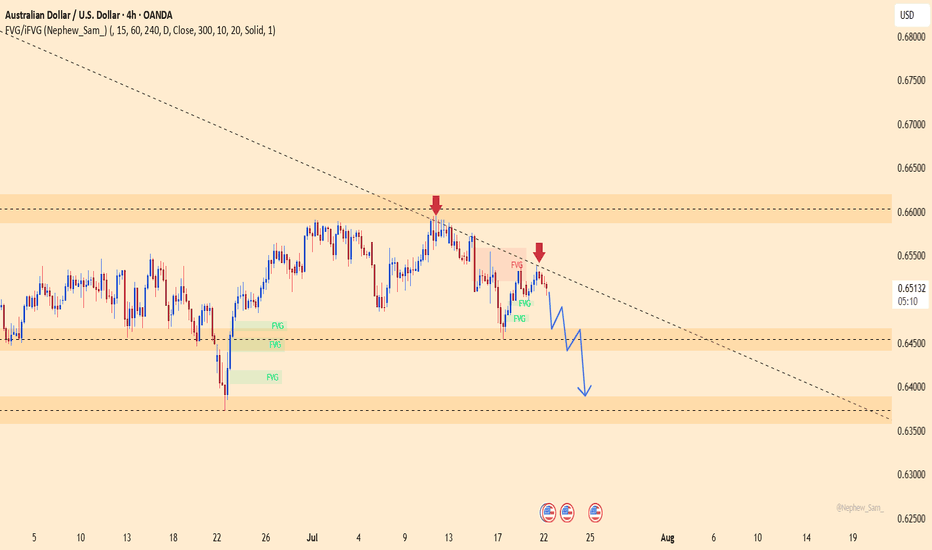

AUDUSD – Sellers taking over, the drop is on!This pair just got slapped hard at the descending trendline, right as it hit a familiar resistance zone. No more doubts – buyers are losing steam, and sellers are waiting to strike.

Market sentiment from Down Under is shaking, with weak economic signals piling up. Meanwhile, the mighty U.S. dollar is reclaiming the spotlight after gold’s flashy surge. The tide has turned!

Unless a miracle shows up, AUDUSD is set to dive deeper – and this is the perfect stage for traders who thrive on strong downtrends.

Sellers are in position – are you ready to join the ride?

Buy

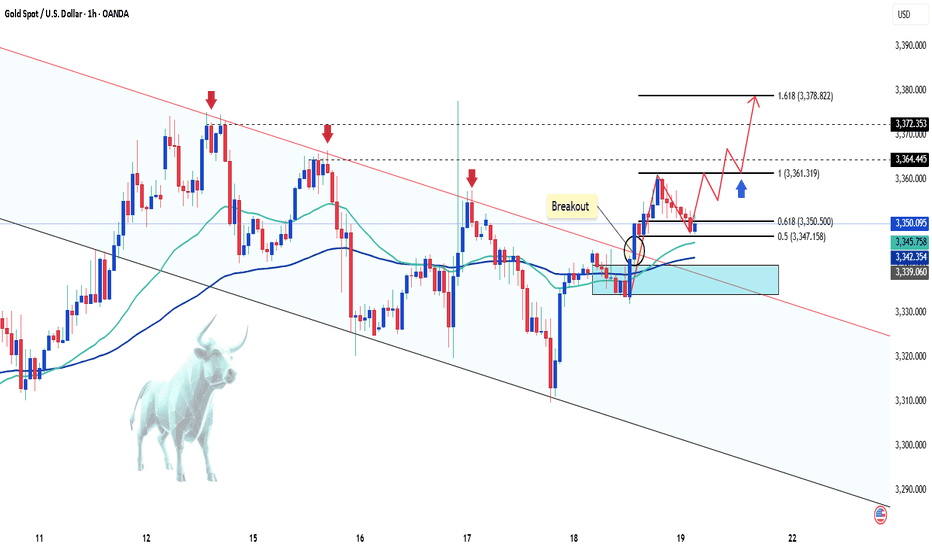

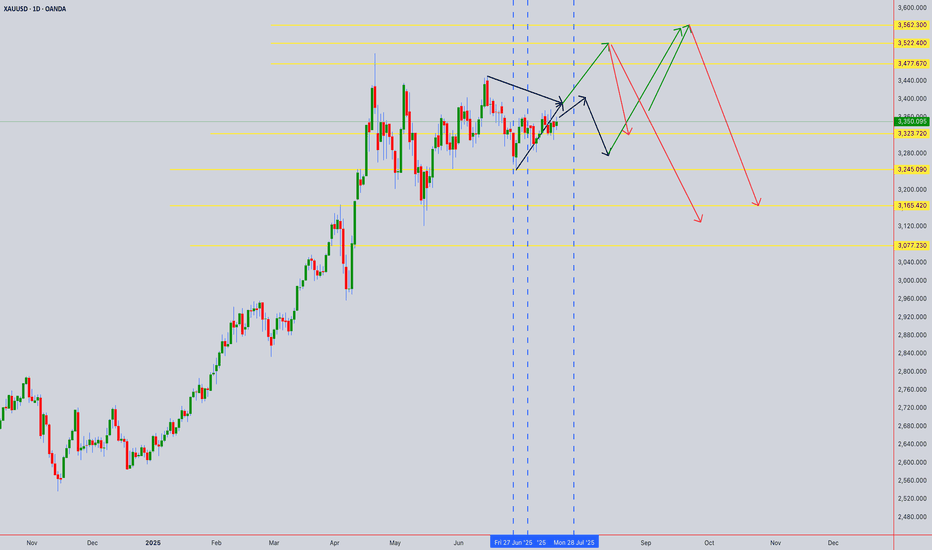

Gold Sees Mild Increase as USD WeakensGold ended Friday's session with a slight increase, regaining the 3350 USD level and recovering over 100 pips by the end of the day.

The weakening of the US Dollar (USD) allowed XAU/USD to rise modestly. Concerns about US President Donald Trump's erratic trade policies and their potential impact on the global economy further supported the precious metal.

In the short term, the technical chart shows gold breaking out of the downward channel and starting an upward wave. The price is currently adjusting at 3350 USD, which coincides with the 0.618 Fibonacci retracement level and the EMA zone, suggesting the potential for further price increases from this level, with targets towards key resistance levels.

Key resistance levels: 3160, 3172, and 3378 USD.

Support zones: 3350, 3340, 3331 USD.

