GBPAUD - One More Leg for Bears to Take Over!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈GBPAUD has been overall bullish trading within the rising channel marked in blue.

However, it is currently approaching the upper bound of its channel acting as an over-bought zone.

And the $2.1 - $2.104 is a strong resistance zone.

🏹 Thus, the highlighted red circle is a strong area to look for sell setups as it is the intersection of resistance and upper blue trendline acting as a non-horizontal resistance.

📚 As per my trading style:

As #GBPAUD is around the red circle zone, I will be looking for bearish reversal setups (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CFD

EURUSD Shows Signs of Reversal as Momentum Shifts HigherThe EURUSD is beginning to show signs of a reversal as momentum shifts and moves above its 10-day exponential moving average. The EURUSD has recently experienced a significant move since early February, rising to a high of 1.147, which resulted in it becoming overbought, touching its upper Bollinger band, and pushing the RSI above 70. Now, after a brief pullback, the EURUSD appears poised to make another push higher.

The EURUSD has now moved above its 10-day exponential moving average and its 20-day simple moving average. Additionally, it appears to have broken above a minor downtrend that began on 28 April. If this momentum continues, EURUSD could rise back towards resistance at the upper Bollinger band, around 1.145, and perhaps even retest the 1.157 peak seen on 21 April.

Perhaps more importantly, a short-term trend reversal is underway, with the Relative Strength Index breaking above a short-term downtrend that started on 21 April. If this trend break holds, it would indicate that the recent decline in EURUSD has likely ended, setting the stage for another move higher.

Also supporting a potential rebound and move higher is the successful bounce of EURUSD off its 38.2% retracement level, measured from the lows established on 3 February to the highs of 21 April. Combined with the factors mentioned earlier, this suggests the next move for EURUSD is likely upwards.

However, if support fails to hold and EURUSD falls below 1.105, it could decline further towards the next support at 1.075, which corresponds to the 61.8% retracement level from the 3 February lows.

Written by Michael J. Kramer, founder of Mott Capital Management.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed.

No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

GOLD - Trio Retest!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈After rejecting the $3,500 round number and upper bound of the wedge, XAUUSD has been in a correction phase trading within the falling red channel.

📚 As Gold approaches the $3,100 - $3,150 support zone, I will be looking for buy setups on lower timeframes as it is the intersection of three rejections:

1- The lower bound of the falling red channel

2- The lower bound of the rising orange wedge

3- $3,100 - $3,150 support zone

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Gold - Follow The Macro Trend!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 GOLD has been overall bullish from a macro perspective trading within the rising wedge pattern in orange.

After rejecting the $3,500 round number and upper bound of the wedge, XAUUSD signaled the start of the correction phase as marked by the red falling channel.

Moreover, the $3,100 - $3,150 zone is a strong support.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of support and lower orange trendline acting non-horizontal support.

📚 As per my trading style:

As #XAUUSD approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPJPY - Bullish No More!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈As per our last GBPJPY analysis (attached on the chart), it rejected the lower bound of the rising blue channel.

What's next?

GBPJPY is currently approaching the upper bound of its falling trend marked in red.

Moreover, the green zone is a strong structure and resistance.

🏹 Thus, the highlighted red circle is a strong area to look for sell setups as it is the intersection of structure and upper red trendline acting as a non-horizontal resistance.

📚 As per my trading style:

As #GBPJPY approaches the red circle zone, I will be looking for bearish reversal setups (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURNZD - The Bull of the Week!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈EURNZD has been overall bearish trading within the falling channel marked in red.

However, it is retesting the lower bound of the channel acting as an over-sold area.

Moreover, the blue zone is a strong demand!

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of demand and lower red trendline acting as a non-horizontal support.

📚 As per my trading style:

As #EURNZD approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURAUD - Overall Bearish Medium-Term!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈EURAUD has been overall bearish trading within the falling wedge pattern marked in red.

Moreover, the green zone is a strong structure and resistance.

🏹 Thus, the highlighted red circle is a strong area to look for sell setups as it is the intersection of the upper red trendline and resistance.

