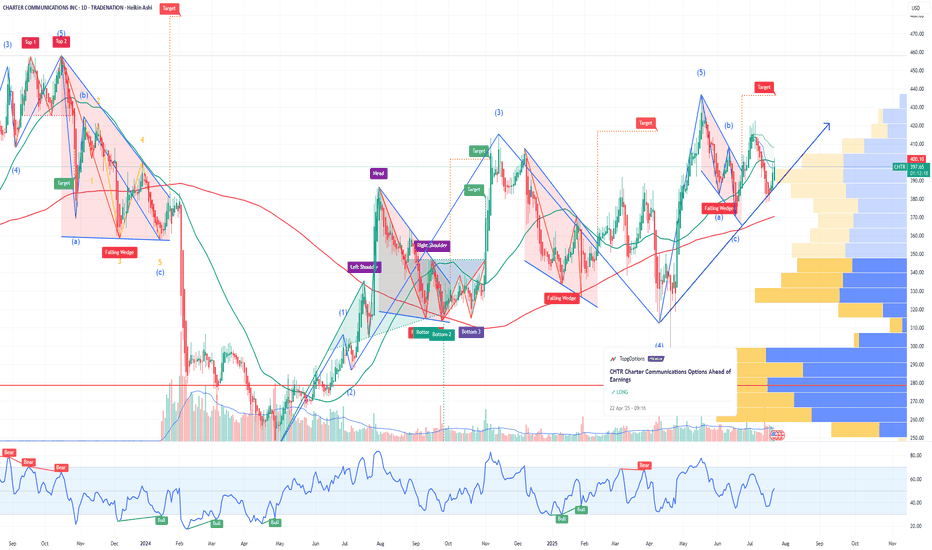

Charter Communications (Revised) | CHTR | Long at $269.50 **This is a revised analysis from December 26, 2024: . My stop was triggered in that original trade after the recent price drop (some gains were taken at 13%, as noted).**

Charter Communications NASDAQ:CHTR stock recently dropped due to a disappointing Q2 2025 earnings report, with earnings per share of $9.18 missing estimates of $9.58 and a larger-than-expected loss of 111,000 residential internet customers. Despite the recent subscriber losses and increased competition, the following factors suggest long-term growth potential:

Network Expansion: Launch of 2x1 Gbps service in eight markets in 2025, boosting competitiveness.

Rural Growth: Rural revenue projected to reach 10–15% of total revenue by 2025.

Cox Acquisition: $34.5B merger expected to close by mid-2026, yielding $500M in annual cost savings by 2028 and enhancing market share.

Mobile and AI Strategies: Strong mobile growth and AI-driven customer service tools to improve retention and efficiency.

Lower Interest Rates: Reduced bowering costs to help with profit margins.

Charter's President/CEO recently grabbed $2.5 million in shares under $300. From a technical analysis perspective, there is an open price gap near $195 that could be of concern in the near-term. I foresee that being closed if the whole market flips or more bad news for the company arises. But, with a P/E of 7x and the industry average being near 13x, I believe NASDAQ:CHTR is a good value at the moment.

Thus, at $269.50, NASDAQ:CHTR is in a personal buy zone with a note of "risk" of a drop near $195 (a second personal entry point if it hits that level before targets are reached).

Targets into 2028:

$330.00 (+22.4%)

$375.00 (+39.1%)

CHTR

CHTR Charter Communications Options Ahead of EarningsIf you haven`t bought CHTR before the previous earnings:

Now analyzing the options chain and the chart patterns of CHTR Charter Communications prior to the earnings report this week,

I would consider purchasing the 387.5usd strike price Calls with

an expiration date of 2025-7-25,

for a premium of approximately $22.55.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Charter Communications | CHTR | Long at $353.00Charter Communications NASDAQ:CHTR has hit the bottom of my historical simple moving average band. It may consolidate for a while around the current price or dip in the near-term (potentially in the $270's), but dropping interest rates will be extremely beneficial for telecommunication companies in the long-term. There are two open price gaps on the daily chart ($700's) that will inevitably close - just a matter of when. With a 90M float and 12% short interest, it's a stock that could get interesting if upward momentum takes over. Earnings and cash flow growth are anticipated through 2027, so at $353.00, NASDAQ:CHTR is in a personal buy zone.

Target #1 = $400.00

Target #2 = $500.00

Target #3 = $600.00

Target #4 = $700.00

Target #5 = $740.00

CHTR Charter Communications Options Ahead of EarningsAnalyzing the options chain and the chart patterns of CHTR Charter Communications prior to the earnings report this week,

I would consider purchasing the 360usd strike price Calls with

an expiration date of 2025-9-19,

for a premium of approximately $22.35.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Charter Communications – Hidden Gem with Up To 85% Upside OpportIf you like this idea, please don’t forget to Boost it.

