Olin Corporation | OLIN | Long at $21.81Olin Corp NYSE:OLN is currently trading within my "crash" simple moving average area (green lines on the chart). Historically, the price trades within this area for the company, consolidates, and then moves up. After today's earnings, which were relatively positive, the stock may gain some traction and move up. However, I am cautious a media-heightened economic downturn could send NYSE:OLN (a global manufacturer of chemical products and ammunition) to $13 to close the existing price gaps on the daily chart. Regardless, it's a strong company that has been trading on the US stock exchange since the mid-1970s - it's seen rough times before. While 2025 is likely to be a tough year, future earnings projections predict robust earnings growth. Time will tell...

Thus, at $21.81, NYSE:OLN is in a personal buy-zone with noted caution if there is an economic downturn down to $13 a share. The price gap around $19 may also be closed in the near-term.

Targets into 2028:

$28.00 (+28.4%)

$31.50 (+44.4%)

Chemicalsector

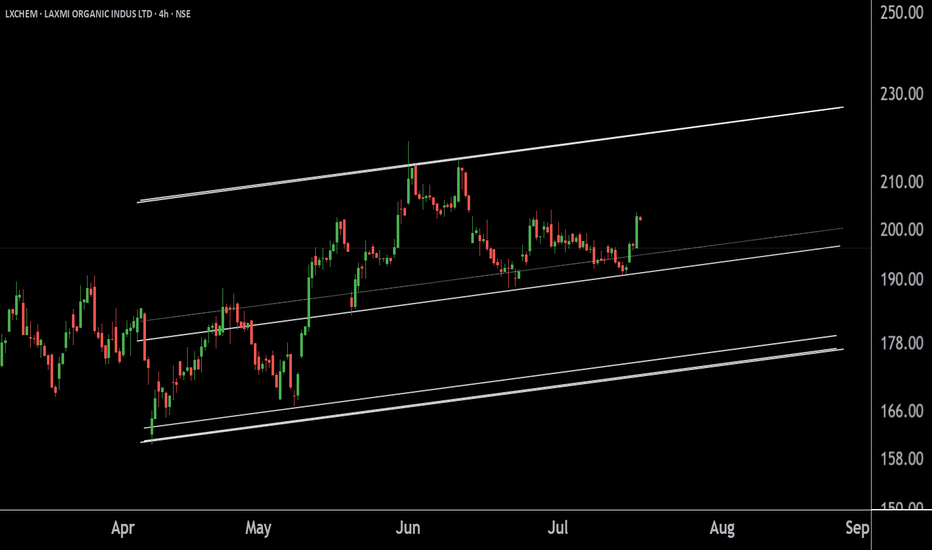

MANGALORE REFINERY & PETROCHEM 'S KEY LEVEL !! BREAKOUT !!This is the 4 hour chart of MRPL.

MRPL having a good law of polarity at 145 range.

MRPL is trading within a well-defined parallel channel, with support in the 135–140 range.

If this level is sustain , then we may see higher prices in MRPL .

THANK YOU !!

RAIN INDUSTRIES ' s Key Support Zone This is the one hour chart of RAIN INDUSTRIES.

Rain Industries is moving within an ascending parallel channel with support around 140 range and resistance around 160 range.

If this level is sustain , then we may see higher prices in the

Rain Industries

Thank You !!

Huntsman Corporation | HUN | Long at $11.34The stock price for Huntsman Corp NYSE:HUN , a manufacturer of organic chemical products, has dropped significantly since its peak in 2022 ($41.65). This was due to lower sales volumes, weak demand in construction and transportation, higher input costs, and European operational challenges, including a $75M hit from closing a German Maleic Anhydride facility. This year (2025) is anticipated to be its worst earnings year, and the stock is priced as such. However, this stock is historically cyclical, and the company expects recovery / growth again in 2026. Moving forward, earnings are forecast to grow and the company is trading at good value compared to peers and the industry. While many headwinds may still exist with tariffs, etc., insider are grabbing shares and large options positions (very bullish). With a book value of $17, debt-to-equity at 0.8x, quick ratio under 1, etc., the company appears healthy.

From a technical analysis perspective, the stock price just barely missed my "crash" simple moving average area (currently between $9.00 and $10.50). It may reach those levels and below in 2025, for which I will add another position as long as fundamentals do not change. This moving average area often signifies "bottom" territory and historically, the stock has rebounded from this area. While my entry at $11.34 may be a little early, predicting true bottoms isn't my trading method and I hope to strengthen the position at lower trading prices.

