EUR/USD Edges Higher Amid Fed Cut BetsThe EUR/USD rose 0.03% to $1.0967 in Asian trade, supported by expectations of Fed rate cuts amid U.S.-China trade tensions. However, gains were limited by concerns over European growth and global trade disruptions. Without signs of market stability, the pair may stay range-bound under risk aversion pressure.

Key resistance is at 1.1100, followed by 1.1150 and 1.1215. Support lies at 1.1000, then 1.0850 and 1.0730.

Chartanalysis

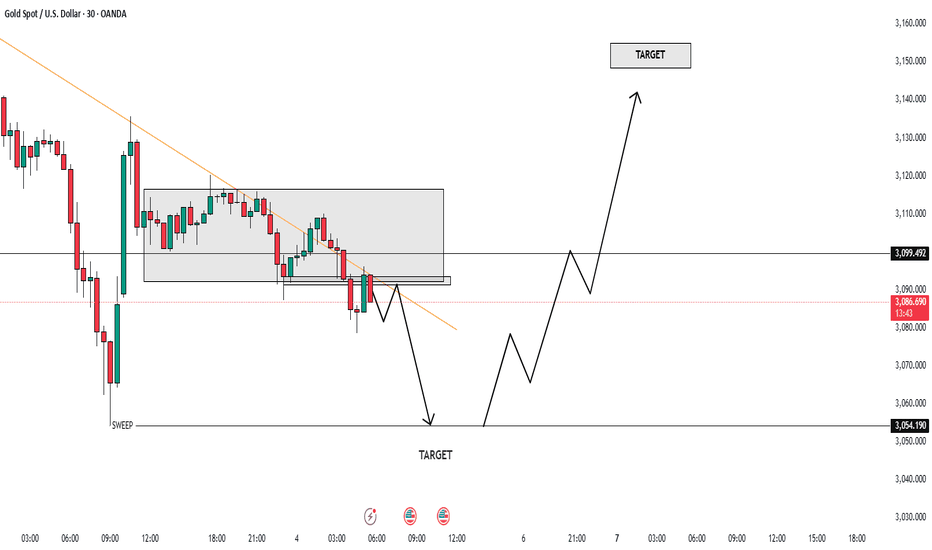

WILL GOLD MARK NEW ATH TRUMP TERRIF ALERT!🚨 GOLD UPDATE (XAU/USD)🚨

Gold is showing a strong bullish trend, and it’s expected to continue for the next month. 🌟 If you see any dips, buy in again and again! We could see gold touch 3200 soon, especially with the ongoing China & Trump tensions. The US economy remains strong, and fundamentally, gold is primed to soar even higher! 📈💥

After Trump's tariffs, gold may dip and sweep more liquidity before bouncing back stronger. ⚡ As China and Trump battle, US strength keeps pushing gold to new heights. 📊

Key Buying Zones 🔑:

- 3030 – 3035: Last zone for reversal 🔄

- 3000: Strong support zone 🚀

Targets 🎯:

- 3100 💰

- 3200 💎

- After 1 month: 3300 💥

⚠️ Always follow risk management⚠️

NFP BIG BULL SETUP BREAKOUT ALERT!🔥 Market Update for Traders! 🔥

Right now, the market is showing BEARISH momentum, and it's looking like we're heading for a dip. We could see the market fall and sweep the area around 3052 👀. Once that happens, expect a *huge* bounce back as the market could be getting ready to **shoot to the moon 🚀🌕!

🛑 KEY BUY LEVEL: 3130 - This is where you want to be ready to go long! 📈

🎯 First Target: Once we hit 3130, eyes on the ATH (All-Time High) for the retest! 🙌 And from there, we're eyeing a target at 3200 🚀🔥.

💥 NFP News Incoming! 💥

After Trump's speech, gold could *fall* around 1000 pips ⬇️, but **NFP could trigger a huge pump 📊💥. Stay sharp and trade with caution.

