BNB ANALYSIS🚀#BNB Analysis : Pattern Formation

🔮As we can see in the chart of #BNB that there is a formation Inverse Head And Shoulder Pattern and it's a bullish pattern. If the candle closes above the neckline then a bullish move could be confirmed✅️

🔰Current Price: $635

⚡️What to do ?

👀Keep an eye on #BNB price action. We can trade according to the chart and make some profits⚡️⚡️

#BNB #Cryptocurrency #TechnicalAnalysis #DYOR

Bullishpattern

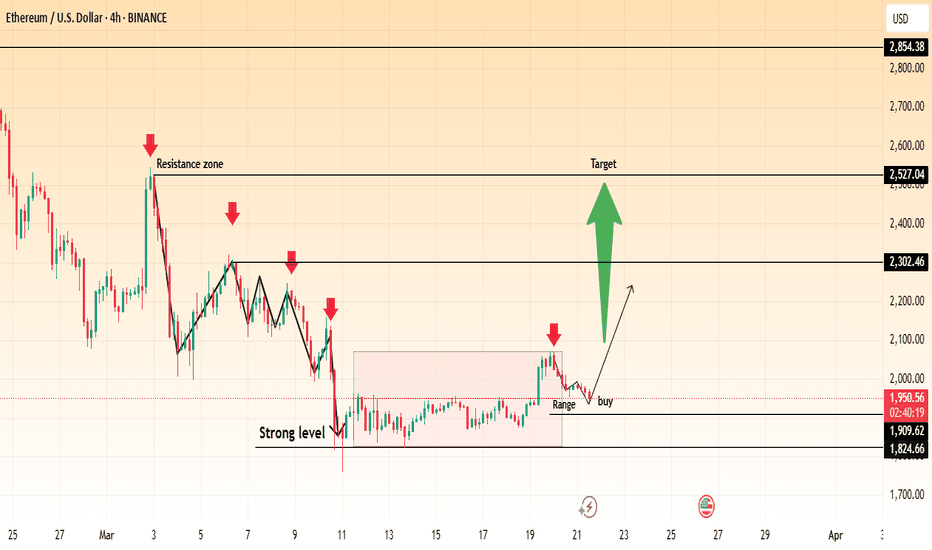

Ethereum (ETH/USD) – Potential Breakout from Range Towards $2,50📊 Chart Insights:

ETH/USD is currently ranging near the $1,950 zone, following a consolidation phase.

A strong resistance zone is visible between $2,302 - $2,527, which has historically acted as a rejection point.

Support levels are established around $1,824 - $1,909, forming a strong base for price action.

A breakout above the current range could signal a bullish move toward the $2,302 resistance level, with a further target at $2,527.

📈 Trading Plan:

✅ Entry: Buy above $1,966 on confirmation of breakout.

🎯 Targets: $2,302 and $2,527 for profit-taking.

❌ Stop Loss: Below $1,909 to manage risk.

📉 Bearish Scenario: If ETH fails to hold $1,909, a retest of $1,824 is possible.

🔥 Ethereum could see a strong rally if momentum builds above resistance! Are you ready?

Ethereum (ETH/USD) - Potential Breakout from RangeEthereum (ETH/USD) - Potential Breakout from Range

Chart Overview:

The price of Ethereum (ETH/USD) has been consolidating within a range after breaking out of a long-term downtrend channel.

A strong support level is identified around $1,852, which has been holding the price steady.

A resistance zone near $2,076 is acting as a short-term barrier for upward movement.

Trading Idea:

If ETH successfully breaks above the range, it may trigger a bullish move towards $2,539 and potentially $2,854.

Entry Strategy: Wait for a confirmed breakout above $2,076 with strong volume.

Stop-Loss: Below $1,852 to minimize risk.

Market Sentiment:

ETH/USD is showing signs of accumulation, and a breakout could signal a new bullish trend.

