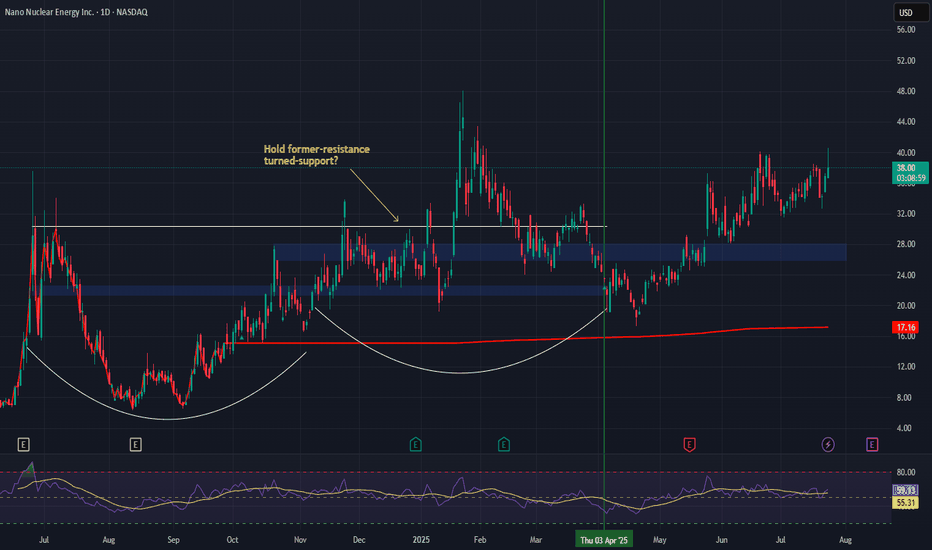

Nano Nuclear (NNE) –Powering the Future of Clean U.S. Energy 🇺sCompany Snapshot:

Nano Nuclear Energy NASDAQ:NNE is a pioneering U.S.-based microreactor company developing compact, modular nuclear power solutions for defense, medical, and national grid applications.

Key Catalysts:

Nuclear Innovation Meets Energy Independence 🔌

NNE is at the forefront of advanced nuclear tech, supporting America’s push toward energy resilience and decarbonization.

Its microreactors are designed for fast deployment, critical for defense bases, hospitals, and remote power needs.

Strong Market Momentum 📈

Since our initial entry on April 3rd, NNE has surged 74%, reflecting rising investor interest in nuclear solutions.

After printing a higher high, the stock is pulling back toward a key support zone.

Policy & Investor Tailwinds 📊

U.S. energy policy is increasingly focused on nuclear as a clean base-load source, giving NNE a strategic edge.

Growing institutional attention on microreactors as scalable, next-gen energy infrastructure.

Investment Outlook:

Bullish Entry Zone: $26.00–$27.00

Upside Target: $58.00–$60.00, supported by innovation, policy alignment, and long-term energy demand.

🔆 NNE is shaping up as a high-conviction play on America’s nuclear energy future.

#NNE #NuclearEnergy #Microreactor #CleanEnergy #EnergySecurity #DefenseTech #GridStability #Innovation #GreenEnergy #NextGenPower #EnergyIndependence

Cleanenergy

“Accumulation, Breakout, Repeat: SBSW’s Time Again?” SBSW | Weekly Chart Analysis

4-Year Cycle | Smart Money Levels | Precious Metals Macro Tailwind

This chart paints a clear picture — Sibanye-Stillwater (SBSW) has followed a reliable 4-year accumulation-to-expansion cycle:

🔹 2015–2016

🔹 2019–2021

🔹 Now shaping up for 2025–2026

Each rally kicked off after institutional accumulation around the $3 level, and once again, we’re seeing the same behavior. History doesn’t just rhyme — it repeats.

🧠 Smart Money Moves

Every major cycle began after price based out near the $3 level. That’s exactly what we’ve just seen — accumulation, basing, and now lift-off. We’ve entered a familiar pattern — the same smart money footprints showing up again.

📊 Technical Breakdown

This is the weekly chart, and we’re now testing the 0.236 Fibonacci retracement level (7.39) drawn from the 2020 high to the recent low.

✅ A weekly close above this level + structure building could confirm the beginning of a long-term leg higher.

📈 Volume Flow Indicator has crossed above the midline for the first time in years, suggesting that real buying pressure is back. That’s a shift in momentum worth noting.

🎯 Key Areas of Interest:

• $10.00 – Volume node + prior S/R

• $12.00 – Fib midpoint + prior pivot

• $14.90 – Confluence zone

These are zones where I’ll be watching for continuation, reaction, or reversal.

🌎 Macro Tailwind: Precious Metals Demand

Platinum and palladium are gaining renewed attention as demand increases in EVs, clean energy, and industrial sectors. SBSW — with its deep exposure to both metals — is positioned as a long-term beneficiary if this trend continues.

Add to that the recent global instability and de-dollarization chatter, and you’ve got a macro backdrop favoring real assets over paper. Precious metals are catching a bid — and SBSW could ride that wave.

🧠 My Position

Started buying $4.00 calls and recently rolled to $5.50s. I’m letting this one develop over time — watching for confirmation and continuation.

(Not financial advice — just sharing my perspective as always.)

🕰️ Cycles matter.

📚 History teaches.

💰 Smart money accumulates before the breakout.

