Massive Move Loading? $SOL Prepping for a BreakoutSolana is showing real strength here.

CRYPTOCAP:SOL consistently taking support from the long-term rising trendline, a sign that buyers are defending key levels. We're also approaching a critical resistance zone, which was the previous ATH area.

If SOL manages to close above this zone, we could witness a strong rally towards $500 and beyond. Until then, it’s a crucial level to watch, a breakout here could set the stage for the next leg up.

DYOR, NFA

Bullrun

Dash RocketDash has been in a bearish trend for some time now, but it has stood the test of time being one of the OG coins of the market with this double bottom within this descending channel on the daily and a retest of demand I believe this coin will see $50 soon.

It’s master node runners and minors have kept the chain going, and we should be breaking its bearishness very soon.

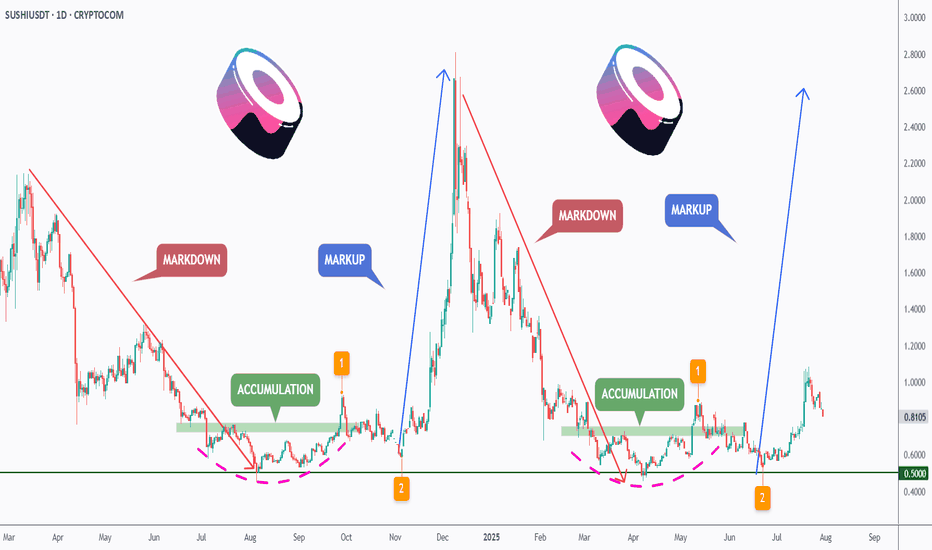

[Deep Dive] SUSHI – Edition 3: Accumulate. Anticipate. Accelerat🧠 Cycle Anatomy: What the Chart Is Telling Us

📉 Phase 1: Markdown

The bears dominated, slicing price downward into key historical support around the $0.50 mark — the same level that anchored the previous accumulation zone.

📦 Phase 2: Accumulation

Both accumulation phases (mid-2023 and Q2 2025) occurred near identical support zones, with rounded bases and sideways chop — signaling strong hands quietly absorbing supply.

📈 Phase 3: Markup Incoming?

Following breakout point “1” and retest point “2,” the current structure aligns remarkably well with the previous markup phase — which propelled SUSHI from ~$0.50 to over $3 in just weeks. While past performance isn’t a guarantee, this fractal deserves attention.

🔥 Why Fundamentals May Support This Move

- SushiSwap v3 continues rolling out on multiple chains, optimizing capital efficiency and fee structure for LPs.

- Governance has stabilized after the rough patches of 2022–2023, with more transparent treasury and development direction.

- Cross-chain expansion and integrations with major aggregators (like 1inch, Matcha, and DeBank) are boosting SUSHI’s visibility in the broader DeFi flow.

Additionally, a surge in TVL and DEX activity on low-fee chains could redirect volume back to SushiSwap — a platform known for its cross-chain capabilities.

📍 What to Watch Next

- A confirmed breakout above $1.00 would validate the “markup” thesis.

- A dip toward the $0.65–$0.70 zone could offer a high-risk/reward entry aligned with point “2.”

- Failure to hold the $0.50 level would invalidate the structure.

For now, the rhythm is clear: markdown → accumulation → markup. And if the pattern holds, SUSHI might just be preparing for its third vertical.

💬 Do you think this is just another fakeout — or is SUSHI gearing up for a DeFi comeback?

🔔 Disclaimer: This post is for educational and informational purposes only. It does not constitute financial advice. Always do your own research and manage risk carefully.

📚 Always follow your trading plan => including entry, risk management, and trade execution.

Good luck!

All strategies are good, if managed properly.

~ Richard Nasr

THETA Bounces Off Key Support – Eyes on Resistance!After months of holding above the key support zone, MYX:THETA is finally showing some strength.

Price is bouncing off the lows and heading toward a minor S/R zone.

If the bulls can break through this level, there’s a good chance we’ll see a move all the way up to the upper resistance line.

DYOR, NFA

ENA Explodes After Breakout – What’s Next?

ENA Exploded 100%+ After Our Post 🚀

Just days ago, we highlighted ENA as one to watch — and it delivered.

Since then, price has nearly doubled, breaking past key resistance with strong volume and momentum.

