Gold (XAU/USD) Breaks Ascending Channel – Bearish Move Ahead?📉 Market Structure:

Gold was moving in an ascending channel, but price has now broken below the support trendline.

This suggests a possible trend reversal or correction.

📌 Key Levels:

Resistance : $3,125 - $3,170

Support: $3,054 - $3,035

Target: $3,000 - $2,995

📊 Trade Idea:

A pullback to support-turned-resistance could give a short entry.

Bearish target: $3,000 if rejection holds.

Invalidation: If price reclaims $3,125.

🔍 Watch for:

Price reaction at the former channel support.

Possible retest before further drop.

Let me know if you need any modifications! 🚀

Chartpatternsanalysis

XAUUSD Head & Shoulders Breakdown – Bearish Target Ahead?This chart represents a detailed technical analysis of Gold Spot (XAU/USD) on the 1-hour timeframe with a structured trade setup based on a Head and Shoulders (H&S) reversal pattern. Below is an in-depth explanation of the chart components, price action, and trade strategy.

1️⃣ Key Chart Patterns and Analysis

A. Head and Shoulders Pattern (Bearish Reversal)

This is a well-known bearish reversal pattern that signals a potential trend change from bullish to bearish. It consists of three peaks:

Left Shoulder: A rise followed by a temporary pullback.

Head: The highest peak in the pattern, showing strong buying pressure before reversal.

Right Shoulder: A smaller rise compared to the head, indicating weakening bullish momentum.

B. Neckline (Support Level) and Breakdown Confirmation

The neckline (horizontal support level) is drawn across the lowest points between the shoulders.

A break below the neckline confirms the reversal, triggering a bearish move.

The chart suggests price is at the neckline zone, preparing for a breakdown.

2️⃣ Trendline and Support/Resistance Analysis

A. Uptrend Trendline Break

The price was following a strong ascending trendline (dotted black line).

A trendline breakout has occurred, indicating potential trend reversal.

This supports the bearish bias further.

B. Resistance and Support Levels

Resistance Level: Marked at the top of the Head region, which aligns with previous price rejection zones.

Support Levels:

First support (TP1 - 3,053.269): This is the first potential take profit level.

Second support (TP2 - 3,030.556): The next target if price continues downward.

3️⃣ Trade Setup & Risk Management

A. Entry Point (Short Position)

Sell (Short) after the neckline breakout, ensuring bearish momentum is confirmed.

B. Take Profit (TP) Targets

TP1: 3,053.269 (Initial support target).

TP2: 3,030.556 (Stronger support zone, deeper profit target).

C. Stop Loss Placement

Stop Loss: 3,150.726 (Above the resistance zone).

This is a logical stop-loss placement, allowing price fluctuations without prematurely stopping the trade.

4️⃣ Overall Market Sentiment & Trade Bias

Bearish Bias: Due to the formation of the Head and Shoulders pattern, trendline breakout, and weakening bullish momentum.

Confirmation Needed: A strong bearish close below the neckline increases probability of downward continuation.

5️⃣ Final Thought – A High-Probability Trade Setup

If neckline breaks, the trade is valid with potential for a 3%+ downside move.

If price holds above the neckline, the pattern may fail, leading to reconsidering trade execution.

This structured risk-managed approach ensures a strategic entry, controlled risk, and maximized profit potential. 📉🔥 Let me know if you need further refinements! 🚀

XAUUSD Bearish Breakdown: Riding the Rising Wedge to Profit1. Chart Pattern: Rising Wedge (Bearish Reversal)

The Rising Wedge is a technical pattern that occurs when price makes higher highs and higher lows within converging trendlines. This pattern is considered bearish, as it usually precedes a breakdown when price fails to sustain the higher levels.

The pattern is clearly visible as price moves within two upward-sloping black trendlines.

The narrowing range suggests that buying pressure is weakening, and sellers are gaining control.

A confirmed breakdown occurs when price breaks below the lower trendline, indicating potential further downside.

2. Key Technical Levels

Resistance Level (Highlighted in Beige, Top Box)

This area represents a strong supply zone where price has struggled to move higher.

Each time the price reaches this level, selling pressure increases, pushing the price lower.

The chart labels this as the Resistance Level, suggesting a potential reversal zone.

Support Level (Highlighted in Beige, Lower Box)

This is the previous demand zone, where price has rebounded multiple times.

Once price reaches this level, buyers may attempt to push it higher.

However, if this level fails to hold after the breakdown, further downside is expected.

Stop Loss Level (~3,150)

The stop loss is placed just above the recent highs.

If price moves beyond this level, it would invalidate the bearish setup.

Traders use stop losses to limit risk in case the market moves against the position.

Target Level (~3,080)

This is the projected downside target based on the height of the wedge.

A measured move (calculated from the highest to the lowest point of the wedge) aligns with this target.

It represents a potential 1.78% decline from the breakdown level.

3. Price Action & Trade Setup

Breakout Confirmation:

The price broke below the lower trendline, confirming a wedge breakdown.

The bearish momentum suggests sellers are in control.

Entry Zone:

A good short-selling opportunity is identified after the breakdown and potential retest of the lower trendline.

Risk Management:

Stop loss at 3,150 (above resistance).

Profit target at 3,080 (expected support).

This gives a favorable risk-to-reward ratio.

4. Market Psychology Behind the Pattern

Rising Wedge Psychology:

The pattern forms as buyers push price higher, but each new high has weaker momentum.

Eventually, selling pressure outweighs buying interest, leading to a breakdown.

Resistance & Support Psychology:

The resistance area acts as a supply zone where big traders sell their positions.

The support zone may hold temporarily, but if it breaks, panic selling could accelerate the decline.

5. Possible Scenarios After the Breakdown

Bearish Case (Most Likely Outcome)

Price continues downward after breakdown.

It reaches the 3,080 target with increased selling momentum.

Confirmation of a bearish reversal pattern.

Bullish Case (Invalidation of Setup)

Price reclaims the wedge and moves back above resistance.

It invalidates the bearish breakdown, stopping out sellers.

A potential bullish continuation toward new highs.

Final Thoughts

This chart presents a high-probability short trade based on the Rising Wedge breakdown and resistance rejection. Traders can manage risk by setting a tight stop loss above resistance while aiming for a target at the next key support zone. The pattern suggests a bearish sentiment in the short term, favoring sell setups over buying opportunities.

Would you like me to add further insights, such as Fibonacci levels or RSI analysis, to strengthen the trade idea? 🚀

XAG/USD Rising Wedge Breakdown To Bearish Trade Setup1. Overview of the Chart

This chart represents Silver (XAG/USD) on the 4-hour timeframe from the OANDA exchange. The price action has formed a Rising Wedge pattern, which is a classic bearish reversal formation. This suggests that a potential breakdown could lead to a significant decline in price.

2. Chart Pattern: Rising Wedge Formation

A Rising Wedge consists of a narrowing price range with higher highs and higher lows, but the slope of the support line (bottom trendline) is steeper than the resistance line (top trendline).

This signals weakening bullish momentum, as buyers are struggling to push the price higher, and sellers are stepping in.

Rising Wedges typically break downward due to the loss of buying strength.

3. Key Technical Levels and Market Structure

A. Resistance Level (Highlighted in Beige Box - $34.50 to $34.80)

This zone has acted as a supply area, where price struggles to break higher.

The price touched this level multiple times, failing to hold above it, which increases the probability of a reversal.

B. Support Level (Highlighted in Blue Box - Around $33.50)

This is a critical short-term support where buyers previously stepped in.

A break below this zone would indicate a confirmation of the wedge breakdown and further downside potential.

C. Stop Loss Level (Marked at $34.80)

Placed above the resistance zone, ensuring protection if price invalidates the pattern and moves higher instead.

This aligns with a logical risk-management strategy to minimize losses if the setup fails.

D. Bearish Breakdown Projection & Target (Marked at $30.46)

The projected target aligns with previous structure support, meaning price may find buyers around this level.

This level is determined by measuring the height of the wedge and projecting it downward from the breakout point.

4. Trading Strategy & Execution Plan

📌 Short (Sell) Trade Setup:

Entry:

Enter a short position once price breaks below the lower trendline of the wedge with strong bearish momentum (e.g., a big red candle closing below support).

A possible retest of the broken support could provide a second entry opportunity.

Stop Loss:

Set at $34.80, above resistance, to ensure the trade is protected against invalidation.

Take Profit (Target):

First target: $32.50 (psychological level and minor support).

Final target: $30.46 (major support and full pattern breakdown projection).

5. Market Psychology & Confirmation Signals

Why This Setup is Bearish?

Price action shows higher highs but with decreasing strength, signaling bull exhaustion.

The Rising Wedge is a well-known bearish structure, and its breakdown typically leads to a strong sell-off.

Volume confirmation: If the breakdown happens with high volume, it strengthens the bearish case.

What to Watch For?

A decisive bearish candle closing below the wedge support confirms the short setup.