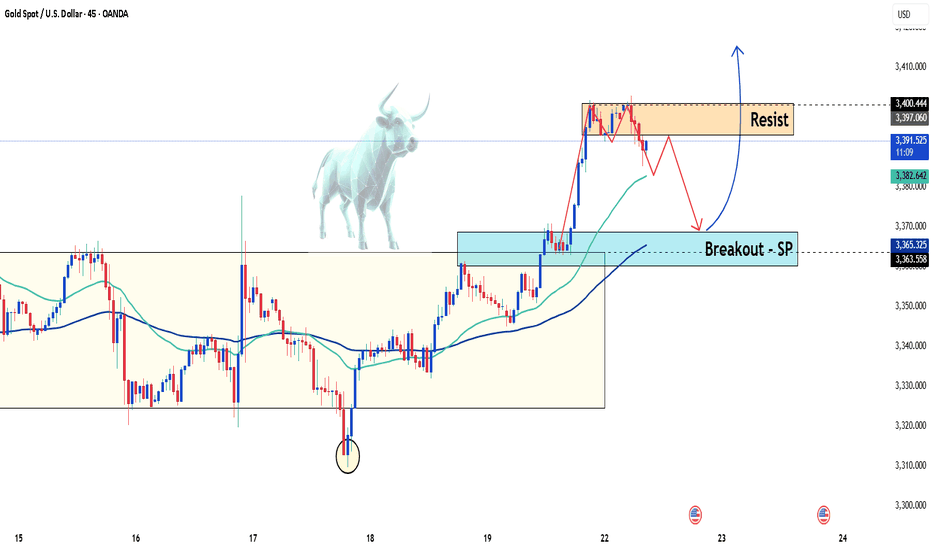

Gold rallies to 4-week high as dollar and yields tumbleHello traders, what are your thoughts on gold today?

Gold prices are heating up again in the global market as the US dollar weakens and Treasury yields drop. At the time of writing, gold has surged by 50 dollars, reaching 3,390 USD per ounce — its highest level in four weeks.

The sharp decline in the US dollar is one of the main drivers behind gold’s impressive rally. The USD Index, which had risen significantly last week, lost momentum and fell sharply in overnight trading. Meanwhile, the yield on 10-year US Treasury bonds has dropped to around 4.3%, down from recent highs, increasing gold's appeal as a non-yielding asset.

Market sentiment is also being shaped by broader macroeconomic factors. Crude oil futures have dipped slightly, trading around 67 USD per barrel, reflecting investor caution amid global economic uncertainty. These combined forces have created a favorable environment for gold's strong upward movement.

If the dollar continues to weaken and bond yields remain low, gold could sustain its bullish trend. However, traders should remain alert to potential volatility driven by upcoming US Federal Reserve policy moves and key economic data releases, such as inflation reports and GDP growth figures, which may impact gold's trajectory.

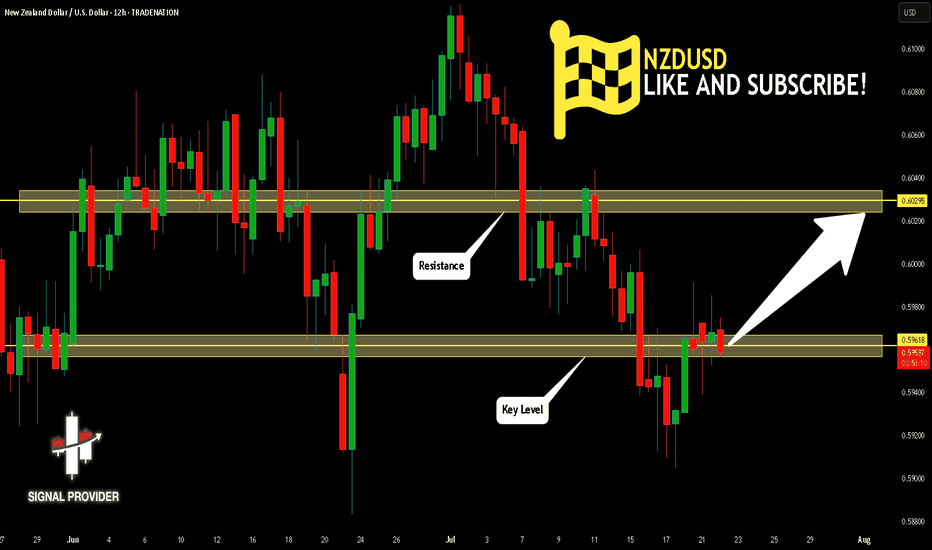

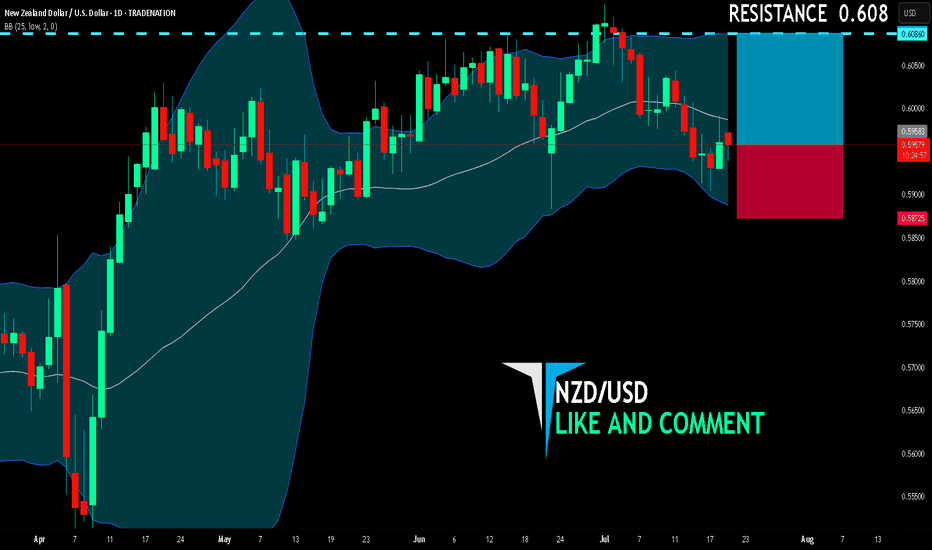

NZDUSD Will Go Higher From Support! Long!

Please, check our technical outlook for NZDUSD.

Time Frame: 12h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is trading around a solid horizontal structure 0.596.