💡 Risk Management is KEY! Always follow your plan, set stop losses, and protect your capital. Don't let emotions drive your decisions! 📉🔑

Trade smart, stay sharp, and let's get those gains! 💸💥

#BearishMomentum #BullishReversal #RiskManagement #GoldPrice #NFPAlert

Polkadot: Shaky SupportPolkadot remains weak, barely holding onto the round $4 mark on Friday. Primarily, we soon expect another sell-off below the support at $3.67 and into the orange Target Zone between $2.40 and $1.07. Once the low of the magenta wave is reached down there, the next major impulsive movement can start and carry the price back above the resistance at $5.38. If Polkadot turns sustainably upward now and directly breaks through the $5.38 mark, the next magenta impulse wave alt. will begin prematurely. In this 20% likely alternative scenario, the corrective structure (still ongoing according to the primary scenario) would have already been completed with the low of March 11.

7 April Nifty50 important level trading zone #Nifty50

99% working trading plan

👆Gap up open 22920 above & 10m hold after positive trade target 23020, 23130

👆Gap up open 22920 below 10 m not break upside after nigetive trade target 22860, 22823, 22709

👆Gap down open 22862 above 15m hold after positive trade target 22918, 23018

👆Gap down open 22862 below 10 m not break upside after nigetive trade target 22818, 22709

⚡big gapdown open 22709 above hold 1st positive trade view

⚡big Gapup opening 23020 below nigetive trade view

Tep . Market new base hi carefully

📌For education purpose I'm not responsible your trade More education following me

NFP REPORT IMPACT ON XAUUSD ALERT!🚨 XAUUSD Market Alert 🚨

🔥 Current Action: XAUUSD is currently range-bound between 3101 and 3114—will it break out soon? The market’s at a critical point, and a sharp move could be on the horizon!

📉 Bearish Scenario: If price slips below this zone, keep an eye on potential support levels at 3070 and 3054. A downward shift could set up fresh opportunities for sellers.

📈 Bullish Scenario: On the flip side, a solid break above 3114 could trigger buying pressure, with targets at 3140 and 3170. A move like this could spark a new uptrend, especially with NFP data on the way, which could impact the gold market!

💬 Let’s Talk Strategy: What’s your take on the XAUUSD setup? Share your insights, and let’s navigate this golden opportunity together! 💰🚀

Decentraland: Summer FlashbackWith the recent sell-off, Decentraland's MANA reached its lowest level since early August of last year. The selling pressure should now intensify further to push the price down to the anticipated new bear market low of the green corrective wave . From there, the next magenta five-wave upward sequence is expected to begin and finally break through both resistance levels at $0.59 and $0.85 during wave . However, according to our 33% probable alternative scenario, the price could reverse upward now and directly start the impulse wave alt. . In this case, the precursor wave alt. of the same color would conclude at the current price level.

XAUUSD UNEMPLOYEMENT CLAIM BREAKOUT ALERT!🚨 XAUUSD Update 🚨

🔥 Price Action: XAUUSD is locked between 3144 and 3151—breakout imminent?

📉 Bearish View: If it drops below this range, watch for targets at 3130 and 3120. Stay sharp!

📈 Bullish View: A break above 3151 could set up buying opportunities. Target 3165 and 3200.

💬 Join the Discussion: Drop your thoughts and strategies below! Let’s ride the golden wave together! 💰🚀

GBPUSD - near to his very expensive region, what's next??#GBPUSD... market just trade in range just below is most expensive region and that is market swing region as well.

keep close that region and only only buy above that region.

means don't holds your shorts above that region.

upside we have long leg if market clear that region.

good luck

trade wisely

Gold (XAU/USD) AnalysisGold (XAU/USD) Analysis

This chart provides a technical outlook on **Gold (XAU/USD)**, showing possible **bullish** and **bearish** scenarios based on price action and support/resistance levels.

Bullish Outlook

Key Support Holding**: Gold is staying above **$3,125-$3,130**, showing buyers are stepping in.

- **Uptrend Structure**: Price is following a rising trendline, meaning bullish momentum is intact.

- **Breakout Zone**: If Gold surpasses **$3,155-$3,160**, it could rally toward **$3,170-$3,180**, as no major resistance exists in that range.

What to Watch?

- A strong breakout with volume above **$3,155-$3,160** confirms upside potential.

- Look for support at moving averages (EMAs) to validate trend continuation.

Bearish Outlook

- **Resistance Rejection**: If Gold fails to break above **$3,155-$3,160**, it might face selling pressure.

