$ET $LIT $CIEN $SPY I OptionsSwing WatchlistET 1W I ET has been consolidating above $11.50 for some time. We have bullish unusual options activity betting on a retest of $12 by 10/21. Reports earnings on 08/02!

LIT 1D I Energy stocks and lithium stocks in general have been overperforming the market for the past two weeks. Watching for a breakout from this downtrend.

CIEN 4H I Bullish unusual activity picked up on our scanner. Possible breakout from this downtrend and fib extension. They are trading the $54c expiring on 06/03.

SPY 1D I A SPY made a double bottom near $385 last week and ended up breaking from its downtrend in just two sessions. Expecting resistance at $430, and support at $410.

Cien

Double-Top Coming For Ciena?Based on historical movement, the trough could occur anywhere in the larger red box. The final targets are in the green boxes. The pending top should occur within the larger green box as has been the historical case. Half of all movement has ended in the smaller green box. In this instance, the signal indicated BUY on February 15, 2022 with a closing price of 68.53.

If this instance is successful, that means the stock should rise to at least 69.51 which is the bottom of the larger green box. Three-quarters of all successful signals have the stock rise 8.261% from the signal closing price. This percentage is the bottom of the smaller green box. Half of all successful signals have the stock rise 17.521% which is the end point of the black dotted arrow. One-quarter of all successful signals have the stock rise 27.504% from the signal closing price which is the top of the smaller green box. The maximum rise on record would see a move to the top of the larger green box. These are the same concepts for the levels in the red boxes as well.

The ends/vertical sides of the boxes are determined in a similar fashion. The peak of the rise can occur as soon as the next trading bar after signal close, while the max rise occurs within the limit of study at 35 trading bars after the signal. A 1% rise must occur over the next 35 trading bars in order to be considered a success. Three-quarters of successful movement occur after at least 9 trading bars; half occur within 20 trading bars, and one-quarter require at least 31 trading bars.

The black dotted arrow represents median historical movement. Medians are a good metric, but they are just one of many I use when forecasting future movement.

As always, the stock could decline the very next bar after the signal without looking back (therefore the red boxes would not come into play) or the stock may never decline (and the green boxes may never come into play).

CIEN ER Gap Fill coming?

$CIEN is looking for gap fill. Beat Q3 ER but COVID guidance tanked the price.

Comparing to $CSCO who MISSED ($0.51 vs $0.70 EPS) their last ER Nov. 12 but gapped up.

$CIEN may gap up for similar reasons if the market sentiment is bullish around the ER.

Reminds me of $FSLY chart which is also looking to fill the gap.

The day of the ER seems to coincide with when NDX had the Sept 2020 correction, so this name seems to have been unfairly punished.

$CIEN has stronger relative strength vs NDX, so once we start filling the gap with higher relative volume, the price action may be faster than normal $1.21 ATR

Market is melting up and $CSCO popping on ER miss could be a preview of what will happen to this name.

Lowered expectation and over reaction on the pull back may help this name to pop.

Play - Bullish

Looking for consolidation and to cool off oversold RSI on Daily and 4Hr for the breakout into the gap.

Selling Credit put spread leading up to the ER for IV crush.

Dec. 18, 2020

$43-$41 credit put spread (currently 0.44 Cr for $200 margin)

Following ER, go long if reaction is positive and above $47.05

Jan 15, 2021 Call $47 (currently most liquid)

PT: $50, $55, $58

Company Profile

$CIEN is a challenger to $CSCO

Ciena Corp is a network strategy and technology company. It provides network hardware, software, and services thatsupport the transport, switching, aggregation, service delivery

and management of video, data, and voice traffic on communications networks

The sectoris outperforming the market thus farin 2020, with a gain of 20.9%. It also

outperformed in 2019, with a gain of 48.0%, and in 2018, with a loss of 1.6%.

-Dec 2, 2020

CIEN trades at 14.6-times our FY20 non-GAAP EPS forecast

and at 14.9-times our FY21 estimate.