If price retests the broken trendline and fails to reclaim it, it provides a second opportunity for entry.

Avoid entering if price consolidates near resistance instead of breaking down.

6. Conclusion: Bearish Bias & Trading Edge

The Rising Wedge formation suggests that Silver is losing bullish momentum and could break down.

Key levels and structure provide a well-defined trade setup, ensuring a good risk-to-reward ratio.

Traders should wait for a confirmed breakdown before entering a short position.

📉 Bearish Outlook – Price likely to drop toward $30.46 target

⚠️ Risk Management is crucial – Stop Loss at $34.80

🎯 Breakdown confirmation needed before entering short positions

Would you like me to refine any part or add more insights? 😊

Silver (XAG/USD) Rising Wedge – Bearish Breakdown Setup!A rising wedge is a pattern that typically forms when the price makes higher highs and higher lows, but the upward momentum starts weakening. The narrowing structure of the wedge indicates that buyers are losing strength, and a breakout to the downside is likely.

Key Characteristics of the Rising Wedge:

✔ Higher highs & higher lows – but with reduced momentum

✔ Trendline support (lower boundary) & resistance (upper boundary)

✔ Volume decline – suggests a potential reversal

Expected Scenario:

If the price breaks below the lower trendline, it signals bearish pressure, and Silver could see a strong decline.

2. Key Levels & Trading Setup

📌 Resistance Level ($34.50 - $34.80)

The upper boundary of the wedge is acting as strong resistance.

Historically, this zone has rejected price action multiple times, indicating sellers are defending this area.

📌 Support Level ($30.20 - $30.50)

A major demand zone where buyers previously stepped in.

If the wedge breaks down, this is the most likely target for the decline.

📌 Stop Loss ($34.81)

Placed just above the recent high and resistance zone to limit risk in case of an unexpected upside breakout.

📌 Target ($30.20)

Measured move from the wedge breakdown projects a sharp decline toward the next strong support at $30.20.

3. Trade Execution Strategy

🔴 Bearish Breakdown Scenario

If the price breaks below the lower trendline (around $33.00), we expect a strong move downward.

📉 Short Entry: Below $33.00 (after confirmation)

🎯 Target: $30.20

❌ Stop Loss: $34.81 (above resistance)

Confirmation Needed:

✅ Strong bearish candle close below support

✅ Increased volume during breakdown

✅ Retest of broken support turning into resistance

🟢 Bullish Alternative (Invalidation)

If price breaks and holds above $34.81, the bearish setup will be invalidated, and a breakout towards $36.00 - $37.00 could be expected.

4. Additional Considerations

📌 Fundamental Factors: Keep an eye on macroeconomic news, Fed decisions, and USD strength, as these impact Silver prices.

📌 Risk Management: Avoid overleveraging and use a proper risk-reward ratio (1:3 or higher).

📌 Market Sentiment: Watch volume trends and confirm breakout or fakeout before entering trades.

Conclusion

This chart presents a high-probability short trade setup based on the rising wedge breakdown.

If the breakdown occurs, Silver could drop toward the $30.20 support zone. However, traders should wait for confirmation before entering to avoid fakeouts.

Would you like me to refine this further for a TradingView post? 🚀

Gold (XAU/USD) Double Top Pattern – High Probability Trade Setup📌 Overview of the Chart:

This 4-hour timeframe chart of Gold Spot (XAU/USD) highlights a Double Top pattern, one of the most reliable bearish reversal signals in technical analysis. The price has tested a strong resistance zone twice (Top 1 & Top 2) but failed to break above, suggesting that bullish momentum is weakening and a possible trend reversal is imminent.

This setup provides an excellent opportunity for a short (sell) trade, provided the price confirms the pattern by breaking below the neckline. The potential downside targets are marked as TP1 ($2,983) and TP2 ($2,938), with a stop loss placed above resistance ($3,056) to manage risk effectively.

📌 Key Chart Patterns & Market Dynamics

1️⃣ Double Top Pattern – The Bearish Reversal Signal

The Double Top pattern occurs when:

✅ The price reaches a resistance zone and gets rejected (Top 1).

✅ It then retraces downward to find support at the neckline.

✅ The price makes another attempt to push higher but fails at the same resistance level (Top 2).

✅ A break below the neckline confirms the bearish trend, as buyers lose strength and sellers take control.

🛑 Why is this pattern important?

The failure of buyers to push beyond resistance shows that sellers are dominating. This creates a psychological shift in the market, making traders and institutions more likely to sell aggressively once the neckline is broken.

2️⃣ Resistance Level – The Rejection Zone

🔵 Price Level: $3,050 – $3,056

🔵 Role: Key supply area where sellers are strong

🔵 Market Impact: Strong rejections at this level indicate that big players (institutions) are offloading positions, leading to bearish momentum.

Why Does This Matter?

📌 If the price breaks above this level, it would invalidate the bearish setup, leading to potential further upside.

📌 This is also why we place our Stop Loss above this level—to protect against unexpected bullish breakouts.

3️⃣ Neckline Support – The Breakout Zone

🔻 Price Level: Around $3,020

🔻 Role: The last line of defense for buyers before a bearish breakout

🔻 Market Impact: If this level is breached, it confirms the Double Top pattern, leading to a sharp decline.

📌 A confirmed break of the neckline is the ideal point for traders to enter a short (sell) position, targeting lower price levels.

4️⃣ Key Take Profit (TP) Targets – Where Price Might Drop

🎯 TP1 – $2,983:

This level is a minor support zone where price may temporarily pause before further decline.

Conservative traders may choose to secure profits here.

🎯 TP2 – $2,938:

A stronger historical support zone, making it a high-probability target for a full bearish move.

More aggressive traders may hold positions until this level.

📌 Why These Levels?

These targets align with Fibonacci retracement zones and previous market structure, increasing the likelihood of a reaction at these points.

5️⃣ Stop Loss – Managing Risk Like a Pro

Placement: Above the resistance zone at $3,056

Reason: If price breaks above resistance, it invalidates the bearish thesis, meaning we need to exit the trade.

Risk-Reward Ratio:

TP1: ~2:1

TP2: ~3.5:1

A good risk-reward setup, ensuring a profitable edge over multiple trades.

📌 Trading Strategy & Execution Plan

📉 Bearish (Sell) Setup:

1️⃣ Wait for confirmation – Price must break below the neckline ($3,020) before entering a short trade.

2️⃣ Sell Entry: On a confirmed break and retest of the neckline.

3️⃣ Stop Loss: Above the resistance zone ($3,056).

4️⃣ Take Profit Targets:

TP1 ($2,983) – First profit level.

TP2 ($2,938) – Secondary target for deeper decline.

📌 Optional Confirmation:

Look for bearish candlestick formations (e.g., Bearish Engulfing, Shooting Star, or Doji) near resistance or after a neckline breakout.

Monitor RSI/MACD for bearish divergence, confirming weakening momentum.

📌 Market Psychology Behind This Pattern

1️⃣ First Peak (Top 1): Buyers push the price up, but sellers step in at resistance and force a pullback.

2️⃣ Pullback to Neckline: Some buyers re-enter, believing the uptrend will continue.

3️⃣ Second Peak (Top 2): Price attempts another rally but fails at the same resistance, showing buyers' exhaustion.

4️⃣ Break of the Neckline: Sellers take full control, leading to a high-momentum sell-off.

📌 Key Takeaway:

💡 The Double Top is a trader’s favorite because it reflects a real psychological shift in market sentiment—from greed (buyers) to fear (sellers).

📌 Final Verdict – High Probability Trade Setup

✅ Double Top formation confirms a bearish trend reversal.

✅ Strong resistance & multiple rejections signal seller dominance.

✅ Clear risk management strategy (Stop Loss & TP Levels).

✅ Waiting for neckline break ensures a high-probability entry.

🚀 Watch this setup carefully! If the neckline breaks, GOLD could experience a sharp decline! 📉🔥

🔍 Pro Tips for Smart Traders

💡 Don’t rush into a trade! Wait for a solid break and retest of the neckline for confirmation.

💡 Monitor volume: A strong breakout should be accompanied by increasing volume for validation.

💡 Use confluence: Combine with other indicators (RSI, MACD, EMA) to increase accuracy.

