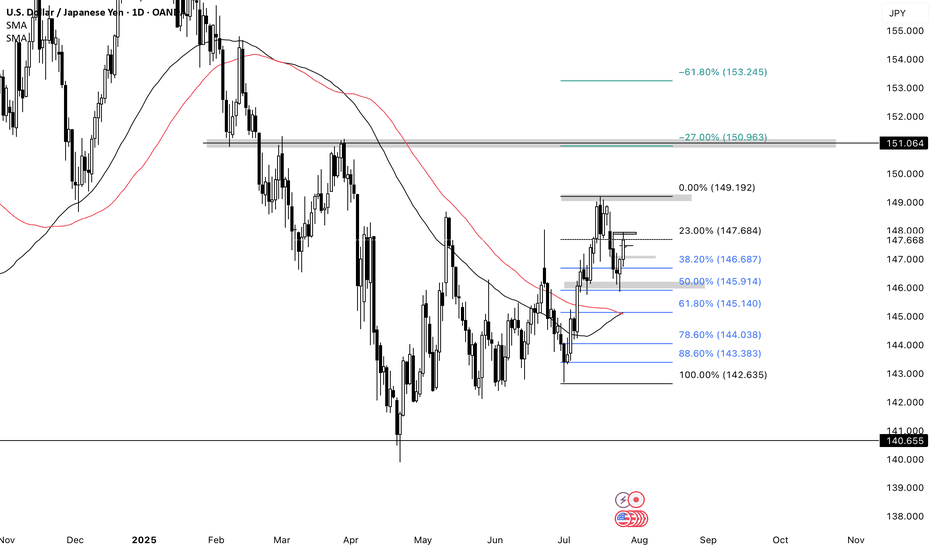

USDJPY BULLISHUJ closed bullish last week so I’ll continue looking for buys this week. There was a daily double bottom & 50% Retracement on the daily timeframe. I would like for price to either break the H4 resistance, form a HL then look for buys. Or price could retrace and form a HL the I’ll look for buys towards daily resistance @149.190 then my next TP will be 151.00

Buys

GBP/USD BUYThis trade is closed now but it is me logging it for anyone and everyone.

This analysis is based on the provided image and should not be considered financial advice. Trading involves risks, and it is essential to conduct your own research and consult with a financial advisor before making any trading decisions.

Update on Tesla This is my update on Tesla stock.

A huge gap that was created today and looking to not go inside the gap.

Not seeing anything to show why this will continue going up without going back to the first GAP mentioned in the last post. Which was in October.

The GAP is showing a whopping 4% rise.

Gold isn't ready to buy yetI've been trading gold for many years and I can say that I have a pretty good handle gold's behaviors.

While I think many think now might be the right time to buy gold as it is "really low" at least by comparison, I don't think so.

Gold Buys slowly and overtime, big bull spikes while they do occur they typically aren't the catalyst for the actual bull push. You'd typically find bearish spikes as these are the fake move.

What I mean by this is I think gold may continue to sell until it starts to slowly create higher highs and higher lows only to break out slowly after that.

The fact that gold is so bearish currently, it is likely to go up to get rid of these sellers within this orange zone (which I have re-analyzed) to the level I've highlighted (black line) and then drop.

But why am I choosing this line in particular, well I've studied gold for such a long time - I've noticed that it actually likes to play between obvious levels rather than go directly to them.

These are just my thoughts and I wouldn't act on them (for sells) until it actually decides to start going bearish. So even if I am wrong about this, who cares lol

GBPUSD Sustained SellsGU unlike EU is actually a bearish market overall and this makes sells more readily available to me. TBH since shifting over to trading gold almost exclusively I can't stand how much slower forex pairs such as GU and EU move by comparison so it is unlikely that I would trade it even if I do end up seeing something but I will call it out if I feel like it needs to do so.

That being said, GU is currently in consolidation right now after just breaking out of a previous consolidation. When we look at what GU has been doing over the past few weeks it also shows heavy bearish momentum

If you even look at the peak one might even say that price stop hunted high to get rid of sellers who had stops higher, but I'm not quite sure so I won't use that as a confluence within this particular analysis.

This is what I see, price stumbling within the consolidation a bit more and then pushing up to about this level or so to get rid of sellers stops within both the consolidation areas and then drop after that.

My reason for using this particular path is simple. I think the dealer wants to get rid of sellers but he can't drive price so high such that he gives new sellers a better opportunity - if price goes any higher he may give sellers the signal they are looking for to get in which invalidates the dealer's move. If price gets up to the level highlighted by the blue marker sells are probably off the table temporarily.

EURUSD Macro Sells PossibleAlright so it's been a literal while since I've analyzed anything other than gold and or maybe BTC. But neither of them have any opportunity currently so I am taking a look at a few other assets to see if there is anything interesting.

