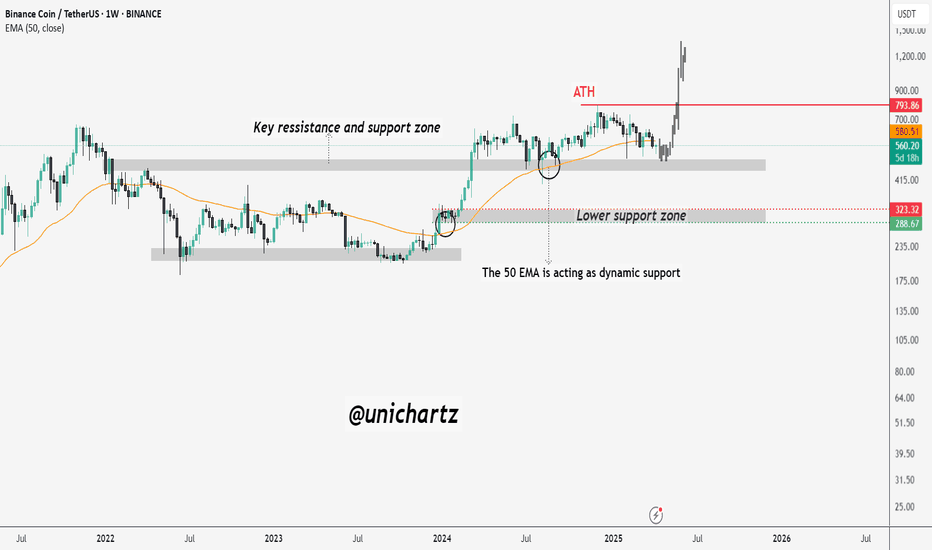

BNB Bulls Must Defend This LevelBNB is currently trading near a key support and resistance zone, a historically significant area that has acted as both supply and demand over the past few years. After reaching its all-time high (ATH) near $793, price has been gradually correcting, and is now approaching a critical point.

The 50-week EMA (Exponential Moving Average) is acting as dynamic support, and so far has played a strong role in providing bounce zones during corrections. This EMA is currently being tested once again, and price action around it will be crucial.

Just below this lies a major horizontal support zone around $415–$430, which previously served as a breakout base in 2023. If this area holds, BNB could see a rebound attempt.

Bullishpattern

We have 3 reasons to here

1. There is a megaphone pattern almost finished (A).

2. A broadening wedge is forming at a high level (B).

3. Another broadening wedge is nearing completion (C).

So, what I think is that Trump will announce something interesting to end the commercial conflict with everyone.

We will see a market recovery period and a new high.

Right now it looks bad, but it's not too bad.

WILL GOLD MARK NEW ATH TRUMP TERRIF ALERT!🚨 GOLD UPDATE (XAU/USD)🚨

Gold is showing a strong bullish trend, and it’s expected to continue for the next month. 🌟 If you see any dips, buy in again and again! We could see gold touch 3200 soon, especially with the ongoing China & Trump tensions. The US economy remains strong, and fundamentally, gold is primed to soar even higher! 📈💥

After Trump's tariffs, gold may dip and sweep more liquidity before bouncing back stronger. ⚡ As China and Trump battle, US strength keeps pushing gold to new heights. 📊

Key Buying Zones 🔑:

- 3030 – 3035: Last zone for reversal 🔄

- 3000: Strong support zone 🚀

Targets 🎯:

- 3100 💰

- 3200 💎

- After 1 month: 3300 💥

⚠️ Always follow risk management⚠️

BTC/USD Weekly Analysis – Cup and Handle Breakout Toward Target🔍 Overview

The chart displays a classic Cup and Handle pattern on the weekly timeframe, a well-established bullish continuation formation often found in long-term uptrends. This pattern, combined with major technical confluences such as trendline support and strong horizontal levels, provides a high-conviction long setup with defined risk and reward.

☕ 1. The Cup Formation

Timeframe: Mid-2021 to early 2024

Shape: Rounded bottom, a hallmark of slow accumulation.

After reaching an all-time high in late 2021, BTC entered a bear market, dropping sharply and eventually bottoming out between $15,000–$20,000.

A gradual recovery followed, forming a wide and symmetrical base—indicating accumulation by institutional and long-term holders.

This phase represents a shift in market sentiment, from bearish to neutral, and eventually bullish, as buyers stepped in around key demand zones.

🔧 2. The Handle Formation

Timeframe: Early 2024 to late 2024

After reclaiming its previous high resistance area near $69,000–$75,000, BTC formed a short-term consolidation or pullback, creating the "handle" portion of the pattern.

The handle appeared as a descending channel, a healthy correction that typically precedes a breakout in this pattern.

This correction also aligned with a trendline retest, offering dynamic support and further strengthening the pattern's reliability.

💥 3. Breakout Confirmation

The breakout from the handle occurred above the descending resistance of the handle pattern.

Weekly candles showed strong bullish momentum, backed by rising volume and rejection from lower trendline levels.

BTC is now trading near $83,000, just above the trendline, confirming both pattern validation and support holding.

🎯 4. Target & Projection

The measured move of the Cup and Handle pattern is calculated by measuring the depth of the cup and projecting that from the breakout point.

Cup Depth: Approximately $60,000

Breakout Point: ~$75,000–$80,000

Target Price: ~$123,000–$125,000

This target aligns with historical Fibonacci extensions and psychological round-number resistance.

🔐 5. Key Levels

Support Zone: $20,000–$30,000 (multi-year accumulation base)

Trendline Support: Drawn from 2022 lows, holding well through handle correction

Resistance Zone: $100,000 psychological barrier

Stop Loss: Placed just below trendline and swing low at $76,340 to protect against downside volatility

🧠 Why This Setup is Strong

Multi-year Base Formation (2.5+ years of consolidation)

Pattern Reliability: Cup and Handle is a well-tested bullish continuation pattern

Confluence of Support: Both horizontal and dynamic trendline support levels

Momentum Structure: BTC has resumed higher highs and higher lows

Volume: Breakout occurred with a noticeable spike in volume, a key validation point

🏁 Conclusion

Bitcoin is displaying strong bullish potential through a large-scale Cup and Handle pattern. This technical setup is supported by:

Long-term accumulation

Structural breakout

Strong support levels

A clear roadmap toward $120K+ targets

As long as BTC maintains above the trendline and doesn't invalidate the handle's structure, the bulls remain firmly in control.