This setup has all the hallmarks of a repeat cycle in progress. I’m locked in.

—

📍 Long-term chartwork, weekly timeframe. Zoom out to see the rhythm.

SBSW | Weekly Chart Analysis

4-Year Cycle | Smart Money Levels | Precious Metals Macro Tailwind

This chart paints a clear picture — Sibanye-Stillwater (SBSW) has followed a reliable 4-year accumulation-to-expansion cycle:

🔹 2015–2016

🔹 2019–2021

🔹 Now shaping up for 2025–2026

Each rally kicked off after institutional accumulation around the $3 level, and once again, we’re seeing the same behavior. History doesn’t just rhyme — it repeats.

🧠 Smart Money Moves

Every major cycle began after price based out near the $3 level. That’s exactly what we’ve just seen — accumulation, basing, and now lift-off. We’ve entered a familiar pattern — the same smart money footprints showing up again.

📊 Technical Breakdown

This is the weekly chart, and we’re now testing the 0.236 Fibonacci retracement level (7.39) drawn from the 2020 high to the recent low.

✅ A weekly close above this level + structure building could confirm the beginning of a long-term leg higher.

📈 Volume Flow Indicator has crossed above the midline for the first time in years, suggesting that real buying pressure is back. That’s a shift in momentum worth noting.

🎯 Key Areas of Interest:

• $10.00 – Volume node + prior S/R

• $12.00 – Fib midpoint + prior pivot

• $14.90 – Confluence zone

These are zones where I’ll be watching for continuation, reaction, or reversal.

🌎 Macro Tailwind: Precious Metals Demand

Platinum and palladium are gaining renewed attention as demand increases in EVs, clean energy, and industrial sectors. SBSW — with its deep exposure to both metals — is positioned as a long-term beneficiary if this trend continues.

Add to that the recent global instability and de-dollarization chatter, and you’ve got a macro backdrop favoring real assets over paper. Precious metals are catching a bid — and SBSW could ride that wave.

🧠 My Position

Started buying $4.00 calls and recently rolled to $5.50s. I’m letting this one develop over time — watching for confirmation and continuation.

(Not financial advice — just sharing my perspective as always.)

🕰️ Cycles matter.

📚 History teaches.

💰 Smart money accumulates before the breakout.

This setup has all the hallmarks of a repeat cycle in progress. I’m locked in.

📍 Long-term chartwork, weekly timeframe. Zoom out to see the rhythm.

🛑 Invalidation below $5.50 — no structure, no conviction, I’m out.

If SBSW breaks back below the $5.50 level with high volume and fails to reclaim it quickly, that would invalidate the current breakout structure and suggest this move was a false start. I'd reassess the cycle thesis if we revisit the $4 range with no buyer defense.

Please feel free to comment and let me your opinion

Why the Sudden Surge in Soybean Oil Prices?Recent sharp increases in Chicago soybean oil prices reflect a confluence of dynamic global and domestic factors. Geopolitical tensions, particularly those impacting crude oil markets, have played a significant role, as evidenced by the recent surge in Brent crude futures following events in the Middle East. This volatility in the broader energy complex directly influences the cost and strategic value of alternative fuels, positioning soybean oil at the forefront of this market shift.

A primary driver of this ascent is the transformative policy initiatives from the U.S. Environmental Protection Agency (EPA). The EPA's proposed Renewable Fuel Standard (RFS) volume requirements for 2026 and 2027 represent an aggressive push towards increased domestic biofuel production. These mandates, significantly exceeding previous targets, aim to bolster U.S. energy security and provide substantial support for American agriculture by boosting demand for soybeans and their derivatives. Key changes, such as the transition to RIN equivalents and reduced RIN costs for imports, are designed to further incentivize domestic consumption and reshape market dynamics.

This policy-driven demand fundamentally reorients the U.S. soybean oil market, causing Chicago Board of Trade futures to increasingly reflect internal American forces rather than global trends. This necessitates a shift in focus for traders towards physical market prices in other regions for international insights. The market has reacted swiftly, with notable increases in futures prices, a surge in open interest, and record trading volumes, indicating strong investor confidence in soybean oil's role within this evolving landscape. Concurrently, the new mandates exert pressure on imported biofuel feedstocks, further solidifying the emphasis on domestic supply.

Ultimately, the rise of soybean oil prices signifies more than just market speculation; it marks a pivotal transformation. It positions soybean oil as an essential commodity within the U.S.'s energy independence strategy, where robust domestic demand, shaped by forward-looking policy, becomes the prevailing force. This transition underscores how intertwined agricultural markets now are with national energy objectives and global geopolitical stability.

GE Vernova Inc. (GEV) – Powering the Global Energy TransitionCompany Overview:

GE Vernova NYSE:GEV is becoming a cornerstone of the global clean energy shift, providing advanced power generation, transmission, and renewable energy technologies that are now mission-critical for national energy strategies.

Key Catalysts:

Explosive Electrification Growth ⚡

Grid Solutions backlog tripled YoY, driven by demand for modern, resilient, and clean grids.

HVDC & FACTS technologies place GEV at the forefront of a global multi-decade grid overhaul.

Recurring Revenue from Wind Repowering 🌬️

1 GW of upgraded capacity in 2024 under the Repower program.

GEV operates the most widely installed wind platform in the U.S., giving it dominance in the high-margin retrofit market.