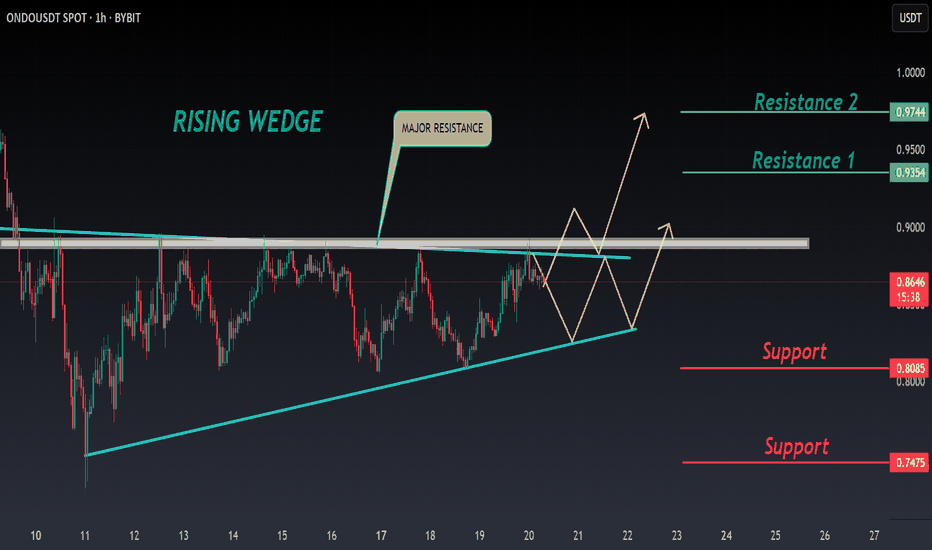

ONDO ANALYSIS 🔮 #ONDO Analysis 💰💰

🌟🚀In 1hr chart we can see a formation "Rising Wedge Pattern in #ONDO. There is a strong resistance zone near at $0.8840 and we could see a rejection from that level but if the price breaks the resistance zone then we would see a bullish move 💲💲

🔖 Current Price: $0.8640

⏳ Target Price: $0.9350

⁉️ What to do?

- We have marked some crucial levels in the chart. We can trade according to the chart and make some profits in #ONDO. 🚀💸

#ONDO #Cryptocurrency #DYOR #PotentialBreakout

Re-Testing of Breakout Level around 520.Re-Testing of Breakout Level around 520.

If Weekly Candle Closes above 520 - 521, we may

expect an Upside towards 550.

Also there is Bullish Divergence so we may

expect that it will play this time & push the price upside.

On the flip side, 500 - 504 is the Channel Bottom.

and Remember, Once 650 is Crossed with Good Volumes,

it may expose New Highs targeting around 700.

WILL GOLD FALL OR RISE IN FOMC SPEAKS ALERT!Hey Trader

there is market going to buy trend and powell speaks at in 2 hour left so if market break NEW ATH with good buy momentum before powell speaks so you see GOLD fall and target area for BEAR side

3000 and 2980

if the ATH break and close above m30 candel so you see gold mark new ATH at 3070

key level or reversal:

3046 for seller

3000 for buyers

follow risk mangement

#FARTCOINUSDT is showing bullish momentum📈LONG BYBIT:FARTCOINUSDT.P from $0.3590

🛡 Stop Loss: $0.3465

🕒 Timeframe: 1H

⚡️ Overview:

➡️ BYBIT:FARTCOINUSDT.P is showing bullish momentum on the 1-hour timeframe.

➡️ The price has recently broken through the resistance zone at $0.3590, which could serve as an entry point for a long position.

➡️ The chart shows an accumulation zone in the $0.3374–$0.3590 range, where volumes (visible on the volume profile to the left) indicate strong buyer interest.

➡️ The POC (Point of Control) is at $0.3462, confirming support below the current price.

➡️ The price is maintaining an uptrend structure: higher lows and highs are forming, and the breakout at $0.3590 is accompanied by increasing volumes, signaling bullish activity.

➡️ The #RSI (14) indicator on the 1H timeframe is at 65, indicating bullish momentum without being overbought, leaving room for further growth.

🚀 Plan:

➡️ Entry: Buy above $0.3590 after the 1-hour candle closes above this level to confirm the breakout.

➡️ Stop Loss: Set at $0.3465 (below the support zone and POC), which provides a 3.5% risk from the entry point and protects against false breakouts.