📚 As per my trading style:

As #EURAUD retests the red circle zone, I will be looking for bearish reversal setups (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPJPY - Crazy Bullish!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈GBPJPY has been overall bullish trading within the rising channel marked in blue.

Moreover, it is retesting a strong demand zone marked in green.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of demand and lower blue trendline acting as a non-horizontal support.

📚 As per my trading style:

As #GBPJPY approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOLD Formed Bearish Head and Shoulders Pattern🚨 TVC:GOLD Formed Bearish Head and Shoulders Pattern 🚨

TVC:GOLD has formed a bearish head and shoulders pattern and appears to be making a pullback to the neckline before a potential drop. However, if the price breaks out above the right shoulder, the bearish pattern could be invalidated.

📈 Technical Overview:

Pattern: Bearish Head and Shoulders

Neckline: Current pullback area.

Bearish Confirmation: A drop below the neckline could confirm the bearish move.

Invalidation: If the price breaks out above the right shoulder, the bearish pattern may be invalidated.

Symmetrical Triangle Nearing Resolution: Breakout or Breakdown?BTC/USD H4 Analysis – Symmetrical Triangle Nearing Resolution: Breakout or Breakdown?

📊 Technical Outlook – 4H Timeframe

Bitcoin is currently consolidating within a clear symmetrical triangle, with price tightening ahead of a potential major breakout. The chart shows price testing the upper boundary of the triangle, supported by MA13 and MA34 from below.

Key resistance zones: 86,594 and the extended target zone at 88,753. A successful breakout above this region could trigger a strong rally toward 90,000+.

Key support levels: 81,397 – 78,725 – 75,102, acting as critical retracement zones in case of downside rejection.

The structure suggests two primary scenarios:

Bullish breakout to 86,594 → 88,753, followed by a pullback and continuation higher.

False breakout or breakdown, leading to a sell-off toward 78,725 and possibly down to 75,102 if market sentiment deteriorates.

🌍 Macro Context & Market Sentiment

Investor sentiment remains fragile, impacted by ongoing geopolitical risks and the Fed’s cautious stance on monetary policy.

Altcoins are underperforming, signaling that capital rotation remains limited – often a precursor to short-term correction or distribution in BTC.

Volume is fading as price coils inside the triangle, typically a precursor to a sharp move in either direction.

🧠 Trading Strategy Ideas

Watch closely for price action near 86,594 – 88,753. If rejection or wick rejections occur, short-term pullback trades may be viable.

A breakdown below the triangle support (~84,000 area) could open up downside targets at 81,397 and 78,725.

A clean breakout with volume confirmation? Look for retest buys around 86k with continuation potential.

⚠️ Caution Advised

BTC is in a “calm-before-the-storm” zone. This is not the time to chase moves or overleverage. Let the market confirm direction and trade based on structure, not emotion.

💬 Are you leaning bullish or bearish on BTC’s next move? Will we see 90k or a drop back to 75k? Share your thoughts below! 👇👇👇

Gold (XAUUSD) — Technical and Fundamental Analysis 2HTechnical Outlook

On the 4H chart, gold is forming a rising structure and is currently trading near the 3236–3260 resistance zone, aligned with the 1.272 Fibonacci extension. This area is expected to act as a short-term cap, with a potential corrective move ahead.

🔹 Key Levels:

Resistance: 3236, 3260

Support: 3132–3140 (trendline), 3082 (horizontal zone)

🔹 Formations:

Potential retracement setup after an extended impulse

Expected correction toward 3132–3140 (rising trendline)

If support holds, price may resume the uptrend toward 3308 (1.414 Fibonacci extension)

🔹 Indicators:

RSI near overbought zone

MACD shows momentum weakening

EMA 50/200 continue to support the bullish trend

Fundamental Drivers

Inflation concerns and soft landing expectations support safe-haven flows

Market is pricing in potential Fed rate cuts in H2 2025

Central banks continue to accumulate gold reserves

Dollar weakness provides additional support for gold prices

Scenario

Base case:

Rejection at 3236–3260 → pullback to 3132–3140 → continuation toward 3308

Alternative:

Break above 3260 → direct move to 3308.

Break below 3132 → possible slide toward 3082.

