Gold (XAU/USD) - Head & Shoulders Breakdown & Bearish MoveOverview of the Chart & Market Context

The 1-hour chart of Gold (XAU/USD) reveals a classic Head and Shoulders (H&S) pattern, a well-known bearish reversal formation. This pattern suggests that the recent uptrend has lost momentum, and a potential downside move could be in progress.

Currently, the price is testing the neckline, which serves as a key support level. If a decisive breakdown occurs, it could confirm further bearish momentum, leading to a sharp decline toward the projected target price of $2,995.

Key Technical Analysis & Levels

🔹 Resistance Level & Reversal Zone (~$3,055–$3,060)

The price attempted to break this resistance but faced strong rejection, forming the head of the pattern.

The area was tested multiple times, confirming that sellers are in control.

This level acts as a supply zone, preventing the price from moving higher.

🔹 Support Level (Neckline of H&S Pattern at ~$3,025–$3,030)

This level represents the critical neckline, which has been tested multiple times.

If price breaks and sustains below this support, the H&S pattern will be validated, signaling a deeper drop.

A successful retest of the neckline as resistance could provide an optimal shorting opportunity.

🔹 Projected Target Price (~$2,995)

The expected downside move is calculated using the measured move technique, measuring the distance from the head to the neckline.

This target aligns with previous structure support, increasing its significance.

Detailed Breakdown of the Head & Shoulders Pattern

📍 Left Shoulder Formation

The market experienced an initial bullish push, reaching a local high, but sellers entered and pushed prices down.

This formed the first lower high, hinting at potential weakness in the bullish trend.

📍 Head Formation

After retracing from the left shoulder, buyers made another attempt to push prices higher.

The price formed a new peak, but it was unable to sustain the breakout above the resistance level (~$3,055–$3,060).

A sharp sell-off followed, reinforcing that sellers are dominant at higher levels.

📍 Right Shoulder Formation

The price attempted another rally but failed to break the left shoulder’s high, creating the right shoulder.

This failure confirmed a gradual loss of bullish strength.

After forming the right shoulder, the price began to drop toward the neckline support.

📍 Breakout Confirmation & Bearish Price Action

The price has now broken the neckline (~$3,030), indicating an early-stage breakdown of the H&S pattern.

If the breakdown holds, further downside movement toward $2,995 is likely.

A retest of the neckline as new resistance would be an ideal entry point for short positions.

Trade Setup & Risk Management

📌 Potential Short Trade Setup:

Entry: After a confirmed break and retest of the $3,030 neckline.

Stop-Loss: Above the right shoulder (~$3,045–$3,050) to minimize risk.

Take-Profit: Around $2,995, aligning with the measured move.

📌 Risk Factors & Market Conditions:

If the price fails to hold below the neckline, it could indicate a false breakdown and a possible bullish reversal.

Macroeconomic data (such as interest rates, inflation, and geopolitical tensions) may impact gold prices.

Traders should watch for volume confirmation – increased selling pressure strengthens the validity of the breakdown.

Final Thoughts & Market Outlook

📉 The Head and Shoulders pattern signals that gold is losing bullish momentum, with a potential drop toward $2,995.

🔍 A break and retest of the neckline as resistance would confirm further downside movement.

⚠️ However, a failed breakdown could lead to a recovery, so traders should wait for confirmation before entering trades.

💬 What do you think about this setup? Are you going short on gold? Drop your thoughts in the comments below! ⬇️

