CHF/USD – Rising Wedge Breakdown | Bearish Setup The CHF/USD (Swiss Franc to US Dollar) 15-minute chart is currently displaying a classic Rising Wedge Pattern, which is widely recognized as a bearish reversal pattern. This setup signals weakening bullish momentum and an increased probability of a price breakdown. The chart provides a clear sell trade setup, with key levels including entry, stop loss, and target, making it a structured and well-defined opportunity for traders.

🔹 Key Technical Elements on the Chart

1️⃣ Resistance Level (Sell Zone)

📌 Location: Near 1.1350 – 1.1360

📌 Significance:

This level represents a strong supply zone, meaning sellers have consistently pushed prices down from this area.

Price attempted to break through this zone multiple times but was rejected, reinforcing the bearish outlook.

It serves as the upper boundary of the rising wedge, confirming its role in restricting upward movement.

Traders should be cautious of any false breakouts above this level before confirming a bearish move.

2️⃣ Support Level (Demand Zone)

📌 Location: Near 1.1295 – 1.1305

📌 Significance:

This level has historically acted as a demand zone, where buyers stepped in to push prices back up.

However, the formation of the rising wedge suggests weakening demand at this level.

Once the price breaks below this support zone, it confirms a bearish trend continuation.

3️⃣ Rising Wedge Pattern (Bearish Setup)

📌 Pattern Characteristics:

The rising wedge is a bearish continuation pattern that typically signals an upcoming sell-off.

Price moves inside a narrowing upward-sloping range, where buyers lose strength while sellers gradually gain control.

The lower trendline (dotted black line) has been providing support, but as price struggles near resistance, a breakdown becomes likely.

Once price breaks below the wedge, the pattern confirms a strong bearish move.

📌 Why Is This Important?

This pattern indicates that buyers are losing momentum, and a shift toward bearish control is taking place.

The expected move is a sharp downward breakout, leading to lower price levels.

4️⃣ Trendline Support (Breakdown Confirmation)

📌 Location: The dashed black line below price action

📌 Significance:

This trendline acted as a rising support, keeping price within the wedge.

A clean break below this trendline confirms the bearish breakout.

The breakdown is expected to be followed by increased selling pressure and higher trading volume.

📉 Bearish Trade Setup (Short Position Strategy)

Based on the rising wedge breakdown, traders can consider the following sell trade setup:

✅ Entry Point: Sell below 1.1325 (Confirm breakdown with volume)

✅ Stop Loss: Above 1.1356 (To avoid false breakouts)

✅ Target 1: 1.1295 (First support level)

✅ Target 2: 1.1275 (Deeper downside potential if momentum continues)

🛠 Trade Rationale (Why Take This Trade?)

🔸 Bearish Price Action → Price is rejecting resistance and forming a lower high, signaling weakness in the uptrend.

🔸 Pattern Confirmation → The rising wedge has a high probability of breaking downward, leading to a sharp decline.

🔸 Risk-Reward Ratio → The setup provides a favorable risk-to-reward ratio, as traders can manage risk efficiently by placing a stop loss above resistance.

🔸 Volume Analysis → If selling volume increases upon breakout, the move becomes more reliable.

📊 Market Outlook & Final Thoughts

🔹 Bearish Scenario:

If price breaks below 1.1325, expect a strong decline toward 1.1295 and potentially lower.

A sharp move downward could accelerate selling pressure, targeting 1.1275 in an extended move.

🔹 Bullish Reversal Risk:

If price closes back above 1.1356, the bearish setup is invalidated.

Traders should exit shorts if price reclaims the resistance level.

🚨 Final Verdict: Bearish Breakdown Expected!

📉 Short Setup Activated – Targeting 1.1295 🚀

📊 Watch for Volume Confirmation Before Entering!

