Chart Patterns

GBPJPY: Strong Bullish Reversal from Demand ZoneGBPJPY has bounced sharply from a key demand zone, indicating renewed bullish momentum. The pair continues to follow the broader bullish bias in GBP crosses, with JPY weakness driven by the Bank of Japan's dovish policy stance.

Technical Analysis (4H Chart)

Pattern: Bullish rejection from the 195.30–195.50 demand zone.

Current Level: 195.58, rebounding from strong support, setting up for a potential upward leg.

Key Support Levels:

195.34 – immediate demand zone and critical support.

194.90 – deeper backup support if a pullback occurs.

Resistance Levels:

197.31 – near-term resistance and first upside target.

199.72 – extended target if bullish continuation strengthens.

Projection: As long as 195.34 holds, GBP/JPY could push toward 197.31, with potential for 199.72 if GBP strength persists.

Fundamental Analysis

Bias: Bullish.

Key Fundamentals:

GBP: Supported by the BOE’s cautious but tight stance due to persistent inflation pressures.

JPY: Remains fundamentally weak, with the BoJ avoiding major policy tightening while intervention threats only provide short-term support.

Risk Sentiment: Mild risk-on conditions favor GBP over safe-haven JPY.

Risks:

BoJ FX intervention could temporarily strengthen JPY.

A dovish BOE shift could slow GBP momentum.

Key Events:

BOE policy updates and UK CPI.

BoJ commentary and risk sentiment indicators.

Leader/Lagger Dynamics

GBP/JPY is a leader among JPY pairs due to GBP’s volatility and strength. It often outpaces EUR/JPY and CHF/JPY, making it a key pair for JPY sentiment shifts.

Summary: Bias and Watchpoints

GBP/JPY is bullish, with price rebounding from the 195.34 demand zone. Upside targets are 197.31 and 199.72. Watch for BOE communication, BoJ intervention signals, and global risk sentiment for confirmation of the move.

iExec RLC · Trading at Bottom with a Bullish BiasiExec RLC (RLCUSDT) is still trading at bottom prices but the overall market conditions are good. Good for the future because the market moves in waves alternating always between rising and falling.

RLCUSDT went bearish between May 2021 and June 2022, 399 days. Then it went bullish from June 2022 to March 2024, 630 days. Then it went bearish again between March 2024 and present day, August 2025. More than 510 days.

While RLCUSDT has been bearish more than a year, the action is still happening as a long-term higher low. That is, prices today and at the lowest—16-June 2025—are still higher compared to the low in June 2022.

Of course before being bearish in 2022 the market was bullish between March 2020 and May 2021, 427 days. Here we can clearly see the fluctuations between bear and bull, uptrends and downtrends.

The last uptrend came in 2021 and we are due a new one. Crypto grows every four years and market conditions are perfect for the next run. The market has been mixed, sideways and neutral for years on end, the long-term higher low is a single of strength. After the current retrace is over, you can prepare for a major bullish wave.

Namaste.