- Argus Report, Jim Kelleber CFA

Sept 8th, 2020 - BUY

CIEN Week of 11/16What I love about CIEN for the week of 11/16.

1) Broke an old resistance point of $43.27 and retested it as support.

2) Double Bottom Breakouts are my favorite.

3) Up-trending Higher Highs.

4) HUUUGGGEE 25-30% Gap to fill

Im actually holding this over the weekend Hoping for a gap up on Monday. Earnings is less than a month away and run up is expected.

As always leave your comments and corrections below.

Dav-O Setup (Papertrade)Entertainment Purpose only, not trading advice, DYOR

*Enter at confirmation of double bottom at daily close above wick at $40.40.

*Stop Loss at 2 ticks below tail of double bottom, $38.15.

*Sell 1/2,my position at $45.46, move remaining to scratch.

-If internals remain strongly bullish, employ 3 lows-highs stop management tool to keep feeding the market and taking profit.

Another tidbit. There are many significant fundamental factors looming, Covid, elections in the US, and other geo-political events around the world. A big enough fundamental event could throw the TA out the window.

Now we can start shorting earnings (reposted with proper chart)Take a look at CIEN and PD today, dropped right back into pre-COVID trading range.

Appears the zero interest rate pump is finally over, we can finally start looking for stocks to short on earnings . Look for stocks that have melted up but don't have the earnings to back it up.

Expect a lot of stocks to drop to pre-COVID levels. Not all tech stocks though, COVID has changed the way some companies do business. Certainly there will be more video conferencing and working from home even after a vaccine comes out, and PPE sales will be higher than pre-COVID levels, etc. But I think the parabolic trajectory is over.

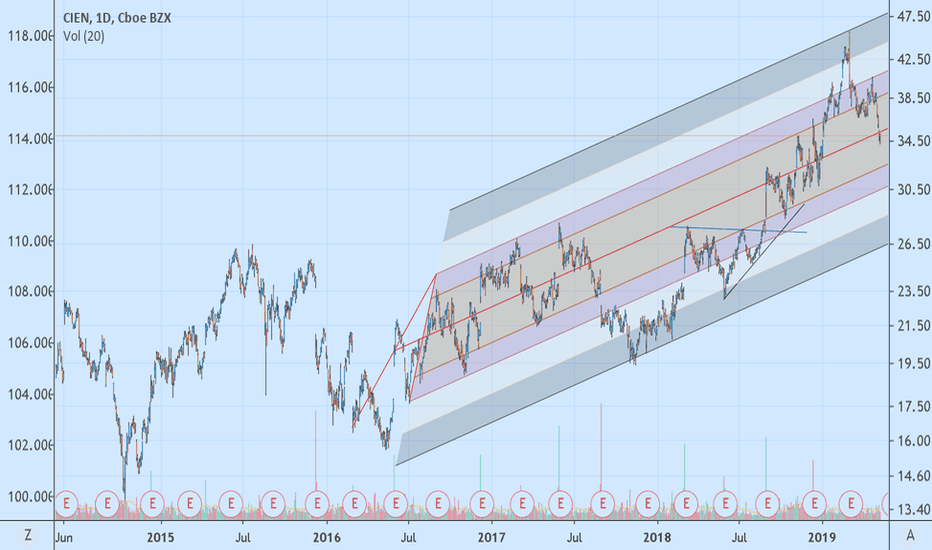

CIEN Trend Analysis with Modified Pitch ForkAlthough the short term signal is SHORT, look for a reversal to LONG around $31.

When using Modified Pitchforks, it's important that the projected lines provide multi-sigma coverage of the linear regression slope. In the case of CIEN, a Modified Pitchfork from the 2017 lows provides almost perfect symmetry and gives the trader several levels to trade Ciena. It's important to note CIEN had been in a flat range since 2002, however, it's a very wide range from $10 to $40, with two outliers that extend the range to $50 (1/03-1/04) on the high-end of the range and $5 on the low-end of the range (11/08-02/09).

