NFP Miss Implications: Recession Signal or Rate Cut CatalystCME_MINI:NQ1! CME_MINI:ES1! CME_MINI:MNQ1!

Happy Friday, folks!

Today is the first Friday of August, and that means the highly anticipated Non-Farm Payroll (NFP) numbers came in at 7.30 am CT.

US Non-Farm Payrolls (Jul) 73.0k vs. Exp. 110.0k (Prev. 147.0k, Rev. 14k); two-month net revisions: -258k (prev. +16k).

Other key labor market indicators were as follows:

• US Unemployment Rate (Jul) 4.2% vs. Exp. 4.2% (Prev. 4.1%)

• US Average Earnings MM (Jul) 0.3% vs. Exp. 0.3% (Prev. 0.2%)

• US Average Earnings YY (Jul) 3.9% vs. Exp. 3.8% (Prev. 3.7%, Rev. 3.8%)

• US Labor Force Particle (Jul) 62.2% (Prev. 62.3%)

Data and Key Events Recap:

What a year this week has been! It's been packed with high-impact economic data and pivotal central bank decisions, especially from the Federal Reserve. On top of that, trade and tariff announcements have dominated the headline.

U.S. economic data this week was broadly strong. Second-quarter GDP came in at 3.0%, beating expectations and signaling solid growth. The ADP employment report also surprised to the upside, printing 104K vs. the 77K forecast. Consumer confidence showed resilience as well, with the Conference Board’s reading rising to 97.2.

Inflation data was mixed but mostly in line. Core PCE for June rose 0.3% MoM, while the YoY reading ticked up to 2.8%, slightly above the expected 2.7%. The broader PCE Price Index also came in at 0.3% MoM, with a YoY print of 2.6%, slightly higher than forecast.

The Federal Open Market Committee (FOMC) voted to keep the federal funds rate target range unchanged at 4.25% – 4.50%. Notably, Governors Waller and Bowman dissented, favoring a 25-basis-point rate cut as expected, however, marking the first dual dissent by governors since 1993.

Changes to the FOMC Statement included a downgraded assessment of economic growth, reflecting slower real consumer spending. The Committee reiterated that uncertainty around the economic outlook remains elevated. It maintained its view of the labor market as "solid" and inflation as "somewhat elevated." Forward guidance remained unchanged, emphasizing the Fed’s readiness to adjust policy as necessary while continuing to monitor risks to both sides of its dual mandate.

Here’s a summary of key points from the FOMC press conference:

• On current policy stance:

“We decided to leave our policy rate where it’s been, which I would characterize as modestly restrictive. Inflation is running a bit above 2%... even excluding tariff effects. The labor market is solid, financial conditions are accommodative, and the economy is not performing as if restrictive policy is holding it back.”

Chair Powell commented on the need to see more data to help inform Fed’s assessment of the balance of risks and appropriate Fed Funds rate.

• On labor market risks:

“By many statistics, the labor market is still in balance... You do see a slowing in job creation, but also a slowing in the supply of workers. That’s why the unemployment rate has remained roughly stable.”

• On inflation and tariffs:

“It’s possible that tariff-related inflationary effects could be short-lived, but they may also prove persistent. We’re seeing substantial tariff revenue—around $30 billion a month—starting to show up in consumer prices. Companies intend to pass it on to consumers, but many may not be able to. We’ll need to watch and learn how this unfolds over time.”

Trade Headlines:

US President Trump announced tariffs on countries ranging from 10%-41%. Average US tariff rate now at 15.2% (prev. 13.3%; 2.3% pre-Trump), according to Bloomberg. US officials said that if the US has a surplus with a country, the tariff rate is 10% and small deficit nations have a 15% tariff, US officials said they are still working out technicalities of rules of origin terms for transshipment and will implement rules of origin details in the coming weeks. No details on Russian oil import penalty. Sectoral Tariffs White House said new reciprocal tariff rates take effect on Friday. Although Canada’s tariffs were increased to 35%, excluding USMCA goods, the effective rate is only 5%.

The economic data is showing strength, on the contrary, tariffs announcements for most countries have now been announced. Investors need to consider that tariffs are not just a tool to reduce trade deficit, it is also a geopolitical tool presently being used to shape alliances. The US wants to soften BRICS, China and Russian influence on the world stage.

