Candlestickpattern

EURUSD buy zoneBuying zone on EURUSD

Yesterday we determined the buying zone on EURUSD and it remains unchanged.

We will watch if the price reaches the zone and pullback from it.

The announcement of Interest rate for USD is on Wednesday.

It is possible that before this there will be no great movements and one should not enter into trades without grounds!

It is important that all positions must have a stop and lower risk before the news!

GBPJPY - 4 HR Projection and Analysis Just a couple of options i have drawn out for GJ. There are obviously many more ways price can move here. But these are just the main couple i am anticipating.

Also note that the depths and amounts of retracements may vary - making it seem that there are way more options for price to travel but they are all pretty much the same - As long as the direction continues in the same manner and the pullbacks react at significant areas, i am not too worried.

As long as my anticipated direction and behavior reflects the actual behavior on the charts, I am not fixated on price hitting the exact numbers like 158.500 etc. I just have those as a rough guide or area.

When price hits those areas i will then readjust and re-assess my perspective and analysis. 😊

AUDJPY - 1Hr Analysis and Projection updateHey guys,

Just an update on AJ. These are a couple of the options i have drawn out as my biases. I am completely aware that price can continue bearish, and that price can also not retrace at all and continue bullish.

If I am looking to enter, I need price to retrace to either of those key levels inside the FIB and then give me confirmations. This retracement will put me in the best overall position to buy with minimal risk.

It just makes more sense for price to go long to me for a few reasons:

1. Its trending in a bullish channel - Traders are caught that these channels play out perfectly every time and to treat them the same and enter at a break and retest or whatever they are taught. This thing looks too pretty and too perfect - and i always say whenever something looks too good to be true it usually is. So, it's just accumulating liquidity at this point and its getting ready to remove everyone from the market.

2. Because of this channel - Everyone and their dog is selling from the top of it causing the overall sentiment for AJ to be bearish. Its 69% bearish at this point, so it makes so much more sense for the market to target all of these sellers first. If it still wants to drop after that and continue bearish it can - but it's definitely not going anywhere bearish until it raids liquidity and manipulates price.

3. The Daily and weekly - Like i said before look - like a perfect 'Head and shoulders' - which means its luring all the new pattern traders in and accumulating them over time. Again - If you were ever taught that a H&S means only reversals and sells, I suggest you get a lobotomy and forget that info ASAP as they are one of the biggest liquidity traps in the market. Well, if you know how to trade them, they aren't. But because of the way they are taught - they end up blowing everyone's accounts. Including mine for my first year of trading. 🙃

These are just my personal biases, and I am aware that price can do many more things - But this is the only thing that i am looking for in terms of me entering. If it does something different i will adjust my perspective and my analysis accordingly. If you are bearish or have a completely different perspective to me and your charts look totally different, do not second guess yourself because I could be the one that is wrong, and price may play out the way you want. Be confident in your analysis and your skill and don't second guess yourself.

It took me 3 years to be able to finally come on here and share my ideas because I was so easily influenced, and I would always look at other people's charts and think i was the one who was wrong and i would think i wasn't good enough to be a trader - Only to enter the other persons trade and copy their analysis and it would hit SL and price would go the way I had originally drawn out!! So just always trust in your analysis and be confident in yourself always and that is honestly a large part of this journey.

A Strong Uptrend Pattern!The daily and weekly candlesticks indicate a positive trend. Hence, a strong uptrend pattern backed by large volume confirms the uptrend movement towards the price resistance R1.

MACD indicates a positive outlook, hence, confirming the price uptrend.

Precaution for a price correction between 5%-10% from the recent price with a minimum volume being transacted.

Let's save EKOVEST in WL and watch out for significant price movement after the price correction towards R2.

R 0.435, 0.490

S 0.365

GJ - WEEKLY PROJECTIONSimilar to my previous post on the Monthly.

These are my HTF projections So obviously, there's not much detail on them but I am a swing trader and I like to project from the monthly downwards as there is a lot that is missed if you don't analyze from the monthly down in my opinion.

