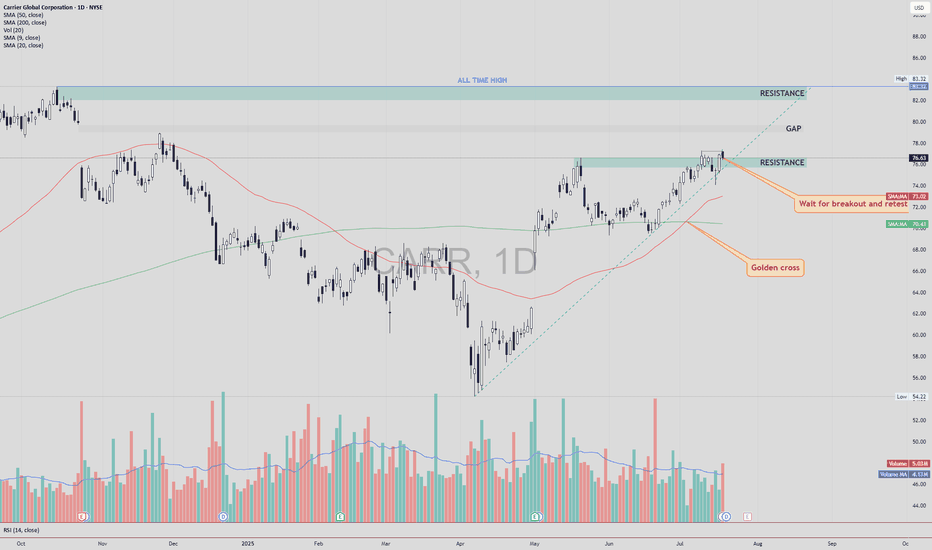

CARR – Bullish Breakout Toward Gap and ATHCarrier Global NYSE:CARR has closed above a key resistance zone near $76.50–$77.00 , indicating a possible breakout setup in progress. This move comes after a Golden Cross , where the 50 SMA crossed above the 200 SMA — a long-term bullish signal.

🔍 Technical Highlights:

✅ Golden Cross: Bullish momentum building.

✅ Breakout level: Price broke above horizontal resistance zone.

🔄 Next step: Wait for a potential retest of the breakout zone.

🔊 High volume on the breakout and retest would increase the strength and reliability of the setup.

🎯 Target Levels:

First Target (TP1): ~$80.00 — near the top of the existing gap.

Second Target (TP2): ~$83.32 — the current All-Time High (ATH).

🛡 Trade Plan:

Entry idea: After a clean retest of the breakout level with supportive volume.

Stop-loss: Below the retest zone or under 50 SMA (~$72-74 area).

Invalidation: If price falls back below resistance on high volume.

Conclusion:

CARR shows a strong breakout setup after a Golden Cross. A confirmed retest with volume could open the door toward the gap fill and new all-time highs.

DYOR – This is not financial advice.

Buyposition

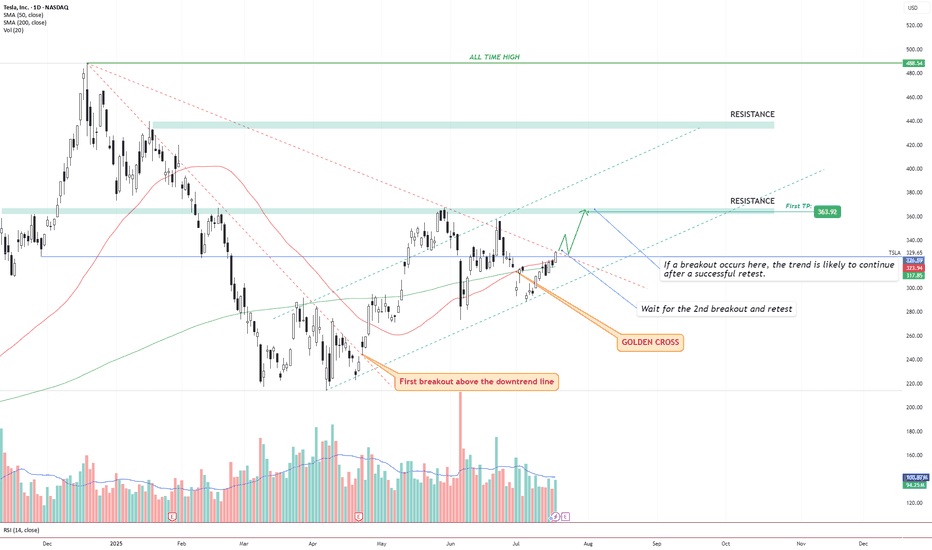

TSLA – Golden Cross + Dual Breakout Structure Targeting $363 andIdea Text:

Tesla NASDAQ:TSLA has recently printed a powerful Golden Cross , where the 50 SMA has crossed above the 200 SMA — signaling a potential long-term bullish shift in trend.

But price action shows more:

We’re observing a dual-breakout structure, where the first breakout above the long-term downtrend line has already occurred (see orange label), and the price is now approaching a critical horizontal resistance zone.

Let’s break it down step-by-step:

🔸 Step 1: Golden Cross

The 50 SMA crossed above 200 SMA — a classic signal for trend reversal. This often attracts institutional interest, especially if followed by breakout confirmation.

🔸 Step 2: First Breakout (Already Confirmed)

Price broke above the descending trendline, retested it, and maintained higher structure. This breakout initiated a shift in market sentiment from bearish to neutral-bullish.

🔸 Step 3: Second Breakout (Setup Forming)

Price is now testing horizontal resistance around $330–$335 zone. This zone also coincides with dynamic resistance from prior failed swing attempts. A successful breakout above this level, followed by a clean retest, can serve as confirmation for a bullish continuation.

🔸 Step 4: Target Setting

🎯 First TP is set at $363.92, a well-defined resistance level. If the breakout holds, next potential targets may develop around key zones such as $395 and $440, depending on price strength and continuation.

🔸 Risk Management

✅ Ideal entry after retest of breakout above ~$335.

❌ Stop-loss below the breakout level or below 50 SMA (~$315 area), depending on entry style.

🔄 Monitor volume: breakout without volume = weak move.

Conclusion:

We are watching a classic price action + moving average confluence setup. Golden Cross, breakout + retest structure, clean resistance level, and defined targets all align.

This setup is valid only with confirmation. No breakout = no trade.

⚠️ Not financial advice. DYOR.

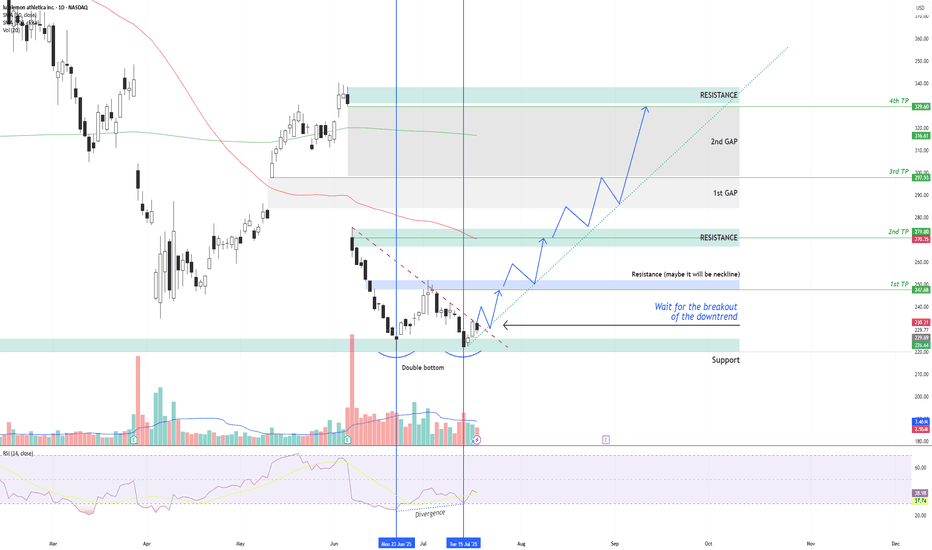

LULU – Double Bottom + RSI Divergence: Multi-Target Setup After LULU NASDAQ:LULU is showing signs of a potential bullish reversal after forming a double bottom structure around the $220 support zone , along with a bullish divergence on the RSI indicator.