The above observations make me that the market will inevitably achieve 0.602 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

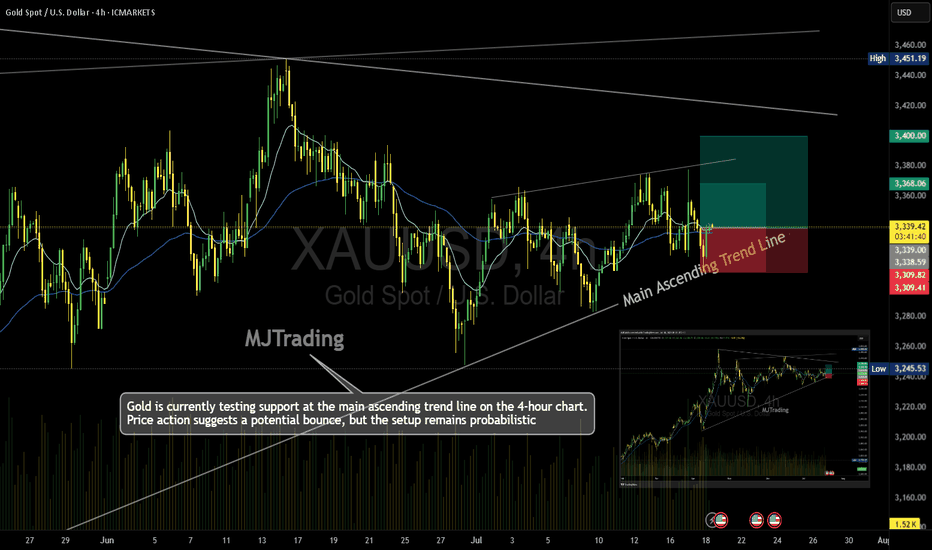

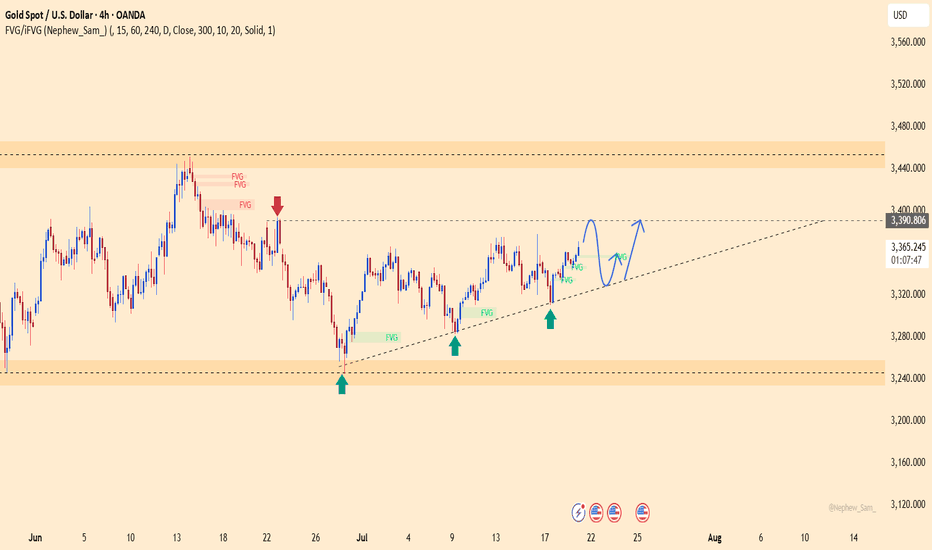

Gold (XAU/USD) – 4H Time Frame Trade Idea📈MJTrading:

Gold is currently testing support at the main ascending trend line on the 4-hour chart. Price action suggests a potential bounce, but the setup remains probabilistic—ideal for traders who operate on higher time frames and manage risk with discipline.

🔹 Trade Setup

Entry: 3340

Stop Loss: 3309

Take Profit 1: 3368

Take Profit 2: 3400

🔍 Technical Context

Price is respecting the long-standing trend line, hinting at bullish continuation.

Risk-reward ratio is favorable, especially for swing traders.

A break below the trend line invalidates the setup—hence the tight SL.

⚠️ Note: While the trend supports upside potential, failure to hold the trend line could trigger deeper retracement. Trade the probabilities, not the certainties.

In case it's not shown properly on your monitor because of different resolutions:

Psychology Always Maters:

#MJTrading #Gold #XAUUSD #Trend #Trendline #Forex #Chart #ChartAnalysis #Buy #Long

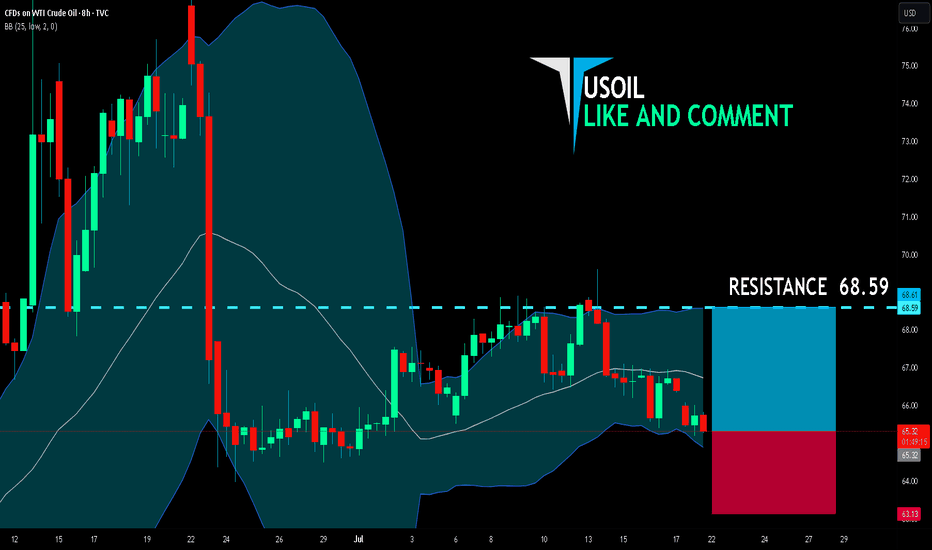

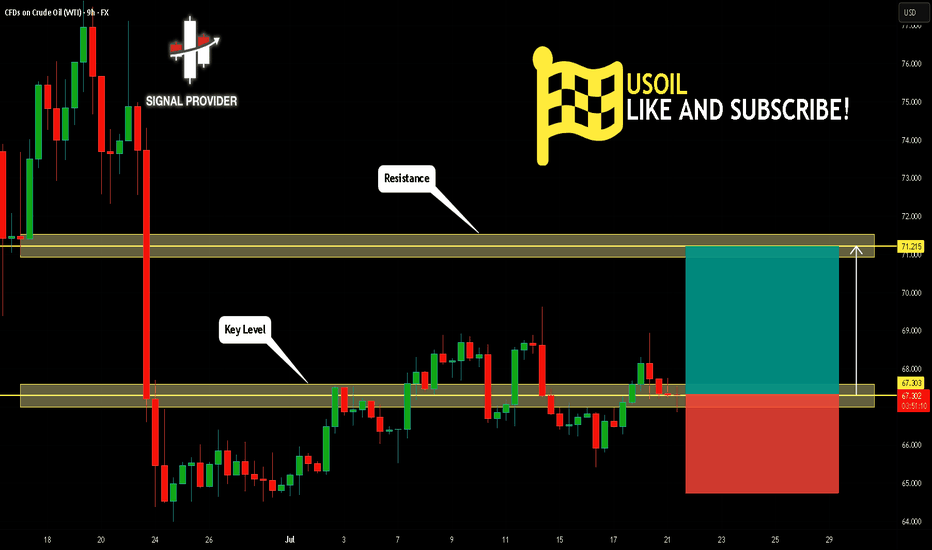

USOIL BULLS ARE STRONG HERE|LONG

USOIL SIGNAL

Trade Direction: long

Entry Level: 65.32

Target Level: 68.59

Stop Loss: 63.13

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 8h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

