Cardano

ADA Catambra! I Summon You!🐉🍀 8-8 Double Luck — ADA Catambra! I Summon You! 🚀🔮

Today is 8-8 — in Chinese culture, “88” sounds like double fortune, the most powerful number for luck and prosperity.

In numerology, 8 is the angel’s number — abundance, alignment, destiny.

Now… why “Catambra” instead of “ Cadabra” ?

Because in Greek, that’s how it sounds when you shout it with passion.

Yes, it’s a “spell mistake” — but it’s on purpose.

This isn’t Harry Potter… this is ADA Summoning Magic.

ADA / Cardano — hear the call:

💥 No more boring sideways.

💥 Time to wake up and pump.

💥 Target: $3.48.99 🎯

From $0.72 support, the line is drawn.

ABBA ABBA… ADA Catambra!

Double luck, double gains, double ADA.

The prophecy is clear. The candle will burn bright.

ADA, I summon you.

One Love,

The FXPROFESSOR 💙

Disclosure: The summoning thing is the LAST RESORT of a desperate ADA CArdano lover.. Let's go

!

ADA/USDT | ADA Gains 18% – Bullish Momentum Ahead!By analyzing the Cardano chart on the 3-day timeframe, we can see that after correcting down to $0.69, the price saw renewed demand and has so far rallied over 18% to reach $0.80. Given the strength of this new bullish trend, I expect ADA to continue its upward move, with the next targets at $0.85, $0.93, and $1.00. Keep a close eye on this pair — this analysis will be updated!

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

ETH/USDT | ETH Surges 18% – Next Targets Above $4000 in Sight!By analyzing the Ethereum chart on the weekly timeframe, we can see that, as expected, the price continued its rally, gaining over 18% and reaching $3969. It is now trading around $3915, and I expect this bullish momentum to continue, with the price soon pushing above $4000. The next targets are $4100, $4400, and $4900. This analysis will be updated soon!

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

Cardano Higher High Hidden Signal Confirmed · UpdateGood news. We already have a higher low and Cardano back into the long-term accumulation zone but on the bullish side. You know a channel has a middle portion always and the lower portion relates to the bears while the upper portion is owned by the bulls. This is the good news, Cardano is staying safely, nicely on the bullish side of the 2025 consolidation channel. Cardano has been in this range almost the entire year but everything looks great.

The broader bias is bullish based on the strong advance late last year. This was a strong advance and every strong move needs to be consolidated before anything else happens. This is the correction followed by sideways action. After this phase is over, now, then we see a new move develop, the continuation of the previous move—the bullish wave.

We have 140% profits potential (PP) to $1.83 but this is still some middle way, mild, middle portion move. The market will continue to heat up, evolve and grow and as this happens we will be taking out several resistance zones and with these gone we can expect higher prices and finally the new all-time high we have been waiting for for so long. Patience of course.

Chart: Cardano (ADAUSDT) Daily Timeframe with MA200

Notice just three days below MA200 and now back above this level. In the past when ADAUSDT moved below MA200 it would stay months below this level. This time it was pierced briefly and the action moves back above. This means that the bulls are in control.

The retrace was short, small and low volume which means weak. Weak bears, weak sellers means that we are bullish and bullish means green.

With all this said and done, you can expect growth for months. Continue to buy, continue to trust and continue to hold. You will be happy with the results. Crypto is going up.

Energy for all readers. Let's grow together, let's be open, learn and share. The best is yet to come. You are special. You are a divine living being and you deserve the best... Thanks a lot for your continued support.

Namaste.

ADA Just Broke Out... But Will It Hold or Collapse From Here?Yello Paradisers, are you ready for what Cardano is about to do next? After weeks of being trapped in a falling wedge, #ADA has finally broken out and this move could either be the start of something big or just another fakeout to trap late buyers.

