CKBUSDT – Still Time to Catch the Move?Some say the move is over.

But when you know what to look for, you see what others miss.

🧠 Smart Entry Zone

The blue box sits right below value on the volume profile, where weak hands panic and smart money prepares.

On the footprint, we’re seeing signs of absorption, aggressive sellers hitting into passive buyers.

CDV is stable, showing strength beneath the surface.

These are not guesses, they're signals built on experience and data.

🎯 What I’m Doing

If price returns to the blue box:

✅ I’ll wait for renewed absorption

✅ CDV must support the move

✅ Structure reclaim confirms the intent

When these align, I don't hesitate.

Because when you have a plan, you're not reacting, you’re executing.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

📊 Simple Red Box, Extraordinary Results

📊 TIAUSDT | Still No Buyers—Maintaining a Bearish Outlook

📊 OGNUSDT | One of Today’s Highest Volume Gainers – +32.44%

📊 TRXUSDT - I Do My Thing Again

📊 FLOKIUSDT - +%100 From Blue Box!

📊 SFP/USDT - Perfect Entry %80 Profit!

📊 AAVEUSDT - WE DID IT AGAIN!

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

CKBUSDT

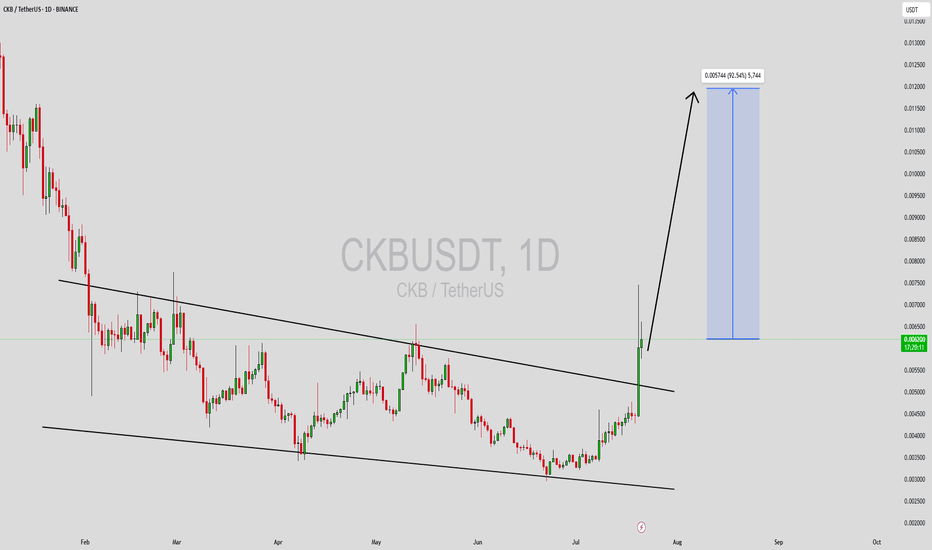

CKB Forming Descending ChannelCKBUSDT is currently showing strong signs of a potential breakout from a descending channel pattern, a formation widely interpreted as bullish once price breaks above the channel's resistance line. This setup, combined with consistent good volume, indicates that the asset has likely found a solid base and is ready for a significant upside move. Based on the pattern's breakout potential and technical projections, a gain of 80% to 90%+ is expected if the breakout confirms with strong momentum.

The descending channel has allowed CKB (Nervos Network) to consolidate after previous highs, cooling off indicators like RSI and setting the stage for a healthier, more sustainable bullish run. Nervos is gaining traction as a blockchain platform focused on interoperability and layer 2 scalability, attracting developer interest and investor attention. This fundamental strength adds weight to the technical breakout scenario.

Market participants should closely watch the price action near the upper boundary of the channel. A daily close above this resistance with strong bullish volume would validate the breakout and open the door for an extended rally. As investor interest grows and trading volume remains elevated, this could serve as a catalyst for CKBUSDT to surge toward the projected targets.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

Nervos (CKB) · 1,877% - 2,608% Profits Potential · New 2025 ATHNervos (CKB) is headed first for the "baseline" to produce some 500% growth. This is the start...

Good morning and thanks for taking the time to read.

I appreciate your continued support.

The last four week we have seen rising prices, this is the start. The baseline level on the chart is actually the first wave fully in and complete. Maybe the first and part of the third if we consider a five up-wave structure.

Within a consolidation period, the baseline would be the end of the bullish action. After reaching this level, CKBUSDT would move back down to produce either a lower low or higher low compared to the start of the bullish move. We are not in a consolidation period anymore, we are entering the 2025 bull market phase so things will be different.