I have deleted the monthly fib because it clutters my chart but keeping this in mind you can see its reacted at the monthly fib and now, we are currently sitting at the weekly/daily fib to go bullish. Also - If anyone has ever told you that a 'head and shoulders pattern' is great for determining reversals, make sure you go get a lobotomy and forget it ASAP because they are one of the biggest Liquidity Raids/Price Manipulation setups you will ever find and rarely ever play out like your courses tell you.

Just like AJ - It looks too pretty and too perfect to continue as a 'Head and shoulders' into a downtrend. I would be very surprised if it did, and the only way I could ever see it doing that is if it has a massive liquidity raid and manipulates everyone out of the market before reversing and becoming bearish.

But - I never say never because anything is possible, and you have to always keep an open mind otherwise you will never make money in these markets.

At the moment - its looking like GJ is accumulating sellers because most sellers are taught to sell when they see a 'Head and shoulders'. I'm thinking it will temporarily trend bearish into the lower fib to remove liquidity first before it reverses to continue bullish after removing all buyers.

Don't forget that the weekly/monthly Fib has not been touched yet so I'm waiting for price to trend bullish to fulfill it. From there we have a few options but i will assess and adjust as the week goes on. It may trend bullish, hit the Fib and retrace to remove more liquidity and then either tank or continue bullish removing all sellers and also fill that imbalance to the left. Thats what i would like to see but it's way too early to tell.

:)

GJ - DAILY PROJECTION + ANALYSISFor me to enter i would need GJ to come down and hit the current fib and 158.500 or 157.500 to buy it up.

At 164.500 I'll need to assess what price wants to do to there because it can drop from there or it can retrace temporarily and fake everyone into selling at that fib only to continue bullish and raid everyone's stop losses. (I would if I was a bank)

This is probably my 1st choice of outcome as it just screams pure evil and hedge funds. Now as you can see - there are 2 bullish options and they both just depend on the depth of the retracement at the fib.

Basically, it depends on how pissed off the banks are on a Monday morning (today). If they feel like running everyone out of the market, they will flood the market and cause that deep retracement at about 156.500 or 157.500 or lower and THEN continue bullish.

Or they will only cause a shallow liquidity raid and let some of us live at roughly 162.500 or slightly lower and then continue bullish.

Remember - whatever I say here is not verbatim.

ANYTHING and everything can happen. I am always re assessing and readjusting my analysis's - as some of my projections will change mid-week and I'll then have a new projection depending on how price plays out and also depending on this week's news as there's a lot. (I don't trade news)

I will say this again and again - you MUST adapt to the market. Just because your projection at the beginning of the week says one thing it doesn't mean you need to stick to it just to prove to everyone on trading view and on your Instagram that you are 'right'. You will end up losing all your money and end up deleting your insta and blocking everyone.

During the week, if your analysis plays out differently to your Sunday projection so be it! Who cares if your wrong? Change it and adapt to the market conditions and be confident.

That is the difference between professional and amateur traders. There is no shame in being wrong in your analysis. What's wrong is being stubborn and wanting to always be right just to prove a point. The market doesn't give a f*ck if you are right or wrong it will just eliminate you with everyone else. The traders who adapt and evolve with the market conditions are the ones that make it and thrive. The sooner you can do that, the sooner you will make money consistently. :)

Head & Shoulders Pattern counters meThis Head and Shoulders Pattern counters my original trading bias. In case you doesn't get it, I'm having a buying bias on this AUDCAD, so the Head and Shoulders Pattern is like a kill-joy. I'll still trade the pattern once the market retest back to the level I am looking for.

However, my overall bias on AUDCAD remains Bullish.

Free 21pips to grabIf you have been following me, you would know this is not the kind of Trade I'll be sharing. But there you go. Shorting on the Red Line and Turning your shorts to long once it has a pattern confirmation on the blue like is where you get to long the same pair.

It's kind like free money, until it doesn't work.

If I have to pick a side, I will focus in looking for a Shorting opportunity, and that's because a Bearish Shark Pattern 🦈 has formed up.

EURUSD-Weekly Market Analysis-Feb23,Wk1EURUSD is on a Bullish Trend 🐮. On the Daily Trend EURUSD hit a resistance at 1.0878 as the market respect the Bearish Crab Pattern's HOP Level. If you are looking for Trend Trading Opportunity (looking to buy), I'll be looking to long at 1.0817 because the potential Bullish Shark Pattern converge with the Bullish Crab Pattern, this will attract 2 groups of buyer to engage the trade.