Strategic Manufacturing Expansion 🏭

$600M+ in investments across Florida and India expand capacity and de-risk the supply chain.

Supports global demand from infrastructure stimulus and decarbonization mandates.

Investment Outlook:

Bullish Case: We are bullish on GEV above $410.00–$415.00, as clean energy investment accelerates.

Upside Potential: Price target of $600.00–$610.00, backed by order momentum, retrofit leadership, and global energy reform.

🔋 GE Vernova – Electrifying the Future. #GEV #CleanEnergy #GridModernization #WindPower

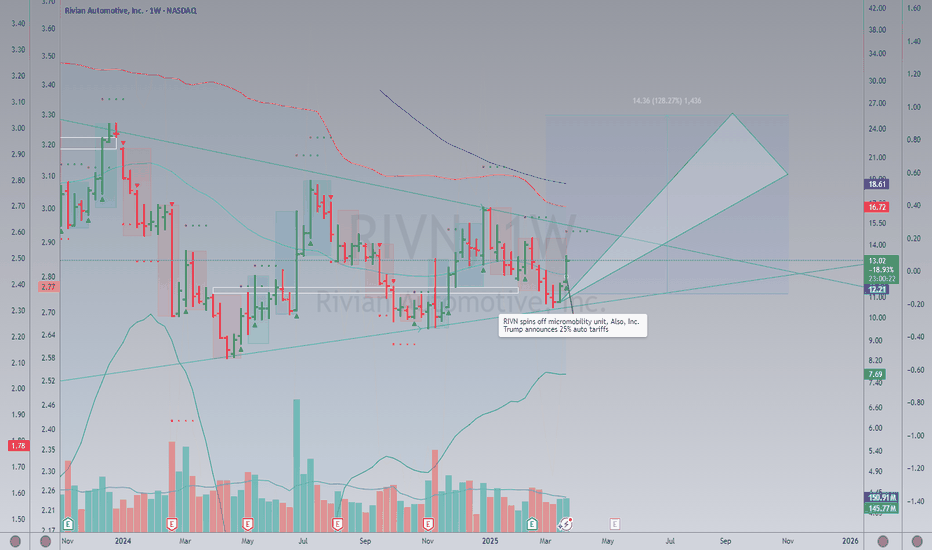

Rivian Kicking Off Potential UptrendHey, all. I'll get down to it. Obviously NASDAQ:RIVN has been an incredibly tough stock to own. Fake out after fake out. It has been brutal - unless you have been nimble enough to buy the dips and sell the rips.

I would like to posit, however, that NASDAQ:RIVN is going to start marching back higher here over time. In the signal system I have been taught via the T@M strategy, Rivian is putting in a range expansion to the upside on the weekly time frame. If you take the range of the past monthly consolidation period, attach it to the "mode" (or central zone of the consolidation range), it gives you a target of $25 over the next few months. Now, whether this is another fake out just to reverse on us... again... remains to be seen of course. It is early in the idea. But potentially offers a decent risk/reward position here.

I just do not see Rivian really going away at all and, if they can keep refining their business, they could see some success going forward. Anyway, hope you enjoy this idea! As always, position carefully as the market is risky business.

Including the Daily Chart below for your reference as well.

Clean Energy: The Power That Will Shape Our FutureEnergy is the lifeblood of civilization—it fuels innovation, sustains economies, and powers every aspect of modern life. As demand skyrockets, we face a crucial decision: continue relying on fossil fuels that damage our planet or embrace clean energy solutions that pave the way for a sustainable future.

Despite geopolitical tensions, trade wars, and shifting policies around ESG and the Paris Climate Agreement, the clean energy sector remains unstoppable. While industries like digital finance, artificial intelligence, robotics, space exploration, quantum computing, and cloud infrastructure are experiencing unprecedented growth, they all hinge on one fundamental resource: energy. Without it, progress would stall.

Yet, as we race toward technological advancement, one truth remains: our planet’s well-being is inextricably linked to our energy choices. Sustainability is not just an option—it is a necessity.

The Four Elements of Clean Energy

Nature has already gifted us four forces of life—the sun, wind, water, and earth—each holding the potential to drive a clean energy revolution.

Solar Energy ☀️: Every hour, the sun showers Earth with more energy than humanity consumes in a year. Advances in photovoltaic technology are making solar power more efficient and affordable than ever. Countries leading the solar revolution—like China, Germany, and the U.S.—are setting a precedent for global energy transformation.

Wind Energy 🌬️: Harnessing the wind is one of the most effective ways to generate clean electricity. Offshore wind farms are growing at an exponential rate, proving that sustainable energy is not limited to land. The beauty of wind energy? It is limitless.

Hydropower 🌊: Water is power. Hydroelectric dams, tidal energy, and wave power offer continuous energy supply, proving to be one of the most reliable renewable sources available.

Geothermal Energy 🌍: Deep within the earth, heat energy is waiting to be tapped. Countries like Iceland have perfected the art of using geothermal power for electricity and heating, demonstrating that sustainable energy is not just a dream—it’s already reality.

Overcoming Challenges: The Resilience of Clean Energy

Yes, clean energy faces obstacles—tariff disputes, political instability, and corporate resistance. But progress is relentless. Costs of renewables are dropping, supply chains are adapting, and governments know that fossil fuels will not sustain global economies forever.

