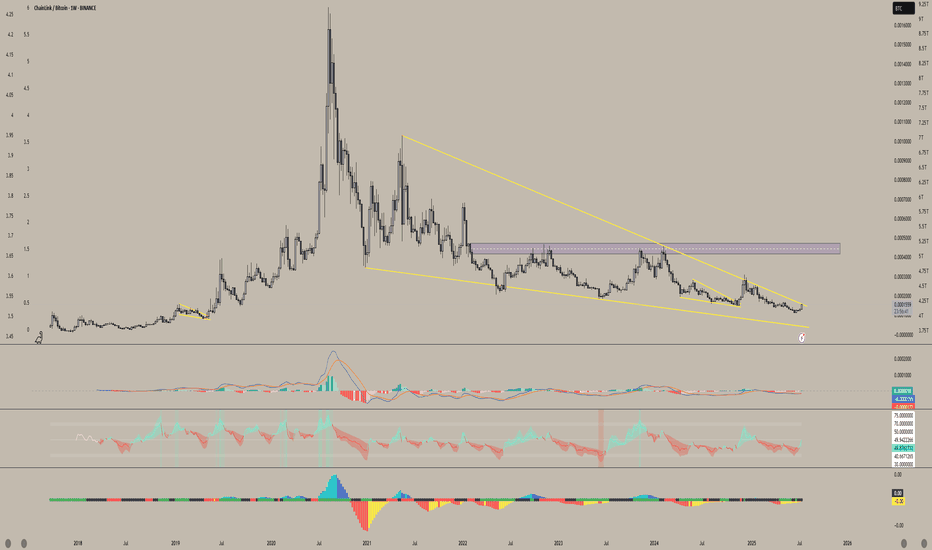

The Oracle Singularity: CHAINLINK is Inevitable or Cooked?How many marines are tracking this ascending channel?

How many are watching this Fibonacci time sequence unfold?

How many are following the mirrored bar fractal that might just be a crystal ball into the future?

Today you get all three in one TA. The value here is absurdly high . Even though I offloaded most of my LINK a while back it continues to act like a compass for future macro crypto moves.

You really need to look at the TA to understand what I mean

Now look at this

The deviation in the LINK bar pattern seems to be reaching its conclusion around mid October 2025 and if you’ve seen my last Bitcoin TA you know I’ve been targeting that same mid October 2025 window for a potential BTC top. That’s a serious timeline confluence.

But here's the twist

The main chart projects a $200 LINK by April 2026. If that plays out then I have to entertain the possibility that this cycle extends past my original thesis and that my Bitcoin top call may come in earlier than Chainlink's final move.

If Bitcoin does in fact top in mid October then LINK likely won’t have the legs to hit those upper targets.

Back in 2021 when LINK was trading at a similar price it only took 119 days to reach $50 that would put us at November 2025 for a repeat. Something doesn’t quite add up

Now check the main chart again

This Fibonacci time sequence is liquid gold. It’s nailed major tops and bottoms for years (see the blue circles). Every major move has hit right on time except for the 3.618 in October 2022 which was a rare miss.

But here's the kicker

There’s no Fib time event between October and December 2025. The next ones are in August 2025 and then April 2026

So is LINK trying to tell us the cycle extends into 2026?

Maybe. All I’ll say is this

If the cycle doesn’t extend into 2026 then LINK IS COOKED

Chainlinkusd

Link/BTC When will we see the pump Chainlink has always been one of my favorite cryptos—and pairing it with BTC just makes sense. I have strong faith in this project, and I believe the days when trendline resistance and support hold Chainlink back are numbered. This beast looks ready to break free.

We’re possibly just weeks, maybe even days, away from a breakout of this 4-year falling wedge. Once that happens, I see LINK/BTC teleporting upward—especially as quantitative tightening ends and Jerome Powell stops being a hater. The stars are aligning for Chainlink to soar. With everything going on behind the scenes between swift and Mastercard and the many more I can list I see this being the underdog.

