Gold price continues to increase above 3400, next week✍️ NOVA hello everyone, Let's comment on gold price next week from 08/11/2025 - 08/15/2025

⭐️GOLDEN INFORMATION:

Spot gold held steady on Friday, while futures surged to a record high of $3,534 following reports that the United States will impose tariffs on imported gold bars. Traders also continued to digest recent U.S. economic data as they looked ahead to next week’s key inflation release. XAU/USD last traded near $3,397, little changed on the day.

Overnight, the price spread between New York COMEX futures and spot prices widened by more than $100, Reuters reported, after the Financial Times revealed that the U.S. had levied tariffs on one-kilo gold bars, citing a letter from U.S. Customs & Border Protection.

⭐️Personal comments NOVA:

Gold price accumulates around 3400, buying power remains good as interest rate cut expectations approach

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3418, $3437, $3500

Support: $3344, $3310

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

Buysellsignal

BTC recovers, trying to get back to 120k💎 WEEKEND BTC PLAN UPDATE (08/08)

🔍 BTC Analysis (H4 timeframe):

1. Elliott Wave Structure:

• BTC is following an impulsive wave sequence 1–2–3–4–5.

• Currently in wave (4) and may bounce to complete wave (5) around the ~119,000–120,000 zone.

2. Key Support Levels:

• 116,000–116,200: Support area for wave (4) – can look for buying opportunities here if confirmation signals appear.

• Below that, strong support lies around 115,200–115,600 (confluence of 0.5–0.618 Fibonacci retracement + MA200).

3. Resistance Levels:

• Previous high around 117,500 (Fibo 1.0) is the nearest resistance.

• Wave (5) target: 119,400–120,000 (Fibo 1.618).

4. Trading Plan:

• Buy at 116,000–116,200, SL below 115,600.

• Expected TP: 117,500 – 119,400.”

FTT : Go to work, it's goodHello friends🙌

✅after the decline we had, you can see that the price was supported by buyers in the support area we identified with Fibonacci and broke its resistance.

✅Now you can buy in the support areas we have identified for you with risk and capital management and move towards the set goals.

🔥Follow us for more signals🔥

*Trade safely with us*

BTC continues to accumulate, waiting for breakout to go up💎 MID-WEEK BTC PLAN UPDATE (06/08)

Brief BTC Analysis – 4H Timeframe:

• Main Trend: Price is consolidating within a descending channel (green diagonal lines).

• Support: The 112,500–113,000 zone has been tested twice and bounced (green arrows).

• Resistance: The 114,800–115,200 zone (purple area) – this is the key level that will determine the next trend.

⸻

Two main scenarios:

🔺 Bullish Scenario (Preferred):

• Price breaks above the 115,200 resistance zone → confirms a breakout from the descending channel.

• Next targets: 116,500 → 119,000.

🔻 Bearish Scenario:

• Price gets rejected at around 115,000 and breaks below the 113,000 support → likely to revisit 110,000.

📌 Key Signals to Watch:

• A clear breakout above 115,200 with volume is a strong buy signal.

• If the price fails to break this zone, consider selling once there is a clear bearish reaction.

Continue to return above 3400, gold price increases⭐️GOLDEN INFORMATION:

Gold (XAU/USD) slipped slightly during Wednesday’s Asian session, pulling back from a nearly two-week high near $3,390 reached the day before, effectively ending a four-day winning streak. The precious metal came under pressure as Asian equities advanced, tracking a solid rebound in U.S. equity futures—dampening demand for safe-haven assets.

Additionally, a mild uptick in the U.S. Dollar further weighed on gold. However, the downside appears limited, as broader market caution continues to support the metal’s underlying appeal.

⭐️Personal comments NOVA:

Maintain the upward momentum, the same scenario as the beginning of this week. Adjust down in Asian and European sessions and continue to increase in US session. Aim for 3400

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3428- 3430 SL 3435

TP1: $3418

TP2: $3408

TP3: $3392

🔥BUY GOLD zone: $3331-$3329 SL $3324

TP1: $3340

TP2: $3352

TP3: $3365

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

BTC accumulates, slightly adjusts down💎 BTC PLAN UPDATE – START OF THE WEEK (04/08)

🔍 1. Current Technical Structure

Price Pattern: The chart shows BTC is forming a falling wedge pattern, with converging support and resistance lines.

