"FRA40/CAC40 HEIST! Bullish Loot Before Bear Trap – Act Fast!"💰 FRA40/CAC40 "FRANCE40" INDEX HEIST – THIEF TRADING STYLE MASTER PLAN 🏴☠️🚀

🔥 Steal the Market Like a Pro – Bullish Loot & Escape Before the Trap! 🔥

🤑 GREETINGS, FELLOW MONEY MAKERS & MARKET ROBBERS!

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

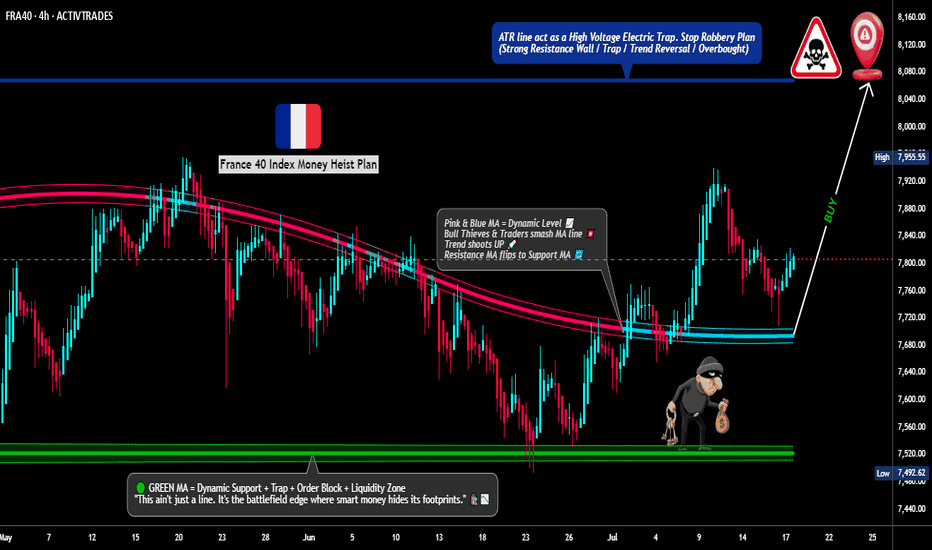

This is your VIP invite to the ultimate FRA40/CAC40 heist! Based on the 🔥Thief Trading Style🔥, we’re locking in a bullish raid before the bears set their trap. Time to swipe the loot & escape like a pro!

📜 THE HEIST BLUEPRINT – TECHNICAL & FUNDAMENTAL RAID PLAN

🎯 ENTRY POINT: "THE VAULT IS OPEN!"

📈 Long Entry: The market’s handing out free cash—swipe bullish positions at any price!

🔄 Pro Thief Move: Use buy limit orders within 15-30 min timeframe for pullback entries.

🎲 DCA/Layering Strategy: Deploy multiple limit orders to maximize loot & minimize risk.

🛑 STOP LOSS – SAFETY NET FOR THIEVES

SL at Nearest Swing Low (4H TF): 7650.00 (Adjust based on your risk, lot size & entry layers).

⚠️ Warning: Bears are lurking—don’t get caught in their trap!

🏆 TAKE PROFIT – ESCAPE BEFORE THE POLICE ARRIVE!

🎯 Primary Target: 8060.00 (or exit early if the market turns sketchy).

🚨 Danger Zone: Yellow MA Zone (Overbought, Reversal Risk, Bear Trap!)

📡 FUNDAMENTAL BACKUP – WHY THIS HEIST WILL WORK

💰 France40 is riding bullish momentum due to:

Strong Macro Data (Eurozone recovery signals)

Institutional Buying (COT Report Insights)

Geopolitical Calm (For Now… Stay Alert!)

Index-Specific Strength (Tech & Luxury Stocks Leading)

🔗 For full analysis (Fundamentals, COT, Intermarket Trends, Sentiment Score):

👉 Check the Liinkk 🔗! 👈

🚨 TRADING ALERT – NEWS & POSITION MANAGEMENT

📰 High-Impact News = Market Chaos! Protect Your Loot:

❌ Avoid new trades during major news drops.

🔐 Use Trailing Stops to lock profits & dodge sudden reversals.

💥 BOOST THE HEIST – SUPPORT THE MISSION!

🚀 Hit the "Boost" button to strengthen our robbery squad!

💰 More boosts = More profitable raids!

