CLVUSDT

CLV Clover FinanceIf we do see a bank less world these interoperable plays could be trusts/less providers.

I do believe we will see the world financial system change dramatically in this lifetime and sooner than later.

I've decided today to toss $1,000 into CLV and if it hits that's cool and if it does not.... It does not.

I will roll half my position into LTC if this does giga pump.

THIS IS NOT FINANCIAL ADVICE!!!

CLVUSDT 1WCLV ~ 1W Analysis

#CLV This is the lowest support block for now. Buy from here if you still have a Conviction on this coin with a minimum target of 20%+.

IDUSDT UPDATEIDUSDT is a cryptocurrency trading at $0.3183. Its target price is $0.5000, indicating a potential 50%+ gain. The pattern is a Bullish Falling Wedge, a reversal pattern signaling a trend change. This pattern suggests the downward trend may be ending. A breakout from the wedge could lead to a strong upward move. The Bullish Falling Wedge is a positive signal, indicating a potential price surge. Investors are optimistic about IDUSDT's future performance. The current price may be a buying opportunity. Reaching the target price would result in significant returns. IDUSDT is poised for a potential breakout and substantial gains.

CLVUSDT: Approaching Key Buyer Zone—Stay Alert! CLVUSDT: Approaching Key Buyer Zone—Stay Alert! ⚠️

CLVUSDT is closing in on a critical area where buyers could activate. This is a moment to proceed with sharp focus and well-placed alerts.

Key Zone Ahead: We’re entering a level where buyer activity might pick up significantly.

Watch for Confirmations: Low-timeframe bullish breakouts are crucial, but they must align with the following:

CDV showing clear buyer dominance.

Volume Profile indicating strong support.

Heatmap revealing liquidity building in higher zones.

Execution Plan: If these conditions align, it’s a setup worth considering.

Final Note: Precision and patience are your allies here. Evaluate carefully before jumping in. Boost, comment, and follow for more critical updates! 🚀

Let me tell you, this is something special. These insights, these setups—they’re not just good; they’re game-changers. I've spent years refining my approach, and the results speak for themselves. People are always asking, "How do you spot these opportunities?" It’s simple: experience, clarity, and a focus on high-probability moves.

Want to know how I use heatmaps, cumulative volume delta, and volume footprint techniques to find demand zones with precision? I’m happy to share—just send me a message. No cost, no catch. I believe in helping people make smarter decisions.

Here are some of my recent analyses. Each one highlights key opportunities:

🚀 RENDERUSDT: Strategic Support Zones at the Blue Boxes +%45 Reaction

🎯 PUNDIXUSDT: Huge Opportunity | 250% Volume Spike - %60 Reaction Sniper Entry

🌐 CryptoMarkets TOTAL2: Support Zone

🚀 GMTUSDT: %35 FAST REJECTION FROM THE RED BOX

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

This list? It’s just a small piece of what I’ve been working on. There’s so much more. Go check my profile, see the results for yourself. My goal is simple: provide value and help you win. If you’ve got questions, I’ve got answers. Let’s get to work!

CLVUSDT 1WCLV ~ 1W

#CLV This trade is very high risk,. But if you still have Conviction on this coin,. This support block would be a very good buying place for now,. with a minimum target of 20%+

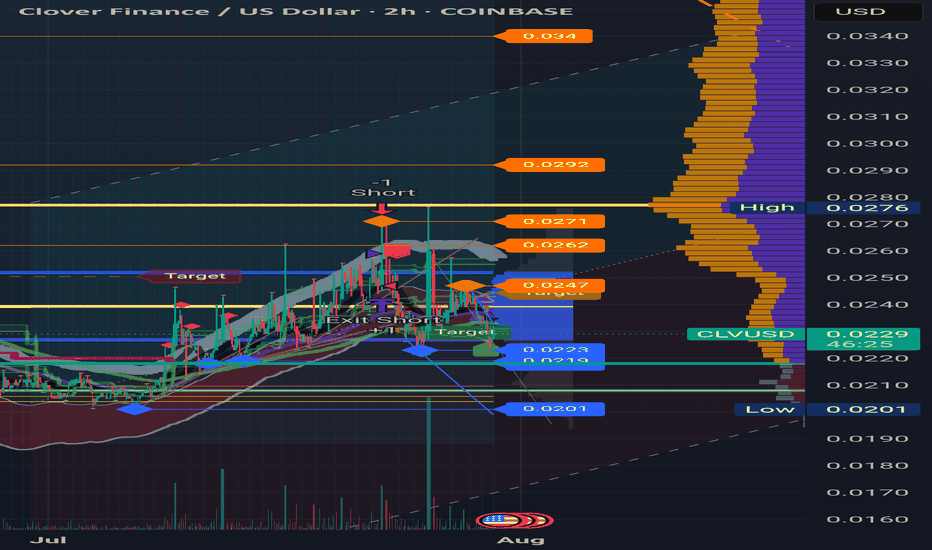

CLV local swing trade targetsAll main targets for CLV still relevant and with CLV 2.0 updates looks promising