Chartpatternanalysis

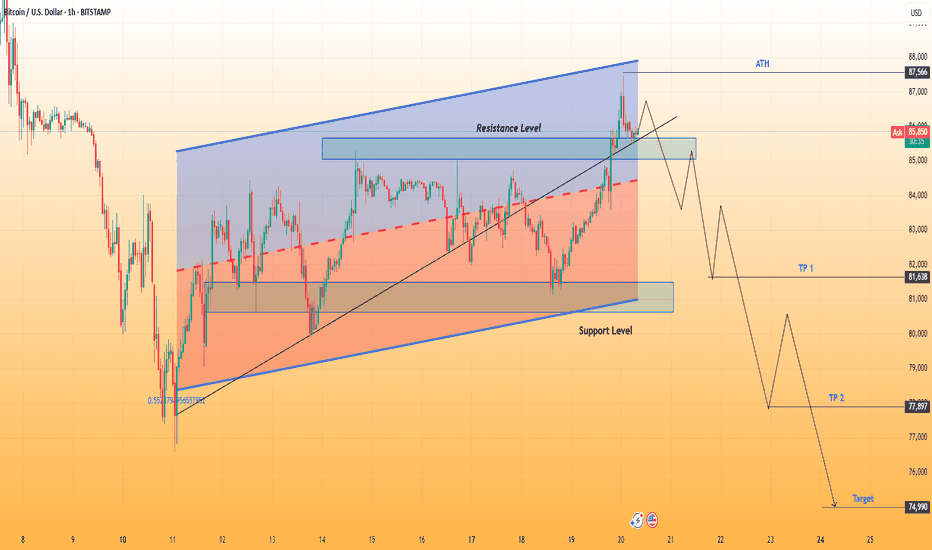

BTCUSD | Rising Wedge Breakdown – Bearish SetupChart Overview:

This chart represents Bitcoin (BTC/USD) on the 1-hour timeframe and showcases a Rising Wedge pattern. The price action has reached a key resistance level, and a potential breakdown scenario is unfolding.

1️⃣ Pattern Identification: Rising Wedge Formation

A Rising Wedge is a bearish reversal pattern that forms when price moves within two converging upward-sloping trendlines. The narrowing price range indicates a weakening trend, and a breakdown usually leads to a significant price drop.

Upper Trendline (Resistance): Marked in blue, this trendline connects the higher highs.

Lower Trendline (Support): Also in blue, connecting the higher lows.

Breakdown Confirmation: The price has already moved below the wedge support, confirming the bearish bias.

2️⃣ Key Price Levels & Zones

🔹 Resistance Zone (Blue Box)

This strong resistance level has repeatedly rejected the price.

The final rejection led to a breakout failure and potential trend reversal.

🔹 Support Zone (Blue Box)

A strong demand zone, but a breakdown below it triggers a bearish trend.

This level is now acting as potential resistance after the breakdown.

🔹 ATH (All-Time High) – $87,566

This marks the highest price level reached in the given timeframe.

3️⃣ Market Structure Breakdown

🔻 Bearish Momentum & Breakdown

After touching the resistance, BTC failed to sustain upward movement.

A breakout of the wedge's lower trendline confirms a trend reversal.

Price action suggests a lower-high, lower-low structure, indicating a bearish market shift.

📉 Expected Price Movement (Wave Structure)

The breakout retest could result in a small pullback to previous support (now resistance).

After confirmation, price is likely to continue downward in a wave-like structure.

Fibonacci levels or key support zones will act as profit-taking targets.

4️⃣ Trade Setup & Targets

🔻 Short Setup (Bearish Trade Idea)

Entry: On a successful retest of the broken support zone.

Stop-Loss (SL): Above the previous resistance zone for risk management.

Take Profit (TP) Targets:

TP 1: $81,638

TP 2: $77,897

Final Target: $74,990

5️⃣ Summary & Conclusion

📌 BTC/USD has broken out of a Rising Wedge pattern, confirming a bearish trend.

📌 A pullback and retest may occur before further downside continuation.

📌 The chart suggests a short opportunity, targeting lower support zones for potential profit-taking.

📌 Traders should manage risk with a well-placed stop-loss above key resistance.

This setup aligns with technical analysis principles, confirming a high-probability short trade for BTC. 🚀

Silver (XAG/USD) – Rising Wedge Breakdown & Bearish ContinuationTechnical Analysis & Market Outlook

The Silver (XAG/USD) 1-hour chart presents a clear rising wedge formation, a well-recognized bearish reversal pattern. This formation develops when price action creates higher highs and higher lows within a contracting range, signaling a potential exhaustion of bullish momentum.