#LAYERUSDT setup remains active 📉 LONG MEXC:LAYERUSDT.P from $1.5722

🛡 Stop loss: $1.5440

🕒 Timeframe: 1H

✅ Market Overview:

➡️ The coin is showing "its own game" — price action is independent of #BTC and #ETH, reacting to internal volume dynamics.

➡️ Ascending triangle breakout with a confirmed close above the key $1.5440 zone.

➡️ Empty space ahead — no major resistance levels until $1.6060–$1.6210.

➡️ Accumulation is forming between $1.5440–$1.5700 — a breakout may follow.

➡️ Important: candles must close above $1.5440 to confirm the long scenario.

🎯 TP Targets:

💎 TP1: $1.5880

💎 TP2: $1.6060

💎 TP3: $1.6210 (full measured move from triangle pattern)

📢 Recommendations:

If volume MEXC:LAYERUSDT.P increases during a breakout above $1.5722 — expect a rapid move.

If price pulls back — the $1.5254 area could offer a second entry opportunity.

The coin looks strong but slightly overbought — partial take profit at TP1 is advised.

📢 A strong breakout above $1.5700 may lead to a sharp move due to lack of resistance.

📢 Avoid 1H candle close below $1.5440 — scenario invalidation.

📢 If the move occurs on weak volume — watch for a potential reversal near TP1.

🚀 MEXC:LAYERUSDT.P setup remains active — holding the key level could lead to a move toward TP2–TP3!

"Gold Approaching Key Support – Will Bulls Take Control?"🔹 Market Structure:

Gold is currently in a corrective phase after a strong bullish run, facing a pullback from recent highs around $3,160. The price has now approached a key horizontal support zone near $2,980 - $3,020.

🔹 Key Levels:

✅ Resistance: ~$3,160 (previous high)

✅ Horizontal Support: ~$2,980 - $3,020 (marked in blue)

✅ Target Level: ~$3,099 (potential bounce area)

🔹 Potential Scenarios:

1️⃣ Bullish Reversal: If the price finds support in the marked zone and forms bullish confirmation (e.g., hammer candle, bullish engulfing), we could see a retest of $3,099 and potentially higher levels.

2️⃣ Breakdown Scenario: If support fails, gold may see further downside towards $2,950 or lower.

🔹 Trading Plan:

📈 Buy Setup: Look for bullish confirmation near support (~$3,020) with a target of $3,099 - $3,120.

📉 Sell Setup: If support breaks, short positions could target $2,950 - $2,920.

🔸 Bias: Bullish above support, bearish below it.

🔸 Risk Management: Use a stop-loss below support (~$2,980) to manage risk.

Would you like me to refine this further or add any indicators like RSI, Moving Averages, etc.? 🚀

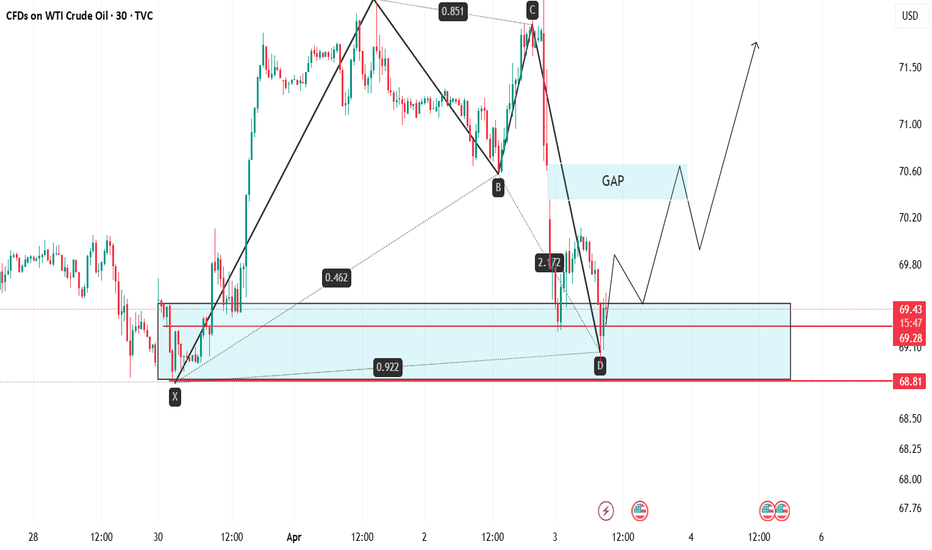

USOIL: Key Levels and Bullish Prospects Amid Trade War ConcernsGood morning Traders,

Trust you are doing great.

Kindly go through my analysis of USOIL.

USOIL is currently experiencing market imbalance due to the nature of its opening range, following a gap-down decline last night in response to trade war concerns that have fueled recession fears. The price dropped from its weekly high of 72.22 to a key support zone at 69.00, which is near the week's low. As we anticipate the release of the ISM Services PMI at 3 PM GMT+1, I expect the demand zone to hold, driving the price higher—initially to fill the gap and subsequently toward the 71.35 region. Furthermore, this outlook is strengthened by the formation of a bullish Bat pattern on the M30 chart.

The key levels I will be monitoring for potential price action include the previous week's high at 70.10, the five-week high at 70.62, and the 71.35 region. These areas represent significant resistance levels that could be tested as price moves upward. A break below 68.80 will invalidate this outlook.

Cheers and Happy trading.

