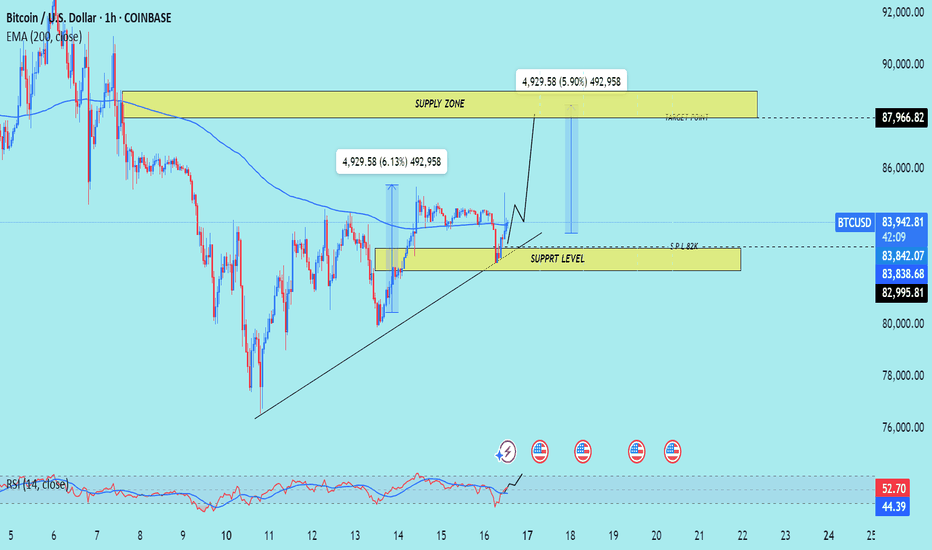

BTCUSDT TRADING POINT UPDATE >READ THE CHPTAIANBuddy'S dear friend

SMC Trading Signals Update 🗾🗺️ crypto Traders SMC-Trading Point update you on New technical analysis setup for crypto BTC USDT. ) list time post signals 💯 reached target point ) 👉 New technical analysis setup BTC USDT looking for bullish trend 📈 FVG level support level. 83k 82k support level 87k 88k resistance level ). Guys 🤝 good luck 💯💯

Key Resistance level 87k + 88k

Key Support level 83k - 82kà

Mr SMC Trading point

Pales support boost 🚀 analysis follow)

Chartpattren

EUROUSD TRADING PINT UPDATE >READ THE CHPATIAN Buddy'S dear friend

SMC Trading Signals Update 🗾🗺️ SMC-Trading Point update you on New technical analysis setup for Euro USD) Euro USD) Technical patterns choch looking for Bullish patterns support level 1.0866 Resistance level 1.09361 ) good luck guys 🤝

Key Resistance level 1.09361+ 1.09483

Key Support level 1.08802 - 1.08666

Mr SMC Trading point

Pales support boost 🚀 analysis follow)

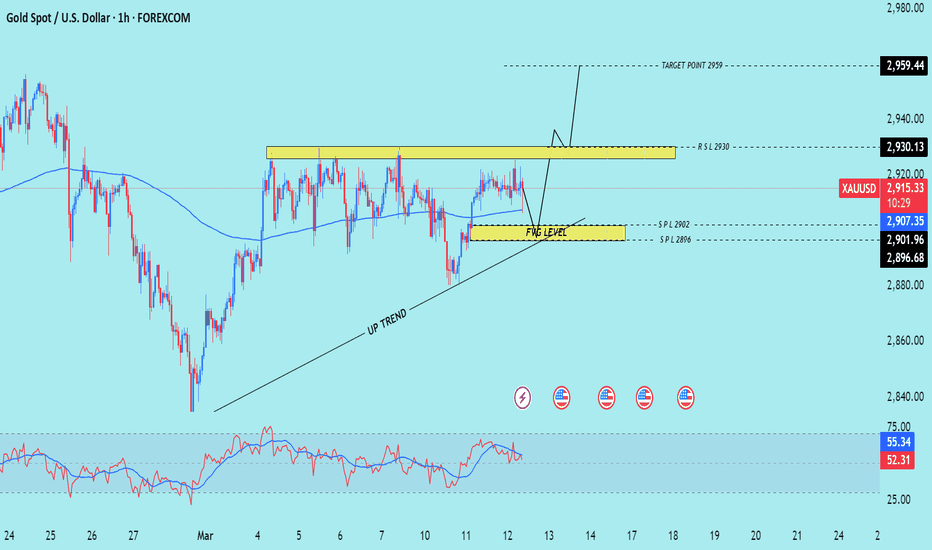

GOLD TRADING PONT UPDATE >READ THE CHAPTIANBuddy'S dear friend 👋.