The Paris Climate Agreement keeps nations accountable, pushing for policies that support decarbonization and incentivize clean energy innovation. Meanwhile, ESG-driven investors are demanding sustainable business practices, forcing corporations to rethink their energy strategies.

Even legacy industries like oil and gas are shifting toward renewables, investing billions in solar, wind, and hydrogen technology. This is not just a trend—it is the future.

A Future Powered by Clean Energy

Imagine cities illuminated by solar grids, transportation fueled by hydrogen, and industries driven by wind power. Clean energy is not just about reducing emissions—it is about progress, prosperity, and survival.

The global energy demand is rising, but so is innovation. If space exploration, AI, robotics, and quantum computing are to thrive, clean energy must be at the core. And it will be—because the world is waking up to its necessity.

A cleaner, brighter future is not wishful thinking—it is already unfolding. The only question is: will we accelerate the transition, or hesitate in the face of change?

The time to act is now.

NASDAQ:CLNE NASDAQ:CETY NASDAQ:ICLN NASDAQ:CELS NASDAQ:GWE AMEX:PBD TVC:DXY

Celsius Holdings (CELH) – Fueling the Wellness Energy RevolutionCompany Snapshot:

Celsius NASDAQ:CELH is a top-tier functional beverage brand, capitalizing on the explosive growth of health-conscious energy drinks. Known for its clean-label, metabolism-boosting formulas, CELH is a favorite among fitness enthusiasts and wellness-driven consumers.

Key Catalysts:

Strategic Acquisition – Alani Nu 🎯

Expands CELH’s reach into the women-centric energy drink market

Enhances brand diversity and strengthens product portfolio

Accelerates penetration into lifestyle & wellness channels

PepsiCo Distribution Partnership 📦

Unlocks massive scale and global shelf visibility

Boosts velocity in convenience, grocery, and fitness retail

Strategic alignment continues to fuel international expansion

Clean Energy Demand on the Rise 🌱

Consumers are actively shifting from sugary and synthetic brands to low-calorie, functional alternatives

Celsius delivers on performance + wellness—a powerful consumer value prop

Brand Loyalty & Community 👟

Strong digital engagement with a cult-like following

Supported by fitness influencers, events, and brand ambassadors

Investment Outlook:

✅ Bullish Above: $30.00–$31.00

🚀 Upside Target: $52.00–$53.00

📈 Growth Drivers: New market segments, global scaling via Pepsi, clean-energy trend momentum

📢 CELH: Redefining energy drinks with purpose, performance, and wellness.

#CELH #FunctionalBeverages #CleanEnergy #WellnessTrend

Short- Term Bottom Forming in ICleanICLN could get a bounce in short term from buyers at 11 dollar mark. Longer term trend suggests some more pain for ICLN. However, ICLN's starting to looking oversold on RSI.

Keeping an eye on this. Interested in adding a long when/if price action enters green channel.

Chart Industries (GTLS) AnalysisCompany Overview:

Chart Industries NYSE:GTLS is a leading manufacturer of cryogenic equipment, offering solutions vital for the storage, distribution, and processing of clean energy resources like LNG, hydrogen, and oxygen. The company plays a pivotal role in supporting the global energy transition, addressing the growing demand for sustainable and low-carbon solutions.

Key Growth Drivers

Innovative Clean Energy Solutions:

Hydrogen and LNG Leadership: Chart Industries is at the forefront of clean energy infrastructure, with its cryogenic storage and distribution systems enabling the transition to low-carbon fuels. This expertise positions GTLS to benefit from rising investments in renewable energy and clean fuels.

Proprietary IPSMR® Technology: Chart’s IPSMR® liquefaction technology delivers cost-effective and efficient LNG production, making it highly attractive for major energy players. Key adoption includes:

Woodside Energy's Louisiana LNG Project: A significant endorsement of GTLS's technology and its potential for broader industry adoption.

Global Expansion and Diversified Revenue:

ExxonMobil Collaboration: The agreement with ExxonMobil for the Mozambique Rovuma LNG Project expands GTLS's footprint in international markets and diversifies its revenue base. Such collaborations showcase its engineering expertise and align with global energy majors’ transition strategies.

Broader Market Reach: Chart’s solutions are gaining recognition across multiple geographies, reinforcing its position as a global leader in cryogenic and energy transition technologies.

Alignment with Sustainability Trends:

Decarbonization Demand: With growing regulatory and consumer focus on reducing emissions, Chart’s solutions for hydrogen and carbon capture technologies are poised for sustained demand. The company’s portfolio aligns perfectly with long-term sustainability goals globally.

Strategic Positioning in Clean Energy Ecosystems: Chart is strategically positioned to serve critical energy sectors, including LNG for power generation, hydrogen for mobility, and oxygen for healthcare and industrial applications.

Investment Thesis:

Chart Industries is uniquely positioned to benefit from the global clean energy transition, driven by its cutting-edge technologies, strategic partnerships, and alignment with sustainability trends. Its focus on hydrogen, LNG, and carbon capture enhances its long-term growth potential, supported by increasing capital allocation toward clean energy projects worldwide.

Bullish Case:

Target Price Range: $340.00–$350.00

Entry Range: $180.00–$181.00

Upside Potential: Chart Industries’ advanced solutions and participation in large-scale global projects position it for substantial revenue growth and shareholder value creation in the coming years.