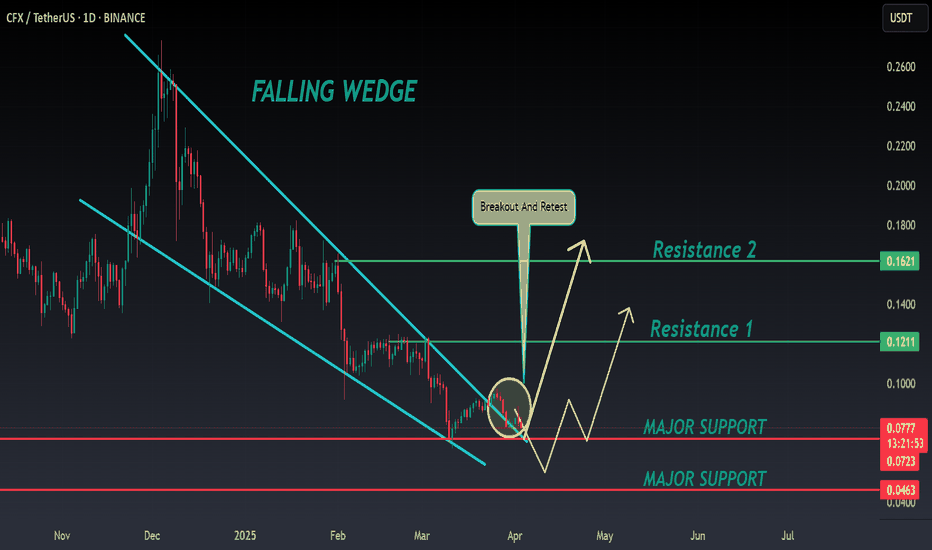

CFX ANALYSIS📊 #CFX Analysis

✅There is a formation of Falling Wedge Pattern on daily chart with a good breakout and currently retests from the major resistance zone🧐

Pattern signals potential bullish movement incoming after a successful retest

👀Current Price: $0.0775

🚀 Target Price: $0.1210

⚡️What to do ?

👀Keep an eye on #CFX price action and volume. We can trade according to the chart and make some profits⚡️⚡️

#CFX #Cryptocurrency #TechnicalAnalysis #DYOR

Bullish on All Time Frames.Bullish on All Time Frames.

Monthly Closing above 211 - 212 would

be very positive for OGDC.

Retested the Previous Breakout Level

around 194 - 195.

Hidden Bullish Divergence on Daily Tf.

227 - 228 is the Weekly Resistance that

seems to break this time.

If this level is Sustained, we may witness

250+ initially.

EUR/GBP: Inverse Head & Shoulders Breakout Towards TargetChart Overview

Asset: Euro / British Pound (EUR/GBP)

Timeframe: 1-hour (1H)

Date and Time: Published on April 2, 2025, at 19:21 UTC

Publisher: GoldMasterTraders on TradingView

Current Price (at the time of the chart):

Open: 0.83668

High: 0.83670

Low: 0.83260

Close: 0.83635

Change: -0.00035 (-0.04%)

Price on the Right Axis: The price scale ranges from approximately 0.83100 to 0.84447, with the current price around 0.83642 (ask) and 0.83635 (bid).

Chart Elements and Technical Analysis

1. Candlestick Price Action

The chart displays a 1-hour candlestick representation of EUR/GBP, showing price movements from mid-March to early April 2025.

Trend Context:

Prior to the formation of the pattern, the price experienced a downtrend, declining from around 0.84200 (March 12) to a low of 0.83260 (March 25). This indicates a bearish trend leading into the pattern formation.

Following this decline, the price began to consolidate, forming the Inverse Head and Shoulders pattern, which suggests a potential reversal from bearish to bullish.

Recent Price Action:

On April 2, the price appears to have broken out above the neckline of the Inverse Head and Shoulders pattern, closing above the resistance level with a bullish candle. The current price of 0.83642 is above the breakout level, supporting the bullish thesis.

2. Chart Pattern: Inverse Head and Shoulders

Pattern Identification:

The chart highlights an Inverse Head and Shoulders pattern, a bullish reversal pattern that typically forms after a downtrend. It consists of three troughs:

Left Shoulder: A low around 0.83400 (March 20), followed by a bounce.

Head: A deeper low at 0.83260 (March 25), marking the lowest point of the pattern.

Right Shoulder: A higher low around 0.83400 (March 30), indicating diminishing selling pressure.

The neckline is drawn by connecting the highs between the shoulders (around 0.83600–0.83700), sloping slightly downward in this case.

Pattern Dynamics:

The Inverse Head and Shoulders pattern signals a shift from bearish to bullish sentiment. The left shoulder and head represent selling pressure, while the higher right shoulder indicates buyers stepping in at a higher level, showing increased demand.

The breakout occurs when the price closes above the neckline, confirming the reversal. In this chart, the breakout is confirmed around April 2, with the price closing above the neckline at approximately 0.83600–0.83700.

Breakout Confirmation:

The price broke above the neckline on April 2, with a strong bullish candle closing at 0.83635. The current price of 0.83642 is holding above the breakout level, which is a positive sign for bulls.

The breakout level aligns with the resistance zone, making the move significant as it also clears this key barrier.

3. Key Support and Resistance Levels

Support Level:

A horizontal support zone is marked around 0.83425 (approximately 0.8340–0.8345).

This level corresponds to the lows of the left and right shoulders, where buyers stepped in to defend the price. It also aligns with the lower boundary of the pattern, reinforcing its importance.

Resistance Level:

A resistance zone is marked around 0.83700 (approximately 0.8365–0.8375).

This level corresponds to the neckline of the Inverse Head and Shoulders pattern and a previous high from March 19. It acted as a barrier during the pattern formation but has now been broken, turning it into potential support on a retest.

Target Level:

The target for the breakout is projected at 0.84447.

This target is calculated using the standard method for Head and Shoulders patterns: measuring the height of the pattern (from the head at 0.83260 to the neckline at 0.83700, which is 0.00440) and projecting that distance upward from the breakout point (0.83700 + 0.00440 = 0.84140). The target of 0.84447 is slightly higher, possibly adjusted for the next significant resistance.