🎉 Let’s dominate the market daily with the Thief Trading Style!

🔐 DISCLAIMER (LEGAL SAFETY NET)

This is NOT financial advice—just a strategic raid plan. Trade at your own risk. Markets change fast; adapt or get caught!

🤑 Stay tuned for the next heist… The vaults won’t rob themselves! 🐱👤💨

Cac40index

FRANCE 40 Heist in Progress | Bullish Reversal Zone Spotted.💼 CAC40 Market Heist: Thief Trading Blueprint for Smart Traders (Swing/Day Trade Edition) 💼

🌍 Bonjour, Hola, Hallo, Marhaba, Ola, Hello! 🌍

Welcome to all Market Hustlers, Silent Snipers, and Profit Seekers! 🤑💸🎯

We're back with a precision-built Thief Trading Plan — this time targeting the FRANCE40 / CAC40 Index, using a combination of street-smart technicals and sharp macro insights.

🧠 Game Plan: The “Market Heist” Strategy

This strategy revolves around a Long Entry setup aiming for the high-risk Red Zone. Price is pushing into potential overbought territory, with signs of consolidation and trend exhaustion. That’s exactly where reversal opportunities and big moves live — right before the herd wakes up. 🐂💰

🔓 Entry Plan – "The Vault’s Open"

📍 Enter on bullish setups – recommended through:

Recent 15/30 min support levels or

Swing low/high based buy limit zones

💡 Pro Tip: Set alerts at those critical swing levels so you’re always one step ahead.

🛑 Stop Loss – "Stay Out of Jail"

🎯 Suggested SL: Near the recent 3H swing low (~7600 zone)

🧩 Adjust SL based on:

Risk tolerance

Lot size

Multiple entries

Trading strategy preference

🎯 Take Profit – "The Great Escape"

📌 Primary TP: 7830.00

🔐 Trailing SL advised to secure profits during the climb

🚨 If market shifts or trap signs emerge, exit early and protect the bag.

⚔️ Scalpers vs Swingers – Choose Your Crew

Scalpers: Only ride the long waves. Use momentum & micro breakouts.

Swing Traders: Follow the blueprint. This is your time to rob the trend cleanly. 🕶️📈

🧩 Market Insight & Fundamentals

This bullish momentum is backed by key drivers:

Economic releases

Institutional positioning (COT Reports)

Sentiment & intermarket flows

Geopolitical & macro factors

📌 Always update your narrative. Markets shift fast. Stay informed. Stay sharp.

⚠️ Important Trading Notice – News Risk & Management

🚫 Avoid fresh entries during high-impact news events

🔄 Use trailing SLs to lock gains

🧠 Be aware of volatility traps

❤️ Support the Strategy – Hit Boost & Join the Crew

If this strategy made sense to you, smash that Boost Button.

You're not just supporting a post — you're fueling a Thief Trader movement where smart, fearless traders take what’s theirs from the market. 🚀💰

🎉 Keep winning, stay alert, and I’ll see you in the next heist! 🧠💸🐱👤

FRA40/CAC40 "France40" Indices Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🚀

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the FRA40/CAC40 "France40" Indices Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (8040) then make your move - Bearish profits await!" however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: Thief SL placed at 8160 (swing Trade Basis) Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

Primary Target - 7900 (or) Escape Before the Target

Secondary Target - 7680 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT Report, Sentimental Outlook, Positioning Analysis:

FRA40/CAC40 "France40" Indices Market is currently experiencing a Bearish trend., driven by several key factors.

✴✴Fundamental Analysis✴✴

Economic Indicators: France's GDP growth rate is expected to continue its upward trend, with the France 40 index increasing by 10.34% since the beginning of 2025.

Earnings Reports: The CAC 40 companies' earnings reports have been showing signs of growth, with some companies experiencing increased revenues and profits.

Dividend Yield: The CAC 40 dividend yield is around 3.5%, which is relatively attractive compared to other major European indices.

✴✴Macro Economics✴✴

Monetary Policy: The European Central Bank (ECB) has maintained its hawkish stance, keeping interest rates at 4.25% to combat inflation (latest ECB meeting minutes).

Fiscal Policy: The French government has announced plans to reduce its budget deficit, aiming for a 3.5% deficit-to-GDP ratio by the end of 2025 (latest budget proposal).