False Break: There was a false break below the strong support zone around ~112,000, followed by a sharp rebound. This indicates buyers are actively defending this level, showing potential buying pressure.

Fibonacci Retracement: From the recent low to high, the 0.5 (115,559) and 0.618 (116,361) Fibonacci levels are acting as key resistance zones.

Key Price Levels:

• Strong support: 111,800 – 112,300

• Near resistance: 115,500 – 116,500

• Next resistance: downtrend line and previous high around 118,000 – 119,000

🔄 2. Possible Trend Scenarios

✅ Main scenario (bullish):

BTC made a false break below the wedge → rebounded toward Fibonacci resistance → potential:

• Continue rising to the 115,500 – 116,500 zone

• If it breaks and holds above this zone, BTC could break out of the wedge pattern and target 118,000 – 120,000

• A longer-term target could be the 1.618 Fibonacci Extension around ~123,159

❌ Alternative scenario (bearish):

If BTC fails to break above 116,000 and gets rejected:

• It may retest the 112,000 support zone again

• A breakdown below this support would bring back the downtrend

🔄 3. Bullish Supporting Factors:

• The false break signals a shakeout of weak sellers.

• A potential inverse head-and-shoulders pattern is forming, supporting a bullish reversal.

• Moving Averages (MA): Price is nearing the 200 MA (red) – a possible bullish crossover with shorter-term MAs may occur, signaling a buy.

🧭 Suggested Trading Strategy

• Safe buy zone: Around 113,500 – 114,000 if there’s a pullback.

• Take profit in stages: 116,500 – 118,000 – 120,000

• Stop-loss: Below 112,000 in case of a confirmed breakdown

Bulls continue to be active following NFP data⭐️GOLDEN INFORMATION:

Gold (XAU/USD) slips toward $3,360 in early Asian trading on Monday, snapping a two-day winning streak. However, disappointing U.S. job data and lingering tariff concerns could pressure the U.S. Dollar and help cushion the downside for the Dollar-denominated metal.

The yellow metal is under pressure from a recovering Greenback, though gains may remain capped as weaker-than-expected Nonfarm Payrolls (NFP) data has strengthened expectations of a Federal Reserve rate cut in the near term.

⭐️Personal comments NOVA:

Buyers maintained early in the week, continuing to move towards higher resistances: 3374, 3387

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3374- 3376 SL 3381

TP1: $3365

TP2: $3350

TP3: $3333

🔥BUY GOLD zone: $3328-$3326 SL $3321

TP1: $3335

TP2: $3348

TP3: $3360

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

SWING IDEA - JUBILANT PHARMOVAJubilant Pharmova , a diversified pharmaceutical company focused on CRAMS and specialty pharma, is presenting a strong swing opportunity backed by a major pattern breakout and volume confirmation.

Reasons are listed below :

Breakout from an Inverted Head & Shoulders pattern after over a year of consolidation

Attempting breakout above 1250, a key resistance zone with multiple rejections in the past

Strong marubozu candle on the daily chart with a notable volume spike, signaling conviction

Trading near all-time highs, and comfortably above key EMAs, reinforcing trend strength

