CAKEUSDT Potential DownsidesHey Traders, in today's trading session we are monitoring CAKEUSDT for a selling opportunity around 2.17 zone, CAKEUSDT is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 2.17 support and resistance area.

Trade safe, Joe.

Cakeusdt

CAKE/USDT | Rising Wedge ⇒ Bearish ReversalCAKE/USDT | Rising Wedge ⇒ Bearish Reversal

Following my previous CAKE prediction—which delivered a +30% gain—the pair now looks poised to turn bearish again.

📈 Market Structure

Pattern: Rising wedge from April lows, with price compressing into higher highs and higher lows under converging blue trend-lines.

Implication: Wedges often break down as bullish momentum fades into the apex.

🎯 Supply / Short Zone

Zone: 2.257 – 2.380 USDT (blue–purple shaded area)

Lower edge aligns with the upper wedge trend-line.

Upper edge marks April’s horizontal resistance.

⚔️ Short Entry Strategies

Aggressive: Short on the initial test of 2.257–2.380 USDT with a bearish rejection signal.

Conservative: Wait for a confirmed reversal pattern near the zone.

🛑 Stop Loss

Level: Above wedge resistance at 2.45 USDT—allows for a false breakout while limiting risk.

🎯 Profit Targets

TP1: 2.135 USDT

TP2: 2.010 USDT

TP3: 1.840 USDT

🔧 Trade Management

Scale out partial positions at each TP to lock in gains.

Move stop to breakeven once TP1 is hit.

If price closes above 2.45 USDT, invalidate the setup and reassess.

CAKEUSDT Short Setup – Watching 2.40 Zone for RejectionHey Traders,

CAKEUSDT is currently trading within a well-defined downtrend, consistently forming lower highs and lower lows. The recent move appears to be a corrective rally, bringing price back toward a key daily resistance zone around 2.40, which also aligns with the descending trendline.

I’m monitoring this area closely for potential bearish price action to develop, signaling a continuation of the dominant bearish trend.

Key Confluences:

Major daily resistance at 2.40

Approaching descending trendline

Market still in a clear downtrend

Possible lower high formation in progress

Trade Plan:

If I see bearish confirmation in this zone (e.g. rejection candles, bearish structure break on lower timeframes, or weakening momentum).

A strong break and hold above 2.40 would invalidate the setup!

TradeCityPro | CAKE: Slicing Through the Market's Range Box👋 Welcome to TradeCity Pro!

Let's dive into the analysis of Bitcoin and key crypto indices, focusing today on the CAKE coin, as requested in the comments. This coin holds a market cap of $511 million, ranking 93rd on CoinMarketCap.

📅 Weekly Timeframe

In the weekly timeframe, as you can see, there's a very large range box existing from 1.093 to 4.753. This box represents a substantial range, and the price has been in this box for almost three years.

🔍 There's a significant area within this box at 1.549, which currently acts as a very important support. The price has hit this level several times but has yet to break through it.

⚡️ In this timeframe, indicators are not very useful because it's a ranging trend, and in ranging trends, these tools don't perform well. The best tool we can use to analyze a ranging market is support and resistance.

📊 Currently, there is a support at 1.549, as mentioned, which the price has hit several times and has been supported by. If this support breaks, there's another very important support at 1.093, which will be the last support area for the price.

🛒 For buying this coin in spot, there is a very strong supply zone near 4.753. I recommend waiting until this area is broken to start the main bullish trend. This break would signify a potentially strong upward move, so entering before this break could expose you to unnecessary risks given the current ranging conditions.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

