CBOE

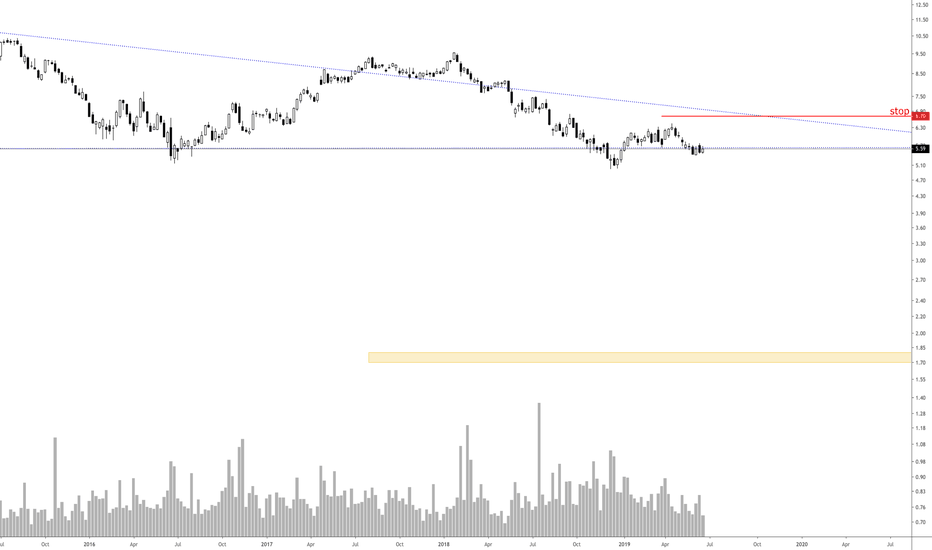

CGC Triple Top ! Hello Traders,

Lets have a look at CGC - Canopy Growth Corporation

Points to consider

- A clear Triple Top

- Overall trend putting in higher highs

- Stoch in lower regions

- RSI coming into a tighter pattern

- Volume declining rapidly

- VPVR showing low volume of transactions after this support

- EMA's giving price resistance

CGC has had a strong bull rally, the first impulse retraced back to the .618 Fibonacci Zone before pushing another leg up. Price was in discovery mode after this push before retesting the .618 Fibonacci again, holding support but at the same time making the price put in a triple top. CGC is testing a very key trend line, if respected, will put in a higher high in the market structure. However if price does not respect the trend line and breaks below, then CGC is more probable to have a major correction. Price can really tank if this support is broken as the VPVR is showing very low volume of transactions between the support zones. With the volume declining, we can expect a move very soon...

What are your thoughts on CGC's price actions

Please leave a like and comment,

and some food for thought

“I think investment psychology is by far the more important element, followed by risk control, with the least important consideration being the question of where you buy and sell.” – Tom Basso

CREE - company report is bad!Company report is bad, and as we see the fall of the asset.

The stock market is easier because it is logical to trade

and cryptocurrency 24/7

I asked a friend to make a schedule of this asset AZNtechnical analysis

The asset goes to the weekly channel.

I see a pattern that is drawn in red)

Mid channel pushed buyers away.

Let's go on the script.

If you look at the timeframe you can find a better entry point,

I would enter after the breakdown of the white border and put a stop flat abroad)

TSLA at "make it or break it" moment$TSLA has been rebounding for just over a month now, but is facing a pretty heady resistance line. Price action is lagging behind our model a bit, but if price can make it through the resistance we could see a huge rally as everyone who were doubters pile back in.

Tesla inc - trend change?From the point of view of technical analysis on the daily time frame,

there is a continuation triangle moving up indicated by an arrow.

Something strong in the range of $ 180-177

when you exit the descending channel and fixing above it, you can say that the trend has reversed.

But against the background of the trade war between the States and China, they can spoil the picture with the change of trend.

If you can go locally in Long, it suddenly strikes)

During the breakdown, the main resistance level is marked in yellow (level $ 250)

A couple of my indicators hint at a purchase!

Solve.Care : The Repeated Pattern0. Let me tell you in advance. There is no direction. The following is a strategy for chart patterns. Please note that patterns can break at any time.

1. Box 1, Box 2, Box 3, and Box 4 maintain similar patterns such as Eliot pulses (12345-ABC) and Triangular convergence in the process of creating C waves. The difference may be masked by whether it is upward deviation or downward deviation at the end of each triangular convergence. Box 4 If the chart is triangular converged at the current position, which is the last small box, it is likely to show a large fluctuation at the end just like boxes 1, 2, and 3. For we expect to see a rise in the long term, We can take strategy with reducing risk, buy chase or taking a risk, buy low price.

2. Fibonacci extension level 1.618 is keeping well. Marketing strategy according to Fibonacci extension level 1.618

- Target #1 : 0.00004408 satoshi

- Target #2 : 0.00004780 satoshi

- Target #2 : 0.00005424 satoshi

- Stop Loss : 0.00003739 satoshi

HIGH GRADE COPPER FUTURES (JULY 2019) (HG) 4-HR TIMEFRAME SHORTCopper prices have just broken out of a support level of 2.8495, with the former resistance at 2.9750. The market has completed the advancing and distribution stages, and has just started the decline stage. I expect prices to tank further, as commodities are in large sell-offs these past weeks. The price is also forming a new downtrend, as it makes lower highs and lower lows. Possible targets include the 2.6875 and 2.6565 areas. May the bears be upon us!

