Buysignal

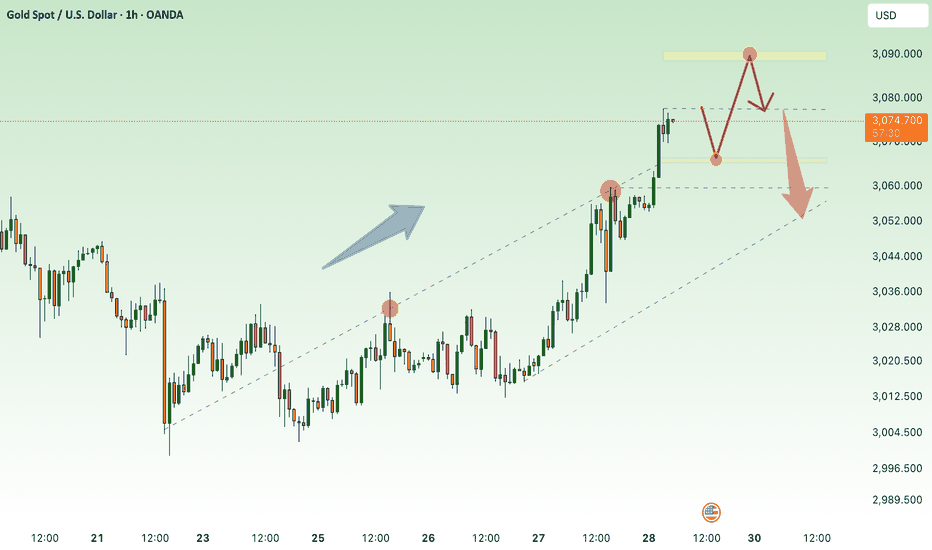

Safe Haven Demand - Gold Makes New ATH 3089⭐️GOLDEN INFORMATION:

This triggered swift responses from global leaders, with Canada and the European Union (EU) vowing to retaliate against President Trump’s trade measures.

In the US, the labor market remains resilient, as reflected in the latest unemployment claims report, while the economy continues to show strength following the release of fourth-quarter 2024 Gross Domestic Product (GDP) data. Although housing data saw some improvement, it confirmed the broader slowdown in the sector.

Meanwhile, money markets have factored in 64.5 basis points of Federal Reserve rate cuts for 2025, according to interest rate probabilities from Prime Market Terminal.

⭐️Personal comments NOVA:

growth, gold becomes a safe haven investment channel. continue to create new ATH

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: $3088 - $3090 SL $3095

TP1: $3080

TP2: $3070

TP3: $3060

🔥BUY GOLD zone: SCALPING: 3066, 3057

🔥BUY GOLD zone: $3034 - $3032 SL $3027

TP1: $3040

TP2: $3050

TP3: $3060

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Bears maintain selling pressure, pressure below $3000⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) faces difficulty in securing strong momentum during Tuesday’s Asian session but remains above the key $3,000 level amid mixed market signals. The US Dollar (USD) sustains its recovery from a multi-month low, hovering near Monday’s three-week high. Additionally, improved risk sentiment—fueled by optimism surrounding a potential Russia-Ukraine peace deal, less disruptive US trade tariffs, and China’s stimulus measures—dampens demand for the safe-haven metal.

⭐️Personal comments NOVA:

Selling pressure from bears continues to cause gold prices to fall and sideways around 3000

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: $3038 - $3040 SL $3045

TP1: $3030

TP2: $3020

TP3: $3010

🔥BUY GOLD zone: $2992 - $2994 SL $2987

TP1: $3000

TP2: $3008

TP3: $3018

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

When will the gold price adjust down?⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) enter a phase of bullish consolidation near their record high, as traders take a cautious stance ahead of the highly anticipated Federal Open Market Committee (FOMC) policy decision on Wednesday. The consensus widely expects the Federal Reserve (Fed) to maintain the federal funds rate within its current range of 4.25% to 4.50%. Consequently, market attention will be centered on the Fed’s updated economic projections and Chair Jerome Powell’s post-meeting remarks, which could offer crucial insights into the future trajectory of interest rate cuts. These developments will be instrumental in shaping US Dollar (USD) movements and influencing gold’s next directional move.

⭐️Personal comments NOVA:

continue to grow, long term uptrend

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: $3058 - $3060 SL $3065

TP1: $3050

TP2: $3040

TP3: $3030

🔥SELL GOLD zone: $3044 - $3046 SL $3049

TP1: $3040

TP2: $3030

TP3: $3020

🔥BUY GOLD zone: $3004 - $3002 SL $2997

TP1: $3010

TP2: $3020

TP3: $3030

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

EURCHF is starting to turn upLooks like a trend reversal at last.

1. Strong pinbars from the levels below 0.92 that rob the stops.

2. A broken trend line, higher lows, higher highs

3. it is currently at a very important level,we are watching how it will react and whether it will be overcome.

4. We are now long on a larger time frame.

SRF: Breakout of Symmetrical TriangleA symmetrical triangle is a chart pattern in technical analysis that forms when the price consolidates with lower highs and higher lows, creating a converging triangle shape. This pattern indicates a period of consolidation before the price breaks out in either direction.

SRF stock has already given a bullish breakout. One should go long on the stock with Stop loss below 2550 for the measured target of 3475-80 zone.