Here is just a local swing idea

Possible Targets and explanation idea

➡️D tf after 2 main signal to buy from TradeOn indicator we pumped and form the top but not sweep the structure on higher timeframes

➡️November money inflow signal marked. Now need a new one for continuation

➡️Based on TradeON we could see 2 signals to sell for correction

➡️Healthy correction can be to the green block

➡️Now we trade over Exit line of Take profit indicator. need to see correction and even test of buy line on 12h or D tf

➡️Red block marked zone for fixation of swing trade and 0.29 cents like middle term fixation of investments

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

---

• Look at my ideas about interesting altcoins in the related section down below ↓

• For more ideas please hit "Like" and "Follow"!

CLV ready to get a step upCould see a solid push or two up any moment.

Youtubers have been pushing many towards buying into highs.

I tell you when i buy and start to take profit often.

Currently I'm in and stacking more.

I think we will struggle to take $0.10 out. Possible we bust through and use it as support??

NOT FINANCIAL ADVICE!!!

CLV / USDT : Poised for a breakout above key resistance CLV/USDT: Poised for a Breakout Above Key Resistance

CLV/USDT is nearing a crucial resistance level, setting the stage for a potential breakout 📈. The price has been steadily climbing, building momentum for a significant upward move 💥. A successful breakout could ignite a strong bullish trend 🚀. Keep this pair on your radar and wait for a confirmed move before entering.

Key Insights:

1. Critical resistance: CLV/USDT is approaching a major resistance level that has acted as a ceiling in the past. Breaking above this level could trigger a powerful rally.

2. Volume watch: Monitor trading volume during the breakout. A surge in volume 🔥 would indicate strong buyer interest.

3. Bullish indicators: Momentum indicators like RSI and MACD are showing positive trends ⚡, reinforcing the potential for a bullish breakout.

Steps to Confirm the Breakout:

Wait for a clear 4H or daily candle to close above the resistance level 📍.

Look for a noticeable increase in volume during the breakout to validate buyer strength 📊.

Watch for a retest of the broken resistance, turning it into support, to confirm the move ✅.

Be wary of fake breakouts, such as sharp reversals or long wicks above resistance ⚠️.

Risk Management Strategies:

Implement stop-loss orders to protect your capital 🔒.

Adjust your position sizing to align with your trading plan 🎯.

This analysis is for educational purposes only and is not financial advice. Always do your own research (DYOR) 🔍 before making any investment decisions.

Long trade idea for CLVUSDT Long trade idea for CLVUSDT

Falling Wedge measured from NOV 2024

Potentially min 596% profit from current date. Target $0.62

Do note potential pullback according to purple line.

Note that there are Bearish Order Blocks as shown.

Do exercise due diligence and that all trades comes with risks

CLV ready to pump?? 12 cents incoming??CLV hitting a trend line of resistance and more recent support. Got the 5 count down with an extra 4 to 5.

I think we can go slightly higher than .12

After that a small dip maybe 10-25%, flat line or an PIT(pull back in time).

Ultimate targets low of .40 high near $10(if decentralized finance kicks in big).

NOT FINANCIAL ADVICE

CLVUSDT (CloverFinance) Updated till 16-11-24CLVUSDT (CloverFinance) Daily timeframe range. we can see a insane pump here from its local low. shitload of money made by traders. now its trying to stay above 0.10274 which will be easy for retrace back. if not than fall back to old support than possible to pick up.

Elastos looking readyTook some solid profits out of CLV and rotated into ELA.

Could see an explosion if web 3 really does kick off.

Anyone mine ELA?? Should I start mining also or look for other opportunities?

I see some great potential here& will DCA down but a bag just got packed.