ENTRY: Now

Stop Loss: 2.7810

Target One: 2.875

Target Two: 2.6565

SILVER DAILY TIMEFRAME SHORTSilver is set to follow it's long lost posh cousin, gold, on the sell-off. This is quite a risky trade considering the large pullbacks in the silver market. Plus there is the notion of entering a short when the market is already oversold. But we don't care about indicators, do we? Surely i entered a short trade on the last gold trade when the stochastic oscillator was heavily oversold, but i came out with some profits. The only perk was i had to go and write an exam the following day, while holding the trade and when i came back home to the Wi-Fi zone, it had barely moved. It only started moving when i was relaxing thinking of of how to get rid of my headache. Still, we won the trade so that's that. My entries on the trade are as follows:

Entry: now or never!!!

Stop loss: 14.583

Take Profit: 14.000 or sooner!!!

VIX - Indices Trading | Elliott Wave Structures | Q2 2019*Please support this idea with a LIKE if it helps you. Thanks!

More details about me in my signature.

VIX - Elliott Wave Outlook

Pattern:

Leading Diagonal in Intermediate (1) (blue)

"Bullish" Divergence soon to launch a spike

Next expected swing:

Violent rise and a spike in volatility in Intermediate (2) (blue)

Structure change:

An impulsive continuation for the down-side could lead towards Indices rallying in a 3 of 3's.

VIX - Market Crash Cycles | Indices | Macro Trends*Please support this idea with a LIKE if it helps you. Thanks!

More details about me in my signature.

VIX should be able to resume the down-trend soon and complete the "greed" cycle, which in turn would translate bullish momentum for Indices and a postpone on the inevitable Market Crash sequence.

If however a break-out would occur, then a proper spike could be in play, translating into a prolonged "fear" period.Nevertheless, these are crucial times and the movements will be epic.

Just need to be on top of it and keep on tracking, confirm and then tap into the real trend.Eat, sleep, trade and visualize those pips piling up.

Impact of CME Expiration Date on BTC*** This article is not for sale or buy.

The CME expiration date has a major impact on BTC's trend transition. Inverse head and shoulders pattern & CME expiration date, Triangle pattern & CME expiration date.

1. Current Coin Market Status

- Coin Cap : 179 Billion $

- Bitcoin Dominance : 52.0%

- Volume by National Currencies : USD(36.5%), JPY(44.2%), KRW (4.09%)

2. The Comparison of Coin Market Cap

- Coin Cap : about 179 billion $

- Stock Market Cap around the world : about 50 trillion $ / 0.27%

- Korean Stock Market Cap : about 1760 billion $ / 10%

- Samsung Electronics Cap : about 240 billoion $ > Coin Cap

3. Futures Expiration date

1) CME : On the last Friday of every month at 4 pm / UTC

2) CBOE : On Third Wednesday of each month at 10 pm / UTC

4. The Long-Term BTC Forecast

- A similarity with the 2015 bottom & Influence of halving

- The rising curve by pattern

5. 2021, The bubble of new industry for overcoming economic crisis?

6. Around CME Expiration Date, since BTC trends often change or price fluctuations increase, you should look more carefully. The charts listed below are some of my previous analyses of how the CME expiration date has affected BTC pricing. Please check. If you liked this idea, please, 'Thumbs up', 'Follow', 'Comment'~^^

1) CME Expiration Date on June 2018 )

2) CME Expiration Date on July 2018 )

3) CME Expiration Date on December 2018 )

4) CME Expiration Date on March 2019 )

2015 bottom VS 2019 bottom*** This article is not for sell or buy. If you liked this idea, please, 'Thumbs up', 'Follow', 'Comment'~^^

If you look at the title, main chart, and secondary chart, you can easily understand. Therefore, the explanation is omitted.

[ ] 13.11 ~ 17.12 (about 1470d) >> 0.85% >> [ ] 17.12 ~ 21.05 (about 1250d)

---------------------------------------------------------------------

(1-1) 13.11 ~ 14.12 (about 400d) >> 0.85% >> (2-1) 17.12 ~ 18.11 (about 340d)

(1-2) 14.12 ~ 15.10 (about 300d) >> 0.85% >> (2-2) 18.11 ~ 19.07 (about 255d)

(1-3) 15.10 ~ 17.03 (about 500d) >> 0.85% >> (2-3) 19.07 ~ 20.09 (about 425d)

(1-4) 17.03 ~ 17.12 (about 270d) >> 0.85% >> (2-4) 20.09 ~ 21.05 (about 230d)

0. the comparison of indicator : 50MA, 100MA, 200MA

1. Current Coin Market Status- Coin Market Cap : $ 184 Billion

- Bitcoin Dominance : 53.4%- Volume by National Currencies : USD( 45.4% ), JPY( 39.0% ), KRW ( 2.0% )

2. The Comparison of Coin Market Cap

- Coin Market Cap : about $ 184 billion- Stock Market Cap around the world : about $ 50 trillion / about 0.37%- Korean Stock Market Cap : about $ 1760 billion / about 10%- Samsung Electronics Cap : about $ 240 billoion >Coin Market Cap

3. Futures Expiration date- CME : On the last Friday of every month at 4 pm- CBOE. : On Third Wednesday of each month at 10 pm

4. The Long-Term BTC Forecast- A similarity with the 2015 bottom &Influence of halving

kr.tradingview.com The rising curve by pattern