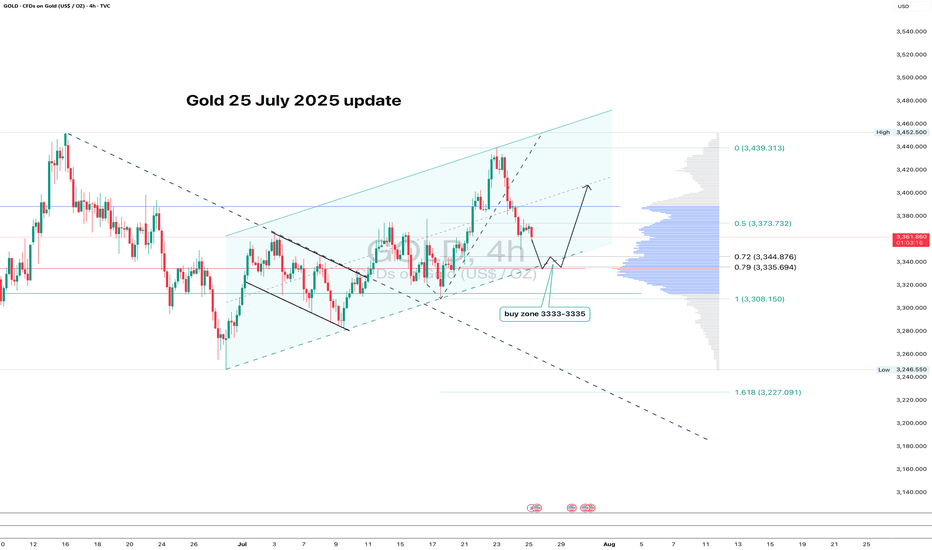

GOLD: clean pullback - now let’s see if support holdsGold continues to trade within an ascending channel on the 4H chart. After a local high, the price pulled back and is now approaching the key zone at 3333–3335. This area lines up with the 0.79 Fib retracement, the lower channel boundary, and a major volume cluster — a classic confluence zone.

If buyers show up here and we get a bullish reversal candle, this becomes a valid long setup with a tight stop just below the level. First target is 3373 (0.5 Fib), followed by a potential retest of the high near 3439.

The structure remains intact, the pullback is orderly, and volume supports the move. As long as the channel holds - the bias stays bullish.

Buyzone

Boeing (BA, 1W) Falling Wedge + H-Projection TargetOn the weekly chart, Boeing has formed a classic falling wedge — a bullish reversal pattern that typically signals the end of a correction phase. After a sharp decline from $267.97 to $138, price action began to compress within a wedge, forming lower highs and higher lows on declining volume — a textbook setup for a breakout.

The structure remains active: a confirmed breakout above the upper wedge boundary, with a retest near $181.60 (0.618 Fibonacci retracement), would validate the pattern and trigger the next upward phase.

The projected move (H) equals the height of the previous impulse — $130.02. Adding this to the base of the wedge (~$138) yields a technical target of $268.00, aligning with the previous high and completing the structural recovery.

Technical summary:

– Multiple confirmations of wedge support

– Volume declining into the apex (bullish)

– Entry zone: breakout + retest at $181.60

– Mid-level resistance: $198.09 (0.5 Fibo)

– Final target: $267.97–$268.00 (H-projection complete)

Fundamentals:

Despite operational setbacks, Boeing remains structurally positioned for recovery as demand for commercial aircraft rebounds. Additional support could come from improving supply chains, increased defense contracts, and a more dovish outlook from the Federal Reserve heading into 2025.

A breakout above $181.60 and sustained momentum would confirm the falling wedge pattern and activate the H-measured move toward $268. This is a structurally and fundamentally supported mid-term recovery setup

SILVER 1DA possible scenario for silver on the daily timeframe involves buying from the levels of 30.90-31.00 with further targets at 33.02, 34.8291 and the expected completion of the rounding pattern with a subsequent movement to the zone 40.0251

Everything is clearly depicted on the graph!

Have a good day!

Backberry is up, still a good outlook at the Sell Zone!My first area of support is at my Buy Zone 1 which starts at $3.42 down to $3.36 where it hovered for days, and there's a bullish ICT Order block in that zone. It shot out of there and is at $3.67 now. I'm going to wait because my Sell Zone started at $3.66 so we may get some resistance in this area. However, long-term I'm Bullish on BlackBerry, because there's a chance that even a small pullback to my 1st buy Zone at $3.42 would potentially give a great entry to hold.