Once a leader in networking hardware, Ciena lost tremendous market share to Motorola Solutions (MSI) , Arista ANET and Cisco CSCO by not recognizing the importance of 4G early enough. That mistake led them to invest heavily in 5G and the company is benefiting from this as it emerges as a potential leader in the crucial migration to 5G. With US sanctions pressuring their lead international competitor, Huwei, Ciena is poised for a massive repricing of its market cap, which at $5.5B ranks it amongst the smallest amongst its peer group: MSI: $25B, ANET: $20B, CSCO: $232B. CIEN's market cap is roughly equal to Lumentum LITE ($4.9B) but the latter trades at a PE of 130 compared to CIEN's PE of 23. If CIEN was priced at the same earnings multiple as LITE, the stock would be trading around $200/sh.

For a long position, look for a convergence of technical zones. Looking at a monthly chart, you'll see that the high end of 2010-2018 range is $30. The 50p EMA is crossing above the 100p EMA and the 24p EMA crossed above both slower EMA's last October.

On the weekly scale, the 100p EMA is at $30 with the 200p EMA just below around $27.

On the daily scale, a Fibonacci fan of the May 2018 to March 2019 move projects the 3rd fan line around $32, with prices presently hugging the 2nd fan line at $35, which also coincides with the 200p EMA. RSI is close to penetrating the lower band, confirming the stock is getting oversold, but there is still downside left before CIEN finds a floor. When it does, load the boat.

I also use a proprietary short term price predictor overlaid against a linear regression slope. When the predicted price forecast moves above the linear regression slope, it's generally a good time to step in. To create a similar 'indicator', you can use a Time Series Forecast (similar to a MA) with a periodicity of 9 overlaid against a Linear Regression Indicator with a periodicity of 18. When the TSF crosses above or below the LRI, it's a powerful buy/sell signal, but use the slope itself as a filter to avoid chop in sideways markets and this technique will help you capture very large moves. As of this writing, this method is in a sell signal with the linear regression slope pointing down. Look for when the slope levels off, and the TSF crosses above/below the LRI, as happened in early February just before the move from $38 to $46 for a buy signal, and in late February for a sell signal as the slope leveled off and the crossover occurred near $45 for a short trade that remains open. Using the linear regression slope as a filter for the TSF/LRI crossover would have avoided the chop from March to late April, and then the current short trade would have been validated at the end of April at $40.

Possible reversal for $CIENCIEN is getting closer the the uptrending support, it has bounced on this support multiple times and has followed this pattern the whole entire time.

I'll be keeping an eye on this one, I will be looking to take a position if the stock reacts nicely to the support, hopefully in the 36,5 ish area

THE WEEK AHEAD: CIEN, TLTEARNINGS

CIEN announces earnings on 8/31 (Thursday) before market open.

Due to the size of the underlying, I would probably go short straddle or iron fly here, as a short strangle and/or iron condor really don't pay.

The Sept 8th 24 short straddle is currently paying a 2.35 credit at the door with break evens wide of the expected move, while the Sept 8th 21/24/24/27 iron fly pays 1.92 with break evens right at the expected.

OTHER HIGH RANK/HIGH IMPLIED VOLATILITY PLAYS

There are currently no other liquid high rank/high implied volatility individual stocks with >70%/>50% metrics out there I consider worth playing. For example, ANF and UNIT have the right metrics, but I can't seem to get enough premium out of a setup to make a play in either worthwhile.

Similarly, there aren't any exchange-traded funds at >70%/>35% rank/implied volatility.

LOW RANK/LOW IMPLIED VOLATILITY PLAYS

TLT (9/10) has both low rank and lowed implied volatility such that a low volatility strategy might make sense (i.e., calendar or diagonal). The Oct/Dec 40 delta back/same strike front skip month 125 put calendar (say that three times fast) currently costs a 1.31 debit/contract to put on. Given the fact that you generally shoot for 10-20% max out of these, multiples might be required to make it worthwhile ... .

VIX

I've been waiting for a term structure trade opportunity for months now, but it looks like I'll have to continue doing the same. There aren't any /VX futures that are greater than 16 with 90 days or less to go; the first /VX expiry at greater than 16 is way out in March ... .