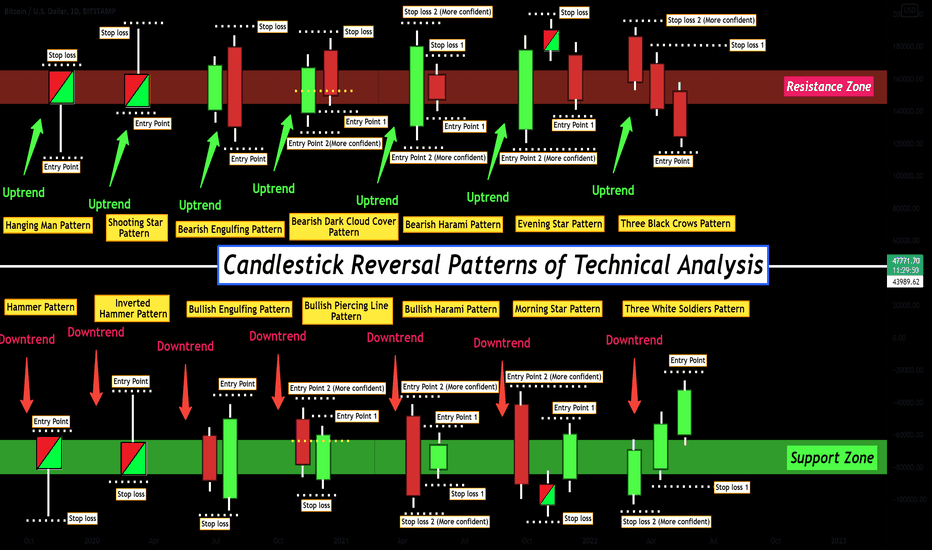

Candlestick Reversal Patterns of Technical Analysis !!!👨🏫 In this post, I tried to show you the most important Candlestick Reversal Patterns of Technical Analysis with Entry points & Stop loss points . you can use these patterns for Triggers of your traders at any timeframe ⏰ (These patterns are more valid at higher timeframes).

Please do not forget the ✅ 'like' ✅ button 🙏😊 & Share it with your friends, Thanks, and Trade safe.

What Is A Candlestick ❗️❓

A candlestick is a type of price chart used in technical analysis that displays the high, low, open, and closing prices of a security for a specific period. It originated from Japanese rice merchants and traders to track market prices and

daily momentum for hundreds of years before becoming popularized in the United States. The wide part of the candlestick is called the "real body" and tells investors whether the closing price was higher or lower than the opening price

(black/red if the stock closed lower, white/green if the stock closed higher).

Bullish Pattern 🌅:

🟢 Hammer Pattern : A hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies within the period to close near the opening price. This pattern forms a hammer-shaped candlestick, in which the lower shadow is at least twice the size of the real body. The body of the candlestick represents the difference between the open and closing prices, while the shadow shows the high and low prices for the period.

🟢 Inverted Hammer Pattern : The inverted hammer candlestick pattern (or inverse hammer) is a candlestick that appears on a chart when there is pressure from buyers to push an asset’s price up. It often appears at the bottom of a downtrend, signaling a potential bullish reversal. The inverted hammer pattern gets its name from its shape – it looks like an upside-down hammer. To identify an inverted hammer candle, look out for a long upper wick, a short lower wick, and a small body.

🟢 Bullish Engulfing Pattern : A bullish engulfing pattern is a white candlestick that closes higher than the previous day's opening after opening lower than the previous day's close. It can be identified when a small black candlestick, showing a bearish trend, is followed the next day by a large white candlestick, showing a bullish trend, the body of which completely overlaps or engulfs the body of the previous day’s candlestick. A bullish engulfing pattern may be contrasted with a bearish engulfing pattern.

🟢 Bullish Piercing Line Pattern : A piercing pattern is a two-day, candlestick price pattern that marks a potential short-term reversal from a downward trend to an upward trend. The pattern includes the first day opening near the high and closing near the low with an average or larger-sized trading range. It also includes a gap down after the first day where the second day begins trading, opening near the low and closing near the high. The close should also be a candlestick that covers at least half of the upward length of the previous day's red candlestick body.