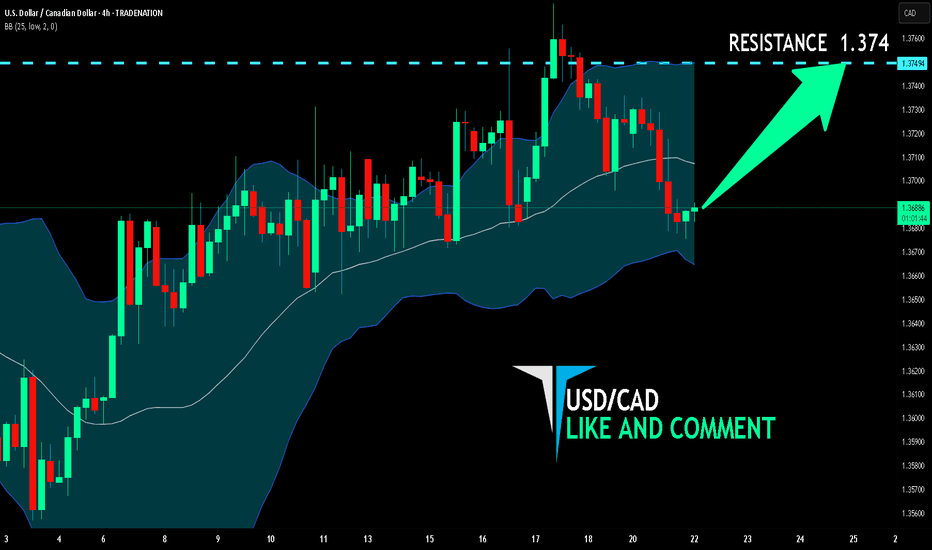

USD/CAD BULLS WILL DOMINATE THE MARKET|LONG

Hello, Friends!

USD/CAD pair is in the uptrend because previous week’s candle is green, while the price is clearly falling on the 4H timeframe. And after the retest of the support line below I believe we will see a move up towards the target above at 1.374 because the pair is oversold due to its proximity to the lower BB band and a bullish correction is likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

