Dollar could gain on FOMC meeting The greenback is on the offensive against major rivals on Wednesday despite the prevailing risk-on sentiment in the global financial markets amid some signs pointing to China tariff delay. Traders are fairly optimistic about the ongoing Federal Reserve policy meeting that concludes later today.

The US central bank is widely expected to deliver a non-dovish message on the economy and the outlook for its monetary policy, which would be dollar-positive. The Fed may point to the economic conditions that don’t warrant additional stimulus at this stage. As a reminder, last week’s employment data impressed the markets as the US economy created 266,000 jobs, exceeding the 180,000 estimate. Moreover, wages growth was decent and services sector remained strong last month. Against this backdrop, Powell may confirm that the regulator won’t rush to adjust its interest rates unless economic conditions materially change.

In this scenario, EURUSD could extend the retreat from local highs around 1.11 and get back below the 100-DMA which lies around 1.1060. At that, demand for gold could wane quickly, sending the bullion to the $1,458 area and lower. USDJPY will likely regain the 200-DMA around 108.80 and retarget the 1.11 handle. Also, the US CPI report could affect USD crosses in the near term. Weak numbers may temper local demand for the US currency.

Capitalmarkets

Gold bulls cautious ahead of a risk event After a dramatic plunge on Friday amid a broad-based dollar rally on upbeat US jobs data, gold prices have been making recovery attempts since the start of the week. The $1,480 area continues to serve as the key resistance area, standing on the way to the $1,500 figure.

Safe-haven demand seems to be reemerging on Tuesday as investors still don’t see any concrete progress towards at least a partial trade deal between the United States and China. Moreover, the December 15 tariffs deadline looms and this makes investors nervous. Therefore, should investor sentiment deteriorate further in the short term, the yellow metal may receive a boost and recoup at least a part of the recent losses.

On the other hand, there is a major risk event for gold this week. On Wednesday, the two-day Federal Reserve policy meeting concludes, with the outcome of the event will set the tone for the greenback and in turn for the precious metal. The selling pressure on gold could come from a possible pock up in USD demand should the US central bank express a less dovish tone on the outlook for the country’s economy and its monetary policy.

Technically, gold prices need to hold above the $1,454 figure in order to avoid deeper losses in the short term. In a positive scenario, the bullion may regain the $1,466 area and retarget the above mentioned resistance around $1,480.

EURUSD licks its wounds after a plunge EURUSD is making shallow recovery attempts on Monday, struggling to make decent gains after a sell-off witnessed amid unexpectedly strong economic data out of the United States on Friday. Payrolls surged 266,000 in November while unemployment rate declined from 3.6% to 3.5%, to the lowest level since 1969. More importantly, average hourly earnings rose by 3.1%, above +3% expected.

Spectacular figures fueled dollar demand against major currencies, sending the euro to the lows around 1.1040. On Monday, the pair sees a limited upside bias, struggling to get back above the 100-DMA around 1.1065. Interestingly, the common currency fails to see fresh gains despite decent imports and exports data from Germany. This is in part due to a mixed risk sentiment at the start of the week, as investors turned cautious again, citing lack of progress towards a partial trade deal between the US and China despite the two countries continue to signal they are moving towards a deal.

In the short term, the pair will likely continue to follow risk trends, with market focus gradually shifting to the FOMC meeting that begins on Tuesday. As rate changes are not expected, traders will closely follow the tone by the central bank. In this context, the latest employment and wages data could serve as an argument for a pause in cutting rates, as the recession risks seem to be receding.

Gold prices unsettled by trade- and OPEC-related optimism Gold prices struggled to challenge the 100-DMA earlier this week, which continues to serve as the key barrier on the way to the $1,500 psychological level. On Friday, the precious metal shows a bearish bias but stays positive in the weekly charts. Market sentiment has improved today, which caps the safe-haven gold demand amid investor optimism surrounding the potential trade deal and OPEC+ gathering.

