Casino

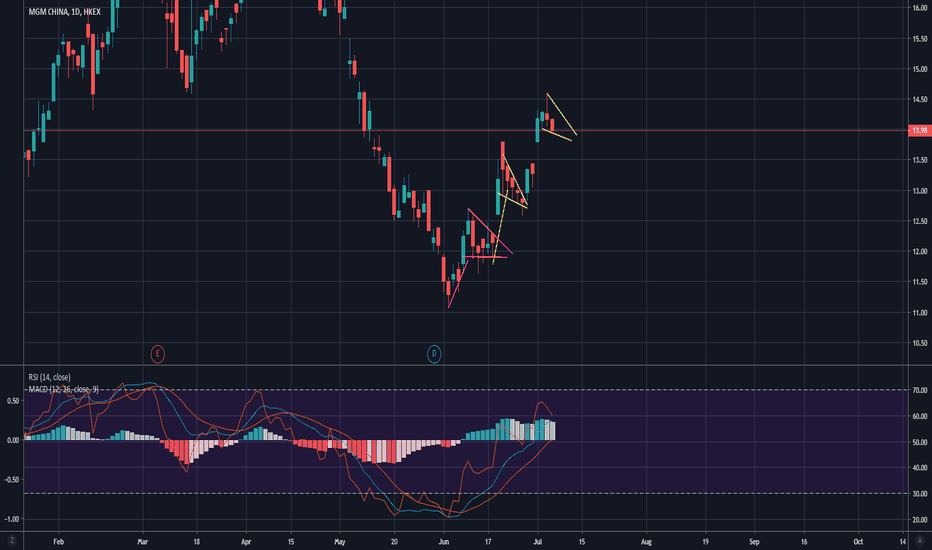

MGM ✅ Why Go To Vegas When You Can Speculate On MGM From Home!💬 MGM International Resorts (MGM) is rolling out its new 'Viva Las Office' campaign to get people to work from Vegas. That could help drive business to MGM properties, which could be why the market is showing us some bullish options flow and decent price action. While we are skeptical this single event makes a giant impact, we think all these factors together (along with the recent earnings beat) are enough for a conservative swing play. Let's see if we can find a setup that works.

Hit that 👍 button to show support for the content!

Help the community grow by giving us a follow 🐣

-----

Support:

S1: Our entry is going to be off the minor price pivot point, a current S/R flip, and previous orderblock cluster range. The logic is that we retest this level before moving up. Meanwhile, we are placing our stop below the S/R flip to give us a solid 1:5 Risk-to-Reward that keeps us well away from any short term downside volatility that might be seen as the price is finding support.

Resistance:

R1: Our target is the orderblock at the previous swing high as highlighted on the chart.

-----

Summary:

We have a pretty straightforward setup here. Retest the S/R filp, and then go long until the next resistance level is hit while keeping a comfortably placed stop well below support to mitigate risk... its a gamble with good odds, and we didn't even have to leave the office to do it.

Resources:

finance.yahoo.com

www.marketbeat.com

✨ Drop a comment asking for an update, we do NEW setups every day! ✨

$CNTY can rise in the next daysContextual immersion trading strategy idea.

Century Casinos, Inc. operates as a casino entertainment company worldwide.

The share price rose after good earnings. I see some preconditions the share price will continue growing.

The demand for shares of the company still looks higher than the supply.

These and other conditions can cause a rise in the share price in the next days.

So I opened a long position from $5,13;

stop-loss — $4,80.

Information about take-profits will be later.

Do not view this idea as a recommendation for trading or investing. It is published only to introduce my own vision.

Always do your own analysis before making deals. When you use any materials, do not rely on blind trust.

You should remember that isolated deals do not give systematic profit, so trade/invest using a developed strategy.

If you like my content, you can subscribe to the news and receive my fresh ideas.

Thanks for being with me!