Chfusdshort

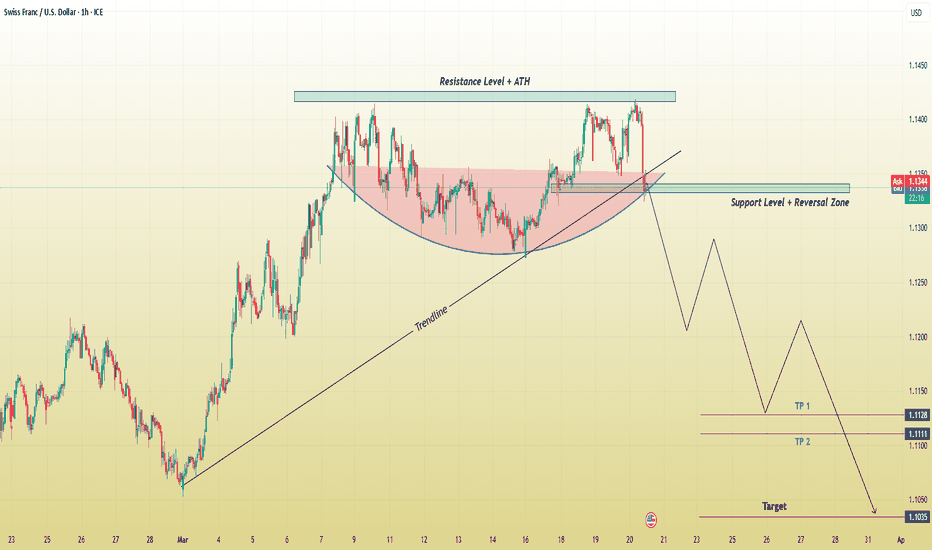

CHF/USD Bearish Reversal: Trendline Break Strong Sell-Off!his CHF/USD (Swiss Franc/U.S. Dollar) 1-hour chart showcases a bearish trading setup, signaling a potential downside move after a failed breakout at a key resistance level. Below is a comprehensive breakdown of the chart, highlighting key technical elements, potential trade setups, and risk management considerations.

1. Identified Chart Pattern – Cup & Handle (Failed Breakout)

The chart initially formed a Cup and Handle pattern, a bullish continuation setup where:

The rounded bottom (cup) indicated accumulation and a gradual shift in trend from bearish to bullish.

The handle consolidation represented a minor pullback before a potential breakout.

However, the pattern failed to hold its bullish momentum. Instead of continuing higher, the price was rejected at the resistance level (ATH – All-Time High), signaling a shift in sentiment.

2. Key Technical Levels

Resistance Level + ATH (All-Time High)

The price reached a significant resistance zone (marked in blue), aligning with an all-time high (ATH) level.

Multiple rejections at this level indicate strong selling pressure, making it a potential distribution area where smart money is offloading positions.

Support Level + Reversal Zone

After rejection from the resistance, the price retraced to a critical support zone, previously acting as a demand area (buyers stepping in).

A break below this level confirms bearish momentum, increasing the likelihood of further downside movement.

Trendline Break – Bearish Confirmation

The trendline (marked in black) represents the primary uptrend support that guided price movement.

The break below this trendline signals a loss of bullish strength, increasing the probability of a trend reversal rather than a continuation.

3. Projected Price Movement – Bearish Scenario

Given the trendline break and rejection from resistance, the chart suggests a bearish wave with the following expectations:

A retest of the broken trendline and support zone before continuing downward.

Lower highs and lower lows formation – confirming a new downtrend.

A potential drop towards key downside targets (marked as TP1, TP2, and the final target).

Take Profit (TP) Targets:

✅ TP1 (1.1128): A minor support level where price may find temporary buying interest.

✅ TP2 (1.1111): A more significant support area that previously acted as demand.

✅ Final Target (1.1035): The ultimate downside objective, aligning with a major support zone and historical price action levels.

Stop-Loss Placement (SL):

📍 Above the broken trendline OR the recent swing high, ensuring protection against false breakouts or retracements.

4. Trade Execution & Risk Management

Entry Strategy (For Short Positions)

🔹 Aggressive Entry: Enter short immediately after the support zone break.

🔹 Conservative Entry: Wait for a retest of the support-turned-resistance area for confirmation before shorting.

Risk-Reward Ratio Consideration:

A properly placed stop-loss above resistance ensures a favorable risk-to-reward ratio.

Ideal ratio: 1:2 or better, meaning potential reward should be at least twice the risk.

5. Market Sentiment & Possible Alternative Scenario

While the primary outlook is bearish, traders must remain flexible and monitor price action closely:

If price reclaims the support zone and breaks above resistance, it invalidates the bearish setup, shifting momentum back to bullish.

A sustained close above the trendline could trap early sellers, leading to a short squeeze rally back toward resistance.

6. Final Thoughts

🔹 Bearish Bias: This setup favors downside movement due to trendline break, resistance rejection, and market structure shift.

🔹 Key Levels to Watch: Support zone retest, trendline confirmation, and target levels.

🔹 Risk Management is Essential: Using stop-loss protection and proper trade sizing to mitigate potential losses.

Conclusion: High-Probability Bearish Setup

🚀 The CHF/USD pair has shifted to a bearish structure after failing to break its ATH resistance. The breakdown of the trendline and key support level suggests a strong sell-off towards the 1.1035 target. Traders should look for short opportunities on pullbacks while managing risk effectively.

Would you like me to refine or simplify any part of this analysis for your TradingView post? 📉🔥

CHF/USD Trading Idea – Bearish Reversal from Key ResistanceThis CHF/USD chart presents a compelling bearish setup, suggesting that the pair may be headed for a decline after facing strong resistance. The price action has followed a technical breakout and retest pattern, with a clear rejection from a well-defined resistance level.