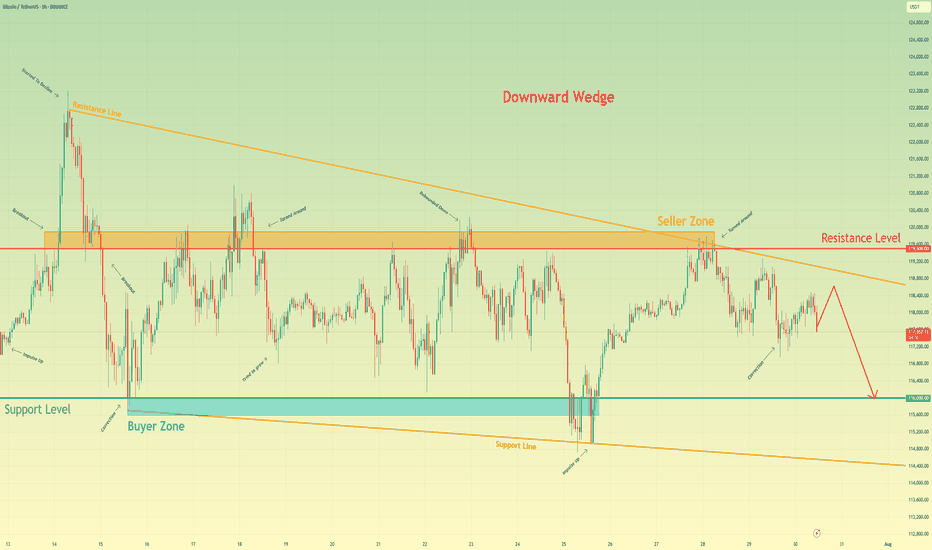

Bitcoin will continue to decline to support levelHello traders, I want share with you my opinion about Bitcoin. Following a period of a broad downward trend, bitcoin's price action has been channeled into a large downward wedge, a pattern that signifies converging volatility and a period of consolidation before an eventual decisive move. This market action is taking place between two critical, well-established zones: a major seller zone capping rallies around the 119500 resistance level and a significant buyer zone providing support near 116000. Recently, an upward rebound attempted to test the upper boundary of this wedge but was met with strong selling pressure from the seller zone, confirming its validity as a formidable barrier. The price is now correcting downwards after this rejection. The primary working hypothesis is a short scenario, anticipating that the bearish momentum from this recent failure will continue to drive the price lower. While a minor bounce or retest of local resistance is possible, the path of least resistance within the pattern's structure is now towards its lower boundary. Therefore, the TP is strategically set at the 116000 level. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

Xrp - It all comes down to this!🚀Xrp ( CRYPTO:XRPUSD ) has to break structure:

🔎Analysis summary:

After Xrp created the previous all time high in 2018, we have been seeing a consolidation ever since. With the recent all time high retest however, Xrp is clearly showing some considerable strength. It all comes down to bulls being able to push price higher, above the massive horizontal structure.

📝Levels to watch:

$3.0

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

EURGBP Will Collapse! SELL!

My dear subscribers,

EURGBP looks like it will make a good move, and here are the details:

The market is trading on 0.8667 pivot level.

Bias - Bearish

My Stop Loss - 0.8675

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 0.8650

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

USDZAR-SELL strategy 6 hourly chart Reg. ChannelSame as the USDX of course, the pair is overbought. i felt yesterday we may see higher, but was not convinced to belong, however, we can add to our SELL, or have SELL position up here. The Reg. Channel is violated amidst this overbought status provides a good warning of potential corrective action.

Strategy SELL @ 18.2000-18.2500 and take profit near 18.0350 for now.

SOL Both scenarios are valid! SOL is still bullishSOL Both scenarios are valid! SOL is still bullish

SOL is in a critical zone. The price is still inside a large bullish pattern and as long as it stays inside the pattern, the trend remains bullish and SOL should follow the bullish scenario.

The bullish targets are at 205, 214 and 224

It may happen that the FOMC will bring surprises, so if SOL manages to break below the pattern, it will activate the bearish scenario after that and the chances of falling will increase further as shown in the red scenario.

The bearish targets are at 160 and 139

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

GBPUSD Technical Overview GBPUSD Technical Overview

GBPUSD recently peaked at 1.3790, aligning with a key historical resistance zone from October 2021. On the Daily Chart, this move completed a significant bearish pattern, suggesting the potential for further downside.

Over the last 7 trading sessions, the pair has declined nearly 400 pips, moving decisively lower.

Given the steep drop, a technical correction may be on the horizon before GBPUSD potentially resumes its bearish trajectory, as indicated by the current chart setup.

If NFP data can be strong today, GBPUSD could extend to the first target 1.3100 or 1.3000 as shown in the chart.

Overall, GBPUSD looks like it has started a downtrend.

Let's see how the price will unfolds.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD/CAD Rises to 2-Month HighUSD/CAD Rises to 2-Month High

Today, the USD/CAD exchange rate briefly exceeded the 1.3870 mark – the highest level seen this summer. In less than ten days, the US dollar has strengthened by over 2% against the Canadian dollar.

Why Is USD/CAD Rising?

Given that both the Federal Reserve and the Bank of Canada left interest rates unchanged on Wednesday (as expected), the primary driver behind the pair’s recent rally appears to be US President Donald Trump's decision to impose tariffs on several countries – including Canada:

→ Despite efforts by Prime Minister of Canada Mark Carney to reach an agreement with Trump, no deal was achieved;

→ Canadian goods exported to the US will now be subject to a 35% tariff;

→ The tariffs take effect from 1 August;

→ Goods compliant with the United States-Mexico-Canada Agreement (USMCA) are exempt.