Key to note is that these tariffs are substantially lower than what was announced on April 2nd, 2025.

The key question now remains, do participants buy the dip or ‘sell the fact’ is the current playbook?

Market Implications

Given the prior revisions in NFP data of -258K, July’s payroll came in at 73K, missing forecasts of 110K. What does this mean for markets? Markets are now pricing in 75% chance of a September rate cut. Prior revisions along with the current job market slowing down imply that risks to the downside are substantially increasing. Fed’s current policy is not just moderately restrictive but rather it may likely tip the US into a recession if Fed Funds rates remain elevated. The Chair asked to see more data, and here it is but I do wonder why they did not take this data into account for the July meeting. Surely, it would have been available to them.

Another question to ask would be, is it due to defiance of rate cut calls by the US administration? Is the Fed already behind the curve?

Fed’s dual mandate targets inflation and maximum employment. While inflation is sticky, the Fed may need to abandon their 2% mandate in favor of average inflation of 2.5% to 3%. A less restrictive policy will provide needed stimulus along with the fiscal stimulus provided via the BBB bill.

This drastically changes, in our analysis, how investors position themselves heading into the remainder of the year.

Markets (equities) may retrace slightly but the dip in our opinion will still be the play given weaker labor market data and increased rate cut bets. The bad news here means that the Fed has the data it wants to see to start cutting. Market pricing in 2 cuts seems to be the way forward for now.

Chart Patterns

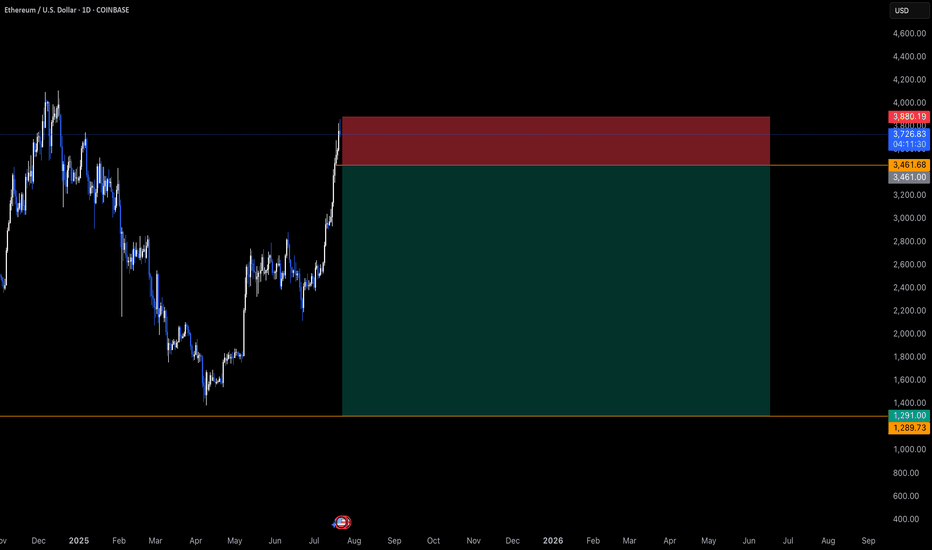

BTC Dominance and Altcoins SituationBitcoin dominance has reached a key support on the daily time frame. The NEW RSI indicator still sees the market as bearish but is pulling back. We will probably not see the growth of major altcoins like Ethereum for a few days. This analysis is not a financial recommendation in any way.

LINKUSDT 12H#LINK has broken below the neckline of the double top pattern on the 12H timeframe.

📌 Place your buy orders near the key support levels:

$15.90 – $15.42

If the price reclaims the neckline and breaks above it, the potential upside targets are:

🎯 $18.96

🎯 $20.28

🎯 $21.54

⚠️ As always, use a tight stop-loss and apply proper risk management.