Gold long-time analysis, bull run is coming.The possibility of a global recession

Successive increase in interest rates in all economies of the world and imposing costs on economies.

Political tensions (Ukraine/Taiwan/Iran)

Printing money without backing(just see USM2 chart).

Inefficiency of the crypto market.

EURGBP uptrend - continuing⭐️Smart investment, Strong finance

⭐️EURGBP INFORMATION:

EUR/GBP extends its winning streak since March 3, hovering around 0.8440 during Tuesday’s European session. The pair gains momentum as the European Union (EU) considers boosting defense spending through joint borrowing, EU funds, and an expanded role for the European Investment Bank (EIB), with crucial decisions anticipated by June.

⭐️Personal comments NOVA:

EURGBP H1 breakout price zone retreats, continuing the uptrend

⭐️SET UP EURGBP PRICE:

🔥BUY eurgbp zone: 0.84200 - 0.84100 SL 0.83800

TP1: 0.84500

TP2: 0.84800

TP3: 0.85200

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

2941 ! Expected price range today ! XAU⭐️Smart investment, Strong finance

⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) trade with an upward bias during Thursday’s Asian session, holding near the one-week high reached the previous day, though follow-through buying remains limited.

Market concerns over US President Donald Trump’s tariff policies continue to bolster demand for the safe-haven metal. Additionally, growing expectations of an earlier-than-anticipated Federal Reserve rate cut, coupled with bearish sentiment surrounding the US Dollar, further support gold’s appeal.

⭐️Personal comments NOVA:

Gold price has strong growth momentum, after clearing liquidity, there will be great momentum in the near future.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: $2953 - $2955 SL $2960

TP1: $2945

TP2: $2930

TP3: $2920

🔥SELL GOLD zone: $2941 - $2943 SL $2948

TP1: $2935

TP2: $2927

TP3: $2920

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

LONG ON BITCOINIts Timeeeee.....

Bitcoin has tapped into a major demand zone and has given us a change of character/structure to the upside.

It has pulled back to discount price all day today and is now ready to head back up to 100k.

I am purchasing bitcoin now at 83k expecting it to get back to 100k buy the end of the week. BITSTAMP:BTCUSD

LONG ON NZD/USDNZD/USD is giving nice uptrend structure from the higher TF.

Currently it has pulled back to a key support area and is looking good for a rise.

Dollar (DXY) is overall bearish and currently falling. (This has a inverse correlation with XXX/USD pairs)

I will be buying NZD/USD to the next resistance level / previous high for about 150-200 pips.

MXNJPY at Key Support Level - Potential Buy SetupEIGHTCAP:MXNJPY has reached a significant support zone, which has historically acted as a strong demand area. Previous price action suggests buyers may step in here, increasing the potential for a bullish reversal.

If the price holds above this level and confirms support, we could see a move higher toward the 7.50700 level, which represents a logical target based on past price behavior and current market structure.

Just my take on support and resistance zones—not financial advice. Always confirm your setups and trade with solid risk management.

Best of luck!

Long S/USDT (h4-d1). x3-4 probably.Long Sonic on H4-D1.

Entry : current level or limit order @ 0.48

TP : 1.5 and 2

Exit : confirmation on D1 below 0.38 (2nd test on Feb,8 of local lows)

FA:

Sonic - EVM L1-chain with high performance (10k TPS with subsec finality)

Previously it was Fantom but recently rebranded.

CTO - Andre Cronje.

Trades on all major CEX.

Top-21 among Chains (Defillama) by TVL - $393mln

1/ Strategic angel investors: Michael (Curve), Stani (Aave), Robert (Compound), Tarun (Gauntlet), and Sam (FRAX), as well as our venture partners Hashed, Signum Capital, and UOB Venture Management (source: soniclabs).

2/ FDV = MCap!!!

3/ Massive airdrop on June around $100mln (current TVL - $393mln, so it's 25% profit on you locked capital if the price remains the same)

4/ 90%-revenue sharing with dApps built on Sonic

TA:

1/ EMA21 and 55 cross on H4

2/ strong bounce on high volume above PoC and MA-cross

3/ capitulation on Feb,3 (weak hands shakeout)

Can repeat that SUI did.

Bullish zone - continue towards old ATH - scalping⭐️ Smart investment, Strong finance

⭐️ GOLDEN INFORMATION:

Gold price (XAU/USD) surges again, nearing $2,920 on Thursday, as traders dismiss the impact of January's US inflation data. They also seem unfazed by reports of an upcoming meeting between US President Donald Trump and Russian President Vladimir Putin to discuss a potential peace deal. Despite these factors, gold continues its strong rally, highlighting traders' confidence in the safe-haven asset.

⭐️ Personal comments NOVA:

Gold is currently accumulating in the European session at 2910-2920, waiting for the next uptrend. Waiting for BUY entry at 2908.

⭐️ SET UP GOLD PRICE:

🔥 BUY GOLD zone: $2908 - $2906 SL $2903

TP1: $2912

TP2: $2916

TP3: $2922

⭐️ Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️ NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

PANW Palo Alto Networks Options Ahead of EarningsSnalyzing the options chain and the chart patterns of PANW Palo Alto Networks prior to the earnings report this week,

I would consider purchasing the 195usd strike price Calls with

an expiration date of 2025-2-21,

for a premium of approximately $9.90.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.