BTC in Tight Range: Calm Before the Storm?$BTC/USDT is consolidating within a tight range (highlighted in the blue box) for the past 8 days. This looks like a strong accumulation phase, suggesting that the next breakout could be explosive.

Watch for a decisive move above the range for confirmation.

DYOR, NFA

Bullishpattern

Bullish Triangle Pattern on ProgressIn my previous update on BINANCE:CRVUSDT , I mentioned three potential scenarios: a bullish triangle formation, sideways movement, and a double top pattern.

Right now, it looks like the bullish triangle pattern is playing out. If this continues, I expect the price to reach the 0.7853 – 0.8343 target zone. But before that, all eyes are on the key resistance at 0.6667 — the prior high.

The best-case scenario would be a strong breakout above 0.6667, ideally with a solid bullish candle showing strong buyer momentum.

However, stay cautious. If price breaks the resistance but quickly falls back into the triangle and breaks the low of the breakout candle, that could be a false breakout (or what some might call a liquidation sweep). In that case, reducing exposure could be a wise move, as price might enter a sideways phase.

On the other hand, if price gets rejected (before breakout) at 0.6667 with a large red candle, that’s still acceptable — as long as price holds above the invalidation level at 0.5781.

Let’s keep watching how price reacts around key levels. Market structure still favors the bulls, but risk management is key.

Daily and weekly poised for a bull run, BULL FLAG $SKLZPersonally see 6.89-7.33 in the coming weeks potentially 9$-10$ by summer with momentum and positive ER. SKLZ is a sleeping giant

Many analyst say its a buy and the chart is bullish for a 6month swing trade easy or a great long term position. Final time we see south of 5$ !?

We shall see, in time

Bullish Flag / Pennant Pattern Formation appearing.

Bullish Flag / Pennant Pattern Formation appearing.

87 - 88 is the Breakout Level; but Important Resistance

lies around 90 - 92

Closing above 100 - 101 would trigger more positivity.

Crossing & Sustaining this level may expose new Highs

around 130.

However, it should not Break 73.

The chart #MANEKIUSDT looks strong📉 LONG BYBIT:MANEKIUSDT.P from $0.002990

🛡 Stop loss: $0.002772

🕒 Timeframe: 1H

📢 Market Overview:

➡️ The token broke out impulsively after consolidating above the Point of Control (POC) at $0.002253 — a strong bullish sign.

➡️ The BYBIT:MANEKIUSDT.P stop-loss is set just below the key accumulation zone, at $0.002772 — a logical support level.

➡️ The volume profile shows heavy interest below current levels, indicating buyer support.

➡️ Current price ($0.002915) is slightly below the entry zone but testing resistance around $0.002944.

➡️ A breakout here could quickly push price to TP1 and TP2.

🎯 TP Targets:

💎 TP 1: $0.003100

💎 TP 2: $0.003210

💎 TP 3: $0.003300

📢 Watch for confirmation above $0.002944 — this would open the way toward TP1.

📢 Weak breakout may trigger a retest of the entry area.

🚀 The chart BYBIT:MANEKIUSDT.P looks strong — bullish momentum could continue!

CADJPY possible Bullish My analysis for CADJPY expect that price will move down to take liquidity at Point A. Following this liquidity grab, I will be looking for confirmation signals of bullish momentum. If confirmed, the first profit target would be within the Fair Value Gap (FVG) at Point B, second profit target would be the liquidity level at Point C.

NASDAQ Futures Long Setup: Pullback Entry After Tariff BoostMarket Outlook – April 13, 2025

Quick recap: In my last public analysis, I mentioned watching the 18,350–18,000 zone for signs of support — a level stacked with confluence (50–61.8% Fib, EMA, VWAP, pivot). Price broke down deeper than expected but responded beautifully:

✅ Tagged 18,000 almost to the tick

✅ Rejected hard at the 61.8 Fib

✅ Respected the 50 Fib on the way back up

All solid signs of strength.

Now with tariff exemptions announced today (bullish for tech/Nasdaq), I’m opening the door to more long setups this week.

Here’s What I’m Watching:

🔹 Scenario A: Pullback into the 18,575–18,500 zone (first dotted white line). If price reclaims structure or gives me something clean — EMA bounce, VWAP tag, candle pattern — I’ll look for longs.

🔹 Scenario B: If that level breaks or I miss the first shot, I’ll look for a second chance around 18,000–18,300. Same deal: not jumping in blindly, waiting for a setup to form.

To be clear — these are areas of interest, not automatic trades. I want clean structure and confirmation before entering.

Let’s see how it plays out. Will update if/when I take a position. Stay sharp. 📈

Weekly Support is around 80000.Weekly Support is around 80000.

However, 72500 - 73000 is its previous

breakout level & probably a Best Buying Rage

(if it touches) which is also a Confluence area of

Trendline Support+Important Fib. level.