➡️ Risk/Reward Ratio: From 1:2 (for TP1) to 1:5.5 (for TP3), making this trade attractive from a risk management perspective.

🎯 Take Profit Targets:

💎 TP1: $0.3660

(nearest resistance level, +1.9% from entry)

💎 TP2: $0.3730

(zone of previous highs, +3.9%)

💎 TP3: $0.3790

(key growth target, +5.6%)

📢 A price consolidation above $0.3590 with sustained volume increases the likelihood of reaching the targets. The $0.3660 and $0.3730 levels may act as profit-taking zones, so monitor price action in these areas.

📢 Risks: If the price drops below $0.3465, it could signal a false breakout and a return to the consolidation zone of $0.3374–$0.3465. In this case, consider reassessing the position.

📢 Market Context: The rise of BYBIT:FARTCOINUSDT.P may be supported by the overall positive sentiment in the crypto market. As of March 19, 2025, BYBIT:BTCUSDT.P is trading steadily above $90,000, creating a favorable backdrop for altcoins.

BYBIT:FARTCOINUSDT.P is showing strength and potential for growth on the 1H timeframe. A confirmed breakout above $0.3590 is your signal to act! We expect a move toward the $0.3660–$0.3790 levels.

CAD JPY BUY Trade Setup 2 hour timeframe On the 2 hour timeframe CAD JPY has broken a key structure level forming a Higher high and higher low uptrend pattern, we need to wait for a retest of the higher low level for the completion of a Bullish Break and Retest pattern, also this level align with the Fib Retracement zone 0.618-0.50

Entry will be based off candlestick confirmation on the retest level.

Patience Patience ⏰👌🏻

TREND LINE BREAKOUT AND RETEST FOR BULLISH MOVE ALERT!Hey Trader

Congratulation all trader for new ATH 3038

THERE is OB in H1 and market is near to break trend line zone and goes for sell for hunting some liquidity from 3015 area.

Now trend is BUll so we just scalp in sell for long term GOLD bull move is going to the moon and month prediction is 3200.

TARGET AREA FOR BULL 3039 AND 3060.

follow risk management

BTC ANALYSIS🚀#BTC Analysis :

🔮As we can see in the chart of #BTC that there is a crucial support and resistance zone. Now trading at a crucial resistance zone. We could expect a bullish move from this level

⚡️What to do ?

👀Keep an eye on #BTC price action. We can trade according to the chart and make some profits⚡️⚡️

#BTC #Cryptocurrency #TechnicalAnalysis #DYOR

EUR/USD Bullish Continuation Setup📈 Trend Analysis:

The price is trading within a rising channel, suggesting an overall bullish trend.

The market recently pulled back to a key support level, presenting a potential buy opportunity.

🔍 Key Levels:

Buy Zone: Around 1.08680 - 1.08966, marking strong support.

Target: 1.10140, aligning with the upper trendline resistance.

📌 Trade Plan:

Look for buy entries near the lower boundary of the ascending channel.

Confirmation through bullish candlestick patterns (e.g., engulfing, pin bar) strengthens the setup.

⚠ Risk Management:

Stop loss: Below the 1.08680 support level.

Take profit: Gradually scale out at 1.10140 resistance.

ADBE to $465 - Chance for a BounceNASDAQ:ADBE ADBE, as well as other tech stocks, was beaten hard over the last couple of months. The earnings recently did not provide any relief for the chart either, although the figures were not particularly bad. In particular, the possible prospect of finally being able to expand and monetize Adobe's own AI “Firefly” continues to offer good opportunities.

With a PE of now under 20, Adobe has become quite favorable as a company that continues to grow well in the SaaS sector. It has also reached several technical support zones. We are at the lower edge of a very large bull flag that has been in place since the beginning of 2024. Horizontal support at $385 is also supportive. We have 3 large daily gaps in the chart above us and a bullish wedge within the flag. This is a good place to start buying for a possible bounce towards $465.

However, one must bear in mind that the overall market remains bearish. Purchases should therefore be closely hedged and not be too large. However, it would be wrong not to use this opportunity to enter the market.