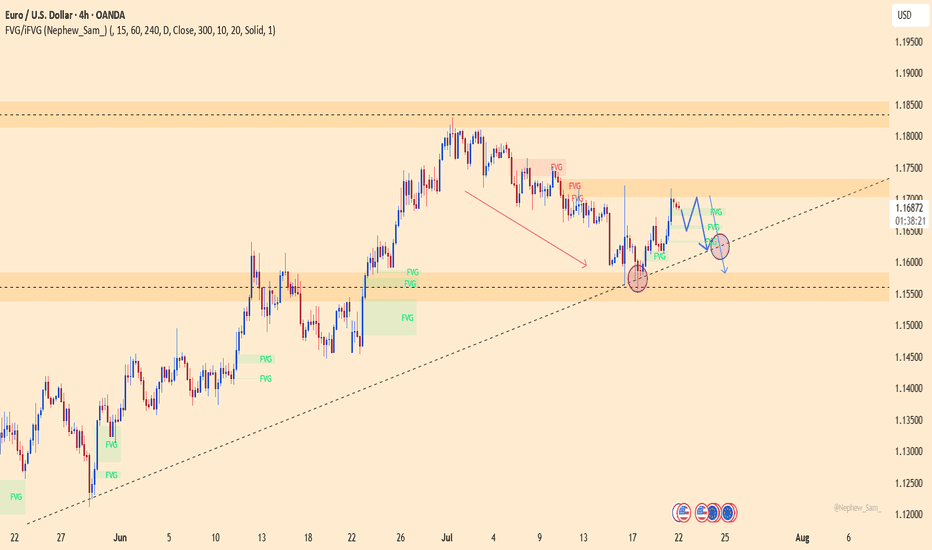

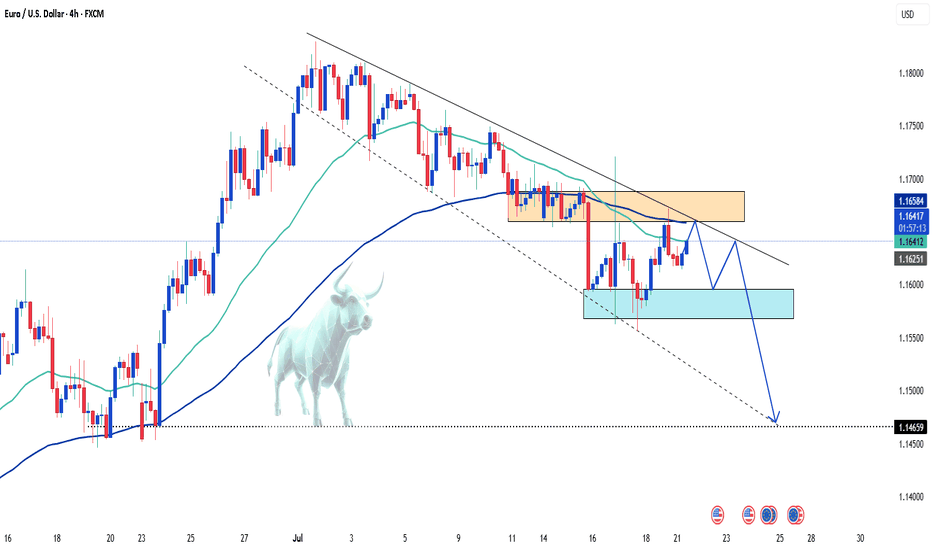

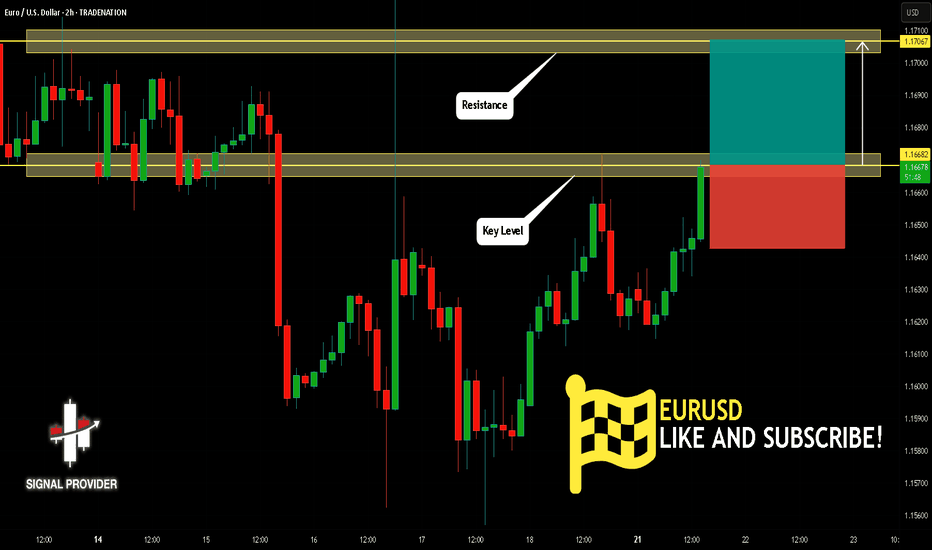

EURUSD – Is the rally over? Time for a collapse?The technical picture reveals that EURUSD is losing momentum after a brief rebound. The 1.1700 level stands as a key resistance – if bulls fail to break it, the bears will take the wheel! A clear scenario is forming: lower highs, FVGs filled, and a potential drop toward the 1.1580 support zone this week.

The bad news for the euro isn’t over: yesterday’s Eurozone PMI data disappointed heavily, signaling stagnating growth. Meanwhile, the USD is gaining traction from strong labor data and hawkish Fed remarks, putting EURUSD under double pressure.

If the ascending trendline breaks, EURUSD could plunge even further – get ready for a potential breakdown!

Suggested strategy: Prioritize SELL below 1.1700, with a short-term target at 1.1580.

Stop-loss: Above 1.1720 – a breakout here would invalidate the bearish setup.

XAUUSD – Strong bullish structure, buyers in control!Gold is trading within a well-defined ascending channel, with each higher low being consistently respected – indicating strong buying pressure. The recent move broke through a fair value gap (FVG) and is approaching short-term resistance. High-probability scenario: a pullback toward the rising trendline, followed by a strong rebound aiming for the previous highs.

RSI remains in a positive zone, supporting the bullish bias. If the trendline support holds, the next target is the upper resistance area.

Supporting news: The US dollar has stalled after a sharp rally, while persistent inflation concerns and renewed hopes for a mild Fed rate cut are boosting gold’s appeal.

EUR/USD: Bearish Trend in FocusHello everyone, what are your thoughts on EUR/USD?

From my personal analysis, it's clear that EUR/USD is extending its downtrend. The pair is trading around 1.164 and is under pressure from sellers after breaking below both the EMA 34 and EMA 89, with EMA 34 already turning downward — a classic bearish signal.

On the macro side, the European Central Bank is set to announce its monetary policy decision on Thursday. Meanwhile, U.S. President Donald Trump's ongoing trade tensions may add further uncertainty to the market. This corrective downtrend in EUR/USD could very well continue in the weeks ahead.

What do you think — will EUR/USD keep falling?

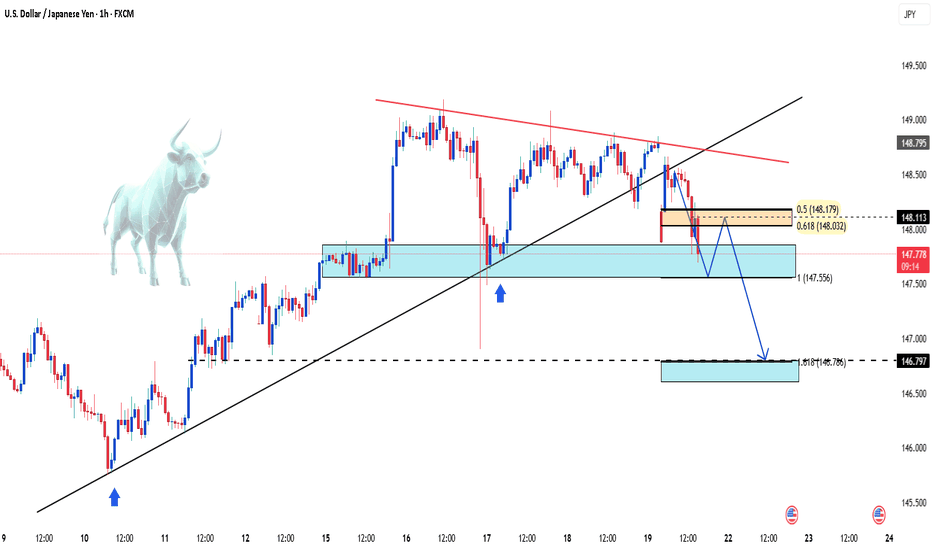

USD/JPY Drops as Market Awaits Powell's RemarksIn today’s trading session, the USD/JPY pair is showing renewed weakness, currently trading around 147.76 — down more than 0.68% from the previous session. The decline is driven by falling U.S. Treasury yields and cautious investor sentiment ahead of an upcoming speech by Federal Reserve Chair Jerome Powell, which is weighing on the U.S. dollar.

From a technical perspective, USD/JPY has broken its short-term uptrend and is approaching a key support level at 147.60. If this level fails to hold, the bearish momentum could extend further.

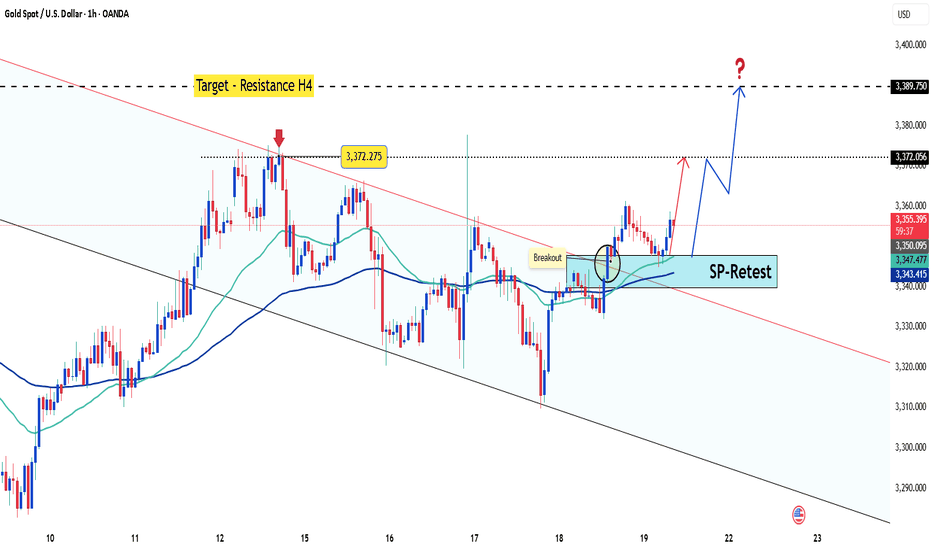

Latest Gold Price Update TodayHello everyone, what do you think about the price of gold today?