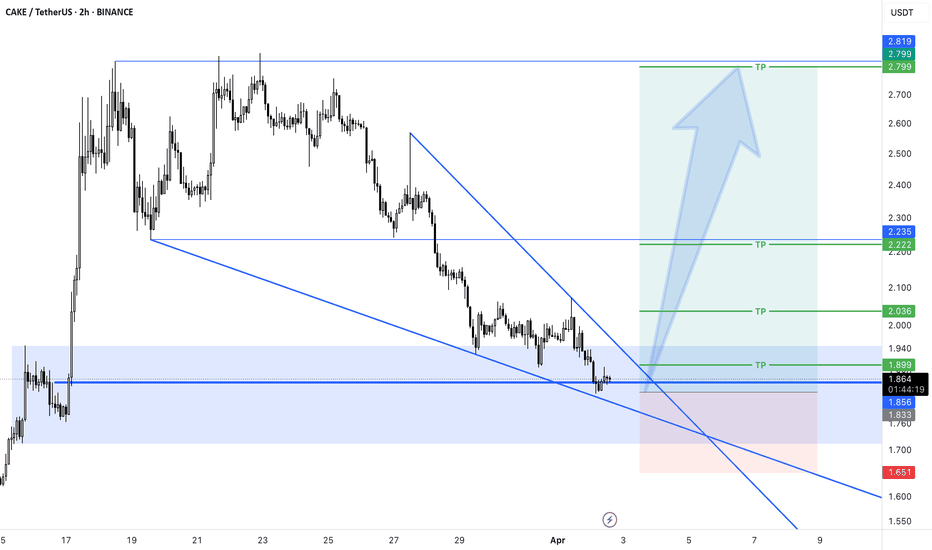

Long Position CAKE/USDTPancakeSwap (CAKE) has entered a critical Long Zone between $1.48 – $1.64, where price historically found strong support before a major Long rally. After a prolonged downtrend, we’re now approaching a potential reversal zone.

🔹 Long Entry Zone: $1.48 – $1.64

🔹 Potential Upside Target: $2.82+

🔹 Rationale: Previous bounce zone + strong demand area

🟢 This is a high-reward opportunity for patient bulls waiting for a bottom formation. Watch closely for early signs of strength — if price holds and confirms a reversal, we may see a sharp push to the upside.

⚠️ Reminder: No entry without confirmation and risk management.

CAKEUSDT (PancakeSwap): Sweet Gains or Stale Trade?(1/9)

Good afternoon, everyone! ☀️ CAKEUSDT (PancakeSwap): Sweet Gains or Stale Trade?

With CAKE at $2.599, is this DEX token a tasty treat or a flat pancake? Let’s flip the details! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $ 2.599 as of Mar 25, 2025 💰

• Recent Move: Consolidating $2.6-$2.8, up from $2.34, per data 📏

• Sector Trend: Crypto steady, DeFi mixed amid trade tensions 🌟

It’s a flip-flop—value might be cookin’! ⚙️

(3/9) – MARKET POSITION 📈

• Market Cap: Approx $760M (292M circulating) 🏆

• Operations: Leading BNB Chain DEX, yield farming, staking ⏰

• Trend: Deflationary model burns 102% minted, per data 🎯

Firm in DeFi, but volatility’s the spice! 🚀

(4/9) – KEY DEVELOPMENTS 🔑

• Recent Surge: Up 45% earlier in March, per X posts 🌍

• Platform Updates: Expanded NFT marketplace, per web data 📋

• Market Reaction: High volume ($230M daily), showing interest 💡

Adapting to DeFi trends, cooking up growth! 🍳

(5/9) – RISKS IN FOCUS ⚡

• Regulatory Risks: Crypto scrutiny could hit DEXs 🔍

• Market Volatility: Crypto swings could drag price down 📉

• Competition: Other DEXs like Uniswap challenge, per data ❄️

It’s a risky recipe—watch the heat! 🛑

(6/9) – SWOT: STRENGTHS 💪

• DEX Leader: Top on BNB Chain, strong user base 🥇

• Deflationary Model: Burns tokens, potentially boosts value 📊

• High Volume: $230M daily, per data, shows activity 🔧

Got a sweet spot in DeFi! 🏦

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Price volatility, regulatory fears 📉

• Opportunities: DeFi adoption, new features like lending 📈

Can it rise or get burned? 🤔

(8/9) – POLL TIME! 📢

CAKE at $2.599—your take? 🗳️

• Bullish: $3+ soon, DeFi booms 🐂

• Neutral: Steady, risks balance gains ⚖️

• Bearish: $2 drops, market sours 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

CAKE’s $2.599 price reflects consolidation, with strengths in its platform and deflationary model, but risks from market volatility and competition persist. DCA-on-dips could be a strategy to average in over time, banking on long-term growth. Gem or bust?