The chart indicates a potential move of 0.00627 (0.75%), which aligns with the distance from the breakout level (0.83700) to the target (0.84447).

4. Stop Loss and Risk Management

Stop Loss:

The stop loss is suggested below the support level at 0.83425.

Placing the stop loss below this level ensures that if the breakout fails and the price falls back below the neckline and the right shoulder, the trade is exited with a controlled loss.

The distance from the breakout level (0.83700) to the stop loss (0.83425) is 0.00275, representing the risk on the trade.

Risk-Reward Ratio:

The chart indicates a potential move of 0.00627 (0.75%) to the target.

The risk is 0.00275 (from 0.83700 to 0.83425), and the reward is 0.00627 (from 0.83700 to 0.84447), giving a risk-reward ratio of approximately 2.28:1 (0.00627 / 0.00275). This is a favorable ratio for a trading setup.

5. Additional Annotations

Pattern Components:

The chart labels the Left Shoulder, Head, and Right Shoulder, clearly identifying the structure of the Inverse Head and Shoulders pattern.

A blue arrow labeled “Inverse Head & Shoulder pattern” points to the formation, making it easy to recognize.

Arrows and Labels:

A green arrow labeled “Support Level” points to the 0.83425 zone, indicating where buyers have defended the price.

A red arrow labeled “Resistance Level” points to the 0.83700 zone, highlighting the neckline and the breakout area.

A blue arrow labeled “Target” points to 0.84447, showing the projected price objective.

A blue arrow labeled “Stop Loss” points to 0.83425, indicating the risk management level.

Price Labels on the Right Axis:

The right axis shows key price levels, with the current ask price at 0.83642 (red) and bid price at 0.83635 (black), reflecting the live market spread.

Trading Setup Breakdown

Based on the chart, here’s the detailed trading setup:

Entry:

Position: Long (buy) EUR/GBP.

Entry Point: The setup suggests entering after the price breaks out above the neckline of the Inverse Head and Shoulders pattern, which occurred around April 2, 2025, at approximately 0.83700.

Confirmation: The breakout is confirmed by a strong bullish candle closing above the neckline, with the current price at 0.83642, slightly below the high of 0.83670 but still above the breakout level. Traders might wait for a retest of the neckline (now acting as support) for a safer entry, though this isn’t explicitly suggested in the chart.

Stop Loss:

Level: Place the stop loss below the support level at 0.83425.

Rationale: This placement protects against a false breakout. If the price falls back below the neckline and breaches the right shoulder, the bullish thesis is invalidated, and the trade should be exited.

Risk: The distance from the entry (0.83700) to the stop loss (0.83425) is 0.00275, or approximately 0.33% of the entry price.

Take Profit/Target:

Level: The target is set at 0.84447.

Rationale: This target is derived from the height of the pattern projected upward from the breakout point. It also aligns with a logical extension toward the next significant resistance.

Reward: The distance from the entry (0.83700) to the target (0.84447) is 0.00627, or approximately 0.75% of the entry price.

Risk-Reward Ratio:

The risk-reward ratio is approximately 2.28:1, which is attractive for a trading setup. For every unit of risk (0.00275), the potential reward is over 2 units (0.00627).

Trade Management:

Trailing Stop: Once the price approaches the target at 0.84447, traders might consider trailing the stop loss to lock in profits, especially if the price shows signs of stalling.

Partial Profit Taking: Some traders might take partial profits at a minor resistance level (e.g., 0.84000) and let the remaining position run toward the target.

Broader Market Context

Trend Analysis:

The broader trend before the pattern was bearish, as evidenced by the decline from 0.84200 to 0.83260. The Inverse Head and Shoulders pattern suggests a potential reversal to the upside, with the breakout confirming this shift.

The price action after the breakout will be critical. A strong move toward 0.84000 with high volume would confirm the bullish momentum.

Volume and Momentum:

The chart doesn’t display volume or momentum indicators (e.g., RSI, MACD). However, a typical confirmation of an Inverse Head and Shoulders breakout includes:

Volume: An increase in volume on the breakout candle, indicating strong buying interest.

Momentum: A bullish signal from indicators like RSI (e.g., moving above 50) or MACD (e.g., a bullish crossover).

Traders should check these indicators to validate the breakout’s strength.

Market Factors:

EUR/GBP is influenced by factors like Eurozone and UK economic data, interest rate differentials, and Brexit-related developments. On April 2, 2025, traders should consider:

Economic Data: Key releases like UK GDP, Eurozone inflation, or central bank statements around this time could impact the pair.

Geopolitical Events: Any developments related to UK-EU relations or global risk sentiment could drive volatility in EUR/GBP.

Potential Risks and Considerations

False Breakout:

If the price fails to hold above the neckline (0.83700) and falls back below the right shoulder, the setup is invalidated. The stop loss at 0.83425 mitigates this risk.

Resistance at 0.84000:

The price may encounter resistance around 0.84000, a psychological level and a previous high. Traders should watch for bearish price action (e.g., a shooting star or bearish engulfing candle) near this level.

Market Volatility:

EUR/GBP can be volatile on a 1-hour timeframe, especially around economic data releases. Unexpected news could lead to sharp price swings, potentially triggering the stop loss prematurely.

Timeframe Limitations:

This is a short-term setup on a 1-hour chart, so the target might be reached within hours to a couple of days. However, intraday noise could lead to choppy price action, requiring active trade management.

Conclusion

The TradingView chart by GoldMasterTraders presents a well-structured bullish trading setup for EUR/GBP based on an Inverse Head and Shoulders pattern. The price has broken out above the neckline on April 2, 2025, signaling a potential move toward the target of 0.84447. Key levels include support at 0.83425 (where the stop loss is placed) and the neckline resistance at 0.83700, which the price must hold above to maintain the bullish thesis. The setup offers a favorable risk-reward ratio of 2.28:1, making it an attractive trade for short-term traders.

