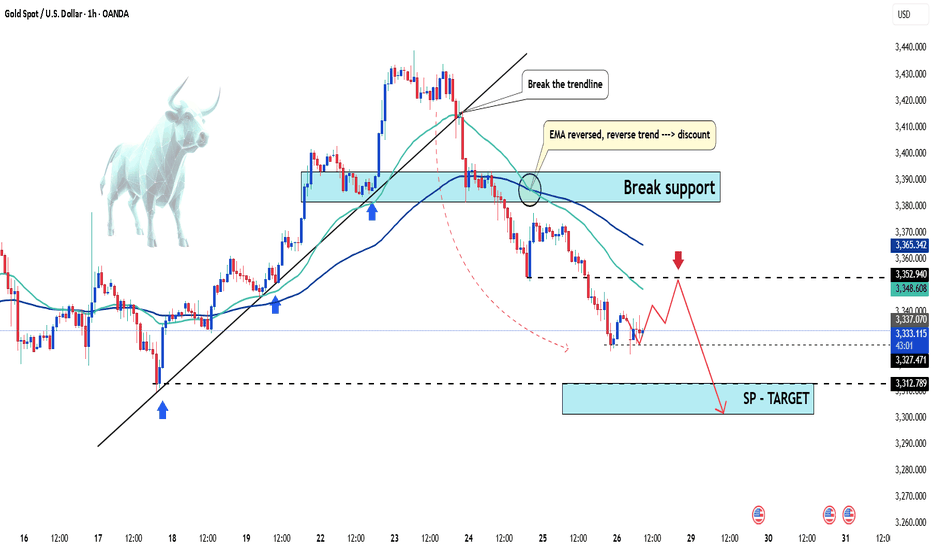

Gold Under Pressure – Temporary Pullback or Start of a DowntrendHello everyone, great to see you again.

Today, let’s focus on the bearish factors surrounding gold. At the time of writing, gold is trading around 3,331 USD, down 50 pips on the day, continuing its downward correction since the end of last week.

Within just a few days, gold has plunged from its peak of 3,433 USD—losing nearly 100 USD per ounce.

This sharp drop is largely driven by profit-taking and market anticipation ahead of key economic data next week, including U.S. interest rate decisions, inflation, and job reports.

This week is packed with critical updates: growth figures, inflation stats, employment numbers, and monetary policy decisions from major central banks—all of which could significantly impact gold’s next move.

According to a recent survey, 36% of analysts expect gold to fall further, while retail investors remain optimistic about a rebound.

For now, the market is clearly in a correction phase. Caution is advised.

What do you think—will gold bounce back or continue to drop?

Buy

USD/JPY(20250729)Today's AnalysisMarket news:

After gold prices soared to an all-time high of more than $3,500 an ounce in April, the latest report from the Commodity Futures Trading Commission (CFTC) showed that fund managers have increased their bullish bets to the highest level in 16 weeks.

Technical analysis:

Today's buy and sell boundaries:

148.19

Support and resistance levels:

149.23

148.84

148.59

147.78

147.53

147.14

Trading strategy:

If the price breaks through 148.59, consider buying, the first target price is 148.84

If the price breaks through 148.19, consider selling, the first target price is 147.78