Both China and the US continue to signal further progress towards a phase one deal. Still, there are no any details on the tariffs, which dents the upside in risky assets. Meanwhile, OPEC+ countries are discussing output cuts by additional 500,000 barrels per day, along with extension of the existing deal, which is positive for the oil market and high-yielders in general. Against this backdrop, the dollar sees the downside pressure against major rivals, which in turn curbs the bearish bias in gold prices.

In the short term, the yellow metal will likely remain under pressure amid market optimism. But the bullion may yet jump to the recent highs around $1,485 should the trade uncertainty reemerge any time soon. When and if the US and China strike an interim deal, gold could come under the selling pressure though.

AUDUSD corrects lower, 0.68 eyed The aussie turned into a corrective mode on Wednesday, after a rejection from three-week highs around 0.6860 yesterday. The recent two-day rally looks overdone, with profit-taking looking fairly attractive and reasonable at current levels, considering the prevailing risk-off sentiment in the global financial markets.

Risk aversion intensified overnight after Trump indicated a possibility of striking a trade deal with China after the 2020 election. Moreover, China vowed to retaliate against the US on Hong Kong and Xinjiang bills and highlighted that it will not set any timeline or deadline for trade deal with the United States. Against this backdrop, risky assets including the Australian dollar came under the selling pressure.

AUDUSD has been challenging the 100-DMA and looks set to test the 0.68 figure as traders have already digested yesterday’s RBA decision to keep rate on hold. The pair received a boost from the central bank’s meeting as monetary authorities showed commitment to keep its cash rate on hold and assess the effect of previous cuts.

Now, the additional downside pressure comes from the domestic economic data. The Australian economy expanded by a less-than-expected 0.4% in the third quarter, with the annual figure came in at 1.7%. Despite the result improved from the previous quarter's 10-year low, growth remained below trend.

Oil hinges on OPEC+ verdict Crude oil prices struggle to shift into a recovery mode on Tuesday after a rejection from the $62 region at the start of the week. Brent has been flirting with the $61 handle, where the 100-DMA lies. The futures struggle for direction despite a modest bullish bias amid a heightened uncertainty on the trade front and ahead of the OPEC+ meeting due later this week.

The cartel and its allies are widely expected to extend the deal and the question is if the producers will show a willingness to reduce crude output more aggressively as us shale oil production hit another all-time high last month. So far, there are no clear signs of a consensus on this issue among the alliance members, which makes oil traders nervous these days.

In the short term, market participants will focus on the US industry data out of the United States. Should the API report point to a decline in crude oil inventories, Brent could gain marginally but in general, market reaction to the release will likely be rather muted and short-lived as investors are preparing for the crucial OPEC+ meeting, with the outcome of this event will set the tone for the market in the medium term.

Technically, Brent needs to hold above the $60.30 area in the near term, with the immediate important target comes around the $62 handle. Depending on the verdict of OPEC countries, prices could easily get back below the $60 level should the alliance disappoint.

Gold struggles for a clear direction After a rally on Friday, gold prices are back under the selling pressure as risk sentiment has improved at the start of the trading week. Positive data out of China eased investor concerns over the state of the world’s second largest economy and fueled risk appetite across the board. China official manufacturing PMI came in at 50.2 in November up from 49.3 in October, to hit the highest level since March.

However, this optimism could wane quickly if there is no progress on the US-China trade front. So, the downside risks for the previous metal still look limited at this stage as risk aversion could reemerge at any moment, especially amid the speculations that the two countries may postpone the phase one deal into 2020 due to a number of issues that have yet to be resolved.

As such, gold could regain the $1,465 figure should investor sentiment deteriorate again, with the $1,450 area will continue to serve as a meaningful support for the market. In the short-term charts, the technical picture looks bearish, with prices need to get back above the 100-SMA just below $1,463 in the 4-hour timeframes to shrug off the selling pressure. Otherwise, the metal may challenge last week’s lows below $1,450, where some bids could limit the downside impetus. As there is high uncertainty on the trade front as well as ahead of the crucial OPEC+ meeting, gold will likely remain directionless in the days to come and the intraday volatility nay stay elevated.