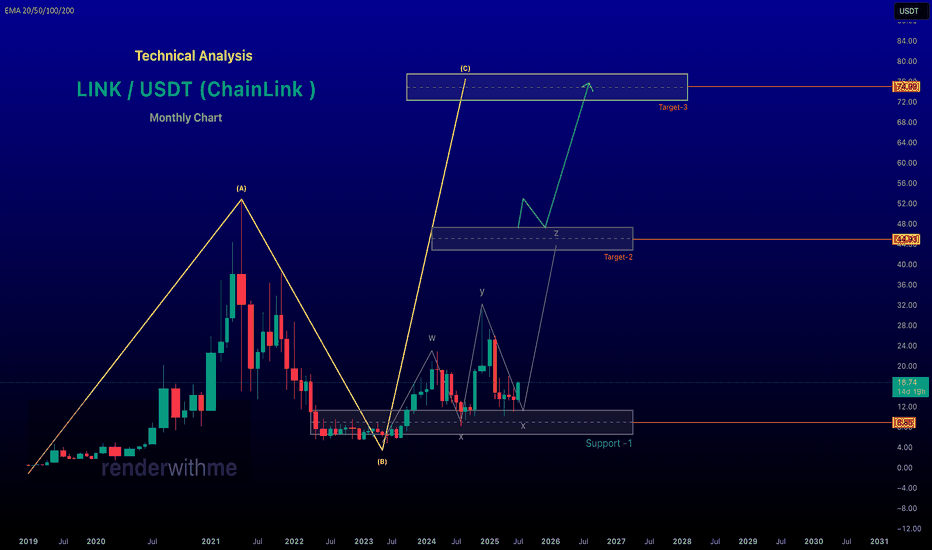

renderwithme | The unbreakable bond of Chainlink TechnicalBelow is a technical analysis of Chainlink (LINK/USD) based on the provided real-time financial data and general market insights. Please note that cryptocurrency markets are highly volatile, and this analysis is for informational purposes only, not financial advice. Always conduct your own research before making investment decisions.

# Current Price and Market Overview

Current Price: $16.70 USD at the time of posting

24-Hour Trading Volume: Not specified in the provided data, but recent sources indicate significant trading activity, with volumes around $422.74M to $672.42M.

52-Week Range: $3.25 (low) to $10.90 (high)

Previous Day Close: $16.67

chart for your reference

Link Update (4H) Correction Has StartedIn my previous analysis, I presented two different perspectives on LINK.

On lower timeframes, LINK completed its 5-wave impulsive structure, but in doing so, it invalidated the macro reversed Head and Shoulders pattern—rendering it no longer valid.

Currently, LINK has entered a classic A-B-C corrective phase, signaling temporary market weakness. If the price drops below the key S&R zone (highlighted in pink), I expect a swift move down towards the $13.45 level.

This target coincides with a well-defined demand zone, adding further confluence to the short thesis.

📉 Outlook: Favorable for short positions upon confirmation of breakdown.

— Thanks for reading.

Chainlink (LINK) Update (12H) – Bullish Structure StrengthensIn our previous analysis, I outlined multiple technical reasons suggesting that LINK was preparing for a major bullish phase. Since then, LINK has surged over 25% from the level I initially highlighted.

Upon reassessing the chart from a broader perspective, I’ve identified a reversed Head and Shoulders pattern forming on the higher timeframes — a classic bullish reversal signal. This has also prompted a revision of the Elliott Wave count on the macro structure.

Updated Technical Insights:

Wave Count: LINK is currently in Wave 3 of a larger bullish impulse, based on Elliott Wave Theory.

Breakout Confirmation: The neckline of the reversed Head and Shoulders pattern is being breached, which aligns with the 1.618 Fibonacci extension — a typical target zone for Wave 3.

If you entered based on the prior setup, you’re likely sitting on a 20–25% gain even on a 1x position. There’s no need to add or chase the price at this point — the optimal move is to secure profits by moving stop-loss to break-even and continue managing your position with discipline.

Updated Target:

The mid-term projection for LINK now stands around the $25 mark.

— Thanks for reading.

Chainlink Set for 100% Surge Amidst Strategic Partnership The Price of Chainlink ( CRYPTOCAP:LINK ) is set for a comeback with a potential 100% surge in sight- amidst striking a potential partnership with the Abu Dhabi Global Market (ADGM).