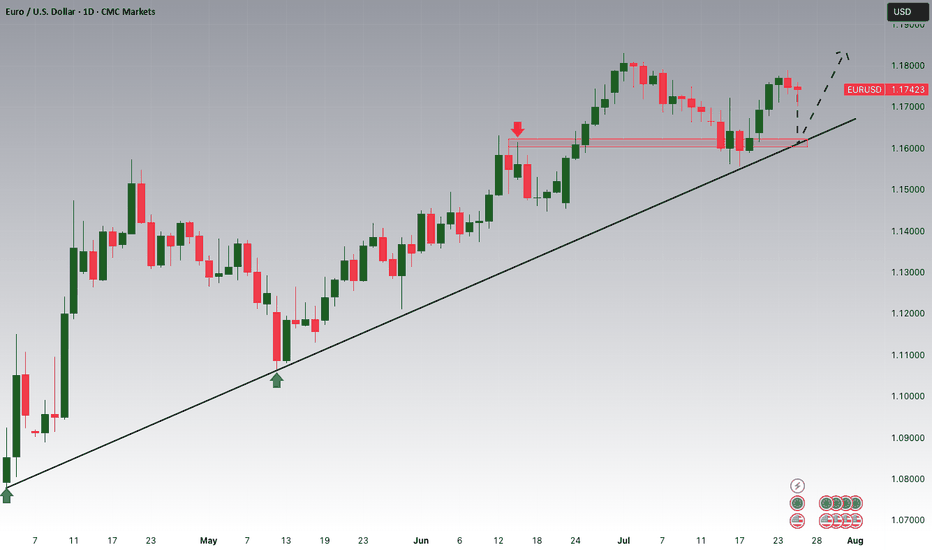

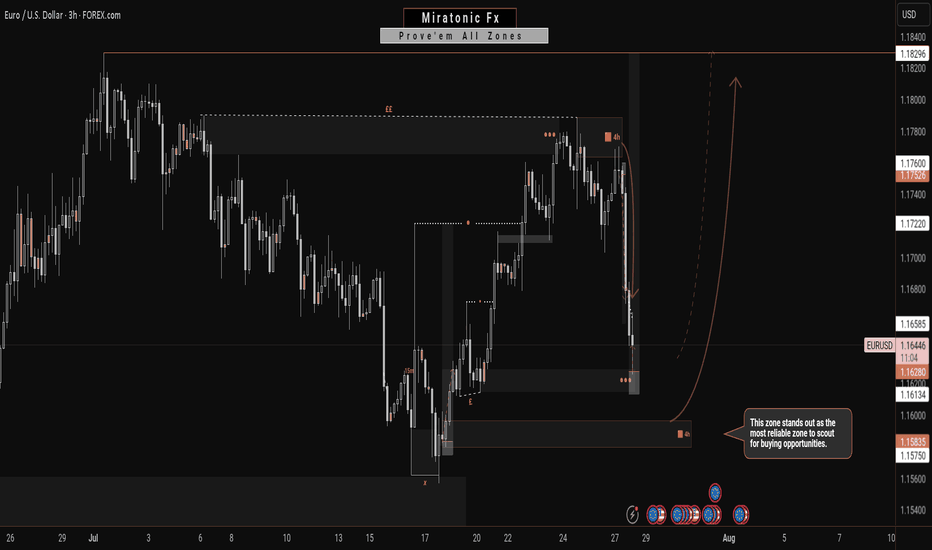

Potentially, A Safer Way To Long The EURUSDIn contrast to my previous outlook, the current price action suggests an increased probability of a deeper bearish move—potentially invalidating the buy zone marked out in the previous analysis. This sudden change is largely driven by the prospect of untapped liquidity residing beneath that zone, reinforcing the well-known market principle that price seeks out liquidity before committing to directional moves.

Given this development, the newly identified zone on the chart emerges as a more technically sound and reliable area from which to anticipate bullish interest. It aligns better with the broader liquidity profile and offers a stronger base for accumulation. Traders may opt to wait for confirmations within this zone or, depending on their risk appetite, consider executing buy positions upon price entry.

As always, patience and clarity are key as we allow price to reveal its intention.

Fingers crossed 🤞

Wishing you all a focused and profitable trading week.

Catch you on the next one. 🫡

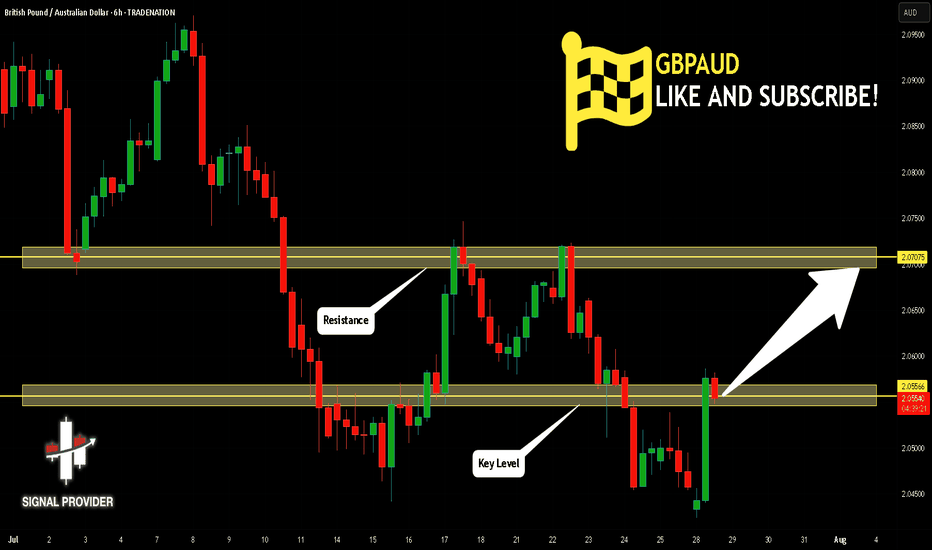

GBPAUD Is Going Up! Long!

Here is our detailed technical review for GBPAUD.

Time Frame: 6h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is on a crucial zone of demand 2.055.