SMC Trading Signals Update 🗾🗺️ Gold Traders SMC-Trading Point update you on New technical analysis setup for Gold 🪙 Gold Traders Gold 1H time. Look 👀 first take FVG level that take entry buying said target point 2959 New ATH wait for FVG level good luck 🤞

Key Resistance level 2930 + 2959

Key Support level 2909 - 2902 - 2896

Mr SMC Trading point

Pales support boost 🚀 analysis follow)

GOLD VIEW 3H READ THE CAPTAINHello 👋 gold traders

3-hour timeframe of Gold Spot (XAU/USD) with technical analysis levels and moving averages. Here’s a breakdown of the key points:

Key Observations:

1. Support & Resistance Levels:

Support Level: Around 2,909.870 - 2,902.340 (marked as the buying zone).

Resistance Level: 2,930.173.

Target Point: 2,960.607.

2. Exponential Moving Averages (EMAs):

30 EMA (Red Line): 2,909.870 (Short-term trend).

200 EMA (Blue Line): 2,884.578 (Long-term trend, acting as strong support).

3. Price Action:

The price is currently in a consolidation phase around the resistance zone.

If the price breaks above 2,930, we might see a bullish move toward the target at 2,960.

If the price fails to break resistance, a pullback to the buying zone (support level at 2,909-2,902) is possible.

Trading Strategy Ideas:

Bullish Scenario (Breakout Above 2,930): Look for long positions targeting 2,960.

Bearish Scenario (Rejection at Resistance): A retest of the buying zone (2,909 - 2,902) before another push higher.

GOLD TRADING POINT UPDATE > READ THE CHAPTIANBuddy'S dear friend 👋

SMC Trading Signals Update 🗾🗺️ Gold Traders SMC-Trading Point update you on New technical analysis setup for Gold 🪙 Gold Traders Gold 3 time frame 🖼️ looking FVG rejected point below 👇 2929+ 29209. Technical patterns). Weekly basis setup. )

Key Resistance level 2929 + 2957

Key Support level 2891 - 2848

2832

Mr SMC Trading point

Pales support boost 🚀 analysis follow)

BTCUSDT TRADING POINT UPDATE >READ THE CHAPTIAN Buddy's dear friend 👋

SMC Trading Signals Update 🗾🗺️ crypto Traders SMC-Trading Point update you on New technical analysis setup for crypto BTC USDT BTC still rejected supply zone. Again. Back Short Trade. FVG level) 83k I'm want to Sell now short trend 📈

Key Resistance level 93k + 95k

Key Support level 85k - 83k

Mr SMC Trading point

Pales support boost 🚀 analysis follow)

$GOOGL Rising bearish wedge with declining volume; $165 belowNASDAQ:GOOGL here looks weak to me trying to reclaim it's support of $175-$180. This is on my watchlist for a short term short, if this name tanks back into the $150's I will load everything I got for the long side. I see this name in a downside trend currently in a rising wedge with declining volume, buyers can't hold it up much longer. It's retested that support on 3 or more daily candles and hasn't busted through. I expect this name to drop into a support zone of $160-$165. I will look to enter puts off a retest of $176-$178 area keeping the stops tight.

WSL.