RRR Broke Out of Major Resistance on Short Squeeze & AMC RumorsCasino stocks are back. Red Rock Resorts is following the trend of all other Casinos. Swings are huge on this one. Golden cross coming as Casinos start reopening process. Casinos have already started implementing a lot of safety procedures for workers and patrons alike and workers are slowly being brought back. $RRR has a correlation with $AMC and $PLAY. Keep your eyes on other bear trap stocks like $GME yesterday at $4.17.

MGM - Divergence was corerct. How low will it go now?Hello Investors,

Last time I made a bold statement that probably was distasteful to read. However the divergence we looked at did work and MGM did drop, I'm happy about that turnout. I didn't make any money on the drop, but it tells me I'm in harmony with the market sentiment at the moment.

Looking at the current 200 MA (close), I think the price will gravitate towards the 200MA. I'm pondering the questions, "How low will it go before it goes back towards the 200MA?".

MGM is a CASINO, it will bounce back it just depends on locals and tourists going to the casinos. People love to gamble, if the casinos are still closed that means people can't go inside to spend money. MGM acting CEO stated that all USA MGM's were closed, Macau MGM(been there) is still open. MGM USA will stay closed until the state stay-at-home order is lifted.

"Nevada: Gov. Steve Sisolak said in a press conference on April 21 that there is no firm date when businesses will be allowed to reopen." (source: abcnews.go. com/US/list-states-stay-home-order-lifts/story?id=70317035)

I hope this was valuable. Please comment, like and follow, I would appreciate it.))

$MGM can fall in the next daysContextual immersion trading strategy idea.

The demand for shares of MGM Resorts International looks lower than the supply.

The company owns and operates an integrated casino, hotel, and entertainment resorts.

Due to the spread of COVID-19, the demand for the company's services fell.

This and other conditions can continue to cause a fall in the share price in the next days.

So I opened a short position again from $10,49;

Information about stop-loss and take-profits will be later.

Do not view this idea as a recommendation for trading or investing. It is published only to introduce my own vision.

Always do your own analysis before making deals. When you use any materials, do not rely on blind trust.

You should remember that isolated deals do not give systematic profit, so trade/invest using a developed strategy.

If you like my content, you can subscribe to the news and receive my fresh ideas.

Thanks for being with me!

$BYD can fall in the next daysContextual immersion trading strategy idea.

Boyd Gaming Corporation has a strong downside trend.

Due to the downside market trend and spread of the COVID-19, the demand for casino services fell.

This and other conditions can cause a fall in the share price in the next days.

So I opened a short position from $8,79;

stop-loss — $9,71.

Information about take-profits will be later.

Do not view this idea as a recommendation for trading or investing. It is published only to introduce my own vision.

Always do your own analysis before making deals. When you use any materials, do not rely on blind trust.

You should remember that isolated deals do not give systematic profit, so trade/invest using a developed strategy.

If you like my content, you can subscribe to the news and receive my fresh ideas.

Thanks for being with me!

NETFLIX NEEDS TO BUY ViacomCBS (VIAC) - GREAT COMBINATION! The mega deal, CBS / Viacom, is finally done but now we have ViacomCBS sitting at just 5x earnings.

Netflix could gobble up ViacomCBS without hesitation.

If Netflix bought ViacomCBS (VIAC), it would create a mega media mogul. With the purchase of ViacomCBS, Netflix would cut it's royalties / expenses because it would then own a mega selection of content.

Also, with ViacomCBS in the sport betting industry, Netflix could open up sports betting in its app. which could generate billions in profits for Netflix.

National Amusements / The Redstone family are in full control of ViacomCBS and with that said, the family is always looking for the next mega deal!

Netflix has a market cap of around $162 Billion while ViacomCBS is sitting at around $21 Billion.

Netflix could swallow up ViacomCBS without a blink of the eye and create a media giant that almost no other could compete with.