The oversold market condition in a combination with key structure gives us a relatively strong bullish signal with goal 2.070 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

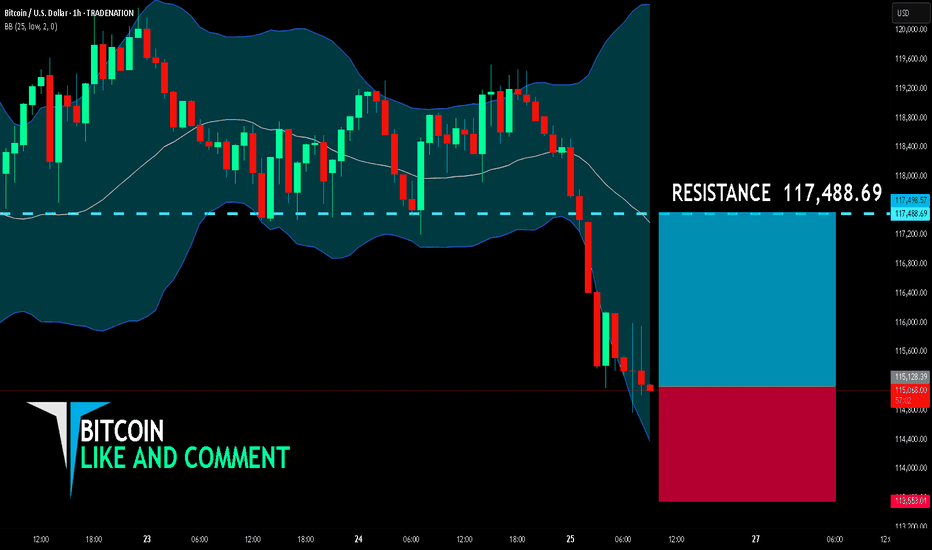

BITCOIN BULLS ARE GAINING STRENGTH|LONG

BITCOIN SIGNAL

Trade Direction: long

Entry Level: 115,128.39

Target Level: 117,488.69

Stop Loss: 113,553.01

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

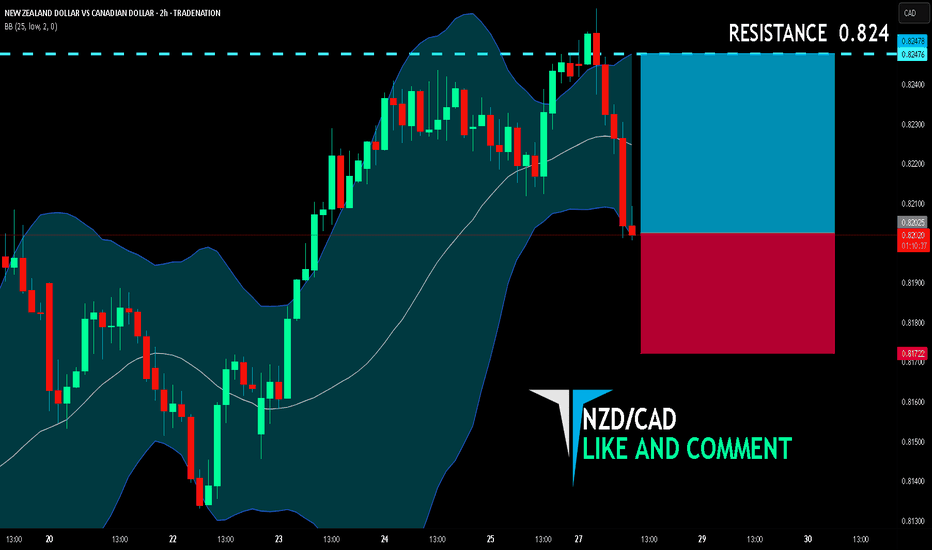

NZD/CAD BULLS ARE GAINING STRENGTH|LONG

NZD/CAD SIGNAL

Trade Direction: long

Entry Level: 0.820

Target Level: 0.824

Stop Loss: 0.817

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 2h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

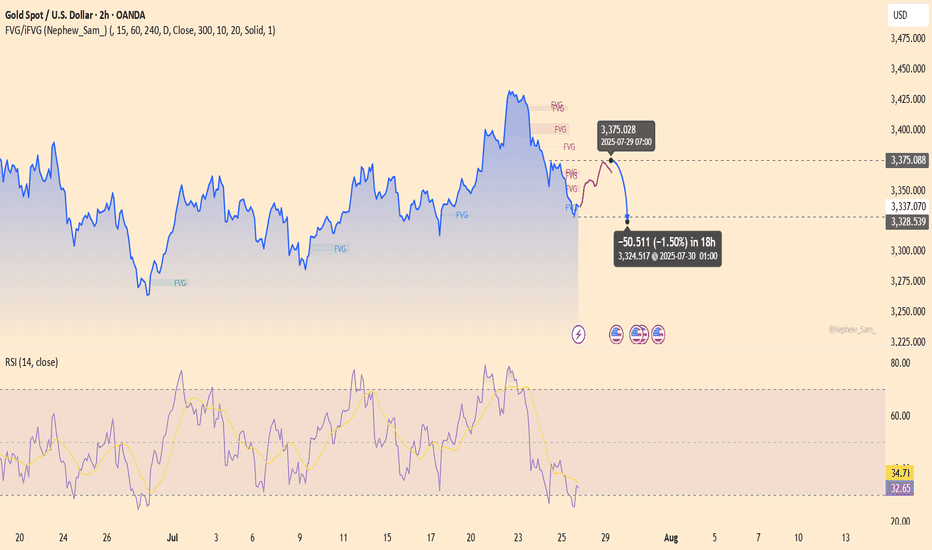

XAUUSD – The assassin returnsGold is showing a weak reaction around the 3,375 zone — a previous supply area — with RSI dipping into oversold territory but failing to bounce significantly. The chart reveals layered FVG traps, hinting at a potential -1.5% drop toward 3,324 within the next 18 hours.