- **Break Below $3,140**: If price drops under this level, it could target **$3,125-$3,110**, which is the next key support.

- **Further Downside**: A breakdown below **$3,110** could lead to a deeper decline towards **$3,090-$3,080**.

What to Watch?

- A drop below **$3,140** with strong volume could confirm further downside.

- If selling pressure increases, Gold may retest lower support zones.

Final Thought

Gold is currently in an **uptrend**, but traders must monitor key levels:

✔ **Bullish if** it breaks **$3,160** 📊

✔ **Bearish if** it falls below **$3,140** 🔻

Stay cautious and wait for price confirmation before making a move! 🚀

Gold setup (XAU/USD) Chart analysis Gold (XAU/USD) Scenarios

*Market Overview:*

- Gold is currently trading around *$3,132.70*, maintaining its upward trajectory.

- The price remains *above key moving averages* (7, 21, and 50 EMA), signaling ongoing bullish strength.

*Critical Price Levels:*

- *Resistance Zone ($3,140-$3,145):* Price has tested this level but hasn’t managed to break through convincingly. A strong move above could open the door for further gains.

- *Support Area ($3,127-$3,130):* Holding above this region is crucial for buyers to maintain control.

- *50 EMA ($3,110.38):* Acts as a dynamic support; a drop below this level may indicate weakening momentum.

*Potential Scenarios:*

🔹 *Bullish Outlook:*

- A *decisive breakout* above *$3,145* could accelerate gains, pushing towards *$3,160-$3,170*.

- Increased buying pressure with strong volume would reinforce the uptrend.

🔻 *Bearish Outlook:*

- If Gold *fails to hold support* at *$3,127, we might see a pullback towards *$3,110** (50 EMA).

- A break below *$3,110* could shift sentiment, potentially leading to a dip toward *$3,070-$3,080*.

*Final Thoughts:*

Gold remains *bullish* but needs to clear resistance for further upside. If support holds, buyers may push higher; otherwise, a retracement could be in play.

GOLD - where is current support ? What's next??#GOLD... perfect move as per our discussion and now market again at his current support (that was our resistance )

Keep close the supporting region and if market holds then we can expect a further rise towarss next resistance areas.

Good luck

Trade wisely

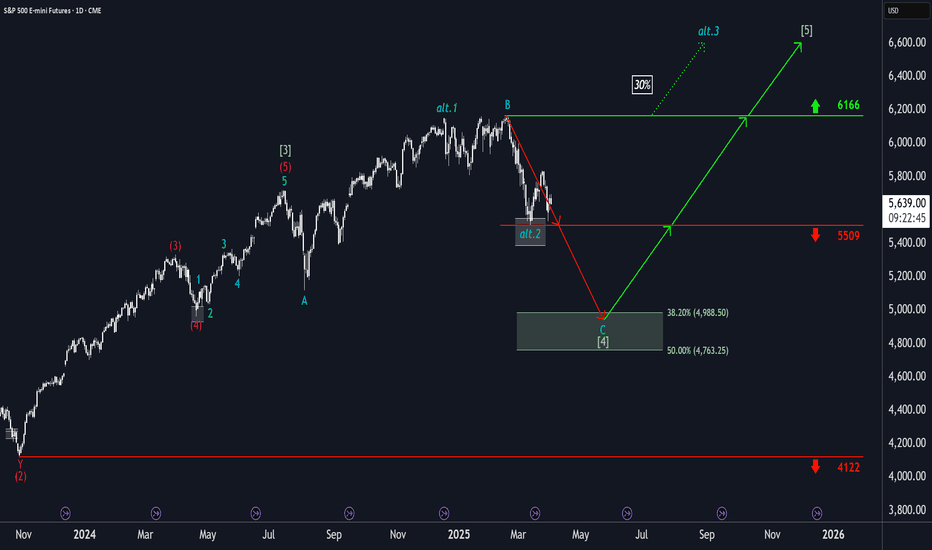

S&P500: Persistent SupportThe S&P 500 continued its recovery following its reaction to the support at 5509 points. However, in our primary scenario, we expect the index to fall below this mark to ultimately complete wave in green within our color-matched Target Zone (coordinates: 4988 points – 4763 points). Within this range, there are entry opportunities for long positions, which could be hedged with a stop 1% below the Zone’s lower boundary. Once the corrective movement has reached its low, the final upward movement of the green wave structure should commence. In the process, the index should gain significantly and reach the high of wave above the resistance at 6166 points. If this mark is surpassed prematurely, our alternative scenario with a 30% probability will come into play.