GOLD TRADING POINT UPDATE >READ THE CHATPIAN Buddy'S dear friend 👋

SMC Trading Signals Update 🗾🗺️ Gold Traders SMC-Trading Point update you on New technical analysis setup for Gold traders SMC trading point ☝️ list time post signals 🚀 Hit sucksfully My target point 2920 ) Now Gold rejected point below 👇 supply zone 2892- 2875 FVG level up trand My target 🎯 point 2961 long Trade 🤝. First take short trend 📈 And buying it)

Key Resistance level 2915 + 2920 + 2956+ 2961

Key Support level 2892 - 2875

Mr SMC Trading point

Pales support boost 🚀 analysis follow)

GOLD TRADING POINT UPDTAE >READ THE CHAPTIAN Buddy'S dear friend 👋

SMC Trading Signals Update 🗾🗺️ Gold Traders SMC-Trading Point update you on New technical analysis setup for Gold 🪙 🪙 Gold Traders Gold Ready for again take New bos). Choch) FVG level up trand) Gold still going to bullish trend 🚀 I'm want buying it target point 2945 + 2956 Technical patterns.

Key Resistance level 2945 + 2956

Key Support level 2911- 2900

Mr SMC Trading point

Pales support boost 🚀 analysis follow)

GOLD TRADING POINT UPDATE > READ THE CHAPTIAN Buddy'S dear friend 👋

SMC Trading Signals Update 🗾🗺 Gold Traders SMC-Trading Point update you on New technical analysis setup for Gold 🪙 💥 Gold Traders Gold 4 Time Frame. Tast diamond zone support level. Close above EMA ) indicator. ) SMC Trading point expect it. Bull 🐂 trend 📈 supply zone 2920 2930. This levels. Expect it selling Arya )

Key Resistance level 2920 + 2930

Key Support level 2852 - 2834

Mr SMC Trading point

Pales support boost 🚀 analysis follow)

ADA/USDT at Decision Point – Major Move Incoming!ADA/USDT is testing a major resistance zone after retesting the 100 EMA and bouncing from the rising support line. The price remains in a long-term symmetrical triangle, with the resistance trendline as a key breakout level.

The Stochastic RSI is recovering from oversold levels, indicating potential bullish momentum. A breakout above resistance could trigger a strong uptrend continuation, while rejection may lead to a pullback toward support.

Bitcoin Cash at Critical Trendline – Next Big Move?Bitcoin Cash (BCH/USDT) is currently showing signs of a strong reversal after testing a key support zone and the ascending trendline. This level has acted as critical support in previous price cycles, making it an important area to watch.

The price has rebounded from the strong support line, which aligns with the accumulation zone from early 2023. Additionally, BCH remains within a long-term descending channel, with the upper resistance line acting as a ceiling for previous bullish moves.

$COIN Spinning Stop Candle in Downtrend; ReversalWe have 7 days of straight beating, assault, slaughter and murder. Do I think this thing reverses 10 fold? No but do I expect a bounce into the mid 220’s? Yes. RSI is relatively low (sold) for its name, it fundamentally smashed earnings and the candle here that closed on the daily is known as a spinning stop with a green closure. Expect a volatile move soon - tomorrow or and into Friday. NASDAQ:MSTR held up well today. This is always a craps shoot, no matter the trade, no matter the look of the chart and all the indicators we use. It just creates an edge. Good luck. I’m going to look at calls here for a bounce.

Wall Street Loser.

ARKM | CHART PATTERNS | BUY the BOTTOMARKM is a fairly new altcoin that's been on my TOP alt list for some time.

The bearish M chart pattern is a pattern that signifies a large correction, especially in the macro timeframe such as the weekly. By looking at the chart, e can see the correction is nearly over since it has almost retraced ack to opening levels - almost .

Opening levels have in fact not yet been retested, and this may be a great place to stack up / re-accumulate if you're a believer.

Another ALT that's seems to be approaching a bottom is AVAX:

______________

BINANCE:ARKMUSDT

Bitcoin (BTC/USD) Trade Setup – Potential Bullish ReversalHelle Guys Here Is My First Analysis On BTC/USD Keep Me Update In And Follow Me For More Instrutions thanks

On the 1-hour chart, Bitcoin recently broke out of an ascending channel but faced a sharp correction. Price has now found support around $94,400, which aligns with a key demand zone. A rebound from this level could trigger a bullish move toward the $99,700 target, where strong resistance is expected.

Trade Plan:

Entry: Near $96,200, after confirmation of support.

Target: $99,700 (key resistance zone).

Stop Loss: Below $94,400 to manage risk.

If price holds above support and reclaims key levels, a bullish continuation is likely. However, failure to hold could lead to further downside. Traders should monitor price action and volume for confirmation before entering.