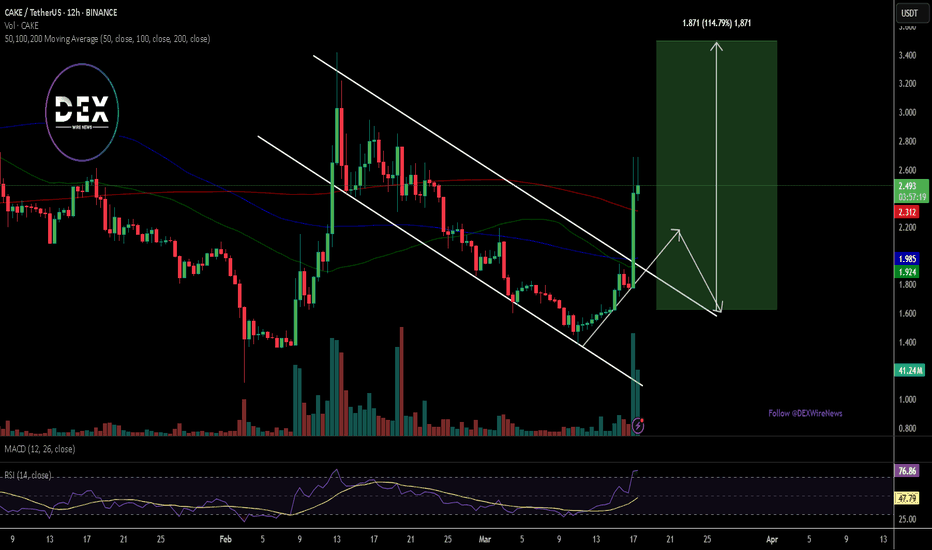

Breaking: $CAKE Surge 16% Amidst Breakout of a Falling wedge The price of Pancakeswap saw a noteworthy uptick of 16% today amidst breakout of a falling wedge pattern. With the Relative Strength Index (RSI) at 72, more upside is envisioned in the long run as traders step in sparking a move to the $3.8 pivot point.

About PancakeSwap

PancakeSwap is a decentralized exchange (DEX) built on multiple blockchains, primarily BNB Chain and Ethereum, offering trading, staking, and yield farming services. The platform uses automated market makers (AMM) to enable users to trade cryptocurrencies directly from their wallets, with CAKE as its native token that powers various platform features and rewards. Since its launch, it has evolved into one of the largest DEXs by trading volume, incorporating features like perpetual trading and cross-chain functionality.

PancakeSwap Price Live Data

The live PancakeSwap price today is $2.79 USD with a 24-hour trading volume of $399,375,543 USD. PancakeSwap is up 15.87% in the last 24 hours, with a live market cap of $816,022,085 USD. It has a circulating supply of 292,717,453 CAKE coins and a max. supply of 450,000,000 CAKE coins.

#CAKEUSDT is setting up for a breakout📉 Long BYBIT:CAKEUSDT.P from $2,710

🛡 Stop loss $2,607

1h Timeframe

⚡ Plan:

➡️ POC is 2,515

➡️ Waiting for consolidation near resistance and increased buying activity before the breakout.

➡️ Expecting an impulsive upward move as buy orders accumulate.

🎯 TP Targets:

💎 TP 1: $2,790

💎 TP 2: $2,870

💎 TP 2: $2,920

🚀 BYBIT:CAKEUSDT.P is setting up for a breakout—preparing for an upward move!

CAKEUSDT – Patience Pays, Wait for the Blue Box!CAKEUSDT – Patience Pays, Wait for the Blue Box!

“Chasing price is how retail traders get trapped—smart money waits for the perfect entry!”

🔥 Key Insights:

✅ Bullish Structure, But Overextended – Price needs a proper retrace.

✅ Blue Box = Ideal Buy Zone – This is where smart money steps in.

✅ FOMO Kills Accounts – The best trades feel uncomfortable because they require waiting.

💡 The Smart Plan:

Wait for Price to Reach the Blue Box – No chasing, let the trade come to us.

CDV & Volume Profile Must Confirm the Entry – We need proof buyers are stepping in.