Connecting Your Tickmill Account to TradingView: A Step-by-Step In this step-by-step guide, we’ll show you exactly how to connect your Tickmill account to TradingView in just a few seconds.

✅ Easy walkthrough

✅ Real-time trading from charts

✅ Tips for a smooth connection

Don’t forget to like, comment, and subscribe for more trading tutorials!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

Gold (XAUUSD) – Technical Analysis for April 7, 2025 (1H)After a sharp drop, price reached the key demand zone around 3025-3030. This area forms a potential buy zone from which a rebound toward 3080–3100 may occur. The chart suggests a possible W-shaped recovery. A breakout above 3100 could unlock further upside toward 3127 and then resistance at 3167.

However, a breakdown below 3015–3020 could increase bearish pressure and lead to a decline toward 2997 support. Indicators are showing signs of local oversold conditions, hinting at potential technical recovery.

Main scenario – reversal from 3025-3030 with a move toward 3080–3100.

Alternative – breakdown to 2997.

GBPAUD - Already Over-Bought!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈GBPAUD has been bullish trading within the rising channels in orange and red.

Currently, GBPAUD is retesting the upper bound of the channels.

Moreover, the $2.085 - $2.1 is a strong resistance zone.

🏹 Thus, the highlighted red circle is a strong area to look for sell setups as it is the intersection of the upper trendlines and green resistance zone.

📚 As per my trading style:

As #GBPAUD approaches the red circle zone, I will be looking for bearish reversal setups (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

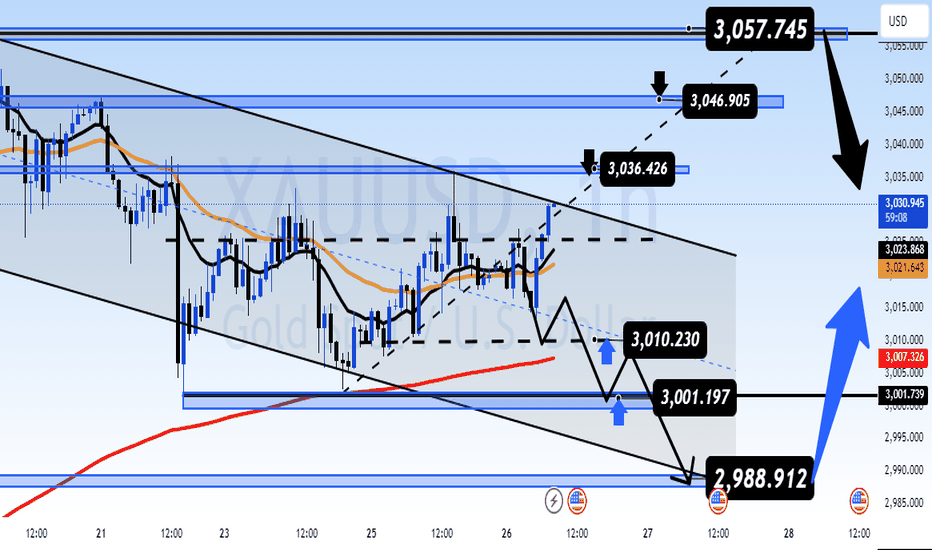

Gold Outlook – Steady Range Before Key Data Hits🟡 Market Context:

Gold has been trading in a steady range since the start of the week, with no significant breakout or momentum shift observed.

Today’s session is expected to remain quiet, as there are no major economic events scheduled.

All eyes are on the Thursday GDP release and Friday’s PCE inflation data from the US — both of which are likely to determine the direction for gold into the end of the month and quarter.

📆 Key Data to Watch:

Thursday: US Quarterly GDP

Friday: US PCE Price Index (Federal Reserve’s preferred inflation gauge)

These events are considered high-impact catalysts that may trigger sharp moves in gold, especially if surprises occur.

🔍 Technical Structure:

Price continues to respect key support and resistance zones identified earlier this week.

There is no confirmed breakout yet, so the strategy remains range-based:

➡️ Trade the levels. Watch for reaction signals at extremes.

➡️ Wait for clearer momentum following the macro releases.

