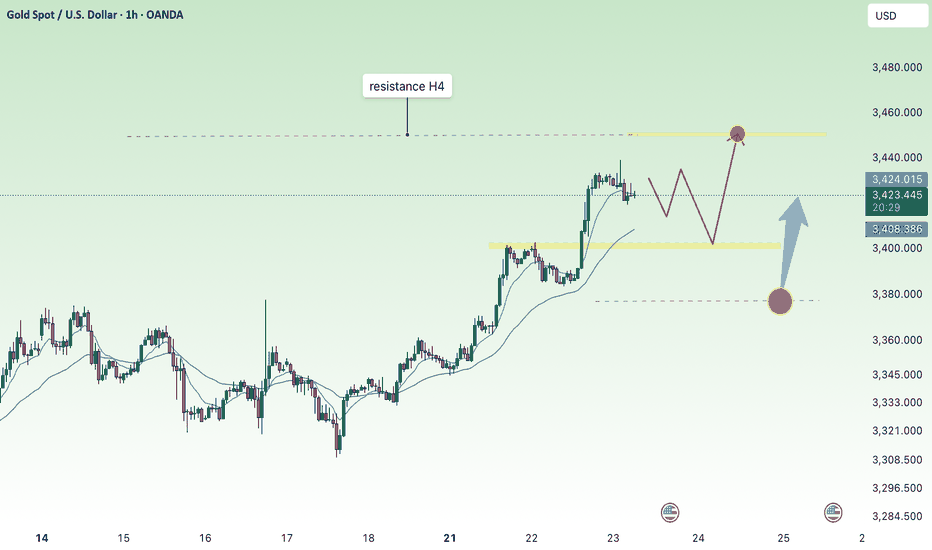

Gold price continues to increase above 3400, next week✍️ NOVA hello everyone, Let's comment on gold price next week from 08/11/2025 - 08/15/2025

⭐️GOLDEN INFORMATION:

Spot gold held steady on Friday, while futures surged to a record high of $3,534 following reports that the United States will impose tariffs on imported gold bars. Traders also continued to digest recent U.S. economic data as they looked ahead to next week’s key inflation release. XAU/USD last traded near $3,397, little changed on the day.

Overnight, the price spread between New York COMEX futures and spot prices widened by more than $100, Reuters reported, after the Financial Times revealed that the U.S. had levied tariffs on one-kilo gold bars, citing a letter from U.S. Customs & Border Protection.

⭐️Personal comments NOVA:

Gold price accumulates around 3400, buying power remains good as interest rate cut expectations approach

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3418, $3437, $3500

Support: $3344, $3310

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

Buygold

Bulls maintain weekend above 3400⭐️GOLDEN INFORMATION:

Gold (XAU/USD) eased back from a more than two-week high near $3,409–3,410 during Friday’s Asian session, as traders booked profits ahead of the weekend. A broadly positive tone in equity markets, coupled with a modest rebound in the U.S. Dollar, added to the downward pressure on bullion. Even so, several factors continue to underpin the metal, urging caution for aggressive bearish positioning.

Lingering trade-related uncertainty—intensified by President Donald Trump’s latest tariff threats this week—has helped maintain gold’s safe-haven appeal. At the same time, growing expectations that the Federal Reserve will resume its rate-cut cycle in September are likely to cap any sustained dollar strength, encouraging dip-buying interest around the $3,380 level.

⭐️Personal comments NOVA:

Tariff tensions, along with a very positive market about the possibility of interest rate cuts, helped gold prices return above the 3400 zone.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3428- 3430 SL 3435

TP1: $3418

TP2: $3408

TP3: $3392

🔥BUY GOLD zone: $3373-$3371 SL $3366

TP1: $3382

TP2: $3395

TP3: $3410

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold price maintains upward trend to 3400⭐️GOLDEN INFORMATION:

Gold (XAU/USD) edged lower during the North American session, pressured by rising U.S. Treasury yields, profit-taking, and reports that President Donald Trump may announce a replacement for Fed Governor Adriana Kugler later this year. The precious metal is trading around $3,372, down 0.23%.

After a three-day rally, bullion struggled to gain further traction as investors locked in profits. This came despite Trump signing an executive order imposing a 25% tariff on India in response to its continued imports of Russian oil. The new duties—set to take effect 21 days after August 7—will raise tariffs on select Indian exports to as much as 50%.