Targets:

$15.00 (+32.2%)

$17.25 (+49.9%)

Celanese Corp | CE | Long at $39.64Celanese Corp is another chemical company (like Dow Inc) crushed by tariffs and economic headwinds. It's dropped -78% in one year.... However, this is a very strong company with strong credit market interest and no immediate liquidity crisis. From a technical analysis perspective, this... like in 2008 and 2020... is the time to gather shares given it has reached the "abysmal crash" levels based on my selected simple moving averages. In the past, recovery to new highs has taken 1-2 years. History doesn't always repeat, but fear is opportunity in the stock market. If negative news continues to reign, a dip into the high $20's isn't out of the question.

If the company can squeak through 2025 and not continue to stack debt (debt/equity=2.43x), the growth opportunity into 2027-2028 looks promising.

I'm keeping my targets into 2026 low, but this could be a good buy and hold for the right investor.

Targets:

$47.00

$54.75

Dow Inc.: Low in PlaceDow Inc. managed to hold and respond well within our active Target Zone(s) between $35.93 and $22.83 at the relevant Fibonacci levels. We currently assume that wave (II) in blue has been successfully completed, which leads us to anticipate a rise above the two indicated resistance levels ($55.67 and $71.86). Our zones remain active and could still be used for entering long positions. However, it should be noted that the price range could be tested further, and a completely new low is even possible under our alternative scenario: this wave count outlines a significantly stronger setback with the blue wave alt.(II), which would mean breaking through our dark green-blue Target Zones (probability: 35%).

UPL Ltd. (NSE: UPL) AnalysisOverview: UPL Ltd. is currently trading at ₹545.50, showing signs of consolidation near its short-term moving averages. The price is poised at a critical level with a potential for either a breakout or a breakdown, depending on market dynamics and volume activity.

Technical Insights:

1.Support and Resistance Levels:

Immediate Support: ₹528 (marked by recent lows and a strong demand zone).

Key Resistance: ₹549.50 (current level) and ₹584.05 (previous swing high and significant supply zone).

2.Volume Profile:

The visible range volume profile indicates a concentration of volume between ₹540-₹550, suggesting this zone as a pivot for future price action.

A breakout above ₹549.50 could attract higher volumes, pushing the stock towards ₹584.

3.Moving Averages:

The stock is near its 20-day and 50-day EMAs, indicating a neutral short-term trend.

A clear break above the 200-day EMA would signal a shift in momentum towards the bulls.

4.RSI (Relative Strength Index):

RSI is hovering around 50, indicating a lack of strong momentum. A breakout above resistance could drive RSI towards overbought territory, confirming bullishness.

Scenarios:

Bullish Case: A breakout above ₹549.50 with high volumes could see the stock targeting ₹584.05 in the short term. Sustained momentum may lead to further upside towards ₹600.

Bearish Case: Failure to sustain above ₹549.50 might result in a pullback to ₹528. A breakdown below ₹528 could open doors for lower levels, around ₹510.

Trading Plan:

Entry:

Bullish: Above ₹550 for targets of ₹584 and ₹600.

Bearish: Below ₹528 for targets of ₹510.

Stop-Loss:

Bullish: ₹535.

Bearish: ₹540.

Final Thoughts: UPL Ltd. is at a crucial level with a well-defined risk-reward setup. Traders should wait for confirmation of direction with strong volume support before taking positions. Monitor global agrochemical sector trends and news for potential catalysts.

SWING IDEA - CHAMBAL FERTILISERChambal Fertilisers , a prominent player in the fertiliser industry, has recently garnered attention for its intriguing price action and technical indicators, prompting a closer examination for potential trading prospects.

Reasons are listed below :

Recent price action witnessed a breakthrough of the strong resistance zone at 350 levels, indicating a potential shift in market sentiment towards bullish momentum.

A bullish engulfing candle on the weekly timeframe signals a bullish reversal, suggesting a possible uptrend ahead.

The price aligns closely with the 0.382 Fibonacci retracement level, providing added support to the bullish outlook.

After over two years of consolidation, the stock has finally broken out of this range-bound behavior, indicating a change in trend dynamics.

Recording its highest close in eight weeks, Chambal Fertilisers trades above the 50 and 200 exponential moving averages (EMA), indicating strong bullish momentum.

Consistent higher highs in the price action suggest a sustained uptrend.

Notable upticks in trading volumes accompany recent price movements, indicating heightened investor interest and potential for significant price moves.