However, traders should confirm the breakout with additional indicators (e.g., volume, RSI) and monitor broader market conditions, as this chart is a snapshot from April 2, 2025, and market dynamics may have evolved since then. If you’d like to search for more recent data on EUR/GBP or check the outcome of this setup, I can assist with that!

EUR/USD: Bullish Falling Wedge Breakout Towards TargetLet’s analyze the 1-hour candlestick chart of EUR/USD (Euro / U.S. Dollar) on TradingView, published by GoldMasterTraders on April 2, 2025, at 19:04 UTC. The chart highlights a trading setup based on a Falling Wedge pattern, indicating a potential bullish breakout. I’ll describe the chart pattern and the trading setup in detail.

Chart Pattern: Falling Wedge

Pattern Description

Type: The chart identifies a Falling Wedge pattern, which is a bullish chart pattern that typically signals a reversal or continuation of an uptrend. A Falling Wedge forms when the price consolidates between two downward-sloping trendlines that converge over time, with the upper trendline (resistance) sloping more steeply than the lower trendline (support).

Appearance on the Chart:

The Falling Wedge is clearly marked with two converging trendlines:

Upper Trendline (Resistance): Connects the lower highs, sloping downward.

Lower Trendline (Support): Connects the lower lows, also sloping downward but at a less steep angle.

The pattern began forming around March 19, after a sharp decline from 1.9400 to 1.8700, and continued until the breakout on April 2, 2025.

Breakout Direction:

Falling Wedges are typically bullish, meaning the price is expected to break out to the upside. The chart shows the price breaking above the upper trendline of the wedge around April 2, 2025, with a strong bullish candle, confirming the breakout.

The breakout level is around 1.90840, and the price has moved slightly above this level, closing at 1.90864 at the time of the chart.

Key Levels and Trading Setup

1. Support Level

A horizontal support zone is marked around 1.90730 (approximately 1.9070–1.9080).

This level acted as a base during the wedge formation, with the price bouncing off this zone multiple times (e.g., on March 23 and March 30).

The support level aligns with the lower boundary of the wedge, reinforcing its significance as a key area of buying interest.

2. Resistance Level

A resistance zone is marked around 1.92000 (approximately 1.9190–1.9210).

This level corresponds to a previous high reached on March 19, before the wedge formation began. It represents a significant barrier where selling pressure previously emerged.

After the breakout, the price is expected to test this resistance as part of the bullish move.

3. Target

The target for the breakout is projected at 1.92110.

This target is likely calculated by measuring the height of the wedge at its widest point (from the highest high to the lowest low within the pattern) and projecting that distance upward from the breakout point.

The chart indicates a potential move of 0.00435 (0.40%), which aligns with the distance from the breakout level (around 1.90840) to the target (1.92110).

4. Stop Loss

A stop loss is suggested below the support level at 1.90730.

This placement ensures that if the breakout fails and the price falls back into the wedge, the trade is exited with a manageable loss.

The stop loss is just below the breakout level (1.90840), with a distance of approximately 0.00110, representing the risk on the trade.

Trading Setup Summary

Entry:

The setup suggests entering a long (buy) position after the price breaks out above the upper trendline of the Falling Wedge, which occurred around April 2, 2025. The breakout is confirmed by a strong bullish candle closing above the trendline at approximately 1.90840.

Stop Loss:

Place a stop loss below the support level at 1.90730 to protect against a false breakout or reversal. The distance from the breakout level (1.90840) to the stop loss (1.90730) is 0.00110, or about 0.06% of the entry price.

Take Profit/Target:

Aim for the target at 1.92110, which is near the next significant resistance level. The distance from the breakout level to the target is 0.01270, or a 0.40% move.

Risk-Reward Ratio:

The risk is 0.00110 (from 1.90840 to 1.90730), and the reward is 0.01270 (from 1.90840 to 1.92110), giving a risk-reward ratio of approximately 11.55:1 (0.01270 / 0.00110). This is an exceptionally high risk-reward ratio, making the setup very attractive, though traders should ensure the breakout is well-confirmed due to the tight stop loss.

Additional Observations

Price Action Context:

Before the wedge formed, the price experienced a sharp decline from 1.9400 (March 13) to 1.8700 (March 19), indicating a strong bearish trend.

The Falling Wedge represents a consolidation phase within this downtrend, and the upside breakout suggests a potential reversal or at least a corrective move higher.

Volume and Momentum:

The chart doesn’t display volume or momentum indicators (e.g., RSI, MACD). However, a typical confirmation of a Falling Wedge breakout would include:

An increase in volume on the breakout candle, indicating strong buying interest.

Bullish momentum signals, such as an RSI above 50 or a bullish MACD crossover.

Traders might want to check these indicators for additional confirmation of the breakout’s strength.

Timeframe:

This is a 1-hour chart, so the setup is intended for short-term trading, with the target potentially being reached within a few hours to a day.

Market Context:

EUR/USD is influenced by factors like U.S. dollar strength, Eurozone economic data, and interest rate differentials. A bullish move in EUR/USD could be driven by a weaker dollar (e.g., due to dovish U.S. economic data) or positive Eurozone developments.

Conclusion

The TradingView idea presents a bullish setup for EUR/USD based on a Falling Wedge pattern on the 1-hour chart. The price has broken above the wedge’s upper trendline, confirming a bullish move with a target of 1.92110. The setup includes a stop loss at 1.90730 to manage risk, offering an impressive risk-reward ratio of 11.55:1. Key levels to watch include the support at 1.90730 and the resistance at 1.92000. Traders should consider additional confirmation from volume and momentum indicators, as well as broader market conditions, before executing the trade. Since this chart is from April 2, 2025, market conditions may have evolved, and I can assist with searching for more recent data if needed!