Target : 1480 // 1600

Stoploss : weekly close below 1090

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights

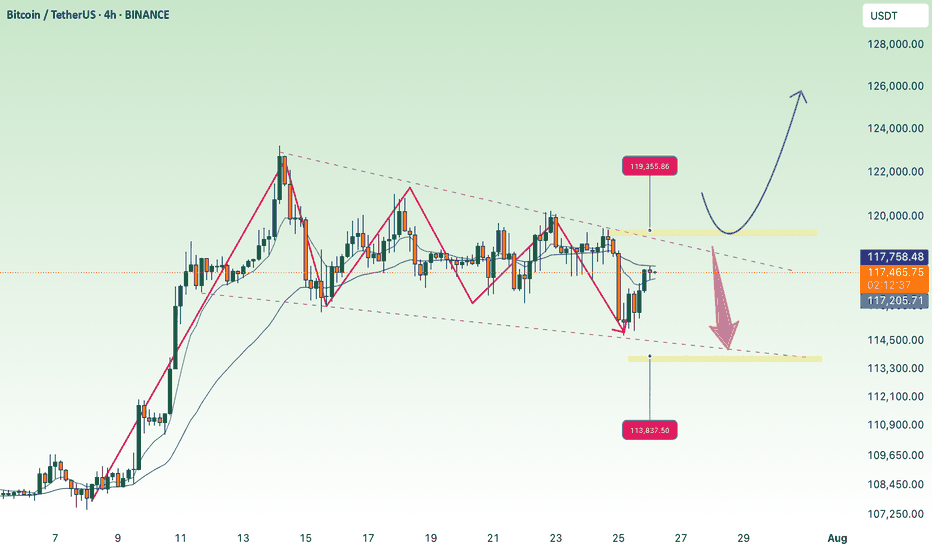

BTC Consolidates Below 119,300 Over the Weekend💎 BTC WEEKEND PLAN UPDATE (26/07)

NOTABLE BTC NEWS

The cryptocurrency market is attempting to stabilize after a wave of sell-offs during Friday’s Asian session, when Bitcoin (BTC) dropped to an intraday low of $114,723. A recovery trend is gradually strengthening, with BTC trading at $115,868 at the time of writing, indicating that buying interest at lower levels may increase in upcoming sessions.

TECHNICAL ANALYSIS PERSPECTIVE

Symmetrical Triangle Pattern

BTC is currently fluctuating within a symmetrical triangle pattern, with converging upper and lower trendlines. This pattern typically signals a strong consolidation phase before a decisive breakout.

Scenario unfolded as planned:

• The price failed to break the resistance zone around $120,000 (previously forecasted as a likely failed breakout zone).

• BTC then dropped sharply to the support zone around $115,000, touching the lower trendline and the potential breakout zone.

• At this level, the price rebounded as expected, indicating strong buying pressure at support.

MA lines supporting the trend:

• The price is currently moving around the 200-day MA (red line), showing that the dynamic support is working effectively.

• The 50-day MA (yellow line) is acting as short-term resistance. If broken, it could support the recovery momentum.

Two potential upcoming scenarios:

🔼 If BTC breaks above the $119,500 – $120,000 zone with strong volume, it may continue to test higher levels around $123,000 – $125,000.

🔽 Conversely, if it faces strong rejection around $119K and turns downward, BTC may retest the support zone at $114,000 – $115,000 once again.

Stay tuned to the channel for the latest and continuous updates on XAUUSD, CURRENCIES, and BTC.

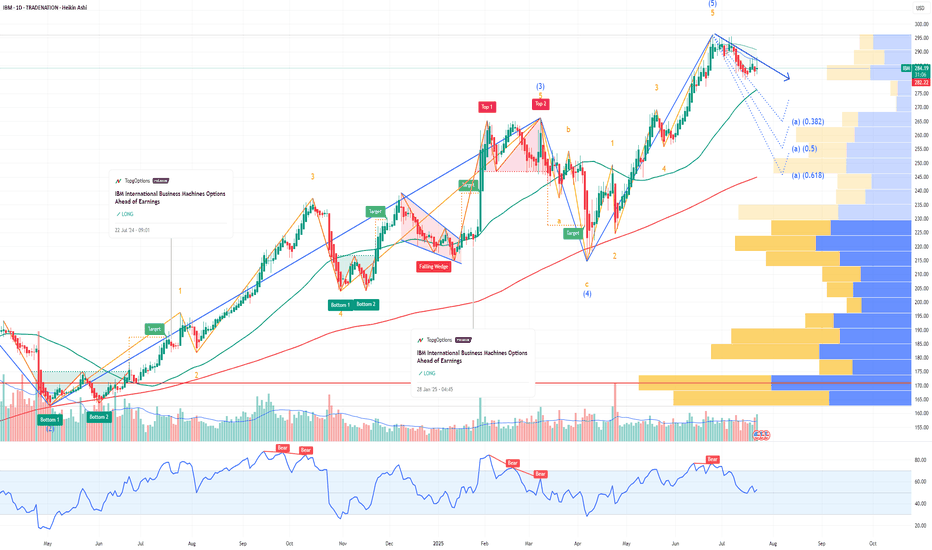

IBM International Business Machines Options Ahead of EarningsIf you haven`t bought IBM before the rally:

Now analyzing the options chain and the chart patterns of IBM International Business Machines prior to the earnings report this week,

I would consider purchasing the 290usd strike price Puts with

an expiration date of 2025-9-19,

for a premium of approximately $17.30.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

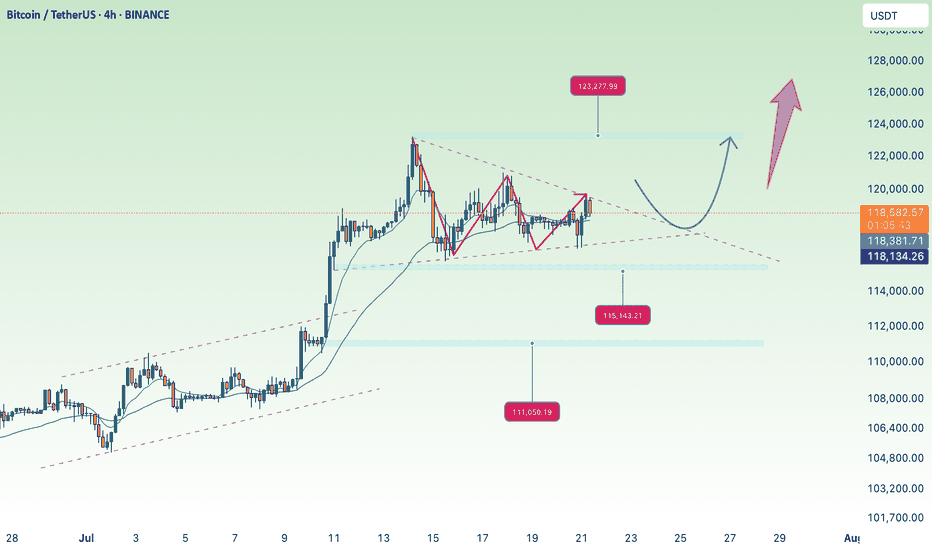

accumulate, continue to aim for new ATH💎 Update Plan BTC (July 21)

Notable news about BTC

CEO of Charles Schwab, Rick Wurster, said the company plans to deploy Bitcoin and Ethereum transactions for customers.

This company aims to compete with Coinbase, where customers buy BTC.

This development takes place after the progress of cryptocurrencies when President Donald Trump signs the Genius bill into law.

In an interview on Friday, the CEO of Charles Schwab, Rick Wurster, said the company plans to launch Bitcoin (BTC) and Ethereum (ETH) to compete with Coinbase cryptocurrencies. The move took place after President Donald Trump signed the Genius bill, officially confirming the first cryptocurrency law in the United States.

Technical analysis angle

🟠 Main trend:

BTC is sideway accumulated in the amplitude of 117,000 - 122,000 after a sharp increase.

The chart shows the descending triangular model - a potential sign for Breakout.

🔍 important areas:

Resist:

122,000 - 122,700: Strong resistance area, fibonacci mold 1.0.

130,600 - 131,100: The expected area if Breakout is successful (Fibonacci extension 1.618).

Support:

116,000: Support close, coincide with EMA 200.

111,100: The support area is stronger if the current support breaks.

✅ Scenario 1 - Rise:

If the price turns from supporting 116k → Test the resistance area of 122k.

If the 122K break is definitive, the next goal is 130k - 131k.

❌ Scenario 2 - Discount:

If the 116k area is lost, the possibility of falling will fall more deeply at 111k.

This is also the strong EMA area Fibo 0.382 of the previous wave.