Fundamental Indicators:

Sector – Communication Services

US Business Cycle Stage – late cycle, when this sector is neutral

Revenue – consistently growing for the past 5 years, with 13% average annual rate

Profits – even more explosive growth, with 26% average annual rate

Net margin – decent 12% which has considerably increased since 2018

P/E – quite low with 13.6 ratio compared to S&P500 with 21 and Communication Services sector with 17.5

Liabilities - debt ratio is at 0.91 which is a little over the norm, Net Debt/ EBITDA is at 4.54 – no major problems with debt

Conclusion – great performance across all indicators apart from the debt ratio, which shouldn’t be a concern at this stage – stock likely to continue growing

Technical Analysis (Elliott Waves):

Main scenario of this idea suggests that we are still observing development of the global growth cycle which is currently at the stage of completing wave 5 of 5 (see higher timeframe graph)

The key elements of this scenario are Contracting Tringle of wave 4 that lasted between 2017 and 2019 which reflects accumulation phase, and the final fifth which is taking a complex shape

This final fifth wave is clearly shaping up by a choppy movement which indicates formation of an Ending Diagonal (see guidelines for Ending Diagonals below)

Waves 1 to 4 have already formed and wave 5 is just about to start

This may present a good long term opportunity with a target of $825 – up to 85% upside

This is a higher timeframe to reflect the full history of Charter Communications and to provide full wave count:

This is the link to the guidelines for Ending Diagonals

What do you think about Charter Communications and its short term prospects?

Also let me know if you would like to see other stocks, indices, Forex or Crypto analysed using Elliott Waves. And BOOST this idea if you like it.

Thanks

Charter Comm lost an earpiece. CHTRGoals 521, 504. Invalidation at 615.

We are not in the business of getting every prediction right, no one ever does and that is not the aim of the game. The Fibonacci targets are highlighted in purple with invalidation in red. Fibonacci goals, it is prudent to suggest, are nothing more than mere fractally evident and therefore statistically likely levels that the market will go to. Having said that, the market will always do what it wants and always has a mind of its own. Therefore, none of this is financial advice, so do your own research and rely only on your own analysis. Trading is a true one man sport. Good luck out there and stay safe

Amazon and my shopping basketDisney, T Mobile, Amazon, Charter Communications, Netflix.

What do all of these companies have in common?

1) They are all >$100B market cap.

2) They all have >10B Gross Profits.

3) They are all at 52 Week Lows.

4) They're all on my shopping list.

Amazon just had it's worst week since 2018 after underperforming the S+P in 2021, but this behemoth isn't going anywhere. I don't need to tell you about the value of it's core ecommerce business that we all use, or the AWS that runs a huge chunk of the internet, the 2nd largest hosting provider with their cloud hosting servicing 42% of the top 10k websites by traffic (Source: BuiltWith), or the success of Prime through logistical brilliance, a successful streaming platform and acquisition of Wholefoods to make the most convenient home shopping platform in the world.

I don't have to tell you about the 31 acquisitions Amazon has made since 2017, 15 of those since 2019.

I don't have to tell you that Amazon is an incredible company that still has a long runway of success and innovation ahead in a growing number of sectors (drones? Yes please!)

That's why Amazon is one of my top choices for investment in 2022.

The business circumstances for each company deserve separate posts in their own right, but to put it simply these companies are the cream of the crop in their industries and we currently have a fire sale.

When the market dips, it's the perfect time to go shopping, and each of these companies deserve serious consideration in your portfolio. Do your own research and make your decisions, but when it comes time to go bargain hunting why not start with the best in class?

A few more stocks I'm looking at meet that >$100B market cap, >$10B gross profits, industry leaders but that are at 6 Month Lows include:

Estee Lauder

Target

Oracle

Blackrock

Salesforce

Alphabet (GOOG)

We can see where the market takes us this week, but I can say with certainty I'll be a buyer on a number of these names this week.

huge insider buys in T with trading planCEO John Stankey and CFO Pascal Desroches bought into AT&T with their new focus on 5G only in hopes of being valued more like a CHTR or TMUS. The insider buys totaled 4.5 million dollars between the two.

CHTR and TMUS have far outperformed T, and pretty much every other stock for that matter over the past year. With the dividend being cut and the massive burden of trying to be a second-tier player in the streaming space, which has been getting more and more crowded and difficult to operate in, should allow them to hyper focus on the growth areas of their business.

This is a huge vote of confidence; granted they were buying into weakness, they still are putting their money where their mouths are and are dead-set on wiping the dust off this old dividend play stock which was more like a bond/fixed income than anything else.

*Personal trading plan* Buy stock and long naked calls expiring October 15th at the $30 strike price to give it plenty of time to come to fruition and begin trading closer to its new peers.

CHTR - DAILY CHARTHi, today we are going to talk about the Charter Communications Inc and its current landscape.

Charter Communications Inc enters in the spotlight of the market as T- Mobile has announced that John Legere will leave the seat of CEO of the company, been replaced by Mike Sievert in April 2020. The former CEO that has been leading the company since 2012 will remain a member of the board. Its replacement Mike Sievert is the current president and chief operating officer (COO). The transaction period seems set to be smooth as Legere will assist with the acquisition process of its rival company Sprint, that it's controlled by Softbank that also holds control of WeWork, where Legere its quoted to be the new CEO. The acquisition of Sprint (an $26 billion deal) makes the T-Mobile step up its potential of competition in the Telecommunications Sector, possibly imposing a reducing of market share for Charter Communications Inc.

Thank you for reading and leave your comments if you like.

To have access to our exclusive contents, join the Traders Heaven today! Link Below.

Disclaimer: All content of Golden Dragon has only educational and informational purposes, and never should be used or take it as financial advice.

CHTR approaching support, potential bounce! CHTR is approaching our first support at 271.73 (horizontal swing low support, 61.8% Fibonacci extension, 76.4% Fibonacci retracement) where a strong bounce might occur above this level pushing price up to our major resistance at 304.11 (horizontal overlap resistance, 50% Fiboancci retracement).

Stochastic (89,5,3) is also approaching support where we might see a corresponding bounce in price.