A letter was recently sent to the Netflix board of directors asking the board to look at purchasing ViacomCBS and cut the cost / expense of royalties Netflix pays out for content.

Lets see what happens!

DISCLAIMER

This website and our posts are for general information only. No information, forward looking statements, or estimations presented herein represent any final determination on investment performance. While the information presented in this website and our posts has been researched and is thought to be reasonable and accurate, any investment is speculative in nature. StockKid, and/or our agents cannot and do not guarantee any rate of return or investment timeline based on the information presented herein.

By reading and reviewing the information contained in this website and our posts, the user acknowledges and agrees that StockKid, and/or our agents do not assume and hereby disclaim any liability to any party for any loss or damage caused by the use of the information contained herein, or errors or omissions in the information contained in this website or our posts, to make any investment decision, whether such errors or omissions result from

negligence, accident or any other cause.

Investors are required to conduct their own investigations, analysis, due diligence, draw their own conclusions, and make their own decisions. Any areas concerning taxes or specific legal or technical questions should be referred to lawyers, accountants, consultants, brokers, or other professionals licensed, qualified or authorized to render such advice.

In no event shall StockKid, and/or our agents be liable to any party for any direct, indirect, special, incidental, or consequential damages of any kind whatsoever arising out of the use of this website, our posts or any information contained herein. StockKid, and/or our agents specifically disclaim any guarantees, including, but not limited to, stated or implied potential profits, rates of return, or investment timelines discussed or referred to herein.

$150 BILLION INDUSTRY. 5x EARNINGS. DIRT CHEAP, STRONG BUY -READCBS Sports Partners with William Hill. It's the Latest Media Company to Embrace Sports Betting. -- Barrons.com

Mentioned: VIAC VIACA

By Nicholas Jasinski

ViacomCBS' sports division will join with U.K. bookmaker William Hill on creating sports betting content across its digital and television platforms. It follows Fox Corp's deal with Stars Group on FOX Bet. Anticipated growth in sports betting in the U.S. is a part of many investors' bullish theses for media companies that broadcast live games. Announced on Monday evening, the agreement will give CBS Sports (ticker: VIAC) access to William Hill's (WMH.UK) betting odds, data, and sports books to be used in its TV programming and online offerings. CBS' main sports offerings include NFL games and the NCAA men's basketball championships -- the March Madness tournament. William Hill will be able to exclusively promote its brand on CBS Sports' website and on its fantasy sports platform, which have more than 80 million users a month, according to the company.

"The power of our distribution, combined with the strength of our brands and the expertise of William Hill, has us well positioned to tap into the explosive growth of the legal sports betting industry in the U.S.," said CBS Sports Digital Executive Vice President Jeffrey Gerttula in a statement. "Together, we will deliver even more value to this rapidly growing segment of sports fans."

The offering will have a limited launch in March, followed by a full rollout this summer. Financial terms of ViacomCBS' partnership with William Hill weren't disclosed. Sports betting is now allowed in 20 U.S. states with more on the way. The Supreme Court struck down a federal law banning sports betting across most of the country in May 2018. A recent Barron's cover story examined the booming industry, which could have a potential market as large as

$150 billion annually.

Fox Sports (FOXA) already has a deal with the Stars Group (TSG), an online poker leader. Stars plans to merge with Flutter Entertainment (FLTR.UK) -- the owner of Fan Duel -- after which Fox will have the option to buy 18.5% of Flutter. Fan Duel and DraftKings are the two leading online sports betting platforms in the U.S. (Fox has common ownership with Barron's parent company, News Corp.)

DISCLAIMER

This website and our posts are for general information only. No information, forward looking statements, or estimations presented herein represent any final determination on investment performance. While the information presented in this website and our posts has been researched and is thought to be reasonable and accurate, any investment is speculative in nature. StockKid, and/or our agents cannot and do not guarantee any rate of return or investment timeline based on the information presented herein.