EURUSD bears struggle to break 1.10 In a muted Black Friday session, EURUSD remain stuck in a tight range, oscillating around the 1.10 key support since the start of the week. The liquidity is fairly low due to holidays in the United States, and many traders have already left the markets on Wednesday, suggesting the consolidation will continue until the end of the day.

Despite the bearish bias prevails in the EURUSD pair, the euro bears struggle to push the prices below the mentioned hurdle. On the positive side, Eurozone inflation data came in a tad higher than expected in November, the official preliminary data showed. The core CPI rose to 1.3% versus +1.2% y/y expected. In theory, the report points to a slight rebound in inflation pressures. But the question is can the momentum keep rising next year. In other words, to derive a substantial support from this indicator, the common currency needs to see a more convincing sustainable rise in inflation.

Technically, the pair needs to hold above the 1.10 level in the short term. Otherwise, the euro will slide to the 1.0990 support zone. A break below this barrier could open the way towards the 1.0930 region. For now, the 1.0990 continues to hold the downside pressure. On the upside, the initial bullish target comes around 1.1030.

USDJPY rally stalls amid trade war escalation The USDJPY soared to highest since May on Wednesday amid a broad-based rally in risky assets fueled by positive comments from the trade front. The greenback rallied to 109.60 but the bulls were stirred by the 100- and 200-SMAs in the weekly charts. Early on Thursday, the pair shifted into a correction mode as risk appetite wanes across the board. Still, the prices stay above the 109.00 handle and remains decently higher in the weekly timeframes.

The sentiment in the global markets turned sour after Trump signed two US bills supporting Hong Kong's pro-democracy protesters. In turn, China foreign ministry said that the bills to be met with strong countermeasures. So far, there are no details on how Beijing may retaliate but it still looks like Trump’s signing of the bills will not derail a phase one trade deal, otherwise financial markets will see an aggressive sell-off across the board.

For now, risk aversion is fairly moderate, which is seen in a subdued demand for the yen and gold. Depending on further developments, USDJPY may get back below the 109.00 handle should investor sentiment deteriorate further. On the downside, the 200-DMA at 108.90 now serves as the immediate support. As long as the pair remains above this area, bearish risks are limited. Of note, US markets are closed today in observance of Thanksgiving. As such, the volatility could pick up during the day amid thin trading volumes.

Oil struggles to make gains despite trade optimism Crude oil prices shifted into a consolidation mode on Wednesday after a local rebound yesterday. Brent has settled above the $63 handle but has yet to confirm a breakout as the upside momentum looks unsustainable fragile. In the daily charts, the futures remain stuck between the 100- and 200-DMAs.

Oil market remains sensitive to trade-related headlines, with Trump’s positive comments on a so-called phase one deal providing some support to prices. On the other hand, as market dynamics shows, traders remain cautious. Also, the API data cap further bullish attempts, with the report showing a build in inventories by 3.6 million barrels last week. Now, traders are looking forward the official EIA report which could push Brent north should the results come in better than the private estimate.

In a wider picture, further direction in Brent still hinges on trade developments. As the December 15 tariff deadline looms, markets want to see a concrete progress in negotiations and striking a partial deal between the two countries. Otherwise, oil prices along with other risky assets could suffer decent losses amid concerns over the outlook for the global economy. In the short term, Brent needs to regain the $63.50 area in order to confirm a break above $63.

Gold remains in a downtrend channel but may trim losses Gold prices dipped to two-week lows on Tuesday after four days of losses. The bullion received support around the $1,451 level and bounced slightly, as investor optimism seems to be waning early in Europe. In the weekly charts, the picture remains bearish amid the lingering hopes for striking a so-called interim trade deal between the US and China.

Also, some negative pressure on the yellow metal came from Fed’s Powell speech on Monday. The central bank governor pointed to a favorable outlook on the US economy, suggesting the monetary authorities will leave rates on hold for the time being. As a reminder, gold demand picks up when rates are lower.

The precious metal remains within the downtrend channel and shows little signs of a breakout, mainly amid rising chances for a trade deal between the world’s two largest economies. In recent developments, trade negotiators from the US and China held another phone call this morning and reached consensus on how to resolve related problems.