This is why timing + conviction matters. When the setup is clean, the move speaks for itself.

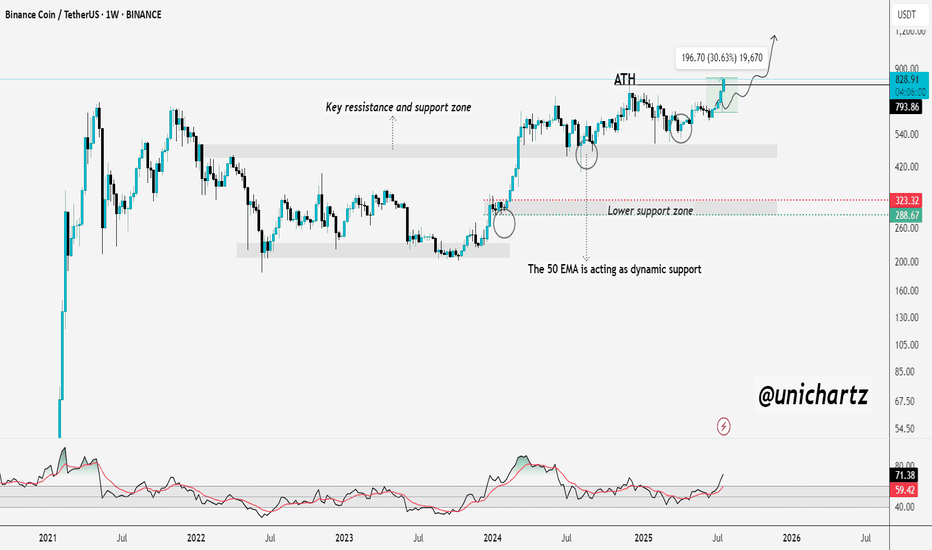

BNB Breaks ATH – Just Like I PredictedBNB ATH Breakout – Just As Predicted 🚀

A few days ago, I said it loud and clear:

"Mark my words — BNB will not only retest its ATH but break it and go beyond before the year ends."

Well... today, it happened.

BNB just smashed through its previous ATH and printed a new all-time high, exactly as charted.

Strong structure ✅

EMA support held ✅

Momentum built up ✅

Bulls showed up ✅

This is what conviction backed by TA looks like.

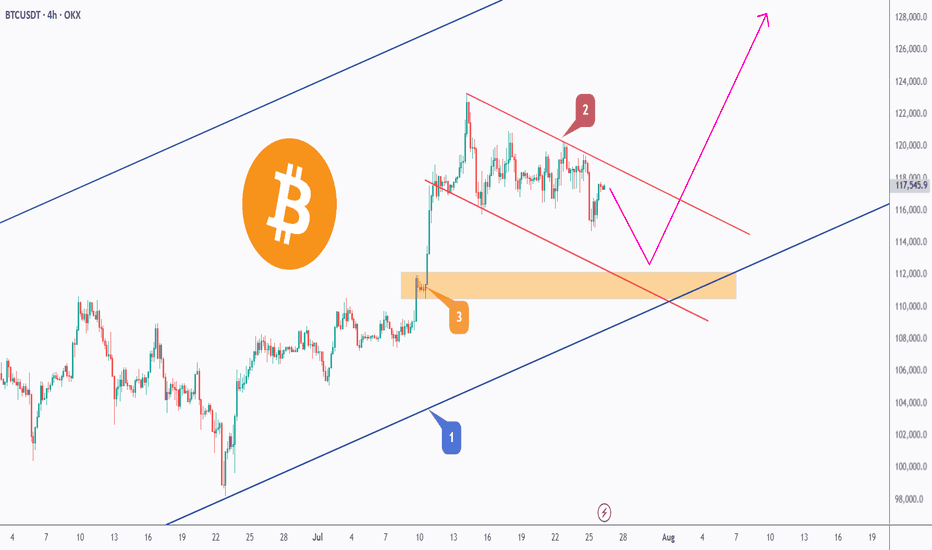

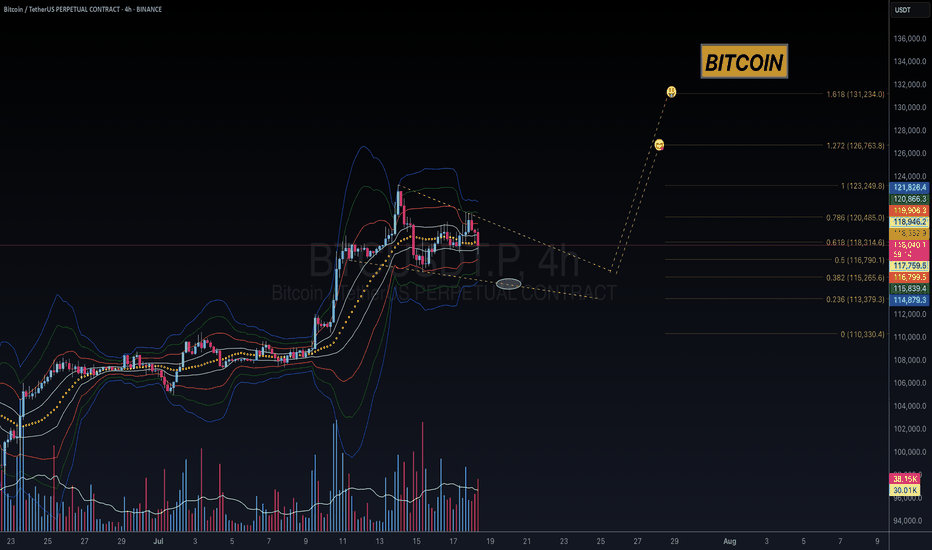

BTC - Trap, Tap, and Blast Off!BTC has been overall bullish, trading within the rising blue channel (1). After reaching a local high, it entered a short-term correction, forming a falling red channel (2).