⭐️Personal comments NOVA:

Gold prices continue to increase, heading towards 3400. The context of trade tensions heats up again, along with increasing expectations of interest rate cuts.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3429- 3431 SL 3436

TP1: $3418

TP2: $3408

TP3: $3392

🔥BUY GOLD zone: $3332-$3330 SL $3325

TP1: $3342

TP2: $3355

TP3: $3368

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Continue to return above 3400, gold price increases⭐️GOLDEN INFORMATION:

Gold (XAU/USD) slipped slightly during Wednesday’s Asian session, pulling back from a nearly two-week high near $3,390 reached the day before, effectively ending a four-day winning streak. The precious metal came under pressure as Asian equities advanced, tracking a solid rebound in U.S. equity futures—dampening demand for safe-haven assets.

Additionally, a mild uptick in the U.S. Dollar further weighed on gold. However, the downside appears limited, as broader market caution continues to support the metal’s underlying appeal.

⭐️Personal comments NOVA:

Maintain the upward momentum, the same scenario as the beginning of this week. Adjust down in Asian and European sessions and continue to increase in US session. Aim for 3400

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3428- 3430 SL 3435

TP1: $3418

TP2: $3408

TP3: $3392

🔥BUY GOLD zone: $3331-$3329 SL $3324

TP1: $3340

TP2: $3352

TP3: $3365

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Bulls continue to be active following NFP data⭐️GOLDEN INFORMATION:

Gold (XAU/USD) slips toward $3,360 in early Asian trading on Monday, snapping a two-day winning streak. However, disappointing U.S. job data and lingering tariff concerns could pressure the U.S. Dollar and help cushion the downside for the Dollar-denominated metal.

The yellow metal is under pressure from a recovering Greenback, though gains may remain capped as weaker-than-expected Nonfarm Payrolls (NFP) data has strengthened expectations of a Federal Reserve rate cut in the near term.

⭐️Personal comments NOVA:

Buyers maintained early in the week, continuing to move towards higher resistances: 3374, 3387

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3374- 3376 SL 3381

TP1: $3365

TP2: $3350

TP3: $3333

🔥BUY GOLD zone: $3328-$3326 SL $3321

TP1: $3335

TP2: $3348

TP3: $3360

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Continued recovery, positive after NFP news✍️ NOVA hello everyone, Let's comment on gold price next week from 08/04/2025 - 08/8/2025

⭐️GOLDEN INFORMATION:

Gold prices surged over 1.5% on Friday, climbing toward $3,350, as a weaker-than-expected U.S. Nonfarm Payrolls (NFP) report signaled a faster-than-anticipated slowdown in the labor market. Heightened geopolitical tensions between the U.S. and Russia further boosted safe-haven demand for the precious metal.

Following the disappointing July jobs data, markets began pricing in a potential interest rate cut by the Federal Reserve. While the Unemployment Rate held relatively steady, signs of labor market softness supported recent comments from Fed officials Michelle Bowman and Christopher Waller, who advocated for a 25-basis-point rate cut at the July 29–30 meeting.

Additional data added to the cautious sentiment: the ISM’s July report confirmed that U.S. manufacturing activity remains in contraction territory, while consumer confidence took a hit, according to the University of Michigan’s latest survey.

⭐️Personal comments NOVA:

Gold prices continue to be positively affected after last week's NFP news, market expectations of an early rate cut are rising

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3384, $3434

Support: $3331, $3307, $3268

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

Continued price increase - gold increased to 3450⭐️GOLDEN INFORMATION:

Gold prices climbed for a second straight session on Tuesday, gaining over 0.9% as sliding US Treasury yields continued to weigh on the US Dollar. Investors remained cautious amid lingering uncertainty over upcoming US trade agreements. At the time of writing, XAU/USD is trading at $3,427, having rebounded from an intraday low of $3,383.

Yields on US government bonds have now declined for five consecutive days, pressuring the Greenback—reflected in the softer US Dollar Index (DXY). Heightened speculation that the US and European Union (EU) may fail to secure a trade agreement before the looming August 1 deadline has intensified demand for safe-haven assets. As a result, gold surged to a five-week high of $3,433.