By reading and reviewing the information contained in this website and our posts, the user acknowledges and agrees that StockKid, and/or our agents do not assume and hereby disclaim any liability to any party for any loss or damage caused by the use of the information contained herein, or errors or omissions in the information contained in this website or our posts, to make any investment decision, whether such errors or omissions result from

negligence, accident or any other cause.

Investors are required to conduct their own investigations, analysis, due diligence, draw their own conclusions, and make their own decisions. Any areas concerning taxes or specific legal or technical questions should be referred to lawyers, accountants, consultants, brokers, or other professionals licensed, qualified or authorized to render such advice.

In no event shall StockKid, and/or our agents be liable to any party for any direct, indirect, special, incidental, or consequential damages of any kind whatsoever arising out of the use of this website, our posts or any information contained herein. StockKid, and/or our agents specifically disclaim any guarantees, including, but not limited to, stated or implied potential profits, rates of return, or investment timelines discussed or referred to herein.

VIAC ANNOUNCES SPORTS BETTING! UNDERVALUED STOCK, STRONG BUY!Today after the market closed, VIACOM announced a sports betting deal with William Hill - As many know, Sports Betting is becoming legal statewide & it's a multi-billion dollar industry.

Feb. 10, 2020 – LAS VEGAS – CBS Sports and William Hill, America’s leading sports book operator, today announced a strategic partnership that makes William Hill the Official Sports Book and Wagering Data Provider across all CBS Sports platforms. The deal will reimagine fan engagement through a unique integration of sports betting, media, product and technology. The partnership will tip off with initial integrations in March on CBS Sports digital platforms, with a full rollout planned for the fantasy football season.

The partnership extends CBS Sports’ digital leadership in the sports betting space, and allows for the creation of even more relevant content across its wide array of platforms. CBS Sports will utilize William Hill’s odds, experts and more than 140 sports books to bolster its current digital offerings, delivering deeper information and programming produced from William Hill sports books across the country, and further engaging sports bettors and fans. In addition, the partnership includes opportunities to feature William Hill data, odds and markets across CBS television programming.

William Hill will receive exclusive rights to promote its brand across CBS Sports’ broad range of digital platforms, including through CBS Sports Fantasy, one of the largest fantasy platforms in the world, resulting in highly efficient customer acquisition for the sports betting company.

“We’re thrilled to launch this momentous partnership, which will allow us to deepen our investment and further extend our leadership in delivering multiplatform sports wagering content, while providing William Hill with unprecedented reach for their market-leading betting platform as they continue to grow their industry-leading U.S. business,” said Jeffrey Gerttula, Executive Vice President and General Manager, CBS Sports Digital. “The power of our distribution, combined with the strength of our brands and the expertise of William Hill, has us well positioned to tap into the explosive growth of the legal sports betting industry in the U.S. Together, we will deliver even more value to this rapidly growing segment of sports fans.”

PRESS RELEASE: www.viacomcbspressexpress.com

We feel VIACOM is undervalued at current prices making it one of the most compelling stories / stocks for 2020

At less than 5 times earnings, the stock is dirt cheap!

DISCLAIMER

This website and our posts are for general information only. No information, forward looking statements, or estimations presented herein represent any final determination on investment performance. While the information presented in this website and our posts has been researched and is thought to be reasonable and accurate, any investment is speculative in nature. StockKid, and/or our agents cannot and do not guarantee any rate of return or investment timeline based on the information presented herein.

By reading and reviewing the information contained in this website and our posts, the user acknowledges and agrees that StockKid, and/or our agents do not assume and hereby disclaim any liability to any party for any loss or damage caused by the use of the information contained herein, or errors or omissions in the information contained in this website or our posts, to make any investment decision, whether such errors or omissions result from negligence, accident or any other cause.

Investors are required to conduct their own investigations, analysis, due diligence, draw their own conclusions, and make their own decisions. Any areas concerning taxes or specific legal or technical questions should be referred to lawyers, accountants, consultants, brokers, or other professionals licensed, qualified or authorized to render such advice.