In a knee jerk reaction, investors cheered the reports but the optimism has waned quite quickly due to a lack of details. Now, markets need to see the concrete progress on this front to stay afloat. Otherwise, some profit taking could follow which would benefit gold prices. Should risk sentiment continue to deteriorate in the short term, the bullion may regain the $1,462 area.

Further ascent in USDJPY under question After two weeks of declines, USDJPY makes bullish attempts at the start of a new trading week. The pair is now back around the 200-DMA which continues to serve as the immediate resistance zone, coming around 109.00.

Dollar demand picked up amid the renewed trade optimism after China said it will raise penalties on violations of intellectual property rights. As this issue is one of the sticking points in trade talks with the US, investors took this decision as a step towards a potential trade truce between the two countries. It remains to be seen how Trump will react to this step from Beijing, and positive signals from Washington could further boost risk sentiment in the short term.

In this scenario, USDJPY may extend gains but to show a decisive break above the mentioned moving average, the pair needs to receive a clear positive message from the United States. Otherwise, the trade uncertainty could cap investor bullishness and bring back the safe-haven demand for the Japanese yen.

Also, market focus will son shift to Fed’s Powell testimony. Should the Federal Reserve governor express a dovish tone, the greenback will come under pressure across the board, which will cap the upside bias in the pair.

EUR/USDJust received a Signal at 4pm today to go short

The white horizontal line is my entry point

At 4pm today i got the confirmed signal that the 10 ema crossed below the 20 ema on the 4 hr chart

My 1hr analysis is a fib retracement from the most recent high before the red vertical to the most recent low before the red vertical line

I am waiting for a pull back up the the 38.2 fib level

I will re adjust my fib level if the pair makes a new low

Thank you guys for following me!!!

Oil needs to confirm a breakout Brent crude extends gains for a third day in a row. Prices registered two-month highs around the $64 handle and tries not to lose the upside momentum after some consolidation during the Asian session on Friday. Now, the immediate hurdle for the market comes at the 200-DMA around $64.30.

The rally was fueled by positive comments from China. The government officials confirmed that the two countries remain in close contact and the talks are set to continue. This helped to ease market concerns over a phase one deal as mid-December tariffs looming. Also, oil traders cheered the reports that OPEC+ countries may deliver deeper production cuts next month in order to support the market.

Against this backdrop, Brent turned positive in the weekly charts and showed a spectacular recovery from recent lows. Nevertheless, the prices still remain stuck between the 100- and 200-DMAs and need a firm break above the latter to confirm a bullish breakthrough. Otherwise, a partial profit taking could follow and take the futures back below $62.40. In the near term, prices will continue to react to trade-related headlines and further positive comments from this front may help traders to push the barrel above $64.

Gold could regain upside momentum due to trade troubles Gold prices registered two-week highs above the $1,478 on Wednesday but failed to preserve gains and turned slightly negative on the day. The intraday volatility pickup in the market was due to mixed signals from the trade front which remains in market focus.

On the positive side, Trump said that they continue the trade talks with China and Beijing wants to make a deal, with White House representatives highlighted that negotiations are continuing and progress is being made on the text of the phase-one agreement. But there were also reports that the deal may not be completed this year, which caused a slight wave of risk aversion on Wall Street and lifted gold prices off daily lows.

Against the rising trade uncertainty, the precious metal could stage a more substantial ascent in the near term should investors receive a confirmation of the talks about a delay in the partial deal. The longer the markets wait, the more nervous the investors become. In this context, the bullion may receive a boost if risk off sentiment intensifies any time soon.

As such, the yellow metal could finally regain the 100-DMA which serves as the key local resistance for the last two weeks. Once above this moving average that now comes just below the $1,481 figure, the prices may retarget the $1,500 psychological level.

EURUSD still capped by the 100-DMA The EURUSD pair failed to break above the 100-DMA on several occasions and stays below this line since early-October. After four days of gains, the euro resumed the decline on Wednesday, though the downside pressure looks limited so far.