💎Price has now closed above the descending resistance, confirming the breakout of the falling wedge structure. The 0.7300–0.7450 zone is currently acting as the first area of support. This level needs to hold in order to maintain bullish momentum, or the entire setup could be invalidated. Below that, the major demand zone between 0.6700 and 0.7100 remains critical if #Cardano slips into that range, we’ll be watching for either a bounce or signs of a deeper breakdown.

💎On the upside, the first short-term target sits at 0.8600 where minor resistance is expected, but the real battle will take place between 0.9300 and 0.9500 a strong resistance zone where many traders will be looking to take profits or re-enter shorts. Momentum indicators are showing early strength, with RSI recovering and confirming renewed buyer interest.

💎If bulls can maintain control above the breakout zone, #ADA could enter a healthy consolidation phase before launching into the next leg up. However, a drop below 0.6600 would completely invalidate the current structure and shift the bias back to the downside so risk management remains essential here.

🎖Strive for consistency, not quick profits. Treat the market as a businessman, not as a gambler.

MyCryptoParadise

iFeel the success🌴

Executed two trades in ADA yesterdayTrade Journal Update – BINANCE:ADAUSDT

Yesterday, I executed two trades on ADA. Since then, I haven’t observed any valid psychological trade setups, so I’ve chosen to stay out of the market.

Staying disciplined, strictly following my trading plan, and managing risk as per my strategy.

Open to feedback—feel free to share your thoughts, suggestions, or questions in the comments!

We are moving - Cardano weekly update August 6 - 12thCardano appears to have completed a clean Wave 2 correction and is now forming the first 1-2 setup within a larger impulsive move to the upside. From an Elliott Wave perspective, this suggests we are at the very beginning of a broader bullish development. Structurally, the chart aligns across multiple degrees of trend: we are currently within Cycle Wave 3, Primary Wave 1, and Intermediate Wave 3 — a highly favourable configuration for strong upside momentum.

The recent retracement reached the 0.5 Fibonacci level, where price reacted strongly and formed a well-defined bullish order block. This confluence between Fibonacci support and structural demand reinforces the idea that the local bottom is likely in place. The move off the lows also began with a clear five-wave advance, indicating that an impulsive structure is developing.

While an alternative scenario is shown on the chart — suggesting a possible deeper correction — this is considered low probability. The main reason this alternative exists is the relatively short time duration of the Wave 2 correction, which might appear shallow compared to expectations. However, given the structural symmetry, the clear order block, and the impulsive reaction from support, the primary bullish scenario remains heavily favoured.

Additional confluence comes from sentiment and derivatives data. Funding rates are still in negative territory but are turning upward, signalling a potential shift in market positioning toward longs. At the same time, open interest is increasing — an encouraging sign of growing participation and conviction in the current move.

The liquidity heatmap currently shows significant clusters both above and below the current price, making the liquidity picture overall neutral. However, this also implies potential for strong directional movement should one side be taken out decisively. Overall, the technical and sentiment-based evidence points to a structurally sound bullish setup with limited downside risk, so long as the current low remains protected.

ADA Correction Nearing Completion — Is It Time to Load Up?After tagging the golden pocket resistance zone between $0.9208–$0.9527, ADA completed a clean 5-wave Elliott impulse right into a major resistance. Since then, price has corrected -25%, and we’re now likely nearing the end of an ABC correction — the final wave C.

🧩 Technical Breakdown

➡️ Wave A: 5-wave drop after the peak

➡️ Wave B: Bounce rejected at yearly open (yOpen) — that was a great short opportunity around $0.845

➡️ Wave C: Now working toward completion

🎯 C Wave Target Zone: $0.69–$0.65

This zone has strong confluence:

0.618 Fib retracement of the entire 5-wave move at $0.6732

1.0 TBFE (Trend-Based Fib Extension) aligns perfectly

Sell-side liquidity (SSL)

0.786 Fib Speed Fan support

Monthly 21 EMA/SMA adding a final confluence layer

🟢 Long Setup

Entry Zone: $0.69–$0.65 (ladder in)

Stop Loss: Below the monthly 21 EMA/SMA ($0.6)

Target 1: mOpen key resistance

Target 4: 0.666 Fib at ~$0.95

Risk:Reward: ~1:4+

💡 Educational Insight

After a 5-wave impulsive move, ABC corrections are common. Using the Trend-Based Fib Extension tool to project wave C, especially when paired with liquidity zones, VWAP, or moving averages, helps pinpoint high-probability reversal zones. It’s about confluence and reaction — not prediction.