⭐️Personal comments NOVA:

Gold price continues to increase, FOMO from the market is good and positive. Heading towards 3450

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3449- 3451 SL 3456

TP1: $3435

TP2: $3422

TP3: $3405

🔥BUY GOLD zone: $3380-$3378 SL $3373

TP1: $3390

TP2: $3400

TP3: $3415

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold price maintained above 3400⭐️GOLDEN INFORMATION:

Gold prices surged over 1% on Monday as both the US Dollar and Treasury yields declined sharply, driven by ongoing uncertainty surrounding trade negotiations, despite a generally positive risk tone in broader markets. At the time of writing, XAU/USD trades at $3,397, having rebounded from daily lows of $3,338.

While risk sentiment has improved ahead of upcoming US corporate earnings releases, anxiety lingers as the August 1 tariff deadline set by the White House approaches. Investors remain cautious about potential trade disruptions between the US and its key partners—the European Union (EU), Canada, and Mexico.

Meanwhile, reports from Bloomberg indicate that EU officials are preparing to convene this week to finalize a retaliation strategy, should trade talks with President Trump collapse. This backdrop of trade tension continues to support gold’s safe-haven appeal.

⭐️Personal comments NOVA:

Gold price continues to increase before FED's statement, market's expectation of early interest rate cut, setting new ATH in Q4/2025

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3450- 3452 SL 3457

TP1: $3435

TP2: $3422

TP3: $3405

🔥BUY GOLD zone: $3332-$3330 SL $3325

TP1: $3345

TP2: $3358

TP3: $3370

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

3380 gold price recovered at the beginning of the week⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) trade with modest gains around $3,350 in early Asian hours on Monday, supported by persistent uncertainty surrounding global trade negotiations as the US tariff deadline approaches. Lingering concerns over fresh levies are likely to sustain demand for the safe-haven metal. Investors now look ahead to comments from Federal Reserve (Fed) Chair Jerome Powell, scheduled for Tuesday, for clearer policy direction.

On Sunday, US Commerce Secretary Howard Lutnick confirmed that August 1 remains the firm deadline for countries to comply with Washington’s tariff demands. While President Trump’s earlier announcements saw shifting deadlines, the White House now insists this date is final. This cloud of uncertainty continues to bolster gold’s appeal as a hedge in volatile markets.

⭐️Personal comments NOVA:

Gold prices continued to recover last weekend, mainly still accumulating above 3300.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3380- 3382 SL 3387

TP1: $3370

TP2: $3360

TP3: $3350

🔥BUY GOLD zone: $3322-$3320 SL $3315

TP1: $3333

TP2: $3345

TP3: $3356

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

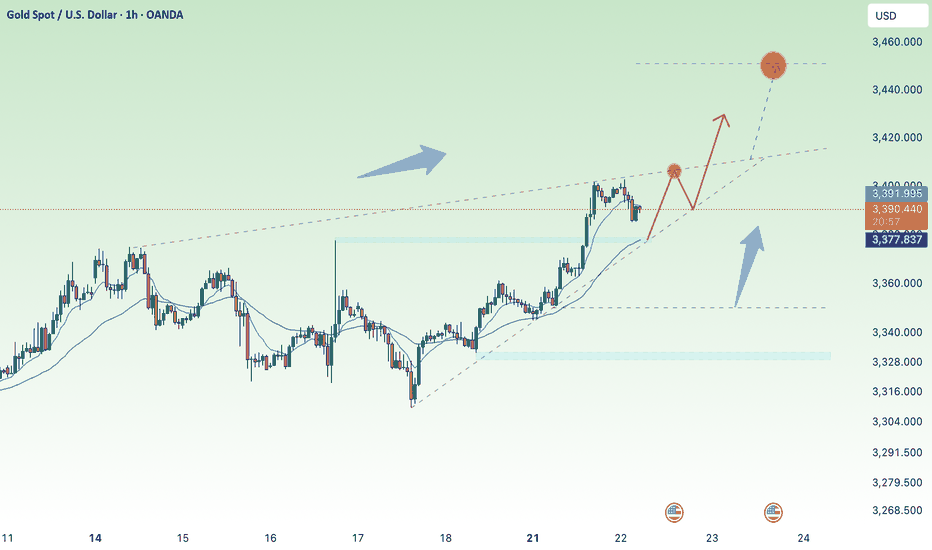

Gold price maintains accumulation below 3400✍️ NOVA hello everyone, Let's comment on gold price next week from 07/21/2025 - 07/25/2025

⭐️GOLDEN INFORMATION:

Gold prices edge higher in Friday’s North American session as a softer US Dollar and pre-weekend profit-taking lend support. Dovish remarks from a Federal Reserve (Fed) Governor, hinting at a possible rate cut as early as July, further bolster the yellow metal. At the time of writing, XAU/USD is trading around $3,353, gaining 0.43%.