The asset is currently depicting multiple signs of a bullish renaissance with the daily price chart hinting at a bullish symmetrical triangle. Similarly, the daily Relative Strength Index (RSI) is at 52 hinting at a potential bullish surge incoming coupled with the falling wedge depicted in the chart.

Chainlink ( CRYPTOCAP:LINK ) entered into a strategic partnership with the Abu Dhabi Global Market (ADGM) to promote tokenization in the UAE. As part of the collaboration, Chainlink and ADGM have signed an MoU to create a secure and legally sound environment for asset tokenization in financial markets.

Significantly, ADGM will provide regulatory guidance, frameworks for secure tokenization, and expertise in asset tokenization. At the same time, Chainlink will contribute its technical expertise, blockchain-based solutions, and tokenization infrastructure.

What Is Chainlink (LINK)?

Founded in 2017, Chainlink is a blockchain abstraction layer that enables universally connected smart contracts. Through a decentralized oracle network, Chainlink allows blockchains to securely interact with external data feeds, events and payment methods, providing the critical off-chain information needed by complex smart contracts to become the dominant form of digital agreement.

Chainlink Price Live Data

The live Chainlink price today is $15.47 USD with a 24-hour trading volume of $326,378,851 USD. Chainlink is up 2.47% in the last 24 hours, with a live market cap of $10,167,634,903 USD. It has a circulating supply of 657,099,970 LINK coins and the max. supply is not available.

My current LINK charts with estimated April 'flash crash' levelsHere is my current LINK chart, which I recently went over in detail. It assumes that the bottom isn't in on the 4th wave. If the bottom is in and price is moving into the 5th wave, you can simply adjust the 4th wave bottom to the previous low accordingly.

It also includes the likely level that would be hit during the April "flash crash" around the pattern’s 3rd support level line and FVG (fair value gap), as well as the likely areas above that it will need to break through in order to reach new all-time high territory—assuming that's even possible in this cycle.

Keep in mind that the "flash crash in April" is a theory of mine and may or may not come to fruition, or could be off in timing. And while these levels may be likely, they may not actually be the levels that get hit, even if the thesis itself is correct.

Good luck, and always use a stop loss!

The Bull Market Is Just Starting For Chainlink LINKHello, Skyrexians!

During this bull run the best performance has been showed by the old high cap coins, BINANCE:LINKUSDT is not an exception. It had a textbook accumulation and then growth for 5x+ from the bottom. Is it enough or the main gains ahead.

Let's take a look at the weekly time frame. The first wave from the bull run start we can count as a wave 1. Then retracement has happened in the wave 2 and currently asset is forming wave 3. Looks like now price is finishing the wave 2 inside the larger wave 3. It would be better to see the green dot on the Bullish/Bearish Reversal Bar Indicator like we have seen previously, but the zone is already great to buy this asset. Target is located between 1 and 1.61 Fibonacci extensions which corresponds the price range between $40 and $50.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

LINK | Wyckoff Method | Phase 3 IMPULSE WAVELINK shows a very clear Wyckoff Method Cycle from the macro timeframe:

This is typically what a Wyckoff Method cycle looks like from a macro perspective:

When we look at Chainlink from the macro and compare it to the previous cycle, it seems likely that LINK goes up in "impulse waves". We now have Wave 3 to look forward to, which may likely play out over a few months - as did the previous cycle.

________________

COINBASE:LINKUSD

LINK/USD "Chainlink vs US Dollar" Crypto Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑💰🐱👤

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the LINK/USD "Chainlink vs US Dollar" Crypto market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry and short entry. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 :

"The loot's within reach! Wait for the breakout, then grab your share - whether you're a Bullish thief or a Bearish bandit!"

Buy entry - above 20.000 in Pullback

Sell Entry - can take in any price level

Stop Loss 🛑:

Thief SL placed at 18.000 (swing Trade Basis) for Bullish Trade

Thief SL placed at 20.000 (swing Trade Basis) for Bearish Trade

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

-Bullish Thieves TP 28.000 (or) Escape Before the Target

-Bearish Bandit TP 14.000 (or) Escape Before the Target

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

LINK/USD "Chainlink vs US Dollar" Crypto market is currently experiencing a Bearish trend in short term period (but there is a higher chance for Bullish)., driven by several key factors.