🔥 What’s Your Take on This Setup? Will You Trade It? Let Me Know in the Comments! 🚀

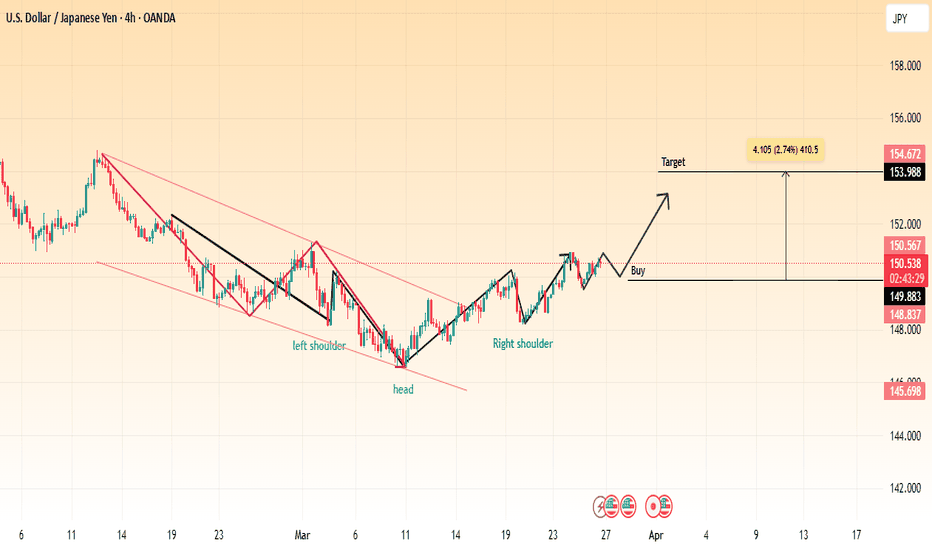

USD/JPY Bullish Reversal (Inverse Head & Shoulders)📌 Pattern: Inverse Head & Shoulders

📌 Analysis: The chart showcases an inverse head and shoulders pattern, a classic bullish reversal formation. The price has successfully broken out of the downward trendline, indicating potential upside movement.

🔹 Left Shoulder: Formed during the previous retracement.

🔹 Head: The lowest point of the pattern, marking strong support.

🔹 Right Shoulder: Completed with a breakout above resistance.

📈 Trading Plan:

✅ Entry (Buy): After a confirmed breakout and possible retest.

🎯 Target: 153.988 - 154.672 (2.74% potential gain).

🔻 Support: 149.883 - 148.837 (Stops should be placed accordingly).

📊 Conclusion:

If the price maintains above the breakout level, we may see a strong rally toward the resistance target. Watch for volume confirmation and pullback retests before entering a trade.

EUR/GBP Chart Analysis – Double Bottom Reversal & Breakout Setup1. Market Structure & Context

The EUR/GBP daily chart presents a well-defined double bottom reversal pattern, indicating a potential trend shift from a prolonged downtrend to an uptrend.

The pair has been in a bearish phase, as reflected by the descending trendline.

However, price action suggests a possible trend reversal, as buyers are stepping in near a key demand zone.

A successful neckline breakout would confirm the bullish reversal, potentially leading to significant upside movement.

2. Key Chart Patterns & Technical Levels

A. Double Bottom Formation (Bullish Reversal Pattern)

The double bottom is a powerful reversal pattern, often signaling the end of a downtrend. It consists of two similar low points, forming a "W" shape.

Bottom 1: The first low was established around 0.8200 - 0.8250, where buyers initially stepped in to push prices higher.

Bottom 2: Price retested this demand zone, but sellers failed to push it lower, confirming a strong support level.

Bullish Significance: The inability of sellers to break below the support zone suggests the exhaustion of selling pressure and increasing buy-side interest.

B. Neckline Resistance & Potential Breakout Zone

The neckline resistance is drawn around 0.8450 - 0.8500, a key level where previous price rallies were rejected.

A breakout above this zone, ideally with strong bullish volume, would validate the double bottom pattern and trigger a bullish breakout trade.

C. Descending Trendline Breakout Attempt

The long-term downtrend resistance (trendline) has been holding since mid-2024.

Price is currently testing this trendline; a clear breakout and retest would add further confidence to the bullish bias.

3. Trade Setup & Execution Plan

A. Entry Strategy

There are two possible entry strategies, depending on risk appetite:

Aggressive Entry: Buy immediately upon a breakout above 0.8500, anticipating a strong rally.

Conservative Entry: Wait for a breakout + retest of the neckline before entering, ensuring confirmation.

B. Stop Loss & Risk Management

Stop Loss (SL): Placed below the recent swing low at 0.82029.

This level acts as the last line of defense for bulls; if price drops below it, the bullish thesis is invalidated.

C. Take Profit (TP) Targets

TP1: 0.86122 (first resistance zone, a previous swing high).

TP2: 0.87284 (higher resistance level, next supply zone).

These levels serve as potential profit-taking areas where sellers may re-enter the market.

4. Additional Technical Confluences Supporting Bullish Bias

✔ Key Support Zone Holding Strong – The price has bounced twice from the demand zone (0.8200 - 0.8250), confirming strong buyer interest.

✔ Volume Confirmation Needed – A breakout with high volume increases the probability of sustained bullish momentum.

✔ RSI & Momentum Indicators – If RSI crosses above 50, it would further confirm bullish momentum, supporting the breakout trade.

✔ Favorable Risk-to-Reward Ratio (RRR) – A well-defined stop loss & take profit strategy ensures an optimal trade setup.

5. Summary & Final Trading Plan

Current Market Bias: Bullish if neckline breaks (Double Bottom Confirmation).

Entry Confirmation: Look for a breakout above 0.8500 with strong volume.

Profit Targets:

TP1: 0.8612

TP2: 0.8728

Stop-Loss Level: Below 0.8202 to protect against fake breakouts.

🚀 Final Tip for Traders:

Monitor price action & volume closely. A breakout without volume may lead to a false move. Confirmation with bullish momentum is essential for a high-probability trade setup.

EUR/USD Triple Bottom Reversal | Bullish Breakout SetupChart Overview

This is a EUR/USD 1-hour chart showing a classic Triple Bottom Reversal Pattern, a strong bullish reversal signal. The price has tested a key support level multiple times, forming three distinct bottoms, indicating that sellers are losing momentum while buyers are stepping in.

This setup suggests an upcoming breakout, with well-defined entry, take profit, and stop-loss levels to capitalize on the potential upward move.

Technical Breakdown

1. Support & Resistance Zones

Support Zone (Highlighted in Beige)

The price has tested this zone multiple times without breaking below, confirming strong buying interest.

Each time the price touched this level, it rebounded, indicating accumulation by buyers.

Resistance Zone (Highlighted in Beige)

The price previously reversed from this level, making it a key area to watch for a breakout.

A confirmed breakout above this resistance could trigger strong upward momentum.

2. Triple Bottom Formation

A Triple Bottom is a strong bullish reversal pattern. It consists of:

Bottom 1: First rejection from support.

Bottom 2: A retest of support with buyers defending the level.

Bottom 3: The final touch before an upward move, confirming the pattern.

This pattern signals that selling pressure is diminishing and buyers are preparing for a strong breakout.

3. Bullish Reversal & Breakout Zone

A breakout above the neckline resistance (around 1.0843) will confirm the pattern.

Traders should wait for a confirmed candle close above the resistance before entering a long position.

A retest of the breakout zone can provide an additional entry opportunity.

Trade Setup & Key Levels

🔹 Entry Strategy

Aggressive Entry: Enter at the breakout level (above 1.0843) with volume confirmation.

Conservative Entry: Wait for a breakout retest before entering long.

🎯 Take Profit Targets

TP1: 1.08868 (First resistance zone)

TP2: 1.09642 (Major resistance zone, strong price reaction expected)

❌ Stop Loss Placement

Stop Loss: Below 1.06786, under the support zone.

This ensures that if the price breaks below the key level, the trade is invalidated.

Market Sentiment & Expected Move

If the price breaks the resistance → Expect a strong bullish move toward TP1 and TP2.

If the price fails to break out → It may consolidate further or retest support.

Watch for increased volume on the breakout to confirm strength.

📌 Final Thoughts

This is a high-probability bullish setup based on a well-formed Triple Bottom Reversal pattern. Traders should monitor price action near the breakout zone and manage risk effectively with proper stop-loss placement.

Silver (XAG/USD) – Rising Wedge Breakdown & Retest📌 Overview of the Chart

The chart illustrates a classic Rising Wedge pattern that has broken down, signaling a potential bearish continuation. The price action respected technical structures, including support and resistance levels, trendlines, and key psychological zones.

The breakdown of the rising wedge led to a sharp decline, followed by a retest of the previous support as resistance, confirming further downside momentum. Traders analyzing this setup can identify clear entry points, stop-loss placements, and target objectives based on price action behavior.

🔹 1️⃣ Understanding the Rising Wedge Pattern

A Rising Wedge is a bearish pattern that forms when price moves upward within converging trendlines. It indicates that buying momentum is slowing, and a potential reversal or breakdown is imminent.

✔ Characteristics of the Rising Wedge on This Chart:

📈 Higher Highs and Higher Lows: The price was trending upwards, but the narrowing structure indicated exhaustion.

📊 Decreasing Momentum: Volume likely started declining as the price approached resistance.

📉 Bearish Breakdown: Price broke below the lower trendline, confirming the pattern’s bearish nature.

🔻 What Happened Next?

The price dropped sharply after the wedge breakdown.

A retest of the broken trendline acted as a confirmation of resistance.

The downtrend continued, targeting a lower support level.