🟢 Bullish Harami Pattern : The Bullish Harami candle pattern is a reversal pattern appearing at the bottom of a downtrend. It consists of a bearish candle with a large body, followed by a bullish candle with a small body enclosed within the body of the prior candle. As a sign of changing momentum, the small bullish candle ‘gaps’ up to open near the mid-range of the previous candle. The opposite of the Bullish Harami is the Bearish Harami and is found at the top of an uptrend.

🟢 Morning Star Pattern : A morning star is a visual pattern consisting of three candlesticks that are interpreted as bullish signs by technical analysts. A morning star forms following a downward trend and it indicates the start of an upward climb. It is a sign of a reversal in the previous price trend. Traders watch for the formation of a morning star and then seek confirmation that a reversal is indeed occurring using additional indicators.

🟢 Three White Soldiers Pattern : Three white soldiers is a bullish candlestick pattern that is used to predict the reversal of the current downtrend in a pricing chart. The pattern consists of three consecutive long-bodied candlesticks that open within the previous candle's real body and a close that exceeds the previous candle's high. These candlesticks should not have very long shadows and ideally open within the real body of the preceding candle in the pattern.

Bearish Patterns 🌄:

🔴 Hanging Man Pattern : The hanging man is a type of candlestick pattern. Candlesticks display the high, low, opening, and closing prices for a security for a specific time frame. Candlesticks reflect the impact of investors' emotions on security prices and are used by some technical traders to determine when to enter and exit trades. The term "hanging man" refers to the candle's shape and what the appearance of this pattern infers. The hanging man represents a potential reversal in an uptrend. While selling an asset solely based on a hanging man pattern is a risky proposition, many believe it's a key piece of evidence that market sentiment is beginning to turn. The strength in the uptrend is no longer there.

🔴 Shooting Star Pattern : A shooting star is a bearish candlestick with a long upper shadow, little or no lower shadow, and a small real body near the low of the day. It appears after an uptrend. Said differently, a shooting star is a type of candlestick that forms when a security opens, advances significantly, but then closes the day near the open again. For a candlestick to be considered a shooting star, the formation must appear during a price advance. Also, the distance between the highest price of the day and the opening price must be more than twice as large as the shooting star's body. There should be little to no shadow below the real body.

🔴 Bearish Engulfing Pattern : A bearish engulfing pattern is a technical chart pattern that signals lower prices to come. The pattern consists of an up (white or green) candlestick followed by a large down (black or red) candlestick that eclipses or "engulfs" the smaller up candle. The pattern can be important because it shows sellers have overtaken the buyers and are pushing the price more aggressively down (down candle) than the buyers were able to push it up (up candle).

🔴 Bearish Dark Cloud Cover Pattern : Dark Cloud Cover is a bearish reversal candlestick pattern where a down candle (typically black or red) opens above the close of the prior up candle (typically white or green), and then closes below the midpoint of the up candle. The pattern is significant as it shows a shift in the momentum from the upside to the downside. The pattern is created by an up candle followed by a down candle. Traders look for the price to continue lower on the next (third) candle. This is called confirmation.

🔴 Bearish Harami Pattern : A bearish harami is a two-bar Japanese candlestick pattern that suggests prices may soon reverse to the downside. The pattern consists of a long white candle followed by a small black candle. The opening and closing prices of the second candle must be contained within the body of the first candle. An uptrend precedes the formation of a bearish harami.

🔴 Evening Star Pattern : An evening star is a stock-price chart pattern used by technical analysts to detect when a trend is about to reverse. It is a bearish candlestick pattern consisting of three candles: a large white candlestick, a small-bodied candle, and a red candle. Evening star patterns are associated with the top of a price uptrend, signifying that the uptrend is nearing its end. The opposite of the evening star is the morning star pattern, which is viewed as a bullish indicator.