Target Zones

$465.00

Support Zones

$385.00

$360.00

#DYMUSDT is showing signs of growth📉 Long BYBIT:DYMUSDT.P от $0,4575

🛡 Stop loss $0,4350

🕒 1H Timeframe

⚡️ Overview:

➡️ The main POC (Point of Control) is at 0,4149, indicating the area with the highest trading volume.

➡️ The 0,4572 level acts as a local support, as the price previously bounced from this zone.

🎯 TP Targets:

💎 TP 1: $0,4720

💎 TP 2: $0,4850

💎 TP 2: $0,4970

📢 Monitor key levels before entering the trade!

📢 If 0,4572 is broken downward, the trade may be invalidated.

BYBIT:DYMUSDT.P is showing signs of growth — expecting further upside movement!

Gold (XAU/USD) – Bullish Reversal & Breakout PatternChart Pattern Analysis

The 15-minute chart of Gold (XAU/USD) showcases a classic support-resistance structure, along with a potential bullish reversal pattern forming. The price is currently reacting to key levels, and the setup suggests an impending move toward higher price targets.

Key Chart Patterns Identified:

🔹 Support & Resistance Flip:

The price initially struggled at resistance (~$3,038 - $3,045) before experiencing a pullback.

It found strong support (~$3,027 - $3,030), confirming a potential retest zone for a bullish reversal.

🔹 Double Bottom Reversal Pattern:

The price bounced twice from the support zone, forming a possible double-bottom pattern – a classic bullish reversal sign.

If the price successfully holds this level, a breakout above the previous high (ATH - $3,045) is expected.

🔹 Break & Retest Structure:

A bullish breakout from resistance could trigger a rally toward the next target zone ($3,056 - $3,060).

A possible higher low formation suggests market accumulation before an upward continuation.

Trade Plan – How to Approach This Setup

📌 Entry Confirmation:

Look for a bullish candle formation at support (~$3,027 - $3,030).

A strong breakout and retest above ATH ($3,045) would provide further confirmation.

📌 Stop-Loss Placement:

Below support ($3,027) to limit downside risk.

If price breaks below this zone, the bullish scenario gets invalidated.

📌 Take-Profit Targets:

1️⃣ First Target: $3,045 (ATH breakout confirmation)

2️⃣ Final Target: $3,056 - $3,060 (Major Resistance & TP Zone)

Potential Market Scenarios:

✅ Bullish Breakout:

If price breaks & retests resistance ($3,045), a rally toward $3,060 is likely.

❌ Bearish Breakdown:

If price fails to hold support ($3,027), a drop to $3,020 - $3,015 could occur.

🚀 Final Thoughts:

This setup presents a high-probability bullish opportunity, but confirmation is key! Wait for price action signals before entering.

📊 Do you agree with this analysis? Drop your thoughts in the comments! 🔥

$BANANA @BananaGunBot ─ Possibly beginning of Accumulation Range🍌 $BANANA @BananaGunBot 🍌

Could this possibly be the beginning of an Accumulation Range?

As usual, my base case is Wyckoff Accumulation Schematic #1.

Time and more data will tell—adding $BANANA to the watchlist.

Clues to Support an Idea:

1️⃣ Prolonged downtrend

2️⃣ Preliminary Support (PS) – Surge in selling volume followed by above-average buying volume

3️⃣ Selling Climax (SC) – Huge increase in selling volume

4️⃣ Automatic Rally (AR) – Short-lived spike in buying volume

EUR/GBP Technical Analysis - 4H Chart

📌 Pair: EUR/GBP

📈 Current Price: 0.84092

Key Levels:

🔹 Support Zone: 0.83766 - A key area where price has previously bounced.

🔹 Resistance Zone: 0.84400 - A strong resistance level where price has faced rejection.

🔹 Target Level: 0.85004 - Potential bullish target if price breaks above resistance.

Market Structure & Trade Idea:

EUR/GBP has shown strong bullish momentum, breaking above the support zone (0.83766).

Currently, price is testing the resistance level. A slight pullback toward support could provide a new buying opportunity.

A break above resistance would confirm bullish continuation toward 0.85004.

Trading Plan:

✅ Bullish Scenario: Wait for a pullback to 0.83766 before entering long, targeting 0.85004.