🔹 2️⃣ Key Support & Resistance Levels

🔵 Major Resistance – 34.27 USD (All-Time High & Supply Zone)

This level served as a strong supply zone, rejecting multiple bullish attempts.

Price struggled to break this level, leading to a sell-off.

The stop-loss for short trades is placed above this zone to minimize risk.

🟠 Support Level – 32.80 USD (Previous Support Turned Resistance)

This was a key support zone before the wedge breakdown.

Once broken, price retested this level and faced rejection, confirming a trend shift.

⚫ Trendline Support (Now Broken)

The lower support trendline was a crucial guide for bulls.

Once price broke below, it signaled strong bearish control.

A retest of the trendline was unsuccessful, confirming a bearish continuation.

🟢 Target Zone – 31.93 USD (Projected Breakdown Target)

The measured move target of the rising wedge aligns around 31.93 USD.

If selling pressure continues, price may reach this level.

🔹 3️⃣ Trading Strategy – Short Setup & Execution

This setup provides a high-probability short trade based on the pattern breakdown.

📉 Short (Sell) Entry Criteria:

✅ Entry Zone: After the price broke below the wedge and retested the trendline (~33.80 USD).

✅ Confirmation:

Bearish candlestick formations (Doji, Engulfing, or Pin Bars).

Increased volume on bearish moves.

🚫 Stop-Loss Placement:

🔹 Above the resistance level (34.27 USD) – If price breaks above this, the setup is invalid.

🔹 Reasoning: Protects against unexpected bullish reversals.

🎯 Take-Profit Target:

🔻 Target Price: 31.93 USD (based on measured move projection).

🔻 Risk-Reward Ratio: At least 2:1 (adjusted based on volatility).

🔹 4️⃣ Market Psychology & Price Action Analysis

Understanding trader sentiment is crucial:

📌 Before the Breakdown:

Bulls were in control, pushing price higher.

However, momentum slowed down, forming the rising wedge.

Traders who identified this pattern anticipated a potential trend reversal.

📌 After the Breakdown:

Sellers overpowered buyers, causing a rapid break of structure.

The price retested the previous support as resistance, confirming further downside.

The market sentiment shifted to bearish, aligning with technical confirmations.

🔹 5️⃣ Alternative Scenarios & Risk Factors

🔄 Bullish Reversal (Invalidation of Bearish Bias)

🚨 If price reclaims 34.00-34.27 USD, it invalidates the bearish setup.

📌 A break above this level could trigger a new bullish wave, targeting higher highs.

⚠️ Key Risk Factors:

Unexpected macroeconomic events (e.g., Fed policy, inflation data, geopolitical tensions).

Strong bullish rejection at lower support zones (~32.00 USD).

Volume divergence (if selling volume dries up, bears may lose control).

📢 Conclusion: High-Probability Bearish Trade with Clear Risk Management

This rising wedge breakdown provides a strong short setup, with technical confirmations and price structure supporting further downside movement.

📉 Bearish Bias Until 31.93 USD

A breakdown retest suggests sellers remain in control.

Price is expected to continue lower unless bulls regain 34.00+ levels.

🔍 Key Trading Question:

Will Silver (XAG/USD) continue to its measured target of 31.93 USD, or will bulls defend key support and push prices higher?

Let’s discuss! 🚀👇

EUR/GBP (1H) Symmetrical Triangle Breakdown – Trade SetupThe EUR/GBP 1-hour chart presents a symmetrical triangle formation that has now broken to the downside, signaling a bearish continuation. This pattern is widely recognized in technical analysis and often acts as a continuation or reversal pattern, depending on the breakout direction. In this case, the price has breached the lower support boundary, indicating that sellers have taken control of the market.

In this detailed analysis, we will explore the chart structure, key technical levels, potential trade setups, and risk management strategies to navigate this move efficiently.

1️⃣ Understanding the Symmetrical Triangle Formation

A symmetrical triangle occurs when price action creates lower highs and higher lows, forming two converging trendlines. This reflects a period of market indecision, where buyers and sellers are evenly matched until a breakout occurs.

📌 Key characteristics of this triangle:

✅ Converging Trendlines – Representing lower highs and higher lows, suggesting market compression.

✅ Price Consolidation – The pair traded within this structure, awaiting a catalyst for breakout.

✅ Breakout Direction – A breakdown from the support level confirms a bearish move.

Pattern Psychology:

A symmetrical triangle often precedes a significant price move. Traders and investors monitor the breakout direction to determine the next trend. Here, the breakdown below the lower boundary signals a continuation of the prevailing bearish trend.

2️⃣ Key Levels & Chart Structure

🔹 Resistance Zone (Upper Boundary) – 0.84227

The upper trendline acted as a strong resistance level, preventing price from breaking higher multiple times.

The yellow-highlighted area represents a supply zone, where selling pressure was dominant.

Price attempted to break above this region but failed, confirming bearish dominance.

🔹 Support Level (Lower Boundary) – 0.83500

The lower boundary of the triangle previously held as support, where buyers attempted to push the price higher.

However, once price broke below this support, it confirmed a bearish trend continuation.

The blue horizontal support line represents a potential retest area, where sellers may step in again.

🔹 Breakout Confirmation & Price Action

The chart clearly shows a bearish breakout, as price broke through the lower trendline.

Retest Probability: Many breakouts experience a pullback to the broken support (now resistance) before resuming the downtrend.

The dashed black lines illustrate the expected bearish move, with a potential decline towards 0.82815.

3️⃣ Trading Plan & Entry Strategy

Based on this setup, traders can capitalize on the bearish move using a structured trading plan:

📌 Bearish Trading Setup (Short Position)

✔ Entry Strategy:

Traders can enter a short position either immediately after the breakout or after a retest of the broken support at 0.83500 - 0.83700.

The ideal confirmation would be bearish candlestick patterns, such as an engulfing candle or pin bar rejection on the retest.

✔ Stop-Loss Placement:

To mitigate risk, a stop-loss should be placed above the previous resistance level (0.84227).

This ensures protection against fake breakouts or sudden reversals.

✔ Target Price (Take Profit Level):

The measured move of a symmetrical triangle breakout is typically equal to the height of the triangle.

Based on this projection, the expected target is around 0.82815, a significant support level.

Traders may also scale out at intermediate levels (0.83000) to lock in profits.

✔ Risk-Reward Ratio (RRR):

A well-structured trade here presents an attractive RRR of approximately 1:3, meaning the potential reward is three times the risk.

A higher RRR enhances the probability of profitability over multiple trades.

4️⃣ Market Context & Fundamental Analysis

🔍 Why Is EUR/GBP Dropping?

While technical patterns are valuable, traders must also consider fundamental factors that drive currency pairs.

🟢 Possible Bearish Catalysts for EUR/GBP:

GBP Strength: If the British Pound (GBP) strengthens due to strong economic data or hawkish Bank of England (BoE) policy, EUR/GBP may continue declining.

EUR Weakness: The Euro (EUR) may be under pressure due to weak GDP growth, higher inflation, or dovish European Central Bank (ECB) statements.

Geopolitical Events: Any negative news impacting the Eurozone (e.g., political instability) could trigger further selling pressure on EUR/GBP.

5️⃣ Risk Management & Alternative Scenarios

While the current outlook favors a bearish move, traders must remain prepared for alternative scenarios.

⚠ Alternative Scenarios: 📌 False Breakdown:

If price closes back above the support level (0.83500 - 0.83700), it could indicate a failed breakout, potentially leading to a bullish reversal.

In this case, a breakout above 0.84227 would invalidate the bearish setup.

📌 Sideways Consolidation:

If the price stalls around 0.83300 - 0.83500, the market may range before the next move.

Traders should wait for clear confirmation before entering new trades.

6️⃣ Summary & Key Takeaways

✅ Pattern Identified: Symmetrical Triangle Breakout (Bearish).

✅ Breakout Direction: Price has broken below support, confirming a downtrend.

✅ Trade Setup:

Sell below 0.83500 (or on retest at 0.83700).

Stop Loss: Above 0.84227 (previous resistance).

Take Profit: Targeting 0.82815 based on the pattern’s measured move.

✅ Risk-Reward: Favorable, offering 1:3 or higher RRR.

✅ Fundamental Drivers: GBP strength or EUR weakness could accelerate the downtrend.

📢 Final Thoughts

This symmetrical triangle breakdown offers a high-probability trading opportunity for short sellers, with a clear technical structure supporting the bearish move. However, traders should remain cautious of false breakouts and adjust stop-loss levels accordingly.

For best results:

✔ Wait for price action confirmation (retest rejection or bearish candle formations).

✔ Follow proper risk management (stop-loss placement and profit-taking levels).

✔ Monitor key economic events impacting EUR and GBP movements.

