CARA a Biotech Pennys Stock with earnings coming LONGCARA is here on a 15 minute chart. The earnings report is due March 4th. The price action is

already demonstrative of bullish momentum. CARA rose 60% this past week. It is still on sale

at 95% off its all time high. Spiking buying volume, and so an upgoing Price Vulme Trend and

squeeze release triggers on lower time frames all have CARA moving well prior to earnings.

I see this as a long trade setup quite well. The available option contract on a thin-chain

for strike 2.5 on March 15 added 20% on Friday. I will pass on any options contracts as the

thin volume is a higher-than-acceptable risk. I will be more than happy with another 60%

price rise in the upcoming week and it could be more.

CARA

Cara Therapeutics Shifts Focus, Initiates Layoffs.Cara Therapeutics (NASDAQ: NASDAQ:CARA ) is undergoing a significant transformation as it announces strategic shifts in its operations, including substantial layoffs and a departure at the executive level. The biopharmaceutical company is redirecting its focus towards its late-stage notalgia paresthetica program, necessitating a withdrawal from advanced chronic kidney disease (CKD) initiatives. This move aims to extend the company's financial runway until 2026, leveraging the $101 million on hand at the end of 2023. The restructuring decision, however, comes at the cost of up to 50% of the company's workforce.

Layoffs and Strategic Reprioritization:

Cara Therapeutics ( NASDAQ:CARA ) President and CEO, Christopher Posner, expressed the rationale behind the strategic pivot, emphasizing the discontinuation of the advanced CKD program to allocate more resources to the oral difelikefalin Phase 2/3 clinical program. This shift is expected to optimize the company's position in the competitive pharmaceutical landscape and enhance its ability to bring innovative solutions to patients suffering from notalgia paresthetica.

Posner acknowledged the contributions of patients, investigators, and employees involved in the advanced CKD clinical program, highlighting the company's commitment to transforming the lives of CKD patients experiencing pruritus. The decision reflects a calculated move to reallocate resources where they can have the most significant impact, aligning with Cara Therapeutics' commitment to delivering groundbreaking therapies.

Financial Implications and Extended Cash Runway:

By refocusing its efforts, Cara Therapeutics ( NASDAQ:CARA ) aims to capitalize on the promising prospects of its oral difelikefalin program, positioning itself for success in the evolving pharmaceutical landscape. The company anticipates that this strategic realignment will extend its cash runway into 2026, providing the financial stability required for the successful development and commercialization of its late-stage programs.

Study Results and Timeline:

Investors and stakeholders can anticipate the first part of Cara Therapeutics' study results in the third quarter of 2024, with final results expected by the end of 2025. The secondary study results are slated for release in 2026. These milestones represent crucial steps in the company's journey to bring new therapeutic options to patients, and the market will undoubtedly be watching closely.

Leadership Departure:

In conjunction with these strategic changes, Cara Therapeutics ( NASDAQ:CARA ) also announced the departure of Frédérique Menzaghi, the Chief Scientific Officer and Senior Vice President of Research and Development. Menzaghi's exit, scheduled for February 2, marks a significant transition in the company's leadership. Investors and industry observers will be keen to understand the implications of this departure and how Cara Therapeutics ( NASDAQ:CARA ) plans to navigate this change in its executive team.

Conclusion:

Cara Therapeutics' recent announcements underscore the dynamic nature of the biopharmaceutical industry. The strategic realignment, layoffs, and leadership changes indicate a company poised to adapt to emerging opportunities and challenges. As the pharmaceutical landscape evolves, Cara Therapeutics' bold moves reflect a commitment to innovation and a focused approach to addressing unmet medical needs.

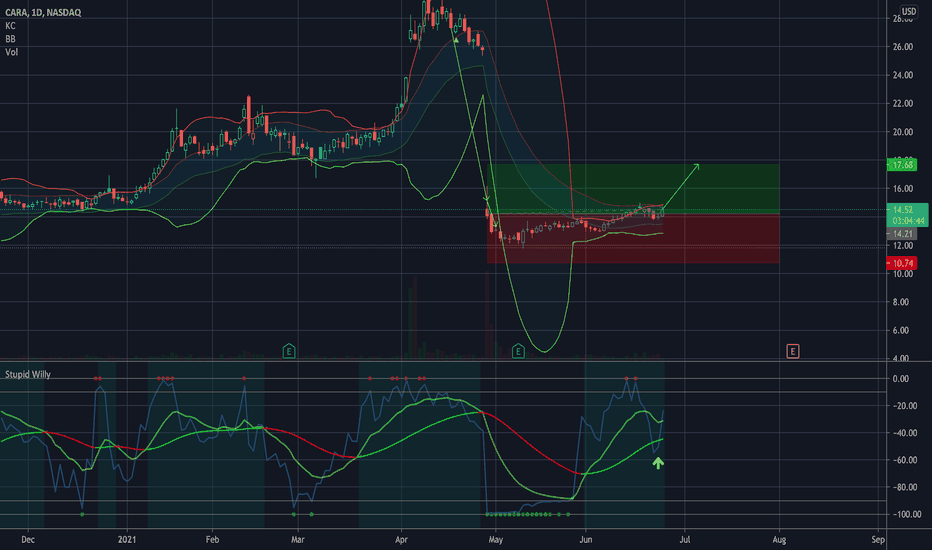

CARA Cloud Pop Already Re-test Cloud Ready!On the 4hr and 8 hr there are low signals puddling up all over the place. This is ready to pop. In the Past the lowest pop witht hese same signals was 61% move. Taking this to at the lowest $16.85

by iCantw84it

03.26/22

$CARA Target 17.68 for 24.42%$CARA Target 17.68 for 24.42%

Or double position at 10.74

I'm not sure if I published this one when I first bought on that hellacious dip, haha. 🤣 Anyway, it looks like it found a little bit of support here so, might as well publish it here

This might not be a trade you want to play... I will post better ones... just for reference here.

