USD_JPY RESISTANCE AHEAD|SHORT|

✅USD_JPY is going up now

But a strong resistance level is ahead at 151.232

Thus I am expecting a pullback

And a move down towards the target of 150.368

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Chart Patterns

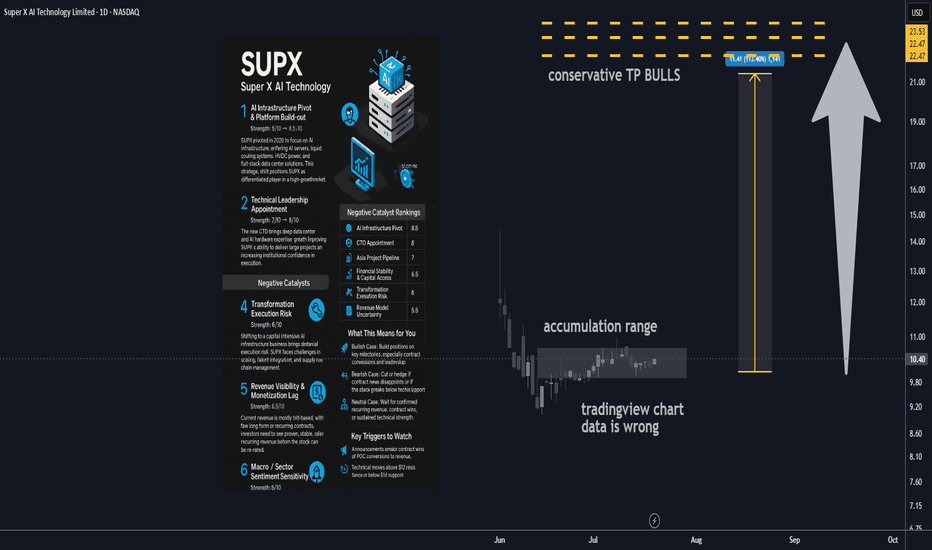

Super X AI Technology Ltd AI Infrastructure Stock 100% upside🔋 1. AI Infrastructure Pivot & Platform Build-out

Strength: 8/10 → 8.5/10

SUPX has made a major pivot in 2025, transitioning from a legacy business into next-gen AI infrastructure. The new focus includes AI servers, liquid cooling systems, HVDC power, and full-stack data center offerings targeting the rapidly growing demand for AI compute in Asia. This shift positions SUPX as a differentiated player in a high-growth market, opening doors to larger contract values and broader verticals.

________________________________________

🤖 2. Technical Leadership Appointment

Strength: 7/10 → 8/10

A major recent step forward is the hiring of a seasoned CTO with deep data center and AI hardware experience. This upgrade significantly enhances SUPX’s execution ability and credibility in enterprise infrastructure. Institutional investors and potential partners will see this as a sign SUPX can deliver on its technical roadmap and close major deals.

________________________________________

📈 3. Asia Institutional Partnerships Pipeline

Strength: 6.5/10 → 7/10

SUPX is developing a solid pipeline of institutional AI infrastructure projects across Asia, especially with established banks and tech companies. While many projects are still in proof-of-concept or pilot stages, these early relationships can drive high-margin, recurring business if successfully converted to long-term contracts.

________________________________________

💰 4. Capital Structure & Financial Health

Strength: 6/10 → 6.5/10

The company’s cash position has improved after new equity raises, giving SUPX a runway for continued R&D and expansion. While the business is still operating at a loss and share dilution remains a factor, debt levels are manageable and financial flexibility should support continued transformation and growth.

________________________________________

________________________________________

⚠️ Negative Catalysts

🛠️ 5. Transformation Execution Risk

Strength: 6/10 → 6/10

Transitioning from a legacy model to a complex, capital-intensive AI infrastructure business brings substantial execution risk. SUPX must navigate operational scale-up, talent integration, and supply chain challenges, with no guarantee of seamless delivery. Any delays or setbacks could erode investor confidence.

________________________________________

🌐 6. Revenue Visibility & Monetization Lag

Strength: 5.5/10 → 5.5/10

Most current revenue is still pilot-based, with few long-term or recurring contracts secured. The business model relies on successful conversion of its pipeline and faster ramp-up in recognized sales. Investors will need to see evidence of stable, recurring revenue before the stock is re-rated.