NuScale Power Corporation (SMR) AnalysisCompany Overview: NuScale Power Corporation NYSE:SMR is at the forefront of the nuclear energy revolution, leveraging its cutting-edge small modular reactor (SMR) technology to address the growing demand for clean, reliable energy. With the backing of the U.S. Nuclear Regulatory Commission’s (NRC) certification, NuScale holds a strong first-mover advantage in the nuclear energy space, positioning it for significant growth as global efforts to transition to cleaner energy sources accelerate.

Key Catalysts:

NRC Certification: NuScale is the only SMR company with NRC certification, giving it a significant regulatory and market advantage in deploying its innovative nuclear reactors.

Growing Demand for Clean Energy: As countries worldwide commit to reducing carbon emissions, demand for clean nuclear energy is rising. NuScale’s scalable, safe, and cost-effective SMR technology is well-suited to meet this need.

Data Center Opportunities: In addition to energy generation, NuScale is exploring applications for its SMRs in the data center industry, offering on-site, scalable power solutions that align with the industry's increasing energy demands.

Global Expansion: NuScale's technology appeals to both developed and developing nations as a reliable and safe alternative energy source, with strong international interest in SMR deployment.

Investment Outlook: Bullish Outlook: We are bullish on SMR above $10.50-$11.00, reflecting the company’s first-mover status in the nuclear SMR market and its potential to capture significant market share in both energy and data center applications. Upside Potential: Our target range for SMR is $23.00-$24.00, driven by growth in clean energy adoption and increasing demand for scalable power solutions in high-growth sectors like data centers.

🚀 SMR—Pioneering the Future of Clean, Reliable Nuclear Power. #NuclearEnergy #CleanEnergy #SmallModularReactors

Copper Pulls Back as China Optimism FadesCopper extended the August rebound into autumn and reached three-month highs, helped by the Fed’s jumbo rate cut and massive stimulus from Chinese authorities aiming to prop the economy and the property sector. However the measures do little to address the structural problems and the real estate market is unlikely to return to its former glory, while the lack of follow through on the fiscal front this week caused prior optimism to subside. Furthermore, the Fed has struck a more cautious approach towards further easing and Friday’s strong jobs report supported the reserved commentary. Markets have now priced out previous aggressive bets for 75 bps of cuts this year, aligning with the Fed’s 50 bps projections.

Copper pulls back as a result, threatening the EMA200 (black line) and the 50% Fibonacci of the recent recovery. A breach would pause the upside bias, send the non-ferrous metal into the daily Ichimoku Cloud and expose it to the ascending trend line from the August lows. Deeper correction however does not look easy under the current technical and fundamental backdrop.

There are still hopes for additional Chinese stimulus (potentially within the weekend), while prospects of US soft-landing and easier monetary policies in major economies can support higher prices. So do the AI boom and the green energy transition. Copper tries to defend the EMA200 that maintains its recovery momentum. This will allow it to push again towards 4.791, but we are cautious around further strength at this stage.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 64% of retail investor accounts lose money when trading CFDs with this provider . You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (trading as “FXCM” or “FXCM EU”) (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider . You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763). Please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this video are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed via FXCM`s website:

Stratos Markets Limited clients please see: www.fxcm.com

Stratos Europe Ltd clients please see: www.fxcm.com

Stratos Trading Pty. Limited clients please see: www.fxcm.com

Stratos Global LLC clients please see: www.fxcm.com

Past Performance is not an indicator of future results.

TAN - Invesco Solar ETFSimply go long, it's the future! If the USA doesn't want to increase this ETF by 20 or 30 or 40%, the world will end up on its last legs! NVDA won't save the planet!

ENPH

Enphase Energy, Inc. 10.11%

FSLR

First Solar, Inc. 8.64%

NXT

Nextracker Inc. 7.68%

RUN

Sunrun Inc. 7.10%

3800.HK

GCL Technology Holdings Limited 5.01%

0968.HK

Xinyi Solar Holdings Limited 4.45%

ECV.DE

Encavis AG 4.18%

HASI

HA Sustainable Infrastructure Capital, Inc. 3.71%

SEDG

SolarEdge Technologies, Inc. 3.47%

NEOEN.PA

Neoen S.A. 3.35%

ICLN - ISHARES GLOBAL CLEAN ENERGY ETF - USD Simply go long, it's the future! If the USA doesn't want to increase this ETF by 20 or 30 or 40%, the world will end up on its last legs! NVDA won't save the planet!

ENPH

Enphase Energy, Inc. 7.93%

FSLR

First Solar, Inc. 7.36%

ED

Consolidated Edison, Inc. 6.34%

IBE.MC

Iberdrola, S.A. 6.02%

VWS.CO

Vestas Wind Systems A/S 5.83%

600900.SS

China Yangtze Power Co., Ltd. 4.09%

EDP.LS

EDP, S.A. 4.01%

9502.T

Chubu Electric Power Company, Incorporated 3.81%

ORSTED.CO

Ørsted A/S 3.74%

SUZLON.BO

Suzlon Energy Limited 3.17%

Copper Finds Support at Key Tech LevelsAfter hitting record highs in May, Copper has pulled back and heads towards a losing month, challenging critical tech levels. It has slipped below the EMA200 (black line), into the daily Ichimoku cloud and tests the 38.2% Fibonacci of the advance fromthe 2022 lows. This exposes it to 4.196, but sustained weakness does not look easy, technically nor fundamentally.