Currently, Silver has broken below the lower trendline of the wedge, confirming a bearish breakout. This move suggests that the recent uptrend is weakening, and sellers are beginning to take control. A retest of the broken support level as new resistance could provide an ideal entry for a short position.

Key Technical Levels & Trading Plan

1️⃣ Resistance & Supply Zone: 34.00 - 34.20

Price has struggled to break above this region multiple times, confirming strong selling pressure.

The market rejected this level sharply, leading to the current downside movement.

A stop-loss can be placed slightly above this zone to protect against unexpected reversals.

2️⃣ Support Level & Retest Zone: 33.50

Previously, this level acted as a strong support, but the breakdown confirms a shift in market structure.

If price retests this level and faces rejection, it could serve as an optimal entry point for short trades.

3️⃣ Short Entry Confirmation

Traders should look for price rejection from the 33.50 zone before entering a short position.

A bearish candlestick pattern (e.g., bearish engulfing, pin bar, or a lower high formation) would further validate the entry.

4️⃣ Bearish Target: 31.90 - 32.00

The projected downside move aligns with the measured move of the wedge breakdown and previous support zones.

If price maintains bearish momentum, further downside potential exists beyond this target.

5️⃣ Stop-Loss Placement: Above 34.20

Setting a stop-loss above the recent resistance ensures protection against invalidation of the bearish setup.

This placement accounts for potential price spikes or false breakouts.

Trade Execution Strategy:

📌 Entry: Short on a retest of the 33.50 level, ensuring confirmation via price rejection.

📌 Stop-Loss: Above 34.20 to avoid premature stop-outs.

📌 Take-Profit: Targeting the 31.90 - 32.00 zone for an optimal risk-to-reward ratio.

Conclusion & Risk Management:

The breakdown from the rising wedge signals a shift in market sentiment, favoring a bearish move. Traders should remain patient for a retest of broken support to confirm the validity of the trade. Proper risk management with a well-placed stop-loss and a defined target ensures controlled exposure to market fluctuations.

📊 Overall Bias: Bearish 📉

🔍 Key Watch Areas: Retest of 33.50 for Short Confirmation

EUR/USD Chart Pattern Analysis (1H Timeframe) – Bearish SetupThe EUR/USD 1-hour chart presents a compelling bearish setup, characterized by a rejection from a key resistance zone, a weakening support level, and a potential trendline breakdown. These technical elements suggest an increased probability of downward movement if bearish momentum persists.

Key Technical Components:

Resistance Rejection & Selling Pressure:

The price action tested a well-defined resistance zone, which aligns with previous swing highs.

A rejection from this level indicates that sellers have stepped in, preventing further upside movement.

This area serves as a supply zone, reinforcing a bearish outlook as long as price remains below it.

Support Level at Risk of Breakdown:

The market is currently testing a support zone, which has previously acted as a demand area.

A break below this support would confirm increased selling pressure, likely triggering a more significant decline.

The support level is structurally weak, as the price has already tested it multiple times, increasing the likelihood of a breakdown.

Ascending Trendline Violation:

The ascending trendline has been a key dynamic support for the recent uptrend.

If the price breaks below this trendline with strong volume, it would signify a potential trend reversal, shifting market sentiment from bullish to bearish.

A confirmed breakdown would further validate the bearish continuation scenario.

Sell Stop Placement & Profit Targets:

A Sell Stop order is positioned below the support zone to capture a breakdown trade.

The first Take Profit (TP1) is set at 1.08312, a level that has historically acted as support and resistance.

The second Take Profit (TP2) is placed at 1.07659, representing a more extended bearish move toward the next major demand zone.

Conclusion & Trading Strategy:

Bearish Scenario: If the price breaks below the support level and ascending trendline, it could trigger a sell-off, leading to a potential downside move toward TP1 and TP2.

Bullish Rebound Possibility: If the support level holds and buyers regain control, the price may attempt to retest the resistance zone. However, the bearish structure remains dominant unless the price breaks above resistance.

Final Outlook:

Traders should closely monitor price action at the support and trendline intersection. A confirmed breakdown below these levels, preferably with increased volume, would reinforce the bearish outlook. Proper risk management and stop-loss placement above the resistance zone are recommended to mitigate potential reversals.