Hear me out... I've not been posting much (welcome to adhd/autistic life), but if anyone ever drops me a message, I'm always still trading, so feel free to ask me any questions ever :)

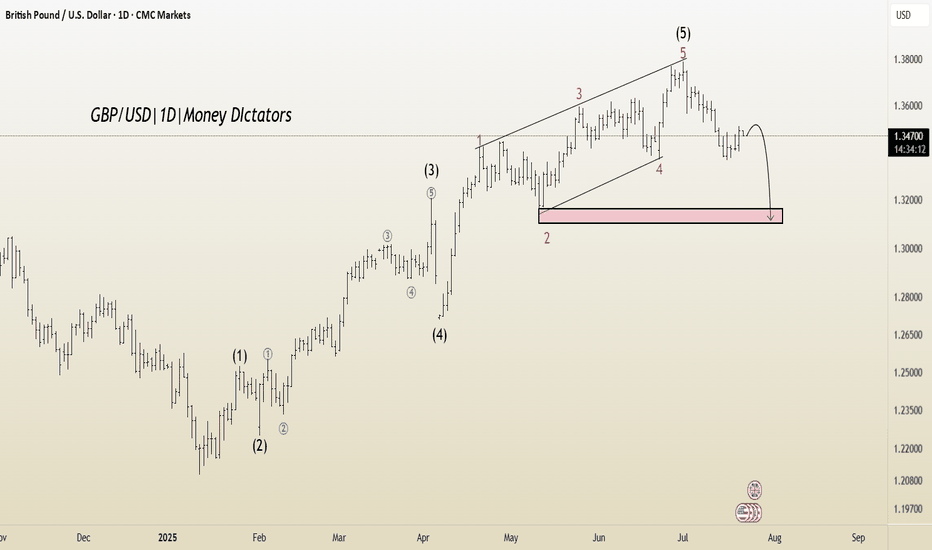

So while much of the tariff movement was priced in with the recent drop from the top (1.38 range), we could (and have seen) an expected fall out, with today being the official tariff announcement/last day from Trump.

This afternoon we have NFP, unemployment rate and PMI.

Based on where we are from a TA standpoint, I imagine these to be positive for GBPUSD (least not much more downfall anytime soon/ much lower than where we bottomed out today).

I'm going to update this idea with further notes, but you can see what we're currently working with and get an idea based on the chart what I'm thinking.

We've got the small H&S pattern at work (neckline #1), and a potentially bigger one at play (neckline #2), and then a previous one which I will discuss in the notes (neckline #3).

You can see across the chart a number of downward resistance lines (red).

I've shown them to express that we can see that every time we cross over the line, while it might bounce off it and then keep dipping further, it never crosses back under.

The only time it does cross back over is usually quite briefly (as per the orange arrows), but it's always short lived.

Case and point, we're not only very close to the current resistance-turned-support red line, but we're also hitting major support area.

This paired with such a big drop out (i.e. we could do with at least some short/mid term reversal) and the possibility of a retest of neckline #1, we've got plenty to work with.

You can see I've posted 2 arrows - one GREEN, the other WHITE.

I'll explain my thesis on that at some point and why I think it could easily cross back over the neckline before continuing to the downside.

We've also got the thin purple lines, which as you can see previously act as a resistance to where the reversal will happen at the lower end of the chart (which lines up with the major support line on the weekly chart, which I'll add to the notes at some point too.

Let me your thoughts.

I have a position open from today's drop to neckline #2, so let's see where it takes us :)

XRP/USD Breakout Watch: $3.22 Target in SightA key blue trendline on the XRP/USD chart that reflects market sentiment. If price breaks above it with strong volume, we could see a rally toward $3.22.

Support zone: $0.55–$0.60

Bullish case: Improved sentiment, easing tariffs, and regulatory cooling

Strategy: Wait for breakout confirmation before entering

Share your thoughts — are you preparing for a breakout?

XRP VS AI ?Hi,

This is fun, come on XRP $4.95

Average Speed (Points/Day) 0.053

Retracement Amount (Points) 0.80

Retracement % 51.28%

Probability of Retracement % 5-10%

Projected Next Move Size (Points) 2.09

Next Projected High Price 4.95

Estimated Duration to Next Target 39.4 days

Projected End Date 2025-09-10

All the best

Not a guru

BTCDOM : Near to breakout from trendline resistanceBitcoin dominance is nearing a breakout from trend line resistance. Keep a close watch as a breakout from here could lead to a short-term market correction, negatively affecting altcoins. Stay cautious with your long positions and use proper stop loss strategies.

KEEP A CLOSE WATCH ON IT

GBP/USD: Post-Impulse Sell Setup from Ending DiagonalThe chart depicts a completed 5-wave impulsive structure, culminating at the top of wave (5). The internal wave structure of the final fifth wave forms a classic ending diagonal pattern, typically signaling a trend reversal or deep correction.