Ready to ride the wave? Here's everything you need to know!🚨 Calling all Traders!🚨

XAUUSD is making moves and breaking records like never before! Here’s your latest update:

🔻 Bearish Scenario: Watch out for a potential drop below the 3120-3114 range. If it dips, targets such as 3000 and 3090 are next in line. Keep an eye on these key support levels! 👀

🔺 Bullish Scenario: If price breaks above this range, expect buying opportunities to open up! Look for action above 3120 with potential targets at 3130 and 3943. 📈💥

💡 Risk Management** is everything! Protect your capital and trade wisely! 💰

Jump into the conversation and share your insights! Let’s ride this golden wave to success together! 🌟

GOLD - single supporting area , holds or not??#GOLD. well guys now we have 3112 as immediate supporting area and upside we have 3125 as immediate resistance area so keep close and if market hold 3112 then we can expect another bounce towards upside next targets.

keep in mind that 3112 is our single supporting area so if market clear that level then we will go for short means cut n reverse but on confirmation.

good luck

trade wisely

ExxonMobil: Toward the ResistanceExxonMobil: Toward the Resistance

As planned, XOM recently continued to rise with the magenta wave . We give this movement a bit more room, but another smaller corrective movement of wave should start below the resistance line at $126.34 before XOM ultimately surpasses this mark. Once the upward movement stalls below $126.34, it is important that the price doesn't fall too deeply afterward. After all, there is a 40% probability for our alternative scenario, where not wave in magenta but wave alt.2 in turquoise would develop its high – confirming an already established top of the overarching wave alt.(B) and, thus, a generally corrective scenario.

Trade analysis EURAUD 01.04.2025Hi,

very good patten /setup was form in EURAUD , this patten is very identical in forex/crypto/other market, usually built in TOP or bottom ..

comment if you find similar..

Do not ask for Buy or Sell tips.

I/We are not SEBI Registered Advisors. We don't provide any types of Buy/Sell signals. This is purely for educational and learning purposes. i/We shall not be responsible for your profit or loss. Please confirm with your financial advisor.

BTUSDT Analysis 01.04.2025, W- pattern HI,

W- pattern formed in 30 min Time frame ,

Do not ask for Buy or Sell tips .

I/We are not SEBI Registered Advisors. We don't provide any types of Buy/Sell signals. This is purely for educational and learning purposes. We shall not be responsible for your profit or loss. Please confirm with your financial advisor.

#TRUMPUSDT — Breakdown or Reversal Confirmation🚀 BYBIT:TRUMPUSDT.P — Breakdown or Reversal Confirmation? Full Breakdown on 1H & 4H!

Let’s start by analyzing the charts on different timeframes:

✅ On the 1H chart , we clearly see a reversal pattern — Inverted Head & Shoulders — and the neckline breakout has already occurred. The volume on the breakout is high, which confirms the strength of the signal.

➡️ The target for this pattern is around $10.75–$10.80, which also aligns with the upper VPOC level from the previous range.

➡️ The POC level for BYBIT:TRUMPUSDT.P is $10.159, which may now act as support — this can be a potential entry zone.

➡️ Nearest resistance is at $10.40. A breakout above this level could trigger an impulse move towards $10.75–$10.80.

✅ On the 4H chart , a bearish flag is forming, which could potentially push the price lower — but this scenario hasn't played out yet.

➡️ There's also a local double bottom, confirmed by a price bounce. A retest of the flag’s lower boundary will be a key moment.

Let’s break down the patterns:

✅ 1. Inverted Head & Shoulders (1H) – A classic bottom reversal formation.

➡️ The neckline breakout occurred on increased volume — a key confirmation for a long setup.

✅ 2. Volume (Volume Profile & Bars) – Strong volume spike during the breakout confirms buyer interest.

✅ 3. Price broke out of consolidation – We’ve seen an impulsive breakout and the price is holding above the neckline.