Let me know your thoughts in the comments! Do you see BTC recovering or breaking lower? 🚀📉

Must Support Me And Share it With Your friends And Family thanks Trade At Own Risk and Strategy

The SECRET to BULLISH CHART PATTERNS | EducationBullish chart patterns play out towards the upside... atleast most of the time.

In some cases, a bullish pattern forms - seemingly strong- but ends up going the complete opposite direction. There is a way to navigate this very frustrating outcome - by waiting for confirmation.

Through waiting a little longer, you will surely reduce the profits - but this greatly reduces the risk of playing a "failed" pattern.

Keep a close eye on this bullish chart pattern forming on SUI:

__________________________

# Shree Cement , 1W and 1D Good Looking Pattern for Breakout , Bullish Pattern

It is Positional Setup .

Enter when the Upper Trendline Breaks and

Be careful when You enter because They are chance to happen false breakout . Avoid False Breakout by Considering the Nifty50 Trend .

aim for 30% in short Term and aim for up to 80% in Long Run .

This is my Point of view .

If you want to trade the good patterns and want to learn the good price action trading

follow me and like the charts to encourage me .

#NH , 1D and 1W Bullish Pattern

Looks Very Good in Weekly And Daily Time Frame , It is Ready for Breakout from Pattern .

It has Repeated the same pattern in Past so High chances to go up .

if u find this Chart Helpful pls like and Follow for More like this charts .

I am A Swing Trader , Trade only Price Action Patterns .

SUI | ALTS | BULLISH Chart Pattern?A bullish chart pattern is forming on SUI in the daily chart.

It should be noted that this patter is still premature - meaning that it's not yet completed and there is not yet the confirmation that we need to act on it:

Don't miss the most recent update on XRP here:

_________________________

COINBASE:SUIUSD

#BAKEUSDT shows correction signals📉 SHORT BYBIT:BAKEUSDT.P from $0.2670

🛡 Stop Loss: $0.2834

⏱ 15M Timeframe

✅ Overview:

➡️ BYBIT:BAKEUSDT.P experienced a sharp upward spike, reaching $0.2834, but was followed by a strong decline, indicating profit-taking from major players.

➡️ POC (Point of Control) at $0.2837 shows a high-liquidity area where most trading volume occurred, suggesting a possible resistance zone.

➡️ The $0.2670 level currently acts as short-term support, but a confirmed breakdown could trigger further downside.

➡️ The chart structure signals a potential correction after this steep rally, making short positions at these levels attractive.

⚡ Plan:

➡️ Enter short after confirming a breakdown below $0.2670.

➡️ Risk management through Stop-Loss at $0.2834, placed above the liquidity zone.

Targets:

💎 TP 1: $0.2585

🔥 TP 2: $0.2452

⚡ TP 3: $0.2310

🚀 BYBIT:BAKEUSDT.P shows correction signals — expecting further downside!

📢 BYBIT:BAKEUSDT.P saw a vertical spike, but the lack of strong buying interest at higher levels suggests potential profit-taking.

📢 If $0.2670 breaks downward, we could see continued selling pressure towards $0.2310.

📢 However, a breakout above $0.2834 could change the scenario, so risk management is crucial.

GOLD - at DO or DIE area, holds or not??#GOLD - well guys as you know that today is CPI day and we will see aggressive move in market according to technical point of view we have single supporting area that is around 2881 to 2886

that is today most expensive region.

and only holdings of that region can create and resume buying trend again otherwise below that market will again drop towards his next supporting areas.

so don't be lazy here and stay sharp at that region and don't hold your buying positions below that.

NOTE: we will go for cut n reverse below 2881

good luck

trade wisely

GOLD 4H CHART ANAYLSIS / BULLISH OR BEARISH? READ CAPTION PLZ4H Gold Analysis – 7th Feb 2024

Dear Traders,

Today's market movement aligns with our strategy of buying dips. Here's a summary of key insights:

Previous Chart Review (5th Feb)

* Target 1 (2850.15) ✅ – Successfully hit

* Target 2 (2876.95) ✅ – Successfully hit

* Target 3 (2903.76) – Pending

Key Resistance Levels Activated: 2850, 2876

Goldturn Levels Hit: 2852, 2828

What is next for Gold? Bullish or Bearish?