Two vertical lines highlight the divergence: while price made a lower low, RSI formed a higher low – indicating a possible momentum shift in favor of buyers.

Currently, price is moving just below a descending trendline, which has been acting as dynamic resistance. The first condition for a long setup is a confirmed breakout above this trendline followed by a successful retest. If that happens, an entry can be considered .

📌 Entry Plan:

Entry: After a breakout and retest of the descending trendline.

1st TP: ~$247 — This level coincides with a local resistance zone, which may act as a neckline of the double bottom.

If price breaks above $247 and retests, it confirms bullish continuation.

📈 Target Structure:

2nd TP: ~$271 — next major resistance zone.

3rd TP: ~$297 — aligns with the first major gap zone.

4th TP: ~$329 — final gap resistance from previous sell-off levels.

This structure allows for scaling into the trade in stages — each breakout and retest offers a new confirmation and extension to the next target zone.

Volume analysis, price action, and RSI momentum all support the probability of a trend reversal — but confirmation is key.

Not financial advice. Always conduct your own research and risk management.

Unity Software (U) – Strong Earnings and Bullish FlowsFundamental Overview

Unity Software has been consolidating within a defined range for approximately a year following a significant decline in its stock price. Despite previous challenges, the company has consistently surprised investors with its earnings over the past year, maintaining strong performance. Historically, Unity tends to perform well during the May–June period. Looking ahead, projections suggest a decline in net margin, though net income is expected to increase, reinforcing the company's strong execution.

Additionally, Unity has exceeded expectations for four consecutive earnings reports, underscoring its resilience and growth trajectory.

Technical Outlook

- Momentum & Price Action: The stock exhibits solid momentum and is currently situated in a buy zone.

- Options Flow: Bullish sentiment is evident in options activity, signaling strong institutional interest.

- Analyst Ratings:

- Needham analyst Bernie McTernan maintains a Buy rating but lowers the price target from $33 to $30.

- Barclays analyst Ross Sandler maintains an Equal-Weight rating and lowers the price target from $26 to $25.

Given the current trends, bullish options flows, and favorable seasonality, Unity Software appears poised to test $25 in the upcoming weeks, particularly if momentum continues to drive price action.

$MOVE Setup Looks Clean – Support Holding Strong!!TVC:MOVE busted out of the downtrend and is currently testing the resistance trendline as a support line✅

Price is remaining at the level of the 0.236 Fib and resting on a pivotal area the retest has the potential to prepare the ground for the next leg up to $0.24+.

DYOR, NFA

#BTCUSDT. Is ready for a retest of 103.98 and higher.Structurally, over the next few days it looks like an attempt by the First Cryptocurrency to adjust its recent growth with a small correction into the zone of 92000-90200 - near these levels one can look for setups for buying.

Near these zones there may be an attempt to buy back at 103.98.

It looks promising, we are watching.

GER40 LONG SETUP IDEA - BUY THE DIP📈 LONG SETUP - BUY THE DIP (Swing Trade)

Entry: 22,350 - 22,400

Take Profit (TP): 23,500 (first target), 24,000 (extended target)

Stop Loss (SL): 22,150

Reasoning:

Strong historical support at 22,300 - 22,400.

Bullish divergence on MACD and RSI on 1H and 4H charts.

High timeframe trend remains bullish; expecting continuation after the retracement.

📈 Market Overview & Bias

Daily & 4H Charts:

The GER40 has been in a strong bullish trend over the past few months but is currently experiencing a retracement.

The 21 EMA and 8 EMA are converging, signaling indecision or potential trend exhaustion.

200 EMA remains below price, suggesting long-term uptrend remains intact.

The 100 EMA is acting as resistance on lower timeframes.

Key support zones: 22,300 and 21,900.

Key resistance zones: 23,000 and 23,500.

Lower Timeframes (1H & 15M)

The price is consolidating between the 22,400 - 22,700 range.

A potential reversal pattern is forming on the 15M chart with bullish divergence on RSI and MACD.

ATR values suggest increased volatility, so tight stop losses are necessary.

Key Economic & Geopolitical Considerations

ECB Rate Decision (March 21, 2025)

Hawkish stance → Might push GER40 lower.