✅ 4. Local Market Structure Break (MSB) – A shift from local downtrend to an emerging uptrend.

📍 Key Point: If the price holds above $10.40, this confirms a breakout from the descending channel, increasing the chance of reaching $10.75–$11.00.

📍 Price must also stay above $10.15 and not fall back into the previous range. A retest and bounce from this level would serve as further confirmation.

📢 If the price drops back below $10.15 and breaks $9.87, the “Inverted Head & Shoulders” pattern will be invalidated. In that case, a bearish trend will likely resume and a short toward $9.50–$9.00 could be considered.

📢 On the 4H chart, the risk of the bearish flag playing out still remains. We are monitoring the structure closely — a sharp pullback is possible.

📢 The volume zone around $10.15–$10.20 is key. As long as the price stays above it — the long scenario remains dominant.

🚀 As of now, BYBIT:TRUMPUSDT.P has strong technical reasons to support a long bias, especially if it holds above $10.40 — that would open the door to $10.75–$11.00.

Risks remain — particularly around the 4H bearish flag — but for now, bullish momentum prevails.

🚀 BYBIT:TRUMPUSDT.P still holds upside reversal potential — LONG scenario remains the priority!

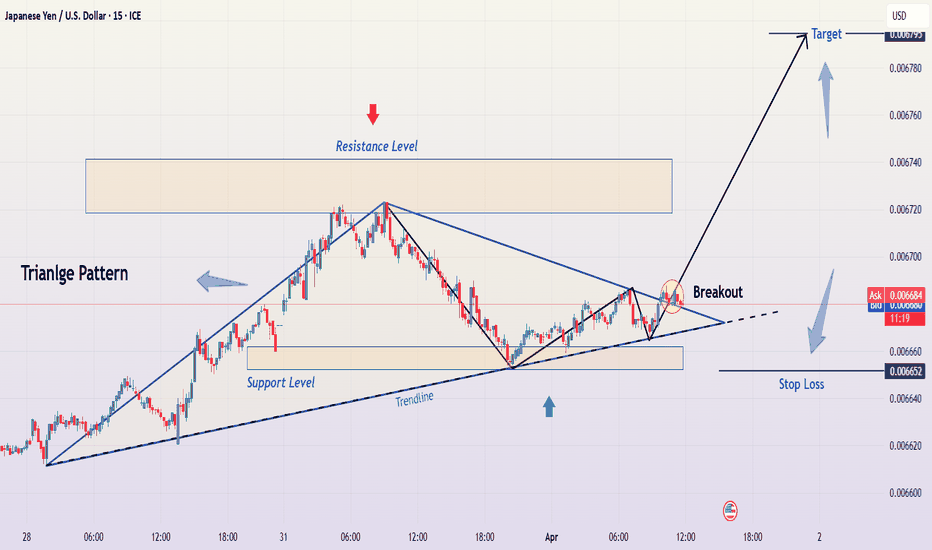

Triangle Breakout in JPY/USD – Bullish Move Ahead?This TradingView chart represents a detailed technical analysis setup for the Japanese Yen (JPY) against the U.S. Dollar (USD). The main focus of the chart is a symmetrical triangle pattern breakout, a common formation that signals potential price movement.

In this detailed breakdown, we will analyze the following aspects:

Technical Pattern: Symmetrical Triangle Formation

Support and Resistance Levels

Breakout Confirmation

Trading Setup Explanation

Risk Management Strategy

Market Expectations (Bullish & Bearish Scenarios)

Conclusion & Trading Plan

1. Technical Pattern: Symmetrical Triangle Formation

The chart showcases a symmetrical triangle, which is a continuation pattern that typically occurs in trending markets. It indicates a period of consolidation where buyers and sellers struggle for dominance, leading to an eventual breakout.

Characteristics of the Symmetrical Triangle in This Chart:

Converging Trendlines:

The upper trendline (resistance) is sloping downward, showing lower highs.

The lower trendline (support) is sloping upward, showing higher lows.

Apex Formation:

As the price moves closer to the triangle's apex, volatility decreases, creating a squeeze effect.

Breakout Possibility:

Once price reaches a critical point, a breakout is expected in either direction.

Why is This Pattern Important?

Symmetrical triangles suggest that the market is indecisive, but once a breakout occurs, it can trigger a strong price movement.

