CHFJPY Correction ahead.The CHFJPY pair has been on a strong rally that smashed through our target on the last analysis:

Right now the price formed a new Channel Up, remaining within a Fibonacci Channel where it broke above the 1.5 Fib extension and almost reached as high as the 2.0.

However with the RSI hitting its October 20 2021 Resistance and the MACD forming a Bearish Cross, we have a strong set of indicators pointing towards a pull-back similar to June 2021 and August 2020. On both of those correction phases, the price pulled-back to at least the 0.5 Fibonacci retracement level. Currently that is on 126.565. It might make contact with the 1D MA200 (orange trend-line) there. If broken, the last Support is the 0.618 Fib at 124.455. After that correction we expect the pair to continue its long-term bullish trend.

--------------------------------------------------------------------------------------------------------

Please like, subscribe and share your ideas and charts with the community!

--------------------------------------------------------------------------------------------------------

Chf-jpy

CHFJPY Monthly Liquidity GrabJPY pairs have been tricky lately. They have mainly been the pairs that I've had to re entered after being stopped out. Fortunately, CHFJPY just had a major liquidity grab from a monthly chart, and going down to the 4H chart, there was a major move downward. I have set my stop loss just above the movement before it fell. I'm expecting a small movement to the downside and will try and capitalize on this movement.

CHFJPY Short Welcome back! Here's an analysis of this pair!

**CHFJPY - Bearish breakout and strong rejection at key level. Targets 132.76, 55, and 131.00 swing.

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Trade wisely!

Brian & Kenya Horton, BK Forex Academy

CHFJPY potential for dip! 5th April 2022Prices have broken out of our triangle pattern. We see the potential for further bearish continuation towards our Take Profit at 131.411 in line with 127.2% Fibonacci Projection. MacD is showing bearish momentum, further supporting our bias.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.

CHFJPY ReversalCHFJPY currently begins to trend upward as it closes in on a major reversal level. However there are still many stops and short sell limit orders residing above that level thus creating liquidity. We can expect either a move to the downside after residing in the reversal zone or we can expect price to continue moving upward to grab that liquidity before the movement downward. Lets see how this plays out, but regardless of what happens, we can play both sides of the market.

Dominant Currency Sentiment – AUD Supported Heading into today’s European trading session, the risk tone is leaning risk-on. Asia-Pacific indices are notably positive, measures of volatility subdued and safe-havens pressured.

Leading Asia-Pacific indices to the upside is the Hang Seng at +6.16%, followed by the Nikkei 225 at +3.46%, the Topix at +2.47% and the CSI 300 and ASX 200 at +1.96% and +1.05%, respectively.

In the FX complex, the positive risk-on tone – which remains a function of hopes for further stimulus from Beijing – sees safe-havens leading to the downside. CHF is currently the session laggard, followed closely by JPY and USD, with AUDUSD reclaiming the 0.73 handle.

Indeed, the positive risk tone and strong employment report sees AUD leading to the upside. Both Employment Change and the Unemployment Rate beat expectations causing some analysts to now to suggest the RBA should adopt a more aggressive stance. CBA notes there is now a clear risk the RBA would drop its commitment to being “patient” on rates at the next policy meeting.

Looking ahead. Today’s European trading session will see the latest inflation figures from Europe. However, the main event will be the BoE’s latest policy decision, where the central bank is widely expected to announce a further 25 basis point hike.

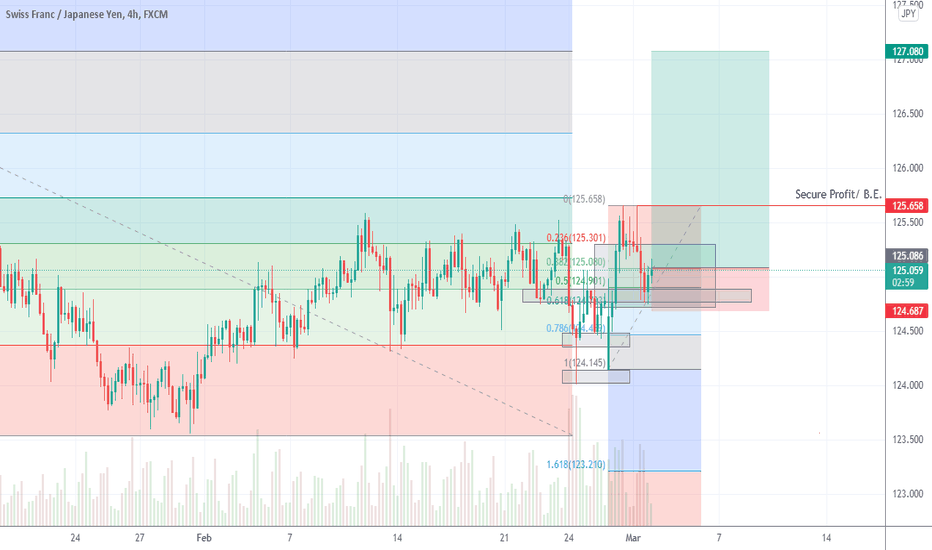

CHFJPY potential for bounce | 7th MarchPrice near buy entry price of 124.297 in line with 100% Fibonacci projection . Price can potentially bounce from the buy entry level to the take profit level of 125.866 in line with 61.8% Fibonacci projection and graphical swing high. Our bullish bias is supported by the stochastic indicator as it is at support level .