________________________________________

🔁 7. Macro / Sector Sentiment Sensitivity

Strength: 5/10 → 5/10

As a small-cap AI/infra play, SUPX is highly exposed to swings in broader market sentiment. Any downturn in tech or risk-off moves in global markets could lead to outsized stock volatility, regardless of execution progress.

________________________________________

________________________________________

🚀 Refreshed Catalyst Rankings

Rank Driver Score

1 AI Infrastructure Pivot 8.5

2 CTO Appointment (Execution) 8

3 Asia Project Pipeline 7

4 Financial Stability & Capital Access 6.5

5 Transformation Execution Risk 6

6 Revenue Model Uncertainty 5.5

7 Macro / Sector Volatility 5

________________________________________

📊 Analyst Ratings & Price Outlook

• No major Wall Street coverage; visibility remains driven by news flow and early institutional/retail adoption.

• Technicals: The stock has established higher lows since its business model pivot. Resistance sits near $11.50–12, with support at $9.80–10.00.

• Price target: A $20 target remains plausible if SUPX delivers on growth milestones and secures new capital or contracts, representing a potential doubling from current levels.

________________________________________

🗞️ Recent Developments

• Hired a proven CTO to drive the new AI/data center focus.

• Company rebranded and fully pivoted its business model in 2025, shifting all resources to AI infrastructure.

• Implemented a new equity incentive plan to attract and retain top tech talent.

• Announced a robust pipeline of institutional projects across Asia, although most are not yet recognized as revenue.

________________________________________

🔍 Summary Outlook

SUPX is an emerging transformation play, now fully aligned with surging demand for AI infrastructure. Its success depends on management’s ability to scale, close institutional contracts, and prove out recurring revenue. While the story is compelling and early traction is positive, the company remains high-risk and execution-dependent at this stage.

Bull Case:

If SUPX converts pilots into revenue, delivers operationally, and continues to attract top talent, the stock could re-rate to the $15–20+ range as its business model is validated.

Bear Case:

Stumbles in execution, monetization, or funding could send the stock back to $7–8 support.

Neutral:

Many investors may choose to wait for confirmation of contract wins, recurring revenue, or sustained technical strength before committing.

Technical Levels to Watch:

• Bullish breakout if it clears and holds $11.50–12.00.

• Bearish risk if it fails to hold $9.80–10.00, with possible drop toward $8.

________________________________________

✅ What This Means for You

• Bullish: Build positions into execution milestones, focusing on contract conversions and leadership updates. Upside potential to $20 if catalysts align.

• Bearish: Cut or hedge exposure on failed contract news or technical breakdown.

• Neutral: Stay on the sidelines until more evidence of recurring revenue, confirmed contract wins, or positive sector momentum.

AUDCHF Will Go Down! Short!

Here is our detailed technical review for AUDCHF.

Time Frame: 9h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is on a crucial zone of supply 0.524.

The above-mentioned technicals clearly indicate the dominance of sellers on the market. I recommend shorting the instrument, aiming at 0.522 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

AMD Projection and Entry PointThis is speculation just like before, which played out very well so this is me having another shot at it.

Going off of the prior cycle AMD went through and comparing it to the one it's currently in, you can see a lot of similarities.

Learning from it's past and seeing how it likes to react to certain Fib levels, you can see that the 76.40% has been respected as a major level of resistance which resulted in its short retracement back in June '23 , It also acts as a very strong level of support as shown in August '24.

Assuming AMD rejects at the current 76.40% level again, using the prior 76.40% you can see it aligns perfectly with the golden ratio I have setup as my buy entry.

It all lines up too perfectly that in my mind, I'm certain it will play out. But of course it's all speculation, and the markets do as they please.

GBPUSD – DAILY FORECAST Q3 | W31 | D1 | Y25📊 GBPUSD – DAILY FORECAST

Q3 | W31 | D1 | Y25

Daily Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FX:GBPUSD

Gold (XAU/USD) on the 1‑hour timeframeGold (XAU/USD) on the 1‑hour timeframe

Chart Structure & Bias

* Price remains trapped in a **rising channel** (\~\$3,328–3,333), pressing against resistance near **\$3,340–3,345**.