Improved market sentiment also underpins bullion, following the University of Michigan’s report showing that US consumers are growing more optimistic about the economy, with inflation expectations easing. Meanwhile, Fed Governor Christopher Waller’s call for rate cuts weighed on US Treasury yields, adding positive momentum to gold.

The US Dollar Index (DXY) weakens to 98.48, down 0.13%, making USD-priced gold more attractive to foreign buyers and helping sustain the current uptrend.

⭐️Personal comments NOVA:

Gold price remains in the accumulation range of 3300 - 3400, the market awaits information on upcoming interest rate policy

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3367, $3392

Support: $3305, $3280, $3246

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

SWING TRADE OPPORTUNITY 〉LONGAs illustrated, I try to visualize what the next bullish impulse could look like if price holds 3300 as a key psychological and algorithmic price level.

Illustrated are the potential buy areas (a current one and an extended one in case a pullback occurs to manipulate lower levels in the next 24-48 hours).

This projection, if valid, could hold from now until next week, so it can be considered a swing trade to hold at least the next week and into the following one).

--

After this post, I will upload another analysis on the Daily timeframe projecting the longer term move, so make sure to go in my profile to check it out.

GOOD LUCK

THE LONG SHOT 〉POTENTIAL OUTLOOKAs illustrated, I'm trying to visualize how a potential continuation impulse could look like during " Bullish July " and toward the end of the year (depending on how aggressive buyers step in; specially central banks and institutions).

As you can see on this Daily chart, price respected a long term trend line + is forming higher lows, funneling into a shorter and shorter range of accumulation.

This is a very strong bullish behavior; when price gets tighter and tighter respecting a resistance level, but making higher lows. It tends to indicate that price is accumulating and "loading" (sort of speak).

Now, analyzing gold from the fundamental aspect, one MUST align those factors with price. In other words: DOES IT MAKE SENSE TO BE BULLISH OR "THINK" PRICE COULD RISE?

Well, ask yourself and do the research on the following (but not limited to) questions:

1. How is the US dollar doing? (Since it is the world's "reserve" currency)

2. Are the interest rates in the USA favoring the economy?

3. How is the world economy as a whole doing?

- inflation in the top world powers and important economies?

4. How is international trade policy looking like for the world?

- Positive or negative? Are countries happy with each other currently, trading without any issues? (Or maybe... there's a tariff war and a trade war goin on?...)

5. Politically speaking, is the general public UNITED or POLARIZED? (politics is a key fundamental aspect for the price of gold, as it either adds to uncertainty and tensions, or it calms things down).

6. Geopolitically speaking (and most importantly); is the "conflict" (war) ending, getting better, resolving? ...

7. Where is the money going and flowing? Black rock, vanguard, and other top hedge funds; where are they investing their money? ( because central banks keep BUYING gold... )

Those are some of many many questions one must study and understand, in order to align the technical aspects of the price of the yellow metal.

If any question/factor DOES NOT POINT to bullishness in price, then the technical and price projection of any analysis starts to have weakness.

On the other hand, if the fundamental factors and questions in play INDEED POINT toward an uncertain situation, adding bullishness to the price, any analysis and bullish projection simply has those aspects to its favor.

--

GOOD LUCK!

persaxu

IMPORTANT BREAKOUT 〉BULLS ARE BACKAs illustrated, price has broken out of an important 4H and 1D trend line that had kept price bearish since the beginning of the month.

Yesterday, gold made its way to a ket resistance level and broke it, CLOSING above it in the 4H timeframe, which is a key sign that bulls are back.

An interesting sign is that price bounced from the 61.8 - 67% retracement of the last bullish impulse that had an extended correction.

Should price manage to stay above 3250-3300 next week, , (a very strong psychological and algorithmic price range), the path to a new ATH is well opened and the probabilities arise on its favor.

I try to visualize a potential buy area shown in green, and the invalidation of this idea would be the level from which price has bounced.

--

I have been bullish on gold since 2023, ignoring any correction to be a "bearish market" and rather accumulation phases of longer term potential for growth.