By combining technical analysis, fundamental insights, and sound risk management, traders can enhance their profitability and navigate the markets with confidence. 🚀📉

EUR/JPY – Double Bottom Breakout & Trendline Retest, Trade Setup📊 Chart Type: 1-Hour (H1)

💹 Asset: EUR/JPY

📈 Technical Patterns: Double Bottom, Trendline Breakout, Retest

📌 Overview of the Chart

The EUR/JPY chart showcases a bullish reversal setup, characterized by a Double Bottom pattern, a trendline breakout, and a successful retest. This combination suggests a potential continuation towards higher price levels, making it an ideal setup for traders looking for breakout entries.

The price action initially followed a downtrend, but buyers stepped in at key support zones, leading to the formation of a strong reversal pattern. Now, the price is testing a key resistance level, and if it breaks out, we could see a significant upward move.

🟢 Key Technical Analysis Breakdown

1️⃣ Double Bottom Formation – A Bullish Reversal Signal

🔹 The Double Bottom is a classic reversal pattern that forms after an extended downtrend.

🔹 In this case, price found strong support at 160.139, forming two lows (Bottom 1 & Bottom 2), indicating buyer dominance.

🔹 The confirmation of the pattern comes with a break above the neckline at around 162.000, suggesting a shift from bearish to bullish momentum.

2️⃣ Trendline Breakout & Retest

🔹 A descending trendline had been acting as dynamic resistance, pushing prices lower.

🔹 Recently, the price broke above the trendline, signaling a potential trend shift.

🔹 Now, price is retesting the trendline, which is a key factor in confirming whether the breakout is valid.

🔹 If the retest holds, it could trigger a strong bullish move towards the next resistance zone.

📍 Support & Resistance Zones

🔹 Support Level (160.139):

The lowest point in the chart, where price tested twice and formed the Double Bottom.

Buyers stepped in aggressively at this level, preventing further decline.

Stop Loss Placement: Below this support zone for long trades.

🔹 Resistance Zone (163.725 - Target Level):

The previous swing high and a major supply zone.

A breakout above this area could lead to further bullish momentum.

📈 Trading Strategy – How to Trade This Setup?

✅ Bullish Trade Setup (Breakout & Retest Confirmation)

This setup is ideal for traders looking to capitalize on breakout and retest strategies.

📌 Entry:

Wait for a strong bullish candle to confirm the retest of the trendline.

A break above the 162.500 level could be a good entry confirmation.

📌 Target:

First target: 163.725 (Resistance Zone).

If momentum continues, the next upside target could be around 164.500.

📌 Stop Loss:

Below 160.139 (previous support level) to minimize risk.

Alternatively, place it below the trendline retest zone if entering aggressively.

📌 Risk-to-Reward Ratio (RRR):

This trade offers a strong RRR, as the downside risk is limited, while the upside potential is higher.

🔴 Bearish Scenario – What if the Retest Fails?

While the bias is bullish, traders must be prepared for a fake breakout scenario. If price fails to hold above the trendline and neckline, the structure might break down.

📌 Bearish Entry:

If price rejects the retest zone and closes back below 161.500, it could indicate a false breakout.

📌 Target:

160.139 (Support Level).

📌 Stop Loss:

Above the trendline retest zone to protect against unexpected bullish moves.

🔎 Key Takeaways & Final Thoughts

✅ The Double Bottom pattern signals a potential trend reversal.

✅ The trendline breakout & retest adds further confirmation to the bullish bias.

✅ A breakout above 162.500 could accelerate buying pressure toward 163.725.

✅ Risk management is essential: A well-placed stop loss below the support level ensures minimal downside risk.

✅ If price rejects the retest zone, traders should be prepared for a possible bearish reversal.

📌 Overall Bias: Bullish ✅

📌 Trade Confirmation: Needs trendline retest hold + bullish breakout 📈

📌 Key Level to Watch: 162.500 (Breakout Confirmation Zone) 🔥

💡 Pro Tip : Always wait for confirmation before entering a trade. A strong bullish candlestick pattern (e.g., engulfing candle) on the H1 or H4 timeframe could provide extra confidence in the setup! 🚀

EUR/GBP Chart Analysis – Inverse Head & Shoulders Bullish SetupThis EUR/GBP 1-hour chart showcases a classic Inverse Head & Shoulders (H&S) pattern, signaling a potential trend reversal from bearish to bullish. This pattern is considered one of the most reliable technical formations for spotting upcoming upward momentum, particularly after a prolonged downtrend.

🔎 Market Overview

Currency Pair: EUR/GBP

Timeframe: 1-Hour (H1)

Current Price: 0.83720

Trend: Transitioning from a downtrend to a potential bullish breakout

Key Pattern: Inverse Head & Shoulders

Trading Bias: Bullish (Pending breakout confirmation)

📊 Chart Breakdown & Technical Analysis

1️⃣ Market Structure & Trend Analysis

Before the formation of the Inverse Head & Shoulders, the market was in a strong downtrend, making lower highs and lower lows. However, buyers started stepping in near the 0.8350 level, preventing further decline. This rejection at key support has set the stage for a potential trend reversal.

Left Shoulder: Price formed a minor low around 0.8370, followed by a small bounce.

Head: Price made a deeper low around 0.8351, confirming strong support and buyer interest.

Right Shoulder: Price attempted another dip but failed to break below the previous low, forming a higher low near 0.8370, signaling increasing bullish pressure.

Neckline Resistance: 0.8385 - 0.8390 zone – a crucial level that price needs to break for confirmation of an uptrend.

2️⃣ Key Support & Resistance Levels

Support Level: 0.83513 (Major demand zone)

Resistance Levels:

Neckline: 0.8385 - 0.8390 (Breakout confirmation zone)

Major Resistance: 0.84308 (Target level)

Curve Zone: A dynamic resistance trendline that has been containing price action. A breakout above this curve signals a potential shift in trend.

📈 Trading Strategy – Bullish Breakout Plan

✅ Entry Strategy:

A long trade should be considered only after a confirmed breakout above the neckline (0.8385 - 0.8390). The confirmation comes when:

A strong bullish candle closes above the neckline.

Increased trading volume supports the breakout.

A possible retest of the neckline as new support (0.8385) before continuation.

🎯 Target Price & Stop Loss:

Take Profit (TP): 0.84308 (Projected move based on pattern size).

Stop Loss (SL): Below 0.83513 (Right Shoulder low).

Risk-to-Reward Ratio (RRR): 1:2 or higher, making this a high-probability trade setup.

🛑 Risk Management & Trade Confirmation:

Volume Confirmation: A breakout should be accompanied by a volume spike, confirming strong buyer interest.

Fakeout Warning: If price briefly breaks above the neckline but then falls back below, it could be a false breakout. In this case, waiting for a retest would be a safer approach.

Trailing Stop: Once price moves toward 0.8410, a trailing stop can help secure profits in case of market reversals.

🧐 Summary – Key Takeaways

✅ Inverse Head & Shoulders Identified – A reliable bullish reversal pattern.

✅ Breakout Zone: 0.8385 - 0.8390 (Watch for confirmation).

✅ Target Price: 0.84308 (Potential profit zone).

✅ Stop Loss: Below 0.83513 (Protect against downside risk).

✅ Risk-to-Reward Ratio: Favorable (1:2 or better).

✅ Trading Plan: Buy above the neckline, aim for 0.8430, and manage risk properly.

📌 Final Thought: If the neckline is broken with strong momentum, expect a bullish move toward 0.8430+. However, traders should remain cautious of potential fakeouts and manage risk accordingly.

📢 Share your thoughts in the comments! Are you bullish on EUR/GBP? 🚀📊

#EURGBP #ForexTrading #TechnicalAnalysis #TradingSetup #InverseHeadAndShoulders

EUR/USD Falling Wedge Breakout – Professional Chart AnalysisOverview of the Chart

The EUR/USD 1-hour chart presents a bullish trading setup, featuring a well-defined falling wedge pattern, a trendline breakout, and a retest phase, signaling a potential upward move. The chart is marked with key technical elements such as support and resistance zones, breakout confirmation, and risk management parameters.

This analysis will break down each component of the chart, explaining the logic behind the setup and how traders can approach this opportunity.

1. Identified Chart Patterns

Falling Wedge Formation (Bullish Reversal Signal)

The price action formed a falling wedge, characterized by lower highs and lower lows, creating a narrowing price channel.

This pattern is typically a bullish reversal structure, as it indicates weakening selling pressure before an expected breakout.

The wedge’s downward movement ended with a strong breakout to the upside, signaling buyers regaining control.

2. Key Technical Levels

Support & Resistance Zones

Support Level (Buyers’ Stronghold)

The horizontal support level is a price area where buyers have previously stepped in, preventing further declines.

This level has been tested multiple times, reinforcing its strength as a key demand zone.

Resistance Zone (Profit Target Area)

The highlighted resistance zone represents a supply area where the price has struggled to move past in previous sessions.

The target price level aligns with this resistance, making it a realistic profit target for the long position.

3. Trendline Breakout Confirmation

Before forming the wedge, the chart shows an uptrend with a breakout above a trendline.