Copper already defends the pivotal 38.2% Fibonacci and tries to reclaim the EMA200. Successful effort would reaffirm the bullish bias and create prospects for new all-time highs (5.200). The favorable supply-demand dynamics also point to further upside. The market has tightened significantly as key miners lower their activity this year, while consumption is boosted by the AI boom and the clean energy transition.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading CFDs with this provider . You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (trading as “FXCM” or “FXCM EU”), previously FXCM EU Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading CFDs with this provider . You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763). Please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this video are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed via FXCM`s website:

Stratos Markets Limited clients please see: www.fxcm.com

Stratos Europe Ltd clients please see: www.fxcm.com

Stratos Trading Pty. Limited clients please see: www.fxcm.com

Stratos Global LLC clients please see: www.fxcm.com

Past Performance is not an indicator of future results.

Enphase EnergyThis is a chart of Enphase Energy (ENPH). For those who are not familiar with the company, Enphase Energy develops and manufactures microinverter systems for the solar photovoltaic industry. They are one of the preeminent companies in solar power. Recently, price gapped up on the daily chart following news that Congress would pass legislation to fund sustainable infrastructure projects.

In the above chart, each candlestick represents a 6-month period. Analyzing higher timeframes can often help us determine trend reversals long before they happen. This higher timeframe chart reveals a very peculiar candlestick pattern: the sneaky bearish tri-star pattern. This pattern occurs when three Doji candlesticks form after a bull run. This pattern can warn that a major reversal is coming. See below image.

A bearish tri-star pattern is an insidious topping pattern that Wall Street smart money would love for you to not know about. In short, it appears because Wyckoff distribution is occurring underneath the surface.

While I cannot describe the entirety of Wyckoff distribution in this post, I can say that, in short, Wyckoff distribution is when smart money gradually distributes or sells their shares near the top. The gradual nature of the selloff traps the unsuspecting "weak hands" (mostly small retail traders) who buy while unaware that the bull run is in its final phase. Sometimes, since smart money is especially manipulative, they manufacture a sudden upthrust in price near the end of the Wyckoff distribution, which may be what's happening right now.

This sudden upthrust (UT or UTAD) is a price move above resistance that quickly reverses and closes lower. The upthrust is a test of the remaining demand. It is also a bull trap: It appears to signal the resumption of the bull run but in reality, is intended to trick uninformed breakout traders. A UT or UTAD allows Wall Street smart money to mislead the public about the future trend direction and, subsequently, sell additional shares at elevated prices to breakout traders before the markdown begins. In addition, a UTAD may induce smaller traders in short positions to cover and surrender their shares to the larger interests who have engineered this move.

In my years of trading experience I have seen the above chart many times before, and the result is almost always the same. This chart is in the phase that some of us traders call a "fake out". A fake out occurs when price appears to be breaking out when actually it is just forming an upper wick. This occurs when price has been moving within an ascending wedge and after bearish divergence has occurred on the RSI. The final phase is when the RSI breaks out after bearish divergence and while in overbought territory. Price then pulls back down strongly and a long upper wick forms on the candlestick. In essence, this is just another way of visualizing the upthrust phase of Wyckoff distribution. The final RSI breakout is the UTAD of Wyckoff distribution.

Here's another Trading View user who is apparently seeing the same thing as I am, though this post is from before the current upthrust:

Also worth mentioning is that it is interesting that corporate insiders have been only selling their positions and there has been no reported insider buying for nearly a year (see below). This is not usually predictive of future price action, but it can give a general sense of sentiment among insiders at a company.

So it's worth watching to see if ENPH will reverse downward. Perhaps it will blast through this level and my analysis prove wrong. As a trader, you must always be willing to accept when you're wrong because your money is more important than your ego. With that said, just remember this is a long-term chart and price may continue moving up before reversing down. Some related charts, including the charts of ETFs that hold ENPH and the ENPH/SPY relative chart, suggest that ENPH does have the momentum necessary to break out to the upside. It's just looking very suspicious right now.

This post is not making a short call on ENPH, it is just an observation. It is not financial advice. Although I may choose to open a position, at the time of writing this, I have neither a long nor a short position open on ENPH. This is an objective, non-biased analysis.

I'll be keeping an investigative eye on this chart.

CLNE Pump to $5.66 in a few Days🐂 Trade Idea: Long - CLNE

🔥 Account Risk: 1.00%

📈 Recommended Product: Knockout / Option

🔍 Entry: +/- 4.90

🐿 DCA: No

😫 Stop-Loss: 4.21

🎯 Take-Profit #1: 5.66 (50%)

🎯 Trail Rest: Yes

🚨🚨🚨 Important: Don’t forget to always wait for strong confirmation once possible entry zone is reached. Trade ideas don’t work all the time no matter how good they look. Do not get a victim of FOMO, there is always another trade idea waiting. 🚨🚨🚨

If you like what you see don’t forget to leave a comment 💬 or smash that like ❤️ button!

—

Clean Energy has a strong weekly support over multiple years in the 4.00 region that was holding strong the last couple of months. After consolidating bullish inside the bigger box on the top right corner we saw a break-out yesterday. Considering the strong weekly support and the successful break-out with one large candle we can try to catch this trade right away. We do not want to see it falling below the it’s local higher low at around 4.22 which leads to our stop loss just below that. This trade should play out in a couple of days.