🔍 Indicators

For this analysis, I’m using my own indicators

DriftLine – Pivot Open Zones and

MFT MA Support/Resistance Zones

both available for free. You can find them on my profile under “Scripts” and apply them directly to your charts for extra confluence when planning your trades.

_________________________________

💬 If you found this helpful, drop a like and comment!

BTC/USDT | Bitcoin Eyes Rebound from $110K Support Zone! (READ)By analyzing the Bitcoin chart on the 4-hour timeframe, we can see that after reaching a new high at $123,218, the price began to pull back and has now corrected down to around $112,500. I expect the current volatility to ease soon. The next critical support zone lies between $110,500–$112,000 — watch price action closely here, as BTC could bounce from this area and push back toward $116,000+. Other key demand zones are located at $109,000, $107,900, and the $105,000–$106,000 range.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

ADA/USDT | ADA Slips Below Support – Watching $0.61 for Support!By analyzing the Cardano chart on the 3-day timeframe, we can see that the price failed to hold above the $0.75 support and is currently trading around $0.72. Given the current momentum, a deeper correction for ADA seems likely. If the price fails to stabilize above $0.69, we could see a sharp drop toward the $0.61 zone. If ADA reaches this key support area, keep a close eye on it — a strong bullish reaction could lead to the next big upside move!

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

ETH/USDT | ETH Under Pressure – Watch $3500 Support!By analyzing the Ethereum chart on the weekly timeframe, we can see that after reaching the $3940 zone, ETH faced selling pressure and is now trading around $3540. If the price fails to hold the key $3500 support, a deeper decline is likely, with potential targets at $3040 first and possibly $2680 as the second bearish target.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

DeGRAM | ADAUSD held the $0.7 level📊 Technical Analysis

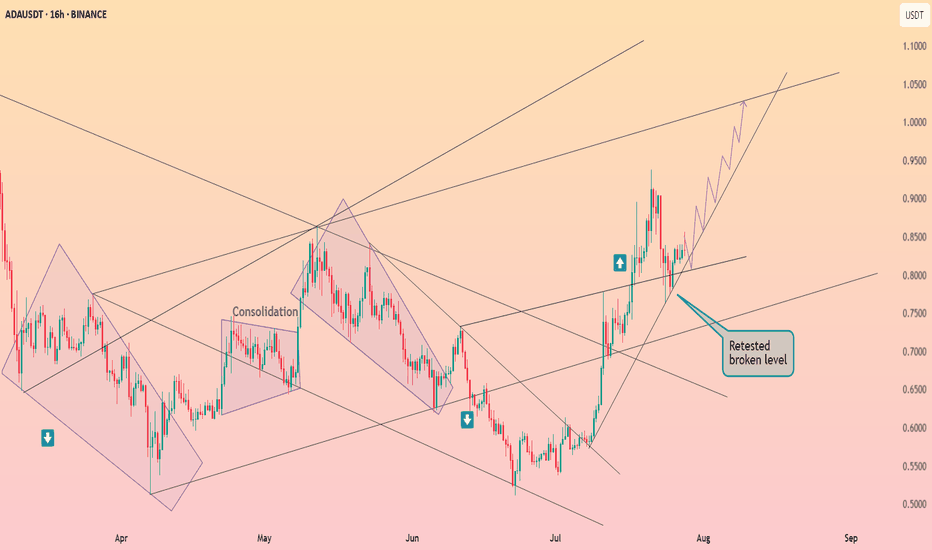

● ADAUSD is respecting the newly established rising support line after bouncing from the 0.695 level, confirming higher lows within a bullish channel.