This trendline breakout was an early signal of bullish strength, aligning with the later wedge breakout.

After the breakout, the price came back for a retest, which is a key confirmation before further upward movement.

4. Retesting Phase Before the Upward Move

After breaking out of the wedge, the price returned to the breakout level to confirm support.

Retesting is a crucial validation step—if the price holds above this level, it increases the probability of a continued bullish move.

This retesting action provides a potential entry point for traders looking to go long.

5. Trade Setup & Risk Management Strategy

Trade Entry:

A buy entry is considered after the retest is confirmed (price holding above the breakout level).

Stop Loss Placement (Risk Control):

The stop loss is placed below the previous low at 1.07790, ensuring protection against fake breakouts or unexpected reversals.

Take Profit Target (Projected Price Move):

The target price is set at 1.09698, which aligns with previous resistance levels and the measured move from the wedge breakout.

This provides a strong risk-to-reward ratio, making the setup favorable for bullish traders.

6. Risk-Reward Ratio & Trade Viability

Risk: The distance between the entry point and the stop loss is relatively small, making it a low-risk trade.

Reward: The potential upside move is significantly higher than the risk, creating a high reward-to-risk ratio trade.

This type of technical confluence increases the probability of a successful trade, making it an attractive opportunity.

7. Conclusion & Trading Strategy

📌 Key Takeaways:

✅ The falling wedge breakout signals a bullish reversal.

✅ The trendline breakout and retest add further confirmation to the trade setup.

✅ The support and resistance zones provide a clear risk management strategy.

✅ The risk-reward ratio makes this an attractive long trade setup.

💡 Trading Plan:

🔹 Enter Long after retest confirmation above the breakout level.

🔹 Stop Loss: 1.07790 (below previous low).

🔹 Take Profit: 1.09698 (previous resistance zone).

Final Thoughts

This EUR/USD setup is a textbook example of a bullish reversal following a falling wedge breakout. Traders who patiently wait for a confirmed retest can capitalize on this high-probability trade setup, aiming for a strong bullish continuation.

🔹 Tags: #EURUSD #ForexTrading #TechnicalAnalysis #Breakout #PriceAction #TradingSetup #SupportResistance

Trading Setup for CHF/USD – Triple Bottom Breakout Strategy📌 Chart Pattern: Triple Bottom with Trendline Breakout

This CHF/USD chart showcases a triple bottom formation, a bullish reversal pattern that signals a potential uptrend after three consecutive lows at a strong support level. The price action respects this support zone and attempts a trendline breakout, suggesting a shift in momentum from bearish to bullish.

📊 Full Chart Breakdown & Professional Analysis

1️⃣ Key Levels & Structure:

✅ Support Level (1.1300 - 1.1270):

The price has tested this region three times, indicating strong buying interest.

This forms a triple bottom, a reliable reversal pattern in technical analysis.

✅ Resistance Zone (1.1400 - 1.1420):

The price previously reversed from this zone, making it a key short-term resistance level.

✅ Target Level (1.1457):

A breakout above resistance could drive the price toward this measured move target, representing a 1% potential gain.

✅ Stop Loss (1.1269):

Placed below the support zone to minimize risk in case of a breakdown.

2️⃣ Price Action & Trendline Breakout:

📌 Triple Bottom Formation:

Price hits the same support level three times, signaling strong demand.

Each bounce from support indicates a gradual weakening of bearish momentum.

📌 Trendline Breakout:

The price broke a downward-sloping trendline, suggesting a potential bullish move.

A successful retest of the trendline could confirm further upside.

📌 Expected Move:

Scenario 1: Price confirms the breakout, retests, and moves toward resistance.

Scenario 2: If resistance is broken, price targets the next major level at 1.1457.

3️⃣ Trading Strategy – How to Trade This Setup?

🎯 Buy Entry:

Enter long after a confirmed breakout and retest of the trendline.

📉 Stop Loss:

Below 1.1269 (beneath triple bottom support) to limit downside risk.

🎯 Take Profit Targets:

Target 1: 1.1400 (Resistance Area)

Target 2: 1.1457 (Measured Move Projection)

💡 Risk-Reward Ratio:

Favorable risk-reward ratio of 1:3, making it an attractive setup for traders.

4️⃣ Market Psychology Behind This Move:

Bears losing strength: Multiple failed attempts to break support indicate sellers are exhausted.

Bulls gaining momentum: Trendline breakout shows buyers are stepping in with confidence.

Breakout confirmation: If resistance breaks, a strong rally toward 1.1457 is likely.

📌 Summary: Bullish CHF/USD Trade Idea

🔹 Pattern: Triple Bottom + Trendline Breakout

🔹 Entry: Buy on retest confirmation

🔹 Stop Loss: 1.1269

🔹 Target: 1.1400 & 1.1457

🔹 Risk-Reward: Favorable 1:3 setup

🚀 This is a high-probability trade setup with strong technical confirmation, making it a great opportunity for breakout traders! 🚀

JPY/USD Head & Shoulders Breakdown – Full Professional Analysis1. Introduction to the Chart Pattern

The JPY/USD chart on the 1-hour (H1) timeframe displays a well-defined Head & Shoulders (H&S) pattern, which is a well-known bearish reversal pattern in technical analysis. This pattern signals the potential end of the previous uptrend and the beginning of a downward move.

A Head & Shoulders pattern consists of three main components:

Left Shoulder: The price rallies to a peak, then retraces.

Head: The price rises higher than the left shoulder, marking the highest point before declining.

Right Shoulder: A lower peak compared to the head, indicating weakening bullish strength.

Neckline: The horizontal support level that, once broken, confirms the bearish trend.

2. Key Levels & Market Structure

🔹 Resistance Level (Supply Zone)

The blue box at the top represents the resistance area, where price action was repeatedly rejected.

This indicates strong selling pressure at this level, preventing further bullish momentum.

🔹 Support Level (Neckline)

The horizontal blue line acts as the support level or neckline of the H&S pattern.

Price has tested this area multiple times, confirming it as a crucial level for trend continuation or reversal.

🔹 Trend Line (Dynamic Support)

The black dashed trend line represents the previous uptrend, which provided support before being violated.

The break of this trend line suggests a weakening bullish structure and increased chances of a bearish move.

3. Breakdown of the Head & Shoulders Pattern

Initial Uptrend:

The market was in a strong uptrend before forming the Head & Shoulders pattern.

Buyers pushed the price higher, making higher highs and higher lows.

Formation of Left Shoulder:

Price reached a peak and then retraced, forming the left shoulder as sellers entered the market.

Formation of the Head:

A strong rally followed, breaking the left shoulder’s peak and reaching a new high, forming the head.

However, buyers started losing momentum, leading to another retracement.

Formation of Right Shoulder:

The price made another attempt to move upward but failed to surpass the head’s high, forming the right shoulder.

This signaled a reduction in bullish strength and potential trend exhaustion.

Neckline Breakdown (Bearish Confirmation):

The price dropped below the neckline (support level), confirming a bearish reversal.

This is the official entry signal for traders looking for a short setup.

4. Expected Market Behavior & Trading Setup

📉 Bearish Confirmation Steps:

Neckline Retest: The price might retest the broken neckline before continuing downward.

Bearish Candlestick Patterns: Look for rejection signals like bearish engulfing or shooting star formations.

Volume Increase on Breakdown: Strong selling pressure confirms the trend continuation.

🎯 Potential Take Profit Levels:

1️⃣ Target 1 (TP1): 0.006492 – This is a short-term support level, where the price might pause before further decline.

2️⃣ Target 2 (TP2): 0.006430 – A stronger support zone, where sellers may take profits.

🚨 Stop Loss Placement:

A stop-loss should be placed above the right shoulder to protect against false breakouts.

This ensures a favorable risk-to-reward ratio.

5. Risk Management & Market Conditions

✅ Entry Strategy: Wait for a retest of the neckline for a higher probability short trade.

✅ Risk-to-Reward Ratio: Ideally, aim for 1:2 or 1:3 to ensure profitability.

✅ Market Catalysts: Be cautious of fundamental news events, as they can cause unexpected volatility.

6. Conclusion: Bearish Outlook for JPY/USD

🔸 The Head & Shoulders pattern breakdown suggests a strong bearish trend reversal.

🔸 If the neckline holds as resistance, a short trade offers a high-probability setup.

🔸 Price may reach TP1 first, then potentially extend to TP2 if selling pressure persists.

📢 Final Verdict: Bearish trend confirmed; watch for short opportunities on retest.

📊 TradingView Tags:

#JPYUSD #HeadAndShoulders #ForexTrading #TechnicalAnalysis #BearishBreakout #ShortTrade

XAU/USD – Triple Top Formation & Bearish Breakdown Potential📌 Overview of the Chart

This chart presents the XAU/USD (Gold Spot vs. USD) price action on a 15-minute timeframe, highlighting a classic Triple Top pattern. The Triple Top is a well-known bearish reversal pattern that forms after an extended uptrend. It signals that buyers have attempted to push the price higher multiple times but failed, indicating weakening bullish momentum.