* Short-term momentum is bearish: both EMA 7 and EMA 21 sit above current price, with declining volume signaling weakening buyer strength.

* Overall trend leans neutral‑to‑bearish until market clears key zones decisively.

Trade Scenarios

**Bearish Breakdown (Preferred)**

* **Trigger:** Break and close below channel support (\~\$3,326).

* **Targets:** Initial drop toward **\$3,320**, then **\$3,300**, and possibly lower if momentum intensifies.

* **Invalidation:** Price pushes back above **\$3,333–3,335**, negating bearish structure.

**Bullish Breakout (Conditional)**

* **Trigger:** Clean breakout and sustained close above **\$3,342–3,345**.

* **Targets:** Upward stretch toward **\$3,355–3,360**, and if strong, **\$3,367–3,375+**.

* **Invalidation:** Fails to hold structure—retesting from above back beneath **\~\$3,338**.

Macro Drivers & Market Conditions

* Caution prevails pre‑Fed decision and ADP / GDP releases—market awaits cues on interest rate direction.

* Safe‑haven demand has softened as global trade sentiment improves, while U.S. dollar strength continues to cap upside in gold.

* Analysts favor **sell‑on‑rise positioning**, bumping up potential for controlled pullbacks.

Verdict

Gold is consolidating in a tight upward channel, showing short-term bearish pressure. The **bearish breakdown scenario holds the edge** unless price convincingly clears above **\$3,345** on strong volume, which could flip bias. A confirmed break below **\$3,326** sets the stage for downward moves toward **\$3,300** or lower.

Gold Crashing After Hot U.S. Data – More Pain Ahead?Minutes ago, important indices were released from the US , which catalyzed the continuation of gold's downward trend .

Key U.S. Economic Data Just Dropped!

ADP Employment: 104K

GDP q/q: 3.0%

Both came in stronger than expected , signaling that the U.S. economy is holding up better than many thought!

Strong job growth

Solid economic expansion

The result? A stronger U.S. dollar ( TVC:DXY ) and potential downward pressure on Gold .

All eyes are now on FOMC meeting .

Will the Fed still hint at future rate cuts despite the solid data? Or is the easing cycle officially on hold? What is your idea!?

----------------------

Gold ( OANDA:XAUUSD ) has already managed to break the Support zone($3,350-$3,326) , Monthly Pivot Point , 50_EMA(Daily) , Support lines , and the lower line of the ascending channel . Also, Gold trading below $3,333 plays an important role for me, which can increase the possibility of a continuation of the downtrend .

I expect Gold to drop to at least the Potential Reversal Zone(PRZ) before the FOMO meeting and if the Support zone($3,307-$3,272) is broken, we can expect further declines to $3,253(Second Target) .

--------------------------------

Information we need to know:

How should the Federal Funds Rate be announced to cause a deeper drop in Gold ?

The Fed needs to take a hawkish stance — meaning:

They keep rates unchanged, but make it clear they intend to keep them elevated for a prolonged period.

They emphasize strong economic data like today's solid ADP and GDP numbers .

They express concern that inflationary risks remain, and cutting rates isn’t on the table anytime soon.

In this case, markets get disappointed, rate cut hopes fade, and gold drops as real yields( TVC:US10Y ) rise and the U.S. dollar strengthens.

--------------------------------

Note: Stop Loss (SL) = $3,340

Gold Analyze (XAUUSD), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅ ' like ' ✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