As the new week begins, gold continues the upward trend started at the end of Friday’s session. As of now, the precious metal is trading around 3356 USD, with the uptrend still being supported.

From a carefully analyzed technical perspective, gold successfully broke out of the downward channel, taking advantage of the weakening USD. The price increase is convincing in the short term, especially after testing and confirming the previous breakout as a new support zone (around 3345 USD).

The upward target is expected to continue, with key levels to watch being 3372 USD and the H4 resistance at 3390 USD.

What do you think about the price of gold today? Feel free to share your thoughts in the comments!

Good luck!

IB pattern after correction bellow the 50EMAThis market is in uptrend

it has been in a correction phase

it reached bellow the 50EMA and near the strong

daily support zone of 1.34000

then it formed a nice IB pattern

which is triggered after the breakout and close the

HH of the MB and above the 50EMA

so I opend at the end of day a buy order at the market

at 1.34909

SL 1.33500

TP 1.37500

so the RR=1:2

USOIL Will Go Higher! Buy!

Take a look at our analysis for USOIL.

Time Frame: 9h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a key horizontal level 67.303.

Considering the today's price action, probabilities will be high to see a movement to 71.215.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

EURUSD Will Go Up! Long!

Please, check our technical outlook for EURUSD.

Time Frame: 2h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a significant support area 1.166.

The underlined horizontal cluster clearly indicates a highly probable bullish movement with target 1.170 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

USDJPY Is Very Bullish! Buy!

Here is our detailed technical review for USDJPY.

Time Frame: 1D

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a significant support area 144.493.

The underlined horizontal cluster clearly indicates a highly probable bullish movement with target 148.651 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

GBPJPY Will Go Up! Buy!

Please, check our technical outlook for GBPJPY.

Time Frame: 3h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a key horizontal level 197.240.

Considering the today's price action, probabilities will be high to see a movement to 198.091.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

USDCAD Will Move Higher! Long!

Take a look at our analysis for USDCAD.

Time Frame: 2h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is testing a major horizontal structure 1.368.

Taking into consideration the structure & trend analysis, I believe that the market will reach 1.373 level soon.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

USDCHF Will Grow! Long!

Here is our detailed technical review for USDCHF.

Time Frame: 9h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a significant support area 0.796.

The underlined horizontal cluster clearly indicates a highly probable bullish movement with target 0.804 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

NZD/USD BUYERS WILL DOMINATE THE MARKET|LONG

NZD/USD SIGNAL

Trade Direction: long

Entry Level: 0.595

Target Level: 0.608

Stop Loss: 0.587

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

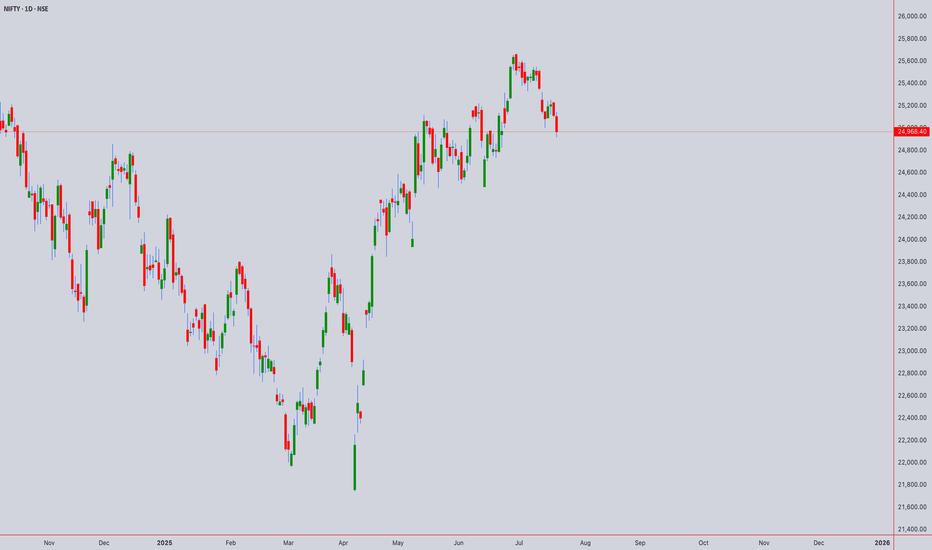

Technical Analysis: NIFTY50 (Closing: ₹24,968.40 on 18-Jul-2025)*Analysis as of 21-Jul-2025 (Monday)*

1. Candlestick Patterns

Daily: A bearish engulfing pattern formed on 18-Jul-2025, closing below the prior candle’s low. Signals short-term reversal risk.

Weekly: Doji formation (indecision) near all-time highs. Weekly close below ₹25,000 warns of exhaustion.

Intraday (4H): Bearish pin bars at ₹25,100 resistance. Watch for follow-through selling below ₹24,900.

2. Harmonic Patterns

Daily: Potential Bearish Bat pattern in development:

XA: ₹23,200 → ₹25,200 (100%)

B: 61.8% retracement at ₹24,400 (pending)

Confirmation below ₹24,400 targets ₹23,800 (0.886XA).

3. Elliott Wave Theory

Weekly: Final waves of Wave 5 (impulse) likely complete at ₹25,200.

Daily: Starting ABC corrective wave:

Wave A: ₹25,200 → ₹24,800 (if breaks ₹24,900)

Wave B: Rally to ₹25,000–25,100 (short opportunity)

Wave C: Target ₹24,300 (1.618xA).

Intraday (1H): Minute wave iii down in progress below ₹24,950.

4. Wyckoff Theory

Phase: Potential distribution near highs:

Upthrust (18-Jul high ₹25,120) failed to hold.

Spring Level: ₹24,900. Break confirms downtrend (test supply).

Downside target: ₹24,500 (fall after distribution).

5. W.D. Gann Analysis

Square of 9:

Key support: √24,968 ≈ 158.0 → 158² = 24,964 (critical pivot).

Close below 24,964 opens ₹24,650 (next square).

Time Cycles:

21-Jul is 180° from 21-Jan 2025 high. Watch for trend change.

Gann Angle: 1x1 angle from Jul-2025 high at ₹25,200 → breaks below imply ₹400/day decline.

6. Ichimoku Kinko Hyo (Daily)

Tenkan: ₹24,950 (resistance)

Kijun: ₹24,800 (support)

Cloud: Lagging span below price; cloud thinning (bearish momentum).