👀All eyes are now on the key demand zone (3), which aligns with the lower bound of both the red channel and the rising blue structure.

🔎As long as this confluence holds, we anticipate a potential bullish impulse in August.

A retest of the $111,500–$112,000 zone could serve as the trigger for the next leg toward $128,000. Let’s see if BTC is gearing up for another breakout or if a deeper correction is in play.

🔔 Disclaimer: This analysis is for educational and informational purposes only. It does not constitute financial advice or a recommendation to buy or sell any asset. Always do your own research and manage your risk accordingly.

📚 Always follow your trading plan => including entry, risk management, and trade execution.

Good luck!

All strategies are good, if managed properly.

~ Richard Nasr

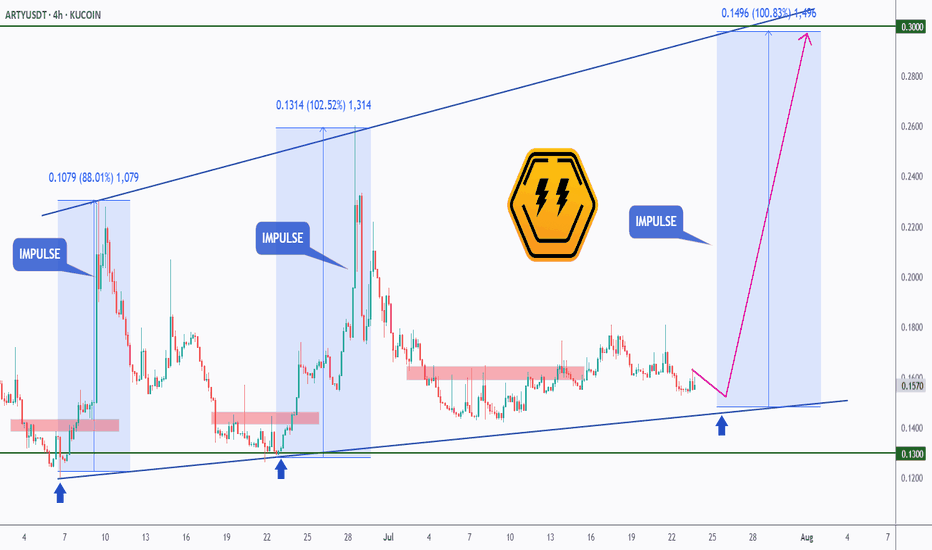

ARTY - The Undervalued Gaming Rocket?While most eyes are on memecoins and major Layer-1s, a sleeping giant may be gearing up in the GameFi sector — and this time, it’s powered by real innovation and user growth.

🎮 Fundamental Boost

Artyfact has just launched its long-awaited Play-and-Earn mode — the first of its kind. This new feature is expected to onboard hundreds of thousands of gamers into the ecosystem. And here’s the catch: players can only purchase gaming NFTs using KUCOIN:ARTYUSDT . This shift not only introduces a fresh wave of demand but also builds real token utility — the kind most GameFi tokens lack.

💼Additionally, recent sell pressure from early investors has now faded. Those who had been staking ARTY for three years have finally taken their profits. With that wave of selling behind us, the token now has room to breathe — and potentially fly.

And yes, I bought ARTY myself — not financial advice, but I’m personally betting on its next big move.

📊 Technical Analysis

AMEX:ARTY has been trading within a bullish ascending triangle, forming higher lows and maintaining strong support around the $0.13 level. Each time it tapped this zone, it triggered strong impulse moves — one up 88%, another over 100%.

Right now, ARTY is back at that exact support level, with a third impulse wave potentially brewing. A bounce from here could send it back toward the upper trendline near $0.30 — our first target.

If that breaks, the next resistance sits around the $0.70 zone, a previous structural high and psychological round number. And if the gaming adoption kicks in as expected, we could be heading toward a macro bull market target of $1+, which would represent a multi-X move from here.

📈 3 Bullish Targets for AMEX:ARTY

$0.30 — top of ascending triangle

$0.70 — structural resistance from prior impulse

$1.00+ — psychological milestone backed by new NFT demand and adoption

📍 Why ARTY?

Artyfact is not just another GameFi project — it’s building a functional gaming economy where NFTs have real use, and where the token is required for participation. In a sea of hype-driven tokens, ARTY stands out by actually shipping product and onboarding users.

With the new Play-and-Earn mode gaining traction, a solid technical base forming, and sell pressure behind us, ARTY could be setting up for its biggest run yet.