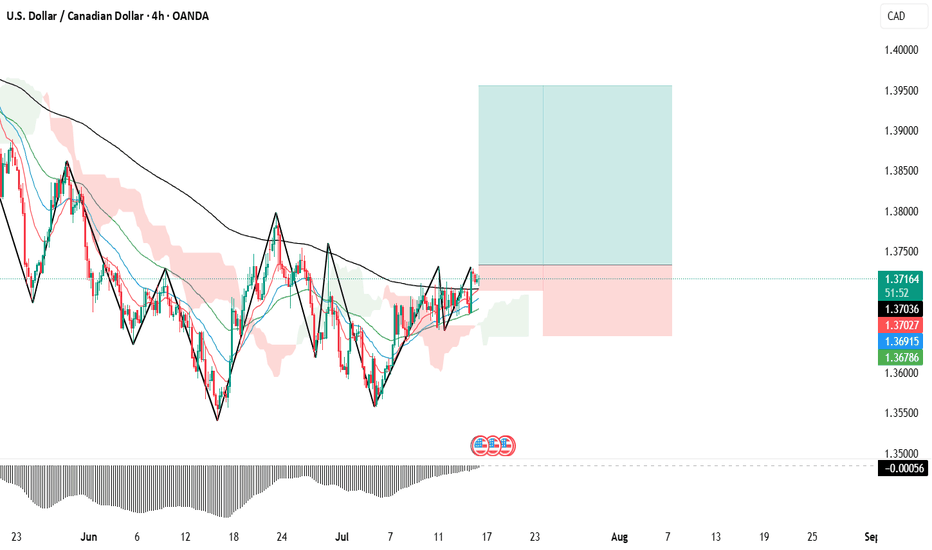

USDCAD Analysis – July 16, 2025

Following the ceasefire between Iran and Israel, oil prices have weakened, reducing support for the Canadian dollar, which is closely tied to crude. As a result, CAD could remain among the weaker currencies over the next two weeks.

Meanwhile, the US dollar may gain strength following the CPI data released on July 15, 2025, potentially setting up a favorable swing opportunity for USDCAD bulls.

🟥 High-Risk Setup – R:R 7.0

This aggressive setup targets a sharp upside move with a tight stop loss, aiming for a high reward relative to the risk. It's suitable for traders comfortable with volatility and willing to accept a lower probability for a higher payout.

🟦 Moderate-Risk Setup – R:R 2.5

A more balanced scenario with a wider stop and a closer target, offering a higher probability of success and smoother trade management. This setup aligns well with swing trading strategies seeking consistent results.

Both setups are based on the current price action structure visible on the chart.

Trade safe, manage your risk, and follow your plan. ✅

GOLD SETUP – BUY THE DIP OR SELL THE LIQUIDITY?Smart Money Playbook with Macroeconomic Context

📅 Date: July 31, 2025

🧠 Analyst: Clinton Scalper

🔍 Technical Breakdown (XAU/USD – H1/H4 Confluence)

Price is currently reacting within a key Fair Value Gap (FVG) zone and appears to be setting up a liquidity sweep on both sides before committing to a strong directional move.

🟢 BUY PLAN

Entry: 3,284

SL: 3,275

TP Targets:

▫️ TP1: 3,290

▫️ TP2: 3,300

▫️ TP3: 3,310

▫️ TP4: 3,320

▫️ TP5: 3,330

▫️ TP6: 3,340

▫️ TP7: 3,350

Key Support Zone: 3,276–3,284

→ Bullish OB + previous demand + potential BOS if price holds

🔴 SELL PLAN

Entry: 3,324

SL: 3,334

TP Targets:

▫️ TP1: 3,320

▫️ TP2: 3,310

▫️ TP3: 3,305

▫️ TP4: 3,300

Sell Zone: Inside FVG + liquidity inducement structure

→ Sell into imbalance after price fakes above recent swing highs

🔎 Smart Money Logic

Price is navigating a deep retracement inside a key FVG, targeting both sides of liquidity before trend continuation.

The BUY PLAN aligns with a classic "liquidity sweep → OB rejection → internal structure break".

The SELL PLAN is a short-term scalping idea inside the FVG liquidity zone, where institutional orders are often triggered before real bullish continuation.

🌍 Macroeconomic Context

US GDP data recently came in slightly below forecast → weaker USD outlook.

Gold demand remains supported due to:

Geopolitical risks (Ukraine, Taiwan tensions)

Market uncertainty over next Fed move (dovish bias increasing)

Real yields declining → bullish for precious metals

However, any hawkish Fed speak or sudden bond yield spikes can trigger intraday sell-offs into OB demand.

🎯 Trading Strategy Outlook

Buy if price sweeps below 3,284 and holds the demand zone. Target extended upside as macro supports gold.