After this extended fifth wave, the price has started rolling over, confirming the start of a corrective decline. The wave count now expects an ABC correction targeting the previous wave 4/2 demand zone, highlighted in red.

Target 1 (T1): 1.33608

Target 2 (T2): 1.32436

Stop Loss (SL): 1.35988

Ending diagonal at the top of wave (5) signals exhaustion of bullish momentum.

Clear bearish divergence (not shown here) is commonly seen with this pattern.

The price has broken the short-term structure and is now forming lower highs.

Target zone aligns with previous wave 2 consolidation – a typical retracement zone for post-impulse corrections.

RNDR/USDT at a Critical Turning Point: Golden Pocket as the Key?✨ Overview:

Render Token (RNDR) is currently testing a crucial support zone — the Golden Pocket Fibonacci Retracement between 0.5 (3.616) and 0.618 (3.385). This zone not only represents a significant retracement level but has historically acted as a strong demand area, often serving as a springboard for major price reversals.

---

🧠 Detailed Technical Analysis:

🔸 Support Zone & Golden Pocket

Price has retraced back to the 0.5 – 0.618 Fibonacci zone, a high-probability reversal area.

This zone has acted as a demand base multiple times since February 2025.

How the price reacts here will likely define the next major trend direction.

🔸 Market Structure

The overall structure shows a mid-term downtrend, marked by lower highs and lower lows.

However, the current price action shows slowing bearish momentum, indicating potential hidden accumulation.

A potential double bottom pattern could be forming, hinting at a bullish reversal if confirmed.

---

📈 Bullish Scenario:

1. Strong Rebound from the Golden Pocket

Watch for bullish candlestick patterns (e.g., pin bar, bullish engulfing) near $3.38–$3.61.

Initial resistance levels: $4.16 – $4.72

If broken, mid-term targets could extend to $5.47 – $6.68

2. Double Bottom Confirmation

A confirmed double bottom with a neckline breakout around $4.16 would greatly strengthen bullish momentum.

3. Increased Buying Volume

A spike in volume during the rebound would validate bullish sentiment and potential trend reversal.

---

📉 Bearish Scenario:

1. Breakdown Below the Golden Pocket

If the price breaks below $3.385 with strong volume, we could see a move down toward $2.77, the next significant support.

2. Weak Bounce / Lower High

A failed breakout above $4.16 may indicate a bearish continuation after a temporary relief rally.

---

📌 Summary:

RNDR is currently at a technically sensitive zone. The Golden Pocket between $3.38 and $3.61 is the key area to watch. A strong bullish reaction could signal the start of a trend reversal, while a breakdown could trigger further downside continuation. Traders are advised to wait for clear confirmation via price action before committing to any strong positions.

---

🔖 Key Levels to Watch:

Level Description

3.38 – 3.61 Golden Pocket (Potential Buy Zone)

4.16 Minor Resistance

4.72 Bullish Breakout Trigger

5.47 – 6.68 Mid-Term Reversal Targets

2.77 Strong Support if Breakdown Occurs

---

🧩 Chart Patterns Observed:

Potential Double Bottom – early bullish reversal signal.

Golden Pocket Reaction Setup

Descending Structure – still intact but weakening.

---

🔍 Trade Ideas:

🔄 Wait-and-see approach: Wait for clear bullish confirmation on daily candles.

🎯 Aggressive Long Entry: Around 3.40–3.60 with a tight stop-loss.

⚠️ Short Opportunity: If a strong breakdown below 3.38 occurs with volume confirmation.

#RNDR #RenderToken #RNDRUSDT #CryptoAnalysis #GoldenPocket #FibonacciRetracement #DoubleBottom #PriceAction #SupportResistance #AltcoinSetup #CryptoSignals #TechnicalAnalysis

BTC Daily Elliott Wave CountAs mentioned in my analysis on youtube post on Total Market Cap short-term, the daily bullish case is now verified, canceling the bearish case with a break through the daily bearish invalidation level.

This past week price action suggests a move towards the completion of a blue wave x. Make sure to check out my latest analysis on short-term Crypto Total Market Cap.

The link to the chart:

Bullish Count

BTC | Swing Plan UpdatePrice failed to break out above 1D supply and sharply rejected, losing key 4H demand at $117,300.