➡️ As always, make sure to do your own research and only invest in what you truly believe in.

🎯 Stick to your trading plan — entry, risk, and execution.

Good luck!

All strategies are good, if managed properly.

~ Richard Nasr

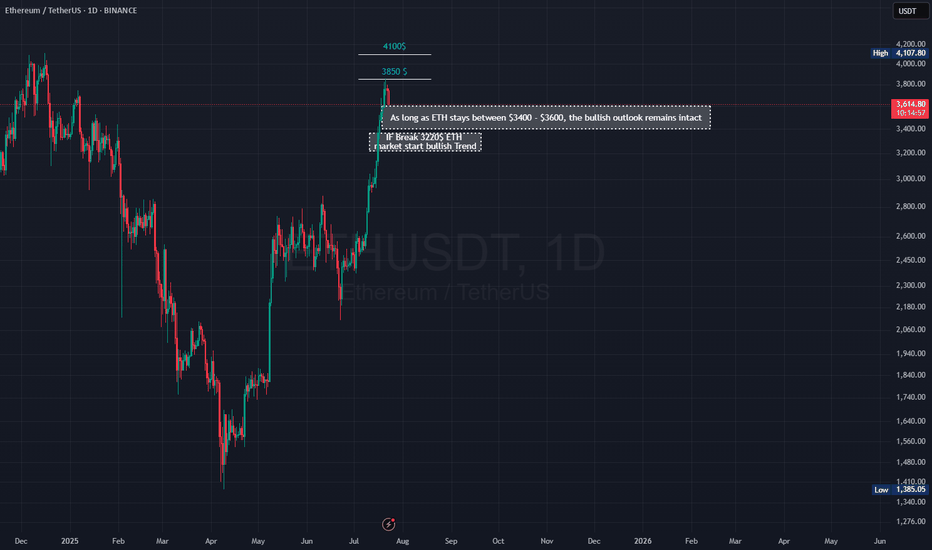

Ethereum Ready for Breakout Above $3850?📊 Ethereum Quick Analysis | Breakout or Breakdown?

✅ As long as ETH stays between $3400 - $3600, the bullish outlook remains intact.

🚨 A confirmed close below $3200 could mark the end of the bull market.

🚀 A clean, shadowless candle close above $3850 may push price toward $4100.

⚠️ However:

📉 Expect retail sell-offs around those highs

💸 But heavy institutional buying could send ETH to $6230 in the short term.

🔥 Altseason is officially here — get ready for explosive moves!

🎯 I'm here to track and update all major targets in real-time 💥

#BullRun#altseason#ETH

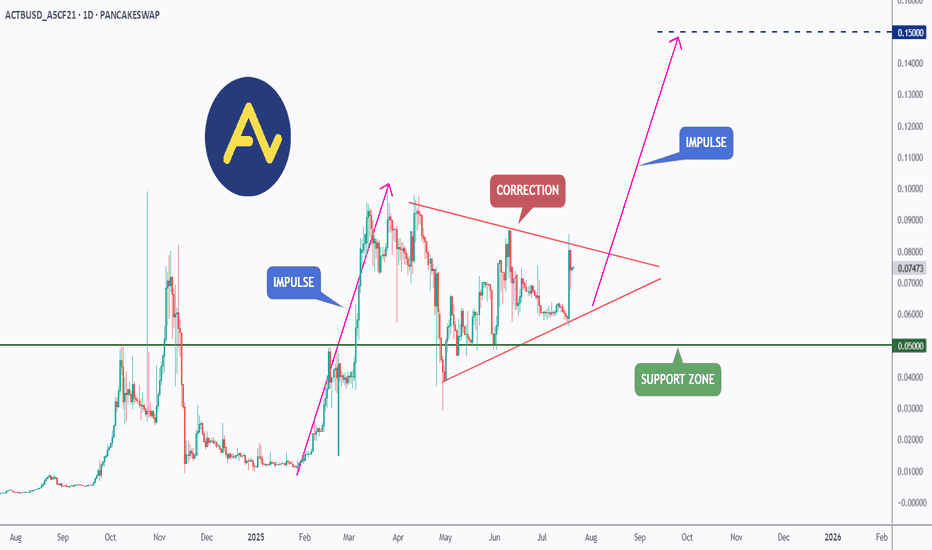

ACT (Acet) - Eyeing the Next Impulse Move?ACT has been forming a textbook bullish continuation pattern.↗️

After a strong impulse leg earlier this year, price has been consolidating within a symmetrical triangle, signaling a healthy correction phase.

🏹Today, ACT broke out of the triangle to the upside , indicating that bulls may be taking control once again.

📍If momentum continues, the next impulse move could push price toward the $0.15 resistance as a first target — a major psychological and technical level.