🧭 Key Price Levels:

🔺 Resistance: 3,010 – 3,036 – 3,046 – 3,057

🔻 Support: 3,010 – 3,001 – 2,988

🎯 Trade Plan – 26/03

BUY ZONE: 2988 – 2986

SL: 2982

TP: 2992 – 2996 – 3000 – 3004 – 3008 – 3015

SELL ZONE: 3045 – 3047

SL: 3051

TP: 3042 – 3038 – 3034 – 3030 – 3026 – 3020

🧠 Final Notes:

The market remains in accumulation mode ahead of key US data.

No need to rush — protect your capital, wait for clean setups, and let the market reveal its hand.

— AD | Money Market Flow

GOLD - Eyeing Two Levels!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 XAUUSD remains overall bullish in both the short and medium term, trading within the rising channels marked in orange and green.

🔍 Here are two key levels I'm watching for potential trend-following long setups:

1️⃣$3,000 – A psychological round number that aligns with the lower orange trendline.

2️⃣$2,950 – A support level that intersects with the lower blue trendline.

Let’s see if the bulls hold the line! 🐂✨

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Silver – Lagging but Still Strong!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 SILVER has been bullish, trading within the rising wedge pattern marked in red.

Following the latest aggressive bullish movement, XAGUSD has formed a demand zone, marked in blue.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups, as it represents the intersection of demand, support, and the lower red trendline, which acts as a non-horizontal support.

📚 As per my trading style:

As #XAGUSD approaches the blue circle, I will be looking for bullish reversal setups, such as a double bottom pattern, a trendline break, and so on.

Additionally, for the bulls to maintain long-term control, a break above $3,500 is needed.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Head & Shoulders Pattern Forming? 📊 GOLD (XAU/USD) 1H Timeframe Analysis – Head & Shoulders Pattern Forming? 🚀

📉 Gold is forming a possible Head & Shoulders pattern on the 1-hour chart.

🔄 Key Levels & Scenarios:

✅ Bearish Scenario: If the price breaks below the blue support zone, the next targets will be at the green line levels.

✅ Invalidation: If the price moves above the right shoulder, the bearish structure is invalidated, and we could see a bullish continuation.

📌 Watch for a confirmed breakout before taking a position!

US30; Heikin Ashi Trade IdeaPEPPERSTONE:US30

In this video, I’ll be sharing my analysis of US30, using my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

GOLD - $3,000 is a Magnet!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 After recording a new all-time high this week, GOLD has been surging in a parabolic manner.

🎯 Next target? The $3,000 round number is lining up perfectly with the upper bound of the rising channel marked in red.

🏹Meanwhile , every bearish correction would be an opportunity to look for trend-following longs, targeting the $3,000 mark.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

HK50; Heikin Ashi Trade IdeaPEPPERSTONE:HK50

In this video, I’ll be sharing my analysis of HK50, using my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

What Are Financial Derivatives and How to Trade Them?What Are Financial Derivatives and How to Trade Them?

Financial derivatives are powerful instruments used by traders to speculate on market movements or manage risk. From futures to CFDs, derivatives offer potential opportunities across global markets. This article examines “What is a derivative in finance?”, delving into the main types of derivatives, how they function, and key considerations for traders.

What Are Derivatives?

A financial derivative is a contract with its value tied to the performance of an underlying asset. These assets can include stocks, commodities, currencies, ETFs, or market indices. Instead of buying the asset itself, traders and investors use derivatives to speculate on price movements or manage financial risk.

Fundamentally, derivatives are contracts made between two parties. They allow one side to take advantage of changes in the asset's price, whether it rises or falls. For example, a futures contract locks in a price for buying or selling an asset on a specific date, while a contract for difference (CFD) helps traders speculate on the price of an asset without owning it.

The flexibility of derivatives is what makes them valuable. They can hedge against potential losses, potentially amplify returns through leverage, or provide access to otherwise difficult-to-trade markets. Derivatives are traded either on regulated exchanges or through over-the-counter (OTC) markets, each with distinct benefits and risks.

Leverage is a very common feature in derivative trading, enabling traders to control larger positions with less capital. However, it’s worth remembering that while this amplifies potential returns, it equally increases the risk of losses.