ADA Cardano announced as part of strategic reserve!!Final liquidity run rapidly approaching as we come off news of strategic reserve!

Ensure LIMIT buy orders are placed at .50 area or just below to ensure they get filled. Just below the last big wick on daily/4hr tf. This news will be manipulated once again to trap over-leveraged bulls & then bears imo.

Perfect opportunity to enter cheap once again & then ride it to 20-50$ buy cycle targets over upcoming months.

XRP strategic reserve announcment! UPDATED FORECASTAs indicated in prior post (see: ) we have now reached the near term liquidity target at 2.8-2.9 zone; this news of a strategic reserve is highly likely to be sold off to trap both bulls & bears who are over-leveraged.

They rarely waste a good PR for such price action.

Expecting one more liquidity sweep below 1.70 for a final discount buy opportunity!! Looking to enter with LIMIIT buy orders at 1.65 area; its possible that we extend as low as 1.35 but my mentality is its best not to be idealistic, perfectionistic, or entitled at those levels! The market does not owe you the best or lowest price on anything! For that reason, consider anything below 1.70 to be a huge gift with a big big bow wrapped around it!

Nasdaq volatility ahead into close of week!Wonderful opportunity to extract profits from the markets on current Nasdaq futures setup.

Pay close attention to those buy-side & sell-side liquidity zones relative to the doji candle established on the 15min tf. Expect that range to be tested once again into London/NY sessions.

Sell-side liquidity target expected to be reached at 21075-21090 levels, corresponding to 1.272 fibonacci extension target on sell structure. After that, I anticipate a strong buy sequence to 21440's buy-side target

A1+ setup...BTC will pump up immediately it grabs liquidity !!!if you are willing to risk 33 pips for 300 pips, this setup is for you then !!!

Reason for entry

* Valid zone

* M5 point of Interest

* Inducement is resting just above the M5 POI

* Due to the fact that investors are hedging their risks on XAU USD because of tarrif talks, BTC USD might share from the gains (my sentiments)

* Bullish structure,

PLUG power consolidation completed! Buy setupBuying now at discount levels near structural support. Expecting bullish thesis to be solidified once we recover above 1.9-2.2 levels.

Expecting fairly rapid progression to gap fill targets by 2026.

Strongly likely we see 6$ before summer 2025 & 10-12$ levels by end of yr

Planning to scale out of buy positions primarily at 10-12$ range. Will leave remainder for long term speculation for possible 14-20$ levels.

FB (META), What is going on?Stocks fall one after another !

We Saw a considerable decline in FB (Meta) Stoc k after earning report after hours of last trading session. What is happening for FB (Meta) in terms of Elliott waves?

FB (META), has likely completed a primary degree ascending cycle started on 4th Sept 2012 at 17.55 USD . This cycle took 9 years to be completed therefore, we can imagine how boring will be the correction phase before completion !

If true , FB (META) has started a correction decline form ATH (384.33) down to Retracement levels with today's pre-market price around 0.382 level.

Although 0.382 retracement is also possible for wave 2s , I give very low possibility to bounce back from this level according to timing and corrective patterns.

Retracement down to 200 , 157 and even 96 USD corresponding to 0.5 , 0.618 Golden Ration and 0.786 Retracement levels is very possible, I tried to show the probability of each possible Retracement with thickness of arrows with the thickest to be the most probable ( As I suppose ) and vice versa.

After completion of this primary degree wave 2 , there will be a huge up going wave which is primary degree wave 3 . This wave 3 will push the price up to at least 700 USD and even higher ( Very good news for long term investors ) depending on at which retracement level this boring correction phase ends. It is too soon to talk about this target we can update our targets in next years !

Please note this is a very long term prediction so, there will be lots of ups and downs and fluctuations in our path. What is happening on FB (META) is more than likely similar to whats happened for ETSY, SHOPIFY, SQ and many others in the market.

As I showed on the chart, this is what I see as the most probable scenario which means there are more optimistic scenarios. Mots probable more optimistic scenario is that FB ( META) is just correcting the wave cycle labeled as wave (5). As far as the stock is trading above 170 USD, this scenario is valid.

Hope this analysis to be helpful and wish you all the best.

PLTR -- more volatility forecasted into MarchExpecting quick progression to 118$ level as final buy-side wave near term.

Looking for renewed significant selling action from that level to retrace price back to pre-earnings levels near 80-85$

Possibility exists (imho) that we fully retrace back to 63-64$ levels by April timeframe, depending on sentiment as we head into next FOMC meeting in mid-March.