As long as the $0.050 support holds, ACT remains in bullish territory with upside potential in sight.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

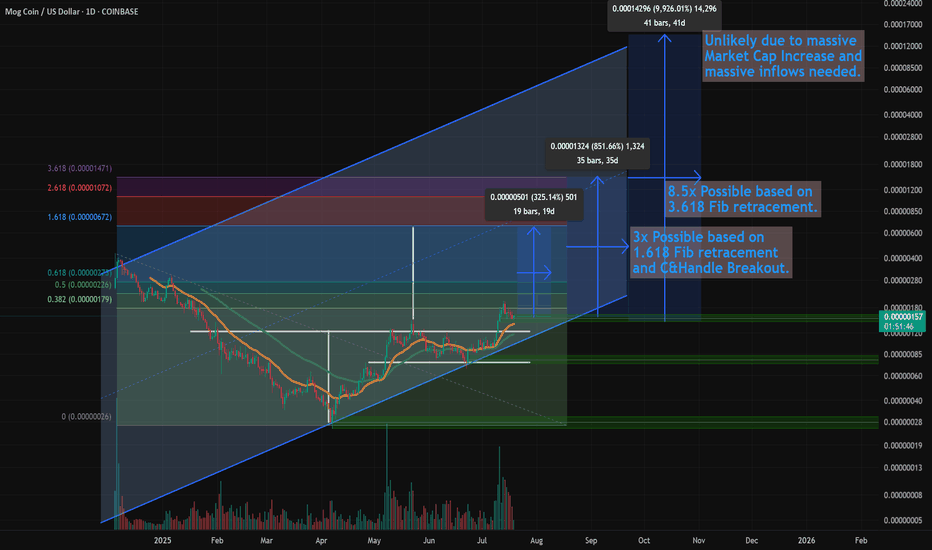

$MOG Setting Up For Cup & Handle Breakout - 10x - 100x TargetsAs I stated in the video, I don't normally cover Meme coins, but this is a great looking chart for MOG and thought I'd do a quick study on this with some potential price targets...

And how I'm using AI to get a better handle on the likelihood of my TA targets.

In short -- 10X here is possible this bull run (8.5x more likely based on the Fib)

But 100X is very unlikely, even though the top of the parallel trend channel shows it's potential.

No surprise there, but watch how using AI can give clarity on this and these decisions.

Let me know what you think...

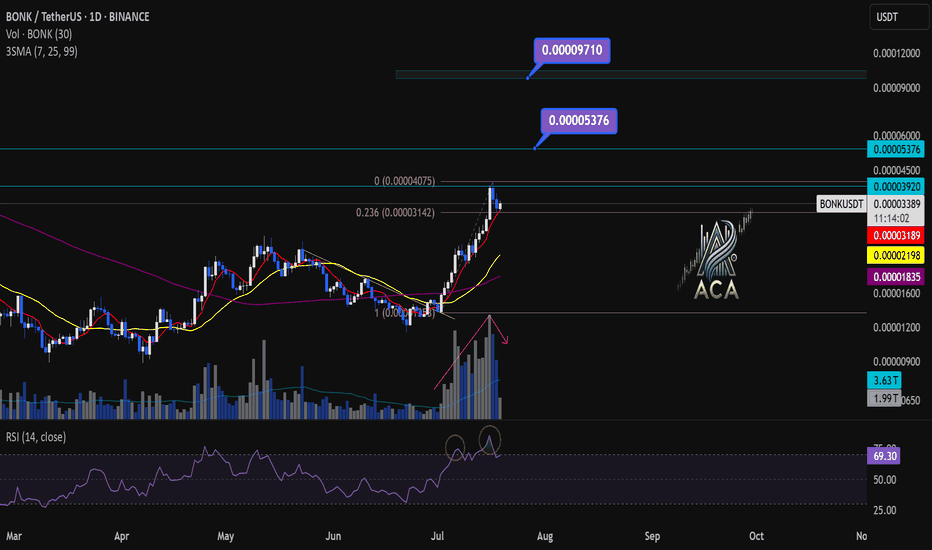

BONKUSDT 1D Chart Analysis | Bullish Momentum is coming...BONKUSDT 1D Chart Analysis | Bullish Momentum Builds After 0.236 Fibo Pullback

🔍 Let’s break down the BONK/USDT daily chart, focusing on the latest price action, strategic moving averages, RSI convergence, and volume dynamics for a complete bullish scenario setup.

⏳ Daily Overview

BONK is showing strong upward momentum, printing consecutive higher highs (HH) in both candles and RSI—a clear bullish trend indicator. After an explosive move, price is currently staging a healthy pullback to the key 0.236 Fibonacci retracement level (0.00003142), which commonly acts as a support platform during aggressive uptrends.

📈 Technical Convergence and Trend Structure

- 3SMA Support: The 7, 25, and 99 SMAs are all trending upward and stacked correctly, with price sitting comfortably above them. The 7SMA acts as immediate dynamic support, reflecting trend strength and buyer interest at every dip.

- RSI Dynamics: RSI just bounced from the 69–70 zone, confirming convergence with price action. The indicator made its own higher high in tandem with the candles, and now, as price pulls back, RSI is reentering the overbought territory—which often precedes renewed momentum.

- Volume Confirmation: Notably, volume surged as the trend accelerated, and is now tapering off during this corrective phase. This is a classic bullish volume signature, showing profit-taking by early longs but no major selling pressure, suggesting trend continuation likely after consolidation.

🔺 Bullish Setup & Targets

- First target: 0.00005376 — retest of the last all-time high (ATH).

- Next resistance to watch: 0.00003920, followed by the ATH region.