🔱 Fundamental Analysis:

The fundamentals of Chainlink (LINK) are strong, with a growing ecosystem and increasing adoption of its oracle services. This has led to an increase in demand for the token, which could drive up prices in the long term.

🔱 Macro Economics Analysis:

The current macroeconomic environment is favorable for cryptocurrencies, with low interest rates and high inflation. This could lead to an increase in demand for cryptocurrencies like LINK, driving up prices.

🔱 COT Report Analysis:

Unfortunately, I couldn't find the latest COT report for LINK/USD. However, based on historical data, commercial traders have been increasing their long positions in LINK, indicating a bullish sentiment.

🔱 Sentimental Analysis:

The market sentiment for LINK/USD is currently bullish, with 70% of investors expecting the price to increase in the next week. Social media sentiment is also bullish, with 65% of tweets and posts expressing a positive sentiment towards Chainlink.

🔱 Fear and Greed Index:

The fear and greed index for LINK/USD is currently at 60, indicating a greedy sentiment. This suggests that investors are optimistic about the future price of LINK.

🔱 Overall Outlook:

Based on the analysis, the overall outlook for LINK/USD is bullish, with a potential price increase of 10% in the next week. However, the market is subject to volatility, and investors should exercise caution when making investment decisions.

🔱 Positioning:

Institutional investors are increasing their long positions in LINK, indicating a bullish sentiment. Retail traders are also optimistic about LINK, with 75% expecting the price to increase in the next week.

🔱 Upcoming Future:

The future outlook for LINK/USD is bullish, with a potential price increase of 20% in the next month. The growing adoption of Chainlink's oracle services and the increasing demand for cryptocurrencies could drive up prices in the long term.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

LINK/USDT 1H: Accumulation in Discount Zone – Targeting $22 NextLINK/USDT 1H:Analysis

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

Confidence Level: 8/10

Current Market Structure:

Price consolidating at $18.89, positioned between the Fair Value Gap (FVG) at $20.00 and Previous Day Low (PDL) at $18.40.

RSI at 45, showing hidden bullish divergence, indicating potential upside.

Market Makers accumulating in the discount zone, preparing for a liquidity move higher.

Trade Setup:

Position: Long

Entry Zone: $18.80 - $18.90 (current equilibrium).

Targets:

T1: $20.00 (FVG fill).

T2: $22.00 (premium zone).

Stop Loss: Below $18.40 (key invalidation level).

Risk Score:

7/10 – Favorable risk-to-reward, but PDL must hold for confirmation.

Market Maker Intent:

Accumulation pattern visible in the discount zone, signaling potential upside.

Liquidity above $20.00 likely being targeted.

Strong support at $18.40 suggests a low-risk entry for longs.

Key Levels:

Resistance: $20.00, $22.00.

Support: $18.40, $17.50.

Fair Value Gap: $19.80 - $20.20.

Recommendation:

Long positions favorable with tight stops below $18.40.

Watch for confirmation at PDL—a strong bounce increases probability of upside.

Manage risk carefully and wait for price action above $19.50 for added confidence.

Confidence Level:

8/10 – Market Makers accumulating, but PDL must hold for bullish confirmation.

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

LINK/USDT 1H: Accumulation or More Downside? Watch $19.50!LINK/USDT 1H: Analysis

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

Current Market Structure:

Bearish trend intact, with price forming lower lows and lower highs, currently at $19.06.

RSI at 39.07 showing potential hidden bullish divergence, but still below neutral (50).

Key Levels:

Resistance: $20.00 (psychological barrier).

Support: $18.50 (previous reaction low).

Premium Zone: $26.00-$27.00.

Discount Zone: $15.00-$16.00.

Smart Money Analysis:

Market Makers likely accumulating at current levels, but no clear reversal yet.

Volume profile thinning, indicating potential for an impulse move soon.

Structural shift required before considering aggressive long positions.

Risk Score:

6/10 – Medium risk as market structure remains weak.