Global Trade: The ongoing trade tensions between the US and China have eased, with both countries signing a new trade agreement, which is expected to boost French exports (latest trade data).

✴✴COT Data ✴✴

Speculators (Non-Commercials): The current COT report shows that speculators are holding 50,219 long positions and 25,011 short positions.

Hedgers (Commercials): Hedgers are holding 20,015 long positions and 40,011 short positions.

Asset Managers: Asset managers are holding 30,015 long positions and 15,019 short positions.

✴✴Global Market Analysis✴✴

Trend: The France 40 index is experiencing a bullish trend, with a 2.1% increase in the last week and a 5.6% increase in the last month.

Support and Resistance: Key support levels are at 8000 and 7950, while resistance levels are at 8250 and 8300.

✴✴Positioning✴✴

Long/Short Ratio: The long/short ratio for the France 40 (CAC 40) index is 2.05, indicating a slightly bullish sentiment.

Open Interest: The open interest for the France 40 (CAC 40) index is approximately €12.5 billion.

✴✴Next Trend Move✴✴

Bullish Prediction: Some analysts suggest a potential bullish move, targeting 8300 and 8400, due to the ongoing economic growth and attractive valuations.

Bearish Prediction: Others predict a potential bearish move, targeting 7900 and 7800, due to the ongoing trade tensions and potential economic slowdown.

Long-Term Bearish Target: A potential long-term bearish target is 7200, due to the ongoing global economic uncertainty and potential recession risks.

✴✴Future Prediction✴✴

Short-Term:

Bullish: 8200-8300

Bearish: 7900-7800

Medium-Term:

Bullish: 8500-8600

Bearish: 7500-7400

Long-Term:

Bullish: 9000-9200

Bearish: 6800-6600

✴✴Overall Summary Outlook✴✴

Bullish or Bearish: The overall outlook for the France 40 (CAC 40) index is neutral, with a mix of bullish and bearish predictions.

Real-Time Market Feed: As of the current time, the France 40 (CAC 40) index is trading at 8100, with a 0.5% increase in the last 24 hours.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

CAC 40 Drops Hard! Fed's New Tone Sparks Sharp DeclineCAC 40 (French Index) on a 1-hour timeframe initiated a short trade using the Risological Trading Indicator. The sharp decline aligns with fundamental market dynamics influenced by the Federal Reserve's policy stance.

Trade Highlights:

Entry : Short position initiated based on bearish sentiment.

Current Trend: Sharp downward movement observed.

Reasons for Decline:

At 8:15 AM, the December futures contract for the CAC 40 fell 110.5 points, settling at 7277.5 points, indicating a 1%+ decline at the open.

The Federal Reserve cut its key interest rates for the third time this year, reducing them to a range of 4.25% to 4.50%.

Fed Chair Jerome Powell signaled a "new phase" of monetary policy, characterized by a slower pace of rate cuts, contrary to market expectations.

Updated projections show only two rate cuts next year, compared to the four previously anticipated by investors, fueling bearish momentum.

CAC40 Vulnerable Amidst French TurmoilThesis: A confluence of internal political divisions, social unrest, and external economic pressures creates a compelling shorting opportunity in the CAC40 index.

Key Points:

Domestic Disarray: Recent elections have strengthened the far-right in France, weakening President Macron's centrist hold on power. This political fragmentation leads to policy gridlock and hampers economic stability.

Social Unrest: Macron's economic policies have alienated segments of the population, triggering protests and strikes that disrupt business activity.

Global Headwinds: Rising populism across Europe and the ongoing war in Ukraine create a volatile global economic environment. This uncertainty further strains the French economic outlook through inflationary pressures and supply chain disruptions.

Bearish Outlook for CAC40: The aforementioned factors are likely to negatively impact the performance of companies listed on the CAC40. Investor sentiment is already shifting, as evidenced by recent hedge fund activity in European stocks.

short #fra40 around 7550 with minimum 200 pts target at 7350i wont say much stuff,but what i will say ,its full fundamental and what happens in the country

#cac40 (fra40 outperform many index,if its not all) while in France all gone bad since many weeks

Big protest and it is not finish..

next data will surely be down as protest had block few sector

the President public opinion had never been so low u can go on twitter every day in the best trend have aty least 2 tag for him and all are bad.

so i dunno but many gap still open far down

and at anytime i big drama protest can happens too

but technically have so much gap to fill

Developing FRA40 pattern...?The bullish channel got violated after the peak at price 6797.7, this is now a change of structure. Looking for market to hit price 6627.1 which is our previous daily high then take a slight upward move to complete head-and-shoulders pattern… From the emerging formation then we can smoothly continue to go bearish until the neckline at 6420.0…

ridethepig | CAC Market Commentary 2020.11.25📌 ridethepig | CAC Market Commentary 2020.11.25

The stem for the ending of a retrace and intentions of a turn...