- Long-term target: 0.00009710 — an upside of 170–180% from current levels, mapped by technical extension and price discovery zones.

📊 Key Highlights

- Price holding the 0.236 Fibo retracement signals a shallow, healthy correction.

- 3SMA alignment confirms long-term bullish bias—actively supporting every dip.

- RSI and price are convergent, reaffirming uptrend strength; RSI’s move back into overbought could ignite the next price surge.

- Volume decreasing on corrections and rising during rallies—bullish confirmation.

🚨 Conclusion

BONK/USDT remains technically poised for further upside. The blend of higher highs, support at the 0.236 Fibonacci retracement, positive 3SMA structure, and RSI convergence all point to bullish continuation. Watch for renewed momentum as RSI reenters overbought territory and volume confirms the next breakout. Next targets: 0.00005376 (ATH), with a long-term projection toward 0.00009710.

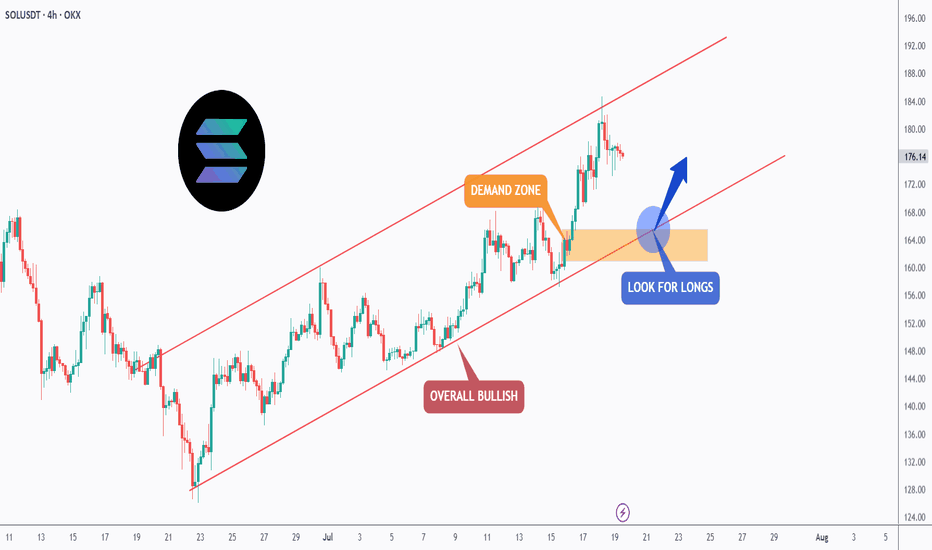

SOL - Trend-Following Longs in the making!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈SOL has been overall bullish trading within the rising channel in red.

Moreover, the orange zone is a strong demand.

🏹 The highlighted blue circle is a strong area to look for buy setups as it is the intersection of the orange demand zone and lower red trendline acting as a non-horizontal support.

📚 As per my trading style:

As #SOL retests the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

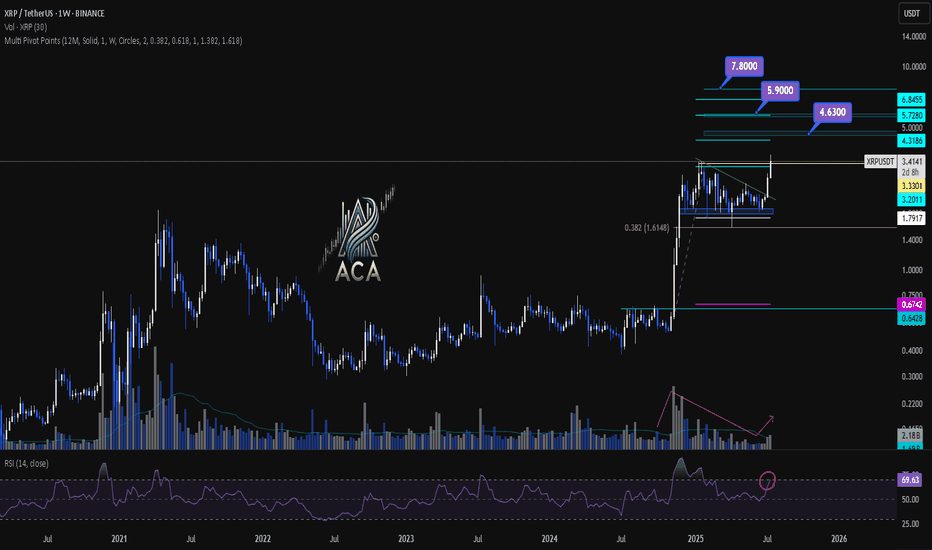

XRPUSDT Weekly Chart Analysis | Next Bullish MoveXRPUSDT Weekly Chart Analysis | Major Resistance Levels Align for Next Bullish Move

🔍 Let’s break down the XRP/USDT weekly setup, highlighting key technical signals and major upside targets for the next rally.

⏳ Weekly Overview

The weekly chart shows consolidation just below a major resistance, with price action tightening and preparing for a breakout. A recent correction found support near the 0.382 Fibonacci retracement level, which has acted as a springboard for renewed momentum. Notably, the R2 pivot point level aligns closely with this area, strengthening its importance as a decision zone for bulls.