Dovish stance → GER40 could break resistance.

US CPI & NFP Reports

Inflation data affecting European stock sentiment.

Strong USD could pressure GER40 downward.

Geopolitical Risks

German & EU economic policies affecting investor sentiment.

Tensions between China/EU and EU/USA on trade policies could add volatility.

mportant: this is not personalized financial advice. It’s an illustration of how one might combine risk management principles with the support/resistance zones in play.

Final Note & Disclaimer

All market scenarios carry probabilities, not certainties. Technical signals are best combined with macro fundamentals (e.g., interest rates, USD behavior, geopolitical risks) to form a well‐rounded market view. This consolidated analysis serves an educational purpose—always do additional research or consult a licensed professional before making trading or investment decisions.

Bitcoin Bullish Scenario: Breakout & Retest Idea📈 Bullish Scenario: Breakout & Retest of the $95,000–$99,500 Zone 🚀

🔹 Idea:

Price breaks above the strong resistance around $95,000 and holds it as new support on a retest.

🎯 Potential Entry:

✅ Trigger: A clear break and close above $95,000 on the 1H or 4H chart, followed by a pullback to retest $95,000–$96,000 as support.

✅ Confirmation: Enter on the first bullish candle or bullish engulfing pattern confirming the retest holds.

🔻 Stop-Loss Placement:

🔸 Aggressive: Below the breakout zone ($94,000–$94,500).

🔸 Conservative: Below the last swing low prior to the breakout ($92,000–$93,000).

🎯 Targets:

🎯 T1: $99,500 (next immediate resistance).

🎯 T2: $105,000–$109,000 (upper resistance on the chart).

💡 Consider taking partial profit at T1 and moving stop-loss to breakeven.

⚠️ Risk Management Tips:

🔹 Risk only 1–2% of your capital per trade.

🔹 If the retest fails quickly and price closes back below $95,000, exit early to minimize losses.

📢 Disclaimer: This is for educational and informational purposes only and not financial advice. Always do your own research and manage risk accordingly before making any investment decisions.

📊 What’s your take on this setup? Drop your thoughts in the comments! 👇🔥

theta midterm buy "🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

#EURUSD let’s see if it can go higherFor #EURUSD our analysis has been failed. Right now I don’t recommend having any short position. For this pair I will go for a long position in case the price drop to flag position and then when it starts moving up, I will open long position. I have shown ENTERY LEVEL, SL & TPs.

#eurusd #trading #forextrading #elliottwave #elliott #tradingview #elliottforecast #elliott_wave

#AUDUSD a failed analysisFor #AUDUSD our analysis was failed. The market generally will move up but I think that we will have a correction @first. I have shown ENTRY LEVEL with TP1 & TP2 and also INVALIDATION LEVEL.

#audusd #trading #forextrading #elliottwave #elliott #tradingview #elliottforecast #elliott_wave

#USDCHF a failed setup may be start of a bullish movementFor #USDCHF my view was wrong & the price broke SL. At the moment I don’t have any accurate position but if the market wants to move for bullish USD I show an ENTRY LEVEL WITH MORE RISK. Keep in mind that we may be in wave B, which may last for more than two weeks. The first target would be 0.92609. It could go higher. If you are in buy position, keep your SL at 0.90551.

Let’s see ENF will give us what we want or not.

#usdchf #trading #forextrading #elliottwave #elliott #tradingview #elliottforecast #elliott_wave

#USDCHF start of a bullish movementFor #USDCHF my daily view is that, the wave B has been started. It will continue @least for 10 days. The first target would be 0.9276. it could go higher even till 0.9376. If you are in buy position, keep your SL at 0.90772. Other entry points would be updated if I have time.

#usdchf #trading #forextrading #elliottwave #elliott #tradingview #elliottforecast #elliott_wave

#USDJPY started bullish movementFor #USDJPY my daily view is that we are in wave B. This wave will continue till @least for 4 days (please keep in mind that @least for 4 days and it can extend more). Our first TP is 109.39 and it can go higher till 110.14. if you are in buy position, please keep SL at 107.49.

#usdjpy #trading #forextrading #elliottwave #elliott #tradingview #elliottforecast #elliott_wave