Instead of the baseline being an unbreakable resistance, CKB is set to continue higher. It is set to challenge the last all-time high and produce a new all-time high. The chart here shows that this is possible and highly probable.

The major correction between April 2024 and June 2025 was a classic ABC. This means that we are about to experience a bullish impulse composed of five waves. 1,2,3,4,5. The 2 and 4 are corrections. The action happens contrary to the main move/trend. The 1, 3 and 5 are advances and happen in accordance with the main move.

This should be smooth sailing with long-term growth. I am mapping 1,877% profits potential on the chart but there can be more, much more.

Namaste.

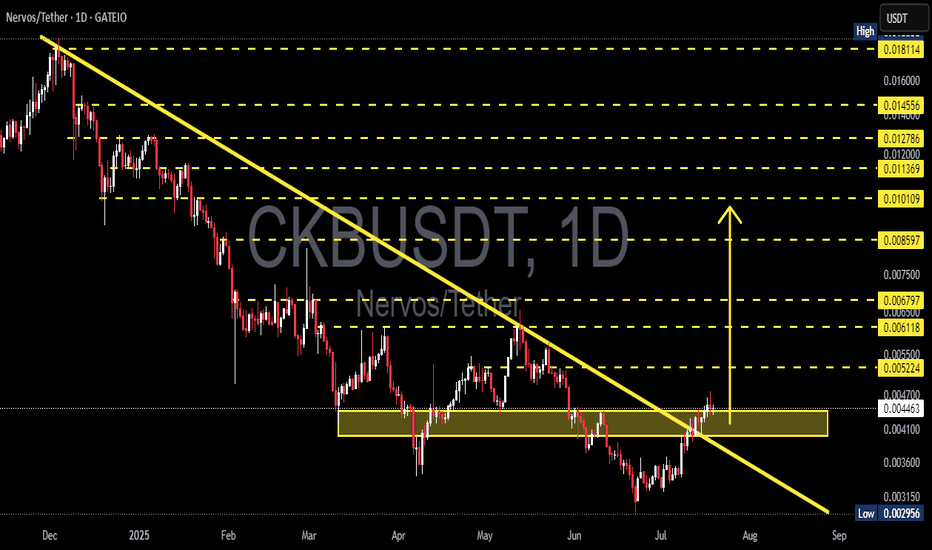

CKB/USDT Massive Breakout Confirmed! Is This the Beginning?🧠 Technical Analysis Overview (1D Chart - Gate.io)

CKB/USDT has officially broken out of a long-term descending trendline that has capped price action since late 2024. This breakout marks a potential trend reversal from a prolonged bearish market into a bullish phase. The breakout occurs alongside a key horizontal accumulation zone (highlighted in yellow), indicating both volume absorption and buyer interest at this level.

📐 Pattern Breakdown:

Main Structure: Descending Trendline Breakout

Supporting Pattern: Horizontal Accumulation / Reaccumulation Box

Confluence Area: The breakout aligns with the top of the accumulation zone, indicating a structural shift.

Psychological Confirmation: The trendline that acted as resistance is now broken, flipping sentiment.

This setup represents a classical technical reversal signal, strengthened by the fact that CKB has consolidated sideways for weeks before breaking upward — a sign of strong base-building.

📊 Bullish Scenario (Primary Outlook):

If the price continues to close above the breakout zone around $0.0044–$0.0047, a multi-level rally could be triggered:

Target Level Zone Type

$0.00522 Minor resistance

$0.00611 – $0.00679 Mid-range liquidity zone

$0.00859 Key supply zone

$0.01010 – $0.01200 Bullish target zone

$0.01455 – $0.01811 Extended rally target

📈 These levels also align with previous support/resistance flips and Fibonacci-based projections.

✅ A successful retest of the breakout zone will add confidence to the bull case.

🐻 Bearish Scenario (Alternative Risk View):

If price fails to hold above the $0.0044–$0.0047 zone and closes back below with increasing sell volume, it may be a false breakout or bull trap. In this case:

Immediate support lies at $0.00360

Major demand and psychological level at $0.00295

Falling back into the downtrend channel would invalidate the bullish thesis

⚠️ Traders should watch for rejection candles, high selling volume, or breakdown retests that fail to recover quickly.

🔎 Key Takeaways:

Trendline Breakout: First time in 8+ months

Accumulation Zone Break: Validated with bullish momentum

Risk Management: Place stop-losses slightly below $0.0044

R/R Potential: Very attractive reward-to-risk toward $0.0085–$0.012 zones

📌 Summary:

CKB is flashing one of its most promising technical signals in recent months. The breakout from a long-term downtrend, combined with a strong horizontal base, makes this setup highly attractive for both swing and position traders.