Dollar demand picked up slightly as risk sentiment turned sour after Trump threatened once again to hike tariffs against China next month should the two countries fail strike a partial trade deal by that time. In fact, there was nothing new in this warning but it served as a reminder for investors about a tight position of the US President in his trade spat with Beijing.

The subsequent safe-haven demand triggered a local rise in the greenback against high-yielding counterparts. As a result, EURUSD slipped back to the levels just above the 1.1050 intermediate support.

At the same time, dollar demand remains limited as traders switched into a wait-and-see mode ahead of the FOMC meeting minutes due later today. Should the central bank disappoint the USD bulls by its dovish tone, the euro could regain strength in the near term. However, it will hardly be enough to make a clear break above the mentioned moving averages which now comes around 1.1090.

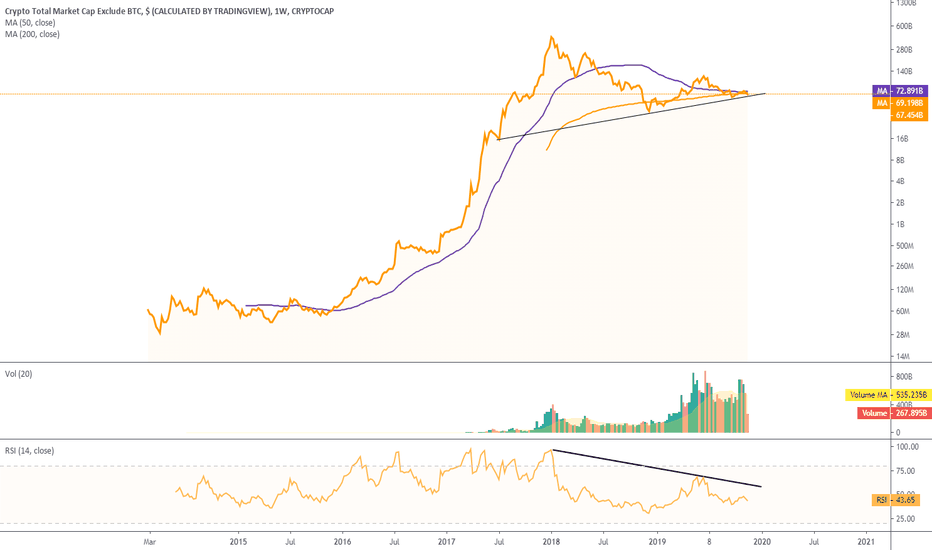

Altcoins market cap chart looks scary, more downside to comeThe market cap excluding bitcoin, aka, Altcoin, is clearly in a downside trend.

MA50 is crossing MA200 and goes down. Death cross generated.

The technical picture looks very dim.

Weekly RSI is 43.66, heading down. Until it breaks out above resistance line, I don't think it's wise to buy the dip.

Oil prices remain vulnerable amid trade uncertainty Crude oil prices failed to preserve gains and got back below the $63 handle. On Tuesday, Brent tries to hold above $62 and struggles to resume the ascent amid the lingering trade uncertainty. Moreover, the market remains vulnerable to further losses despite the futures are holding above the 100-DMA these days.

China expressed pessimism over a partial trade deal with the United States, which spooked investors and triggered risk aversion overnight. The lack of concrete progress in the negotiations between the world’s two largest economies unnerves oil traders amid the ongoing concerns over global oil demand due to further signs that the long-standing trading dispute hurts the global economy. Against this backdrop, Brent could extend the decline in the short term should Washington and Beijing fail to deliver positive updates on their discussions any time soon.

Additionally, the market feels the pressure from OPEC which shows little willingness to take additional steps to support the still unbalanced market. Besides, the US shale production continues to rise along with building inventories, which aggravates investor worries about the oversupplied market globally. As such, despite the current neutral dynamics, downside risks for Brent still prevail, at least in the short term.

Trade optimism hurts the dollar, FOMC minutes eyed The greenback is lower against its major counterparts on Monday, as positive risk sentiment amid renewed trade optimism caps the safe-haven demand for the US currency. Over the weekend, China and US officials held phone talks and discussed the final details of the first phase of a trade deal. The news fueled investor optimism at the start of the trading week but lack of details and the remaining issue of tariffs removal cap the positive sentiment.

