Canada

NFP, Trump's obsession, Morgan Stanley's recommendationsGetting ready for the NFP, Trump's obsession, recommendations of Morgan Stanley

The financial markets are having a torrid week. Financial market participants are concerned about the appearance of a trend that the market currently is following. The concern is about the statistics based on the US labor market outcome, which in the future might provoke the US economic slowdown.

Let's try to figure out what we should and should not be expected after the outcome will be published. It seems like nobody wants to undertake an in-depth analysis of the current state of the economy and labor market, a matter of reasonable inference from “how the forecast has been calculated”. The formula is, therefore, as follows: take the simple arithmetic average of the NFP index over the last couple of years, that is all. Such an approach practically guarantees that actual data will be different from forecast data. That in itself carries an opportunity for earnings.

NFP report outcome creates adverse expectations. We believe that the 160K figure is too optimistic according to the ADP outcome.

Since we are expecting poor forecast data, our trading recommendation is - sell the dollar. Moreover, the markets are concerned about possible US interventions against the dollar in the foreign exchange market. Recall, Trump supports the dollar devaluation idea. Last time the United States came out with interventions on the foreign exchange market was in 2011.

Recently, USD to YEN rate forecast has been sharply lowered by Morgan Stanley’s analysts: from 108 to 102 at the end of this year and from 98 to 94 at the end of the next year. Motivation - a sharp decline in profitability differential: the profitability of American assets decreases faster than the profitability of European and Japanese. Recall that it is not the first time we recommend selling USDJPY.

As for our other recommendations, we will continue to look for points for sales of the Russian ruble and oil. We are working with gold today with no clear without any preference for oscillator signals.

In addition, we recommend paying attention to USDCAD. The fact is that today, statistics on the labor market of Canada will be published. So in the case of a double positive or double negative, the USDCAD may be subjected to strong pressure (ascending or descending). The best option for trading, in this case, is trading on the news. 1-2 minutes before the news releases, we set pending stop orders in both directions (buy and sell) with 30 pips at that time and wait for the news to come out. Almost certainly the movement will be strong and unidirectional. That will lead to the execution of one of the orders and will make it possible to earn quite quickly without any particular risks.

USD at strong support level against the CADThe USD is currently sitting at a very strong support level against the CAD. EMA50 is also above EMA200 on the daily and weekly. Keep in mind that, technically, the pair is in a "no trade zone."

The Canadian economy is also experiencing a number of acute deteriorations vs. the US economy that could put pressure on bank balance sheets in Canada. Increasing non-performing loans in Canada could lead to currency devaluation. The Bank of Canada's inflation targeting also revolves, at least partially, around currency devaluation (a kind of "beggar thy neighbour").

Daily Canada S&P/TSX CAD stock market index forecast timing anal27-Jun

Price Forecast timing analysis by pretiming algorithm of Supply-Demand strength

Investing position about Supply-Demand(S&D) strength: In Falling section of high risk & low profit

Supply-Demand(S&D) strength Trend Analysis: In the midst of a downward trend of strong downward momentum price flow marked by temporary rises and strong falls.

Today's S&D strength Flow: Supply-Demand(S&D) strength flow appropriate to the current trend.

read more: www.pretiming.com

D+1 Candlestick Color forecast: RED Candlestick

%D+1 Range forecast: 0.0% (HIGH) ~ -0.2% (LOW), -0.1% (CLOSE)

%AVG in case of rising: 0.3% (HIGH) ~ -0.3% (LOW), 0.2% (CLOSE)

%AVG in case of falling: 0.2% (HIGH) ~ -0.5% (LOW), -0.3% (CLOSE)

Price Forecast timing is analyzed based on pretiming algorithm of Supply-Demand(S&D) strength.

"USDCAD starting a Long Term Bear Movement?" by ThinkingAntsOkDaily Chart Explanation:

- Price broke the Ascending Channel in which it was in since 2017.

- Price may have potential to go down towards the Support Zones.

Weekly Vision:

However, we found out that the Weekly Ascending Trendline have not been broken yet. That why we are waiting for a confirmation before taking long term positions.

UPDATES COMING SOON!

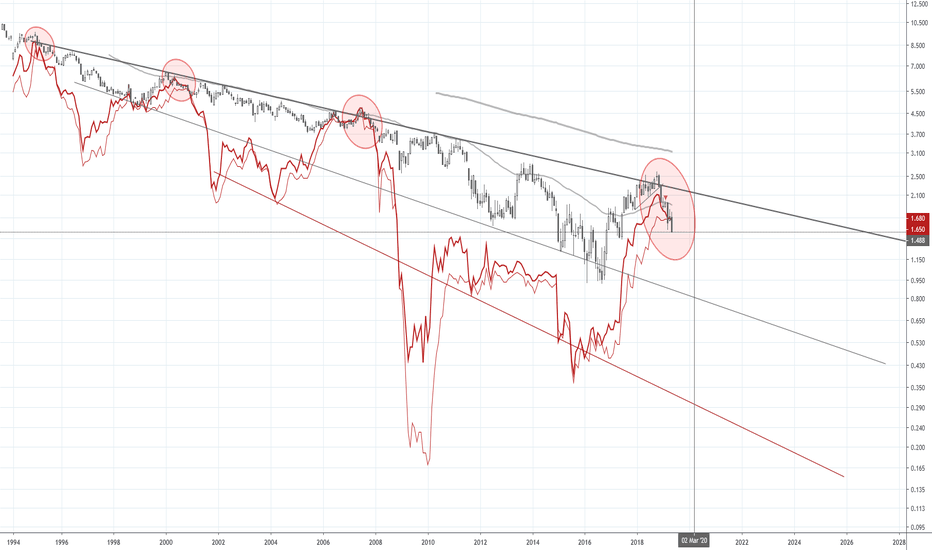

Canada | Bond Yeilds and Recession WatchLooking at the chart we can see the 3 month yield inverted with the 10 year yield a few weeks ago so recession could be anywhere from 12-18 months out. The question is, where do we stabilize in this current down swing? Things will probably go sideways for a while before we break support and rates dive to zero. The catalyst will be nGDP figures and Bank of Canada policy.

Canada | Recession WatchThe 10 year Canadian yield is now below the 1 year and 3 month yield, which is a good indicator of a potential recession ahead. Rates follow economic growth, so we can interpret yields as a function of the economy. These interest rates also impact the price of money (CAD interest rates). One way to interpret lower interest rates in the Canadian economy is that economic activity is lower and cheap money indicates a discount on loans due to a lack of credit demand. Lack of credit demand could be an issue related to demand itself, access, or credit worthiness. So lower interest rates can quickly impact CAD valuations against other currencies in the FX market.

The trend is pretty clear going back to the early 90s; the 10 year provides a kind of ceiling for yields. There is a kind of megaphone pattern as well, which could indicate that rates will go sharply lower in the coming years, with short term rates bottoming out hard and perhaps even going negative.

Gov't Bond Yields & Bank StocksFollowing government bond yields can be crucial to understanding the underlying price action of banks stocks. Take this example of Canadian bonds and stocks. We can clearly see how, following a steady expansion in yields of various maturities, a trend break where bonds suddenly appreciated (yields go down when bond prices go up) the results were a change in trend for the bank stock (in this case CIBC). The inversion of the 3 month and 10 month yields resulted in a trend change confirmation on the smaller timeframes. This is not just a coincidence: bank business models are heavily influenced by their central bank regulator.

RY (Royal Bank of Canada) | 10% Short Trade SetupConfirmation: 103.60

Invalidation: Local high

Type of Trade: Countercyclical (EMA50 above EMA200)

Target: 92.19

TF:4HR

Leverage: 2x

Pattern: 1) daily double top with 2) trendline break, 3) untested 8/1 Gann, and 4) frothy fundamentals (insufficient loan loss provisions).

The last days of Theresa May, more trade wars, worst week of oilThe previous week was tough for financial markets due to the escalation of the trade war between the USA and China, which, moreover, have taken new forms like US attacks on Chinese technology companies.

At the same time, the White House is not planning to stop. The tariff epidemic will spread to other countries, primarily those of them whose currencies are artificially undervalued. Recall that the undervaluing of the national currency provides a powerful competitive advantage in international trade.

In general, things rapidly get worse. We noted that this confrontation may become a new reality, in which it is worth getting used to living in now.

Another key event was Theresa May’s resignation. The inability to provide Brexit provoked Theresa May's resignation. She will remain in office until June 7, when her successor will change her. Most likely Boris Johnson will be. The pound, as we announced in Friday’s review, has grown due to this news. That only confirms the loyalty of our vision and recommendations. So this week we will continue to look for points for buying of the pound, including the medium-term position.

The previous week was the worst for oil for the entire 2019. The reason is the exodus of investors from risky and commodity assets amid fears of a sharp slowdown in the global economy. This scenario was viewed by us as a baseline, and from the very start of the last week we recommended oil sales. So those readers who followed our advice should have made very good money. On Thursday alone, oil lost about 6%.

About the upcoming week, we note that its main events, perhaps, will be the announcement of the Bank of Canada decision on the parameters of monetary policy, as well as data on US GDP for the first quarter (revised). For the rest, the trade war will remain in focus.

As for today, we are waiting for a thin market and potential spikes in volatility on level ground. So you should trade carefully.

Our trading positions for the week did not change much: we will look for points for buying of the euro against the US dollar, sales of oil and the Russian ruble, as well as buying of gold and the Japanese yen. In addition, we begin to buy a pound.

Weak data from the USA, oil in danger and pound under pressureYesterday’s data on US retail sales could be described as weak only. Sales dropped 0.2% in April (with growth forecast at 0.2%) therefore the dollar has suffered sales.

We recommended looking for points for selling the dollar yesterday because the afore-mentioned scenario was considered as fundamental one. Our position is unchanged – we short the dollar. First of all against the euro and the Japanese yen. Perhaps the Canadian dollar could be added. Inflation data came out.

The reason to hope for less aggressive rhetoric from the Central Bank of Canada has been given by inflation data on Canada.

Another data that came out yesterday was the statistics from China. The figures also frankly did not please: industrial production, retail sales and investment growth rates - all indicators appeared much worse than expected. That only assured investors that the world economy will slow down further, and the trade war is - a real evil.

Meanwhile, the pound continues to be under pressure. The basic reason is the same - Brexit. The government is not able to get on well with Labor. This means that the vote on the updated Brexit plan, scheduled in the House of Commons for the first week of June, may fail once again. Our position is to refrain from buying the pound. By “goodbye” we mean the appearance of clarity in Brexit situation. Given that the potential of pound growth is measured in hundreds of points, it is better to receive less than 100-150 pounds of profit but to enter consciously and surely.

Meanwhile, tectonic shifts are possible in the oil market in the near future. The point is that OPEC + is coming to an end. And the decision to extend it is still far from being made. This weekend will be held negotiations of OPEC +. According to rumors, Russia is ready to support the increase in oil production. Given that Saudi Arabia, in general, has similar desires, there is a reason to think that OPEC + will cease to exist, or at least, the size of production cuts will be revised to a significant decrease.

For oil, this means one thing - a reason for a medium-term downtrend formation. So we recommend starting selling oil now, while it costs so much.

Our trading plan for today: we will look for points for buying the euro and the Canadian dollar against the US dollar, sale oil, and the Russian ruble, buy gold and the Japanese yen.

AUDCAD - SELLThe trend is your friend!

Amazing news from CAD, trendline break and retested it already.

Technically and fundamentally bearish!

Hopefully, it was helpful, feel free to support my idea post by hitting the "LIKE" button, it is my only fee from You!

Have a nice day,

Cheers!

*This information is not a recommendation to go "LONG" or "SHORT", it is mostly used for educational purposes only!

RY (RBC BANK) | Watch For Rejection and New DowntrendRY has filled a gap created back at the beginning of 2018 and we also see a potential large double top formation on the daily and weekly timeframes that is being formed by rejection. This is an opportunity to position short for a new downtrend on the lower timeframes, looking for support on the 8/1 Gann and as low as the 4/1 Gann.

On the larger timeframe, don't forget Steve's trade (targets are my own though):

PS. Some Index funds might be worth shorting as well.

Draghi departure & fate of euro, CB of Canada & Japan decisionThe main event on the foreign exchange market yesterday was the announcement of the outcome of the Bank of Canada meeting. For the fourth time, the Central Bank did not raise the rate. The decision is predictable and has been accounted for in the Canadian dollar price. But what was not considered? The fact that the Bank of Canada completely removed the mention of the possibility of a rate hike in the future from its statement. This was a surprise. For the Canadian dollar surprises with a “minus sign”. So, its sales could be called logical.

The rest of the Wednesday was a rather quiet day. Dollar growth has stalled. In the absence of additional drivers for growth. However, today a surge of volatility in dollar pairs might occur after the publication of data on orders for durable goods in the United States. Well, almost certainly not avoid a “roller coaster” on Friday, when data on US GDP for the first quarter will be published.

In relation to relatively calm news background, investors and traders decided to attend to promising events. In particular, what will happen with the euro after the Mario Draghi departure from the post of President of the ECB? According to analysts at UBS, the euro is waiting for its growth regardless of who takes the chair. Motivation - a new president - is a reason to start tightening monetary policy in the Eurozone. That is a positive factor for the euro anyway. So those who are engaged in long-term trading should pay attention to buying euros, which is quite cheap lately.

Another important Central Bank’s meeting this time in Japan was held today. Traditionally, the Bank of Japan did not adjust the country's monetary policy. But at the same time, Central Bank made it clear that the ultra-soft monetary policy will continue until at least 2020. In addition, the Central Bank lowered its forecasts for inflation and GDP in Japan. In general, this is quite a sickening blow to the yen, so its sales remain relevant. So, we are continuing to recommend to buy USDJPY.

According to the US Department of Energy, oil reserves in the United States have risen sharply over the past week (+5.479 million with a forecast of +1.0 million). Despite this clearly bearish signal, oil did not decline. This once again confirms the current situation in the oil market: buyers dominate. This means that it is necessary to continue to look for points for buying on the intraday basis.

As for our other positions, today we are continuing to look for points for selling the dollar against the euro, pound, and also the franc. In addition, we return to the gold buying on the intraday basis.

BOC Decision LoomsAs it is expected that the Bank of Canada will leave rates on hold, traders are already on the move. Both CADUSD SMI and MACD are on the decline, indicating money and momentum moving out of the currency pair.

Furthermore, the pair has great difficulty breaking through its 10-Day EMA (green), indicating a lack of momentum to push prices higher.

CADUSD is moving lower, with the next stop at CADUSD = 0.7329534