—

Disclaimer & Disclosures pursuant to §34b WpHG

The trades shown here related to stocks, cryptos, commodities, ETFs and funds are always subject to risks. All texts as well as the notes and information do not constitute investment advice or recommendations. They have been taken from publicly available sources to the best of our knowledge and belief. All information provided (all thoughts, forecasts, comments, hints, advice, stop loss, take profit, etc.) are for educational and private entertainment purposes only.

Nevertheless, no liability can be assumed for the correctness in each individual case. Should visitors to this site adopt the content provided as their own or follow any advice given, they act on their own responsibility.

From Fossil Fuels to Wind Power: The Transformation of Repsol Alright folks, today we're talking about Repsol, the Spanish energy company, and their joint venture with Ibereólica Renovables in Chile. They've just announced the opening of their second wind farm project, the Atacama wind farm, which has an impressive installed capacity of 165.3 megawatts and is expected to produce over 450 gigawatt-hours of clean energy a year.

Now, here's the thing - this is a positive step for Repsol in expanding their renewable energy portfolio and supporting Chile's goal of reaching 70% renewable energy by 2030. The 14-year power purchase agreement between the companies reflects a promising double-digit return on the asset, which is certainly a good sign for investors.

However, we can't overlook the fact that the energy industry is facing significant disruption and challenges due to increasing pressure to shift towards renewable energy sources and reduce carbon emissions. Repsol's financial performance has also been impacted by the COVID-19 pandemic and declining energy demand.

So, while this joint venture and the Atacama wind farm project are certainly positive developments for Repsol, investors should also consider the broader market conditions and potential risks associated with the energy industry before making an investment decision. It's a complex and rapidly evolving landscape, and it's important to stay informed and evaluate all the factors before making any investment moves.

Bloom Energy Cup and Handle BreakoutTLDR:

I believe that Bloom Energy is about to go through a massive adoption and growth period that will outshine the current geopolitical climate. Based on my cup and handle charting, I estimate that the lowest upgraded value for Bloom Energy's stock will be around $32. However, climate news will largely influence whether that value goes higher. Strong investor sentiment coupled with appropriate corporate growth measures could land a higher valuation closer to $50. Time will tell.

Prelude:

Given the recent discussions of hydrogen energy adoption amongst car manufacturers and energy suppliers alike, it seems most any solid oxide fuel cell company stands to benefit. It just takes time, especially in the face of so much post-covid geopolitical conflict.

Indeed, as Russia has likely anticipated, the Spring and Summer of 2023 will be decisive... but not in their favor. Political sentiment towards environmental remediation has grown among most Western and some Eastern nations. This means reduced reliance on fossil fuels, Russia's primary source of income. And while Bloom Energy still supplies products that can operate using hydrocarbon fuels, they're significantly more efficient than most other fossil fuel energy production methods. If one factors in the growing market adoption of carbon capture technology, it seems feasible for such devices to get retrofitted to Bloom Energy's solid oxide fuel cell stacks.

Bloom Energy has been developing its technology for as long as I've been mature enough to understand it. Their mission has always been to produce cleaner energy as we transition from our dependence on fossil fuels. Our grid will need modular systems with flexible fuel sources like Bloom Energy's while we stabilize battery production and implementation. Wind and Solar will remain, nuclear will grow, but fossil fuel powerplants are likely on their last few decades. Solid oxide fuel cells can replace powerplants before nuclear energy growth and battery integration on the grid happens.

Disclaimer: This is not investment advice and I am not certified in any finance field to offer investment advice. I have a B.S. in Chemistry and am pursuing a Ph.D. in Mechanical Engineering. I have taken one high-school-level economics course. These words are purely speculation and should not be acted upon. Any investment activity you undertake after reading this description is done by your hand, and your hand alone. You are liable for your actions after reading this post. I am not telling you to invest in or against any stocks or sectors discussed above. Be Safe!

NYSE:BE

Tesla Inc. (TSLA) bullish scenario:The technical figure Channel Down can be found in the daily chart in the US company Tesla Inc. (TSLA). Tesla, Inc. is an American multinational automotive and clean energy company. Tesla designs and manufactures electric vehicles (electric cars and trucks), battery energy storage from home to grid-scale, solar panels and solar roof tiles, and related products and services. Tesla is one of the world's most valuable companies and is, as of 2022, the world's most valuable automaker. The Channel Down broke through the resistance line on 24/01/2023. If the price holds above this level, you can have a possible bullish price movement with a forecast for the next 18 days towards 168.10 USD. Your stop-loss order, according to experts, should be placed at 108.76 USD if you decide to enter this position.

Tesla Inc. said Tuesday it plans to spend $3.6 billion to expand its Sparks, Nev., gigafactory where it currently makes batteries and electric-vehicle parts.

The announcement came a day before the EV maker reports crucial quarterly earnings, and after CEO Elon Musk completed his third day of testimony in a trial over shareholder losses following tweets he made in 2018 about taking Tesla private.

Tesla said the battery facility would have capacity to produce “enough batteries for 2 million light duty vehicles annually.” In early January, Tesla said it delivered about 1.31 million vehicles in 2022. Analysts expect Tesla to increase deliveries to about 1.92 million in 2023.

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.