Bullish Breakout from Falling Wedge | Upside Potential Ahead!Market Overview:

The Bitcoin (BTC/USD) 4-hour chart is displaying a Falling Wedge pattern, a well-known bullish reversal structure. This indicates that the downtrend is weakening, and a potential breakout could lead to a strong upside move.

🔹 Key Technical Analysis

1️⃣ Falling Wedge Formation & Breakout

Bitcoin has been trading inside a falling wedge, marked by lower highs and lower lows, signaling a contraction in volatility.

A breakout above the upper trendline of the wedge is forming, suggesting a bullish reversal and the start of an uptrend.

Falling wedges typically lead to a rally equal to the height of the pattern, giving a measured move target of $114,334.

2️⃣ Price Action & Confirmation Levels

A clean breakout above $87,000 would confirm bullish momentum.

If price successfully retests the wedge’s upper boundary and holds support, further bullish continuation is expected.

The psychological level of $100,000 could act as an interim resistance before the final target is reached.

3️⃣ Upside Target & Resistance Zones

The measured move suggests a potential rally towards $114,334, aligning with previous resistance zones.

This target represents a 30.55% gain from the breakout level.

Traders should watch for pullbacks and retests as part of the breakout confirmation.

📈 Trading Plan - Long Setup

🔹 Entry: Look for a confirmed breakout above $87,000, or a retest of support.

🔹 Stop Loss: Below $84,000, protecting against false breakouts.

🔹 Take Profit: $100,000 - $114,334 (previous resistance & measured move target).

🔹 Risk-Reward Ratio: Strong bullish setup with favorable upside potential.

🛑 Risk Factors to Consider

⚠️ A failed breakout and a drop below $83,000 would invalidate the bullish setup.

⚠️ External factors such as macroeconomic events, regulatory news, and BTC ETF developments could influence volatility.

Final Thought

The breakout from the falling wedge signals a potential bullish continuation for Bitcoin, with targets set around $114,334. Traders should watch for confirmation above $87,000 and manage risk accordingly.

XAG/USD Bullish Setup - Falling Wedge Breakout Towards TargetChart Overview

Asset: Silver / U.S. Dollar (XAG/USD)

Timeframe: 1-hour (1H)

Date and Time: Published on April 2, 2025, at 11:17 UTC

Publisher: GoldMasterTraders on TradingView

Current Price (at the time of the chart):

Open: 33.82300

High: 33.89005

Low: 33.79435

Close: 33.88880

Change: -0.05780 (-0.20%)

Price on the Right Axis: The price scale ranges from approximately 32.80000 to 35.25000, with the current price around 33.88880.

Chart Elements and Technical Analysis

1. Candlestick Price Action

The chart displays a 1-hour candlestick representation of XAG/USD, showing price movements from late March to early April 2025.

Trend Context:

Prior to the formation of the pattern, the price experienced a sharp rally from around 32.80000 (March 21) to a high near 34.60000 (March 27). This indicates a strong bullish trend.

Following this rally, the price entered a consolidation phase, forming lower highs and lower lows, which is characteristic of the Falling Wedge pattern.

Recent Price Action:

On April 2, the price appears to have broken out of the wedge pattern, closing above the upper trendline with a strong bullish candle. The current price of 33.88880 is above the breakout level, suggesting a potential continuation of the uptrend.

2. Chart Pattern: Falling Wedge

Pattern Identification:

The chart highlights a Falling Wedge pattern, a bullish chart pattern that can act as either a reversal or continuation pattern. In this case, given the preceding uptrend, it’s likely a continuation pattern.

A Falling Wedge is characterized by two converging trendlines:

Upper Trendline (Resistance): Connects the lower highs, sloping downward.

Lower Trendline (Support): Connects the lower lows, also sloping downward but at a less steep angle than the upper trendline.

The wedge started forming around March 27, after the price peaked near 34.60000, and continued until the breakout on April 2.

Pattern Dynamics:

The narrowing range between the trendlines indicates decreasing selling pressure and a potential buildup of buying interest.

Falling Wedges typically resolve with a breakout to the upside, as the price breaks above the upper trendline, signaling a resumption of the prior trend (bullish in this case).

Breakout Confirmation:

The price broke above the upper trendline of the wedge on April 2, with a strong bullish candle closing at 33.88880. This breakout is a key signal for a potential upward move.

The breakout level appears to be around 33.85000–33.90000, and the price is currently holding above this level, which is a positive sign for bulls.

3. Key Support and Resistance Levels

Support Level:

A horizontal support zone is marked around 33.58553 (approximately 33.58–33.60).

This level acted as a significant support during the wedge formation, with the price bouncing off this zone multiple times (e.g., on March 28 and March 31).

The support level aligns with the lower boundary of the wedge, reinforcing its importance as a key area of buying interest.

Resistance Level:

A resistance zone is marked around 34.60000 (approximately 34.60–34.80).

This level corresponds to the high reached on March 27, before the wedge formation began. It represents a significant barrier where selling pressure previously emerged.

After the breakout, the price is expected to test this resistance as part of the bullish move.

Target Level:

The target for the breakout is projected at 34.82470 (approximately 34.82).

This target is likely calculated using the standard method for wedge patterns: measuring the height of the wedge at its widest point (from the highest high to the lowest low within the pattern) and projecting that distance upward from the breakout point.

The target of 34.82470 is just above the resistance zone, suggesting that a break above 34.60000 could lead to further upside toward this level.

4. Stop Loss and Risk Management

Stop Loss:

The stop loss is suggested below the support level at 33.58553.

Placing the stop loss below this level ensures that if the breakout fails and the price falls back into the wedge, the trade is exited with a controlled loss.

The distance from the breakout level (around 33.90000) to the stop loss (33.58553) is approximately 0.31447, which represents the risk on the trade.

Risk-Reward Ratio:

The chart indicates a risk-reward ratio of 0.9467 (2.80% / 9,469.7).

The potential reward is the distance from the breakout level (33.90000) to the target (34.82470), which is approximately 0.92470, or a 2.80% gain.