Media analysts note that the tariffs are likely to increase pressure on the Canadian economy, as approximately 75% of the country's exports are destined for the United States.

USD/CAD Technical Analysis

At the end of July, the price formed a steep ascending channel (A-B), with bullish momentum confirmed by a decisive breakout above the 1.3790 resistance level, as illustrated by the arrow:

→ the pullback before the breakout was relatively shallow;

→ the bullish breakout was marked by a long bullish candlestick with a close near the session high;

→ following the breakout, the price confidently consolidated above 1.3790.

Provided that the fundamental backdrop does not undergo a major shift, bulls might attempt to maintain control in the market. However, the likelihood of a correction is also increasing, as the RSI indicator has entered extreme overbought territory.

Should USD/CAD show signs of a correction after its steep ascent, support might be found at:

→ line C, drawn parallel to the A-B channel at a distance of its width;

→ the previously mentioned 1.3790 level, which now acts as a support following the breakout.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

EURJPY Poised to test the top after the BOJ Rate DecisionEURJPY Poised to test the top after the BOJ Rate Decision

EURJPY broke out of a descending type of channel pattern or something similar.

The last two candles confirmed the bullish movement in a clear way and the odds are that EURJPY may rise further during the coming hours.

However this movement is also supported by BOJ Interst Rate decision.

BOJ kept rates unchanged at 0.5% as expected and they didn't change anything at all in their comments.

News - reported by forexlive

The Japanese Yen weakened across the board throughout BoJ Governor Ueda press conference. He sounded like someone who's not in a rush to hike rates at all. The two key lines were "monetary tightening effectively works on demand-driven inflation, but current inflation is largely supply-driven" and "current FX rate not diverging far from our assumptions".

He's basically saying that the current inflation is likely to be a one-off event and we all know how much weight they place on sustained inflation to durably hit their 2% target. And the comment about FX suggests that the depreciation in the JPY does not concern them at all, which gives the market the green light for further depreciation (all else being equal).

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOLD (XAUUSD): Bearish Continuation Ahead?!

Gold retested a recently broken significant liquidity cluster.

I see a clear sign of strength of the sellers after its test

with multiple intraday confirmation.

I think that the price will retrace to day to 3276 level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

SP500 → Countertrend correction before growthFX:SPX500 is correcting against an upward trend. In the second half of the week, the market received fairly positive fundamentals during the reporting period.

S&P 500 futures found support after strong reports from Meta and Microsoft, which exceeded earnings expectations and forecasts thanks to AI. The rise in futures supported demand for the “Magnificent Seven” despite Powell's hawkish comments. The focus is on Apple and Amazon reports in the evening, which could strengthen the tech rally. On Friday, we are seeing a countertrend correction in which the market is testing the 6288 zone of interest.

Support levels: 6288.4, 6262.6

Resistance levels: 6342, 6371

Most likely, the market will form a false breakout of support during the correction. If the bulls keep the index above the key level, we can expect continued growth in the short and medium term.

Best regards, R. Linda!

Broadcom (AVGO): Is This the Dip You've Been Waiting For?Broadcom (AVGO) has been demonstrating a remarkably strong bullish trend since early April, carving out a clear path of higher highs and higher lows. This robust upward momentum is well-defined by a series of ascending channels.

Trend and Channel Dynamics:

Initially, we observed price action moving steadily within a well-established ascending green channel. The stock showed consistent respect for the channel's boundaries, indicating controlled yet persistent buying pressure. More recently, AVGO broke out above the upper boundary of this initial channel, suggesting an acceleration in momentum. This breakout led the stock into a new, steeper ascending channel, which it has largely been respecting since late June/early July.

Current Price Action and Retracement:

AVGO is currently trading around the $294.10 mark. After reaching a peak just above $307, the stock appears to be undergoing a healthy pullback. This retracement is a natural part of any strong uptrend, allowing for consolidation and the absorption of profit-taking.

Key Support Levels to Watch:

Intermediate Support ($283 to $288): Our first crucial area of interest is the intermediate support zone between $283 and $288. This level aligns closely with prior areas of consolidation and, importantly, the lower boundary of the most recent ascending channel. A test of this area would be a typical and healthy retest of previous resistance now turned support, and a bounce here would signal continued strength within the current channel.