Would you like me to refine it further for professional publication or trading forums? 🚀

The SECRET to BULLISH CHART PATTERNS | EducationBullish chart patterns play out towards the upside... atleast most of the time.

In some cases, a bullish pattern forms - seemingly strong- but ends up going the complete opposite direction. There is a way to navigate this very frustrating outcome - by waiting for confirmation.

Through waiting a little longer, you will surely reduce the profits - but this greatly reduces the risk of playing a "failed" pattern.

Keep a close eye on this bullish chart pattern forming on SUI:

__________________________

EUR/USD getting close to target after tariffs rebound...The EUR/USD has rebounded nicely from two weeks prior when we gapped down pretty significantly after tariffs were announced. The original observation was bullish after identifying a bullish pattern (Descending Megaphone) alongside MACD divergence.

We're stalling at the moment around 1.0500 and I don't expect any further movement throughout the day considering it's a U.S. market holiday however, I'm continuing to hold on to my long position and eying an exit at 1.0600 which is where the yearly pivot point is located.

If we do get to see the 1.0600 price, I will be evaluating short positions somewhere in this zone. We'll see how the remainder of this week develops and go from there.

Good Luck & Trade Safe.

Corrective Wave and Chart Pattern Analysis - RSI TFW DivergenceCorrective Wave Structure a ABC Analysis pattern in TFW timeframe

Observations:

A bullish divergence is evident in the momentum near the support zone indicating weakening bearish momentum, the end of wave C, and a potential reversal to the upside.

Analysis:

- Wave A: completed descending channel retraced 61.8% of previous uptrend with 5 wave diagonal pattern - wave A.1 the shortest and wave A.3 is the longest.

- Wave B: retraced 61.8% of Wave A with an extended flat 3 wave abc pattern - wave B.c extended 261.8% of B.a

- Wave C: A descending triangle /ending diagonal pattern is visible within Wave C current extending 61.8% of Wave A.

Support:

- The Green zone (liquidity support) around 4.50 THB is significant, acted as a strong support level multiple times in the past.

- A breakdown below this zone could lead to further downside (red arrow scenario) while holding above it might trigger a reversal (green arrow scenario).

Breakout:

- Resistance levels marked by Wave B’s high 6.4+ THB and intermediate levels around 4.9+ THB are critical breakout moving average 20 week dynamic resistance zone.

- An upward breakout past these levels would confirm the end of the corrective phase and the start of a new bullish impulse wave.

Potential Scenarios:

Bullish Case (Green Arrows):

TP1: Price holds the liquidity support zone and breaks above 5.50 THB (near-term resistance).

TP2: A successful retest of 6.50 THB Wave B zone could lead to a new bullish wave formation.

RRR: 3:1

Bearish Case (Red Arrow):

A break below the liquidity support zone 4.50 THB would confirm continued bearish pressure.

Price could target lower levels, possibly extending toward 3.50 THB or beyond.

Action:

+ Look for bullish confirmation with a breakout above descending triangle (ending diagonal) resistance 4.80 THB zone

+ Watch for volume surge volume profile indicator to validate the reversal trigger.

+ Monitor price action near the liquidity support zone 4.50 THB.

+ Accumulate only if the support holds and momentum confirms a bullish reversal.

Always trade with affordable risk, respect your stop.

"Scenario B" for Potential Bearish of Broadening WedgeThe 1st scenario is Broadening Wedge with rebound and break resistance, and then raise to another record with possible to break $2700 first.

In this "scenario B" , I try to make some exception for the resistance. Concern the resistance is too strong after the rebound, therefore we will find the correction until it break the support. After that we will find some retrace or swing high about 50% of last wave, and continue with the pressure to 2614 which is known as point B or point 2.

After the dip correction, please becareful with new demand probably will push the price for another uptrend. Well at least it corrected first before making new high on NFP next friday, right?

The Fair Value Gap (FVG)The term "fair value gap" is known by various names among price action traders, including imbalance, inefficiency, and liquidity void. But what do these imbalances mean? They arise when the forces of buying and selling exert considerable pressure, resulting in sharp and rapid price movements.