This pattern is crucial for traders as it often precedes a trend reversal. The breakdown below the neckline (support level) confirms that selling pressure is taking over, leading to a potential decline.

📊 Identifying the Triple Top Formation

A Triple Top pattern consists of three peaks (Top 1, Top 2, and Top 3) at nearly the same resistance level. Here’s a detailed breakdown of its formation:

🔹 Step 1: Price Uptrend Leading to Resistance

Before the pattern develops, the price follows a strong uptrend with buyers dominating.

The price reaches a key resistance level and faces rejection (Top 1), signaling initial weakness.

🔹 Step 2: Repeated Attempts to Break Resistance

After pulling back slightly, buyers make another attempt to break through resistance (Top 2), but fail again.

This signals that sellers are actively defending this price zone.

🔹 Step 3: Final Rejection & Breakdown Setup

The third attempt (Top 3) fails to break resistance once more.

This repeated rejection confirms a Triple Top formation.

The price then moves toward the neckline (support level), which is a critical area for the bearish breakdown.

📉 Trading Setup & Execution Strategy

✅ Entry Point – When to Open a Short Position?

A short position is confirmed when the price breaks below the neckline with a strong bearish candlestick.

A breakdown with high volume strengthens the bearish confirmation.

Conservative traders may wait for a retest of the broken neckline before entering.

❌ Stop Loss Placement – Managing Risk

The stop loss should be placed above the highest peak ($3,039.076), ensuring protection against false breakouts.

If the price moves above this level, the Triple Top pattern fails, and the bearish setup is invalidated.

🎯 Profit Targets – Where to Exit?

After the breakdown, price action usually follows a measured move based on the height of the pattern. The following target levels are identified:

1️⃣ First Target: $3,000.962 → A key support level where price may pause.

2️⃣ Second Target: $2,991.766 → A deeper support area that aligns with the price projection from the pattern.

Risk-Reward Ratio: The trade setup offers a favorable risk-to-reward ratio, making it an attractive opportunity for short sellers.

📈 Confirmation Signals to Strengthen the Setup

To increase the probability of a successful trade, look for additional confirmations:

🔸 Volume Analysis:

A spike in selling volume at the neckline breakdown suggests strong bearish conviction.

Low volume breakdowns may indicate a false move, requiring extra caution.

🔸 Retest of the Neckline:

Sometimes, after breaking below the neckline, the price retests the level before continuing downward.

This provides a secondary entry opportunity for traders who missed the initial breakdown.

🔸 RSI & Momentum Indicators:

If RSI (Relative Strength Index) shows bearish divergence, it adds confidence to the downside move.

Momentum indicators like MACD crossing bearish further confirm selling pressure.

📍 Key Considerations & Risk Management

🔹 False Breakout Risk: If price bounces back above the neckline after the breakdown, it could be a false move. Waiting for confirmation reduces this risk.

🔹 Macro Fundamentals: Gold prices are sensitive to economic news, interest rates, and geopolitical events. Unexpected fundamental shifts can impact the pattern’s reliability.

🔹 Trailing Stop Strategy: To protect profits, traders can use a trailing stop-loss, adjusting as the price moves toward targets.

🔍 Summary & Trading Plan

📊 Pattern: Triple Top (Bearish Reversal)

📉 Bias: Bearish (Short Setup)

🛠️ Entry: Sell below neckline confirmation

🎯 Targets:

Target 1: $3,000.96

Target 2: $2,991.76

🚨 Stop Loss: Above $3,039

💡 Final Thoughts

The Triple Top pattern on XAU/USD suggests a high-probability bearish setup. A confirmed neckline breakdown signals selling pressure, with price targets well-aligned with historical support zones. Patience and confirmation are key—watch for a clean breakdown or a potential retest before entering.

Would you like any modifications or additional insights? 🚀

EUR/JPY Chart Analysis - Falling Wedge Target with Bullish SetupThis EUR/JPY 1-hour chart reveals a well-defined falling wedge pattern, which is a bullish reversal formation. Additionally, we see key support and resistance levels, a double bottom, and a breakout potential that traders can use to plan an entry. Let’s dissect this chart in a professional and detailed manner to understand the trade setup and market psychology.

🔹 Market Trend & Structure Analysis

The market was previously in an uptrend, making higher highs and higher lows, until it faced strong resistance at the 163.500 level. Upon reaching this zone, the price reversed downward, forming a series of lower highs and lower lows, which resulted in a falling wedge pattern.

This downward movement was accompanied by a trendline break, signaling a shift in momentum. The price has since reached a strong support level and is showing signs of potential bullish reversal.

🔹 Key Technical Patterns & Indicators

1️⃣ Falling Wedge Pattern (Bullish Reversal Signal)

A falling wedge is a pattern characterized by two downward-sloping trendlines that converge, indicating that selling pressure is weakening. This pattern is considered a bullish signal because:

✔️ The declining price movement shows exhaustion of sellers.

✔️ Volume typically decreases as the wedge forms, indicating a breakout is coming.

✔️ Once price breaks out of the wedge, a strong bullish move often follows.

The key here is to wait for a breakout above the upper trendline, which will confirm the bullish momentum.

2️⃣ Double Bottom Formation at Support (Reversal Confirmation)

The price tested the 160.500 support level twice, forming a double bottom pattern. This is another bullish sign, as it indicates:

✔️ Buyers are actively defending this level.

✔️ There’s strong demand around this price zone.

✔️ If price breaks above the wedge resistance, it could trigger a significant rally.

🔹 Key Support & Resistance Levels

Identifying support and resistance is crucial for defining entry and exit points.

✅ Support Levels:

160.500 – Strong horizontal support (Price tested this twice).

158.982 – Stop-loss level (Below this, the bullish setup is invalid).

✅ Resistance Levels:

163.500 – Major resistance (Previous high and supply zone).

165.090 – Final target (Key breakout level).

If the price successfully breaks out of the wedge, it has room to rise significantly, with 163.500 as the first target and 165.090 as the ultimate goal.

🔹 Trade Setup & Execution Plan

🎯 Bullish Breakout Trade Strategy

Since this setup signals a potential reversal, here’s how traders can execute a high-probability trade:

🔹 Entry Points:

✅ Aggressive Entry: Enter as soon as price breaks above the wedge resistance.

✅ Conservative Entry: Wait for a breakout and a retest of the resistance-turned-support before entering.

🔹 Target Levels:

🎯 First target: 163.500 (Previous resistance level).

🎯 Final target: 165.090 (Major resistance zone).

🔹 Stop-Loss Placement:

❌ Place the stop loss below 158.982, as a break below this level would invalidate the bullish setup.

🔹 Risk-Reward Ratio & Trade Justification

📈 Why This Trade Has a High Potential Reward?

Low-risk, high-reward: The stop loss is tight, while the upside potential is large.

Confluence of bullish signals: Falling wedge + Double bottom + Strong support.

Institutional interest likely: Buyers are stepping in at key levels.

A proper risk-to-reward ratio (RRR) for this trade would be at least 1:3, meaning for every 1% risk, there’s a 3% profit potential. This makes it a great swing trading setup.

🔹 Market Psychology Behind the Setup

The falling wedge represents a market correction after a strong bullish trend.

The double bottom shows that sellers are exhausted and buyers are gaining control.

If price breaks out, many traders will enter, triggering a strong upward rally.

This bullish breakout setup aligns with the smart money concept, where institutions accumulate positions before a big move.

🔹 Final Thoughts & Trade Outlook

This EUR/JPY setup presents a high-probability trade opportunity with a bullish breakout scenario. The combination of:

✅ Falling Wedge Pattern (Bullish reversal)

✅ Double Bottom at Support (Buyers stepping in)

✅ Key Resistance Targets (Clear trade exit points)

…creates a great trading setup.

📌 Trading Plan Summary:

✔️ Buy on breakout above the falling wedge.

✔️ Target 163.500 & 165.090 for profits.

✔️ Stop-loss below 158.982 for risk management.

🚀 If executed correctly, this trade has the potential for strong bullish momentum. Would you like a real-time update once the price confirms the breakout? Let’s keep an eye on this trade! 📊🔥

CHF/USD Trading Setup – Triple Bottom Reversal & Breakout Setup🔍 Overview of the Chart Setup

The CHF/USD (Swiss Franc vs. U.S. Dollar) 1-hour timeframe chart reveals a classic Triple Bottom pattern, which is a well-known bullish reversal signal. This pattern indicates that sellers have attempted to break the support level three times but failed, suggesting a potential shift in momentum from bearish to bullish.

Traders closely watch this structure as it often leads to a strong upward breakout once key resistance levels are breached. The current setup provides an excellent risk-to-reward trading opportunity, especially for those looking to capitalize on the breakout.

📊 Key Levels in the CHF/USD Chart

1️⃣ Support and Resistance Zones

🟢 Support Level (~1.1300 - 1.1280 Zone)

This zone has been tested three times, confirming strong buying interest at this price level.