Traders wait for the breakout direction to confirm the trade before entering a position.

2. Key Support and Resistance Levels

Support and resistance levels are crucial for identifying potential entry, stop-loss, and target areas.

Resistance Level:

A horizontal resistance zone (highlighted in beige) is drawn at the top.

This zone represents historical price rejection levels, where sellers have previously stepped in.

A confirmed breakout above this level would indicate strong bullish momentum.

Support Level:

The lower support zone (marked in blue) acts as a buying interest area.

Price has bounced off this zone multiple times, confirming it as a strong support level.

A break below this zone would signal a bearish reversal.

Trendline Support:

The lower boundary of the symmetrical triangle also acts as dynamic support.

If price respects this trendline, it suggests bullish strength leading to a breakout.

3. Breakout Confirmation & Market Reaction

The most important part of the setup is the breakout, which occurs when the price successfully moves beyond the triangle's trendline resistance.

Key Observations from the Chart:

Breakout Zone:

The breakout occurs near the right edge of the triangle (circled in red).

The price breaks above the upper trendline, confirming a bullish breakout.

Confirmation Candle:

A bullish candle follows the breakout, confirming buying pressure.

Traders should wait for a retest of the trendline before entering.

Volume Consideration:

Strong breakout moves are typically accompanied by a rise in volume, increasing the likelihood of follow-through.

4. Trading Setup Explanation

This trade follows a trend-following breakout strategy, where traders capitalize on price momentum after confirmation.

Entry Point:

The ideal entry is just above the breakout candle.

Traders can also wait for a retest of the broken trendline before entering.

Stop Loss Placement:

The stop loss is placed slightly below the previous swing low at 0.006652.

This prevents excessive drawdowns in case of a false breakout.

Profit Target Calculation:

The profit target is set at 0.006795, which is calculated based on:

The height of the triangle formation projected from the breakout point.

The next major resistance level, aligning with historical price action.

5. Risk Management Strategy

Risk management is a critical component of any trading strategy. Here’s how it is applied in this setup:

Risk-to-Reward Ratio (RRR):

A good trade setup maintains an RRR of at least 2:1.

If the stop loss is 33 pips (0.000033) and the target is 112 pips (0.000112), the RRR is 3:1, making this a high-probability trade.

Position Sizing Consideration:

Risk per trade should be limited to 1-2% of the total account balance.

Leverage should be used cautiously, as breakouts can sometimes retest the breakout zone before continuing.

6. Market Expectations (Bullish & Bearish Scenarios)

Bullish Scenario (Successful Breakout):

✅ If price sustains above the breakout level, it will likely continue to rally toward the target at 0.006795.

✅ A strong bullish momentum candle would confirm further buying pressure.

✅ If volume supports the breakout, trend continuation is highly probable.

Bearish Scenario (False Breakout or Reversal):

❌ If price falls back inside the triangle, it indicates a false breakout.

❌ If price closes below 0.006652, bears take control, and price may drop further.

❌ A breakdown below the support level would shift the market sentiment bearish.

7. Conclusion & Trading Plan

This chart presents a classic symmetrical triangle breakout trade with a clear entry, stop-loss, and target strategy.

Summary of Trading Plan:

Component Details

Pattern Symmetrical Triangle

Breakout Direction Bullish

Entry Point Above the breakout confirmation candle

Stop Loss 0.006652 (below support)

Take Profit (Target) 0.006795

Risk-to-Reward Ratio Favorable (3:1)

Market Bias Bullish (if price sustains above breakout)

Final Considerations:

Always wait for confirmation before entering.

Monitor volume and price action for additional validation.

Stick to the risk management plan to minimize losses.

If executed correctly, this setup offers a high-probability trade with a strong risk-to-reward ratio, making it a profitable trading opportunity in the JPY/USD market.

Aurora: Bottom FormationThe Aurora stock continues to trade within the orange Target Zone (coordinates: C$6.84 – C$5.51) and should soon reach the low of the ongoing wave ii in orange. With the completion of this corrective movement, the foundation should be set for a sustainable rise in the corresponding wave iii. However, there is still a 38% probability that the stock will head for a new low below the support level at C$3.84 in the green wave alt. .