On a chart, a Fair Value Gap appears as a three-candlestick pattern. In a bullish context, an FVG forms when the top wick of the first candlestick does not connect with the bottom wick of the third candlestick. Conversely, in a bearish scenario, the FVG is created when the bottom wick of the first candlestick fails to connect with the top wick of the third candlestick. The gap on the middle candlestick, created by the wicks of the first and third candlesticks, represents the Fair Value Gap.

The concept of FVG trading is based on the idea that the market has a natural tendency to self-correct. These price discrepancies or inefficiencies are generally not sustainable over time, and the market often returns to these gaps before continuing in the same direction as the original impulsive move.

What are the Types of Fair Value Gaps?

1. Bearish Fair Value Gap

A bearish Fair Value Gap occurs when there is a space between the bottom wick of the first candlestick and the top wick of the third candlestick. This gap typically appears on the body of the middle candlestick, and the individual characteristics of each candlestick are not particularly important. What’s crucial in a bearish scenario is that the gap on the middle candlestick results from the wicks of the surrounding candlesticks not connecting.

2. Bullish Fair Value Gap

A bullish Fair Value Gap occurs when the top wick of the first candlestick does not connect with the bottom wick of the third candlestick. In this case, the specific direction of each candlestick is not as important. What really matters is that there is a gap in the middle candlestick, where the wicks of the first and third candlesticks have not linked.

3. Inverse Fair Value Gap

An Inverse Fair Value Gap is an FVG that has lost its validity in one direction but remains significant enough to influence price movement in the opposite direction. For example, a bullish FVG is deemed invalid if it fails to act as a demand zone. However, it then transforms into an inverse bearish FVG, which may serve as a supply zone capable of holding the price.

4. Implied Fair Value Gap

The Implied Fair Value Gap is also a three-candlestick pattern, but it does not feature a gap on the middle candlestick, which is why it’s called an “implied FVG.” Instead, it consists of a larger middle candle flanked by two relatively long wicks from the first and third candles.

The “gap” is defined by marking the midpoint of the wick of the first candlestick that touches the middle candle and the midpoint of the wick of the third candle that also touches the middle candle. These two midpoints create the gap.

Here are some factors that can lead to the formation of fair value gaps:

1. Economic Data Releases

Key economic data releases, such as changes in interest rates or unemployment statistics, can similarly create imbalances. If the data surprises the market, it can trigger a swift price movement in one direction, resulting in a gap.

2. Sudden News Events

Unexpected news that significantly affects market sentiment can lead to a rapid increase in buying or selling activity, resulting in a gap as prices adjust to the new information. For instance, if a company unexpectedly reports strong earnings, its stock price may surge, creating a gap on the chart.

3. Market Openings or Closings

Gaps may form during periods of low liquidity, such as at market openings or closings. With fewer market participants, even a small amount of buying or selling can cause a noticeable price jump that isn’t quickly countered.

4. Large Institutional Trades

Significant trades by institutional investors can also lead to fair value gaps (FVGs). When a hedge fund or financial institution executes a large buy or sell order, it can overwhelm the existing order book, causing a rapid price shift and leaving a gap behind.

5. Weekend Gaps

FVG's are often observed between the close on Friday and the open on Monday, reflecting news or events that occurred over the weekend.

KEY POINTS TO KNOW

- Fair Value Gaps (FVGs) are powerful tools traders use to identify market imbalances and inefficiencies.

- FVGs occur when buying or selling pressure leads to significant price movements, leaving behind gaps on price charts.

- FVGs can be identified through technical analysis involving the analysis of candlestick patterns and price chart patterns.

- Traders can categorize FVGs into two types: Undervalued FVGs, where prices are lower than fair value, and Overrated FVGs, where prices are higher.

NZDCAD 4 Hours Technical Analysis ProjectionWe have just spotted a good selling opportunities on NZDCAD 4 Hours Chart as price printed a double top formation at a structural level. This is one of the setups we don't want to miss out on.