Against this backdrop, EURUSD extends the recovery from lows below 1.10, eyeing the 100-DMA marginally below the 1.11 handle, while the immediate resistance comes around 1.1070. Despite the ongoing rally, the common currency remains vulnerable at this stage, as dollar demand could reemerge should risk sentiment turn sour. In this context, further developments on the trade front will remain in focus.

As for other events, the FOMC meeting minutes will attract market attention this week. It will be interesting to see the tone the Federal Reserve could strike amid contradictory economic signals from the US economy and the remaining uncertainty around the trade negotiations despite some progress towards a partial deal. Should the US central bank express a less dovish rhetoric on economy and monetary policy, the greenback may rally across the high-yielding currencies. In this scenario, EURUSD could lose the recovery momentum and reverse a part of recent gains.

TRUMP, BREXIT, CAPITALISM and ANCIENT ROME.Trump, Brexit, Capitalism and Ancient Rome. We’ve been there before.

It is In the light of the Trump's impeachment looming and the Brexit can being kicked further down the road that I wanted to reflect on the reasons behind the two massive 2016 events and the parallels I am seeing with Ancient Rome. The idea behind this article is that although history does not repeat itself, it does run in certain patterns.

The modern West the way we know it today, with the labor laws, human rights and liberal democratic capitalism formed as a system after WW1, or, rather after the 1917 October Revolution in Russia, which scared the rest of Europe into action. It is usually noted that the changes that were brought up were made for the working class, which is true, but in part only.

The key target of the reforms was the emerging middle class as a designed counterweight to the young Soviet proletariat project. The reason for it is that any system needs people who are interested in it for it to survive. It was the middle-class shop owner, rentier, skilled laborers, who needed the democracy, rights, the Republic, and relatively free markets too.

The case was further emphasized after WW2 when the Soviets became a symbol of a completely different alternative system, that posed mortal threat to the West and Capitalism.

With the collapse of the USSR, however, we've reached «the end of history». Capitalism, liberal democracy and all that accompanies these ideas has won. There was one global system only.

And as was the case with Ancient Rome, as soon as they defeated Carthage, the long-standing mortal enemy, a rival City that could bring to an end the entire Roman civilization, Rome immediately turned onto itself. Just as the immune system attacks its own body in the absence of external malicious substances.

Rome turned onto itself, slowly, already the strongest unrivaled force in the region, but not yet a ruler of the whole Mediterranean. As Rome grew, so did the riches of the Rich, not constrained by Rome or Italy, for both enrichment and sources of power anymore, no longer waking up at night to the nightmare of the Hannibal's hoards streaming down the slopes of the Alps.

After the last King left Rome for good, The Veii, The Samnites, The Latins and then the Great Carthage were all strong enough to put Rome to an end. So the social cohesion was strong, as any Roman identified itself with Rome in the first place, his class interest coming second.

However, after the True mortal threat was gone, the metamorphosis in the elite-people relations spilled out in the open with the Social war of the Italian cities, fighting for the same rights as the Roman citizens. The demands, that were reasonable at the very least, as the Italian cities were populated by the Romans in all but name, supplied soldiers to the armies of Rome, yet were getting increasingly smaller parts of the spoils. These demands were rejected by the Senate, fearing an influx of the Novus homo(new people) to the political scene, possibly targeting their rights as nobles, challenging their seats in the Senate.

Then, with the Gracchi Brothers, disturbing Rome for at least a generation in their fight against the oligarchs. Followed by Marius and Sulla years of Struggle, ending with the Death of the Republic at the hands of Caesar and Augustus.

The state of the Republic before its collapse was remarkably similar to the one of the modern West, but nowhere so striking as in the USA and the UK, the two empires, that styled themselves after Rome in one way or the other.

In the days of Caesar, All the land in Italy and outside of it was concentrated in the hands of the few wealthy families, the fields were worked by the hundreds of thousands of the slave hands. The deposed farmers and laborers all flocked to the cities, filing brothels, gangs, and armies of beggars, which ultimately lead to the grain dole being the cornerstone of the late republican and then imperial policy.