● The price is now breaking out of a falling flag structure and is on course to retest the confluence resistance near 0.88 and the descending purple trendline.

💡 Fundamental Analysis

● Cardano’s DeFi metrics remain strong, with TVL surpassing $400M—its highest since early 2022—boosted by staking and stablecoin growth.

● Optimism surrounding the Chang hard-fork and renewed institutional interest is helping reinforce mid-term buying pressure.

✨ Summary

Buy above 0.695. Target 0.86 → 0.88. Setup remains valid while price holds above 0.68 trend support.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support

SOL/USDT | NFP Volatility Could Trigger Drop Toward $154!By analyzing the Solana chart on the daily timeframe, we can see that the price is currently trading around $169. If it fails to hold above the $168 level, a deeper drop could follow. With the upcoming NFP data release, increased volatility is expected across the markets. If Solana begins to decline, the potential correction targets are $163, $157, and $154. Watch the $145–$154 zone closely for a possible bullish reaction and buy opportunity.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

Cardano has successfully completed retesting ┆ HolderStatBINANCE:ADAUSDT is trading inside a symmetrical triangle near support at $0.445. Price continues to coil tightly with lower highs and higher lows, building pressure. A breakout above $0.465 would confirm bullish momentum toward the $0.49–0.50 zone. Key support remains intact and buyers are stepping in at every dip. A major move looks imminent.

TON/USDT | Surges 18% – Eyes on $3.63, Then $4.20 and $4.68!By analyzing the Toncoin chart on the 3-day timeframe, we can see that after a pullback to the $3 area, strong demand kicked in, and within just one week, the price surged over 18%, reaching above $3.5. Toncoin is currently trading around $3.53, and I expect it to hit the $3.63 target soon. The next bullish targets after that are $4.20 and $4.68.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

ADA, long term dubious speculationWARNING: This idea is highly dubious!

This is a logarithmic estimate of potential targets, in case Cardano moves in long logarithmic measures.

The real potential of this idea is strongly linked to the fundamentals evolution on time, i.e.: FED reducing the interest rate, for instance, but not only.

The plot features top and bottom limits drown by hand!, these are not perfect logarithmic measures, thus they certainly lacks of math accuracy. Beware.

There are zones in red and green, as transparent boxes, which depicts potential zones of buy and sell interest, of course, everything is in a log scale.

Everyone wish these kind of scenarios to be true. Only time and reality will show us the true face of it. In any case, in the total chaos of uncertainty that this market is, we try to make a sense of it.

Best of the lucks for everyone.

T.

DISCLAIMER: Do your own research! This idea is not a financial advice. All the information presented is highly speculative and cannot be taken as a reference in any circumstance.

Short Breakdown of Cardano (ADAUSDT) weekly/daily technicalsLooked over this for a friend. Rowland I would love your feedback in the comments 🫡

I will see my biggest expectation is for this to make it's way into the weekly imbalance range below the weekly Mother Candle we are existing within. The entire crypto market seems to want to revisit some key lows to correct some inefficiently delivered rally ranges (meaning too many pending orders left behind due to price not coming back to grab them, happens when HUGE money places--attempts to place/fill--bulk orders).

We are getting what I think is a temporary bullish correction due to taking of profits at key lows. It is my belief/observation that after correcting the newly minted bearish range (grabbing pending shorts above daily highs--turtle soup I think they call it), we will be able to drive down into the bullish imbalance weekly candle's range.

Let's see how we go! 😈

ADA/USDT | Pullback to Key Support – Can It Rebound Toward $1.32By analyzing the Cardano chart on the 3-day timeframe, we can see that after reaching $0.935, the price faced selling pressure and dropped by 18% to the $0.76 area. Now, the key is whether ADA can hold above the $0.75 level by the end of the week. If it succeeds, we could expect further bullish continuation. The next potential targets are $0.86, $0.93, $1.02, and $1.32.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

ADA - Time to buy again! (Update)The pattern has broken, and now I expect the price to rise to $1.20 . AB=CD.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!