The risk is the distance to the stop loss (0.31447), making the risk-reward ratio approximately 2.94:1 (0.92470 / 0.31447), which is favorable for a trading setup.

5. Additional Annotations

Arrows and Labels:

A blue arrow labeled “Falling Wedge” points to the pattern, clearly identifying it for viewers.

A green arrow labeled “Support Level” points to the 33.58553 zone, indicating where buyers have stepped in.

A red arrow labeled “Resistance Level” points to the 34.60000 zone, highlighting the next significant barrier.

A blue arrow labeled “Target” points to 34.82470, showing the projected price objective.

A blue arrow labeled “Stop Loss” points to 33.58553, indicating the risk management level.

Price Labels on the Right Axis:

The right axis shows key price levels, with the current ask price at 33.89900 (red) and bid price at 33.88558 (black), reflecting the live market spread.

Trading Setup Breakdown

Based on the chart, here’s the detailed trading setup:

Entry:

Position: Long (buy) XAG/USD.

Entry Point: The setup suggests entering after the price breaks out above the upper trendline of the Falling Wedge, which occurred around 33.85000–33.90000 on April 2.

Confirmation: The breakout is confirmed by a strong bullish candle closing above the trendline, with the current price at 33.88880, slightly below the high of 33.89005 but still above the breakout level.

Traders might wait for a retest of the breakout level (now acting as support) for a safer entry, though this isn’t explicitly suggested in the chart.

Stop Loss:

Level: Place the stop loss below the support level at 33.58553.

Rationale: This placement protects against a false breakout. If the price falls back below the wedge’s upper trendline and breaches the support, the bullish thesis is invalidated, and the trade should be exited.

Risk: The distance from the entry (33.90000) to the stop loss (33.58553) is 0.31447, or approximately 0.93% of the entry price.

Take Profit/Target:

Level: The target is set at 34.82470.

Rationale: This target is derived from the height of the wedge projected upward from the breakout point. It also aligns with a logical extension beyond the resistance at 34.60000.

Reward: The distance from the entry (33.90000) to the target (34.82470) is 0.92470, or approximately 2.80% of the entry price.

Risk-Reward Ratio:

The risk-reward ratio is approximately 2.94:1, which is attractive for a trading setup. For every unit of risk (0.31447), the potential reward is nearly 3 units (0.92470).

Trade Management:

Trailing Stop: Once the price approaches the resistance at 34.60000, traders might consider trailing the stop loss to lock in profits, especially if the price shows signs of stalling.

Partial Profit Taking: Some traders might take partial profits at the resistance level (34.60000) and let the remaining position run toward the target.

Broader Market Context

Trend Analysis:

The broader trend before the wedge was bullish, as evidenced by the rally from 32.80000 to 34.60000. The Falling Wedge, therefore, acts as a consolidation within this uptrend, and the breakout suggests a continuation of the bullish trend.

The price action after the breakout will be critical. A strong move toward 34.60000 with high volume would confirm the bullish momentum.

Volume and Momentum:

The chart doesn’t display volume or momentum indicators (e.g., RSI, MACD). However, a typical confirmation of a Falling Wedge breakout includes:

Volume: An increase in volume on the breakout candle, indicating strong buying interest.

Momentum: A bullish signal from indicators like RSI (e.g., moving above 50 or 70) or MACD (e.g., a bullish crossover).

Traders should check these indicators to validate the breakout’s strength.

Market Factors:

Silver prices are influenced by factors like U.S. dollar strength, interest rates, inflation expectations, and geopolitical events. On April 2, 2025, traders should consider:

U.S. Dollar Index (DXY): A weakening dollar typically supports higher silver prices.

Economic Data: Key releases like U.S. non-farm payrolls, inflation data, or Federal Reserve statements around this time could impact silver.

Geopolitical Events: Any risk-off sentiment (e.g., due to global tensions) could drive safe-haven demand for silver.

Potential Risks and Considerations

False Breakout:

If the price fails to hold above the breakout level (33.85000–33.90000) and falls back into the wedge, the setup is invalidated. The stop loss at 33.58553 mitigates this risk.

Resistance at 34.60000:

The resistance level has previously capped the price, and there’s a risk of rejection at this level. Traders should watch for bearish price action (e.g., a shooting star or bearish engulfing candle) near 34.60000.

Market Volatility:

Silver can be volatile, especially on a 1-hour timeframe. Unexpected news or economic data could lead to sharp price swings, potentially triggering the stop loss prematurely.

Timeframe Limitations:

This is a short-term setup on a 1-hour chart, so the target might be reached within hours to a couple of days. However, intraday noise could lead to choppy price action, requiring active trade management.

Conclusion

The TradingView chart by GoldMasterTraders presents a well-structured bullish trading setup for XAG/USD based on a Falling Wedge pattern. The price has broken out above the wedge’s upper trendline on April 2, 2025, signaling a potential move toward the target of 34.82470. Key levels include support at 33.58553 (where the stop loss is placed) and resistance at 34.60000, which the price must overcome to reach the target. The setup offers a favorable risk-reward ratio of approximately 2.94:1, making it an attractive trade for short-term traders.

However, traders should confirm the breakout with additional indicators (e.g., volume, RSI) and monitor broader market conditions, as this chart is a snapshot from April 2, 2025, and market dynamics may have evolved since then. If you’d like to search for more recent data on XAG/USD or check the outcome of this setup, I can assist with that!

RENDER ANALYSIS📊 #RENDER Analysis

✅There is a formation of Falling Wedge Pattern on daily chart with a good breakout and currently retests from the major resistance zone🧐

Pattern signals potential bullish movement incoming after a breakout of major resistance zone

👀Current Price: $3.455

🚀 Target Price: $4.4-6.0

⚡️What to do ?

👀Keep an eye on #RENDER price action and volume. We can trade according to the chart and make some profits⚡️⚡️

#RENDER #Cryptocurrency #TechnicalAnalysis #DYOR

Some of you won't be able to holdWeekly stoch RSI crossed bullish. It's the weekly, some more downturns can be had. But are you waiting to time this? Seriously?

