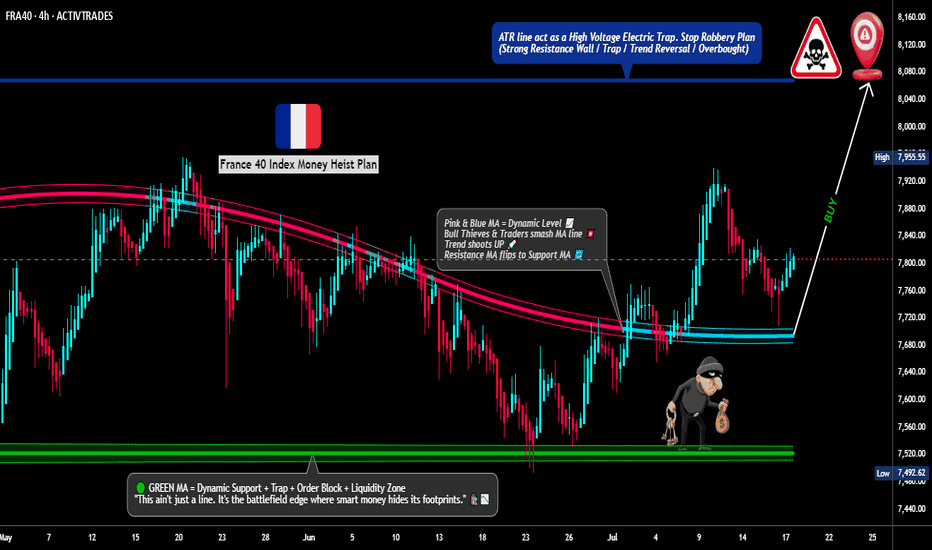

"FRA40/CAC40 HEIST! Bullish Loot Before Bear Trap – Act Fast!"💰 FRA40/CAC40 "FRANCE40" INDEX HEIST – THIEF TRADING STYLE MASTER PLAN 🏴☠️🚀

🔥 Steal the Market Like a Pro – Bullish Loot & Escape Before the Trap! 🔥

🤑 GREETINGS, FELLOW MONEY MAKERS & MARKET ROBBERS!

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

This is your VIP invite to the ultimate FRA40/CAC40 heist! Based on the 🔥Thief Trading Style🔥, we’re locking in a bullish raid before the bears set their trap. Time to swipe the loot & escape like a pro!

📜 THE HEIST BLUEPRINT – TECHNICAL & FUNDAMENTAL RAID PLAN

🎯 ENTRY POINT: "THE VAULT IS OPEN!"

📈 Long Entry: The market’s handing out free cash—swipe bullish positions at any price!

🔄 Pro Thief Move: Use buy limit orders within 15-30 min timeframe for pullback entries.

🎲 DCA/Layering Strategy: Deploy multiple limit orders to maximize loot & minimize risk.

🛑 STOP LOSS – SAFETY NET FOR THIEVES

SL at Nearest Swing Low (4H TF): 7650.00 (Adjust based on your risk, lot size & entry layers).

⚠️ Warning: Bears are lurking—don’t get caught in their trap!

🏆 TAKE PROFIT – ESCAPE BEFORE THE POLICE ARRIVE!

🎯 Primary Target: 8060.00 (or exit early if the market turns sketchy).

🚨 Danger Zone: Yellow MA Zone (Overbought, Reversal Risk, Bear Trap!)

📡 FUNDAMENTAL BACKUP – WHY THIS HEIST WILL WORK

💰 France40 is riding bullish momentum due to:

Strong Macro Data (Eurozone recovery signals)

Institutional Buying (COT Report Insights)

Geopolitical Calm (For Now… Stay Alert!)

Index-Specific Strength (Tech & Luxury Stocks Leading)

🔗 For full analysis (Fundamentals, COT, Intermarket Trends, Sentiment Score):

👉 Check the Liinkk 🔗! 👈

🚨 TRADING ALERT – NEWS & POSITION MANAGEMENT

📰 High-Impact News = Market Chaos! Protect Your Loot:

❌ Avoid new trades during major news drops.

🔐 Use Trailing Stops to lock profits & dodge sudden reversals.

💥 BOOST THE HEIST – SUPPORT THE MISSION!

🚀 Hit the "Boost" button to strengthen our robbery squad!

💰 More boosts = More profitable raids!

🎉 Let’s dominate the market daily with the Thief Trading Style!