🔴 Three Black Crows Pattern : Three black crows is a phrase used to describe a bearish candlestick pattern that may predict the reversal of an uptrend. Candlestick charts show the day's opening, high, low, and closing prices for a particular security. For stocks moving higher, the candlestick is white or green. When moving lower, they are black or red. The black crow pattern consists of three consecutive long-bodied candlesticks that have opened within the real body of the previous candle and closed lower than the previous candle. Often, traders use this indicator in conjunction with other technical indicators or chart patterns as confirmation of a reversal.

Buying opportunities remains The news yesterday caused a lot of volatility and we saw some misleading moves.

The main buying idea remains, but we will look for an entry on a decline to 1.0824.

We are in a sideways movement this week and will likely continue until the interest rate announcement on February 1st.

Buying opportunities on EURUSD There have been no good opportunities over the last two days, but every drop has been fallowed by a sharp rise.

It’s more likely that we will see a continuation of the upward movement towards 1.0990.

There’s a lot of news today and we expect big fluctuations .

Upon heading towards 1,0865 we will watch for a pullback and buying opportunity.

Patience on EURUSD There is no clear opportunity on EURUSD again.

In such moments, it is very important to be patient and wait for the clear grounds for a trade.

We are watching to see if the rise will have the strength to continue or if we will see a lower top.

On the downside, the target is a breakout of the 1.0833 bottom.

We do not consider buys at current levels!

No new trades on EURUSD Yesterday we saw a new high and pullback from the resistance level at 1,0915.

There ate no grounds for new trades on these levels. That’s why we prefer to wait for better trading opportunities.

Upon another rise towards 1,0940 and pullback we will again look for selling opportunities.

When there is no reason for trade, it’s better to find another asset or not to trade at all. Sometimes this is the best choice!

We stop buying GBPUSD Last week provided good buying opportunities for GBPUSD.

This one starts with a new high and it's time to close all buy trades.

We will keep an eye out for new opportunities in the coming days.

If the movement does not have strength to higher values, it is very likely that we will see a decline to 1.2100.

However, in order to trade this move we will need confirmation!

GBPUSD - High Risk TradeWell, this is not your typical high risk trade, but this is the cliche setup that I'll shout, "High Risk, High Return!"

Let me explain why this trading setup is High Risk.

The candlestick did went beyond the PRZ, in layman term the price confirmation zone mark as red rectangle. It touches Point X but didn't violate it(close above X).

The chances of this trade get stopped out is high but the stop-loss that is base on the usual stop-loss level is much lower and this is a potential combo trade aka upsize trade. Which means more than 2 as my profit factor for this trade is 💯 true for my final target

SPX: Imminent Crash! Next Key Points to Watch.• The SPX reversed the short-term bull trend, as it lost our 21 ema in the 1h chart, failing in breaking the previous top (it did a Double Top chart pattern around the 4k);

• In addition, it lost the support we mentioned yesterday, at 3,950, indicating a sharp correction – maybe even an overreaction;

• Either way, the 3,950 is a new resistance on SPX, according to the Principle of Polarity;

• Now, it seems the index is heading to the 21 ema in the daily chart, as I mentioned yesterday (link to my previous public analysis is below this post, as usual);

• What’s more, it triggered our Shooting Star candlestick pattern, which reinforces the bearish sentiment, at least for now;

• Let’s pay attention on how it’ll react around the 21 ema in the daily chart.

Remember to follow me to keep in touch with my daily analyses!

TSLA: BULL TRAP? Pay Attention to the Most Important Support!• TSLA crashed yesterday, and it seems it wants to resume the bear trend, making the previous rally a bull trap;

• Today, TSLA is trying to lose the 21 ema in the 1h chart (pre market), and if that’s the case, we can expect more drop ahead;

• What’s more, if it loses the 21 ema in the 1h chart, it’ll lose yesterday’s low at the same time, triggering a Dark Cloud Cover pattern in the daily chart;

• The area at $123 is the next technical support level in the 1h chart: 1) previous top level; 2) 38.2% Fibonacci’s Retracement; 3) Gap level;

• Therefore, in my view, the $123 area is the most important support level. If TSLA loses it, the bearish momentum will persist, and it could easily seek the $100 again;

• In order to frustrate this bearish thesis, it must stay above the $123, and do a very good (bullish) reaction;

• I’ll keep you updated on this everyday, as usual.

Remember to follow me to keep in touch with my daily analyses!