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.

CHFJPY potential for boucne | 7th MarchPrice near buy entry price of 124.297 in line with 100% Fibonacci projection. Price can potentially bounce from the buy entry level to the take profit level of 125.866 in line with 61.8% Fibonacci projection and graphical swing high. Our bullish bias is supported by the stochastic indicator as it is at support level.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.

Bullish on CHFJPYDear people of tradingview, it has been a long time I didnt publish an idea on this website. Here an analysis with a high probability of profit, but this is not an incitation of taking a trade, only an analysis of mine. The resistance has been very respected until today, with a break-out and a retest, confirming the current analysis, in my opinion of course. The retest occurs and we have now a clear rejection in H1, conforting the bullish trend. Let's see what happens !

CHFJPY potential for dip! | 1st March 2022Prices are abiding by our daily ascending trendline and at a strong resistance at our sell entry. We see the potential for a dip from our sell entry 125.325 in line with 23.6% Fibonacci retracement towards our Take Profit at 124.405 in line with 78.6% Fibonacci retracement. RSI are at levels where dips previously occurred.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.

Chfjpy weekly Analysis Hello guys, this pair will be one of the pairs i will be taking on my swing account as it presents good buying opportunity.

After price retraced nicely on the weekly timeframe, price is expect to continue with it’s uptrend and this presents another opportunity for a buy using good risk/reward ratio. I strongly believe technically this pair will do well this week.

Possible trend shift in CHFJPY – going long Signal ID: 79351

Time Issued: Thursday, 10 February 2022 17:00:16 GMT

Status: open

Entry: 125.357 - 125.671

Limit: N/A

Stop Loss: 124.887

The Tidal Shift Strategy has just bought CHFJPY at 125.514. The system recommends entering this trade at any price between 125.357 and 125.671. The signal was issued because our Speculative Sentiment Index has hit its most extreme negative level for the past 145 trading hours at -14.365, which suggests that the CHFJPY could be trending upwards.The 14-period Average True Range on a daily chart is 0.125, so the stop loss has been set at 124.887. This stop loss order is a trailing stop that will move up as the market moves up. There is no profit target for this strategy. We expect to be closed by the stop loss.Tidal Shift is a trend trading strategy that aims to catch shifts in trend using trader sentiment as an indicator. The strategy looks to buy when the Speculative Sentiment Index reaches its lowest value for the past 145 trading hours, and looks to short when it reaches its highest value for the past 145 trading hours.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.

Possible trend shift in CHFJPY – going long Signal ID: 79351

Time Issued: Thursday, 10 February 2022 17:00:16 GMT

Status: open

Entry: 125.357 - 125.671

Limit: N/A

Stop Loss: 125.199

The Tidal Shift Strategy has just bought CHFJPY at 125.514. The system recommends entering this trade at any price between 125.357 and 125.671. The signal was issued because our Speculative Sentiment Index has hit its most extreme negative level for the past 145 trading hours at -14.365, which suggests that the CHFJPY could be trending upwards.The 14-period Average True Range on a daily chart is 0.125, so the stop loss has been set at 124.887. This stop loss order is a trailing stop that will move up as the market moves up. There is no profit target for this strategy. We expect to be closed by the stop loss.Tidal Shift is a trend trading strategy that aims to catch shifts in trend using trader sentiment as an indicator. The strategy looks to buy when the Speculative Sentiment Index reaches its lowest value for the past 145 trading hours, and looks to short when it reaches its highest value for the past 145 trading hours.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.

CHFJPY Short Opportunity Scalp IntradayWelcome back! Here's an analysis of this pair!

COMMENT BELOW and let us know your thoughts or questions!

**CJ Short Opportunity - top of 4 hr . channel, price in reversal zone, due for correction, wick rejection in key area.

Enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!

Brian & Kenya Horton, BK Forex Academy

CHFJPY bullish bounce | 3rd Feb 2022Price is abiding to the ascending channel on the daily, signifying an overall bullish momentum. We can expect price to push higher up from the pivot level in line with 38.2% Fibonacci retracement and graphical overlap support towards take profit level in line with 78.6% Fibonacci rertracement and 100% Fibonacci projection . Our bullish bias is further supported by the MACD indicator where the MACD line is above the signal line.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.