Signal: Price below Kijun → trend weakness.

7. Key Indicators

RSI (Daily): 62 → declining from overbought (70). Bearish divergence.

Bollinger Bands (4H): Price testing lower band (₹24,900). Break targets ₹24,600 (2σ lower).

VWAP (1H): ₹25,050 → intraday resistance.

Moving Averages:

Death Cross (50-DMA/200-DMA): Not triggered, but 5-DMA (₹25,020) crossed below 20-DMA (₹25,050).

Timeframe Summary

Timeframe Key Levels Bias Pattern/Thesis

5M/15M Res: ₹24,990 Bearish Scalp shorts below VWAP (₹25,050)

30M/1H Res: ₹25,050 Sup: ₹24,900 Bearish Bearish EW wave iii; RSI < 50

4H Res: ₹25,100 Sup: ₹24,800 Neutral Break below ₹24,800 confirms Wyckoff distribution

Daily Res: ₹25,200 Sup: ₹24,400 Bearish Bearish Bat + ABC correction

Weekly Res: ₹25,500 Sup: ₹24,000 Neutral Doji warns of reversal; hold ₹24,400 key

Actionable Outlook

Intraday (21-Jul):

Short below ₹24,900 (SL: ₹25,050) → Target ₹24,800.

Break below ₹24,800 extends to ₹24,650.

Swing (1–2 Weeks):

Sell rallies near ₹25,100 (SL: ₹25,250) → Target ₹24,400.

Weekly close > ₹25,200 invalidates bearish view.

Critical Supports: ₹24,800 (Wyckoff spring) → ₹24,400 (Harmonic/EW target) → ₹24,000 (psychological).

Key Resistances: ₹25,050 (VWAP) → ₹25,200 (ATH) → ₹25,500 (Gann square).

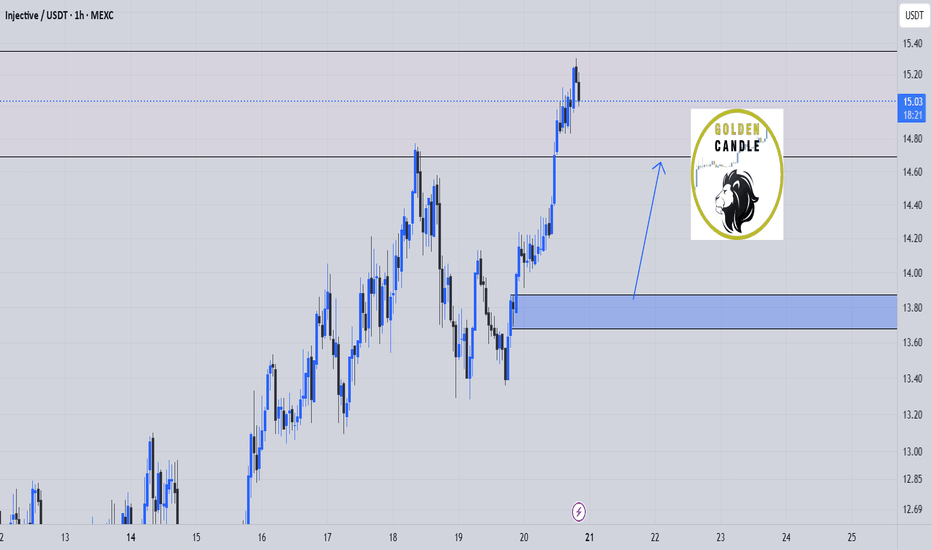

inj buy midterm"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

XAUUSD 24-Hour Technical Analysis Forecast - UTC+4 Current Price: $3,350.095 (Close: Friday, July 18th, 2025) UTC+4

Analysis Period : Next 24 Hours (July 21-22, 2025) UTC+4

Market Status: Weekend - Preparing for Monday Open 02:00AM 21st July 2025

EXECUTIVE SUMMARY - 24H OUTLOOK

Primary Bias: Neutral to Bearish (Short-term)

Key Resistance: $3,375 - $3,390

Critical Support: $3,285 - $3,300

Expected Range: $3,300 - $3,380

Volatility Level: Moderate to High

CANDLESTICK PATTERN ANALYSIS

Friday's Close Formation

Pattern: Doji-like formation at resistance zone

Significance: Indecision after testing $3,350+ levels

Volume: Moderate - no strong conviction breakout

Context: Failed to close decisively above $3,375 resistance

Expected 24H Patterns

Monday Gap: Potential gap down to $3,320-3,330 area

Reversal Patterns: Watch for hammer/doji at support levels

Continuation Signals: Break below $3,300 could trigger bearish continuation

HARMONIC PATTERN ANALYSIS

Current Harmonic Setup

Primary Pattern: Potential Bearish Bat completing

X: $3,285 (previous low)

A: $3,390 (recent high)

B: $3,320 (61.8% retracement)

C: $3,375 (78.6% projection - current area)

D (Target): $3,300-3,285 (88.6% completion zone)

Fibonacci Levels (24H Focus)

Golden Ratio Resistance: $3,375 (current test area)

61.8% Support: $3,320

78.6% Support: $3,300

88.6% Critical Support: $3,285

Pattern Completion Probabilities

Bearish Bat Completion: 70% probability targeting $3,285-3,300

Bullish Cypher Setup: 30% if break above $3,390

ELLIOTT WAVE THEORY - 24H COUNT

Primary Wave Count

Macro Structure: Wave 5 of larger impulse possibly topping

Current Sub-wave: Wave (c) of corrective structure

Mini Count: 5-wave decline from $3,390 high in progress

24-Hour Wave Projection

Wave 1: $3,390 → $3,320 (Completed)

Wave 2: $3,320 → $3,360 (Completed - 50% retrace)

Wave 3: $3,360 → $3,285 (In Progress - Target Area)

Wave 4: $3,285 → $3,310 (Projected)

Wave 5: $3,310 → $3,260 (Extended target)

Critical Levels

Wave 3 = 1.618 × Wave 1: $3,285 (Primary target)

Invalidation: Above $3,390 (Wave 2 high)

WYCKOFF THEORY - 24H PHASE

Current Market Phase

Phase Assessment: Distribution Phase C (Testing Supply)

Composite Operator Action: Testing demand at $3,350 area

Volume Analysis: Declining volume on recent rallies (bearish)

Expected 24H Wyckoff Action

Phase Transition: Moving toward Phase D (Markdown begins)

Supply Test: Failed test at $3,375 confirms distribution

Target: Initial markdown to $3,285-3,300 area

Key Wyckoff Signals (24H)