NOT FINANCIAL ADVICE

#CLV (SPOT) entry range( 0.032- 0.034) T.(0.0999) SL(0.032)BINANCE:CLVUSDT

entry range( 0.03200- 0.03400)

Target1 (0.04110) - Target2 (0.06549)- Target3 (0.07350)- Target4 (0.09990)

1 Extra Targets(optional) in chart, if you like to continue in the trade with making stoploss very high.

SL .1D close below (0.032)

*** collect the coin slowly in the entry range ***

*** No FOMO - No Rush , it is a long journey ***

**** #Manta ,#OMNI, #DYM, #AI, #IO, #XAI , #ACE #NFP #RAD #WLD #ORDI #BLUR #SUI #Voxel #AEVO #VITE #APE #RDNT #FLUX #NMR #VANRY #TRB #HBAR #DGB #XEC #ERN #ALT #IO #ACA #HIVE #ASTR #ARDR #PIXEL #LTO #AERGO #SCRT #ATA #HOOK #FLOW #KSM #HFT #MINA #DATA #SC #JOE #RDNT #IQ #CFX #BICO #CTSI #KMD #FXS #DEGO #FORTH # AST #PORTAL #CYBER #CLV #RIF #ENJ #ZIL #APT #GALA #STEEM #ONE #LINK #NTRN #COTI #CLV ****

CLV (1M_Journey) Entry ( .34 ) Target ( .39 ) Stop ( .32 )BINANCE:CLVUSDT

1 Million Journey

It is a long journey with NO FOMO & NO RUSH

In those trades i will try to make 1 million USD from 1000 USD

*********************************************************************************

(1)

Entry ( .34 )

Target ( .39 )

Stop ( .32 )

*********************************************************************************

General information

************************

1. throw this challenge i will try to make 1 million USD from 1000 USD

2. It will be very long journey not fixed by time with NO FOMO & NO RUSH.

3. I will take this challenge by my personal money and my personal decisions so please if you need to follow ( do your own plan).

4. May be i can achieve that target and may be not.

5. I think it will be educational challenge.

6. May be a lot of challenges Throw the journey, i will try to correct the path every fall.

6. I do not need 1000X in one coin but i need small profit with a lot of successful trades depend on the following formula for 10% Profit

NST= ( IN(FV/C) ) / ( IN (1+P) )

NST = Number of successful trades (NST)

FV = Final value

C = Capital

P = Profit percentage

IN = Natural logarithms ( IN from calculator)

NST = ( IN ( 1000 000 / 1000 ) / ( IN ( 1 + 10% ) ) = 6.908 /.09531 = 73.5 Successful trade. with no loses.

Risk management

**********************

1. Entry by 50% or 75% depend on the market situation.

2. Maximum 5% loses per trade.

3. Maximum 1 lose per day.

4. Maximum 2 loses per week.

5. Maximum 2 trades per day.

6. Minimum rewards has to be 5% and the maximum depends the coin targets & market situation.

Trading rules

****************

1. Figuring the best entry point.

2. After achieving 5% profit moving stop loss to break even.

3. Trading available opportunities in the market ( everyday - every week - every month)

4. Trading will be spot only.

5. Trading will be with trusted & high liquidity platform ( Binance coins).

6. (Monitoring coins - low liquidity coins) will not be traded .

7. (High rewards -low risks - fast trades - lower time frames ) will be traded.

Notes

********

1. these rules can be changed due to the market situations and new challenges.

Remember always, NO FORMO - NO RUSH It is a long journey.

Thank you for reading,

@Crypto_alphabit

#CLV (SPOT) entry range (0.03800- 0.04800)T.(0.1212) SL(0.03680)BINANCE:CLVUSDT

entry range (0.03800- 0.04800)

Target1 (0.06349) - Target2 (0.07350)- Target3 (0.09900)- Target4 (0.12120)

SL .1D close below (0.03680)

*** collect the coin slowly in the entry range ***

*** No FOMO - No Rush , it is a long journey ***

**** #Manta ,#OMNI, #DYM, #AI, #IO, #XAI , #ACE #NFP #RAD #WLD #ORDI #BLUR #SUI #Voxel #AEVO #VITE #APE #RDNT #FLUX #NMR #VANRY #TRB #HBAR #DGB #XEC #ERN #ALT #IO #ACA #HIVE #ASTR #ARDR #PIXEL #LTO #AERGO #SCRT #ATA #HOOK #FLOW #KSM #HFT #MINA #DATA #SC #JOE #RDNT #IQ #CFX #BICO #CTSI #KMD #FXS #DEGO #FORTH # AST #PORTAL #CYBER #CLV ****

CLV back in Bulls control, target $0.10 to $0.128CLV bulls appear to be back in control after finding daily bottom support at $0.070.

The token is currently trading at $0.0867, and eyeing potential resistance zones soon.

The first hurdle for CLVUSDT is expected to be in the range of $0.10 to $0.112. This zone could present a profitable short-term opportunity for traders looking to take advantage of a potential price stall or reversal.

If the bulls can muster enough strength to overcome this initial resistance, the token could set its sights on $0.12830.

However, this higher price point is also seen as a potential resistance zone, offering another profit-taking area for those with a longer-term view.