HTF demand at $109,000 (1D FVG + BOS + S/R) is the next major area of interest—this is where I’ll look for fresh swing setups if the market flushes further.

No need to rush new positions until a clean setup prints or levels are reclaimed.

Plan:

Wait for price to test $109,000 zone before considering a swing long.

Only consider LTF scalp longs if we reclaim the 4H BOS at $118,300.

Stay flat until high-probability entry, let the market show its hand.

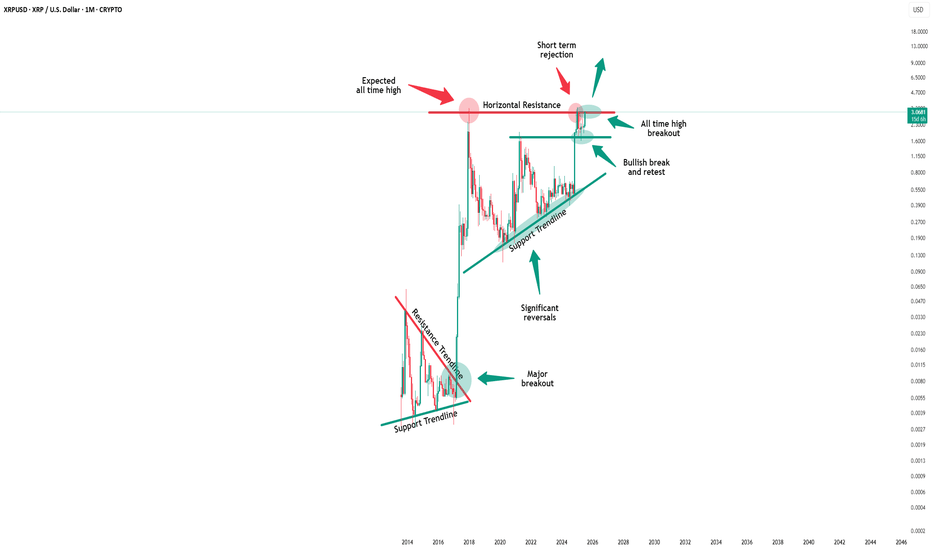

Xrp - The final bullish breakout!💰Xrp ( CRYPTO:XRPUSD ) will create new all time highs:

🔎Analysis summary:

After a consolidation of an incredible seven years, Xrp is finally about to create new all time highs. With this monthly candle of +40%, bulls are totally taking over control, which means that an altcoin season is likely to happen. And the major winner will simply be our lovely coin of Xrp.

📝Levels to watch:

$3.0

🙏🏻#LONGTERMVISION

SwingTraderPhil

AUDUSD Technical & Order Flow AnalysisOur analysis is based on a multi-timeframe top-down approach and fundamental analysis.

Based on our assessment, the price is expected to return to the monthly level.

DISCLAIMER: This analysis may change at any time without notice and is solely intended to assist traders in making independent investment decisions. Please note that this is a prediction, and I have no obligation to act on it, nor should you.

Please support our analysis with a boost or comment!

Gold Market Holds Bearish Structure Below 3291Gold market continues to hold firm within the bearish channel, with 3291 acting as a supply zone, maintaining pressure down toward 3269. As long as this zone remains unbroken, bearish momentum stays in play.

🔍 Key Insight:

3291 = active supply resistance

3269 = short-term target if sentiment holds

follow for more insights , comment and boost idea

$ENPH About to make new highs Enphase trades inverse crypto and the crypto trade is coming to a quick end. Stored energy theory states during times of excess energy BTC will thrive. We are now in a new regime of AI energy cost and ENPHASE has the best batteries to scale. Minimum Target $550

Positions

1130 ENPH $50 Calls for 10/17/2025

511 ENPH $100 Calls for 01/15/2027

USD Turns GBP On Its "Head"FX:GBPUSD has formed a Head & Shoulders Pattern!

Price has already broken down below the "Neckline" to Confirm that Pattern.

Currently, Price is working its way back up to retest the Breakout and if the level is strong enough and holds, we could see Price follow through with its reversal to lower prices!

If the retest is successful, the May 12th Lows of 1.31741 - 1.31394 could be a good Support level to set as a Price Target.

Now we wait for a Retest!