🔐 DISCLAIMER (LEGAL SAFETY NET)

This is NOT financial advice—just a strategic raid plan. Trade at your own risk. Markets change fast; adapt or get caught!

🤑 Stay tuned for the next heist… The vaults won’t rob themselves! 🐱👤💨

Cac40prediction

FRA40/CAC40 "France40" Indices Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🚀

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the FRA40/CAC40 "France40" Indices Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (8040) then make your move - Bearish profits await!" however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: Thief SL placed at 8160 (swing Trade Basis) Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

Primary Target - 7900 (or) Escape Before the Target

Secondary Target - 7680 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT Report, Sentimental Outlook, Positioning Analysis:

FRA40/CAC40 "France40" Indices Market is currently experiencing a Bearish trend., driven by several key factors.

✴✴Fundamental Analysis✴✴

Economic Indicators: France's GDP growth rate is expected to continue its upward trend, with the France 40 index increasing by 10.34% since the beginning of 2025.

Earnings Reports: The CAC 40 companies' earnings reports have been showing signs of growth, with some companies experiencing increased revenues and profits.

Dividend Yield: The CAC 40 dividend yield is around 3.5%, which is relatively attractive compared to other major European indices.

✴✴Macro Economics✴✴

Monetary Policy: The European Central Bank (ECB) has maintained its hawkish stance, keeping interest rates at 4.25% to combat inflation (latest ECB meeting minutes).

Fiscal Policy: The French government has announced plans to reduce its budget deficit, aiming for a 3.5% deficit-to-GDP ratio by the end of 2025 (latest budget proposal).

Global Trade: The ongoing trade tensions between the US and China have eased, with both countries signing a new trade agreement, which is expected to boost French exports (latest trade data).

✴✴COT Data ✴✴

Speculators (Non-Commercials): The current COT report shows that speculators are holding 50,219 long positions and 25,011 short positions.

Hedgers (Commercials): Hedgers are holding 20,015 long positions and 40,011 short positions.

Asset Managers: Asset managers are holding 30,015 long positions and 15,019 short positions.

✴✴Global Market Analysis✴✴

Trend: The France 40 index is experiencing a bullish trend, with a 2.1% increase in the last week and a 5.6% increase in the last month.

Support and Resistance: Key support levels are at 8000 and 7950, while resistance levels are at 8250 and 8300.

✴✴Positioning✴✴

Long/Short Ratio: The long/short ratio for the France 40 (CAC 40) index is 2.05, indicating a slightly bullish sentiment.

Open Interest: The open interest for the France 40 (CAC 40) index is approximately €12.5 billion.

✴✴Next Trend Move✴✴

Bullish Prediction: Some analysts suggest a potential bullish move, targeting 8300 and 8400, due to the ongoing economic growth and attractive valuations.

Bearish Prediction: Others predict a potential bearish move, targeting 7900 and 7800, due to the ongoing trade tensions and potential economic slowdown.

Long-Term Bearish Target: A potential long-term bearish target is 7200, due to the ongoing global economic uncertainty and potential recession risks.

✴✴Future Prediction✴✴

Short-Term:

Bullish: 8200-8300

Bearish: 7900-7800

Medium-Term:

Bullish: 8500-8600

Bearish: 7500-7400

Long-Term:

Bullish: 9000-9200

Bearish: 6800-6600

✴✴Overall Summary Outlook✴✴

Bullish or Bearish: The overall outlook for the France 40 (CAC 40) index is neutral, with a mix of bullish and bearish predictions.

Real-Time Market Feed: As of the current time, the France 40 (CAC 40) index is trading at 8100, with a 0.5% increase in the last 24 hours.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

CAC and the WORLD WIDE EVENT NEARING The chart is that of the FRENCH CAC 40 And The MATH pointing to a Major TOP soon . we have now entered the final 5th wave in wave 5 The Math is been circled for you To understand the target and how tight it is . after this top you should exit anything and Move all funds into US$ in 20 and 90 day T bill . Europe markets and The E.U. To start the Collapse and will fragment! WAVETIMER

CAC 40 Drops Hard! Fed's New Tone Sparks Sharp DeclineCAC 40 (French Index) on a 1-hour timeframe initiated a short trade using the Risological Trading Indicator. The sharp decline aligns with fundamental market dynamics influenced by the Federal Reserve's policy stance.

Trade Highlights:

Entry : Short position initiated based on bearish sentiment.

Current Trend: Sharp downward movement observed.

Reasons for Decline:

At 8:15 AM, the December futures contract for the CAC 40 fell 110.5 points, settling at 7277.5 points, indicating a 1%+ decline at the open.