* Price Action Expectation: Movement between Goldturn levels with EMA5 confirmation for trend direction.

* Strategy: Monitor EMA5 crosses for trade entries.

Bearish Case

* If EMA5 stays below 2850, expect a retest of Goldturn levels.

* Scenario 1: Below 2823, likely drop to 2803.

* Scenario 2: Below 2803, expect 2776.

* Scenario 3: Below 2776, target 2747 (major demand zone).

Bullish Case

* Scenario 1: Above 2852, target 2876 ✅ DONE

* Scenario 2: Above 2876, target 2903.

* Scenario 3: Above 2903, target 2925.85.

Trading Strategy

Short-Term:

Use 1H/4H timeframes for pullbacks at Goldturn levels.

Target 30-40 pips per trade for optimized risk management.

Long-Term:

Maintain a bullish bias, viewing pullbacks as buying opportunities.

Avoid chasing tops; buy dips from key levels for better trade positioning.

Trade with confidence and discipline. Stay updated with our daily insights to stay ahead.

Support us with likes, comments, boosts, and follows!

📉💰 The Quantum Trading Mastery

GOLD 12H CHART ROUTE MAP ANALYSIS FOR THE WEEK Dear Traders,

Here is our 12H chart analysis and target update:

Previous Chart Review:

Outcome:

✅ All targets and entry levels (marked with Golden Circles) were achieved as predicted.

TP1 2745 - DONE

TP2 2786 - DONE

TP3 2826 - DONE

Market Overview:

* ENTRY LEVEL: 2814

* Target TP1 successfully hit already at 2858

* GOLD is trading at an ATH of 2858, oscillating between the weighted level with a gap above 2858 and a gap below the 2814 Entry Level.

* FVG are offering strong support in this range.

Resistance Levels:

2858, 2903, 2948

Key Support: 2618

Support Levels (blue GOLDTURN Levels are activated):

2813 (Critical Weighted Level)

2770 (Critical Weighted Level)

2710 (Critical Weighted Level)

2664 (Major Support Level)

2618 (Lower Major Demand Zone)

EMA5 (Red Line):

* Currently below TP1 (2858), indicating sustained bullish momentum.

* EMA5’s behavior will be pivotal in determining the next price action trajectory.

Recommendations

* Focus on EMA5 Behavior for further confirmation

Bearish Case:

* If EMA5 holds below TP1 (2858) and resistance levels remain intact, bearish momentum may drive prices to retest GOLDTURN weighted levels.

* Scenario 1: If EMA5 crosses and locks below Entry 2813, expect further bearish movement toward GOLDTURN 2770.

* Scenario 2: If EMA5 crosses and locks below GOLDTURN 2770, anticipate another decline toward the major support at GOLDTURN 2710.

* Scenario 2: If EMA5 crosses and locks below GOLDTURN 2710, anticipate another decline toward the major support at GOLDTURN 2664.

* Scenario 2: If EMA5 crosses and locks below GOLDTURN 2664, anticipate another decline toward the major support at GOLDTURN 2618.

Bullish Case:

Scenario 1: If EMA5 crosses and locks above TP1 (2858), the next bullish target is 2903.

Scenario 2: If EMA5 crosses and locks above TP2 (2903), the subsequent bullish target will be 2948.

Short-Term:

* Possible Reversal at the weighted GOLDTURN levels

* Utilize 1H and 4H timeframes to capture pullbacks at GOLDTURN levels.

* Target 30–40 pips per trade, focusing on shorter positions in this range-bound market.

* Each Level allows 30 -40 pips bounce, buy at dip level for proper risk management

Long-Term Outlook:

* Maintain a bullish bias, viewing pullbacks as buying opportunities.

* Buying dips from key levels ensures better risk management, avoiding the pitfalls of chasing tops.

Final Thoughts:

Trade with confidence and discipline. Our detailed and accurate analysis equips you to navigate market movements effectively. Stay tuned for daily updates and multi-timeframe insights to stay ahead in the game.

Please support us by likes, comments, boosts and following our channel.

Best regards,

📉💰 The Quantum Trading Mastery