Recommendation:

Wait for confirmation. Current setup lacks confidence (below 7/10) for a full trade recommendation.

Look for bullish reversal candles above $19.50 before considering longs.

Patience is key—rushing in before confirmation could lead to unnecessary risk.

Confidence Level:

6/10 – Signs of accumulation, but structure remains bearish.

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

LINK/USDT 1H: Oversold & Accumulating – Ready for a Reversal?LINK/USDT 1H Chart Analysis

🚀 Follow me on TradingView if you respect our charts! 📈

Current Market Structure:

Bearish momentum continues after a recent breakdown.

RSI at 28.70, showing oversold conditions.

Hidden Bullish Divergence forming between RSI and price action.

Smart Money Activity:

Market Makers engineered a liquidity sweep below $20.50.

Accumulation likely occurring at the discount zone.

Premium zone identified between $25.50-$26.00.

Key Levels:

Entry Zone: $20.50 - $20.80 (discount zone).

Targets:

T1: $22.30 (FVG fill).

T2: $23.50 (Equilibrium zone).

Stop Loss: Below $19.80 (to protect downside risk).

Risk Score:

8/10 (High volatility – strong R:R setup).

Market Maker Intent:

Likely accumulating at current levels before the next leg up.

Liquidity grab appears complete, suggesting a potential reversal.

No short entries recommended due to oversold conditions.

Recommendation:

Long positions are favorable within the $20.50 - $20.80 range.

Wait for reversal confirmation before entering.

Monitor volume and price action near $22.30 resistance for breakout strength.

Confidence Level:

7/10 for potential bullish reversal.

🚀 Follow me on TradingView if you respect our charts! 📈

Chainlink Could Target $30 Once It Breaks Descending Triangle

Chainlink (LINK), the leading decentralized oracle network, has been consolidating within a descending triangle pattern on its price chart. This technical formation often signals a period of indecision among market participants, but it also carries the potential for a significant breakout. If LINK successfully breaks above the descending trendline, it could ignite a powerful rally, potentially propelling the price towards the $30 mark.

Understanding the Descending Triangle

A descending triangle is a bearish chart pattern characterized by a series of lower highs and relatively flat lows. It suggests that selling pressure is gradually increasing, while buying pressure remains relatively weak. However, the flat lows indicate that there is still significant support for the asset.

In the case of Chainlink, the price has been consolidating within this descending triangle for several weeks. This period of consolidation allows market participants to accumulate positions and prepare for a potential breakout.

Factors Fueling a Potential Rally

Several factors could contribute to a bullish breakout and propel Chainlink's price towards $30:

• Growing Adoption: Chainlink's technology continues to gain traction across various sectors, including DeFi, gaming, and enterprise applications. As more projects integrate Chainlink's oracles, the demand for LINK tokens is likely to increase.

• Technological Advancements: Chainlink is constantly evolving and improving its technology, enhancing its security, scalability, and interoperability. These advancements can attract new users and drive further adoption.

• Favorable Market Conditions: A broader bullish trend in the cryptocurrency market could provide a significant tailwind for Chainlink. If Bitcoin and other major cryptocurrencies experience a sustained rally, Chainlink could benefit from increased investor interest and capital inflows.

• Technical Breakout: A successful breakout above the descending trendline would be a strong technical signal, confirming the bullish sentiment and attracting more buyers to the market.

Technical Analysis

Technical analysis provides several clues about the potential for a bullish breakout.

• Volume: A surge in trading volume accompanying a breakout would significantly increase the likelihood of a sustained rally.

• Moving Averages: A move above key moving averages, such as the 50-day and 200-day moving averages, would further strengthen the bullish case.

• Relative Strength Index (RSI): The RSI is a momentum indicator that can help identify overbought or oversold conditions. A breakout accompanied by a rising RSI would suggest strong bullish momentum.

Potential Challenges and Risks

While the outlook for Chainlink appears promising, it is crucial to acknowledge potential challenges and risks:

• Competition: Chainlink faces competition from other decentralized oracle networks and emerging technologies.