After that, my cycles analysis indicates we will continue higher toward 120...Therefore, I will be planning on taking profits on put option contracts once underlying share price reaches below 85$, and will plan on scaling into long equity positions on discounts between 64-85$ for the projected subsequent buy wave to 120+

SWING IDEA - BAJAJ FINSERV Bajaj Finserv , a prominent player in financial services, presents a compelling swing trade setup.

Reasons are listed below :

Symmetrical Triangle Breakout and Retest : The price has recently broken out of a symmetrical triangle pattern and successfully retested, signaling a strong support level.

Consolidation Break : A significant 3+ year consolidation phase has been broken, indicating potential for a sustained upward move.

0.618 Fibonacci Support : The price is holding above this key Fibonacci level, suggesting strong buyer interest at current levels.

EMA Support on Weekly : Trading above the 50 and 200 EMAs on the weekly timeframe reinforces the bullish sentiment and strengthens support levels.

Target - 1900 // 2030 // 2200

Stoploss - weekly close below 1635

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights

Next Upisde move of the market belongs to TSLA !TSLA can make many investor rich once more !

TSLA has more than likely completed it's major correction at 1 01.8 USD on 6th Jan 2023 similar to many other giant stocks . This scenario matches with my best case scenario for PSX published before which proposed the previous bear market as just correction of the bull run after pandemic low.

TSLA's major correction has been labeled as primary degree wave 2 on the chart which was terminated at 0.74 Retracement of the whole major up going wave from IPO to ATH . Mentioned large upside move has the label of primary degree wave 1 on the chart.

This means that TSLA has started its major up going primary degree wave 3 which at least can push up the stock's price to 770 USD and even much more in long term.

AS shown on the chart , Stock price is reaching to a strong resistance zone at 300-315 which is confluence of two strong static resistances and major down trend line. This strong zone may make an another great buy opportunity to traders and investor if it can push the price back down to 180-217 buy area.

Please note many giant stocks made a new ATH while TSLA is far from the top. This suggests that next upside move of the market belongs to TSLA . If true, current ATH will be like a baby comparing to the future giant one.

Wish you huge profits and Good Luck.

SWING IDEA - SHEELA FOAMSheela Foam , a key player in the Indian mattress and foam market, presents a potential swing trading setup.

Reasons are listed below :

800-850 Support Zone : This strong support level is holding, indicating possible resistance to further downside.

Bullish Hammer Candle on Weekly Timeframe : This pattern suggests a reversal of bearish momentum and renewed buying interest.

Gradual Rise in Volumes : Increasing volumes support the potential for a sustained upward move, reflecting growing investor interest.

Target - 1060 // 1290

Stoploss - weekly close below 780

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights

SWING IDEA - ANAND RATHI WEALTH LTDAnand Rathi Wealth Ltd , a leading wealth management company in India offering financial advisory services, is presenting a potential swing trading opportunity.

Reasons are listed below:

4300 Zone Breakout : The 4300 level has been tested multiple times, and the stock is now breaking out, suggesting renewed buying interest.

Bullish Engulfing Candle on Daily Timeframe : A bullish engulfing pattern has formed on the daily chart, indicating strong upward momentum.

Breaking Consolidation Zone of 6 Months : The stock is breaking out of a long consolidation phase, which could lead to a new bullish trend.

Trading Above 50 and 200 EMA : The price is trading above both the 50 and 200-day exponential moving averages, reinforcing the bullish outlook.

Volume Spike : An increase in trading volumes supports the strength of the breakout, indicating robust market participation.

Target - 4850

Stoploss - daily close below 3990

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights

SWING IDEA - TORRENT POWERTorrent Power, a major player in the power sector, is showing strong technical signs of a swing trading opportunity.

Reasons are listed below :

1650 Support Zone : The 1650 level has acted as a strong support zone, and the price is holding steady around this level, indicating potential upside.

Bullish Engulfing Candle on Daily Timeframe : A bullish engulfing candle on the daily chart suggests strong buying momentum, indicating that the stock may reverse from its current support zone.

Double Bottom Pattern : The formation of a double bottom pattern is a bullish reversal signal, indicating the stock may have completed its downtrend and is now primed for an upward move.

0.618 Fibonacci Level Support : The stock has bounced back from the golden Fibonacci retracement level, providing additional support to the bullish thesis.

50 EMA Support : The price is holding above the 50-day exponential moving average, adding strength to the current setup and suggesting the trend is intact.