Please follow the channel to receive the latest and continuous updates on XauUSD, currency and BTC

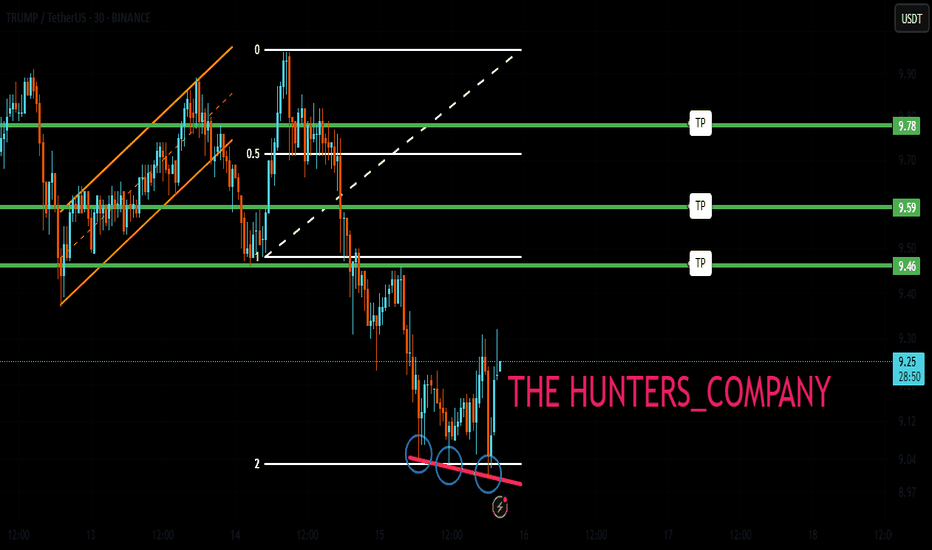

TRUMP UPDATEHello friends🙌

👀You can see that the price formed a reversal pattern after falling at the specified support and the buyers supported it.

⚠Considering the entry of buyers, the price is expected to move to the specified targets, of course, don't forget about capital and risk management.

🔥Follow us for more signals🔥

*Trade safely with us*

UAL United Airlines Holdings Options Ahead of EarningsIf you haven`t exited UAL before the recent selloff:

Now analyzing the options chain and the chart patterns of UAL United Airlines Holdings prior to the earnings report this week,

I would consider purchasing the 92.5usd strike price Calls with

an expiration date of 2025-9-19,

for a premium of approximately $5.12.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

AGI : The fall is comingHello friends

As the price has reached a strong resistance area, you can see that the price has been corrected and lower lows have been made. Now, given the token release that this currency has, there is a possibility of further decline, so we can buy at lower points with capital and risk management and move with it to the specified targets.

*Trade safely with us*

uptrend, heading towards 3400⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) climb toward $3,350 in early Asian trading on Tuesday, supported by renewed safe-haven demand after US President Donald Trump threatened sweeping 100% tariffs on Russia. Traders now shift focus to the upcoming US Consumer Price Index (CPI) report, which could offer further cues for the Federal Reserve’s policy outlook.

Late Monday, Trump warned that unless Russian President Vladimir Putin agrees to a peace deal to end the Ukraine conflict within 50 days, the US will impose 100% tariffs on Russian goods. The proposed sanctions, described as secondary tariffs, lack detailed clarification but have already fueled market anxiety. Heightened geopolitical tensions are likely to sustain near-term demand for gold as investors seek safety in the yellow metal

⭐️Personal comments NOVA:

Maintaining buying pressure above 3350, gold price in an uptrend, paying attention to CPI results to assess the inflation level of the world's number 1 economy

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3400- 3402 SL 3407

TP1: $3390

TP2: $3380

TP3: $3370

🔥BUY GOLD zone: $3330-$3328 SL $3323

TP1: $3340

TP2: $3350

TP3: $3360

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

BTCUSD At Crucial Pivot Point. Is This The Ceiling? - PhoenixFX BTCUSD Price-Action Analysis & Scenarios

Below is an overview of the two possible paths for Bitcoin over the coming days, as sketched out by the black and red arrows on your chart. We’ll also highlight the key pivot level and resistance zone that will decide which scenario plays out.

