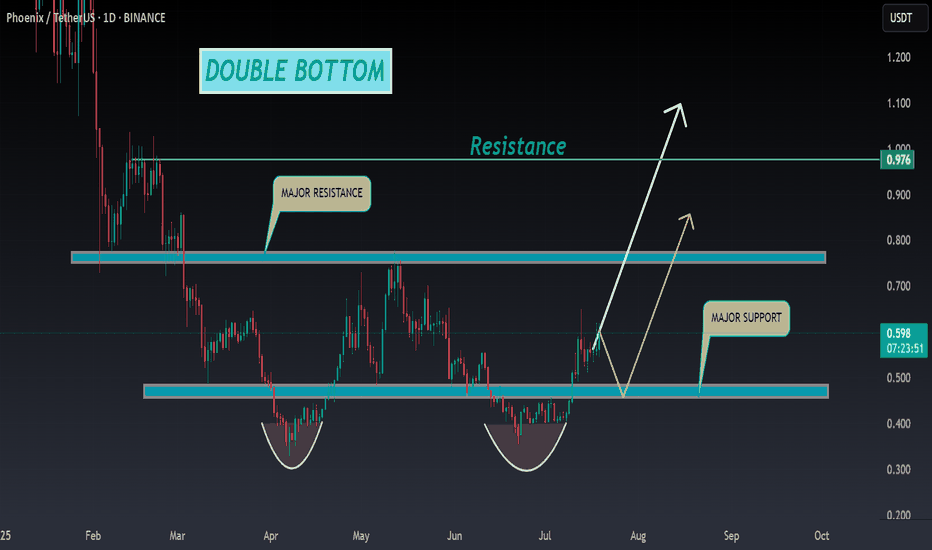

PHB ANALYSIS🔮#PHB Analysis :

📈📈 #PHB is making perfect Double Bottom Pattern. We can see a good pump if #PHB breakout the major resistance zone with good volume and sustains the higher price after breakout 🚀🚀

📊 Current Price: $0.595

⏳ Target Price: $0.780

⁉️ What to do?

- We can trade according to the chart and make some profits in #PHB. Keep your eyes on the chart, observe trading volume and stay accustom to market moves.💲💲

#PHB #Cryptocurrency #Pump #DYOR #Breakout

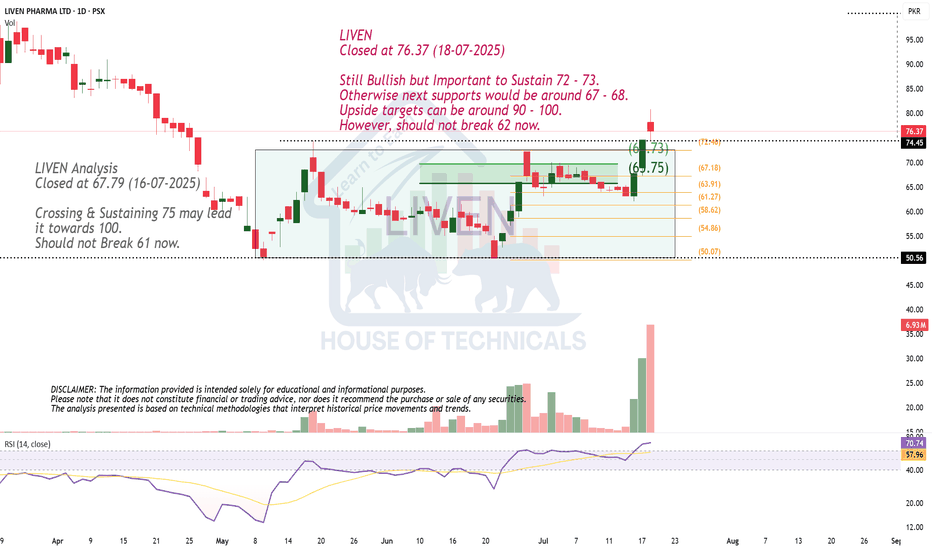

XRPUSDT Weekly Chart Analysis | Next Bullish MoveXRPUSDT Weekly Chart Analysis | Major Resistance Levels Align for Next Bullish Move

🔍 Let’s break down the XRP/USDT weekly setup, highlighting key technical signals and major upside targets for the next rally.

⏳ Weekly Overview

The weekly chart shows consolidation just below a major resistance, with price action tightening and preparing for a breakout. A recent correction found support near the 0.382 Fibonacci retracement level, which has acted as a springboard for renewed momentum. Notably, the R2 pivot point level aligns closely with this area, strengthening its importance as a decision zone for bulls.

🔺 Upside Targets & Confluences:

- First Target: $4.63 — This coincides with the R2 monthly pivot point and aligns with key Fibonacci extension targets, offering strong confluence for a reaction zone.

- Second Target: $5.90 — Our most realistic medium-term target, also backed by cluster resistance from both pivot analysis and fib projections.

- Final Target: $7.80 — This is the major Fibonacci extension level, marking the highest projected upside if momentum persists.

📊 Key Technical Highlights:

- Pivot Point R2 & Fibonacci Confluence: The R2 level reinforces a critical resistance, overlapping with the $4.63 Fibonacci target.

- Fibonacci Retracement: Price respected the 0.382 retracement during the latest correction, signaling healthy trend continuation.

- Volume Confirmation: An uptick in volume confirms that buyers are stepping in, supporting the bullish momentum.

- RSI Signal: RSI is entering the overbought zone, which typically indicates a strong surge in buying pressure and can mark the start of a momentum move.

🚨 Conclusion:

XRP is setting up for a major breakout as key technical levels align. Watch for a sustained move above $4.63 to unlock the $5.90 area, with a final potential push towards $7.80 if bulls maintain control. Volume expansion and an overheated RSI are both classic signs of an incoming momentum wave—keep your eyes on these levels for validation of the setup.

DVLT falling wedge, TP $1+DVLT a relatively new ticker is already drawing a lot of attention. Up 13% today after hitting new all time low yesterday, sure to catch a lot of eyes from retail investors. With recent news releases such as a licensing agreement with IBM, a lawsuit against naked short selling, and US patent allowances, target prices have been announced ranging from $3 to $11/share.

Disclaimer, this ticker is PRONE TO HEAVY DILUTION, however in order to remain listed on NASDAQ the SP will have to hit $1 and remain there. This being the case, the company must have something in the books to break upward out of this falling wedge and give shareholders a reason to stay with the company long term.

I'm just a cat not a financial advisor.

Perfect Sync: V Reversal Meets Bull Flag

Two clean and classic technical structures:

✅ V-Reversal Formation

✅ Bull Flag – still active and building pressure

After a sharp reversal, the price entered a bullish continuation phase.

Currently moving within the flag structure toward its upper edge.

If we see a breakout to the upside, the move could match the flagpole length, which aligns well with the target from the V-reversal pattern.

📍 Bullish scenario remains valid as long as we stay within structure.

📉 Breakdown below $570 invalidates this setup.

🧠 Important Reminder:

Enter only after a confirmed breakout.

✅ Apply strict risk management

✅ Never risk more than 1% of your capital on a single position.

Everything’s clear. No noise. Just wait for confirmation — let the market come to you.