✅ Bearish Scenario: If price breaks below 0.83766, a deeper retracement to 0.82652 may follow.

🔍 Watch for:

Breakout confirmation above resistance.

Strong rejection from support before entering a trade.

Bearish Divergence on Weekly TF but... there is a Breakout..Bearish Divergence on Weekly TF.

However, Breakout on Daily TF from 452 - 453.

Weekly Closing above this level would

be a positive sign.

Upside Targets can be around 495 - 500

& if this level is Sustained, with Good

Volumes , we may witness 540 - 550.

Should not break 400, otherwise, we may see

heavy Selling pressure.

#1000XUSDT is setting up for a breakout📉 Long BYBIT:1000XUSDT.P from $0,05470

🛡 Stop loss $0,05297

1h Timeframe

⚡ Plan:

➡️ POC is 0,04229

➡️ Waiting for consolidation near resistance and increased buying activity before the breakout.

➡️ Expecting an impulsive upward move as buy orders accumulate.

🎯 TP Targets:

💎 TP 1: $0,05640

💎 TP 2: $0,05775

🚀 BYBIT:1000XUSDT.P is setting up for a breakout—preparing for an upward move!

Ethereum at a Turning Point: History Repeating?Ethereum is currently at a decisive moment, sitting at a major support level that has historically played a crucial role in determining the market’s direction. The parallels to 2021 are striking. Back then, ETH experienced a deep correction of over 60 percent after reaching its cycle high. However, once it found support in a key liquidity zone, it staged an explosive rally, gaining over 175 percent in just a few months. Now, in 2025, we are seeing an almost identical setup. ETH has once again corrected significantly from its recent highs, dropping nearly 58 percent, and is now testing the same kind of structural support that previously acted as a springboard for a new bull run.

The technicals indicate that this support level is not just any ordinary price zone. It coincides with the 200-week exponential moving average, a historically strong dynamic support level that has often marked the bottom of major corrections. Additionally, this region aligns with a previously established demand zone that saw significant buying interest in the past. The fact that ETH is testing this support right before a major macroeconomic event makes this moment even more critical. On March 19, the Federal Reserve is set to announce its latest interest rate decision, which could have a direct impact on liquidity conditions across all markets, including crypto.

If Ethereum manages to hold this level and bounce, the upside potential could be significant. The first major resistance to overcome would be around 3929, a level that previously acted as a rejection zone during the last cycle. A breakout above that level could open the door for a move towards 4875, which represents a key structural resistance and would put ETH back in a strong bullish trend. A repeat of the 2021 pattern could mean that ETH is on the verge of another parabolic move.

However, the bearish scenario cannot be ignored. If this support fails and ETH breaks below this critical zone, it would be a major warning sign. A breakdown could trigger further downside pressure, potentially leading to a deeper correction and confirming a bearish trend. This could mean that Ethereum enters an extended bear market, with the next significant support levels much lower. The rejection at resistance, followed by a lower high, would suggest that sellers remain in control, and without strong bullish catalysts, a further decline would be the path of least resistance.

Beyond technicals, fundamentals are playing an equally important role. The crypto market has been increasingly correlated with traditional finance, and with the Federal Reserve’s decision just days away, investors are watching closely. If the Fed signals continued monetary tightening or delays interest rate cuts, risk assets like Ethereum could face further downside. On the other hand, a more dovish stance from the Fed could inject fresh liquidity into the market, acting as a catalyst for ETH to reclaim higher levels.

Sentiment in the crypto space is also crucial. On-chain data suggests that long-term holders are still accumulating, which indicates confidence in Ethereum’s long-term value. However, short-term traders remain cautious due to the uncertain macro environment. Open interest in ETH futures has seen a decline, suggesting that many traders are waiting for confirmation before making big moves. This means that volatility could spike significantly once a clear direction is established.

Overall, Ethereum is at a critical juncture. The historical comparison to 2021 suggests that this could be the start of a major recovery, but whether or not history repeats itself depends largely on external factors like the Federal Reserve’s decision and broader market sentiment. If this support holds, ETH could be at the beginning of another strong bull cycle. If it fails, the bearish alternative could become the dominant narrative. The next few days will be crucial in determining which path Ethereum takes.