Sell scalp at 3,324–3,330 zone if price shows rejection in FVG zone, but don’t overstay shorts.

⏳ Patience is key: Let price fill liquidity zones and follow smart money trail.

📌 Summary

🔸 Primary Bias: Bullish (Buy Plan favored due to macro + structure)

🔸 Secondary Bias: Bearish scalps from premium FVG

🔸 Watch for: USD volatility, yields, and institutional reaction in OB/FVG zones.

AIRLINK | An Imminent Reversal!!!Previous Trend: Bearish, confirmed by Lower Highs (LH) and Lower Lows (LL).

CHoCH (Change of Character): Bullish signal—price broke previous LH.

Pattern: Rounded bottom forming near the 200 EMA (~155), acting as strong support.

Volume: Slight pickup near bottom—early sign of accumulation.

Outlook: Bullish reversal likely. Break above CHoCH with volume confirms uptrend.

EUR/JPY Setup: Retail is 82% Short – Squeeze First, Drop After?🔹 Technical Context

Price reacted with a strong bullish wick in the 169.50–170.30 demand zone, signaling clear buyer defense. The RSI bounced from weakness but remains subdued, showing limited momentum.

📍 Current price action suggests a potential retest of the 172.50–173.30 area, which aligns with a supply zone, before a possible directional decision is made.

🗓️ Seasonality

Historically, August tends to be bearish for EUR/JPY:

5Y average: -0.48%

10Y average: -0.12%

15Y/20Y averages: -1.3% and -1.2%

📉 Seasonality indicates potential weakness, especially in the second half of the month.

🪙 COT Report (EURO & YEN) – July 22

EURO: Strong long accumulation by non-commercials (+6,284) and commercials (+17,575)

JPY: Net decline in both longs (-1,033) and shorts (-4,096), with a drop in total open interest

🧠 The market is heavily positioned on the Euro, while Yen positioning is fading. This creates a divergence between the two currencies, favoring a short-term technical bounce on EUR/JPY, though downside risks remain in the mid-term.

📉 Sentiment

82% of retail traders are short EUR/JPY

Volume: 1,564 lots short vs 352 lots long

📣 This extreme sentiment imbalance suggests a potential short-term squeeze against retail traders.

📊 Market Mood & DPO

Overall mood: Neutral

DPO at -9.0, Wyckoff score below 50

Momentum remains weak, but not showing a clear divergence.

🧩 Operational Summary

Retest of the 172.50–173.30 supply zone

Likely exhaustion in that area

Ideal setup: rejection + bearish confirmation

→ Targets: 170.30, then 169.00

RLT Renergen UpsideRLT Renergen is a Helium producer, and possibly has the worlds best resource located in South Africa Welkom area.

As a difficult resource to liquify, requires energy, which they have to my knowledge, have achieved via sustainable methods.

Helium is required by many Industries as Semiconductor and MRI and more.

Also Balloons? LOL.

The alliance with ASP Isotopes is a perfect match, as the team will now have the required capital to push production to the next stage.

While still somewhat speculative, the future outcomes look great.

As always if you are unsure about Investing please consult with your own personal investment Advisor before making any Trades or Investments as most are 12 months or more views.

Should you appreciate my comments and chart studies - please smash that like button. It's just a click away.

Regards Graham

SHORT ZONE-XRP structure shiftThere was an XRP structure shift last week.

📉 It’s been bleeding ever since.

Now, another bearish setup is forming.

If XRP nears that descending trendline and fails to break through — it enters the SHORT ZONE.

🚫 No breakout? No mercy.

This isn’t the end for CRYPTOCAP:XRP — but a purge may be necessary before liftoff.

A proper cleansing to prepare for the next ascension.

🫡 xrpArmy, forgive me…

But hey, feel free to earn your keep.

Stay Sharp. Regulate Yourself.

🚫 100% NOT financial advice.

🎭 Edutainment purpiz only.

Bearish drop?The Fiber (EUR/USD) has rejected off the pivot and could potentially drop to the 1st support, which acts as an overlap support.

Pivot: 1.1457

1st Support: 1.1372

1st Resistance: 1.1534

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.