Target - 415 // 480 // 515

StopLoss - weekly close below 340

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights

Clean Science - All 4 Sides fully Clean & Green :)Clean Science and Technology is an India-based fine and specialty chemical manufacturing company. The Company is engaged in the business of manufacturing organic and inorganic chemicals. It operates through the Specialty Chemicals segment. This is an Investment / Portfolio Grade stock for long term

After IPO, the price blasted 90% high in short time from 1400 levels to 2700 but then crashed deeply to 1200 levels - falling 54% from the ATH

Now the price has taken a Clean Bullish Reversal and here are 4 different views to look at the 4 sides of Clean Science :)

Top Left: Weekly

Cup and Handle Breakout confirmed on Weekly - above 1552 for Target of 1755 and 1860

Top Right: Weekly

Larger Rounding Bottom Breakout in Progress today - If the Price sustains above 1622 until Friday, then the BO gets confirmed for larger Target of 1998

Bottom Left: Monthly

The Long Term view shows an Amazing Textbook Double Bottom Breakout - done today, if the Price sustains above the 1622 neckline by Friday EOD, then target of Double Bottom is the massive ATH at 2675

Bottom Right: Weekly

The Price broke out of the Falling Parallel Channel on weekly and also completed a Retest and Bounce. Not just an ordinary retest and bounce, but the price followed the Rising 2 Bullish Continuation pattern last week which triggered the blast of 7%+ this week

Once again, this is NOT a Trading Stock - Keep holding for massive 2x-4x returns.

Disclaimer:

Stocks-n-Trends is NOT registered with SEBI. We do not provide Buy / Sell recommendations - rather we provide detailed analysis of how to review a chart, explain multi-timeframe views purely for Educational Purposes. We strongly suggest our followers to "Learn to Ride the Tide" and consult your Financial Advisors before taking any positions.

If you like our detailed analysis, please do rate us with your Likes, Boost and share your comments

-Team Stocks-n-Trends

H&S PATTERN - CHEMICAL HOT STOCK - AARTI INDAarti Industries Ltd, the flagship company of the Aarti group, manufacturing organic and inorganic chemicals at its major facilities in Vapi, Jhagadia, Dahej and Kutch, in Gujarat and in Tarapur in Maharashtra. The company has a strong market position in the NCB-based specialty chemicals segment.

Fundamentally : Neutral

Technically : Neutral to bullish

Happy Trading :)

BASF - An Investment pick with more than 70% ROI.The stock has been in an up trend.

It has broken its all time high in 2021 and in good consolidation for 2 years and broken out of consolidation now.

It has broken out of a bullish flag and pole pattern / falling channel pattern in a 3 M timeframe.

One may also consider this for a swing opportunity , RSI intact in all time frames.

Weekly price action shows, that the stock has broken out of falling channel, retested and reversed Consolidated for 7 weeks. Weekly RSI took support at 60 and bounced. Looks ready for a swing. SL - Previous week low at 3155. Target 1 - all time high, 3880.

Balaji Amines on the way of sky rocketing Here on chart, you can easily check that it had broke the trendline on Friday @ 2348 level, now it will fly towards upside soon. Crucial Levels are:

1st Target - Rs 2700

2nd Target - Rs 3500

3rd Target - Rs 5000

Stoploss - Rs 2000

Note - Please consult your financial advisor before taking any trade in Balaji Amines

looking for 52 percent roi in 152 days go for ProLife longProlife Industries Ltd shares SWOT Analysis

SWOT

TECHNICALS

DEALS

SHAREHOLDING

STRENGTHS (4)

Strong Annual EPS Growth

Company with Low Debt

Book Value per share Improving for last 2 years

WEAKNESS (4)

Negative Breakdown Third Support (LTP < S3)

Poor cash generated from core business - Declining Cash Flow from Operations for last 2 years

Declining Net Cash Flow : Companies not able to generate net cash

OPPORTUNITY (0)

Data not found

THREATS (1)

RSI indicating price weakness

LOOKING FOR 52 % HIKE IN SHARE OF PRO LIFE FROM CMP 214 CAN GO UPTO 350 AND BEYOND AS CHEMICAL THEORY IS ABOUT TO RE RATE

KODK Kodiak long trade from a retracement( Industrial Penny)KODK is the old chemical industrial company that focused on camera film and printing for

decades now a bit or diversified in what it does. Share price is a fraction of what it once

was. KODK had a news catalyst that it was trying to clean up financial issues with its pension

plan which had $ 6 Billion in assets. That may be a good thing but investors through otherwise

and price put in a 20% retracement over a few days. I expect this to rebound and earnings

are about ten days away. The P/E ratio is about 10. While this is a risky penny stock,

I see the potential in a recovery of the 20% of market cap in the pre-earnings period.