Bearish catalyst: The U.S. jobless claims have dropped to a 3-month low → labor market remains strong → Fed likely to keep interest rates high → stronger USD, weaker gold.

Preferred setup:

SELL if price gets rejected at 3,375

SL: 3,390

TP: 3,324 – 3,310

USD/JPY(20250728)Today's AnalysisMarket news:

Trump announced that the US and Europe reached a trade agreement: 15% tariffs on the EU, $600 billion in investment in the US, zero tariffs on the US by EU countries, the EU will purchase US military equipment, and will purchase US energy products worth $750 billion. However, the US and Europe have different opinions on whether the 15% tariff agreement covers medicines and steel and aluminum. Von der Leyen: 15% tariff rate is the best result that the European Commission can achieve.

US Secretary of Commerce: The deadline for tariff increase on August 1 will not be extended. The United States will determine the tariff policy on chips within two weeks.

Technical analysis:

Today's buying and selling boundaries:

147.47

Support and resistance levels:

148.58

148.17

147.90

147.04

146.77

146.35

Trading strategy:

If the price breaks through 147.90, consider buying, the first target price is 148.17

If the price breaks through 147.47, consider selling, the first target price is 147.04

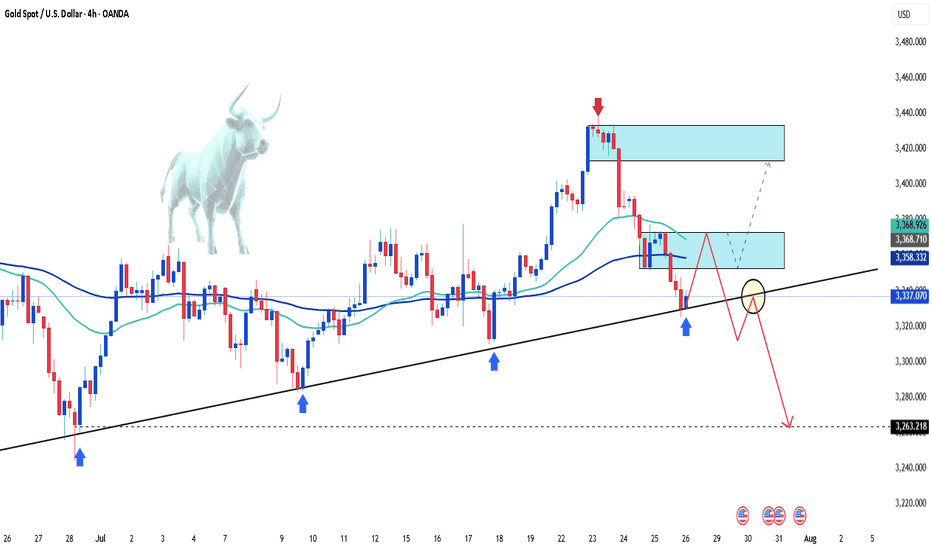

Gold under pressure as USD strengthensGold is facing significant selling pressure as the US dollar regains momentum. Currently, XAU/USD is trading near $3,337, down over $31 from the session high, and pressing directly against the ascending trendline.

The stronger USD is making gold—an asset that yields no interest—less attractive to investors. If this dollar strength continues, the likelihood of a trendline break and further downside is very high.

On the economic front, U.S. jobless claims have fallen to their lowest level in three months, signaling a resilient labor market despite sluggish hiring. This stable jobs data is expected to support the Fed’s decision to hold interest rates steady at 4.25–4.50% in the upcoming policy meeting, even amid rising inflation pressure driven by President Donald Trump’s tariff policies.

At this moment, sellers are in control. Traders should closely watch upcoming support zones and trading volume to spot reasonable entry points.

Good luck!

BTC/USD Buy Setup (6H Chart)📈 BTC/USD Buy Setup (6H Chart)

Strategy: Trendline Support Bounce

🔹 Entry

Price: $118,674.3

Reason: Price is bouncing off a supportive trendline and holding above the 1st Support zone.

🔻 Stop Loss (SL)

Price: $114,470.6

Reason: Below the 1st Support zone to protect against breakdown.