• Regulatory Uncertainty: The regulatory landscape for cryptocurrencies remains uncertain, and any negative regulatory developments could impact Chainlink's price.

• Market Volatility: The cryptocurrency market is highly volatile, and sudden price swings can significantly impact Chainlink's price.

Investment Considerations

Investing in cryptocurrencies carries significant risks, including the risk of losing all or part of your investment.

• Conduct thorough research: Understand the technology behind Chainlink, its potential use cases, and the risks involved.

• Diversify your portfolio: Don't invest all your funds in a single cryptocurrency.

• Invest only what you can afford to lose: Avoid investing more than you can afford to lose financially.

• Stay informed: Keep abreast of the latest developments in the Chainlink ecosystem and the cryptocurrency market as a whole.

Conclusion

Chainlink has the potential to play a crucial role in the future of decentralized finance and blockchain technology.

• If it successfully breaks out of the descending triangle pattern and gains traction in the broader market, it could experience significant price appreciation.

• However, investors should carefully consider the risks involved and conduct thorough research before making any investment decisions.

Disclaimer: This article is for informational purposes only and does not1 constitute financial advice.

• Investing in cryptocurrencies2 involves significant risks, and you should carefully consider your investment objectives, financial situation, and risk tolerance before making any investment decisions.

Note: This article provides a general overview of Chainlink and its potential.

• The cryptocurrency market is dynamic and subject to rapid change.

• It is essential to conduct independent research and consult with a qualified financial advisor before making any investment decisions.

Disclaimer: This article is for informational purposes4 only and does not constitute financial advice.

• Investing in cryptocurrencies5 involves significant risks, and you should carefully consider your investment objectives, financial situation, and risk tolerance before making any investment decisions.6

LINK Fractal | ALTS | Chainlink can EASILY +90%Chainlink is one of those alts that haven't yet made a new ATH with the rest of larger alt market group.

This means that the bullish cycle is taking a detour and it could be extended to another multi-month cycle, as I've previously stated in my BTC updates.

If LINK follows the previous pattern of a multi-month extended patter, we could see a fractal playout that takes us beyond the current ATH over the next few months.

_________________________

BINANCE:LINKUSDT

LINK take profit targets Chainlink take profit targets

Possible Targets and explanation idea

➡️Over 530 days in a range around 27 fib zone

➡️A lot of recommendation close short position signals by Trade ON indicator

➡️Based on my money power indicator we got 2 bullish RSI div on Weekly

➡️Last bullish MACD div on weekly

➡️Take profit some % zones marked red block around 0.5 and 0.618 lvl

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

---

• Look at my ideas about interesting altcoins in the related section down below ↓

• For more ideas please hit "Like" and "Follow"!

Chainlink ($LINK) Dips 10% Amid Ripple PartnershipA Game-Changing Partnership

Chainlink ( CRYPTOCAP:LINK ), known for its role as a blockchain abstraction layer enabling universally connected smart contracts, recently announced a groundbreaking partnership with Ripple. The collaboration aims to integrate Ripple’s RLUSD stablecoin into Chainlink’s decentralized oracle network, boosting its utility across decentralized finance (DeFi) ecosystems.

Launched last year, RLUSD has been making waves in the stablecoin market, with Ripple positioning it as a competitive alternative in the space. The integration with Chainlink will bring RLUSD into Chainlink’s price feed system, enabling secure, real-time transactions on both Ethereum and XRP ledgers.

Jack McDonald, Ripple’s SVP, emphasized the importance of trusted data for maintaining stability in DeFi. “By leveraging the Chainlink standard, we bring trusted data on-chain, further strengthening RLUSD’s utility across institutional and decentralized applications,” he stated.

Chainlink’s Chief Business Officer, Johann Eid, highlighted that the partnership is a strategic move to accelerate RLUSD adoption. By providing reliable on-chain data, the collaboration sets the stage for RLUSD to scale seamlessly within the DeFi space.

Technical Analysis

Despite the positive news, CRYPTOCAP:LINK saw a sharp 10% decline, with the asset currently trading at oversold levels. The Relative Strength Index (RSI) sits at 25, indicating significant overselling pressure. This presents a dual narrative: while the dip may raise concerns, it also offers a potential buying opportunity for traders and investors.