The world economy and geopolitical conflict along many other financial macroeconomic data and circumstances, are simply NOT pointing toward a better future, and gold is screaming so by continuing to rise, and central banks back this up by continuing to buy it physically.

--

GOOD LUCK

Uptrend at the end of the week 3367, maintain the upward force⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) are on track to notch a third straight day of gains on Friday, climbing toward the upper boundary of this week’s trading range as escalating trade tensions fuel safe-haven demand. In a significant intensification of global trade disputes, US President Donald Trump issued formal notices this week to multiple trading partners, detailing individual tariff rates set to take effect on August 1 should no agreements be reached. This has rattled investor sentiment and weighed on risk assets, offering solid support to Gold.

Meanwhile, expectations for an imminent interest rate cut by the Federal Reserve (Fed) have cooled following last week’s strong US jobs data. As a result, the US Dollar (USD) remains firm, holding near a more than two-week high reached on Thursday. This USD strength could limit the upside for the non-yielding yellow metal in the near term. Therefore, traders may look for a sustained breakout before committing to further bullish positions in the XAU/USD pair.

⭐️Personal comments NOVA:

Gold price breaks 3330, maintaining good buying pressure, recovering at the end of the week

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3367- 3369 SL 3374

TP1: $3355

TP2: $3342

TP3: $3325

🔥BUY GOLD zone: $3306-$3308 SL $3301

TP1: $3315

TP2: $3325

TP3: $3338

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

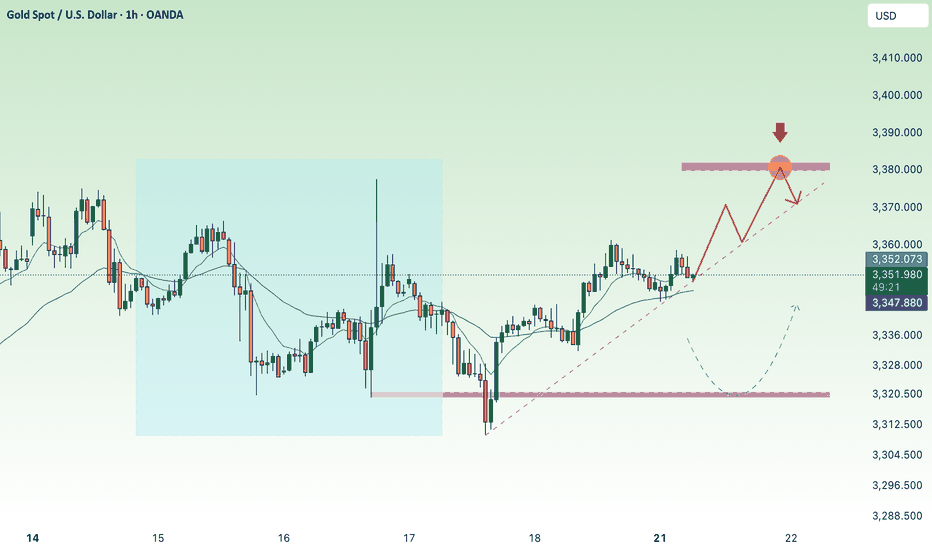

Gold price is moving sideways on H4 frame, above 3242✍️ NOVA hello everyone, Let's comment on gold price next week from 07/07/2025 - 07/11/2025

⭐️GOLDEN INFORMATION:

Gold prices resumed their upward momentum on Friday and are on track to close the week with gains exceeding 1.50%, supported by a weaker US Dollar amid subdued liquidity following the Independence Day holiday in the United States. A mild uptick in trade tensions also contributed to bullion's strength. At the time of writing, XAU/USD is trading at $3,333, up 0.26%.

President Donald Trump announced that the US would begin sending official letters to trading partners on Friday ahead of the July 9 deadline, outlining new tariff measures ranging between 10% and 70%, set to take effect on August 1. Treasury Secretary Scott Bessent added that a wave of trade agreements is expected before the deadline, estimating that around 100 countries will face a minimum 10% reciprocal tariff. He also hinted at upcoming deal announcements.

⭐️Personal comments NOVA:

Gold price continues to move sideways, accumulating in a large range: 3242 - 3450

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3362, $3393, $3446

Support: $3312, $3279, $3241

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

Gold accumulates and moves above 3350⭐️GOLDEN INFORMATION:

Gold prices declined by 0.80% on Thursday after a robust US Nonfarm Payrolls (NFP) report boosted the US Dollar, dampening expectations for a Federal Reserve rate cut at the upcoming July meeting. At the time of writing, XAU/USD is trading at $3,332, after reaching an intraday high of $3,365.