Key "Good Level" Support ($260 to 270) This zone is highlighted as a "good level" for a reason. It perfectly aligns with key Fibonacci retracement levels from the recent major swing low to high:

The 0.5 Fibonacci level at $275.76 sits just above this zone. The crucial 0.618 Fibonacci level is at $268.28. This 'golden ratio' is frequently a strong reversal point in healthy pullbacks. The 0.71 Fibonacci level at $262.44 reinforces the strength of this broader zone. A move into this 260−270 area would represent a deeper but still very much acceptable retracement within a strong uptrend, offering potentially compelling entry or re-entry opportunities for long-term participants.

Overall Outlook:

The current pullback in AVGO should be viewed as a necessary consolidation within a powerful uptrend rather than a sign of weakness. The stock has demonstrated clear impulsive moves followed by corrective retracements throughout its journey higher, as visually reinforced by the white zigzag line.

We will be closely monitoring how AVGO interacts with the 283−288 intermediate support. A successful hold and bounce from this level would suggest a continuation of the upward trajectory. However, if this level is breached, the 260−270 zone becomes the critical area where fresh buying interest is likely to emerge, presenting a lower-risk entry point for those looking to capitalize on AVGO's impressive run.

In summary, AVGO remains firmly in a bullish posture, and these identified support levels offer tactical insights for managing positions or initiating new ones.

Disclaimer:

The information provided in this chart is for educational and informational purposes only and should not be considered as investment advice. Trading and investing involve substantial risk and are not suitable for every investor. You should carefully consider your financial situation and consult with a financial advisor before making any investment decisions. The creator of this chart does not guarantee any specific outcome or profit and is not responsible for any losses incurred as a result of using this information. Past performance is not indicative of future results. Use this information at your own risk. This chart has been created for my own improvement in Trading and Investment Analysis. Please do your own analysis before any investments.

Momentum Continuation after Structural BreakdownHey Candle Fam,

We’re eyeing a clean short setup on SOL after structure broke down and buyers failed to hold key levels. Time to fade the bounce and let the market do the work.

🔥 SOLUSDT.P TRADE IDEA 🔥

Bias: Short

Strategy: Momentum Continuation after Structural Breakdown

Entry: 169.50 – 171.80

Stop Loss: 174.60

Take Profits:

▫️ TP1: 165.10

▫️ TP2: 161.30

▫️ TP3: 158.00 (extension target)

⸻

📊 Rationale:

– HTF structure: Sharp retracement from $215 top, lower highs forming

– LTF structure: Breakdown confirmed, no bullish CHoCH present

– Liquidity targeting: Clean sweep zones below $165 and $160

– Order flow: Sell-side delta dominance, funding positive = longs could unwind

– Volume profile: Imbalance between $172–175 now acting as rejection zone

🎯 Idea: Look for a minor pullback to $170–172, then ride downside liquidity flush. Protect profits fast if market spikes unexpectedly.

⸻

🧠 Stay sharp. Trade smart. Let the market come to us.

Candle Craft | Signal. Structure. Execution.

Possibility of Ethereum moving toward the \$3,330 price range.Considering the breakout of the 4-hour channel and confirmation of the downtrend, reaching the \$3,330 level is not out of the question.

This target was derived using a pattern-based projection from the channel breakout.

I’ve personally taken this position, but I’m not recommending it — just sharing for informational purposes.

Ethereum - The moment of truth!🔬Ethereum ( CRYPTO:ETHUSD ) trades at a key breakout level:

🔎Analysis summary:

Ethereum - after consolidating for the past four years - is once again retesting the previous all time high. And before we will witness another bearish rejection, Ethereum has the chance to finally break out of the long term triangle pattern. It's time for us to start praying.

📝Levels to watch:

$4.000

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

The worst drops often come later!Don’t be fooled by the first crash… The worst drops often come later in a bear market.

Let’s break down the brutal truth about the 2008 GFC and what it teaches us today. 🧵

1.

In the 2007–2009 bear market, the S&P 500 had 7 failed rallies before finally bottoming.

Every bounce looked like the bottom — and every one was a trap.

👇

2.

The early drops were steep:

🔻 Down 11%

🔻 Down 17%

But the most violent crashes came after those…

Near the END — not the beginning — of the bear market.

3.