Traders looking for short-selling opportunities should take note of the key price zones, support levels, and overall market structure before making a move. Let’s break it down in detail.

🔍 Chart Breakdown: What’s Happening?

1️⃣ Falling Wedge Breakout & Bullish Push

The price was consolidating inside a falling wedge, a pattern that typically signals an eventual breakout to the upside.

The breakout led to a strong bullish move, pushing the price toward a well-established resistance zone around 1.1414.

After breaking out, the pair made a significant upward run before stalling at this key resistance.

2️⃣ Key Resistance Level Holding Strong

The price touched the resistance zone but failed to break above it.

This rejection indicates that sellers are stepping in, absorbing the buying pressure.

The market is showing early signs of bearish momentum, hinting at a potential downtrend.

3️⃣ Projected Bearish Move: Lower Targets in Sight

If the current rejection holds, the price is likely to fall toward the nearest support levels:

✅ TP 1 (Take Profit 1): 1.1271 → First major support level, likely to be tested soon.

✅ TP 2 (Take Profit 2): 1.1201 → A deeper retracement if selling pressure increases.

✅ TP 3 (Take Profit 3): 1.1055 → Final downside target if the bearish trend extends further.

4️⃣ Stop Loss Placement – Risk Management

To manage risk, the ideal stop loss should be placed slightly above the resistance level at 1.1414.

This protects against potential false breakouts and unexpected market shifts.

📉 Trade Strategy – How to Approach This Setup?

🔸 Entry Point: Look for a confirmed rejection of the resistance level (e.g., bearish candlestick patterns like engulfing, shooting star, or pin bars).

🔸 Stop Loss: Place above 1.1414 to avoid getting caught in a short squeeze.

🔸 Take Profit Targets:

First TP at 1.1271

Second TP at 1.1201

Final TP at 1.1055 for extended downside moves

⚠️ Important Notes for Traders:

✔ Wait for Confirmation: Don’t rush into a short trade. Look for a strong bearish candle closure or a retest before entering.

✔ Be Aware of News Events: Economic releases, interest rate decisions, and major USD-related news can impact price movement.

✔ Monitor Market Sentiment: If USD strengthens, this setup is even more likely to play out.

🧐 Final Thoughts – High Probability Short Setup?

✅ Why This Trade Looks Strong:

The technical pattern is playing out perfectly, with a clear resistance rejection.

The risk-to-reward ratio is favorable, with well-defined entry, stop loss, and take profit levels.

The overall market structure supports a potential downside move if price continues respecting resistance.

📢 Bottom Line : If price remains below the 1.1414 resistance, this trade setup could provide an excellent opportunity for short-sellers targeting lower support levels. 🚀 Stay patient and wait for confirmation before pulling the trigger!

CHF/USD 4H Analysis - Potential Bearish Reversal Setup

🔹 Market Structure & Price Action:

The price has been trending upwards inside a rising channel, forming higher highs and higher lows.

Recently, price tapped into a key resistance zone (black box), indicating a potential reversal.

A possible bearish correction could unfold from this level.

📉 Bearish Scenario:

If the price fails to hold the resistance, a bearish rejection could drive price downward.

The first major support target aligns with the previous demand zone around 1.10700.

A further drop could test the 1.09100 support area, as shown in the green zones.

📈 Bullish Alternative:

A break and hold above resistance could invalidate the bearish setup and signal further upside movement.

🔻 Trading Plan:

Sell bias near resistance with confirmations (e.g., rejection wicks, bearish engulfing, trendline break).

Targeting the marked support levels.

Invalidation if price breaks and closes above the resistance.

CHFUSD Double Top on Resistance LevelA potential sell signal on the CHF/USD currency pair has emerged due to the formation of a double top pattern on a resistance level. This pattern indicates a potential reversal of the previous upward trend and suggests that a downward movement could follow. Traders considering this setup may look for a target price of 1.0996 and set a stop-loss order at 1.1567 to manage potential risks.

The double top pattern is characterized by two peaks of similar height, with a trough between them, forming a resistance level. This pattern suggests that the market has attempted to break above the resistance level twice but has failed, indicating a potential shift in sentiment and a possible trend reversal. Traders often see this as an opportunity to enter a short position and take advantage of the anticipated downward movement.

To implement this sell signal effectively, traders may consider entering a short position on the CHF/USD pair once the price breaks below the trough (the support level) between the two peaks. This would confirm the pattern and provide an entry point for the trade. Setting a target price at 1.0996 indicates an expectation of the price moving towards that level.

Looking forward to read your opinion about it!