All eyes are on whether this momentum can be sustained through key resistance levels. If so, CKB may be on its way to reclaiming lost ground with a potential 100%+ upside from current levels.

#CKBUSDT #CryptoBreakout #BullishReversal #AltcoinSeason #TrendlineBreak #TechnicalAnalysis #CryptoTrading #CKBAnalysis #NervosNetwork #CryptoSetup

Where is the rebuy zone for CKB? (2D)From the point where we placed the red arrow on the chart, the CKB correction has begun.

It seems that CKB is in a bearish wave C.

We have identified two entry points for rebuy, where a position can be taken in the spot market.

A daily candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

CKBUSDT Enters Critical Accumulation Zone – Multi-X Rebound🧠 Overview:

After a prolonged downtrend throughout early 2025, CKB/USDT has now returned to a major macro support zone between $0.0026 – $0.0035 — a historically strong accumulation range seen during 2022–2023. This area has previously triggered powerful rallies, and once again, the market is flashing early signs of a potential trend reversal.

📈 Bullish Scenario (Potential Rebound):

1. Well-Tested Demand Zone:

The area between $0.0026 – $0.0035 has acted as a long-term floor multiple times over the past 2 years.

This suggests strong institutional accumulation or smart money positioning.

2. Rising Volume Could Confirm Trend Reversal:

A surge in volume from this range could validate a transition into a markup phase (Wyckoff Theory).

3. Stair-Step Rally Potential:

Immediate resistance: $0.0050 – $0.0058

Mid-term target: $0.0076 – $0.0090

Major breakout zone: $0.0127 – $0.0180

4. Technical Projection:

Formation of a Double Bottom or Inverse Head & Shoulders could signal a strong macro reversal.

If confirmed, price could aim for $0.027 – $0.038+ in the longer term.

5. Market Sentiment & Timing:

Historically, altcoins like CKB rally after Bitcoin dominance cools off or when BTC moves sideways.

📉 Bearish Scenario (Breakdown Risk):

1. Losing Macro Support:

If price breaks below $0.0026, further downside may accelerate toward sub-$0.0020 levels.

2. Fakeouts Without Volume:

A weak bounce from support without volume could indicate a bull trap or short-term relief rally only.

3. Sideways Risk:

Extended consolidation or ranging may continue for weeks if there’s no strong catalyst or market-wide recovery.

📐 Structure & Pattern Insights:

Long-Term Accumulation Range: The current price action mirrors the accumulation phase from 2022–2023, possibly forming a Wyckoff Re-accumulation structure.

Reversal Patterns Forming: With a potential higher low next week, we may see an Inverse Head & Shoulders begin to take shape.

📝 Conclusion:

CKB is currently in a "high-reward, low-risk" zone from a swing trader’s perspective. Price is near macro bottom levels, and any breakout from here could result in multi-fold returns in the medium to long term.

However, confirmation through volume and structure breakout is essential. Without that, the risk of prolonged ranging or deeper correction remains.

#CKBUSDT #CKB #AltcoinSeason #CryptoBreakout #TechnicalAnalysis #InverseHeadAndShoulders #WyckoffAccumulation #BullishReversal #CryptoGems #CryptoSetup

WILL HISTORY REPEAT ITSELF WITH CKBUSD-Cross chain Proof of work crypto, with partnerships notably with Cardano

-This one is right where it was before previous pumps

-If the cycle continues from current position to high will be 1000%

-Not too much more room to fall

-Not too heavy on this one but I'm accumulating

Altcoins Market Pre-2025 Bull-Market Behavior: Double-BullishThis is another pair which we looked at recently, I hope we can all agree.

The only purpose for looking at this chart is to confirm that the Altcoins market bottom is already in. Why is this important? Because if the bottom is in, everything that happens next is growth. If the bottom is in, we can buy without reservation. If the bottom is in, we can relax and hold.

I want you to be peaceful and to rest easy knowing that Crypto, Bitcoin and the Altcoins market, are set to grow very strongly this year. I understand and can see how the market shakes, but this is only short-term action, what we call noise, just a few days the whales trying to remove weak hands.

After this chart we will go back to spotting great entry timing and prices because I will assume that we are on the same page.

This is a fractal. We are looking at Nervos Network. CKBUSDT.

On the left we have a down-wave leading to a reversal/bottom pattern. At the end of the bottom pattern we have a strong high volume day and this leads to a bullish jump. There is also a short-term higher low.

On the right, the same pattern is present. First the down-wave. This down-wave produces a bottom pattern and we have the strong high volume day. The next move is a bullish jump and this is will be followed by long-term growth.

The Altcoins market bottom is in.

This is the best possible timing to enter to buy and hold.

This is a friendly reminder.

Patience is key.