Check out my other CHZ ideas for different views on this coin.

Will you be able to hold till the top? It might come within 3 months.

Rustle

EOS ANALYSIS📊 #EOS Analysis

✅There is a formation of Falling Wedge Pattern on daily chart with a good breakout and currently retesting the major resistance zone🧐

Pattern signals potential bullish movement incoming after a breakout of major resistance zone

👀Current Price: $0.6235

🚀 Target Price: $0.9200

⚡️What to do ?

👀Keep an eye on #EOS price action and volume. We can trade according to the chart and make some profits⚡️⚡️

#EOS #Cryptocurrency #TechnicalAnalysis #DYOR

Here's Why I'm Bullish on TSLA: Smart Money is Buying...Here's Why I'm Bullish on NASDAQ:TSLA Multi-Timeframe Analysis Using Larry Williams' Methods

After a significant downtrend, NASDAQ:TSLA is presenting multiple bullish signals based on Larry Williams' methodology. The weekly and daily timeframes are aligning for a potential reversal opportunity with clearly defined risk parameters.

Weekly Timeframe Analysis

The weekly chart reveals several key bullish indicators:

- The COT Proxy Index shows commercials are buying at significantly higher levels compared to 6 months ago, 1 year ago, and 3 years ago.

- Seasonality patterns have reached a turning point, now indicating the beginning of an uptrend phase

- The WillVal indicator shows NASDAQ:TSLA is currently undervalued at multiple securities (DXY, QCCH, ZBLU all showing "Under")

- ADX reading above 60 (currently at 62.42) signals the existing downtrend is likely exhausting and nearing completion

Daily Timeframe Analysis

On the daily chart, we're seeing initial confirmation signals but still waiting for the optimal entry setup:

- The general market has created a Rally Day, and we're now watching for a Follow Through Day to confirm the new uptrend

- Price structure requires further confirmation through a change of character before entry

- The ProGo indicator has already turned positive, providing an early bullish signal

- Williams %R is showing oversold conditions, suggesting a potential bounce

- We need the Large Traders index to turn its slope upward for additional confirmation

Entry Strategy

I'm looking for one of these entry triggers:

- Primary : First pullback after change of character , using Williams %R for precise timing

- Alternative : Entry on first pullback after price moves above the WillTrend line

- Aggressive option : Entry if price breaks above the $245 resistance level

Profit Targets & Risk Management

Targets:

- First target: $327 (1.27 Fibonacci level)

- Second target: $390 (Larry Williams Target Shooter -> 2.00 Fibonacci level )

Risk Management:

- Initial stop loss: $228 or 120% of ATR(3) from entry point

- Once in profit, trailing stop based on price closes at WillTrend levels

The confluence of indicators across timeframes suggests a significant reversal potential in NASDAQ:TSLA , but waiting for daily chart confirmation will provide a higher probability setup with clearly defined risk parameters.

DISCLAIMER

This analysis is provided for informational and educational purposes only. The ideas and strategies presented should never be used without first assessing your own personal and financial situation. This content is not financial advice and should not be construed as a recommendation to buy, sell, or hold any securities or to engage in any specific investment strategy. All investment carries risk, including the possibility of losing some or all of your initial investment. Past performance of securities, including the patterns, signals, and indicators discussed, is not indicative of future results. The author does not guarantee the accuracy, completeness, or usefulness of any information presented. Each investor should conduct their own research and consult with qualified financial professionals before making investment decisions. Trading Tesla ( NASDAQ:TSLA ) stock involves significant risks that may not be appropriate for all investors. You should only invest funds that you can afford to lose.

"ETH/USD: Breakout Incoming? Buy Signal from Falling Wedge!"It illustrates a downward trend with a falling wedge pattern, which is a bullish reversal pattern.

Key Observations:

Falling Wedge Pattern:

The price has been trading within a downward-sloping channel.

The wedge pattern suggests a potential breakout to the upside.

Breakout Opportunity:

The price is currently near the lower boundary of the wedge, suggesting a potential buying opportunity.

A buy signal is indicated at a key support level.

Target Price:

The chart has a target zone around $2,531 – $2,562, which suggests an expected upward move.

Technical Indicators:

The price is currently around $1,815, indicating a possible bottom formation.

A bullish move from this level is expected.

Trading Idea:

Entry: Buy near the current price ($1,815).

Target: $2,531 – $2,562.

Stop-Loss: Below $1,723 for risk management.

This analysis suggests a bullish reversal with a potential breakout from the falling wedge. However, traders should confirm with volume and other indicators before entering a trade.

#API3USDT is showing signs of recovery📉 LONG BYBIT:API3USDT.P from $1.1236

⚡️ Stop loss $1.1030

🕒 Timeframe: 1H

✅ Overview BYBIT:API3USDT.P :

➡️ The chart shows a gradual shift from a downtrend to possible reversal after forming strong support around $1.0680.

➡️ Price is currently attempting to break above the key resistance zone $1.1234–$1.1236, which also marks the potential LONG entry point.

➡️ Volume Profile indicates high trading activity above, with the Point of Control (POC) at $1.2541 — suggesting room for upside movement if breakout holds.

➡️ Bullish volume spikes suggest growing buyer interest.

➡️ Stop loss set at $1.1030, just below recent consolidation lows.

📍 Important Note:

Do not rush the entry!

Wait for a clear hold above $1.1236 before entering the LONG — entering too early may expose you to fakeouts.

🎯 Take Profit Targets:

💎 TP 1: $1.1362

💎 TP 2: $1.1544

💎 TP 3: $1.1707

⚡ Plan:

➡️ Watch for breakout confirmation above $1.1236

➡️ Enter LONG after volume or candle confirmation

📢 Consider partial profit at TP1 and move SL to breakeven for risk-free management.

🚀 BYBIT:API3USDT.P is showing signs of recovery — if the price holds above the entry zone, further upside is expected!