The 1-month low axis serves as an immediate support level. Should this level hold, it could act as a strong barrier against further selling pressure, potentially catalyzing a reversal. A break above the 38.2% Fibonacci pivot point would confirm a bullish recovery, driven by renewed optimism around the Ripple partnership.

Market Sentiment and Outlook

The partnership between Chainlink and Ripple has the potential to redefine stablecoin utility within DeFi ecosystems. With RLUSD poised for broader adoption and Chainlink’s proven track record in delivering secure oracle solutions, the collaboration is a win-win for both platforms.

The recent dip in CRYPTOCAP:LINK may be a temporary market reaction, as fundamentals remain strong. Investors should monitor key technical levels and capitalize on the oversold conditions to position themselves for a potential rebound.

Conclusion

Chainlink’s ( CRYPTOCAP:LINK ) dip, despite its promising partnership with Ripple, underscores the market's volatility. However, the long-term prospects of this collaboration point to a significant boost in utility for RLUSD and an enhanced DeFi ecosystem. For investors, the current oversold conditions could present an ideal entry point as CRYPTOCAP:LINK gears up for a potential rebound.

Chainlink (LINK) Cup & Handle BULLISH!Chainlink (LINK) has formed a Cup & Handle pattern with a bullish scenario. The breakout has formed a bullish trend for the bulls creating pressure to push the price to the upside. In addition, the bears have pulled the price back down towards the neckline which acts as a previous Upper Resistance line.

Bid Zone= $19.27 - $22.87

Expect price to continue to the upside with followed buying momentum from the bulls. After this pullback, Chainlink will now retest previous "All-Time High" dated back from 2021.

Target= $52.28

LINKing Up or Breaking Down: $26.70 to Watch.Unable to break through $30.93, Chainlink declined to below $28.70. We have to watch the price action around this level.

1. We need to see a strong recovery to above $28.70 support level that could signal a continuation of the bullish momentum, potentially driving LINK to retest $30.93 and move higher toward the next resistance at $34.58. Such a scenario would underscore the presence of strong buying interest (Green Projections).

2. On the downside, a failure to maintain $28.70 could expose LINK to further weakness, with a possible decline toward the critical support at $24.49 in 4-Hour Chart.

LINK | ALTCOINS | Chainlink pushes towards 40$Link has seen some great increases after another bump on BTC.

It's likely that this will lead to another mini-cycle, and push the price of Chainlink even higher towards 40$ which is the next major resistance mark.

I'm especially optimistic for Link and other alts once Ethereum has made a new ATH. More on that thought here:

_____________________

BINANCE:LINKUSDT

Chainlink's Bullish Surge: A Potential Rally on the HorizonChainlink (LINK), the leading decentralized oracle network, has been making significant strides in the cryptocurrency market, captivating the attention of investors and analysts alike. The token's price has surged to a multi-year high, surpassing the $30 mark, as hopes for a substantial 80+% rally continue to gain momentum.

The Driving Forces Behind Chainlink's Rally

Several key factors have contributed to Chainlink's bullish momentum:

1. Increased Institutional Adoption:

o A growing number of institutional investors and financial institutions are recognizing the value of Chainlink's decentralized oracle network.

o This increased adoption has led to a surge in demand for LINK tokens, driving up the price.

2. Expanding Ecosystem:

o Chainlink's ecosystem continues to expand rapidly, with new projects and dApps integrating the oracle network.

o This growing ecosystem strengthens Chainlink's position as a critical infrastructure for the blockchain industry.

3. Positive Market Sentiment:

o The broader cryptocurrency market has been experiencing a period of positive sentiment, with many tokens seeing significant price gains.

o Chainlink has benefited from this overall market optimism, as investors seek out high-potential projects.

4. Technical Analysis:

o Technical analysts have identified bullish patterns on Chainlink's price charts, suggesting that the token could continue its upward trend.

o Key technical indicators, such as the Relative Strength Index (RSI) and Moving Averages, are signaling strong buying pressure.