Breaking down ahead of US elections was strategically important.

This was not a typical personality vote, the motives of Democrats are rather exclusively known and transferring the power here will indeed be revolutionary. Neither side can accept the loss, whether we see this end up in the courts or whether we see Biden with the 'hospital pass'... it is irrelevant for the sake of this conversation because in general sense of the term and it is weighing on global equities including DAX, CAC, FTSE, IBEX, FTSEMIB and etc. Eyes on the highs today, a move down from these levels opens up all sorts of problems for buyers.

Thanks as usual for keeping the feedback coming 👍 or 👎

ridethepig | French Equities into the election and beyond📌 An update to the map for French Equities

By now we should have all positioned our portfolios defensively and be sure that in doing so by covering we are ensuring that our opponent will not try a steam roller!

Think back to the diagram and follow the flows....

We have a typical position here in which French Equities can be sold actively. Thanks to the economic slowdown, covid and election risk, we can quickly bring about the attack of our targets. Sellers have already completed the difficult part of the move, but we must not go to sleep on the job!

For the sake of the discussions here, encourage all those who are trading the moves down in equities to start sharing their charts and views in the comments and we can further the conversation and developments.

CAC40 Short Entry on Divergence 13:45:39 (UTC) Wed May 13, 2020As of the open today, the French stock market is down 32 percent from February. There's a broad based stock market crash going on, with financials down 42% year to date. For this, I will be shorting from these regions, and using the futures index as it's proxy.

13:51:33 (UTC)

Wed May 13, 2020

CAC 40 Index - heading towards 2012 lowEurope Markets entering strong bearish momentum.

France is at the beginning of the COVID-19 Pandemic, number of infected people expect to grow exponentially in the upcoming weeks.

France, Spain, Germany following Italy's state of emergency.

We expect now a lower low of the CAC 40 Index.

At the correction move to 4600, we can start shorting the Index with the price target of 2012's low at 2800.

Europe will enter in recession if serious state economic measures are not taken.

"Two of the EU's biggest states, France and Spain, have followed Italy in announcing emergency restrictions to combat the spread of coronavirus. France, a country of 63.5 million, ordered the closure of all non-essential places used by the public from midnight (23:00 GMT)." 15 March - bbc.com

Let me know your view in the comments down below!

#CAC40, The big landslide has begun?We are still a long way from getting the double top pattern confirmation but we have an interesting start here, just in case the CAC40 dropped below 5000 points so the trend change will be final.

RSI + Stochastic 2 These indicators indicate more room for declines.

Target: $ 5450

Channel broken a bit early, but could indicate bear marketMy call on CAC40 is changed from long to neutral now that global markets are increasing their fear on a global slowdown. This is evident in markets around the world as Asian markets plunged today as did European. US is set to be down as well. Overall, the channel break is incredibly disheartening for those expecting higher gains as it was a huge move down (3 percent). If you were not in this trade closer to the bottom, you may have missed your chance. If you didn't sell before this dip then you may have made some money. For those shorter-term traders, you may have already missed the train. We could get back in this channel tomorrow, but that seems unlikely. I'm actually more neutral to short than neutral, but Trading View only gives us three options so I prefer not a drastic shift from long to short. Let's see what happens over the next few days.

What is the next target of #CAC 40 ?The trend of the CAC 40 in recent years is an uptrend.

in October 2011 the Cac has undergone a technical correction of 1200 points and then very quickly he returned to his upward trend, in October 2015 after a long rise the Cac has made technical correction of 1000 points pretty much like the first time and quickly took it back bullish trend, in October 2017 the Cac has made a technical correction of 800 points and at the moment it is in progress and normally should be redone as the last two completed times a rise is exceeded the last record price.

The Cac will seek a goal to reach and the point of the Double Top (6100) in 14% of the current price is probably possible

Buy Cac 40:

Entry Price: 5290

Take Profit: 6100

Stop Loss:5000