Is This the Start of a New Gold Bull Run?News that must be paid attention to:

1. The Middle East region is in constant conflict and the situation is unstable, which may re-stimulate the market's risk aversion sentiment;

2. Trump strongly called for a rate cut, and many Fed directors agreed to the rate cut. Under the situation of internal and external troubles, can Powell withstand the pressure of rate cuts? In addition, the tense relationship between Trump and Powell, as well as the development of Powell's dismissal storm, have increased the market's risk aversion demand and enhanced the market's bullish sentiment;

3. The uncertainty brought about by the tariff issue may disrupt the market.

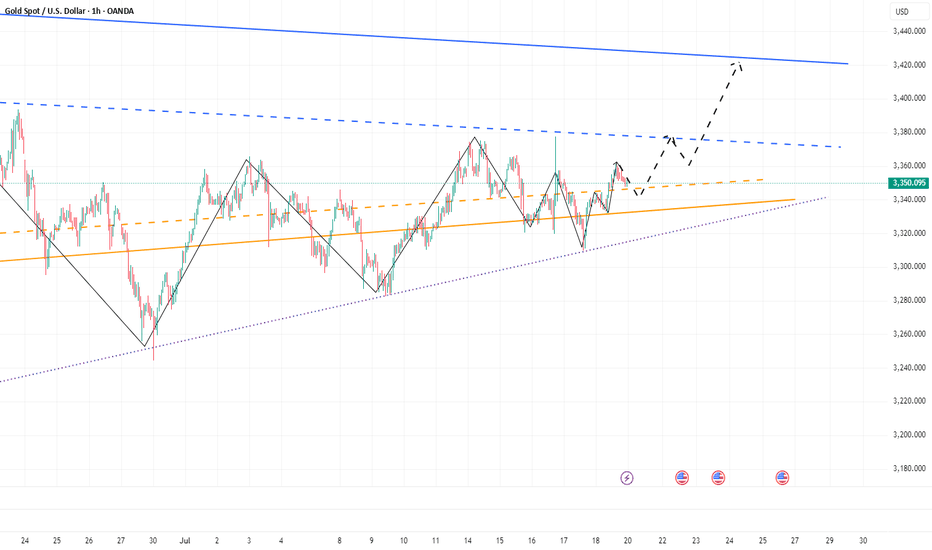

Technical aspects:

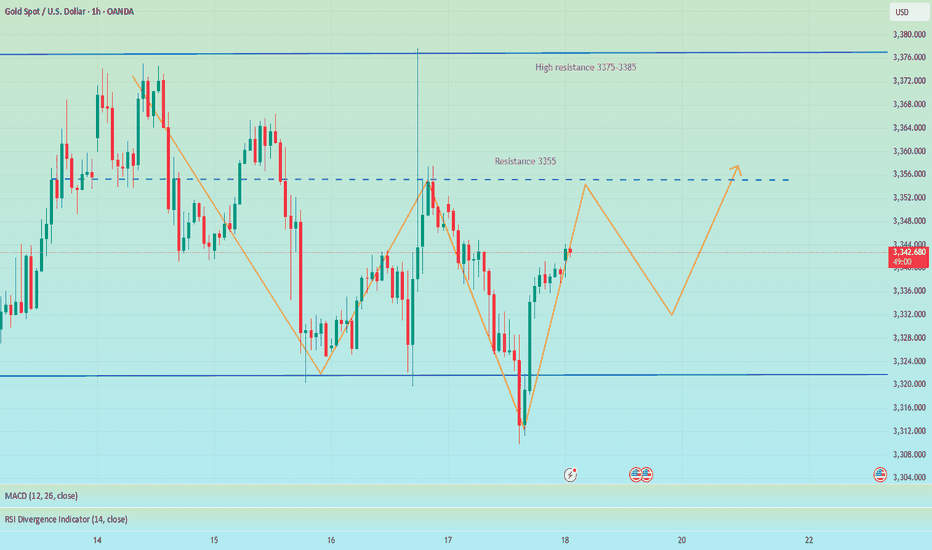

This week, the gold market is roughly a bottoming out and rebounding trend. We can clearly see from the recent candle chart that the recent trend line suppression is located near 3380, and this week gold has repeatedly encountered resistance and fallen in the 3375-3380 area, which has strengthened the suppression effect of resistance in this area to a certain extent; and gold has repeatedly tested the 3320-3310 area support during the retracement process. Gold has not fallen below the support of this area during multiple retracements, giving the market bulls great confidence.

On Friday, gold hit 3360 during the rebound and closed above 3350, which is strong in the short term. As gold continues to rebound, the current bull-bear dividing line is in the 3345-3335 area. If gold cannot even fall below the 3345-3335 area during the retracement next week, it will greatly boost buying power and is expected to hit the 3380 area again. Once gold breaks through the 3380 area during the rise, there will be a chance to further continue the rise and test 3400, or even the 3420 area.

Therefore, at the beginning of next week, if gold retreats to the 3345-3335 area for the first time, I think we must make an attempt to buy gold, first focusing on the target 3370-3380 area, and then bullish to the 3400-3420 area after a strong breakthrough.

Candlestick Analysis

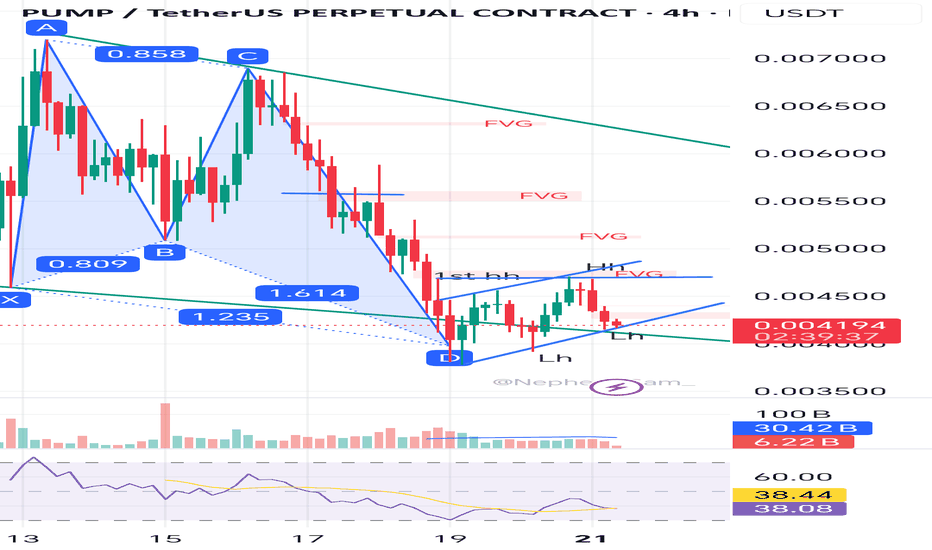

Bullish harmonic but with hidden rising flagThis is mine 2nd post this counter.

Pump just done a higher high and retest created a lower high.

But ytd higher high is not strong, it is in rising flag or rising wedge channel. Might have potential continuation pattern to go Down.. Currently it is still in downtrend anyway.

Still Not an A+ setup in this moment. He needs more times to prove himself.

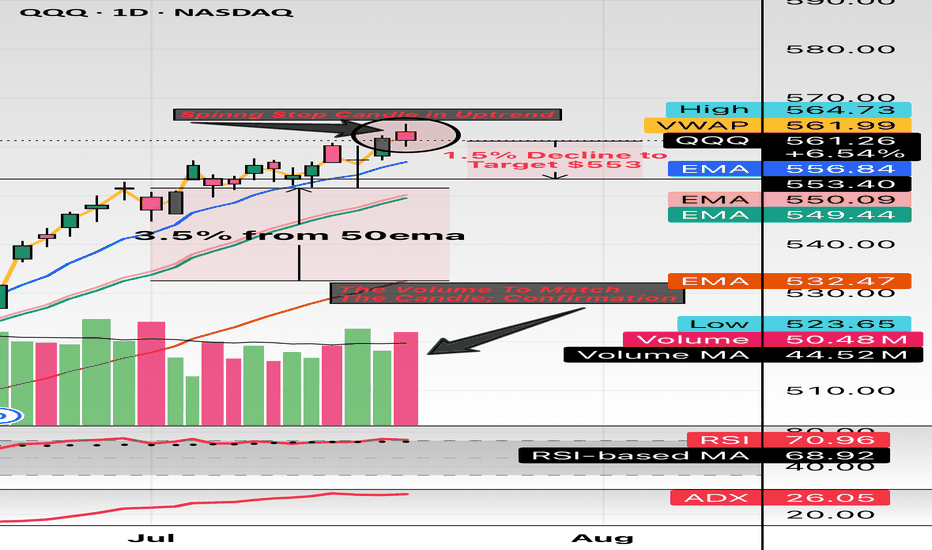

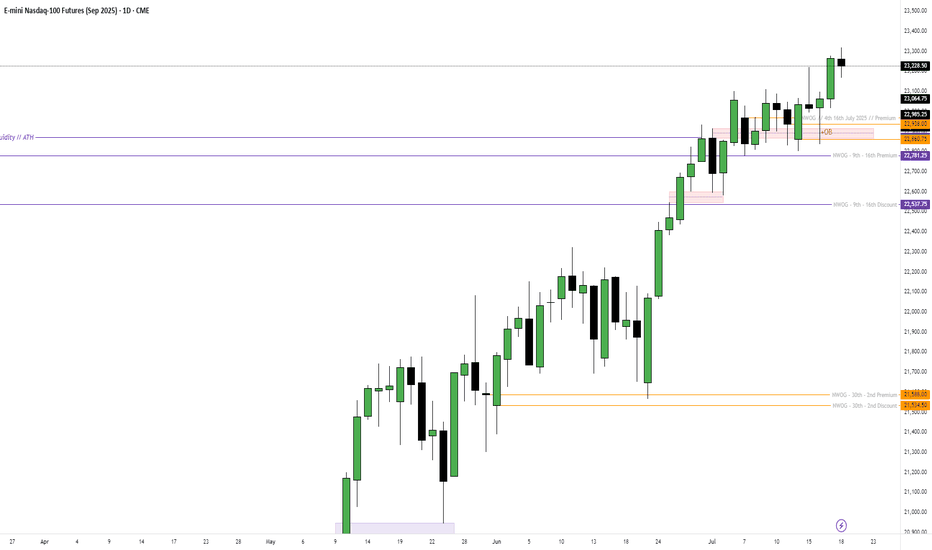

$QQQ this might the spot. Hello and good night, evening, afternoon, or morning wherever you may be. I have been looking at names all day and I wanted to check the indexes: NASDAQ:QQQ and $SPY.

Here we have the indexes up almost 30% from the April lows and sitting about 10% YTD. The candle highlighted is the spinning stop candle and has volume to match. These candles usually take place (green or red) in downtrends or uptrends and provide pivotal indication. The market has major earnings this week (07/21/2025 to 07/25/2025) with names like Google, Tesla, General Dynamics, Verizon, Domino’s And so forth.

This week could be a catalyst to see some great volatility. I believe staying 3% from moving averages so I have noted 3.5% from the 50EMA and revisiting the 20EMA and 21EMA in the low $550 area. My target is $553 which is only a 1.4% move which can happen in one session in this environment while staying 3.5% above the 50EMA.

My trade idea will be $553p for 07/25/2025. Good luck!

WSL

Monday market forecast, pay attention to the 3339 retracement📰 News information:

1. The Trump administration puts pressure on the Federal Reserve to cut interest rates

2. The continued impact of tariffs and the responses of various countries

📈 Technical Analysis:

This week's basic judgment and forecast on the gold market trend were consistent, but on Friday, the overall gold fluctuations were not large. The overall trend of the daily line fluctuated around 3345, and the 3345 line also became a short-term long-short watershed. Although prices are likely to rise more easily than fall in the short term, it should be noted that the three-month adjustment cycle is coming to an end while the fundamentals of the bull market have not changed. It is recommended that you focus on preventing risks from short position operations next week. At the same time, the overall strong shock pattern, the anti-pulling momentum has not reached the top suppression position, and the area around 3339 below is the previous intensive trading area, which constitutes a certain support in the short term. If the market fails to effectively break below next week, it will greatly boost the bullish momentum, and it is not ruled out that there will be a possibility of refreshing the high point near 3380 next week.

On the whole, the short-term focus next week is the 3345-3335 area below. If it falls back to this point, you can consider arranging long orders. The short-term target is 3355-3365, and the strong trend is expected to continue to touch 3375-3385.

🎯 Trading Points:

BUY 3345-3335

TP 3355-3365-3375-3385

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, confronting your mistakes, and strictly disciplining yourself. I hope my analysis can help you🌐.

TVC:GOLD PEPPERSTONE:XAUUSD FOREXCOM:XAUUSD FX:XAUUSD OANDA:XAUUSD FXOPEN:XAUUSD

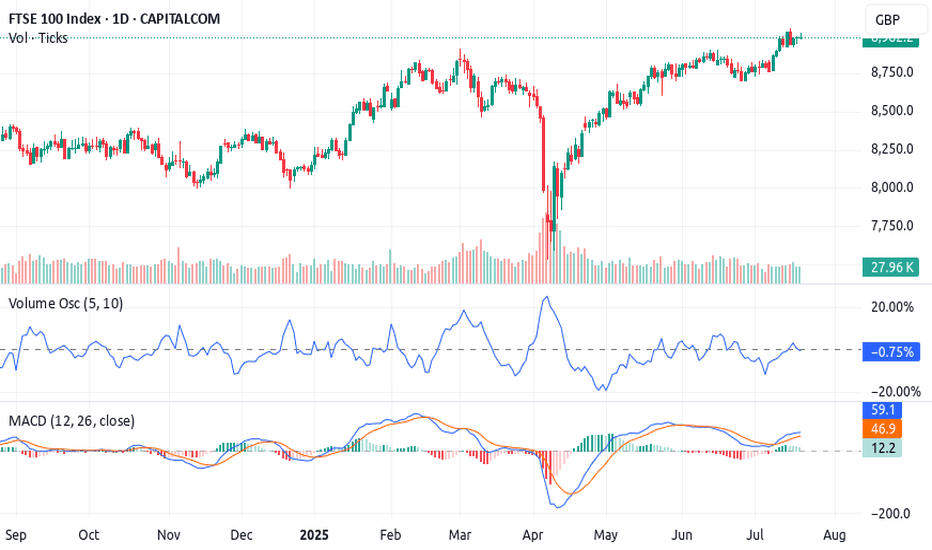

The 3-Step Rocket Booster Strategy – UK100 Bullish Breakout 🚀 The 3-Step Rocket Booster Strategy – UK100 Bullish Breakout Brewing

The UK100 Index is currently aligning perfectly with a high-probability setup I call the 3-Step Rocket Booster Strategy

— a momentum-based play designed to catch strong breakouts before the crowd reacts.

---

🔍 Strategy Breakdown:

✅ Step 1: Price above the 50 EMA

This signals short-term bullish momentum. The UK100 has cleared the 50 EMA decisively, with candles holding strong above it — suggesting buyers are stepping in aggressively.

✅ Step 2: Price above the 200 EMA

Now we’ve got long-term trend confirmation. The index is trending above the 200 EMA, meaning bulls have full control of the higher timeframe direction.

⚠️ Step 3: The Gap-Up with Volume Confirmation

Here’s the key — the "booster". We’re watching for a gap-up move , validated by a Volume Oscillator breakout . While

price has already lifted, the volume hasn’t exploded just yet — this is the final ignition phase before liftoff.

---

📈 Technical Indicators:

MACD: Bullish crossover active — momentum building

Volume Oscillator: Starting to curve upward, hinting at upcoming volume expansion

EMAs: 50 EMA > 200 EMA = confirmed bullish structure

Support Zones : Holding cleanly above recent resistance-turned-support, adding confluence

---

🟢 Trade Insight:

We are now sitting in the perfect entry zone — price is in the pocket before volume confirms . Once volume breaks out, we could see a parabolic move , especially if global market sentiment remains stable.

🎯 Potential Targets :

First target: Recent high (psychological + structural level)

Second target: Measured move based on gap range extension

Risk: A close below the 50 EMA invalidates the setup

---

🔁 Summary:

This setup ticks all three boxes of the 3-Step Rocket Booster Strategy .

The smart money is positioning before the volume shows up. The UK100 is a strong bullish candidate with low-risk entry and high reward potential — don’t ignore this one .

---

📌 Disclaimer: Always use proper risk management. Trade the setup, not the emotion.Use a simulation trading account before you trade with real money

Let me know if you’re tracking this setup too 👇

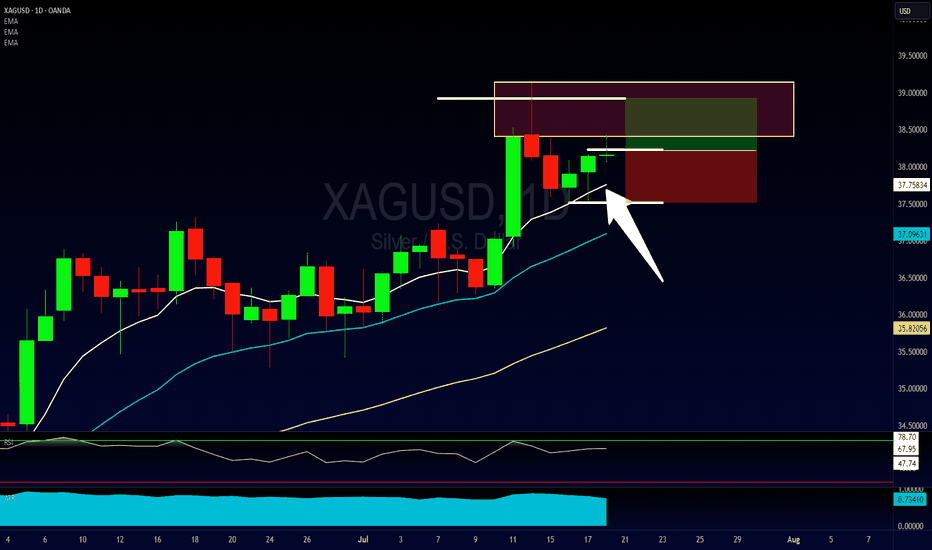

Bullish Daily Chore Strategy Entry on SilverFirst time I've spoken about this strategy here (as I don't personally trade it myself), but the "Daily Chore" is a very popular one amongst the traders I work with.

Essentially what we're looking for is for price action to be on the correct side of our 3 EMA's (8, 20 & 50), and for those EMA's to be running in the correct order.

If so, we are then looking for a pullback into the EMA's and for a pin bar rejection candles to give us a sign for entry.

This is a very difficult strategy to figure out as it requires a lot of testing and tweaks to optimize, but it also allows for a lot for freedom as it only requires a few minutes a day to check up on.

Please leave any questions or comments below and make sure to give me a follow so you don't miss my next shared trading idea.

Akil

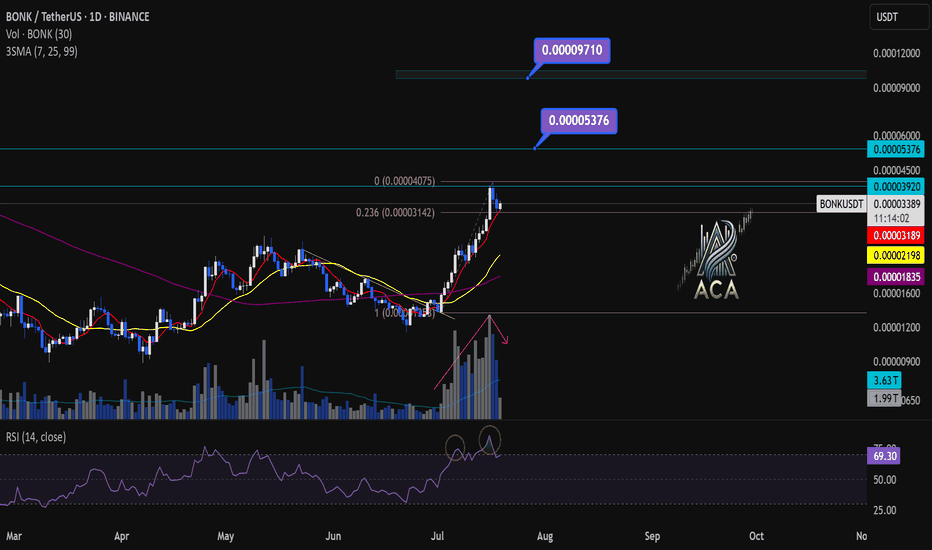

BONKUSDT 1D Chart Analysis | Bullish Momentum is coming...BONKUSDT 1D Chart Analysis | Bullish Momentum Builds After 0.236 Fibo Pullback

🔍 Let’s break down the BONK/USDT daily chart, focusing on the latest price action, strategic moving averages, RSI convergence, and volume dynamics for a complete bullish scenario setup.

⏳ Daily Overview

BONK is showing strong upward momentum, printing consecutive higher highs (HH) in both candles and RSI—a clear bullish trend indicator. After an explosive move, price is currently staging a healthy pullback to the key 0.236 Fibonacci retracement level (0.00003142), which commonly acts as a support platform during aggressive uptrends.

📈 Technical Convergence and Trend Structure

- 3SMA Support: The 7, 25, and 99 SMAs are all trending upward and stacked correctly, with price sitting comfortably above them. The 7SMA acts as immediate dynamic support, reflecting trend strength and buyer interest at every dip.

- RSI Dynamics: RSI just bounced from the 69–70 zone, confirming convergence with price action. The indicator made its own higher high in tandem with the candles, and now, as price pulls back, RSI is reentering the overbought territory—which often precedes renewed momentum.

- Volume Confirmation: Notably, volume surged as the trend accelerated, and is now tapering off during this corrective phase. This is a classic bullish volume signature, showing profit-taking by early longs but no major selling pressure, suggesting trend continuation likely after consolidation.

🔺 Bullish Setup & Targets

- First target: 0.00005376 — retest of the last all-time high (ATH).

- Next resistance to watch: 0.00003920, followed by the ATH region.

- Long-term target: 0.00009710 — an upside of 170–180% from current levels, mapped by technical extension and price discovery zones.

📊 Key Highlights

- Price holding the 0.236 Fibo retracement signals a shallow, healthy correction.

- 3SMA alignment confirms long-term bullish bias—actively supporting every dip.

- RSI and price are convergent, reaffirming uptrend strength; RSI’s move back into overbought could ignite the next price surge.

- Volume decreasing on corrections and rising during rallies—bullish confirmation.

🚨 Conclusion

BONK/USDT remains technically poised for further upside. The blend of higher highs, support at the 0.236 Fibonacci retracement, positive 3SMA structure, and RSI convergence all point to bullish continuation. Watch for renewed momentum as RSI reenters overbought territory and volume confirms the next breakout. Next targets: 0.00005376 (ATH), with a long-term projection toward 0.00009710.

BTCUSDT BTC/USDT (Bitcoin):

Trend: Strong uptrend.

Current Conditions: Price is near key resistance around $117,000-$121,000 after a sharp rise.

Entry Recommendation: Entry is not recommended at this time. It is better to wait for a correction to the previous support area (e.g., $109,000-$111,000 or $105,000-$108,000) and look for confirmation of a bullish reversal. Entry at current levels is high risk due to the potential for a correction.

Cryptocurrency Futures Market Disclaimer 🚨🚨🚨

Trading cryptocurrency futures involves high risks and is not suitable for all investors.

Cryptocurrency prices are highly volatile, which can lead to significant gains or losses in a short period.

Before engaging in crypto futures trading, consider your risk tolerance, experience, and financial situation.

Risk of Loss: You may lose more than your initial capital due to the leveraged nature of futures. You are fully responsible for any losses incurred.

Market Volatility: Crypto prices can fluctuate significantly due to factors such as market sentiment, regulations, or unforeseen events.

Leverage Risk: The use of leverage can amplify profits but also increases the risk of total loss.

Regulatory Uncertainty: Regulations related to cryptocurrencies vary by jurisdiction and may change, affecting the value or legality of trading.

Technical Risks: Platform disruptions, hacking, or technical issues may result in losses.

This information is not financial, investment, or trading advice. Consult a professional financial advisor before making decisions. We are not liable for any losses or damages arising from cryptocurrency futures trading.

Note: Ensure compliance with local regulations regarding cryptocurrency trading in your region.

thanks for like and follow @ydnldn to have more information outlook and free signal.

About me :

"I am a passionate swing trader focused on analyzing financial markets to capture profit opportunities from medium-term price movements. With a disciplined approach and in-depth technical analysis, I concentrate on identifying trends, support-resistance levels, and price patterns to make informed trading decisions. I prioritize strict risk management to protect capital while maximizing profit potential. Always learning and adapting to market dynamics, I enjoy the process of refining strategies to achieve consistency in trading."

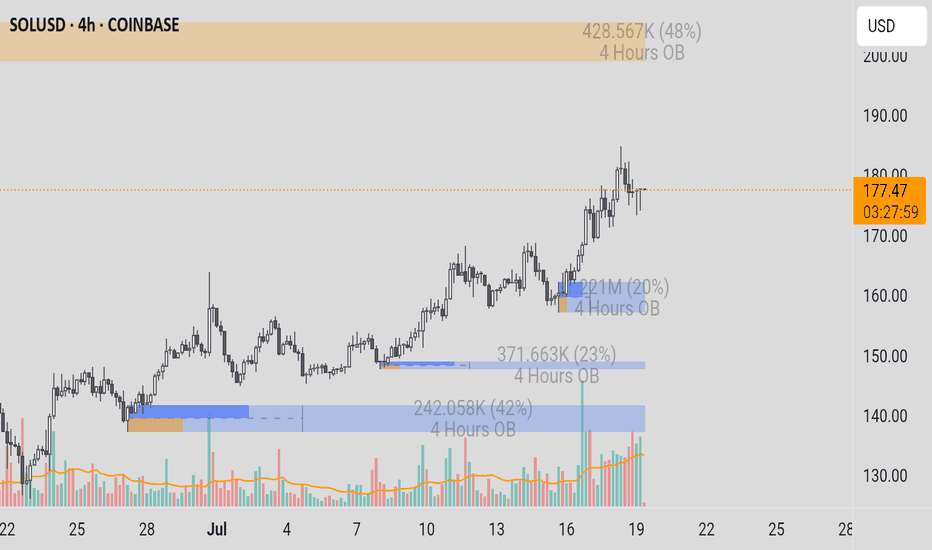

SOLUSDTSOL/USD (Solana):

○ Trend: Very strong uptrend (exponential increase).

○ Current Conditions: Price has reached a new high above $180 after a very rapid and significant rise.

○ Entry Recommendation: Entry is strongly discouraged at this time. The risk of a deep correction is very high. Ideally, wait for a significant correction to a strong support area (e.g., $158-$162 or $148-$152) and look for a bullish reversal signal.

Cryptocurrency Futures Market Disclaimer 🚨🚨🚨

Trading cryptocurrency futures involves high risks and is not suitable for all investors.

Cryptocurrency prices are highly volatile, which can lead to significant gains or losses in a short period.

Before engaging in crypto futures trading, consider your risk tolerance, experience, and financial situation.

Risk of Loss: You may lose more than your initial capital due to the leveraged nature of futures. You are fully responsible for any losses incurred.

Market Volatility: Crypto prices can fluctuate significantly due to factors such as market sentiment, regulations, or unforeseen events.

Leverage Risk: The use of leverage can amplify profits but also increases the risk of total loss.

Regulatory Uncertainty: Regulations related to cryptocurrencies vary by jurisdiction and may change, affecting the value or legality of trading.

Technical Risks: Platform disruptions, hacking, or technical issues may result in losses.

This information is not financial, investment, or trading advice. Consult a professional financial advisor before making decisions. We are not liable for any losses or damages arising from cryptocurrency futures trading.

Note: Ensure compliance with local regulations regarding cryptocurrency trading in your region.

thanks for like and follow @ydnldn to have more information outlook and free signal.

About me :

"I am a passionate swing trader focused on analyzing financial markets to capture profit opportunities from medium-term price movements. With a disciplined approach and in-depth technical analysis, I concentrate on identifying trends, support-resistance levels, and price patterns to make informed trading decisions. I prioritize strict risk management to protect capital while maximizing profit potential. Always learning and adapting to market dynamics, I enjoy the process of refining strategies to achieve consistency in trading."

SANDUSDTSAND/USDT (The Sandbox):

○ Trend: Strong uptrend.

○ Current Condition: Price is consolidating around $0.32-$0.33, after reaching a high of around $0.34-$0.35, and is below significant resistance at $0.39-$0.40. Volume is decreasing during the consolidation phase.

○ Entry Recommendation: Not optimal for entry at this time. It is better to wait for the price to correct to the nearest support area ($0.29-$0.30) and look for a bullish signal from there, or wait for a clear and confirmed breakout above the resistance at $0.39-$0.40 with supportive volume.

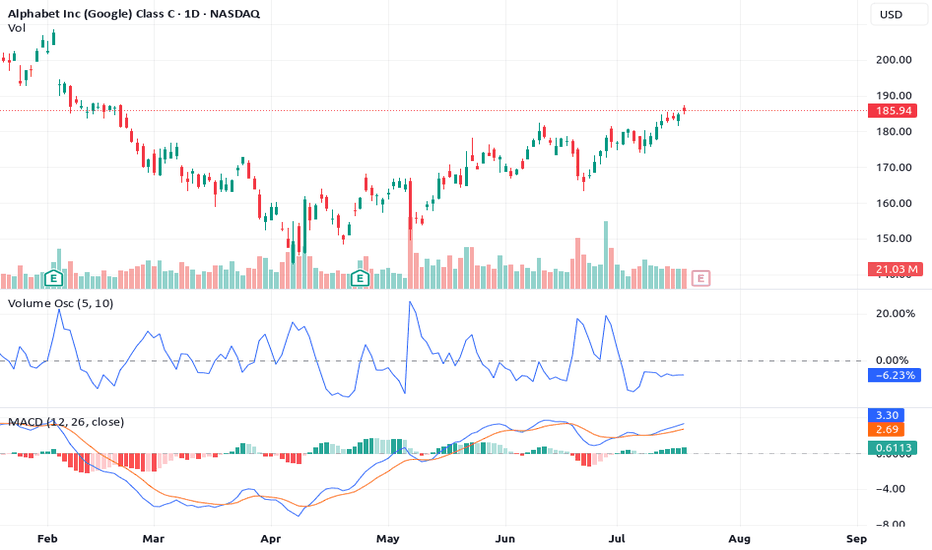

"These 3 power signals boost the 3-step rocket booster strategy"Am lubosi forex and i would like to welcome you.This is where i share with you technical analysis strategies.

I started trading in 2017 and learning about it has not been easy.My hope for you is that this channel will shape your trading journey and help you

Find a path to making money on your own terms.

In this video am showing you the rocket booster strategy

using 3 indicators and catalysts as follows:

1-Volume Oscillator

2-MACD Indicator

3-Earnings Report Catalyst

These 3 power signals boost

the 3-step rocket booster strategy

Watch this video

to learn more

Disclaimer:Trading is risky please use a simulation trading account before you trade with real money

also learn risk management and profit taking strategies.

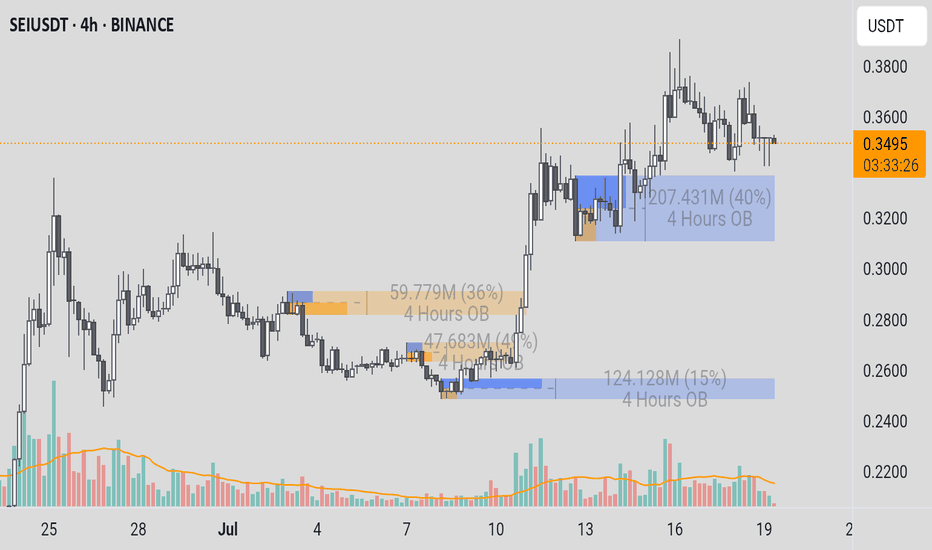

SEIUSDTSEI/USDT (SEI):

○ Trend: Strong uptrend.

○ Current Condition: Price is consolidating around $0.35, above strong Order Block support ($0.30-$0.32), but below the previous high ($0.37-$0.38). Volume appears to be decreasing during the consolidation phase.

○ Entry Recommendation: Not optimal for entry at this time. It is better to wait for a correction to Order Block support at $0.30-$0.32 and seek bullish confirmation for a safer entry, or wait for a clear breakout above $0.37-$0.38 with convincing volume.

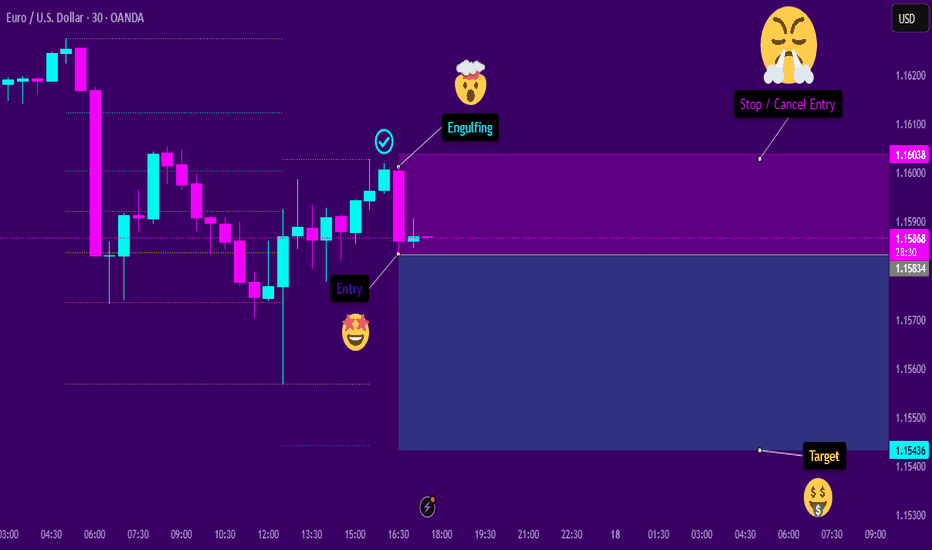

Engulfing SellThe asset shows signs of continuation in a downtrend. After a significant retracement at a favorable Fibonacci level, a bearish engulfing pattern appeared. This engulfing pattern resulted in a behavioral shift, causing the temporary pullback to resume its decline. I believe this will be the case, provided that the subsequent candlesticks confirm the entry signal.

ATM_GS : We are nearing...

Can Reliance and Banks turn Nifty around? do or die Monday. Nifty as of now has taken support at Mother line in daily chart. As expected in my Yesterday's message. So Hopefully if Big Banks Results are in line tomorrow we might see Nifty going upwards from Monday.

Mota Bhai just announced the results. EBITDA is slightly less than expected but Net Profit and Revenue is much better than Market expectation. In my view market should react positively to this result.

Supports For Nifty remain at 24932 (Mother line), 24759, 24503. As indicated earlier if we get a closing below 24503 we may see a Fall towards 24106 or 23929 (In unlikely circumstances).

Nifty Resistances remain at: 25035, 25248, 25400 and 25613 (Channel top Resistance).

Results for tomorrow

HDFC BANK

ICICIBANK

AUSMALL BANK

RBL BANK

UNION BANK

YES BANK

CENTR BANK

PUNJA BANK

CENTR BANK

So it seems like a Do or Die Monday on cards. Shadow of the candle looks neutral as of now.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

Long and short fluctuations, the market is waiting for a break📰 News information:

1. Powell responds to White House issues

2. Will other countries impose reciprocal sanctions on tariffs?

📈 Technical Analysis:

Although the MACD indicator of the gold hourly line formed a golden cross, the market reached a high of around 3361, and the RSI indicator was close to the overbought area, so we need to be cautious about corrections. From the 4H chart, the MACD second golden cross is on the zero axis. Currently, we are paying attention to the moving average SMA5 near 3343, and the SMA60 support line 3332. If the 4H upward trend falls back, we need to go long. At present, gold is still running above, and there is no good participation point in the short term, but on the whole, we should pay attention to the support of 3345-3332 below, and we can consider going long if it retreats and stabilizes. We continue to pay attention to the resistance pressure of 3375-3385 above, and we can try to go short if it does not break.

🎯 Trading Points:

SELL 3375-3385

TP 3365-3355

BUY 3345-3332

TP 3365-3375-3385

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, facing your mistakes, and exercising strict self-discipline. I share free trading strategies and analysis ideas every day for reference by brothers. I hope my analysis can help you.

FXOPEN:XAUUSD OANDA:XAUUSD FX:XAUUSD FOREXCOM:XAUUSD PEPPERSTONE:XAUUSD TVC:GOLD

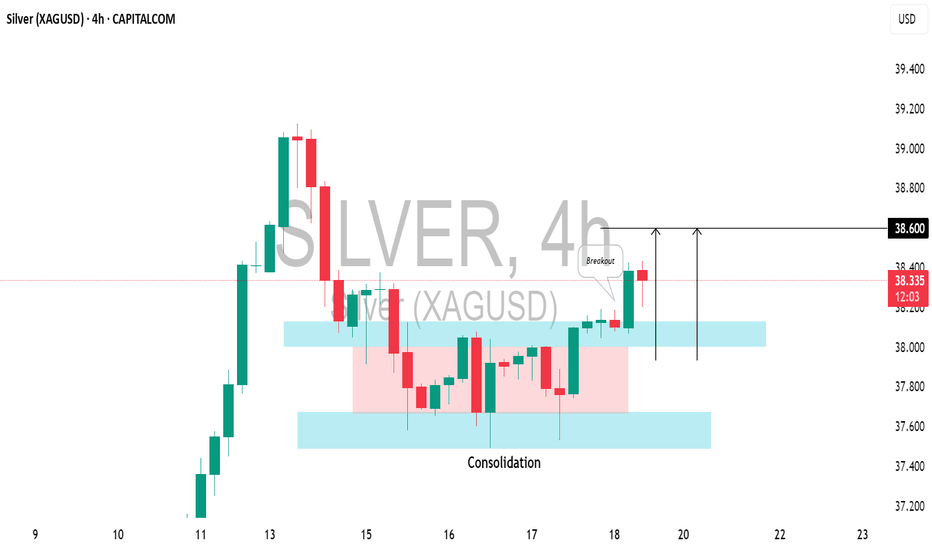

SILVER (XAGUSD): Bullish Move ConfirmedIt appears that the local correction on 📈SILVER has completed, and the pair is shifting back to a bullish trend.

Today's US economic data caused the pair to break through a resistance level within a narrow consolidation range on the 4-hour chart.

The price is expected to rise to the 38.60 level.

The short-selling idea remains unchanged, defend 3355📰 News information:

1. Powell responds to White House issues

2. Will other countries impose reciprocal sanctions on tariffs?

📈 Technical Analysis:

Gold closed with a long lower shadow on the daily line yesterday and closed with a doji on the hourly line. In the short term, gold may continue to rise and is expected to touch the 3355 line. If gold cannot break through and stabilize above 3355, then gold may fall back. We can still consider shorting, and the target can be 3330. If the trend is as expected, it may form the embryonic form of a head and shoulders bottom. On the contrary, if the gold price breaks through 3355, stop loss on short positions and pay attention to the high resistance of 3375-3385.

🎯 Trading Points:

SELL 3340-3355

TP 3330-3320

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, facing your mistakes, and exercising strict self-discipline. I share free trading strategies and analysis ideas every day for reference by brothers. I hope my analysis can help you.

TVC:GOLD PEPPERSTONE:XAUUSD FOREXCOM:XAUUSD FX:XAUUSD OANDA:XAUUSD FXOPEN:XAUUSD

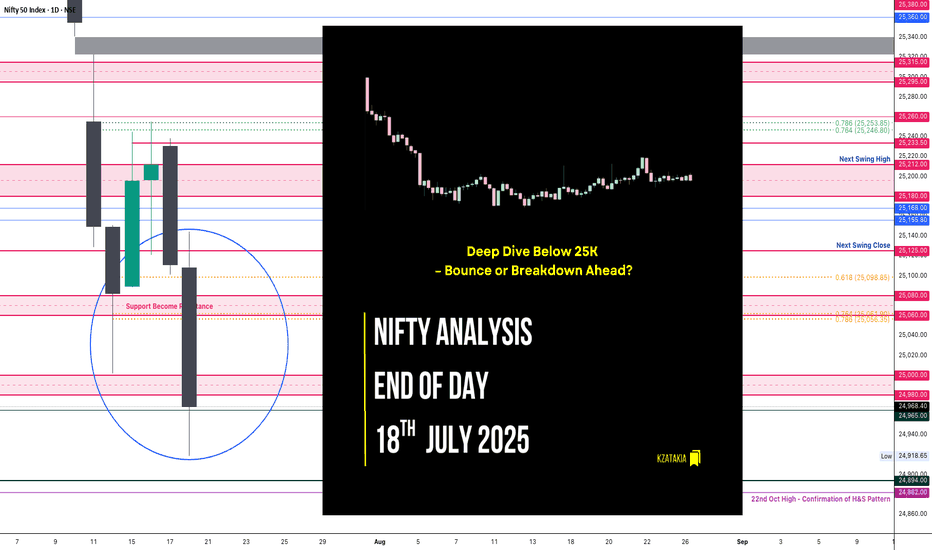

Nifty Analysis EOD – July 18, 2025 – Friday🟢 Nifty Analysis EOD – July 18, 2025 – Friday 🔴

“Deep Dive Below 25K – Bounce or Breakdown Ahead?”

As we discussed yesterday, a big move was on the cards — and Nifty delivered.

The index started flat to negative, and from the opening tick, sellers took firm control. It sharply broke through multiple key supports: PDC, PDL, S1, the important 25,080–25,060 support zone, swing low, 25,000–24,980, and even 24,965.

Buyers finally showed up near 24,920, a crucial level, and pulled off a modest 86-point recovery. The session ended at 24,968.40, still below the psychological 25,000 mark and the fractal swing low of July 14.

🕯 5 Min Time Frame Chart with Intraday Levels

🔍 Mixed Signals:

✅ Positive: Today’s low aligns with the 0.618 Fib retracement from the June 13 low to June 30 high — potential support zone.

✅ Positive: RSI(3 of 3) shows bullish divergence — early reversal sign?

❌ Negative: Closed below July 14 swing low — weak structural signal.

❌ Negative: Below 25,000 — psychological breakdown.

❓Now the big question: Will this bearish move continue, or is it a fakeout before reversal?

You're still bullish on the overall daily trend, but tactically bearish for intraday until a close above 25,125 confirms strength.

🕯 Daily Time Frame Chart For Additional View

🕯 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 25,108.55

High: 25,144.60

Low: 24,918.65

Close: 24,968.40

Change: −143.05 (−0.57%)

📊 Candle Structure Breakdown

Real Body: 140.15 pts → Large red bearish body

Upper Wick: 36.05 pts → rejection near early highs

Lower Wick: 49.75 pts → dip buying near 24,920

🔍 Interpretation

Mildly negative open with early strength attempt near 25,140

Sharp decline through major support zones

Buyers stepped in at 24,920, but recovery lacked follow-through

Close below 25K and key swing low confirms steady intraday selling pressure

🕯 Candle Type

Strong Bearish Candle with both wicks — sellers dominated, but not without some resistance from buyers at the lows.

📌 Key Insight

Short-term bearish momentum confirmed

24,920–24,890 is next critical support; breakdown may extend to 24,882–24,825

Bulls need to close above 25,125+ to reclaim control

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 181.56

IB Range: 126.45 → Medium IB

Market Structure: 🔴 Imbalanced

🟢 Trades Triggered:

09:42 AM – Short Trade → ✅ Trailed SL Hit Profit (R:R = 1 : 3.87)

📌 Support & Resistance Levels

Resistance Levels:

24,980 ~ 25,000

25,080 ~ 25,060

25,125

25,168

25,180 ~ 25,212

Support Levels:

24,965

24,894 ~ 24,882

24,825

24,800 ~ 24,768

💭 Final Thoughts

“Sometimes markets fall not to reverse, but to recharge.”

Today’s drop pierced major support zones, but the bounce from 0.618 Fib hints at possible resilience.

Structure needs clarity — Monday’s session will reveal whether this was a trap or fuel for bears.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

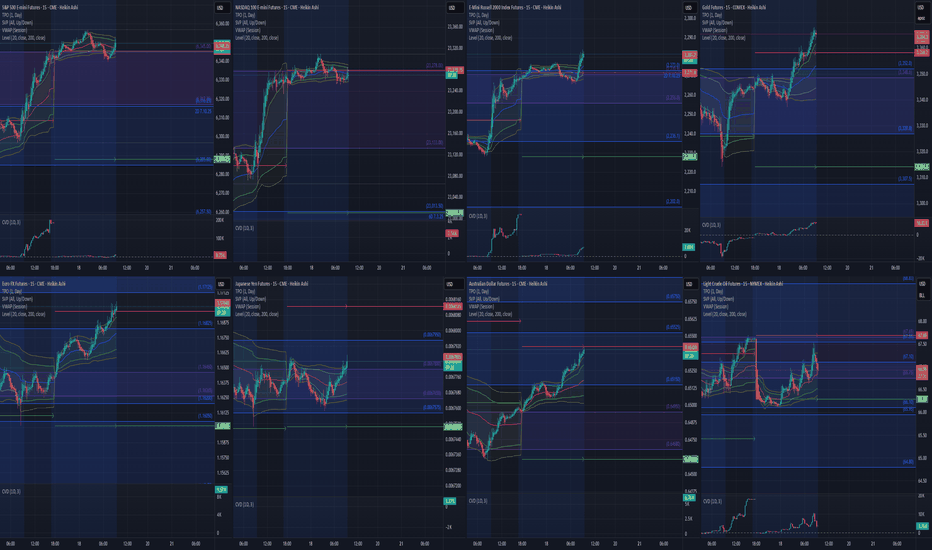

Pre-Market Prep 7.18.2025What it do, everyone! Here’s my pre-market prep for Friday, July 18th. Just to give you a quick overview, I'm using my prior value areas, the prior day's high and low, and the CVA levels from my market profile. I use all this history to help me plan my trades for the day.

So, starting with the S&P, as of now we’re green across the board. We’re in balance up from the prior day’s range, value area, and the CVA. My main plan is to look for acceptance and a pullback to a confluence area for longs. If we get rotational and break out of that area, I’m ready to go short.

For the NASDAQ, it's a similar story. We’re rotational in the prior value area and range, but we’re balanced up from the recent CVA. Right now, I’m waiting to see if we can confirm acceptance and then I’ll look for a short from that rotational area down to the prior value area low.

In the Russell, I’m seeing clear acceptance above all levels, so a pullback to the confluence area for a long would be ideal.

For Gold, I’m also seeing it in balance up on all fronts. My first move would be a long from the prior day’s high. If we drop a bit lower, I’ll be looking at that CVA and PVA area for another long.

The Euro is a bit more mixed. We’re rotational in the prior day’s range but balanced up in the value area and CVA. I want to clear the prior day’s high before taking any big moves.

The Yen is also rotational, so I’m looking to trade the extremes, maybe some scalps while we’re balanced in the prior value area.

For the Aussie Dollar, we’re in balance up from the PVA, but rotational in the prior day’s range and CVA. I’m looking for shorts near the top area and longs at the bottom, staying out of the middle for now.

And finally, Crude Oil is rotational on all fronts. My first plan is to look for shorts from the confluence area down to the prior day’s range.

That’s my pre-market prep for today. Let’s trade smart. Happy Friday, peace!

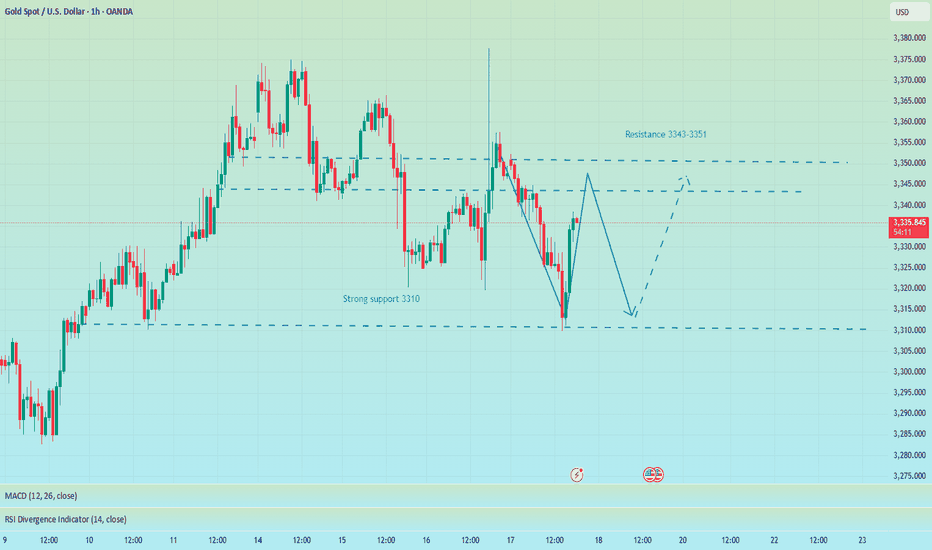

Bottom-out rebound, 3338 short orders enteredYesterday, the gold market was affected by Trump's remarks about firing Federal Reserve Chairman Powell. After briefly falling below 3320, the price quickly rose by nearly 60 points, reaching a high of 3377. Trump later clarified that the news was false, triggering a gold sell-off, and the market rose and fell. As of Thursday's European session, gold prices fell back to around 3320. After a rapid rise and fall in the US market on Wednesday, the downward trend continued on Thursday, with the US market hitting a low of 3310 before rebounding. Judging from the 4-hour chart, the Bollinger Bands failed to open downward, indicating that the current market lacks continuity and the overall market remains in a volatile pattern. In a volatile market, it is recommended to pay attention to key support and resistance levels for high-selling and low-buying operations. The upper resistance range is currently at 3343-3351, and the important watershed support level below is at 3310.

OANDA:XAUUSD