No Demand: Expected at current levels

Selling Climax: Possible if break below $3,285 with high volume

Automatic Rally: Dead cat bounce to $3,320-3,330

W.D. GANN THEORY - 24H ANALYSIS

Square of Nine Analysis

Current Position: 3350° on Gann wheel

Next Cardinal Point: 3375° (90° angle - strong resistance)

Support Angles: 3300° (natural support), 3285° (critical angle)

Geometric Progression: $3,285 = perfect square root relationship

Time Theory - 24H Cycle

Natural Time Window: 24-hour cycle from Friday's high

Critical Time: 14:00-16:00 UTC Monday (historical turning point)

Lunar Influence: New moon phase approaching (bearish for commodities)

Angle Theory

45° Line: Currently at $3,320 (rising support)

63.75° Line: $3,285 (steep support angle)

26.25° Line: $3,375 (resistance angle)

Price Forecasting (Gann Methods)

Primary Target: $3,285 (Square root of 81²)

Secondary Target: $3,240 (Square root of 80²)

Resistance: $3,375 (Square root of 82.5²)

Time Forecasting

Turn Time 1: 06:00 UTC Monday (18 hours from Friday close)

Turn Time 2: 14:00 UTC Monday (26 hours from Friday close)

Major Turn: 22:00 UTC Monday (34 hours - Fibonacci time)

MULTI-TIMEFRAME INTRADAY ANALYSIS

5-Minute Chart Analysis

Trend: Bearish momentum building

Pattern: Lower highs, lower lows since Friday high

Key Levels:

Resistance: $3,360-3,365

Support: $3,330-3,335

RSI: Approaching oversold (35-40 range)

Volume: Increasing on down moves

15-Minute Chart Analysis

Structure: Bearish flag formation

Breakdown Level: Below $3,340

Target: $3,300-3,310 (flag pole projection)

Moving Averages: Price below EMA 20 ($3,358)

MACD: Bearish crossover confirmed

30-Minute Chart Analysis

Primary Trend: Corrective phase active

Chart Pattern: Descending triangle

Apex: Around $3,335-3,340

Breakout Direction: 65% probability downward

Volume Profile: Heavy selling at $3,350-3,375

1-Hour Chart Analysis

Major Structure: ABC correction in progress

Current Position: C-wave development

Fibonacci Target: $3,285 (127.2% extension)

Bollinger Bands: Price touching lower band

Stochastic: Oversold but no divergence yet

4-Hour Chart Analysis

Macro Trend: Still bullish above $3,200

Correction Depth: 23.6% retracement maximum expected

Support Zone: $3,280-3,300 (confluences)

Resistance Zone: $3,375-3,390 (proven strong)

Ichimoku: Price approaching cloud support

TECHNICAL INDICATORS MATRIX

Momentum Indicators

RSI (4H): 42 (Neutral-Bearish)

RSI (1H): 35 (Oversold approaching)

Stochastic: %K: 28, %D: 35 (Oversold)

Williams %R: -75 (Strong oversold)

Trend Indicators

MACD (4H): Bearish crossover pending

ADX: 28 (Moderate trend strength)

Parabolic SAR: $3,365 (Sell signal if broken)

Volume Indicators

OBV: Declining (distribution pattern)

Volume Rate of Change: Negative

Accumulation/Distribution: Slight distribution

KEY SUPPORT & RESISTANCE LEVELS (24H)

Immediate Resistance Levels

R1: $3,365 (Previous support turned resistance)

R2: $3,375 (Major psychological & Gann resistance)

R3: $3,390 (Recent swing high)

R4: $3,410 (Extended resistance)

Critical Support Levels

S1: $3,330 (Immediate support)

S2: $3,300 (Psychological & Fibonacci)

S3: $3,285 (Major harmonic & Gann target)

S4: $3,260 (Extended support)

24-HOUR TRADING SCENARIOS

Scenario 1: Bearish Breakdown (60% Probability)

Trigger: Break below $3,330 with volume

Target 1: $3,300-3,310

Target 2: $3,285-3,290

Extended Target: $3,260-3,270

Stop Loss (Shorts): Above $3,370

Scenario 2: Range-Bound Consolidation (25% Probability)

Range: $3,320-3,375

Strategy: Fade extremes

Buy Zone: $3,320-3,330

Sell Zone: $3,365-3,375

Breakout Confirmation: Volume spike

Scenario 3: Bullish Reversal (15% Probability)

Trigger: Break above $3,375 with volume

Target 1: $3,390-3,400

Target 2: $3,410-3,420

Invalidation: Below $3,285

RISK FACTORS & CATALYSTS (24H)

Bearish Catalysts

US Dollar strength continuation

Risk-off sentiment from geopolitical tensions

Profit-taking ahead of weekend

Technical breakdown confirmation

Bullish Catalysts

Safe-haven demand surge

US Dollar weakness

Central bank buying speculation

Technical oversold bounce

High-Impact Events (Next 24H)

Asian market opening sentiment

US Dollar Index movement

Cryptocurrency correlation effects

Weekend gap analysis

TRADING RECOMMENDATIONS (24H)

For Scalpers (5M-15M)

Strategy: Fade bounces to resistance

Entry: $3,355-3,365 area

Target: $3,335-3,340

Stop: $3,375

Risk/Reward: 1:2

For Swing Traders (1H-4H)

Primary Setup: Short on retracement

Entry Zone: $3,350-3,360

Target 1: $3,300

Target 2: $3,285

Stop Loss: $3,385

Conservative Approach

Wait for: Clear breakdown below $3,330

Entry: $3,325 (confirmation)

Target: $3,285-3,290

Stop: $3,345

CONFLUENCE FACTORS

Bearish Confluence at $3,285

Harmonic Bat pattern completion (88.6% level)

Gann Square of Nine critical angle

Elliott Wave 3 = 1.618 × Wave 1 target

Fibonacci 78.6% retracement level

Previous significant support area

Wyckoff markdown initial target

Resistance Confluence at $3,375

Gann 90-degree angle resistance

Harmonic pattern resistance

Elliott Wave corrective high

Previous breakout level

Psychological round number

FINAL 24H FORECAST SUMMARY

Expected Price Action: Controlled decline toward $3,285-3,300 support zone with potential for brief consolidation before further weakness.

Primary Targets (Downside):

First: $3,300-3,310

Second: $3,285-3,290

Extended: $3,260-3,270

Key Invalidation: Sustained break above $3,375 would shift bias bullish toward $3,390-3,410.

Risk Management: Position sizing should be conservative due to high volatility expectations and weekend gap risks.

Probability Assessment:

60% - Bearish scenario

25% - Sideways consolidation

15% - Bullish reversal

Disclaimer: This analysis is for educational purposes only. Gold trading involves substantial risk. Always use proper risk management and never risk more than you can afford to lose.

Volume profile resistance