🔵 Key Levels to Watch

Established Resistance (~$111,800–$112,500)

This zone marks multiple failed attempts to break higher in recent weeks. It’s where large stop-runs and sell-side limit orders tend to cluster. A decisive daily close above $112K is required to signal genuine bullish continuation.

Daily Pivot Point (~$110,600)

Acting as the “battle line” between bulls and bears, this pivot is the first level to confirm market bias.

Above $110.6K: Tends to favor buyers, suggesting strength and higher-high attempts.

Below $110.6K: Gives the bears the edge, increasing the odds of deeper retracements.

📈 Black-Arrow (“Bullish Continuation”) Scenario

Break & Hold Above Resistance

Price thrusts cleanly above $112K on strong volume.

Retest the H4 Order Block (~$111,000–$111,200)

A shallow pullback into the highlighted H4 demand zone (blue box) offers a lower-risk long entry.

New Highs

From there, Bitcoin resumes its uptrend, closing the week with fresh highs above the prior $113K peak.

Key Trigger: Sustained daily close above $112K, followed by a successful retest of that level.

📉 Red-Arrow (“Bearish Rejection & Dip”) Scenario

Rejection at Resistance

Price stalls and reverses somewhere between $111,800–$112,500, forming a bearish reversal candle.

Drop to Daily FVG Zone (~$104,000–$105,000)

This larger Daily Fair-Value Gap (blue box lower on the chart) coincides with strong weekly support—an ideal zone for dip buyers.

Recovery Rally

After absorbing selling pressure in the FVG, BTC bounces back toward the established resistance, setting up a second test of $112K.

Key Trigger: Clear bearish price action (e.g., engulfing or pin-bar) in the $111.8K–$112.5K zone, followed by a daily close below the pivot at $110.6K.

🎯 How to Trade These Setups

Bullish Entry:

Wait for daily close > $112K

Enter on pullback into $111K–$111.2K (H4 order block)

Stop below $110.6K pivot; target new highs above $113K+

Bearish Entry:

Look for bearish reversal signals in $111.8K–$112.5K

Enter on break & close below $110.6K pivot

Target $104K–$105K (Daily FVG); stop above $112.5K

Note: The pivot at $110.6K is your first “line in the sand” for bias—trade in the direction of the break, and use the major resistance zone to confirm strength or failure. Always manage your risk and adjust to how price actually unfolds!

Just a Heads-Up:

This is my take on the charts—not gospel, not financial advice, and definitely not a crystal ball 🔮. Trading is part skill, part patience, and part “what just happened?” 😅

We all see things a little differently, and that’s the beauty of it. So if you’ve got a hot take, wild theory, or just want to drop some chart wisdom—hit the comments!

Let’s grow, learn, and laugh through the madness together. 🚀📈

Each one, teach one.

— Phoenix FX Team 🔥🦅

EURGBP 1D: This isn't a breakoutEURGBP 1D: This isn't a breakout — it's a deep reaction before the real move

EURGBP continues to form a textbook bullish megaphone, a structure designed not to trend, but to destabilize — forcing liquidity on both sides while smart money quietly positions. Two touches above (January and April), two below (February and May) — clean geometry, expanding volatility. Price is now reacting from the lower boundary, but we are still inside the pattern — and that matters.

The reaction zone sits right on the 0.786 Fibonacci level, near 0.8350, precisely where price meets the lower trendline and the 200-day moving average. The bounce didn’t come from noise — it came from confluence. Candle structure is clean, volume slightly expands — not panic, but controlled demand. As long as price holds above the MA200, the scenario remains intact. A break below kills the setup — but that hasn’t happened.

We’re not in breakout mode — yet. But price action is shifting. Pullbacks are weak, candles are full-bodied, and sellers don’t press. Momentum indicators confirm early recovery, but the real signal lies in how price holds its ground at key structure without struggle. Buyers aren’t running — they’re holding position.

If the market pushes above 0.8430–0.8480 and confirms — acceleration begins. Until then, we remain in balance. Every candle is a stress test — and so far, the structure is holding strong. If smart money controls 0.8350, the breakout won’t just be bullish — it’ll be aggressive.