🎯 Take Profit Targets

TP1: $123,269.6

Reason: Near recent swing high, good for partial profit.

TP2: $127,661.4

Reason: Next resistance zone, ideal for full exit or trailing stop.

#MJTrading

#Bitcoin

AUDUSD Will Go Higher From Support! Buy!

Please, check our technical outlook for AUDUSD.

Time Frame: 12h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is trading around a solid horizontal structure 0.656.

The above observations make me that the market will inevitably achieve 0.662 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

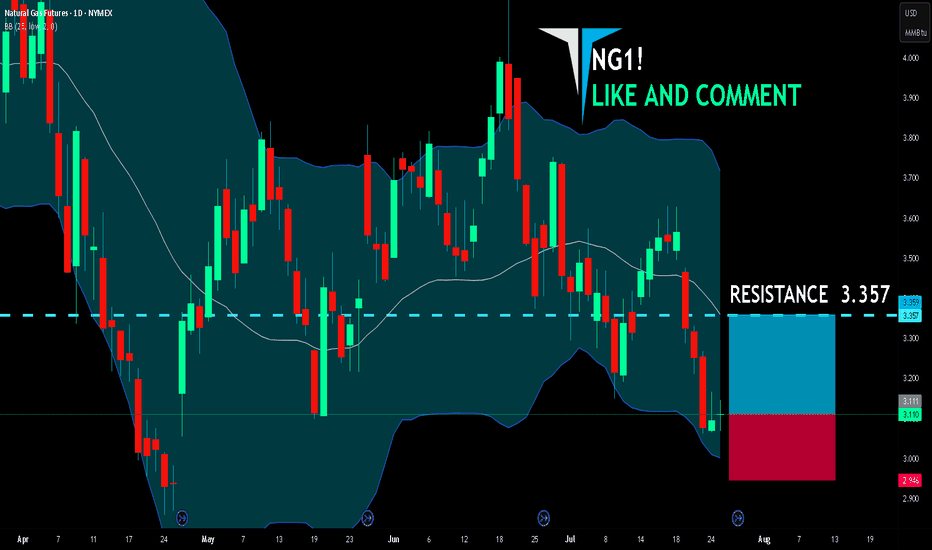

NG1! BEST PLACE TO BUY FROM|LONG

NG1! SIGNAL

Trade Direction: long

Entry Level: 3.111

Target Level: 3.357

Stop Loss: 2.946

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

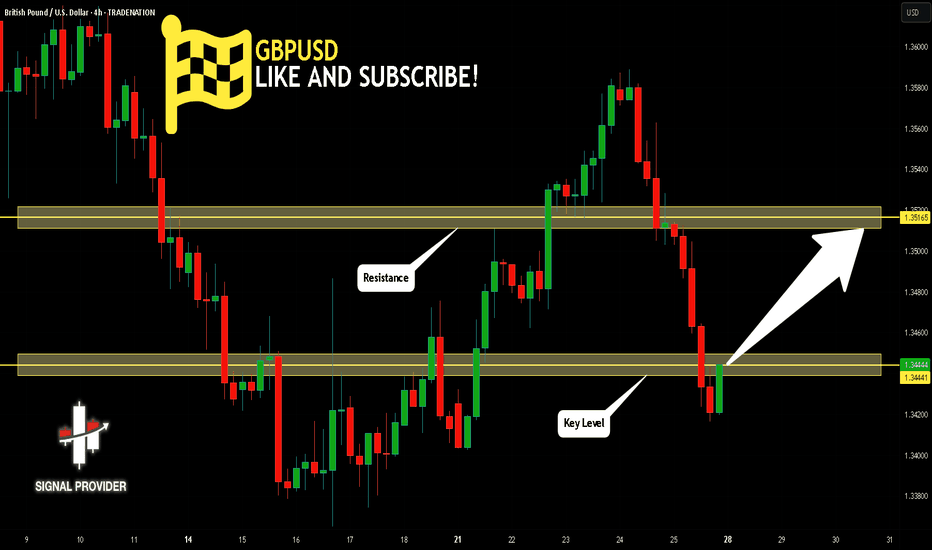

GBPUSD Will Go Higher! Long!

Take a look at our analysis for GBPUSD.

Time Frame: 4h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a key horizontal level 1.344.

Considering the today's price action, probabilities will be high to see a movement to 1.351.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

CUP AND HANDLE $TSLA TO $515 MINIMUMThe cup and handle is a bullish chart pattern commonly used by traders to spot potential buying opportunities. It features a rounded "cup" formation followed by a slight downward drift forming the "handle." This pattern typically signals a continuation of an upward trend once the handle completes its consolidation phase.

