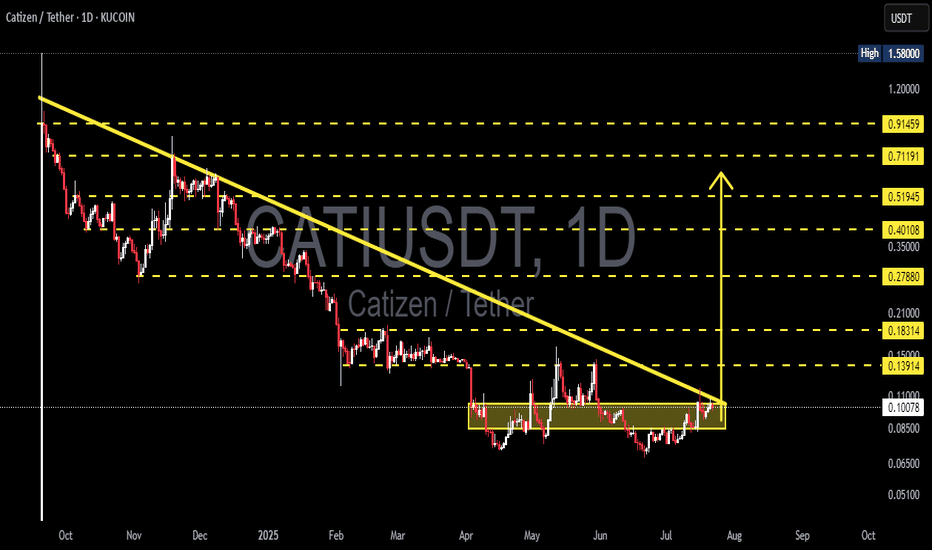

CATI/USDT – Massive Descending Trendline Breakout?🔎 Overview:

CATI/USDT is flashing a major trend reversal signal after months of accumulation and suppression under a dominant descending trendline. For the first time in almost 10 months, price action has successfully broken out of the downtrend, potentially setting the stage for a multi-layered bullish rally.

This breakout is not just a technical level — it’s a psychological shift from bearish to bullish sentiment. The consolidation zone between $0.065–$0.085 has acted as a solid accumulation base, and the breakout past $0.10 marks the beginning of a new phase.

📐 Chart Pattern Explanation:

🔻 Descending Triangle Breakout

Structure: Long-term lower highs with a flat support base.

Breakout Point: Around $0.1029, breaking the descending trendline cleanly.

Volume: A potential rise in volume post-breakout would confirm the breakout’s strength.

Target projection: Based on the height of the triangle, the potential move could extend above 200%.

This pattern is often seen at the end of a downtrend and signals a strong bullish reversal, especially when paired with horizontal accumulation like we see here.

📈 Bullish Scenario – Road to Potential 8x Gains:

If the breakout holds and gains momentum:

✅ First Target: $0.13914 – Previous local resistance.

✅ Second Target: $0.18314 – Strong resistance cluster zone.

✅ Third Target: $0.27880 – Clean psychological and structural target.

✅ Mid-term Target: $0.40108 to $0.51945 – Major Fibonacci level and previous breakdown area.

✅ Moon Target: $0.71191 to $0.91459 – If trend extends with volume and market-wide bullishness.

These targets are based on measured move projections, Fibonacci extensions, and historical price memory.

⚠️ Bearish Scenario – What Could Invalidate the Breakout?

❌ False breakout risk if price falls back below $0.095.

❌ A rejection candle or long wick at $0.13–$0.14 without volume could signal exhaustion.

❌ If Bitcoin or broader market faces correction, CATI might retrace to its base at $0.065 or even revisit $0.051.

Traders should watch for bearish divergence or sudden drop in volume as early warnings of reversal.

🧠 Strategic Notes:

Entry zone: Retest of breakout at $0.095–$0.102 could provide a low-risk entry.

Stop loss: Below $0.085 for conservative risk management.

Position sizing: Scale in during pullbacks. Don’t ape in full at resistance levels.

This setup has the classic ingredients of a low-cap altcoin explosion if momentum sustains.

🔥 Final Thoughts:

CATI/USDT is breaking free from its bearish chains and entering what could be the early stages of a parabolic move. With a textbook breakout pattern, clean structure, and well-defined levels — this is one of those charts traders dream of spotting early.

Keep your eyes on volume and structure — this could be one of the hidden gems of this cycle.

#CATIUSDT #CryptoBreakout #AltcoinGems #TechnicalAnalysis #BullishSetup #CryptoTrading #PriceAction #DescendingTriangle #BreakoutPlay #ReversalPattern

Catisignals

CATIUSDT - NO BUYERS!!??Observing CATIUSDT, one might initially perceive a landscape where all indicators point towards an ascent. Indeed, the superficial appearance suggests a market poised for higher valuations. However, a discerning investor must always ask the fundamental question: where are the buyers? This critical element, the genuine influx of demand, appears conspicuously absent.

Despite what might seem like an elevated price, there is a distinct possibility that the blue box I've identified on the chart could be subject to manipulation. This zone, which might otherwise appear as a resistance level, could be used to draw in unwary participants before a more significant move downwards. My current assessment leads me to believe that, following such a potential manipulation, the ultimate target for CATIUSDT's price is indeed lower. The absence of robust buying conviction, despite the seemingly favorable conditions, strongly reinforces this cautious outlook.

In evaluating such scenarios, it is imperative to scrutinize the volume footprint for any signs of artificial strength or distribution. We would look for CDV (Cumulative Delta Volume) divergences that betray the true underlying sentiment, and patiently await low timeframe (LTF) confirmations which, in this instance, would likely validate a bearish thesis rather than a bullish one. One must be particularly vigilant for liquidity hunts, where price might briefly push into or beyond the blue box only to swiftly reverse.

It is worth reiterating that my focus remains exclusively on assets demonstrating a sudden and significant increase in volume, as such movements often precede more substantial price action. The current state of CATIUSDT, lacking this decisive and authentic buying pressure, necessitates a stance of extreme prudence.

Therefore, while the market may present an illusion of impending rise, the intelligent investor remains grounded in the observable facts. The absence of genuine buying activity, coupled with the potential for manipulation around this blue box, suggests that caution is the most appropriate course. One must be prepared for the possibility that the path of least resistance for CATIUSDT is, regrettably, to the downside.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

📊 Simple Red Box, Extraordinary Results

📊 TIAUSDT | Still No Buyers—Maintaining a Bearish Outlook

📊 OGNUSDT | One of Today’s Highest Volume Gainers – +32.44%

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..