The formation of long wicks on candlesticks signals strong demand and buyer dominance.

A breakdown below this level would invalidate the bullish setup and may indicate a continuation of the bearish trend.

🔴 Resistance Level (~1.1415 - 1.1430 Zone)

This level acts as a price ceiling, where previous bullish attempts were rejected.

A break and retest above this zone would confirm the Triple Bottom breakout.

🎯 Target Level (~1.1457 Zone)

The projected target is based on the height of the pattern, which is measured and added to the breakout point.

This level aligns with previous price action zones and acts as a natural take-profit area for traders.

🚨 Stop-Loss Level (~1.1243 Zone)

A stop-loss is placed below the support zone to protect against false breakouts or an invalidation of the pattern.

📉 Understanding the Triple Bottom Pattern

The Triple Bottom is a strong bullish reversal formation that occurs at the end of a downtrend. It signals that sellers are exhausted, and buyers are gradually taking control.

🔹 Breakdown of the Triple Bottom Formation

✅ Bottom 1 (First Low)

The first bottom forms when the price hits the support level and bounces back.

Sellers are still active, so price declines again to test the same support zone.

✅ Bottom 2 (Second Low - Confirmation of Support)

The second test of the support zone validates the demand area.

Buyers step in again, pushing the price upward.

The market still lacks enough momentum for a breakout, leading to a third retest.

✅ Bottom 3 (Final Low and Strong Rejection)

The third bottom is crucial because it signals the last test of support before a breakout.

The failure to break lower creates a higher probability of an upside move.

📌 Breakout Confirmation & Price Action Signals

🔵 The breakout is confirmed when:

The price closes above the resistance zone (1.1415 - 1.1430) with strong momentum.

Volume spikes during the breakout, indicating institutional buying interest.

A successful retest of the resistance zone as new support further validates the trend reversal.

If the breakout lacks volume or gets rejected, traders should be cautious of a fakeout or potential retracement.

📈 Trading Strategy & Execution Plan

🔹 Conservative Entry (Safe Approach)

Enter after a confirmed breakout above 1.1415, ensuring a strong candle close above resistance.

Look for a retest of the breakout level before entering the trade.

🔹 Aggressive Entry (Early Positioning)

Enter near the third bottom (~1.1300 - 1.1320) with a tight stop-loss.

Higher risk but better reward if the price moves upward without retesting.

🔹 Stop-Loss Placement

Conservative traders: Place the stop-loss below the support zone (~1.1243).

Aggressive traders: Place a tight stop below the recent swing low for better risk management.

📌 Profit Target Projection

Take Profit Target: 1.1457, based on the height of the pattern.

📌 Risk-to-Reward Ratio

Risk: ~60 pips (from entry to stop-loss).

Reward: ~150 pips (from entry to target).

Risk-to-Reward Ratio: 1:3, making it a high-probability trade.

📡 Additional Confirmation Indicators for Stronger Trade Setup

📊 1. Volume Analysis

A spike in volume at the breakout level suggests strong buyer interest.

Low volume on the breakout may indicate a potential fakeout.

📈 2. RSI (Relative Strength Index) Confirmation

RSI should be above 50 and trending upward to confirm bullish momentum.

If RSI is overbought (>70), watch for a pullback before entering the trade.

📉 3. Moving Averages Support

If the 50-period or 200-period moving average supports the breakout level, it adds extra confirmation.

A moving average crossover may further validate the trend reversal.

🔍 4. Beware of Fake Breakouts

If the price briefly moves above resistance but fails to hold, it may be a bull trap.

Always wait for a candle close above resistance and a potential retest before confirming the entry.

🛠️ Alternative Scenarios & Market Risks

🔺 Bullish Scenario (Breakout & Rally to Target)

Price breaks above 1.1415, confirming a trend reversal.

A retest of resistance as support gives additional buying confidence.

Price reaches 1.1457 target before facing new resistance.

🔻 Bearish Scenario (Fakeout & Breakdown Below Support)

Price fails to hold above resistance and falls back below support.

A breakdown below 1.1243 invalidates the pattern, triggering a bearish continuation.

Traders should cut losses quickly if the setup is invalidated.

⚠️ Fundamental Risks to Watch

U.S. Dollar news events (FOMC, NFP, CPI reports) can increase volatility.

Swiss economic data may impact CHF strength.

Unexpected geopolitical events can influence currency movements.

🔎 Summary of the Trading Plan

📌 Trading Strategy Checklist

✅ Pattern: Triple Bottom (Bullish Reversal).

✅ Entry Strategy: Buy after breakout confirmation above 1.1415.

✅ Take Profit Target: 1.1457.

✅ Stop-Loss Level: Below 1.1243.

✅ Risk-to-Reward Ratio: 1:3 (High-Profit Potential with Proper Risk Management).

💡 Final Thought:

This setup provides a high-probability bullish trade with strong technical confluence. However, always remain cautious of market news, economic reports, and sudden volatility that could influence price action.

🚀 Patience & discipline are key—wait for confirmation before entering! 📊

Silver (XAG/USD) – Rising Wedge Breakdown & Bearish Setup📌 Overview

This 1-hour chart of Silver (XAG/USD) presents a textbook Rising Wedge pattern, which is known as a bearish reversal signal. The price was in a strong uptrend but started showing signs of buyer exhaustion, leading to a breakdown from the wedge formation.

The chart clearly identifies:

✅ A Rising Wedge formation

✅ Resistance Level where price faced multiple rejections

✅ Breakdown Confirmation and shift in trend direction

✅ Projected Target & Stop Loss Zones

This setup suggests a strong potential for further downside movement in silver prices. Now, let’s break it down step by step like a professional trader.

🔹 Key Technical Analysis Breakdown

1️⃣ Rising Wedge Pattern – The Bearish Setup

The Rising Wedge is a bearish reversal pattern that forms when price action moves higher within two converging trendlines. The slope of the lower trendline is steeper than the upper trendline, meaning that buyers are getting weaker.

This pattern suggests that even though the price is rising, bullish momentum is fading.

Once the price breaks below the wedge, it confirms a bearish trend.

🔸 Characteristics of this Wedge:

📌 Multiple Higher Highs & Higher Lows – But with decreasing strength

📌 Narrowing Price Action – Indicates weaker buying power

📌 Breakdown Below Support Line – Confirms the bearish move

2️⃣ Resistance Level – Key Price Rejection Zone

The price tested the Resistance Level multiple times before breaking down. This area is where sellers overpowered buyers, preventing further upside movement.

The resistance zone was a liquidity area, meaning large institutional traders likely placed sell orders here.

The price attempted to push higher but failed, showing that demand was exhausted.

Once rejection happened, selling pressure increased, and the breakdown followed.

3️⃣ Breakdown Confirmation – Bearish Momentum Kicks In

After the wedge broke down, the price started moving in a structured downtrend, forming lower highs and lower lows. This confirms that the breakdown was valid and that the trend has shifted.

🔹 Signs of Breakdown Strength:

✅ Strong Bearish Candles – Indicating aggressive selling

✅ No Immediate Recovery – Suggests sellers are in control

✅ Lower Highs Forming – Bearish trend structure confirmed

4️⃣ Risk Management – Stop Loss & Target Zones

A well-planned trade must include a Stop Loss and a Target to manage risk effectively.

📌 Stop Loss Placement (33.95)

Placing a Stop Loss just above the resistance level protects against false breakouts.

If the price goes back above 33.95, it would invalidate the bearish setup.

📌 Profit Target (31.96)

The target is based on the measured move projection, meaning the expected price drop is equal to the height of the wedge at its widest point.

If the price reaches 31.96, traders can lock in profits.

📌 Risk-Reward Ratio (RRR)

The setup offers a favorable risk-to-reward ratio, making it a high-probability trade.

5️⃣ Expected Price Movement – Bearish Outlook

From here, we can expect the following price movement:

📉 Scenario 1: Continuation of Downtrend (High Probability)

The price will likely form lower highs and lower lows on its way to 31.96.

Each small rally should be met with selling pressure.

📈 Scenario 2: False Breakdown (Low Probability but Possible)

If the price moves back above 33.95, the wedge breakdown will be invalid.

This could lead to a bullish reversal instead.

6️⃣ Final Thoughts – How to Trade This Setup?

This Rising Wedge Breakdown provides an excellent short-selling opportunity. Here’s how a professional trader would approach it:

✅ 🔹 Entry Strategy:

Short after a retest of the broken wedge support

Confirmation of lower highs ensures trend continuation

✅ 🔹 Risk Management:

Place Stop Loss above 33.95

Take profits around 31.96

✅ 🔹 Confirmation Signals to Watch:

Lower highs forming after breakdown

Increased selling volume on bearish candles

Price respecting the downtrend structure

🔔 Conclusion – Bearish Bias Confirmed

🔻 Trend Shift: The breakdown signals a potential trend reversal in silver.