These instruments play a pivotal role in modern finance, offering tools to navigate market volatility or target specific investment goals. However, their complexity means they require careful understanding and strategic use to potentially avoid unintended risks.

Key Types of Financial Derivatives

There are various types of derivatives, each tailored to different trading strategies and financial needs. Understanding the main type of derivative can help traders navigate their unique features and applications. Below are the most common examples of derivatives:

Futures Contracts

Futures involve a contract to buy or sell an asset at a set price on a specific future date. These contracts are standardised and traded on exchanges, making them transparent and widely accessible. Futures are commonly used in commodities markets—like oil or wheat—but also extend to indices and currencies. Traders commonly utilise this type of derivative to potentially manage risks associated with price fluctuations or to speculate on potential market movements.

Forward Contracts

A forward contract is a financial agreement in which two parties commit to buying or selling an asset at a predetermined price on a specified future date. Unlike standardised futures contracts, forward contracts are customizable and traded privately, typically over-the-counter (OTC). These contracts are commonly used for hedging or speculating on price movements of assets such as commodities, currencies, or financial instruments.

Swaps

Swaps are customised contracts, typically traded over-the-counter (OTC). The most common types are interest rate swaps, where two parties agree to exchange streams of interest payments based on a specified notional amount over a set period, and currency swaps, which involve the exchange of principal and interest payments in different currencies. Swaps are primarily used by institutions to manage long-term exposure to interest rates or currency risks.

Contracts for Difference (CFDs)

CFDs allow traders to speculate on price changes of an underlying asset. They are flexible, covering a wide range of markets such as shares, commodities, and indices. CFDs are particularly attractive as they allow traders to speculate on rising and falling prices of an asset without owning it. Moreover, CFDs provide potential opportunities for short-term trading, which may be unavailable with other financial instruments.

Trading Derivatives: Mechanisms and Strategies

Trading derivatives revolves around two primary methods: exchange-traded and over-the-counter (OTC) markets. Each offers potential opportunities for traders, depending on their goals and risk tolerance.

Exchange-Traded Derivatives

These derivatives, like futures, are standardised and traded on regulated exchanges such as the Chicago Mercantile Exchange (CME). Standardisation ensures transparency, making it potentially easier for traders to open buy or sell positions. For example, a trader might use futures contracts to hedge against potential price movements in commodities or indices.

Over-the-Counter (OTC) Derivatives

OTC derivatives, including swaps and forwards and contracts for difference, are negotiated directly between two parties. These contracts are highly customisable but may carry more counterparty risk, as they aren't cleared through a central exchange. Institutions often use OTC derivatives for tailored solutions, such as managing interest rate fluctuations.

Strategies for Trading Derivatives

Traders typically employ derivatives for speculation or hedging. Speculation involves taking positions based on anticipated market movements, such as buying a CFD if prices are expected to rise. Hedging, on the other hand, can potentially mitigate losses in an existing portfolio by offsetting potential risks, like using currency swaps to protect against foreign exchange volatility.

Risk management plays a crucial role when trading derivatives. Understanding the underlying asset, monitoring market conditions, and using appropriate position sizes are vital to navigating their complexity.

CFD Trading

Contracts for Difference (CFDs) are among the most accessible derivative products for retail traders. They allow for speculation on price movements across a wide range of markets, including stocks, commodities, currencies, and indices, without owning the underlying asset. This flexibility makes CFDs an appealing option for individuals looking to diversify their strategies and explore global markets.

How CFDs Work

CFDs represent an agreement between the trader and the broker to exchange the difference in an asset's price between the opening and closing of a trade. If the price moves in the trader’s favour, the broker pays the difference; if it moves against them, the trader covers the loss. This structure is straightforward, allowing retail traders to trade in both rising and falling markets.

Why Retail Traders Use CFDs

Retail traders often gravitate towards CFDs due to their accessibility and unique features. CFDs allow leverage trading. By depositing a smaller margin, traders can gain exposure to much larger positions, potentially amplifying returns. However, you should remember that this comes with heightened risk, as losses are also magnified.