🔺 Upside Targets & Confluences:

- First Target: $4.63 — This coincides with the R2 monthly pivot point and aligns with key Fibonacci extension targets, offering strong confluence for a reaction zone.

- Second Target: $5.90 — Our most realistic medium-term target, also backed by cluster resistance from both pivot analysis and fib projections.

- Final Target: $7.80 — This is the major Fibonacci extension level, marking the highest projected upside if momentum persists.

📊 Key Technical Highlights:

- Pivot Point R2 & Fibonacci Confluence: The R2 level reinforces a critical resistance, overlapping with the $4.63 Fibonacci target.

- Fibonacci Retracement: Price respected the 0.382 retracement during the latest correction, signaling healthy trend continuation.

- Volume Confirmation: An uptick in volume confirms that buyers are stepping in, supporting the bullish momentum.

- RSI Signal: RSI is entering the overbought zone, which typically indicates a strong surge in buying pressure and can mark the start of a momentum move.

🚨 Conclusion:

XRP is setting up for a major breakout as key technical levels align. Watch for a sustained move above $4.63 to unlock the $5.90 area, with a final potential push towards $7.80 if bulls maintain control. Volume expansion and an overheated RSI are both classic signs of an incoming momentum wave—keep your eyes on these levels for validation of the setup.

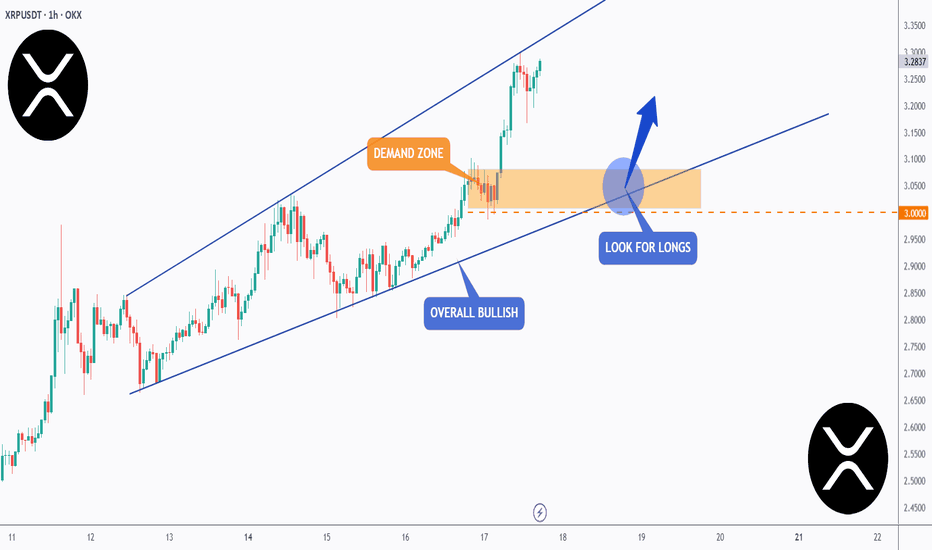

XRP - One More Wave Soon!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈XRP has been overall bullish trading within the rising wedge pattern in blue.

However, it is approaching its all-time high at $3.4.

🏹 The highlighted blue circle is a strong area to look for buy setups as it is the intersection of the orange demand zone and lower blue trendline acting as a non-horizontal support.

📚 As per my trading style:

As #XRP retests the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

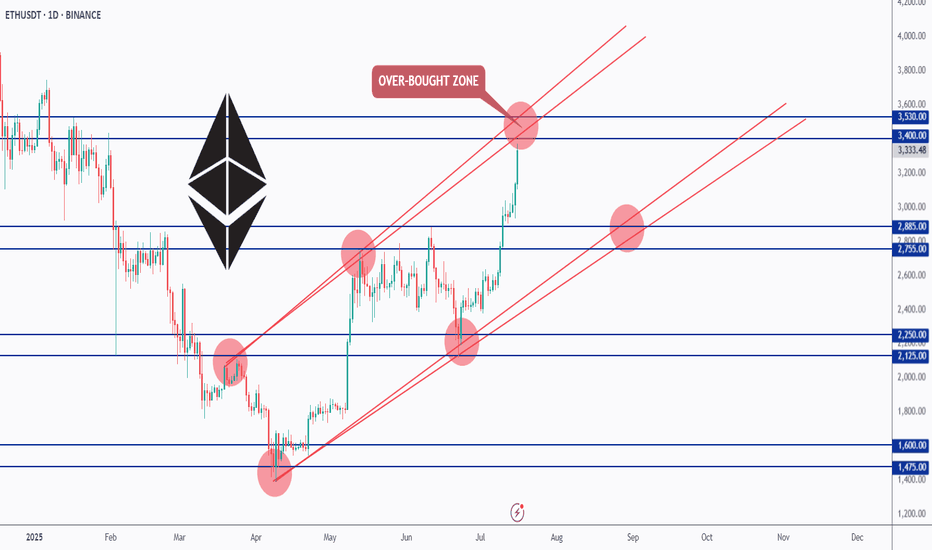

ETH Testing Overbought Zone — What’s Next?📊ETH has been overall bullish, trading inside this rising red channel for months.