Julius Caesar, an impoverished noble, came to prominence opposing his class, pushing for the land reforms, which ultimately resulted in the Senate eager to prosecute him, which as we all know led to the legendary crossing of the Rubicon and the consequent death of the 500-year-old republic.

As I mentioned above, Any system lives only as long as there are enough people interested in its existence. Republics and democracies require an extensive middle class of small property owners(small farmers in the case of Rome) and secondly, large swaths of wealth to be distributed evenly among the elite.

If 50% of all the land belongs to a 1000 nobles, they need a Senate to settle the disputes among themselves and also, they, though reluctantly, need the consent of the other 50% of the owners.

That is the recipe for Democracy and the Republic.

By the time of Caesar, 80% of all the land was in the hands of just a few families, the remaining 10% in other impoverished noble's hands and the remaining 10% belonged to the remaining middle-class farmers.

Neither the 80% nobles nor the poor, the proletariat, ex-middle class, outcompeted by the free slave labor and colonial goods, needed the Republic. It did not serve them anymore.There were not enough people who were interested in its existence. And the Republic fell.

It weathered the Veii, the Gauls, the Samnites, and the Latins, it weathered Carthage, the Macedonian and the Syrian wars. It fell after there was no enemy left to fight.It fought and consumed itself.

I am not here to say that the election of Trump and Brexit vote are in any way comparable to the fall of the Roman Republic. We are not there yet.

However, I can not help but notice the striking similarities between the Late Republic and the modern-day West.

The West fell in love with neoliberalism in the mid-80s. We opened up markets, we deregulated. Which is good. Free markets and capitalism are the ultimate wealth creators.

But we also opened up the borders for migrants. We had electricity prices 3-4 times the ones of China. We had environmental and other regulations kill businesses in droves, driving the survivors out of the West. No one was ready for that.

In the UK we saw both major parties, the Tories and the Labour turning from serving the different parts of the now dying middle class to the one serving the ultra-rich and the other serving the ultra-poor.

In the US, the Dem party saw that the mass uncontrolled migration turned sanctuary cities, red and purple states- blue and the Republicans were hypnotized by the neoliberal mantra, also being busy bombing godforsaken deserts thousands of miles away from the US.

Small farmers died out and were bought up by large estates, migrants turned sleepy peaceful cities across America into the War Zones.

The middle class, slowly dying under the simultaneous assault of the sudden globalization and migrants driving down wages, destroying communities, was constantly bombarded with allegations of racism, fascism, white privilege, homophobia, islamophobia, and many other phobias , by the smirking intellectual coastal financial, media and political elites of the Bay Area, Manhattan and the DC In the US and Southern England/London mansion dwelling Westminster M25 bound elite in the UK.

The elite, that felt that they were smart enough to make the decisions, the brunt of which they were never to bear.They had good jobs, unavailable for migrants, they had private schools, free of the latter, and they did not need any border walls, for their estates were behind the walls anyhow. Migrants mowed their lawns, served their coffee and took out the trash.

They got emboldened by the fall of the Soviet Union in the same way the elites of Rome got emboldened by the defeat of Carthage.

The middle class that was to be a counterweight to the Soviet system was no longer needed, so they were to tax it out of the existence. Tax and regulate the businesses that supported the middle class out of the existence too, substituting them with cheap migrants and overseas labor to take away any bargaining power they had left.

The vote for Trump and Brexit was a massive middle finger to Washington, Hollywood, New-York, Westminster and Brussels. The people of the Leave and Trump didn’t care about the consequences, even if there were to be any. They just told the arrogant elites to “go and love themselves”.

The Trump/Brexit voters were the same people who supported the Gracchi Brothers and cheered Marius And the Popularies.