June’s employment data significantly outperformed forecasts and even surpassed May’s figures, reinforcing the resilience of the US labor market. Notably, the Unemployment Rate edged closer to the 4% mark, underscoring continued labor market strength. The upbeat report casts doubt on Wednesday’s softer ADP private-sector jobs data, which had shown a 33,000 drop in hiring.

⭐️Personal comments NOVA:

Gold price accumulates and recovers around 3350. Friday has no important news and bank holiday in US session, short-term recovery

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3365- 3367 SL 3372

TP1: $3355

TP2: $3342

TP3: $3330

🔥BUY GOLD zone: $3311-$3313 SL $3306

TP1: $3325

TP2: $3338

TP3: $3350

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold growth, recovery 3393⭐️GOLDEN INFORMATION:

Gold prices edge higher during the North American session as investors turn their attention to the upcoming US Nonfarm Payrolls (NFP) report — a key indicator that could influence the Federal Reserve’s next policy move. At the time of writing, XAU/USD is trading at $3,348, up 0.29%.

Recent labor data from ADP revealed that companies are pausing hiring rather than resorting to layoffs, reflecting caution amid uncertain economic conditions. Meanwhile, Microsoft’s decision to cut 9,000 jobs has added to concerns about a softening labor market.

Traders now await Thursday’s official employment report from the Bureau of Labor Statistics, which is projected to show 110,000 new jobs added in June — a slowdown from May’s 139,000. The Unemployment Rate is expected to tick up slightly to 4.3%, still within the Fed’s projected range of 4.4% according to its latest Summary of Economic Projections.

⭐️Personal comments NOVA:

good buy, hold before NF news. Dollar continues to be under selling pressure from investors, worried about the Trump administration's unstable tariff policies.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3393- 3395 SL 3400

TP1: $3380

TP2: $3363

TP3: $3350

🔥BUY GOLD zone: $3296-$3294 SL $3289

TP1: $3308

TP2: $3318

TP3: $3330

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Waiting for gold price to grow with ADP-NF⭐️GOLDEN INFORMATION:

Gold (XAU/USD) finds it difficult to extend its two-day rally and trades within a tight range during Wednesday’s Asian session, hovering just below Tuesday’s one-week high. A modest rebound in the US Dollar—recovering from its lowest level since February 2022—has put pressure on the precious metal. Additionally, improving market sentiment continues to reduce demand for safe-haven assets like Gold, further limiting its upside.

⭐️Personal comments NOVA:

Steady trendline recovery, sustained buying could move towards 3383 with today's ADP-NF data

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3382- 3384 SL 3389

TP1: $3370

TP2: $3360

TP3: $3350

🔥BUY GOLD zone: $3312-$3310 SL $3305

TP1: $3320

TP2: $3330

TP3: $3340

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold price recovers above 3300⭐️GOLDEN INFORMATION:

Gold (XAU/USD) trades at $3,292 after rebounding from an intraday low of $3,246 and looks set to close out June with a modest gain of over 0.18%. However, its upward momentum has been restrained by easing geopolitical tensions in the Middle East and growing optimism over forthcoming trade agreements. Meanwhile, analysts at Citi expect Gold to consolidate within the $3,100 to $3,500 range throughout the third quarter.

In Washington, US Treasury Secretary Scott Bessent expressed confidence that the “One Big Beautiful Bill” will make progress in the coming hours. The sweeping tax reform legislation, which narrowly passed the Senate over the weekend, includes major tax deductions funded by reductions in Medicaid spending and green energy incentives.

⭐️Personal comments NOVA:

Gold price recovers above 3300 , ahead of NF reports this week . Accumulates above 3300

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3353- 3355 SL 3360

TP1: $3340

TP2: $3330

TP3: $3320

🔥BUY GOLD zone: $3272-$3270 SL $3265

TP1: $3283

TP2: $3295

TP3: $3310

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Bulls recover in new week, gold price returns to 3300⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) regained some lost ground during Monday’s Asian session, buoyed by growing expectations that the US Federal Reserve may implement more interest rate cuts this year—and potentially sooner than previously anticipated. Such prospects weigh on the US Dollar, making the dollar-denominated metal more attractive to overseas buyers.