In no event shall StockKid, and/or our agents be liable to any party for any direct, indirect, special, incidental, or consequential damages of any kind whatsoever arising out of the use of this website, our posts or any information contained herein. StockKid, and/or our agents specifically disclaim any guarantees, including, but not limited to, stated or implied potential profits, rates of return, or investment timelines discussed or referred to herein.

Great Long Term Play for MGPNYSE:MGP

MGM Growth Properties has great potential to outperform the market. I believe that right now is a good pullback price and based on a DCF Valuation it is trading at a discount currently. $MGP is at a 6.57 Div/Yield rate and climbing. On top of the great dividend, it has shown solid Capital Appreciation and I'm looking for continuing growth. On top of this, MGP has solid intrinsic value in purchasing ground leases.

CASINOS DONT LOOSE MONEY .) ANDD MAYTAG MEN LOOOOOOOVE CASINOCASINOS DONT LOOSE MONEY .) ANDD MAYTAG MEN DO LOOOOOOOVE THEIR CASINOS FRESH N CLEAN PERMA PRESS EVERY DAY..DDDDDDDDDDDDDDDDD$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$

BUY.. NO BRAINER

LTC/BTC - Monitoring the 1D ChartLitecoin doesn't make a lot of sense to Bitcoin fans, and is seen as some kind of 'regular cola' imitation thing.

But it's friendly image, attractive price and pole position on Coinbase makes it popular with the dumb, unthinking first time gamblers who waddle in to the crypto casino.

For that reason I want to keep an eye on it while we wait for an (inevitable!) resurgence in altcoins.

Will update this regularly with thoughts on how it develops. Expect a relief bounce at one of the old support levels that are detailed with the blue lines.

Roll for our point w/ $CZRCaesars Entertainment has been in a long channel up trend since the start of the year.

Most recently, we have seen higher lows with steady highs. See them on the chart.

BUT- the channel had roughly the same highs. Just yesterday it broke through that channel on the high side, and I bought in. (Entry in blue)

My S/L is at the bottom of the recent gap at/around $9.50 and the target is to break thru $11 for a $1 gain.

2/1 ration here. Not ideal, but manageable.

I am not a financial advisor, just sharing my thoughts with the community.

As always, would love to hear your thoughts!

Wynn Macau Ltd HK 1128 Casino Top Pick Testing RangeWynn Macau Ltd

HKG: 1128

Fundamentals:

Since 2018. Wynn Macau is one of the one casino in Macau to capture most of high-roller gambling activity, consistently leading Macau on the VIP drop. Galaxy and Wynn contributed to close to 45% to the VIP volume.

Why VIP Volume? Investors place heavier emphasis on main revenue driver, revenue numbers, which are mostly generated from VIP segment.

Macau long term growth

Wynn recent upgrade to BUY RATING at Jefferies is giving it a boost with PT 23.80 after Goldman Sachs upgrade the stock in early April

Technicals:

Just Friday, 12 Apr, 50 DMA rose above 200 DMA and 50 EMA crossed 100 EMA.

Golden cross shows no sign of reversing for now while a long flag formation is formed.

Resistance : 22.0

Support : 20.70

Genting Singapore 618 tradeThe main reason that cause Genting Singapore gapped down when open today is due to the increase of casino tax. Good news is government allows expansion of its business.

Suggest to look for opportunity to long

around 0.96 will be a good area to long

SL : 0.84

TP : Follow arrow

Bitcoin Diamond huge return potential Everything is right in the chart.

Buy = green area

Sell = Red resistances

Patience is key!

WYNN -6 to -8% drop coming? I've been following WYNN for a while and I use this as one of my recession indicators of the economy. I believe people are head above water high in credit debt and can no longer afford to gamble or visit the casino.

My prediction is a -6 to -8% drop before it does a dead cat bounce up.