Plug PowerThis is a 2-month chart (each candle represents a 2-month period) of Plug Power (PLUG). For those who are not already familiar, PLUG is an alternative energy company that develops and manufactures hydrogen fuel cell systems.

I recently added PLUG to my portfolio as a long-term investment. In my opinion, it has one of the best long-term charts of any stock right now in terms of the potential for outsized gains in the future. I will explain my reasoning below.

Chart Analysis

The 2-month chart below shows the entire price history of PLUG.

Throughout much of its history, PLUG was resisted by the EMA ribbon (yellow and red lines). The EMA ribbon is a collection of exponential moving averages that act as resistance when price reaches it from below and support when price reaches it from above.

If we zoom in (see below), we can see that the EMA has tightened together and PLUG's price is now sitting right on the ribbon. When moving averages tighten like this, they can act as fairly strong support when the price falls to the moving averages from above.

Each time PLUG's price has fallen below these moving averages buyers have stepped in, thus causing lower wicks to form. This suggests the market is validating the support of these moving averages.

We can see in the chart below that the moving averages held as support even as the Stochastic RSI oscillated down. This is bullish.

Indeed, PLUG is forming a bull flag pattern on the log-scale, higher-timeframe chart. A bull flag of this nature can signal a potentially lucrative investment opportunity.

For those who read my post on using the money supply to gauge whether an asset is wealth-building, you would know that before entering a long-term investment position in PLUG one should first analyze the asset's chart relative to the money supply. (I've linked to this post in the related ideas below)

In the above chart, we see the performance of PLUG relative to the money supply (M2SL). This chart tells us that throughout much of its history, PLUG was a wealth-losing investment asset since the stock's price moved down over time relative to the money supply. The EMA ribbon largely acted as resistance.

However, the chart above shows that the moving averages are tightening together and that PLUG's price is consolidating within these tightening moving averages. This is a quite bullish sign. If a breakout occurs, an investment in PLUG could prove to be quite lucrative.

In the chart below, I apply Fibonacci levels to the length of the pole that forms the bull flag. We can see a perfect Fibonacci retracement is occurring, as price is finding support at the 0.618 level on the log-adjusted chart.

If the bull flag breaks out and a full Fibonacci spiral occurs, PLUG's price can move dramatically higher in the months and years to come.

In the below chart, I construct the Fibonacci levels using the all-time peak to all-time low. I drew projection arrows to show two plausible growth possibilities.

On a more complex, mathematical analysis, PLUG appears to be priming itself to "jump S-curves".

For a more in-depth analysis on what "jumping S-curves" means, you can read my post on the topic linked below. In short, I explain that price action can be graphically represented as a logistic function. Jumping an S-curve occurs when an inflection point is reached whereafter price begins to explode higher at a nearly exponential rate.

When the price of a company's stock jumps S-curves, there is usually some major impetus with regard to its earnings or profitability that occurs. For PLUG, that impetus could be hydrogen finally becoming a cost-effective form of energy. Hydrogen power is poised to benefit from multiple tailwinds in the years ahead: (1) Higher energy costs are driving capital into the development of alternative energy forms; (2) The transition to sustainable energy will drive investment capital into alternative forms of energy, including hydrogen fuel cells; (3) As hydrogen fuel cells gain massive adoption hydrogen power will become more cost-competitive.

My strategy with PLUG is to accumulate shares in my brokerage and retirement accounts up to a certain defined percentage. I can only ever lose 100% of that defined percentage of my portfolio if I am wrong, but if my analysis is right, the gains may reach as much as 8,000% over the course of years. I know most people on here trade on much shorter timeframes than years, but my opinion is that the greatest wealth-building occurs by staying invested over the long term.

Below are some interesting comparable charts. PLUG's current chart looks similar to Monster's chart in 2000 and AMD's chart in 2018.

What's remarkable about these charts is how little of an effect even recessions had on the stocks' price movements. In the case of Monster, its price remained generally flat, despite the S&P 500 experiencing major declines during the early 2000s recession. In the case of AMD, one of the worst stock market crashes in history (March 2020) is barely apparent on its chart. This lends hope that even if the U.S. or global economy experiences a recession in the years ahead and the S&P 500 declines, perhaps stocks like PLUG will be less affected.

To learn more about hydrogen energy including its advantages and disadvantages, you can check out this video from Bloomberg Quicktake:

www.youtube.com

As always, trade at your own risk. Anything can happen and my analysis can prove completely wrong. Feel free to leave constructive thoughts in the comments below. Thank you.

Constellation Energy $CEG leading the energy transition?Constellation Energy provides power, natural gas, renewable energy, and energy management products and services. They are the largest producer of carbon-free and low-emissions energy in the US.

NASDAQ:CEG is in a clear uptrend with great relative strength against its benchmarks. Just look at AMEX:XLE and NASDAQ:QCLN .

NASDAQ:CEG is clearly leading.

I see an actionable first buy at yesterday's high as that would cancel the outside reversal. It would be very bullish.

A second buy point is at $90.20, which would be an ATH.

Lets see if the MAs can hold the price.

Bullish Shark on SunrunI think based off how things went with Oil prices rising that we will likely invest more into clean energy rather that's the right answer or not it seems like it will be the next logical step to prevent a similar situation in the future.

Right now we are at the PCZ of a Bullish Shark with Bullish Divergence on the weekly and i will be accumulating shares within this zone.