LTF Market Structure Break = Final Green Light – Precision beats randomness.

“Discipline prints money. Wait for the blue box, take the high-probability trade, and win!” 🚀🔥

A tiny part of my runners;

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

Breaking: $CAKE Surge 45% Today Amidst a Falling Wedge BreakoutPancakeswap native token NASDAQ:CAKE saw a noteworthy uptick of 45% today amidst a falling wedge breakout.

Pancakeswap was originally built on the BNB Chain and allows users to trade tokens without using a centralized exchange.

Pancakeswap innovates quickly and ships new products regularly. In April 2023, PancakeSwap voted to transition to a deflationary token model called "Ultrasound CAKE." The protocol passed a proposal called CAKE Tokenomics v2.5 to create a structure combining real yield (no supply impact) and reduced token emissions. Over 102% of minted CAKE is burned weekly. This is intended to provide a multi-year runway for emissions and incentivize locking up CAKE, making the token more valuable long-term.

PancakeSwap has an anonymous team of “Chefs,” working in the PancakeSwap “Kitchen.” The platform is open-source and has been audited by multiple reputable blockchain security firms like Peckshield and Slowmist.

Although the bear market has impacted TVL and trading volume for the protocol, PancakeSwap still boasts an annualized revenue of $27 million, with 42% of CAKE is staked.

Technical Outlook

As of the time of writing, NASDAQ:CAKE is up 40.37% currently overbought with the RSI at 77 a trend reversal could be looming ahead. Similarly, a breakout above the $3 resistant point could set NASDAQ:CAKE on a bullish course as the all time high is pegged at $44 with a market cap of just $732 million a move to $5 isn't far fetched.

CAKE potential triple bottomCAKE / USDT

BNB ecosystem coins are catching our attentiont these days, especially #CAKE.

On the chart:

We see a potential triple bottom forming.

($2-$1) is an excellent accumulation zone.

Note : The price must stabilize above $1 at the weekly closes to maintain this view.

CAKE/USD: Ready for a Massive Breakout?Chart Analysis:

1. Timeframe and Price Context

Timeframe: Daily chart (each candlestick represents 1 day of trading).

Price Levels:

The current price is $15.486779, as indicated on the chart.

The price range on the chart spans from near $0 (early 2021) to a peak of approximately $47.862159 (late 2024), followed by a sharp correction to the current level.

Trend Overview:

2021-2023: CAKE starts near $0 and experiences a strong uptrend, likely driven by the growth of the Binance Smart Chain (BSC) and DeFi adoption, peaking around $40-$50 in 2021-2022, with some consolidation.

Late 2024: A significant rally pushes the price to $47.862159, followed by a sharp correction.

Early 2025: The price has stabilized around $15.486779, within the annotated "Buying Zone."

2. Key Patterns and Annotations

Post-Rally Correction:

After reaching a peak of $47.862159, CAKE experienced a steep decline (approximately 68% drop to $1.5486779), indicating a strong correction phase.

This correction likely reflects profit-taking or broader market pressure after the rally.

Buying Zone:

The chart labels a "Buying Zone" around the current price level of $15.486779, suggesting this is a perceived support area where accumulation by traders or whales might occur.

This zone aligns with a horizontal support level where the price has consolidated after the correction.

Breakout Prediction:

An upward arrow with the annotation "TG 4BS" suggests a bullish target, which I interpret as $48 (given the price scale and the prior peak of $47.862159). This would represent a ~210% increase from the current price of $1.5486779.

The target aligns with the prior all-time high, indicating a potential retest or breakout to new highs.

3. Support and Resistance Levels

Support:

The "Buying Zone" at $1.5486779 appears to be a strong support level, where the price has stabilized post-correction.

If this support breaks, the next significant level could be around $10-$12 (a psychological and historical support from 2023).

Resistance:

The immediate resistance is likely around $20-$25, a prior consolidation zone during the uptrend.

The $47.862159 level (recent high) is a major resistance, and the $48 target (as annotated) is the next key level to watch.

4. Volume and Momentum (Not Visible but Inferred)

Volume bars are not clearly visible, but typical behavior suggests:

Volume likely spiked during the rally to $47.862159 and decreased during the correction as selling pressure eased.