Markets and Opportunities

CFDs offer exposure to an extensive range of markets, including stocks, forex pairs, commodities, and popular indices like the S&P 500. Retail traders particularly appreciate the ability to trade these markets with minimal upfront capital, as well as the availability of 24/5 trading for many instruments. CFDs also enable traders to access international markets they might otherwise find difficult to trade, such as Asian or European indices.

Traders can explore a variety of CFDs with FXOpen.

Considerations for CFD Trading

While CFDs offer potential opportunities, traders must approach them cautiously. Leverage and high market volatility can lead to significant losses. Effective risk management in derivatives, meaning using stop-loss orders or limiting position sizes, can help traders potentially navigate these risks. Additionally, costs like spreads, commissions, and overnight fees can add up, so understanding the total cost structure is crucial.

Key Considerations When Trading Derivatives

Trading derivatives requires careful analysis and a clear understanding of the associated risks and potential opportunities.

Understanding the Underlying Asset

The value of a derivative depends entirely on its underlying asset, whether it’s a stock, commodity, currency, or index. Analysing the asset’s price behaviour, market trends, and potential volatility is crucial to identifying potential opportunities and risks.

Choosing the Right Derivative Product

Different derivatives serve different purposes. Futures might suit traders looking for exposure to commodities or indices, while CFDs provide accessible and potential opportunities for those seeking short-term price movements. Matching the derivative to your strategy is vital.

Managing Risk Effectively

Risk management plays a significant role in trading derivatives. Leverage can amplify both returns and losses, so traders often set clear limits on position sizes and overall exposure. Stop-loss orders and diversification are common ways to potentially reduce the impact of adverse market moves.

Understanding Costs

Trading derivatives involves costs like spreads, commissions, and potential overnight financing fees. These can eat into potential returns, especially for high-frequency or leveraged trades. A clear understanding of these expenses may help traders evaluate the effectiveness of their strategies.

Monitoring Market Conditions

Derivatives are sensitive to their underlying market changes, from geopolitical events to macroeconomic data. In stock derivatives, this might be company earning reports or sudden shifts in management. Staying informed helps traders adapt to shifting conditions and avoid being caught off guard by sudden price swings.

The Bottom Line

Financial derivatives are versatile tools for trading and hedging, offering potential opportunities to access global markets and diversify strategies. While their complexity demands a solid understanding, they can unlock significant potential for informed traders. Ready to explore derivatives trading? Open an FXOpen account today to trade CFDs on more than 700 assets with competitive costs, fast execution, and advanced trading tools. Good luck!

FAQ

What Is a Derivative?

The derivatives definition refers to a financial contract whose value is based on the performance of an underlying asset, such as stocks, commodities, currencies, or indices. Derivatives are financial instruments used to hedge risk, speculate on price movements, or access specific markets. Examples include futures, forwards, swaps, and contracts for difference (CFDs).

What Are the 4 Main Derivatives?

The primary categories of derivatives are futures, forwards, swaps, and contracts for difference (CFDs). Futures are commonly traded on exchanges, while forwards, swaps and CFDs are usually traded over-the-counter (OTC). Each serves different purposes, from risk management to speculative trading.

What Is the Derivatives Market?

The derivatives market is where financial derivatives are bought and sold. It includes regulated exchanges, like the Chicago Mercantile Exchange, and OTC markets where customised contracts are negotiated directly between parties. This market supports hedging, speculation, and risk transfer across global financial systems.

What Is the Difference Between Derivatives and Equities?

Equities signify ownership in a company, typically in the form of stock shares. Derivatives, on the other hand, are contracts that derive their value from the performance of an underlying asset, which can include equities. Unlike equities, derivatives do not confer ownership.

Is an ETF a Derivative?

No, an exchange-traded fund (ETF) is not a derivative. It is a fund that tracks a basket of assets, such as stocks or bonds, and trades like a stock. However, ETFs can use derivatives, such as futures, to achieve their investment objectives.

Is the S&P 500 a Derivative?

No, the S&P 500 is not a derivative. It is a stock market index that tracks the performance of 500 large companies listed in the US. Derivatives, like futures, can be created based on the S&P 500’s performance.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.