ROBOTAXI BOOM

BUY NOW NASDAQ:TSLL NASDAQ:TSLA

Cup & HANDLE + Mini Double Bottom: $TSLA to $610 ScenarioI maintain a bullish stance on Tesla ( NASDAQ:TSLA ), supported by a compelling combination of technical patterns and strong fundamental drivers. The current chart setup reveals a Cup and Handle formation complemented by a Mini Double Bottom, both of which are classic bullish continuation patterns. These suggest a potential breakout scenario that could drive NASDAQ:TSLA to $610 by year-end.

Technical Roadmap:

Gap Fill to $408: Anticipated earnings momentum, particularly from the Robotaxi segment, is likely to propel the stock to fill the previous gap at $408.

Consolidation at $450: Following the gap fill, I expect a consolidation phase forming a “box” around the $450 level.

Breakout to $610: A decisive breakout above $450 could trigger a strong rally toward the $610 target.

***Current Key Catalysts Supporting the Bullish Thesis:

Robotaxi Expansion: Tesla’s autonomous driving initiative is gaining traction, with Robotaxi developments expected to significantly boost revenue and margins.

India Market Entry: Tesla’s upcoming launch in India opens access to one of the world’s largest and fastest-growing EV markets.

In-House Chip Development & Dojo 2 Expansion: Continued investment in AI infrastructure and custom silicon enhances Tesla’s competitive edge in autonomy and robotics.

Tesla Diner Launch: The near-completion of Tesla’s themed diner adds to brand visibility and customer engagement.

Global EV Adoption: Tesla continues to benefit from rising EV demand across multiple international markets.

Optimus Robot Hype: Growing interest in Tesla’s humanoid robot project could unlock new revenue streams and investor enthusiasm.

Favorable Macro Trends: A declining interest rate environment supports higher valuations for growth stocks like Tesla.

Institutional Accumulation: Recent trading activity suggests that institutional investors are accumulating shares within the current range.

Grok AI Integration: The integration of Grok AI into Tesla vehicles could enhance user experience and differentiate Tesla’s infotainment ecosystem.

Investment Strategy:

I recommend initiating or increasing exposure to NASDAQ:TSLL (leveraged Tesla ETF) ahead of the upcoming earnings report. This could offer amplified returns if the bullish scenario plays out. Consider accumulating further on any dips, particularly during the consolidation phase around $450.