Bullish Divergence on Shorter Time Frame +

Weekly Support around 80000 (if Sustained)

may push the Price up towards 87000 &

then around 95000 - 96000.

Ultimate Resistance is around 110000.

Crossing this level may open new Highs

Targeting around 136000.

On Shorter Timeframe, 85000 - 86000 is

the Immediate Resistance & Support is

around 80000.

Total 3 targeting 1.5TWelcome back dearest reader,

This is going to be a short one, all information is in the chart above.

Total 3 has been in a Massive Cup and handle formation.

Measured from the base of the cup till the top of the handle gives us a ''total 3'' price target of 1.5T$ which is 100x from here. If you were to do a different analysis and like flags more then we come to the same price target of 1.5T$ (Blue bars).

Price action is now retesting resistance from march 2024 as support. When this is done i expect blast-off mode.

~Rustle

Road to 3200Gold had a strong 4hr timeframe rejection from the 2960-2980 zone.

Also had a triple bottom in the same area.

Showing super strong signs of another bullish run.

Gold is making the strong move up to the 3140 area once 3100 is broke.

Should get a small rejection off the 3140 zone before a strong push up to a new all time high.

Next all time high goal is 3200 🚀

Short Notes:

•Run up to 3140 (Small rejection/load up zone)

•Then Load up zone 3110-3100

•Take Profit area 3200

As always, trade safe during these high volatility times and go crush it!💰

Markets bottom on fearA short term relief is due in the coming days.

I will buy QQQ at the opening of the market, for a few days.

Only the fundamentals (and Trump) will decide if it will be the bottom of a correction or the first bottom of a huge market crash.

I am using here:

- The RSI(14), weekly (below 40).

- The ROC(2), daily (below 10%).

- One other personal indicator

- My personal quant strategy

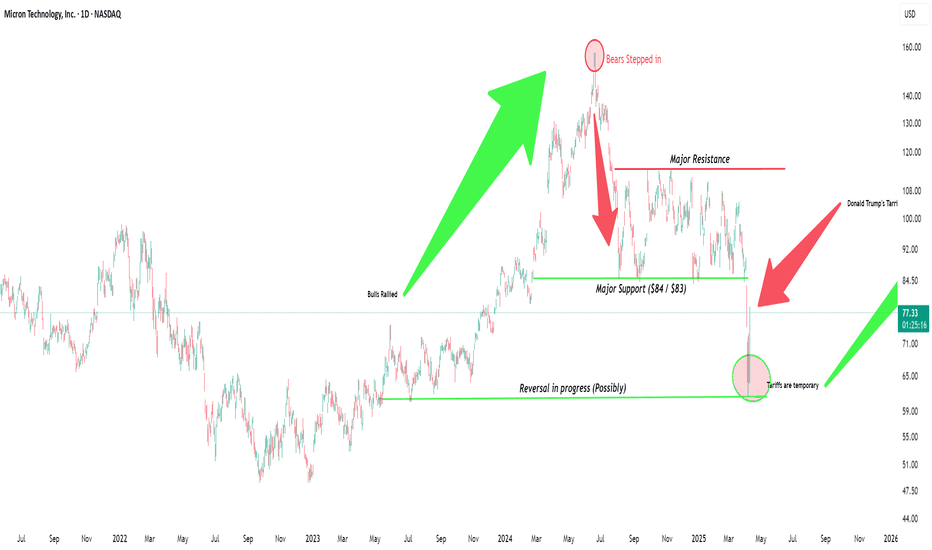

Micron's Time to Be THAT Semiconductor is coming and FastNASDAQ:MU is extremely undervalued, I produced this chart last night. Its time that the market appreciates this monster with such solid fundamentals. Micron since 2022 has been working hard to become a major producer in the United States. I believe that Trump and his government could get behind the only major memory company to be based in the United States.

-----------------------

Balance Sheet:

Cash: $8.22b

Debt: $11.54b

Equity: $48.63b

Total Liabilities: $24.42b

Total Assets: $73.05b

All Stated in $ USD

-----------------------

Valuation:

Price To Sales: 2.72

Price To Earnings: 18.30

Forward Price To Earnings: 6.84

-----------------------

WILL GOLD PUMP AGAIN IN FOMC NEWS ALERT🚨 XAUUSD Market Update! 🚨

Gold is on the move, battling key levels between 3040! Will we see a breakout soon? 🔥

Bearish Watch: If the price drops below this range, we could target 3015 and 3020. ⚠️

Bullish Opportunity: A break above 3042 could signal a buying surge, with targets set at and 3100. 🚀

💬 What’s Your Move? Join the conversation and share your thoughts! Let’s navigate this golden opportunity together and aim for new highs! 💰