The Federal Reserve cut its key interest rates for the third time this year, reducing them to a range of 4.25% to 4.50%.

Fed Chair Jerome Powell signaled a "new phase" of monetary policy, characterized by a slower pace of rate cuts, contrary to market expectations.

Updated projections show only two rate cuts next year, compared to the four previously anticipated by investors, fueling bearish momentum.

Hermes Intl. Lets Try The Screwdriver NowHermès International S.A. is a French luxury design house established on 15 June 1837. It specializes in leather goods, lifestyle accessories, home furnishings, perfumery, jewelry, watches and ready-to-wear.

Since the 1950s, its logo has been a depiction of a ducal horse-drawn carriage.

Technical graph for Hermes stocks (US Dollars - denominated) indicates they turned to extra hot levels earlier this year, somewhere in mid-February 2024.

Due to common uncertainty the bubble is going to be finally screwed.

short #fra40 around 7550 with minimum 200 pts target at 7350i wont say much stuff,but what i will say ,its full fundamental and what happens in the country

#cac40 (fra40 outperform many index,if its not all) while in France all gone bad since many weeks

Big protest and it is not finish..

next data will surely be down as protest had block few sector

the President public opinion had never been so low u can go on twitter every day in the best trend have aty least 2 tag for him and all are bad.

so i dunno but many gap still open far down

and at anytime i big drama protest can happens too

but technically have so much gap to fill

CAC40 to break above Falling Wedge?Falling Flag (Wedge) has formed on CAC40 since April 2023.

We have had the price come down each time but make a higher low and fail to break below 7,056.

It might be premature but, it looks like the momentum is pointing up (along with many other alternative indices).

I'll be happy to go long when the price breaks above. But now it's a waiting game.

7>21>200

RSI>50

Target 1 will be at 7,857

ABOUT THE INDEX

Name:

The CAC 40 is an abbreviation of "Cotation Assistée en Continu", which translates to "continuous assisted trading", and the number 40 refers to the number of companies represented in the index.

Establishment:

The CAC 40 was established on 31 December 1987, with a base value of 1,000 points.

Representative of French Market:

The CAC 40 is the benchmark stock market index in France, which reflects the performance of the 40 largest publicly traded companies listed on the Euronext Paris.

Diverse Sectors:

The index includes a diverse range of sectors, such as manufacturing, banking, pharmaceuticals, media, utilities, luxury goods, etc.

CAC40 Bearish (Downtrend)CAC40 has officially become bearish, I think that was pretty obvious two or three days ago. We've got a bearish divergence on the 1-day timeframe, not to mention the fact stoch and rsi is both topped out completely on 1 week and 1 month timeframe, I believe we could be seeing lows of 6300 points.

Due to the FED moving towards tapering it's possible there could be a tantrum within the market causing major indicies to crash.

4-hour timeframe H&S completed

30-minute timeframe bearish divergence

Descending Channel on countless timeframes (lower)

We're seeing most timeframes oversold though which is quite worrying, however, they seem to be building up due to it just hovering around so we'll see how the market plays out.

ridethepig | CAC Market Commentary 2020.11.25📌 ridethepig | CAC Market Commentary 2020.11.25

The stem for the ending of a retrace and intentions of a turn...

Breaking down ahead of US elections was strategically important.

This was not a typical personality vote, the motives of Democrats are rather exclusively known and transferring the power here will indeed be revolutionary. Neither side can accept the loss, whether we see this end up in the courts or whether we see Biden with the 'hospital pass'... it is irrelevant for the sake of this conversation because in general sense of the term and it is weighing on global equities including DAX, CAC, FTSE, IBEX, FTSEMIB and etc. Eyes on the highs today, a move down from these levels opens up all sorts of problems for buyers.

Thanks as usual for keeping the feedback coming 👍 or 👎

CAC40 Short Entry on Divergence 13:45:39 (UTC) Wed May 13, 2020As of the open today, the French stock market is down 32 percent from February. There's a broad based stock market crash going on, with financials down 42% year to date. For this, I will be shorting from these regions, and using the futures index as it's proxy.

13:51:33 (UTC)

Wed May 13, 2020

#CAC40, The big landslide has begun?We are still a long way from getting the double top pattern confirmation but we have an interesting start here, just in case the CAC40 dropped below 5000 points so the trend change will be final.

RSI + Stochastic 2 These indicators indicate more room for declines.

Target: $ 5450