On EURUSD, we can see here what appears to be price stumbling at a level in which price has bought multiple times in the past and what I find really interesting about this level is the fact that price is bullish.

EURUSD is an overall bullish market so the fact that it is selling suggests that price needs to grab liquidity from the downside. But why? What is down there that price needs so badly?

Well, Think about it. Buyers place stop losses where exactly? At the lows right?

Yeah when you look at it on the weekly timeframe in my opinion it becomes even more clear - price needs to go lower to clear out buyers stops.

BUT

This then means that price needs to sell right? And we can only truly sell when price is bearish enough to do so right?

Well here seems to be very bearish, but I'd admit that I feel like I am drawing at straws here in hopes that it breaks this time, I'd be honest I am not hopeful that it will lol

That being said, what I think is possible for EU is that it will continue to stumble about this level for a while, maybe even go higher, before truly attempting to drop.

As much as I wish to find something here, I don't think there is anything.

The most I can say is maybe more sustained sells (very short term) until price leaves this orange zone

I'd be careful with this one

BULLISH GOLD AHEADGold in our view remains very much bullish. Our level of 2664 and 2626 should hold as strong buying zone and support. IT SHOULD NOT BREAK 2626. Targets are 2800 and 2915-2943. Since this is a long term view , we will be updating as time goes by. Use your own risk management and remember trading comes with its own risk. Lets get it.

SiteMinder (ASX: SDR) - Bullish Momentum Towards Buy-Side LiquidAnalysis and Prediction:

In this analysis, we observe how SiteMinder (ASX: SDR) has reacted exceptionally well off the monthly order block (OB), providing a strong impulse to the upside. This bullish move confirms the demand and buying pressure at this level, suggesting that price is poised to continue its upward trajectory.

On the daily chart, we can see that the price has broken structure (BOS) after tapping into a Fair Value Gap (FVG), further validating bullish momentum. The price respected the FVG upon retesting, offering strong confirmation that buyers are in control, and we anticipate a continuation towards the next buy-side liquidity level.

I project SiteMinder to reach a minimum of AU$7.73 as the next buy-side liquidity area. However, after hitting this level, I foresee a potential retracement before resuming its broader upward trend, offering opportunities for both short-term and long-term traders.

Given the confluence of signals—price reacting off the monthly OB, respecting the FVG, and breaking structure—we have solid confirmation of bullish momentum in play. Traders should consider this context when planning their entries and exits, with a focus on price action near key liquidity levels.

Disclaimer: This is not financial advice. Always conduct your own research (DYOR) before making any investment decisions.

Gold All Time Bullish ! Gold Next Move Buy or sell?Go through the analysis carefully, and do trade accordingly.

Resistance- 2685-2695

Resistance-2700-2710

Resistance- 2717-2725

Support-2650-2645

Support-2620-2610

Strong support area- 2595-2585

Gold Signal Daily for the week

Current price- 2672.5

Advice-For Buying

Buying area= 2640-2645

Best Buying Area= 2620-2625

Best selling area= No Confermation

-POSSIBILITY-1

If 2685 break and sustain then you can sell gold with retest target will be 2700-2717

-POSSIBILITY-2

If it breaks 2650 and sustains then you can sell gold with retest target will be 2620-2615

XAUUSD 16/09/24This week for gold, we are building on the overall outcome of last week's price action, which was a new all-time high—a move we’ve been anticipating for the past few weeks. Price action remains clearly bullish and continues to maintain its upward bias across both higher and lower timeframes.

With this in mind, we need to wait for a clear high to form within the hourly to daily timeframes in order to determine where we expect the price to pull back to until the high of our range is established. For now, we are simply anticipating price action to continue moving upwards. Please refer to the chart for potential short-term price pullbacks if the current high is maintained.

We have a straightforward trajectory of institutional price action heading to the upside. There is a clear area of demand that broke the previous all-time high, so a pullback to these areas is possible. However, until a new high is established, we can’t form a solid short-term pullback bias.

Remember, when prices are reaching new all-time highs, the last thing you want to do is short the market. Therefore, our bias remains long, as it has been for the past several months.

Trade safely, stick to your risk management, and always follow your plan.

GU D Bullish Idea 8/30/24Classic Break And Retest Strategy

Looking for price to return to the previous daily high around 1.30089, break into that area =, then return to the current highs around 1.32662 for TP.

**This is for educational purposes only and should not be considered financial advice because I am not a financial advisor.**

GER30 D BUY IDEA 5/19/24Price has been bullish majority of 2024. Posted my initial buy idea in "GER30 W BUY IDEA 2/2/24" post.

Looking for the Daily to have a correction before continuing bullish.

**This is for educational purposes only and this is not financial advice because I am not a financial advisor.**