Target - 1908 // 2000

Stoploss - daily close below 1610

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights

SWING IDEA - GARDEN REACH SHIP & ENGGarden Reach Shipbuilders & Engineers Ltd ., a leading public sector shipyard in India known for building warships and naval vessels, is showing signs of a potential swing trade opportunity.

Reasons are listed below :

1700 Zone as Strong Support : The 1700 level has acted as a crucial support zone, reinforcing a solid base for potential upside movement.

Bullish Engulfing Candle on Daily Timeframe : A bullish engulfing candle has formed, indicating increased buying pressure.

Golden Fib Zone : The price is currently bouncing from the golden Fibonacci zone, suggesting potential for further gains.

100 EMA Support on Daily Timeframe : The stock is well-supported by the 100-day EMA, further solidifying the bullish trend.

Target - 2200 // 2510

Stoploss - daily close below 1640

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights

SWING IDEA - KPR MILL LTDToday, we delve into KPR Mill Ltd , where a confluence of technical factors suggests a potential swing buying opportunity.

Reasons are listed below :

KPR Mill Ltd recently revisited the critical support at 760 levels, a zone that has historically proven significant. The noteworthy aspect is the successful breach and subsequent retest, signaling potential strength.

Weekly charts showcase a bullish dragonfly doji, signaling a potential trend reversal, while daily charts reveal a bullish hammer pattern, enhancing positive sentiment.

The stock bounced precisely off the 200-day Exponential Moving Average (EMA) on the daily chart, highlighting this level as a robust support.

Continuous formation of higher highs affirms the sustained uptrend in KPR Mill Ltd, reflecting positive market sentiment.

With the stock trading above both the 50-day and 200-day EMAs, there is added strength to the current positive trend.

Target - 861 // 928 // 1050

StopLoss - weekly close below 716

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights

SWING IDEA - HUDCOHUDCO is showing potential for a swing trade based on technical signals.

Reasons are listed below :

230 Zone as Strong Support : The 230 level has been a crucial support zone, providing a solid base for potential upward movement.

Bullish Engulfing Candle on Daily Timeframe : A strong bullish engulfing candle indicates growing buying pressure.

0.618 Fibonacci Support : The price is bouncing off the 0.618 Fibonacci retracement level, suggesting a potential reversal.

200 EMA Support on Daily Timeframe : The stock is finding support at the 200-day EMA, reinforcing the bullish outlook.

Target - 280 // 310 // 345

Stoploss - daily close below 225

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights

INVESTMENT IDEA - PAGE INDUSTRIESPage Industries presents a compelling investment opportunity, supported by both technical indicators and robust fundamentals.

Reasons are listed below :

Technical strengths :

The psychological level of 35,000 has shifted from a resistance point to a strong support level, reflecting market confidence in the company's prospects.

The formation of a hammer candlestick pattern on the weekly chart signals a potential reversal from a downtrend, indicating buyer support at lower price levels.

Finding support at the 0.5 Fibonacci retracement level suggests a healthy correction within an overall uptrend, reinforcing investor confidence.

Page Industries' stock price is supported by the 200 Exponential Moving Average (EMA) on the weekly timeframe, highlighting its stability even during market fluctuations.

Fundamental Strengths:

With well-established brands like Jockey and Speedo, Page Industries maintains a competitive edge and market leadership.

Consistent revenue growth and profitability underscore the company's financial health and prudent management.

Strategic partnerships and expansion efforts enhance Page Industries' market presence and growth prospects.

Page Industries' focus on product quality, innovation, and customer satisfaction ensures its offerings remain relevant and competitive.

Target - 43000 // 53000 // 67000

Stoploss - monthly close below 27000

SWING IDEA - IEXIndian Energy Exchange (IEX) is exhibiting promising technical signals that suggest a potential swing trade opportunity.

Reasons are listed below :

170 Zone as New Support : The 170 level was previously a resistance zone and has now turned into a support level, indicating strong buying interest.

Hammer Candle on Weekly Timeframe : The formation of a hammer candle on the weekly chart suggests a potential reversal, signaling a shift from a bearish to a bullish trend.

0.5 Fibonacci Support : The stock has found support at the 0.5 Fibonacci retracement level, indicating a potential bounce and continuation of the uptrend.

Trading Above 50 and 200 EMA on Weekly Timeframe : IEX is trading above the 50 and 200-week exponential moving averages, confirming the bullish sentiment and providing strong support levels.

Breaking Consolidation Phase of 2+ Years : The stock is breaking out of a long consolidation phase that lasted over two years, signaling the start of a new bullish trend.

Target - 205 // 245 // 300

Stoploss - weekly close below 155

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights