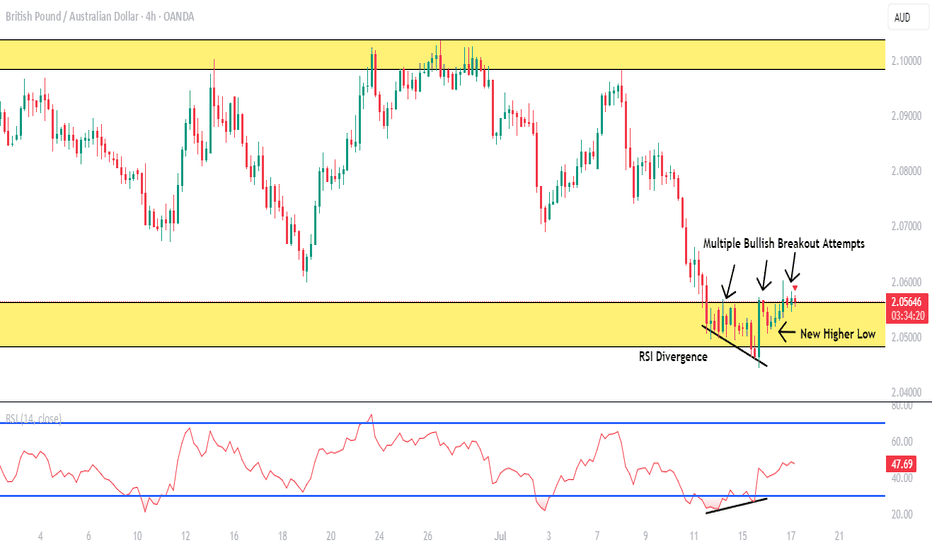

GBPAUD BUY LOW OF THE RANGE (BLSHS)Price is in 3 month trading range, price attempted breakout in either direction but failed multiple times.

In a Trading Range we Buy Low Sell High Scalp (BLSHS).

- Upper Range is at (2.10379 - 2.09843).

- Low of the Range at (2.05636 - 2.04819) where price is currently at.

- Price formed a new higher low at 2.07375 showing buyers coming.

- Price was rejected strongly at the low of the range and formed RSI Divergence at the level signaling a reversal the upside.

- AUD employment data released today at 4:30AM if negative price will breakout strongly

Stop loss below the new higher low at 2.07375 or below the setup at 2.04423.

Take profit at 2.07045 or at the top of the range at (2.10379 - 2.09843).

Candlestick Analysis

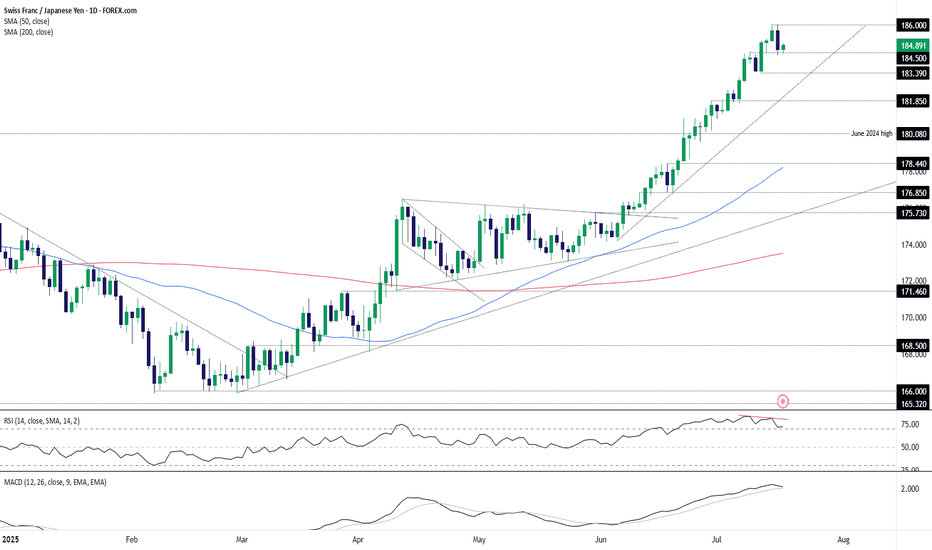

CHF/JPY Reversal brewing?Is the high-flying CHF/JPY cross about to hit an air pocket? Having printed a bearish engulfing candle on Wednesday, and with bearish divergence between RSI (14) and price while still in overbought territory, the risk of a pullback appears to be growing. MACD is also curling over towards the signal line, hinting that bullish momentum is waning.

Should the price break and hold beneath 184.50, shorts could be established with a tight stop above the level for protection. 183.39 screens as an initial target, coinciding with the low struck on July 11. If it gives way, it could open the door to a deeper unwind towards 181.85, a level that acted as both support and resistance in recent months.

If the price resumes its uptrend and takes out the current record high above 186.00, it would invalidate the near-term bearish bias.

Good luck!

DS

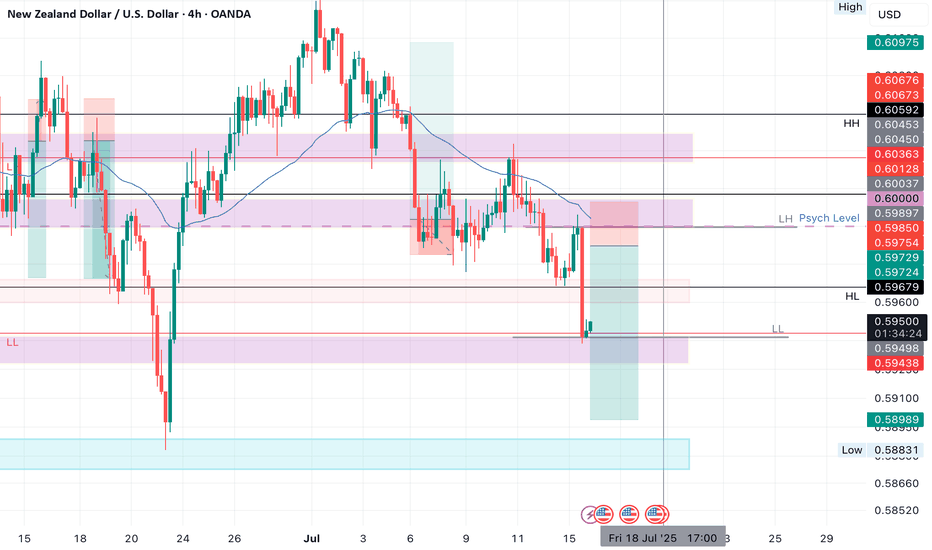

NZDUSD SHORTMarket structure bearish on HTFs DH

Entry at both Weekly and Daily AOi

Weekly Rejection at AOi

Daily Rejection at AOi

Daily EMA retest

Previous Structure point Daily

Around Psychological Level 0.60000

H4 EMA retest

H4 Candlestick rejection

Rejection from Previous structure

Levels 3.93

Entry 105%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

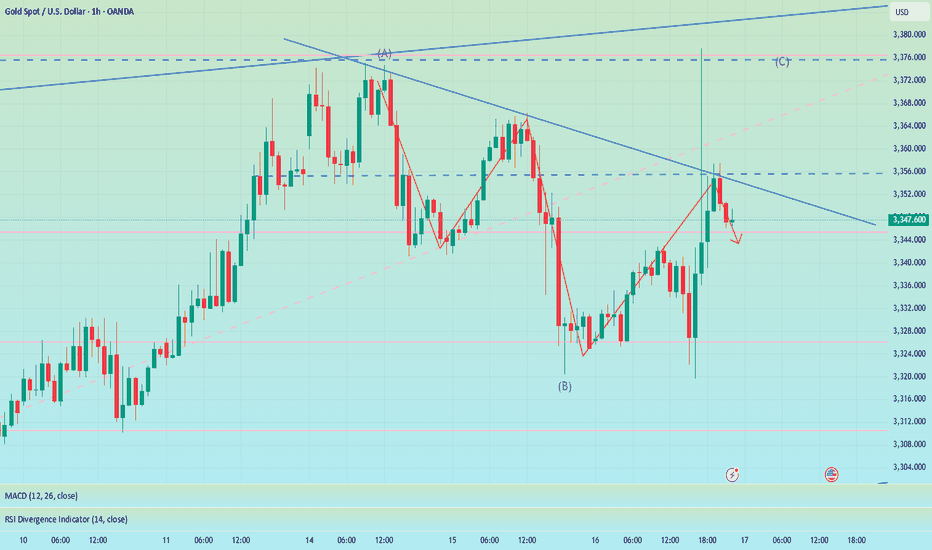

Fake news stirs up the market, market trend analysis📰 News information:

1. Beige Book of Federal Reserve's economic situation

2. European and American tariff trade negotiations

📈 Technical Analysis:

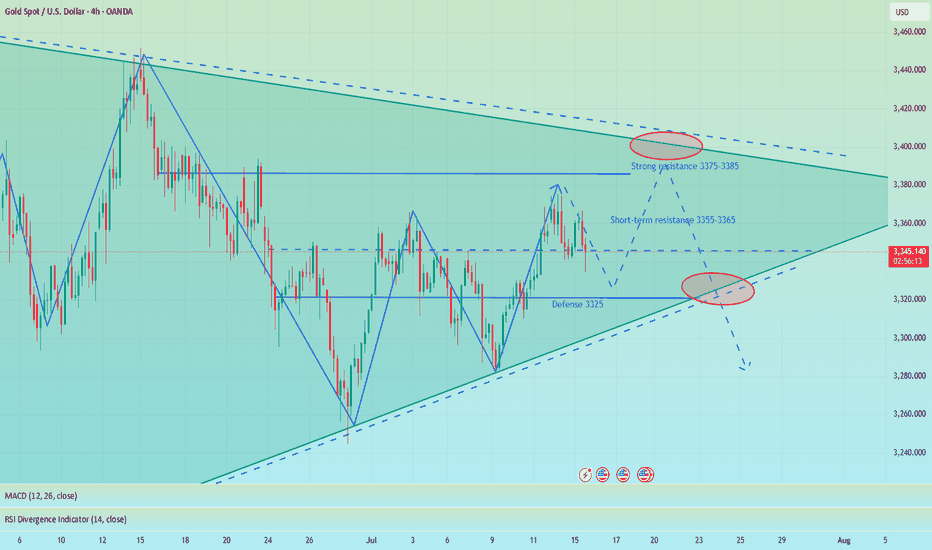

Today, our overall trading can be said to have accurately grasped the trading points, and both long and short positions have earned us good profits.The gold market surged due to Trump's intention to fire Powell. Trump then denied the plan, which dissipated the risk aversion in the gold market and the overall rhythm fell back to a volatile pattern. The current market price of gold closed with a long upper shadow line, indicating that there is a certain need for adjustment in the market. Although the news stimulus has pushed it up to 3377, we need to be vigilant against the risk of a decline after a high rise. Pay attention to today's closing. If it closes below 3345, the bearish trend may continue in the future.

OANDA:XAUUSD PEPPERSTONE:XAUUSD FOREXCOM:XAUUSD FX:XAUUSD OANDA:XAUUSD FXOPEN:XAUUSD

Falling correction, shorting in European session📰 News information:

1. Beige Book of Federal Reserve's economic situation

2. European and American tariff trade negotiations

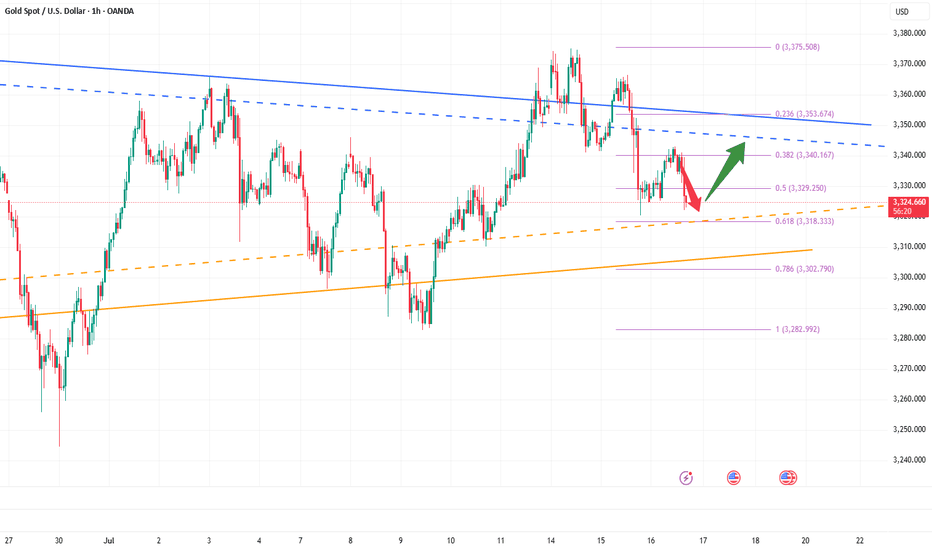

📈 Technical Analysis:

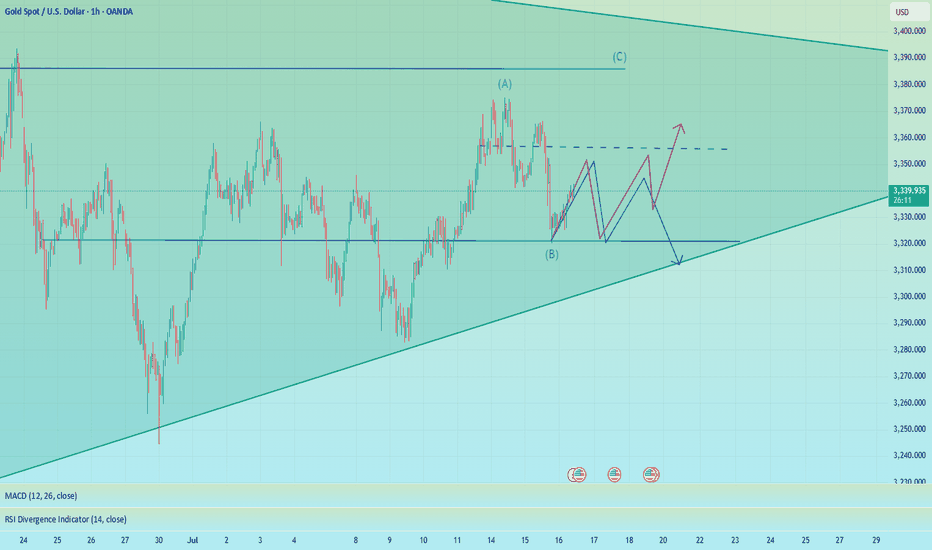

Currently, gold continues to consolidate around 3340, and the daily MACD indicator is stuck to the zero axis. Two consecutive days of negative bars also indicate that the overall trend of gold is weak and volatile. The hourly Bollinger Bands are closing, with the upper band located near 3352. The corresponding positions of the upper pressure middle band and SMA60 are basically at 3335-3350, but it is expected to gradually decline over time. On the whole, there are no particularly clear trading signals at present. Both bulls and bears have certain opportunities. It is recommended to wait and see for the time being. Pay attention to the 3342-3352 area above. If the bearish trend is confirmed in the future, you can consider shorting when it rebounds here, with the target at 3330-3325. If gold retreats directly to 3325-3320 and gains effective support again, you can consider going long.

🎯 Trading Points:

SELL 3342-3352

TP 3330-3325

BUY 3325-3320

TP 3340-3350

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, facing your mistakes, and exercising strict self-discipline. I share free trading strategies and analysis ideas every day for reference by brothers. I hope my analysis can help you.

FXOPEN:XAUUSD TVC:GOLD FX:XAUUSD FOREXCOM:XAUUSD PEPPERSTONE:XAUUSD OANDA:XAUUSD

3325–3315: Potential Bullish Reversal ZoneGold maintained a volatile trend today, but the highest intraday price only touched 3343. Overall, gold is still weak, but the bulls have not completely given up, and there is still a certain amount of energy, which limits the retracement space of gold. The current short-term support is in the 3325-3315 area. If gold cannot fall below this area in such a weak situation, the market may reach a consensus that 3325-3315 is the support area, thereby attracting a large amount of buying funds to flow into the gold market, thereby boosting gold to regain the bullish trend again and is expected to hit the 3350-3360 area.

So for short-term trading, I currently prefer to start long gold with the 3325-3315 area as support, first expecting gold to recover some of its lost ground and return to the 3350-3360 area!

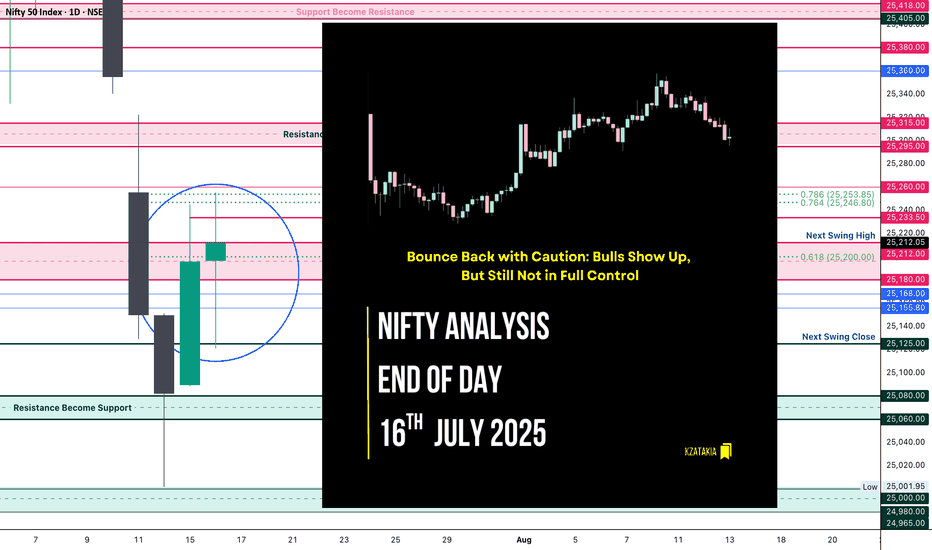

Nifty Analysis EOD – July 16, 2025 – Wednesday🟢 Nifty Analysis EOD – July 16, 2025 – Wednesday 🔴

"Bounce Back with Caution: Bulls Show Up, But Still Not in Full Control"

Nifty started the day on a flat note, but the opening candle turned out to be the day’s high, and from there, it quickly lost 91 points, marking the day’s low at 25,121 within the first hour. The early pressure gave a bearish opening tone, but bulls gradually stepped in.

Around 11:45 AM, Nifty broke above the VWAP–Day Low range, crossed the CPR zone, and then pushed toward PDH. It did make one attempt to break PDH, but failed, resulting in a slow drift downward toward VWAP and CPR into the close. The day ended at 25,212.05, nearly at CPR — a zone of indecision.

📉 The structure shows sharp reversal from the lows, but also clear hesitation near resistance zones. The session was volatile, forming a typical pre-expiry pattern with mixed sentiment. Bulls must take charge tomorrow by crossing the 25,250–25,260 zone to regain strength.

🕯 5 Min Time Frame Chart with Intraday Levels

🕯 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 25,196.60

High: 25,255.30

Low: 25,121.05

Close: 25,212.05

Change: +16.25 (+0.06%)

📊 Candle Structure Breakdown

Real Body: 15.45 points → small green body

Upper Wick: 43.25 points

Lower Wick: 75.55 points → significant downside recovery

🔍 Interpretation

Market opened flat, dropped quickly to test 25,120 zone

Strong buying emerged after initial fall

Buyers lifted the index above CPR, but failed to hold breakout above PDH

Candle closes with long lower wick → buyers defended dip, but lacked closing dominance

🕯 Candle TypeSpinning Top with Long Lower Wick — often a neutral to mildly bullish candle, suggesting buying interest at lower levels, but with uncertain momentum.

📌 Key Insight

Bulls clearly defended the 25,120–25,125 support zone

Momentum will only resume above 25,250–25,260, leading to targets around 25,300–25,315

Failure to hold 25,120 could reopen downside toward 25,000–25,050

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 180.99

IB Range: 91.20 → Medium IB

Market Structure: 🟡 Balanced

Trades Triggered

11:34 AM – Long Trade → ✅ Target Achieved, Trailed SL Hit (R:R 1:2.42)

📌 Support & Resistance Zones

Resistance Levels

25,168

25,180 ~ 25,212

25,260

25,295 ~ 25,315

Support Levels

25,125

25,080 ~ 25,060

25,000 ~ 24,980

24,965

💭 Final Thoughts

“Structure is forming — but conviction is lacking. Let expiry day bring clarity. Above 25,260 we fly, below 25,120 we fall.”

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

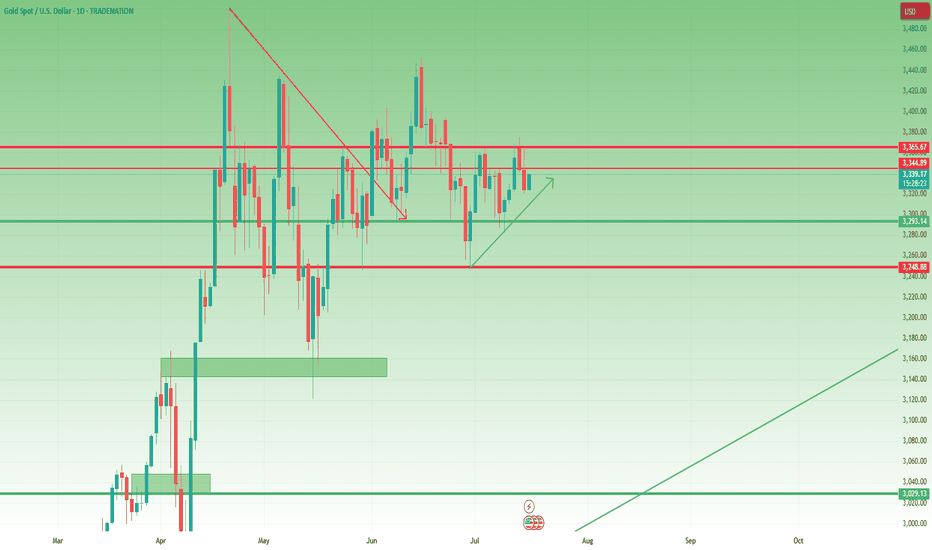

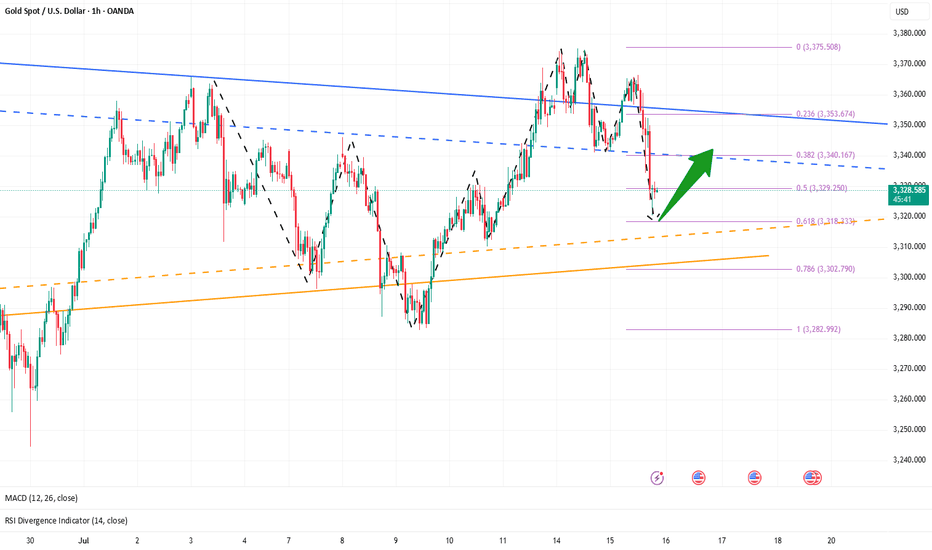

Gold – Bullish Structure Still Intact, but Bears are Knocking📉 What happened yesterday?

As expected, XAUUSD made another leg down, breaking even below my buy zone (3330–3335) and hitting a low at 3320. From there, we’re now seeing a modest rebound, with gold trading around 3333 at the time of writing.

📌 Current position:

I'm currently holding a long position. It hovers around break-even – fluctuating between small gains and small losses. Nothing solid yet.

❓ Key question:

Was this just a deep pullback within a bullish structure… or the beginning of a deeper trend reversal?

🔍 Why bulls still have a case:

• Price prints higher lows – bullish structure technically remains intact

• A clean break above 3350 would show short-term strength

• A confirmed break above 3375 would activate a bullish ascending triangle → targeting the 3450 zone

⚠️ But here's the concern:

• Yesterday’s dip to 3330 happened during the New York session (strong volume)

• The bounce from 3320 has been weak, with no follow-through

• Daily candle closed near the lows, showing a long upper wick → a classic bearish signal

• The confluence support now lies at 3310–3320. A red daily candle closing in this area could mean the medium-term trend is flipping

🎯 My trading plan:

Although I'm still holding my buy, if bulls don’t recover 3350 quickly, I will consider closing early. The break of 3310 would shift my bias bearish.

________________________________________

📌 Conclusion:

We’re in a critical zone. The bullish structure isn’t broken yet, but yesterday’s action was not encouraging. If buyers fail to reclaim control soon, the market may be preparing for a deeper correction. Stay sharp. 🚀

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Pay attention to 3320, if it falls below, go long at 3310-3300The short order has been completed and profit has been realized. Now the 1H technical indicators show that there is still room for decline in the short term. Focus on the 3320 support. If it falls below 3320, the gold price is expected to reach the 3310-3300 area, which is also an ideal trading area for intraday long positions. There is nothing much to say. Follow the wolves and you will get meat. Currently, the brothers who follow me to trade have all made good gains.

OANDA:XAUUSD

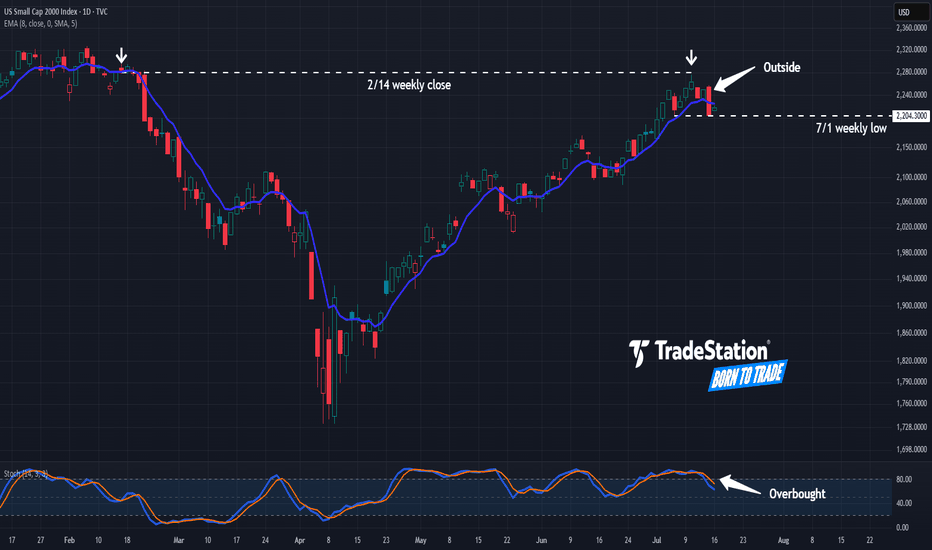

Have Small Caps Hit a Wall?The Russell 2000 has lagged the broader market for years, and now some traders may think it’s stalling again.

The first pattern on today’s chart is the February 14 weekly close of 2,280. The small cap index approached that level last Thursday but couldn’t hold. The resulting “shooting star” candlestick pattern, near a weekly level, may confirm that old resistance remains in place.

Second, RUT made a higher high yesterday and a lower low. That kind of bearish outside day is a potential reversal pattern.

Third, prices returned to a weekly low from July 1. Crossing below it could suggest support is breaking.

Fourth, stochastics are dipping from an overbought condition.

Finally, small caps are sensitive to borrowing costs. The 10-year Treasury yield has been making higher highs and higher lows on its weekly chart. Could further upside keep weighing on small caps?

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

The rebound is not a reversal, continue to shortGold showed a trend of rising and falling back and closing low on Tuesday. The highest intraday rise was 3366, and the lowest fell to 3320. The daily line recorded a medium-sized Yin line with a long upper shadow. The K-line was negative, and the closing line broke the resonance support of the middle track and the short-term moving average, suggesting that the bullish momentum has slowed down and the bears are ready to move. Today, we need to pay attention to the further downward performance of gold. From the 4H level, the price stood firm at the four-hour resistance position last Thursday, and then rebounded upward in the short term. Yesterday, the price fell below the daily support level. Currently, the short-term market is bearish, and attention is paid to the resistance in the 3340-3345 range above. In the one-hour period, the price is in short-term shock adjustment. On the whole, it will be treated as a shock decline before breaking yesterday's low, and the lower side pays attention to the 3225-3320 area support. In the short term, you can consider shorting at 3340-3350 in the European session, and look towards 3330-3320

OANDA:XAUUSD

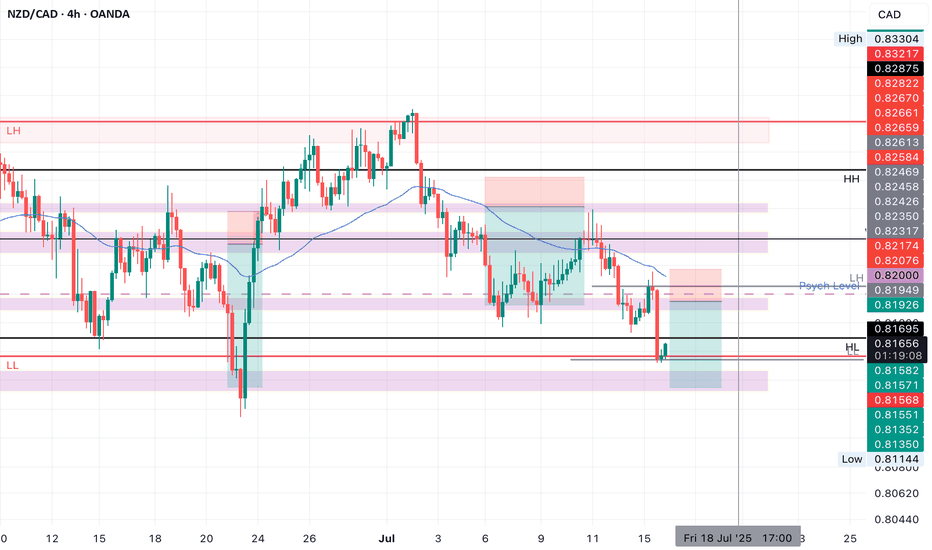

NZDCAD SHORT Market structure bearish on HTFs DH

Entry at both Weekly and Daily AOi

Weekly Rejection at AOi

Daily Rejection at AOi

Previous Structure point Daily

Around Psychological Level 0.82000

H4 EMA retest

H4 Candlestick rejection

Rejection from Previous structure

Levels 2.66

Entry 100%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

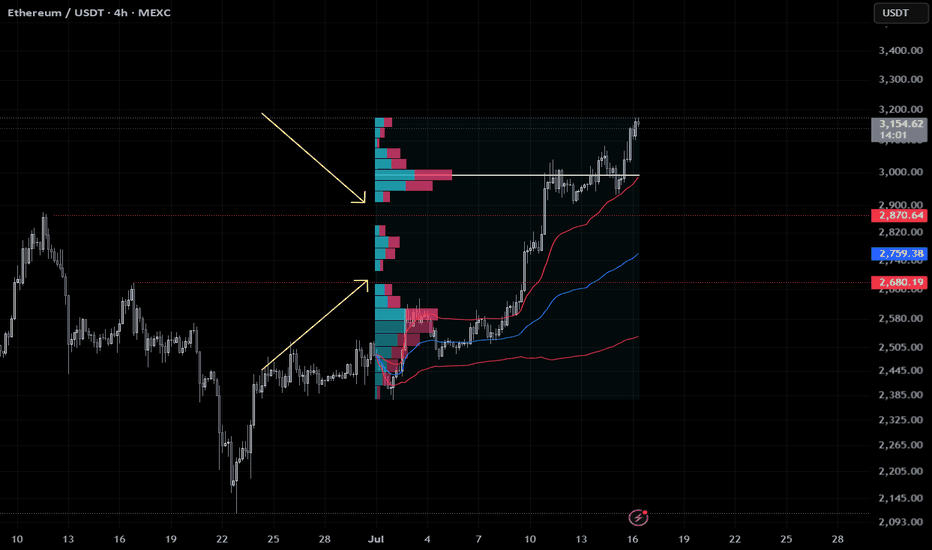

ETH Flash Crash Setup – Gaps Below to WatchEthereum broke out fast, too fast. In the process, it left two clear value gaps around $2850 and $2690 — areas where price barely traded. These usually get revisited.

I’m watching those zones for a potential flash crash setup. If we get a sharp wick down, that’s where I want to be a buyer. No chasing.

Limit orders layered in. Plan is simple:

$2850 — first tap

$2690 — full imbalance fill

Stops below $2600 if triggered

Not saying it has to happen, but if it does, I want to be ready. Mark your levels.

—

Trade safe. This is just my setup, not advice.

Long trade

15min TF

BTCUSD Perpetual – 15-Minute Chart Analysis

Key Trades Highlighted

Trade #1:

Type: Buyside trade

Entry: 114,171.5

Profit Level: 118,677.0 (+3.97%)

Stop Level: 113,635.5 (–0.47%)

Risk/Reward: 8.63

Entry Time: Thu 10th July 25, 5:15 pm (NY Session PM)

Target Reached: Fri 11th July 25, 5:30 pm

Trade Duration: ~24 hrs 15 min

Trade #2:

Type: Buyside trade

Entry: 116,411.5

Profit Level: 121,406.0 (+4.29%)

Stop Level: 115,751.0 (–0.57%)

Risk/Reward: 7.56

Entry Time: Tue 15th July 25, 11:30 am (NY Session AM)

Chart Structure & Technicals

Trend: Strong bullish impulse, minor retracement, continuation attempt.

Moving Averages:

EMA (blue): 117,873.4 (dynamic support/resistance)

WMA (yellow): 117,858.0 (price riding above, confirming bullish momentum)

Key Levels:

Resistance: 121,406 – 121,390 zone (Profit Target)

Support: 116,416 – 116,411 zone (entry confluence for current trade), 115,751 (stop)

Major Swing Low: 113,635 (protective stop on previous trade)

Volume/Orderflow Insights

Impulse up from below 114k, pausing at 121k resistance.

Volume is considered likely to increase at key support zones (116,400–116,000) and around target/profit-taking regions.

Actionable Trade Ideas

If Long:

Stay in: As long as price holds above the 116,411–116,416 support, with stops below 115,751.

Targets: 121,406 (major), consider partials at prior swing highs or if momentum stalls.

If Not In:

Re-entry Zone: Watch for bullish reaction at 116,416–116,000; enter on confirmation (engulfing, break of LTF structure).

Invalidation: Clean 15-min close below 115,751, or signs of heavy sell pressure.

If Short Bias:

Wait for a break and retest below 115,751 for a possible short to 114,700, but primary bias remains bullish above this zone.

Summary Table

Trade Direction Entry Stop Target R: R Duration Status

#1 Long 114,171.5 113,635.5 118,677.0 8.63 24h 15m Closed TP

#2 Long 116,411.5 115,751.0 121,406.0 7.56 In Progress Active trade

Outlook

Maintain bullish bias as long as 116,400 holds.

Look for trend continuation toward 121k+ on breakout.

Monitor for reversal signals if price fails to reclaim/hold above WMA or EMA.

NETC - BuyReading the NETC Monthly chart from the left to right look at that remarkably strong bullish trend (green rotated rectangles) which spanned 3 consecutive TD 1-9 Setups. That's 9 strong months of uptrend culminating in the beginning of the bearish trend with a TD Sequential 13 Sell signal at the apex, a Bearish Engulfing Pattern, and a large Doji immediately preceding the TD 1-9 Setup (red rotated rectangle) which exhausted the downward momentum, and dissipated the downward momentum with the TD Sequential 13 Buy signal (first green circle).

From the TD 13 Buy signal (first green circle) buyers created a higher high, followed by 4 consecutive red TD counts, whose bearish implications were disrupted by the strong Bull Sash pattern. I really like this spot for opening a long position. One caveat is that the Weekly TD Buy Setup is on 7/9 so the next two weeks could bring the price lower, potentially even tapping the TDST support zone, but whether that happens or not look left on the chart everywhere from my entry price and below. This is all wholesale pricing territory!

TDST up at 783 is a nice upside target just shy of the ATH traders will be gunning for.

Now on fundamentals here's where things are really nice. NETC just bought themselves the Danish IT banking company SDC (for 1 Billion DKK) which serves about 100 Nordic banks. That's going to be bringing in sticky, recurring revenues in a critical financial sector. NETC revenues are also not materially tied to the U.S., and doesn't rely on American consumer sentiment, regulatory policy, or supply chains.

Whether price falls from here or not I'm holding on to my shares until this pays off big. Maybe this is a trade for your trading temperament too.

Skeptic | XAG/USD Analysis: Precision Triggers for Spot & FutureHey everyone, it’s Skeptic! 😎 Ready to ride XAG/USD’s next wave? Let’s dive into XAG/USD (Silver) to uncover long and short triggers that can deliver solid profits. Currently trading around $ 36.31 , we’re analyzing Daily and 4-hour timeframes to pinpoint high-probability setups. Here’s the no-nonsense breakdown to keep you sharp. 📊

📈 Daily Timeframe

On the Daily timeframe, we saw a strong primary uptrend sparked by a V-pattern breakout at $ 33.68317 , which drove a 10% rally, as flagged in my previous analyses—hope you caught it! We’re now in a consolidation box, potentially acting as accumulation or distribution. Today’s candle faced a strong rejection from the box ceiling. If it closes this way in 9 hours, the odds of breaking the box floor increase significantly.

Key Supports: If the floor breaks, watch $ 34.78648 and $ 34.41291 as strong reaction zones for potential bounces.

4-Hour Timeframe (Futures Triggers)

On the 4-hour timeframe, let’s lock in long and short triggers:

Long Trigger: Break above resistance at $ 37.29163 , confirmed by RSI entering overbought. Check my RSI guide for how I optimize setups with RSI.

Short Trigger: Break below support at $ 35.59660 , with volume confirmation. Additional confirmation: RSI entering oversold.

Confirmation Timing: Choose your confirmation timeframe based on your style—4-hour, 1-hour, or even 15-minute. I typically confirm triggers on 15-minute closes for precision, but if 1-hour momentum kicks in, I use 1-hour candle closes. Focus on candle body closes, not just shadows, to avoid fakeouts.

Pro Tip: Stick to 1%–2% risk per trade for capital protection.

Final Vibe Check

This XAG/USD breakdown arms you with precise triggers: long at $37.29163, short at $35.59660, with volume and RSI as your allies. The Daily consolidation signals a big move is brewing—stay patient for the ceiling or floor break. Want more cycle-based setups or another pair? Drop it in the comments! If this analysis sharpened your edge, hit that boost—it fuels my mission! 😊 Stay disciplined, fam! ✌️

💬 Let’s Talk!

Which Silver trigger are you eyeing? Share your thoughts in the comments, and let’s crush it together!

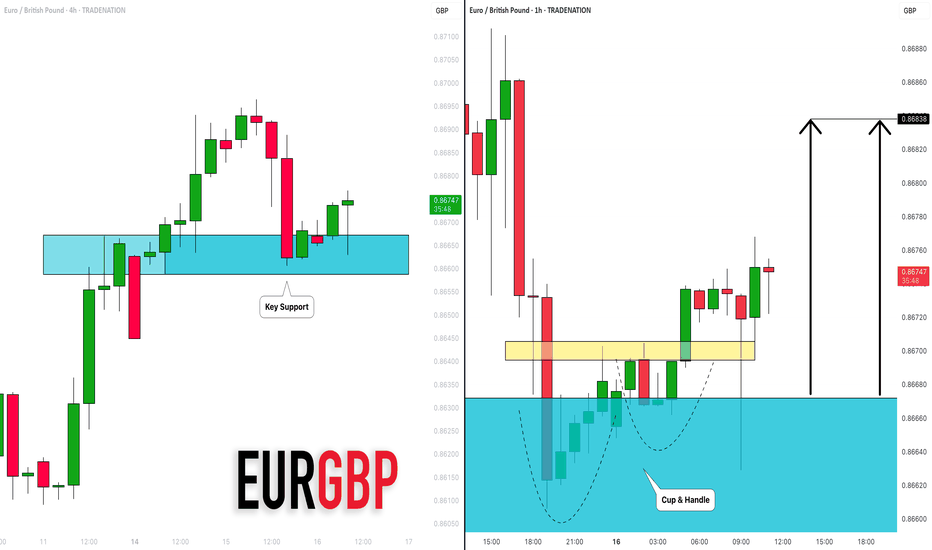

EURGBP: Bullish Move From Support Confirmed?! 🇪🇺🇬🇧

There is a high chance that EURGBP will bounce

from a key intraday horizontal support cluster.

The market looks bullish after UK CPI release this morning.

Goal - 0.8684

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

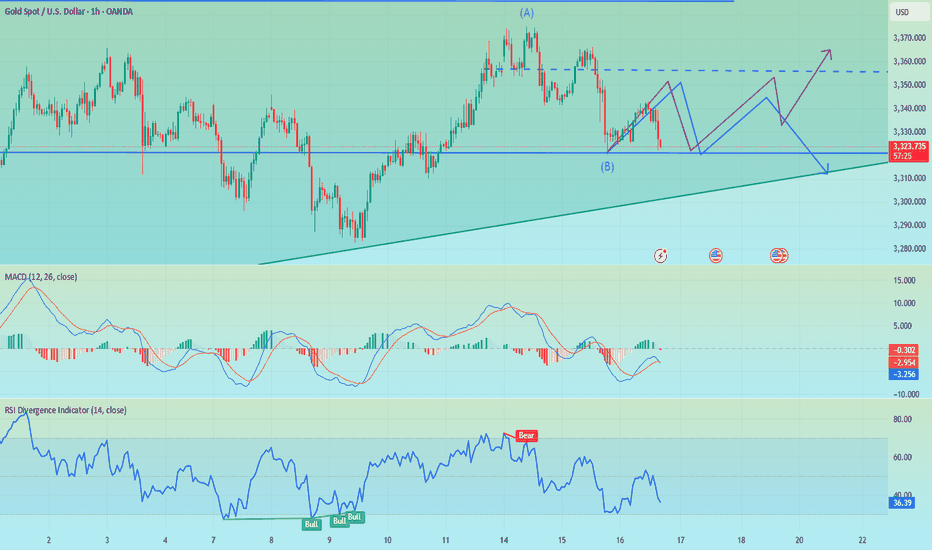

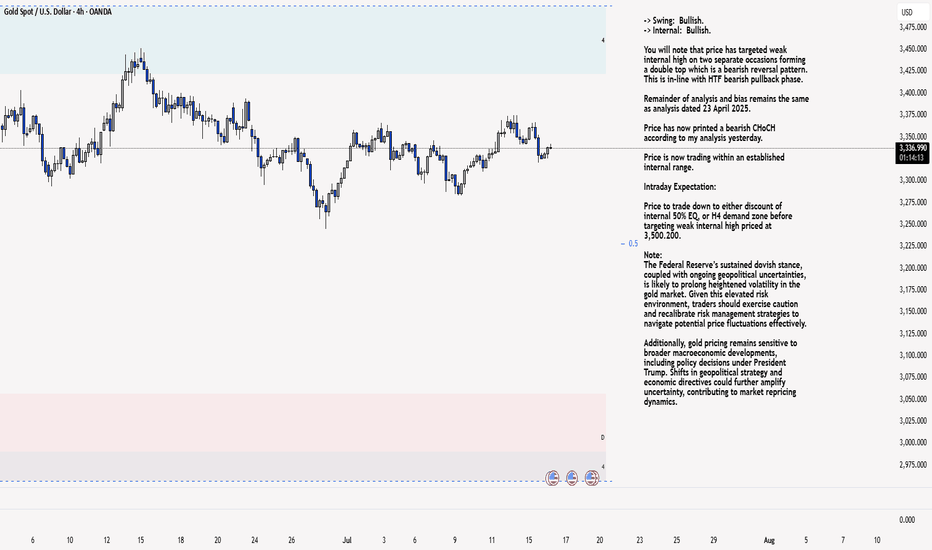

XAU/USD 16 July 2025 Intraday AnalysisH4 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

You will note that price has targeted weak internal high on two separate occasions forming a double top which is a bearish reversal pattern. This is in-line with HTF bearish pullback phase.

Remainder of analysis and bias remains the same as analysis dated 23 April 2025.

Price has now printed a bearish CHoCH according to my analysis yesterday.

Price is now trading within an established internal range.

Intraday Expectation:

Price to trade down to either discount of internal 50% EQ, or H4 demand zone before targeting weak internal high priced at 3,500.200.

Note:

The Federal Reserve’s sustained dovish stance, coupled with ongoing geopolitical uncertainties, is likely to prolong heightened volatility in the gold market. Given this elevated risk environment, traders should exercise caution and recalibrate risk management strategies to navigate potential price fluctuations effectively.

Additionally, gold pricing remains sensitive to broader macroeconomic developments, including policy decisions under President Trump. Shifts in geopolitical strategy and economic directives could further amplify uncertainty, contributing to market repricing dynamics.

H4 Chart:

M15 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

H4 Timeframe - Price has failed to target weak internal high, therefore, it would not be unrealistic if price printed a bearish iBOS.

The remainder of my analysis shall remain the same as analysis dated 13 June 2025, apart from target price.

As per my analysis dated 22 May 2025 whereby I mentioned price can be seen to be reacting at discount of 50% EQ on H4 timeframe, therefore, it is a viable alternative that price could potentially print a bullish iBOS on M15 timeframe despite internal structure being bearish.

Price has printed a bullish iBOS followed by a bearish CHoCH, which indicates, but does not confirm, bearish pullback phase initiation. I will however continue to monitor, with respect to depth of pullback.

Intraday Expectation:

Price to continue bearish, react at either M15 supply zone, or discount of 50% internal EQ before targeting weak internal high priced at 3,451.375.

Note:

Gold remains highly volatile amid the Federal Reserve's continued dovish stance, persistent and escalating geopolitical uncertainties. Traders should implement robust risk management strategies and remain vigilant, as price swings may become more pronounced in this elevated volatility environment.

Additionally, President Trump’s recent tariff announcements are expected to further amplify market turbulence, potentially triggering sharp price fluctuations and whipsaws.

M15 Chart:

Golden Support Holds — Bulls Poised for Another Leg Higher"If gold cannot break through the 3365-3375 area, gold will fall under pressure again, or refresh the recent low of 3341, and continue to the 3335-3325 area." Gold's performance today is completely in line with my expectations. Gold just retreated to a low of around 3320, but soon recovered above 3325, proving that there is strong buying support below.

From the current gold structure, the short-term support below is mainly concentrated in the 3320-3310 area. If gold slows down its downward momentum and its volatility converges when it approaches this area, then after the gold bearish sentiment is vented, a large amount of off-site wait-and-see funds will flow into the gold market to form strong buying support, thereby helping gold regain its bullish trend again, thereby starting a retaliatory rebound, or a technical repair rebound.

Therefore, for short-term trading, I still insist on trying to go long on gold in the 3330-3320 area, first expecting gold to recover some of its lost ground and return to the 3340-3350 area.

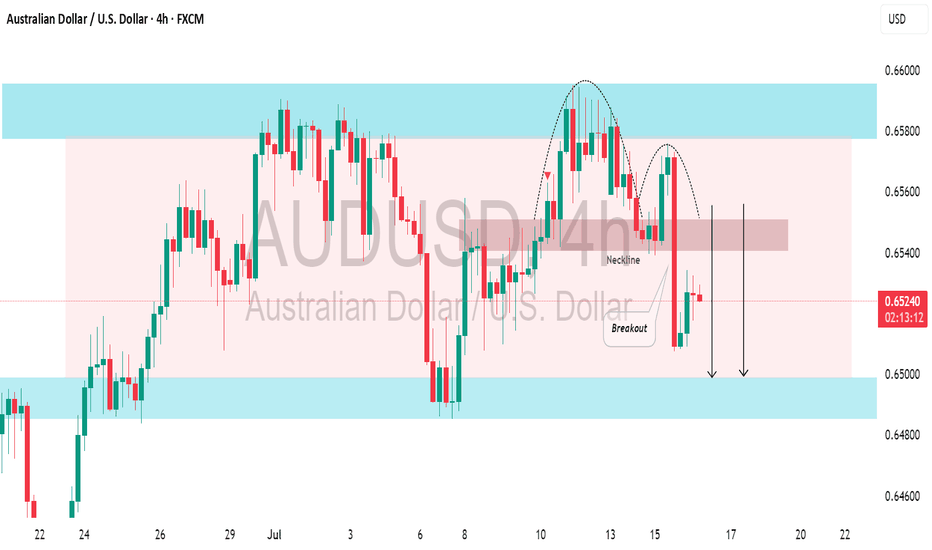

AUDUSD: Consolidation ContinuesThe AUDUSD is currently consolidating within a broad horizontal channel.

A notable bearish response to resistance has occurred, with the formation of a cup and handle pattern leading to a decline.

There is a strong likelihood that the price will soon hit the 0.6500 level.

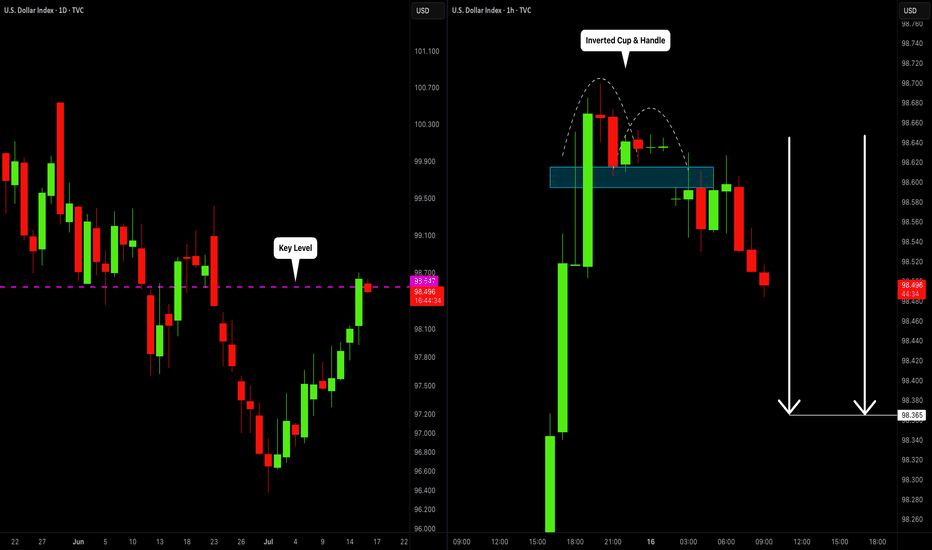

DOLLAR INDEX (DXY): Bearish Move From Key Level

I think that Dollar Index may drop from a key daily horizontal resistance level.

As a confirmation, I spotted an inverted cup & handle pattern on an hourly time frame

and a bearish violation of its neckline.

The market will most likely continue falling at least to 98.36

❤️Please, support my work with like, thank you!❤️

Public short selling profit, NY short-term multiple layoutInterest rate futures data showed that the results were in line with our previous expectations, with a lower rate cut this month and a higher probability of a 25 basis point cut in September. In the short term, gold may first take profits and then rebound. NY session trading has just begun. Bros can pay attention to the 3335-3330 area below. If it falls back and stabilizes, you can consider participating in long positions, defending 3325 and targeting 3355-3365.

OANDA:XAUUSD