1 Hour chart also shows a bearish corrective formation which may give room for sellers to jump onboard.

Gold Market Breakdown: Unfolding Patterns and Key Price MovementGood morning Traders,

Trust you are doing great.

Allow me to continue my storyline of the Gold market.

In my previous analysis of the gold market, I identified two unfolding patterns with similar directional implications. While one pattern was invalidated, the other continues to develop as expected. I projected an appreciation in the gold price from 2370.930 to the 2430-2442 region, which has materialized with gold rallying to 2425.540, where it is currently encountering resistance.

Additionally, a new bearish Gartley pattern has emerged, suggesting a potential decline towards 2314.318 to complete the D-leg of the earlier identified unfolding bullish Gartley pattern. Supporting this bearish outlook are the following factors:

1. The current gold price has met the minimum requirement for leg C of the larger unfolding Gartley pattern, even though there are still room to the upside, but it shouldn't exceed 2436.857.

2. A fully formed smaller bearish Gartley pattern has been observed on the H1 timeframe.

3. The price is currently at a key supply zone that coincides with a critical level in our analysis.

Given these observations, I anticipate a significant drop in the gold price. However, if the price exceeds the maximum harmonic level for the formation of leg C of the unfolding bullish Gartley pattern at 2436.857, this outlook will be invalidated.

Cheers and happy trading!!!

4H Head and Shouders FormationThe closing price of the second shoulder is observed to be lower than the first shoulder, indicating a potential reversal pattern. Furthermore, the price action is positioned below the 200-day Moving Average (EMA), reinforcing the bearish sentiment. Additionally, I noticed seven candles on the first shoulder and head. PHEMEX:BTCUSDT.P May 7, 2024, 2:25pm

Reversal Broadening Wedge pattern in HDFCLIFEHDFC LIFE INSURANCE COMPANY LTD

Key highlights: 💡⚡

📈 On 1 Day Time Frame Stock Showing Reversal of Broadening Wedge Pattern.

📈 It can give movement upto the Reversal Final target of Above 717+.

📈 There have chances of breakout of Resistance level too.

📈 After breakout of Resistance level this stock can gives strong upside rally upto Above 860+.

📈 Can Go Long in this stock by placing a stop loss Below 511-.

ICICIGI Up Move ExpectedIn ICICIGI an up move is expected till 1650. This stock has given a strong breakout and the breakout is also backed by huge volume. This stock can give you a return of around 195 point which is around 13.42 from 1454.85 and also a Risk to Reward Ratio of 1:4.42. You can definitely go for it but only after considering the risk first.

FOLLOW FOR MORE!!

Symmetrical Triangle breakdown in BankniftyBANKNIFTY Index

Key highlights: 💡⚡

✅On 15 Min Time Frame Stock Showing Breakdown of Symmetrical Triangle Pattern .

✅ Strong bearish Candlestick Form on this timeframe.

✅It can give movement up to the Breakdown target of 47000-.

✅Can Go short in this stock by placing a stop loss above 48200+.

Head & Shoulder Pattern breakout in HAPPSTMNDSHAPPIEST MINDS TECHNO LTD

Key highlights: 💡⚡

✅On 1Day Time Frame Stock Showing Breakout of Head & Shoulder Pattern.

✅ Strong Bullish Candlestick Form on this timeframe.

✅It can give movement up to the Breakout target of 935+.

✅Can Go Long in this stock by placing a stop loss below 842-.

Trade_setup _ 20% upside potential in BF Utilities.BF utilities is a Kalyani Group owned company that engages in infrastructure and power generation through wind mill technology.

The chart shows the stock giving a successful breakout from:

i. Inverse head and shoulder pattern.

ii. Horizontal resistance zone(635-655)

The stock closed above both these significant resistances with a spike up in volume and a Bullish 'Marubozu' candlestick.

The target for the Inverse head and shoulder patterns projects to a target almost close to the previous swing high(around 800-815 zone).

On the downside 630 should make a good area to consider for a SL on this stock.

*Note- Views expressed here are based on personal opinions/observations. Please do your own research/analysis before taking any financial positions.