Accordingly, I will take a long trade of stock shares and a put option to hedge those

shares against a downturn.

Blasting Oxidation Starts at Pondy Oxides & Chemicals :) :) :)The Chemical Sector was looking Super Bullish when compared to the Nifty 50. Many Chemical stocks were hitting Sky high last week.

Pondy Oxides & Chemicals is a Multi-bagger stock which already gave me more than 2x-3x returns last year. I booked my profits and after brief gap I re-entered the stock again in Q3/Q4 2023 and now it has given me 55% returns so far.

Technicals:

Weekly: Cup & Handle BO Completed with target of 785

Monthly: With 20% UC today - it has broken out of Another much Larger C&H pattern at Monthly levels for a 2x Target of 1300+

The Oxidation has just started - don't give up now.....The Real Blast is yet to happen. Keep holding your winners

Disclaimer:

Stocks-n-Trends is NOT a SEBI registered company. We do not provide Buy / Sell recommendations - rather we provide detailed analysis of how to review a chart, explain multi--timeframe views purely for Educational Purposes. We strongly suggest our followers to "Learn to Ride the Tide" and consult your Financial Advisors before taking any positions.

If you like our detailed analysis, please do rate us with your Likes, Boost and share your comments

-Team Stocks-n-Trends

Balaji Amines Ltd. Elliott Wave Analysis - Weekly LogarithmicBalaji Amines Ltd. Elliott Wave Analysis - Weekly Logarithmic Chart

The analysis is based on a weekly time frame using a logarithmic chart for Balaji Amines Ltd. The Elliott Wave count reveals a fascinating pattern that can provide insights into potential future price movements. However, it's essential to remember that all trading involves risk, and past performance does not guarantee future results. Always conduct thorough research and consider the inherent uncertainties in financial markets.

Wave Count:

Wave 1 (Nov 2010):

The first wave appears to have completed in November 2010, closing at 57.85. This initial bullish move signaled the beginning of an upward trend.

Wave 2 ABC Correction (Aug 2013):

A corrective ABC pattern followed, completing in August 2013 with a low of 28.05. This retracement set the stage for the next bullish wave.

Wave 3 (Jan 2018):

Wave 3 unfolded with remarkable strength, reaching its peak in January 2018 at a high price of 782. This phase demonstrated the powerful momentum characteristic of third waves.

Target for Wave (3):

The projected target for Wave 3 is at 10267, based on traditional Elliott Wave analysis, indicating the potential magnitude of the bullish move.

Wave 4 ABC Correction (Mar 2020):

The onset of the COVID-19 crash marked the completion of an ABC correction for wave 4, concluding in March 2020 with a low of 200. The market's response to the pandemic created a significant correction.

Wave 5 (Sep 2021):

Wave 5, the final wave of smaller degree, reached its zenith in September 2021, with the stock achieving a high of 5223.55. This completed the five waves of minor degree, establishing a primary degree (1) in September 2021.

Current Scenario:

Post the completion of Wave 5, the stock transitioned into a bearish phase, undergoing an ABC correction near 1880 with a retracement exceeding 61.8%. This correction suggests a significant pullback, indicating a potential change in the overall trend.

Invalidation Level:

The bullish scenario would be invalidated if the stock price falls below the critical level of 1880, signaling potential weakness in the overall Elliott Wave structure.

Disclaimer:

This Elliott Wave analysis is speculative and based on historical price movements. Market dynamics can change, and unforeseen events may impact stock prices. It's crucial for investors to conduct their own research, consider multiple factors, and, if necessary, consult with financial professionals before making any investment decisions. Trading and investing always involve risks, and past performance is not indicative of future results.

The Electrified EV Chemical Industry - (1) Himadri SpecialityWith Indian Government set to replace 800K Diesel Buses to EV by 2030, there is strong Focus and Growth potential on Companies manufacturing EV Related Chemicals

Let review each EV Chemical sector companies

1) Himadri Speciality: Multi-Timeframe Analysis

Monthly: Parallel Channel - Rounding Bottom BO done and nearing Target of 350+

Daily: After Rounding Bottom BO - it is travelling inside a Smaller Parallel Channel with a Fib Retracement of 0.5

Targets - 355, 410, 500

Immediate resistance to cross - Channel BO above 315 WCB

Deepak NitriteHello & welcome to this analysis using Ichimoku Multi Time Frame Analysis

Stock has a history of lengthy periods of sideways correctives. The current scenario suggesting a trend line resistance if taken out then upside till 2250-2350 where it faces a major resistance. Support at 2050-25 if violated then next major support at 1900-1875. Anything below that would be bad for it.

Happy Investing