BUY NOW NASDAQ:TSLA NASDAQ:TSLL

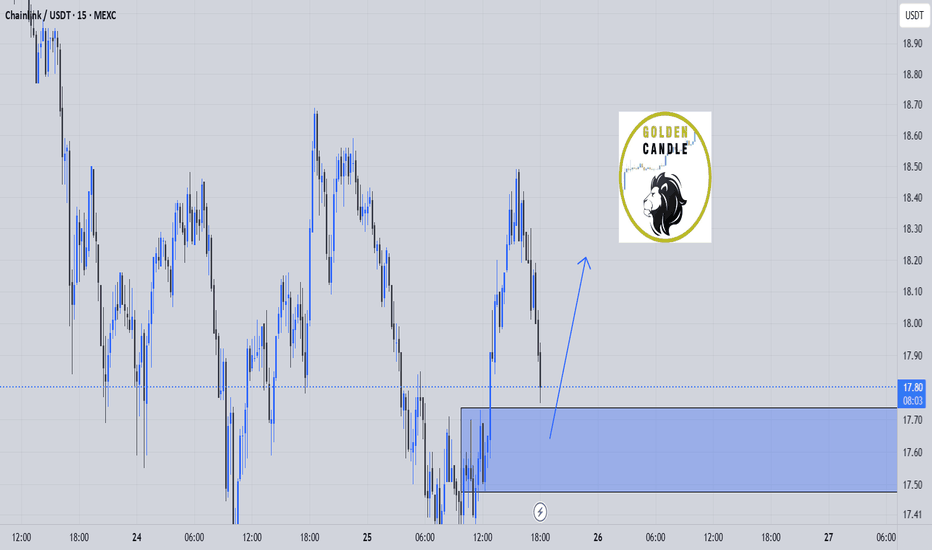

link buy midterm"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

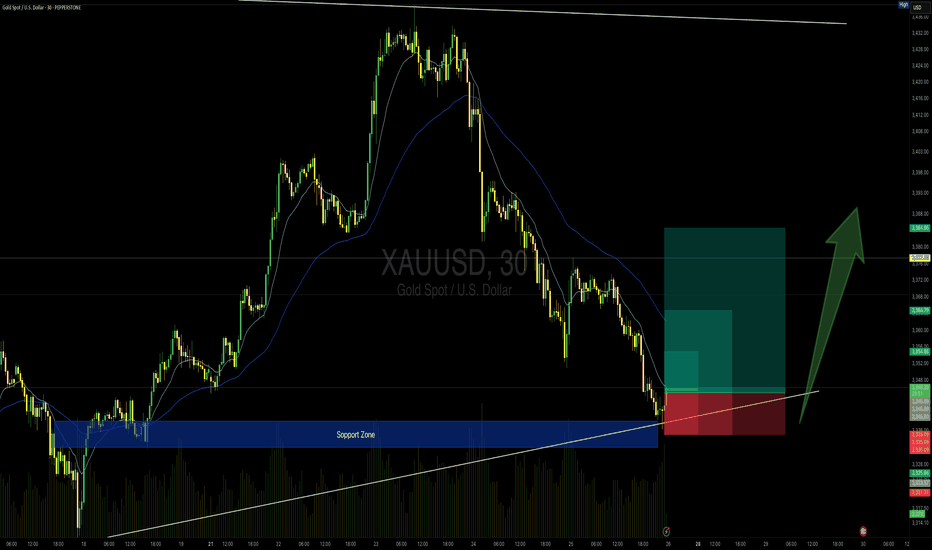

GOLD 30min Buy Setup (High Risk - High Reward)📍 TVC:GOLD 30min Buy Setup – MJTrading View

After an extended bearish leg, price has tapped into a strong support zone that previously acted as a launchpad. Also touching the main Uptrend...

We now see initial signs of absorption with potential reversal setup forming just above the ascending trendline.

🔹 Entry Zone: 3344–3346

🔹 SL: Below 3335 (under structure & wick base)

🔹 TP1: 3355

🔹 TP2: 3365

🔹 TP4: 3385+ (if momentum sustains)

🔸 RR: Up to 1:4 depending on target selected

🧠 Context:

– Still inside broader bullish structure (macro HL)

– Support zone coincides with rising trendline

– Potential for bullish reaccumulation after sharp drop

– Volume spike near zone suggests active buyers

Stay sharp and manage your risk please...

See the below Idea for full concept:

"Support isn't just a level — it’s a battlefield. If buyers win, they don’t look back."

#MJTrading #Gold #BuySetup #PriceAction #SmartMoney #ChartDesigner #ReversalSetup #MarketStructure

Psychology Always Matters:

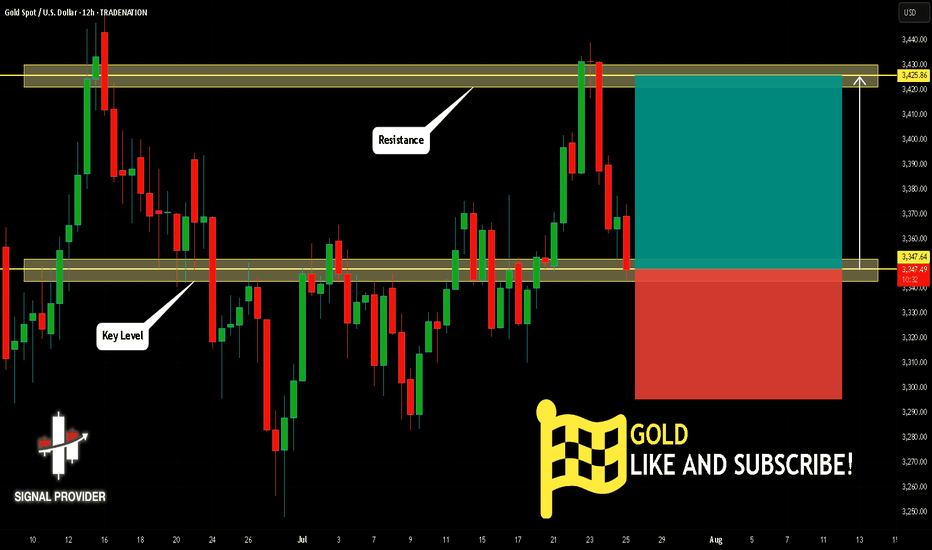

GOLD Will Move Higher! Buy!

Here is our detailed technical review for GOLD.

Time Frame: 12h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is on a crucial zone of demand 3,347.64.

The oversold market condition in a combination with key structure gives us a relatively strong bullish signal with goal 3,425.86 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