You will be happy with the results.

Rest easy because Crypto is going up.

The 2025 bull-market is only getting started.

We are bullish in March 2025 and beyond.

Namaste.

Is #CKB About to Break Out or Break Down? Key Levels to WatchYello, Paradisers! Is #CKB gearing up for a breakout—or on the edge of slipping into bearish territory? Let's see the latest analysis of #NervosNetwork:

💎After several failed attempts to reclaim higher levels, #CKBUSDT is consolidating within a bullish flag pattern, a classic setup that often precedes strong upward moves. However, the clock is ticking for a decisive breakout above this flag. The next crucial target lies at $0.0162, a minor resistance level that could pave the way for a fresh bullish rally if breached.

💎If the breakout fails, attention shifts to $0.0127, a pivotal support zone where buyers must step in to maintain the bullish outlook. A successful defense of this level, followed by a clean breakout above $0.0162, could restore confidence in the market and trigger a powerful upward move. Such a scenario would significantly enhance the likelihood of CKB/USDT breaking through current resistance and aiming for new highs, solidifying its bullish structure.

💎However, the risks of a bearish breakdown remain very real. If $0.0127 fails to hold, the price could slide toward the $0.0113 demand zone, a relatively fresh level that may attract initial buying interest.

💎A failure to sustain demand at $0.0113 would signal a decisive shift to a bearish outlook, potentially accelerating the sell-off as market sentiment turns increasingly negative.

Stay focused, patient, and disciplined, Paradisers🥂

MyCryptoParadise

iFeel the success🌴

CKBUSDT: Bouncing from Support LevelCKBUSDT technical analysis update

CKB's price has touched a strong support level on the weekly chart and is now bouncing from it. We can expect a bullish move from the current level. On the daily chart, the price has dropped below RSI 30, which is another bullish sign for CKB.

This is a good time to accumulate some CKB.

Target 300%-500%

Regards

hexa

Nervos Network (CKB) Post After Halving + ALT SEASON at Q1 2025Good Day Traders !

First of all for my Opinion $CKB Price Action will get a NEW ATH at Q1 2025, there is an such thing do you know.

1. This is a First Time CKB HALVING

in my theory ALT that still using POW will get a higher price after first halving. (ONLY FIRST) not second halving

2. BTC SEASON ECOSYSTEM

CKB Release RGB+ as a supporting Layer for BTC, Seems CKB will got fresh CAPITAL for this new Project

i already bought CKB at 2022 when Bearish, still hold 50% of my portofolio because already MOONBAG!

BINANCE:CKBUSDT

see you at ATH!!

Cheers

Is #CKBUSDT About to Breakout of Falling Wedge? Get Ready Yello, Paradisers! Is #CKB on the verge of a major breakout, or is a pullback looming? Let's dive into the latest analysis of #NervosNetwork and see what's happening:

💎#CKBUSDT is showing strong potential for a bullish continuation as it hovers above a critical demand zone at $0.0079. We've been keeping a close eye on #NervosNetwork as it navigates through a falling wedge pattern—a formation that typically signals an imminent breakout. The next target in sight? The internal minor resistance at $0.0135.

💎If #CKB holds firm at this resistance, we could be on the brink of a substantial bullish rally, echoing previous powerful market moves. A successful breakout above the key resistance at $0.0135 could open the floodgates, pushing towards higher resistance zones and possibly propelling us even further.

💎But here's where caution is key: if the momentum falters at this critical demand zone, we might witness a pullback to the lower demand area, ranging between $0.0059 - $0.0066.

💎Stay sharp and monitor the $CKB price action closely. A daily close below this demand area could invalidate the bullish scenario and set the stage for further declines.

Stay focused, patient, and disciplined Paradisers.

MyCryptoParadise

iFeel the success🌴

#CKB/USDT#CKB

The price is moving within a bearish channel pattern on the 12-hour frame, which is a strong retracement pattern and was broken to the upside.

We have a bounce from a major support area in green at .008700

We have a tendency to stabilize above the Moving Average 100

We have a downtrend on the RSI indicator that supports the rise and gives greater momentum, and the price is based on it to rise after it was broken upward.

Entry price is 0.011000

The first target is 0.015500

The second goal is 0.019000

The third goal is 0.02230

#CKB BEARISH? A CHANGE OF TREND$CKB, A smart contract blockchain project built on the binance blockchain has pumped over 100% in the last 72 hours due to a strong breakout from the demand zone. The token $CKB is however extremely overbought on a 4HR TF and has also mitigated a very strong supply zone. The disrupt in order flow is another solid confirmation to prove that #CKB has changed bias to a bearish trend. I'm bearish. Check the chart and #DYOR