After breaking above the $2,885 resistance, bulls took full control, and price is now approaching the upper red trendline — an overbought zone where we’ve seen rejections before.

As long as ETH holds above the $2,885 zone, the bulls remain in control. But since we’re near a strong resistance and the top of the channel, we’ll be waiting for a potential correction or at least a slowdown in momentum before looking for fresh entries.

📌 Key levels to watch:

Resistance: $3,400 – $3,530

Support: $2,885 – $2,755

Let’s stay patient and follow the market’s lead. 🧠

Let me know your thoughts in the comments 👇

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

LTC Targets 400$ + 1900$ Litcoin LTC Targets for the next run are atm +290% is a realistic szenario. The addvanced targets at 1900$ are very impressiv but remember there are only 21 Mio. Coins too, like BTC because it is the fork and think about an alternative payment methode like btc, would be a reason for 1900$ pro LTC. So in Crypto is nothing unreal if you could imagine, but first of all approx. 400$ are a good direction. GM

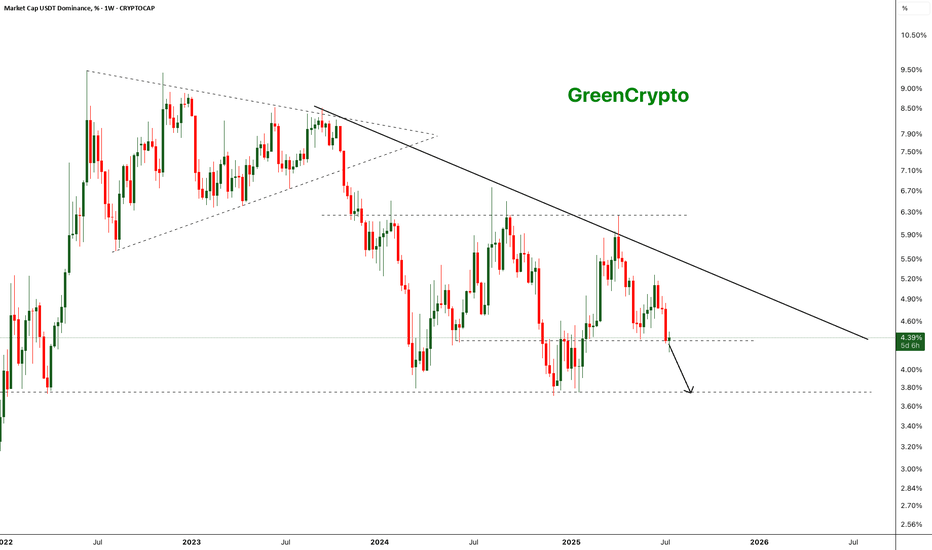

Bearish Breakdown in USDT Dominance - Altseason Loading?The chart shows a clear long-term descending trendline acting as resistance since mid-2023. After multiple failed attempts to break this trendline, USDT dominance has broken below a key horizontal support around ~4.35% on strong bearish momentum.

- Weekly close below the ~4.35% horizontal support.

Next key support zone: ~3.65–3.70% (marked by previous 2023 lows).

- Strong bearish engulfing candle confirming breakdown.

- Bearish continuation expected if dominance remains below 4.35%.

Further drop of the usdt dominance will start the altseason

Cheers

GreenCrypto

When does Bolran start?Read carefullyhello friends👋

💰Many of you are asking when Bolran will start or if it will start at all, we decided to explain it to you in a full post.

Well, you can see the Ethereum chart moving in a channel, and with a drop, it created a big fear that a fall is coming, and meanwhile, the buyers returned the price to above 2000 dollars with a strong and unexpected return.

✅️Now the price is stuck in the specified box between 2200 and 2500, and if this range is maintained, the price will easily move up to the range of 3200 in the first wave, and if it fails to maintain this range, the price will fall below 1500 dollars.

🧐Now, in our opinion, due to the rapid return of the price from the channel, this failure is a fake channel and the range will be maintained, and we are likely to see Ethereum rise in the coming weeks.

🤔You know that Ethereum is the leader of altcoins, and if it grows, important altcoins will grow, which is the beginning of Bolran, and there are important altcoins that can be used for good profit.

🌟You can join us if you like.🌟

🔥Follow us for more signals🔥

*Trade safely with us*

ETH - Confirmed target is 4100- After successfully breakout from the major resistance price is heading towards the next resistance line.

- From the previous all time high, we have a clear resistance around 4100 range.

- We can expect this bullish trend to continue easily and reach the next resistance around 4100.

Stay tuned for more updates

Cheers

GreenCrypto

ADA - Beginning of something crazy- ADA is looking forward to the successfully breakout of the trendline resistance.

- A clean breakout from this resistance must to fuel the bullish trend.

- I'm expecting a target of 3$ from this trend.

Entry Price: 0.72

Stop Loss: 0.4838

TP1: 0.8602

TP2: 1.0342

TP3: 1.3379

TP4: 2.0144

TP5: 2.4818

TP6: 3.0329

Stay tuned for more updates

Cheers

GreenCrypto