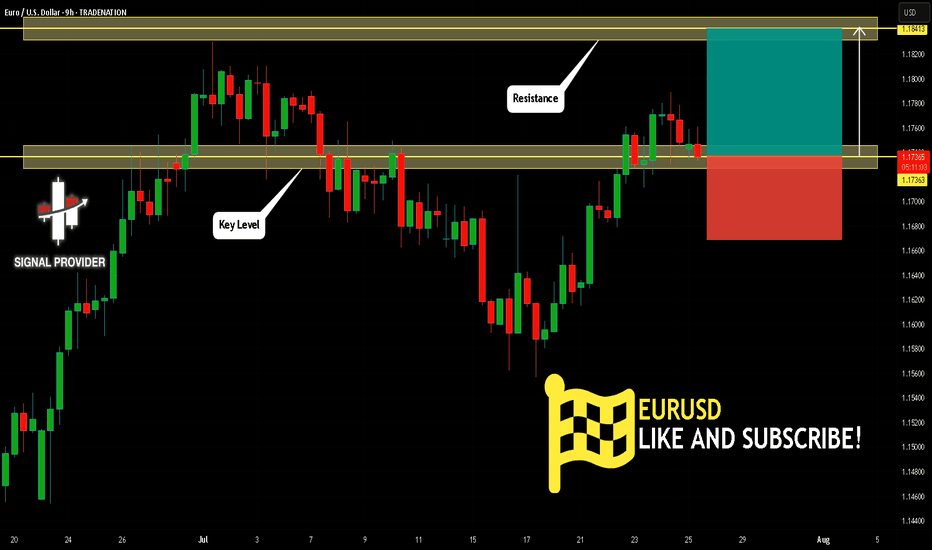

EURUSD Is Bullish! Long!

Take a look at our analysis for EURUSD.

Time Frame: 9h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The price is testing a key support 1.173.

Current market trend & oversold RSI makes me think that buyers will push the price. I will anticipate a bullish movement at least to 1.184 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

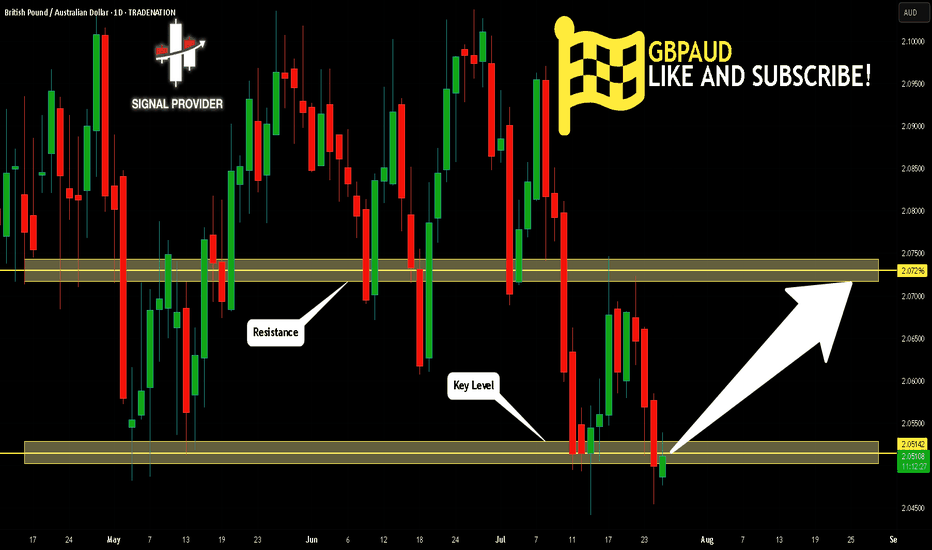

GBPAUD Is Going Up! Buy!

Here is our detailed technical review for GBPAUD.

Time Frame: 1D

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is testing a major horizontal structure 2.051.

Taking into consideration the structure & trend analysis, I believe that the market will reach 2.072 level soon.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

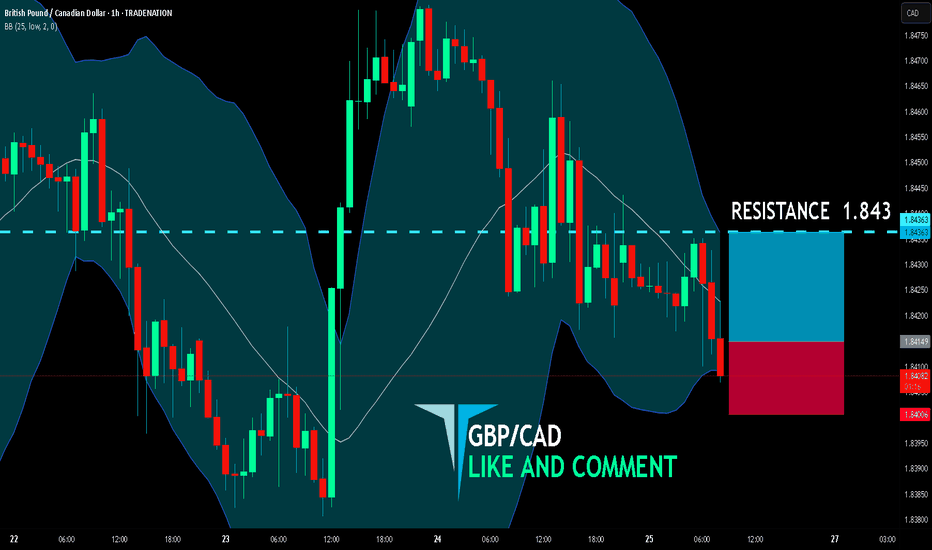

GBP/CAD BUYERS WILL DOMINATE THE MARKET|LONG

GBP/CAD SIGNAL

Trade Direction: long

Entry Level: 1.841

Target Level: 1.843

Stop Loss: 1.840

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