The Potential for an 80+% Rally

While the cryptocurrency market is inherently volatile, many analysts believe that Chainlink has the potential to experience a significant price surge of up to 80+% from its current levels. This bullish outlook is based on several factors:

• Strong Fundamentals: Chainlink's robust technology, growing ecosystem, and increasing institutional adoption provide a solid foundation for future growth.

• Market Sentiment: The overall positive sentiment in the cryptocurrency market can further fuel Chainlink's rally.

• Technical Analysis: Bullish technical indicators suggest that Chainlink's price could continue to climb.

Cautious Optimism and Risk Management

While the potential for a substantial price increase is exciting, it's important to approach the cryptocurrency market with caution and practice sound risk management. Here are some key considerations for investors:

• Diversification: Diversifying your investment portfolio across various cryptocurrencies and other asset classes can help mitigate risk.

• Dollar-Cost Averaging (DCA): Investing a fixed amount of money in Chainlink at regular intervals can reduce the impact of market volatility.

• Risk Tolerance: Assess your risk tolerance and only invest an amount that you can afford to lose.

• Stay Informed: Keep up-to-date with the latest news and developments in the cryptocurrency market, especially regarding Chainlink.

In conclusion, Chainlink's recent price surge and the potential for an 80+% rally have generated significant excitement among investors. While the future of the cryptocurrency market is uncertain, Chainlink's strong fundamentals and growing adoption position it as a promising investment opportunity. However, it's crucial to conduct thorough research, exercise caution, and implement sound risk management strategies.

Chainlink Poised for a 20% Upswing This Weekend?

Chainlink (LINK), the leading decentralized oracle network, has been on a remarkable run in recent weeks. The cryptocurrency has outperformed the broader market, surging by over 22% in the past month. This impressive performance has sparked renewed interest in LINK, with many investors wondering if the token can reach new heights in the coming months.

What’s Behind Chainlink’s Strong Performance?

Several factors have contributed to Chainlink’s recent surge. Firstly, the increasing adoption of decentralized finance (DeFi) protocols has created a growing demand for reliable and secure oracle networks. Chainlink, with its robust infrastructure and proven track record, has emerged as the go-to solution for many DeFi projects.

Secondly, the rise of Web3 and the metaverse has also fueled demand for Chainlink’s services. As more and more applications are built on blockchain technology, the need for real-world data feeds becomes increasingly critical. Chainlink’s ability to provide accurate and timely data from off-chain sources has made it an indispensable tool for Web3 developers.

Finally, the overall bullish sentiment in the cryptocurrency market has also positively impacted Chainlink’s price. As Bitcoin and other major cryptocurrencies continue to rally, investors are looking for alternative investment opportunities, and Chainlink has emerged as a promising contender.

Will LINK Price Reach $50 in 2024?

While it’s difficult to predict the exact price of any cryptocurrency, many analysts believe that Chainlink has the potential to reach $50 in 2024. However, several factors will determine whether this target can be achieved.

First, the continued growth of the DeFi and Web3 ecosystems will be crucial. As more and more projects adopt Chainlink, the demand for the token will increase, driving its price higher.

Second, the overall market sentiment will play a significant role. If the broader cryptocurrency market remains bullish, Chainlink is likely to benefit from the positive sentiment. However, a market downturn could negatively impact the token’s price.

Third, Chainlink’s technical performance will be important. The network needs to maintain high uptime and low latency to ensure the reliability of its services. Any technical issues or security breaches could damage the token’s reputation and negatively impact its price.

Chainlink’s Technical Outlook

From a technical perspective, Chainlink appears to be in a strong uptrend. The token has broken above several key resistance levels, and the momentum indicators suggest that the bullish trend is likely to continue. However, it’s important to note that the cryptocurrency market is highly volatile, and prices can fluctuate rapidly.

Conclusion

Chainlink’s recent performance has been impressive, and the token has the potential to reach new heights in the coming months. However, investors should approach the cryptocurrency market with caution and be prepared for potential volatility. It’s important to conduct thorough research and only invest what you can afford to lose.

As always, it’s crucial to stay updated on the latest news and developments in the cryptocurrency market. By understanding the factors that drive Chainlink’s price, investors can make informed decisions and maximize their returns.