—

On the far right of the chart is my Average (Grey) Current Target (Green), and Next Level to add (Red) Percentage to target is from my average.

I start every position with 1% of my account and build from there as needed and as possible.

I am not your financial advisor. Watch my setups first before you jump in… My trade set ups work very well and they are for my personal reference and if you decide to trade them you do so at your own risk. I will gladly answer questions to the best of my knowledge but ultimately the risk is on you. I will update targets as needed.

GL and happy trading.

I finally added my YouTube Training Video to my profile tagline since I’m not allowed to on here. It’s a quick 15 minute training video on how to set up your chart and how to spot opportunities. So check here first but If you have questions just message me.

My thoughts on Cara Therapeutics As you can see we are sitting in the mid range of the support and resistance . You can clearly see a pattern in movement between spikes.

We have 3 levels to enter here.

We can either jump on the red line which is a pretty aggressive entry, or we can find a entry on the support level / red level, which is more safe but there is also a chance to miss the entry. (Specially the orange level)

I believe there are some good opportunities to make some profit.

What's your thoughts?

Energy building in this biotech stockVery nice symmetry in this H&S pattern. I expect an explosive move

CARA Big Rectangular BottomAn analysis for Cara

a rectangle has formed

currently sitting at middle point of rectangle. I would short this.

Interesting price action

I might do some more development on CARA

Cara, the Cannabis Pharma Sector leaderLight weight company with a strong cannabis product niche. Technical bullflag setup, needs macro bull trend to hold up, and then a company specific catalyst to breakout for new ATHs

CARA in equilibriumInitial spike in volume was caused by fast track and phase 3 news. Nothing to drive the price at the moment. My best best is that we'll see CARA retest $19.65 within a week or so.

Cara Therapeutics - Outbreak or Selloff?Cara Therapeutics is back on the strong resistance line that has been tested 4 times. Only once, in June 2017, was this briefly broken after FDA breakthrough therapy designation.

CR845 reduces itching in patients with chronic liver insufficiency. This brought in June 2018 3 large pharmaceutical companies on the plan, who wanted to market this product against once and milestone payments.

Outlook:

To confirm the breakout, a week-end above the blue resistance line is necessary. Following this, a retest of this resistance would be ideal to confirm this as a support zone.

If share price can not establish a weekly close above, is to expect a subsequent sale.

greeting

Stefan Bode

CARA to meet 50MA soon?I think we may have topped out for now. If you are not in a bullish position right now, perhaps it is wise to hold until resistance is broken, or wait for it to retrace to the 50MA. Indicators show that we're a tiny tad extended atm.

Take a look at ZYNE, if CBD Pharma is your game.

Just my 2 cents. It's free. Trade with caution.

Perfect Double Bottom for ZYNEDouble bottom in an uptrend:

- The double bottom looks like the letter "W". The twice-touched low is considered a support level.

- The advance of the first bottom should be a drop of 10% to 20%, then the second bottom should form within 3% to 4% of the previous low, and volume on the ensuing advance should increase.

- The double bottom pattern always follows a major or minor downtrend in a particular security, and signals the reversal and the beginning of a potential uptrend.

Out of the most interesting cannabis bio pharma companies (GWPH, CARA and ZYNE), this one seems to be ready for another break out. I'm anticipating a quick retrace, then a break through resistance to test the next level.

Just my 2 cents. It's free. Trade with caution.

Buying a bull flag with ZYNEI got in at $3.66. Been in and out, trying to sell the rallies and buy the dip. It has been an interesting ride with some extreme gains. Needless to say that my position is bullish.

So... what's next?

My play with ZYNE is aimed at the CBD legislation that is expected at around October this year. ZYNE has many good patents, ready to market, and once CBD as an additive becomes 'legal', I think ZYNE is well set up to gain from that. I also particularly like that ZYNE is a USA based play.

The most recent move up seems a bit too extended, and with the current price level, volume will probably leave for other plays, for now. I see a target area of former glory, between $16.50 and about $23. Gann tells me we'll be trading in a bit of a wedge, sideways, if nothing bad happens. That means we'll see a bull flag of sorts, right until it is time for ZYNE again to choose direction.

As long as we hold the $12.90 level, and sustain an occasional dip, I think we should be ready to retest $16.48 in a few weeks.

For a long play, imagine ZYNE getting one of their Phase 3 medicine approved for marketing. BOOOM!!! I mean, that is exactly what happened with GWPH. 300% gains, for starters. Without Epidiolex, they would still be $50. Could take some time, but other than CARA, there really is no similar play in this industry. Therefore I think that these current levels are still a fantastic entry point. But keep in mind that failing trials will send a stock down just as hard.

#LongZYNE

CARA- Broke the triangle channel to get a support at 14.10$.

- Forming a hammer may be followed by a confirmation the next day

- The target is about 18i$h

$CARA is Giving a Buy Signal$CARA Therapeutics looks to be a good buy choice for the Tuesday market open. For information on how to access the Megalodon indicator, just send me a message!