However, the recent improvement in global risk sentiment—driven by the US-China trade accord and a ceasefire agreement between Israel and Iran—could reduce demand for Gold’s safe-haven appeal. Investors now turn their attention to upcoming comments from Federal Reserve officials, with speeches from Atlanta Fed President Raphael Bostic and Chicago Fed President Austan Goolsbee expected later in the day.

⭐️Personal comments NOVA:

Gold price recovered, accumulating at the beginning of the new week around the price range of 3300. Still in the main downtrend.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3316- 3318 SL 3323

TP1: $3305

TP2: $3290

TP3: $3277

🔥BUY GOLD zone: $3248-$3246 SL $3241

TP1: $3258

TP2: $3270

TP3: $3286

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

GDP and price range accumulated above 3300⭐️GOLDEN INFORMATION:

Gold prices held firm during the North American session on Wednesday, climbing over 0.30% as easing tensions between Israel and Iran boosted risk sentiment. Meanwhile, disappointing US housing data could prompt future action from the Federal Reserve (Fed). However, Fed Chair Jerome Powell's continued hawkish stance has limited further upside for the precious metal.

At the time of writing, XAU/USD is trading around $3,334, up 0.34%, as the US Dollar pares earlier gains and Wall Street posts modest advances.

⭐️Personal comments NOVA:

moving in accumulation range following 2 trend lines, trading above 3300

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3364- 3366 SL 3371

TP1: $3352

TP2: $3345

TP3: $3330

🔥BUY GOLD zone: $3302-$3300 SL $3295

TP1: $3315

TP2: $3328

TP3: $3340

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

BULLS HOLDING KEY PIVOT 〉ATH AROUND THE CORNER As illustrated, Im trying to visualize what a potential bull run could look like starting from what seems to be a "bullish signature" move by gold: a diagonal double bottom.

Don't believe me; go back in time and study how gold makes bottoms and how new bull runs start. The fact that it was NY that manipulated BOTH times and got the best price, is a strong footprint that MIGHT just indicate a potential bottom (at least of this current bearish correction.

I won't say "this is it" and ATH are next FROM this potential rebound; HOWEVER, it could indicate at least the next 10 to 24 hours of potential bullish impulse to retest a degree of the bearish drop since Sunday's weekly open.

Hammer candle from Tuesday's NY session low + today's 4H bullish engulfing, are also powerful components that show bullish strength indicating 3300 to be a major support area.

I'm expecting (BUT NOT ADVISING) Asia to break aggressively to the upside confirming that this could have been this current correction's bottom, and/or at least this week's low.

Should Thursday close above Tuesday's high or consolidating near it, also shows signs of bullish strength and opens the door for Friday to make a second bullish impulse move.

This would reflect on the Weekly candle leaving a long rejection wick and closing (potentially) back above 3350 - 3360.

Should this be the case, the following week would have the road paved to lift off price to retest previous 4H highs of 3440 - 3450 range.

...

July is a bullish month historically. Don't believe me; search "seasonality tool, gold" and see it for yourself.

It is a matter of weeks for Gold to breakout of this wide accumulation phase it has been since end of April, and start a fresh and brand new bull run that could/should last until the end of the year.

-

GOOD LUCK

Persa

Gold price short term recovery 3366⭐️GOLDEN INFORMATION:

Kansas City Federal Reserve President Jeff Schmid stated on Wednesday that the central bank has sufficient time to assess the impact of tariffs on inflation before making any decisions regarding interest rates. His remarks suggest a cautious approach and align with Fed Chair Jerome Powell’s comments from the previous day.

Chair Powell reaffirmed the view that there is no urgency to alter monetary policy, emphasizing a patient, data-driven approach as the Fed monitors economic developments. This less dovish tone from Fed leadership may help cap downside pressure on gold in the near term.

Meanwhile, money markets are fully pricing in two rate cuts by the end of 2025, with a September move seen as more probable than one in July—although expectations for a July cut have slightly increased since last week.

⭐️Personal comments NOVA:

Gold price recovered and continued to accumulate, pay attention to the GAP 3366 area at the beginning of the week, selling pressure is still maintained.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3366- 3368 SL 3373

TP1: $3358

TP2: $3345

TP3: $3330

🔥BUY GOLD zone: $3303-$3301 SL $3296

TP1: $3315

TP2: $3328

TP3: $3340

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account