Later stage declines:

❌ Down 28%

❌ Down 36%

❌ Down 29%

That’s when capitulation kicked in.

Investors gave up. Fear took over.

4.

Capitulation volume isn’t a guaranteed bottom.

It feels like it’s over.

But if fundamentals haven’t turned and the trend isn’t broken, the bear can still bite — hard.

5.

Final crashes are like cliffs:

Markets are exhausted.

Hope is crushed.

And that’s finally when the real bottom shows up.

6.

The lesson?

Bear markets are full of traps.

Relief rallies can fool even seasoned pros.

Stay patient. Wait for trend confirmation. Don’t chase fake bottoms.

7.

📉 The biggest crashes usually happen at the end of the bear market.

That’s the final flush — and it sets the stage for true opportunity.

Learn from the past. Don’t get trapped. Stay sharp.

Bottom Feeding - Opportunity?Adobe is sitting on two areas of support - an 11 year old trendline and the 0.786 Fibonacci. It looks like it's coiling up in a giant triangle. This is a steadily growing business with a very sticky product suite. Whilst everyone is falling over themselves to buy Figma at $110, I think it's time to start paying attention to Adobe here.

I believe the AI fear is overdone, if you look at the continued growth in Adobe, their cash flow and continued growth, this is definitely the more compelling buy out of the two. If we lost the trendline support and Fibonacci support, things could indeed get worse.

Not financial advice.

JUSDT Short-Term Retrace vs Long-Term UptrendJST is not trading at bottom prices because the low was hit November 2022, but the bigger picture still looks like a long-term consolidation pattern. Sideways for years, this precedes a major bull market.

Good morning my fellow Cryptocurrency trader, I hope you are having a wonderful day.

JSTUSDT is looking weak short-term but we know this to be part of the same process, the one that has been going on for years. Higher lows and higher highs but still no major bullish wave, it is getting closer though because the market can only consolidate for so long.

JST has been rising. The high December last year (2024) hit the highest prices since March 2022, the month when the previous bear market breakdown took place.

The red period is the bear market. Notice how it ends when the downtrend is no more and the market turns blue, sideways. After this period comes green and this is where we are now.

Within the bullish period we also have retraces and corrections. Right now we have a bearish move, short-term, within a wider bullish move, an uptrend long-term. This is the normal and classic market fluctuations; prices moving down and up, up and down, back and forth, every day.

The end of the short-term move will result in the continuation of the bigger move, the uptrend. We should expect a higher low followed by a strong higher high next. The next higher high comes in late 2025, now.

Thank you for reading.

Namaste.

DOGEUSDT Technical Analysis – Bullish Reversal Anticipated DOGEUSDT Technical Analysis – Bullish Reversal Anticipated

🔍 Key Technical Zones:

Support Zone: $0.1990 – $0.2015

Strong bullish reactions noted from this level in previous attempts.

Confluence with volume accumulation on the left (as seen in the Volume Profile).

Signifies a strong demand zone where buyers are stepping in.

Resistance Zone / Target: $0.2220 – $0.2240

Previous structural high and supply zone.

Marked as the first major liquidity area.

Also aligns with imbalance and CHoCH (Change of Character), a common SMC concept.

🔄 Market Structure:

CHoCH (Change of Character) marked multiple times, indicating attempts by bulls to reclaim structure.

Recent price action shows accumulation near support.

Sideways consolidation suggests potential for a bullish breakout.

Liquidity sweep of recent lows could indicate that smart money is accumulating positions before a move higher.

🎯 Trade Setup Idea:

Entry Area: Between $0.2000 – $0.2060 (inside the support zone)

Target: $0.22396 (as marked)

Stop Loss: Below $0.1980 (below the visible support range)

🔧 Indicators and Tools Used:

Volume Profile (VRVP): Shows most volume traded around $0.205 – $0.207, indicating strong positioning from market participants.

Smart Money Concepts (SMC): CHoCH and liquidity concepts signal potential accumulation and reversal.

Price Action Analysis: Clean swing structure with support-resistance rotation visible.

📌 Conclusion:

DOGEUSDT is currently trading in a range-bound structure with a bullish bias from the support zone. If the price sustains above $0.205 and breaks above minor resistance, the upside target of $0.22396 is likely. This setup is supported by strong volume accumulation and smart money structure shifts.