A breakout would require a volume surge to confirm, especially if the price moves toward $48.

Momentum indicators (e.g., RSI or MACD) could indicate whether CAKE is oversold or showing bullish divergence, supporting a reversal.

5. Potential Scenarios

Bullish Breakout:

If CAKE breaks above the $20-$25 resistance with strong volume, it could confirm a bullish trend, targeting the $48 level.

The "Buying Zone" at $1.5486779 suggests accumulation, which could fuel a rally if buying pressure increases. This would align with a ~210% move, consistent with prior bullish cycles in DeFi tokens.

Bearish Breakdown:

If the price fails to hold the $1.5486779 support and breaks below, it could signal further downside.

The next support at $10-$12 could be tested, potentially leading to a deeper correction.

Consolidation:

If the price remains within the "Buying Zone" (around $15-$18), it might continue to consolidate until a catalyst (e.g., BSC ecosystem growth, market rally) triggers a move.

6. Market Context

DeFi and BSC Influence: CAKE, as the governance token of PancakeSwap (a leading DEX on BSC), is influenced by DeFi adoption, BSC network activity, and broader crypto market trends (e.g., Bitcoin and Ethereum performance from your previous charts).

Whale Activity: The "Buying Zone" annotation suggests whales or smart money might be accumulating at this level, similar to your earlier analyses of Ethereum, UNISWAP, Bitcoin, and Dogecoin. This could set the stage for a breakout.

Timing: On a daily timeframe, a breakout could occur within weeks to months, depending on market conditions and catalysts.

Will Cake’s 25% drop unlock the path to $1.20?Hello and greetings to all the crypto enthusiasts, ✌

Let’s dive into a full analysis of the upcoming price potential for Cake 🔍📈.

Cake, unlike its competitors, exhibited limited growth during the previous market surge and swiftly lost those gains. At present, the price is positioned at the upper boundary of a descending channel. A minimum decline of 25% is anticipated, aiming to reach its crucial monthly support level. This correction is essential for achieving the primary target of 1.20. The current market dynamics suggest that further downward movement is likely before any potential recovery.📚🙌

🧨 Our team's main opinion is: 🧨

Cake lagged behind competitors in the last market rally, quickly lost its gains, and now sits at the top of a falling channel, with a likely 25% drop ahead to hit key support at 1.20.📚🎇

Give me some energy !!

✨We invest hours crafting valuable ideas, and your support means everything—feel free to ask questions in the comments! 😊💬

Cheers, Mad Whale. 🐋

PancakeSwap Token: Volume Signal (New All-Time High In 2025)This volume signal reveals the bottom, together with candlestick patterns and price action. Let's get into it.

Good evening my...

Ok. We are going straight to present day.

The 3-Feb. session ended as a perfect "neutral" Doji. This session produced a multi-year low, the lowest price since October 2023 and yet, a higher low. This session is a reversal signal on its own and the green week that follows works as confirmation. This session has really high volume and the week that follows has the highest volume ever. These sessions are green.

After this initial price bounce, there is a retrace, classic retrace, and this retrace is set to end, will end, in a higher low. This higher low is a bullish signal. The volume signal gives the bottom away; the bottom reveals the bull-market, the bull-market implies maximum growth.

A sideways market for years, CAKEUSDT (PancakeSwap Token) is about to turn green.

Let me know if you agree and if you do, follow me.

If you don't agree, make sure to follow anyway. Sometimes, it is good to read stuff that are contrary to our thoughts. Sometimes, it is better to be guided, because no one can approach the high level of accuracy exhibited by the Master of the charts.

Just kidding.

PancakeSwap Token (CAKE) is set to rise bigly and strongly and it will do so for the long-term. A new All-Time High in 2025.

Thank you for reading.

It is my pleasure to write for you again today.

Namaste.

CAKEUSDT, maybe a Long opportunity ?Hello Traders, Hope you are doing great.

for upcoming days I expect continuation of downward correction at first and after that another upward movement to specified Dashed lines.

Don't forget to use proper risk management .

and finally tell me What are your thoughts about CAKE ? UP or DOWN ? comment your opinion below this post.