Now, we are still quite far away from the Caesar/Augustus moment in the West, but we are already close to the Gracchi Brothers moment. However, contrary to the popular mythology, the Era of Emperors in Rome, despite the good optics and splendor and the aura of glory did not benefit anyone, neither the common men nor the elites. So instead of the hysteria about Trump and Brexit that we were all unfortunate enough to be involuntary witnesses to, conclusions are to be made. Yet, with the Calls for the impeachment, Brexit revocation, the further EU federalization and yet even louder calls for the open borders, UBI, slavery reparations, More regulations, the Green new deals of all sorts and other fancy words, that are in reality a mere epitaph of the Middle Class yet be carved on it’s tombstone, if any of that to be enacted, hopes are low.

As I already mentioned, it was the lack of a potent enemy, rather than the existence of one, that killed the republic. In the light of the reaction of the elites to the events observed in this article, the hopes are low, but the salvation of the West might come in a form of a common enemy in the face of China.

If that is not to be the case, the West is bound to consume itself.Alas, unlike Rome, I can't see a shining empire coming out of the flames of the old Republic, metaphorically speaking.

The end.

PS:that is a grotesque exaggeration for a stronger dramatic effect, yet the concerns raised in this article do deserve a good discussion. Which I encourage you to produce in the comment section.

Please, do share and comment. I would appreciate your take on the issue. Let me know if you think my analogies are accurate.

USD could extend the rally Dollar demand seems to be reemerging, with major currencies retreating marginally on Friday. However, the trading activity has been muted amid the lingering trade uncertainty and ahead of key economic updates out of the Eurozone and the United States. At that, US-China trade developments remain on traders’ radars.

The European CPI data could set a short-term direction for the EURUSD pair but US retail sales report will be the key event for USD pairs in general. Should the data exceed forecasts, the release will confirm the latest statements from the Federal Reserve Governor Powell, who pointed to a strong economic activity earlier this week. If so, the dollar could appreciate along with stocks as strong numbers would cool Fed rate cut bets after the central bank lowered rates in late-October for the third time this year.

In this scenario, EURUSD could get back below the 1.10 handle and challenge the 1.0990 level, with the next support lying around 1.0970. The technical picture for the common currency will improve in case of a recovery above 1.1055. In the weekly charts, the pair is trading flat after steep losses during the previous week.

Gold rebounds from three-month lows, further gains may lie ahead Gold prices extend modest gains for a third day in a row, after reaching a three-month low of $1,445.50 earlier in the week. Spot gold has encountered a local resistance around $1,477, which is standing on the way to the 100-DMA. The short-term technical picture has improved somehow after a bounce, but the precious metal remains vulnerable to further losses as long as the prices remain below the $1,500 psychological level.

Despite the recent talks about a so-called phase one deal between the US and China, uncertainty persists on the trade front. Moreover, there are now reports that trade talks have hit a snag over farm purchases, which coupled with the recent contradictory Trump’s comments on tariffs and China raises the risk of another escalation in the long-standing trade dispute between the world’s two largest economies.

As dynamics in gold prices shows, a negative trade-related scenario has not been priced in by gold traders, so there is a possibility that the yellow metal could resume the rally should the two countries fail to deliver good news any time soon. In this scenario, the bullion may regain the above mentioned moving average and target the $1,500 handle im the medium term.

Markets shift focus from Trump to CPI and Powell On Tuesday, Trump disappointed investors, threatening China with substantial tariffs if the two sides fail to strike a trade deal. The US President said the trade deal with China is close but didn’t deliver any details on the possible agreement. Such rhetoric fueled risk aversion on Wednesday, with dollar demand seems to be picking up ahead of the European session.

EURUSD is trading at the 1.10 psychological support which can be broken in the short term on a combination of USD demand and the prevailing risk aversion un the global financial markets. The bearish pressure will increase if the US CPI data surprise to the upside and Powell’s tone in today’s speech comes as less dovish than expected. Also, the Eurozone industrial production data could affect the pair in the near term.

Once below 1.10, EURUSD could reach 1.0990 and then target the 1.0970 area. But should the common currency see a positive scenario, the 1.10 handle will serve as a decent support. The pair could be rejected from this level and proceed to a recovery if the greenback comes under the selling pressure. However, this scenario looks less likely, with downside risks still prevailing for the euro.